MIND CTI Reports Second Quarter 2024 Results

August 06 2024 - 5:43AM

MIND C.T.I. LTD. – (NasdaqGM:MNDO), a leading provider of

convergent end-to-end prepaid/postpaid billing and customer care

product-based solutions for service providers, unified

communications analytics and call accounting solutions for

enterprises as well as enterprise messaging solutions, today

announced results for its second quarter ended June 30, 2024.

The following will summarize our major

developments in the second quarter of 2024 as well as our business.

The financial results can be found in the Company News section of

our website at http://www.mindcti.com/company/news/ and in our Form

6-K.

Financial Highlights

- Revenues of $5.3 million, same as

the second quarter of 2023, and compared to $5.8 in the first

quarter of 2024, where the messaging segment was favorably impacted

by larger than usual customer campaigns.

- Operating income of $1.0 million,

or 20% of total revenues, compared with $1.1 million, or 20% of

total revenues in the second quarter of 2023.

- Net income was $1.1 million, or

$0.06 per share, compared with $1.1 million, or $0.06 per share in

the second quarter of 2023.

- Cash flow from

operating activities was $2.0 million, compared with $1.9 million

in the second quarter of 2023.

Six Month Financial

Highlights

- Revenues of $11.0 million, compared

with $10.7 million in the first six months of 2023.

- Operating income of $2.3 million,

or 20.9% of total revenues, compared with $2.4 million or 22% of

total revenues in the first six months of 2023.

- Net income of $2.5 million, or

$0.12 per share, same as the first six months of 2023.

- Cash flow from

operating activities in the first six months of 2024 was $2.9

million, compared with $2.4 million in the first six months of

2023.

Monica Iancu, MIND CTI’s CEO, commented: “In

August 2024, MIND celebrates 24 years as a public company. We have

delivered some years of growth and encountered some difficult

periods, including the present year, with multiple challenges to

overcome. We have an