MIND C.T.I. LTD. – (NasdaqGM: MNDO), a leading provider of

convergent end-to-end prepaid/postpaid billing and customer care

product based solutions for service providers, unified

communications analytics and call accounting solutions for

enterprises as well as enterprise messaging solutions, today

announced results for its fourth quarter and full year ended

December 31, 2019.

The following will summarize our business in the

fourth quarter of 2019 and provide a more detailed review of the

financial results for the quarter and for the full year. Full

financial results can be found in the Company News section of our

website at http://www.mindcti.com/company/news/ and in our Form

6-K.

Financial Highlights of Q4

2019

- Revenues of $6.7 million, compared to $4.5 million in the

fourth quarter of 2018, with the increase attributed to the

acquisition of Message Mobile in March 2019 and GTX in September

2019, which generated revenues of approximately $2.8 million during

the quarter.

- Operating income was $1.2 million, or 18% of revenue, compared

to $1.5 million, or 33% of revenue in the fourth quarter of

2018.

- Net income of $1.3 million or $0.07 per share, compared to $1.4

million or $0.07 per share in the fourth quarter of 2018.

- Cash flow from operating activities was $1.2 million, compared

to $0.6 million in the fourth quarter of 2018.

- One new win.

Financial Highlights of Full

Year 2019

- Revenues of $22.7 million, compared to $18.1 million in 2018,

with the increase attributed to the acquisition of Message Mobile

in March 2019 and GTX in September 2019, which generated revenues

of approximately $6.1 million during the year.

- Operating income was $5.0 million, or 22% of revenue, compared

to $5.3 million, or 30.0% of revenue in 2018.

- Net income of $5.1 million, or EPS of $0.26 (diluted EPS of

$0.25), compared to $5.1 million, or $0.27 per share in 2018.

- Cash flow from operating activities was $6.7 million, compared

to $4.5 million in 2018.

- Cash position of approximately $15.3 million as of December 31,

2019.

As of December 31, 2019, we had 214 employees,

compared to 221 as of December 31, 2018.

Monica Iancu, MIND CTI’s President and Chief

Executive Officer, commented: “Our lower revenues and income from

our billing platform reflect the expected and previously announced

negative impact of a few customers under maintenance or SaaS

agreements that decided to exit their business. Also, as we

continue to be challenged by the shrinking relevant telecom markets

and strong competition, we lately have encountered fewer new

customers, and our new wins, compared to wins a few years ago, have

lower initial proceeds. At the same time, we are satisfied with the

two acquisitions we completed in 2019. These new subsidiaries have

performed well for us, but their profit margins are lower than that

of our core business. Given our strong cash position and our

experienced organization, we believe that we have the required

resources to respond to market needs, continue to invest in our

core business, bringing permanent value to existing customers and

maintaining up-to-date technology, to be relevant for future market

trends in our core billing, analytics and messaging platforms, as

well as continue with our dividend policy and at the same time

focus on targeting potential acquisitions that could be a source of

growth.”

Message Mobile GmbH

Results

After reviewing the revenue recognition

methodology for messaging and mobile payment transactions, based on

the key principal-versus-agent considerations under ASC 606,

Revenues from Contract with Customers, we concluded to recognize

revenues from Message Mobile’s mobile payments line of business on

a “net basis” instead of a “gross basis”. Consequently, only our

share in the processed transactions is recognized as revenues.

As a result of the above, our final consolidated

revenues for Q2 2019 were $5.7 million instead of $6.0 million

(Message Mobile being $1.6 million instead of $1.9 million) and the

final consolidated cost of revenues were $2.9 million instead of

$3.2 million (Message Mobile being $1.3 million instead of $1.6

million).

Our final consolidated revenues for Q3 2019 were

$5.8 million instead of $6.1 million (Message Mobile being $1.7

million instead of $2.0 million) and the final consolidated cost of

revenues were $2.7 million instead of $3.0 million (Message Mobile

being $1.3 million instead of $1.6 million).

All the other metrics, including gross profit, operating income

and cash, are unchanged from the preliminary Q2 and Q3 amounts

announced in 2019.

Revenue Distribution for Q4

2019

Revenues in the Americas represented 41%,

revenues in Europe represented 52% (including the Message Mobile

and GTX revenues in Germany that represented 42%) and revenues in

Israel represented 4% of our total revenues.

Revenues from our customer care and billing

software were $3.1 million, or 46% of total revenues, revenues from

enterprise messaging and payment solutions were $2.8 million, or

42% of total revenues, and revenues from our enterprise call

accounting software were $0.8 million, or 12% of total

revenues.

Revenues from licenses were $0.6 million, or 9%

of total revenues, while revenues from maintenance and additional

services were $6.1 million, or 91% of total revenues.

Revenue Distribution for Full

Year 2019

Revenues in the Americas represented 53%,

revenues in Europe represented 39% (including the Message Mobile

and GTX revenues in Germany that represented 27%) and revenues in

Israel represented 6% of our total revenues.

Revenues from our customer care and billing

software were $13.6 million, or 60% of total revenues, revenues

from enterprise messaging and payment solutions were $6.1 million,

or 27% of total revenues, and revenues from enterprise call

accounting software were $3.0 million, or 13% of our total

revenues.

Revenues from licenses were $2.3 million, or 10%

of total revenues, compared to $2.1 million, or 12% of total

revenues in 2018, while revenues from maintenance and additional

services were $20.4 million, or 90%, compared to $16.0 million or

88% of total revenues in 2018.

Q4 2019 New

Win

Our new win is a seven-year contract with one of

the largest wireless internet service providers (WISP) in the

United States, which uses fixed wireless and fiber-optic technology

to deliver high-speed internet and voice services to the

under-served enterprise, commercial, governmental agencies and

residential markets of rural and suburban North Central Texas and

Southern Oklahoma. MIND will deploy its unique full suite

that includes order management, inventory management, scheduling,

workforce management, provisioning, mediation, billing, customer

care, self-care and reporting.

Dividend DistributionSince July

2003, when we first adopted a dividend policy, according to which

we declare, subject to specific Board approval and applicable law,

a dividend distribution once per year, we have distributed 17

annual dividends and one special dividend. We continue to believe

that our annual dividends enhance shareholder value.

Taking into consideration our dividend policy

and the remaining cash after the distribution, our Board of

Directors declared on March 11, 2020, a gross dividend of $0.24 per

share. The record date for the dividend will be March 25, 2020 and

the payment date will be April 16, 2020. Tax will be withheld at a

rate of 20%.

Update on

Acquisitions

As previously announced, we believe that

messaging needs are expanding worldwide, be it in traditional text

(SMS) or in instant messaging and we continue targeting potential

acquisitions that could be a source of growth.

Following our two acquisitions in messaging in

March 2019 and September 2019 in Germany, we are focused on the

integration of Message Mobile and GTX.

We continue to explore growth through

consolidation by focusing on acquisition targets at reasonable

valuations that satisfy the criteria we defined: proven revenues,

complementary technology or geography and expected accretion to

earnings within two to three quarters.

AGM

MIND also announced today that its 2020 Annual

General Meeting of Shareholders will be held on Tuesday, May 12,

2020 at 10:00 A.M. (Israel time), at the offices of the Company,

HaCarmel 2, Yoqneam 20692, Israel.

Shareholders of record at the close of business

on April 9, 2020 are entitled to vote at the Meeting. All

shareholders are cordially invited to attend the Meeting in person.

Proxy statements and proxy cards for use by shareholders that

cannot attend the meeting in person will be sent to shareholders

that hold shares registered with the American Stock Transfer &

Trust Company, including shares held via DTC members. The right

under Israeli law of 1% shareholders to request the addition of

appropriate matters to the agenda shall expire 14 days after the

date of this notice.

The agenda of the meeting is as follows:

(i) to re-appoint Brightman

Almagor Zohar (a firm in the Deloitte Global Network) as the

Company’s independent auditor until the close of the following

Annual General Meeting and to authorize the Board of Directors of

the Company to determine its remuneration or to delegate the Audit

Committee thereof to do so;

(ii) to re-elect Mr.

Joseph Tenne as a Class II director of the Company until the 2023

Annual General Meeting;

(iii) to elect Mr. Itay

Barzilay as a Class II Director of the Company until the 2023

Annual General Meeting; and

(iv) to discuss the Company’s

audited financial statements for the year ended December 31,

2019.

About MIND

MIND CTI Ltd. is a leading provider of

convergent end-to-end billing and customer care product-based

solutions for service providers, unified communications analytics

and call accounting solutions for enterprises as well as enterprise

messaging solutions. MIND provides a complete range of billing

applications for any business model (license, SaaS, managed service

or complete outsourced billing service) for Wireless, Wireline,

Cable, IP Services and Quad-play carriers. A global company, with

over twenty years of experience in providing solutions to carriers

and enterprises, MIND operates from offices in the United States,

Romania, Germany and Israel.

Cautionary Statement for Purposes of the "Safe

Harbor" Provisions of the Private Securities Litigation Reform Act

of 1995: All statements other than historical facts included in the

foregoing press release regarding the Company's business strategy

are "forward-looking statements." These statements are based on

management's beliefs and assumptions and on information currently

available to management. Forward-looking statements are not

guarantees of future performance, and actual results may materially

differ. The forward-looking statements involve risks,

uncertainties, and assumptions, including the risks discussed in

the Company's annual report and other filings with the United

States Securities Exchange Commission. The Company does not

undertake to update any forward-looking information.

For more information please

contact:Andrea DrayMIND C.T.I. Ltd.Tel:

+972-4-993-6666investor@mindcti.com

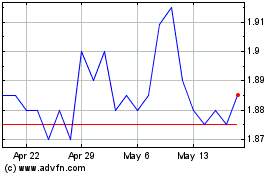

MIND C T I (NASDAQ:MNDO)

Historical Stock Chart

From Mar 2025 to Apr 2025

MIND C T I (NASDAQ:MNDO)

Historical Stock Chart

From Apr 2024 to Apr 2025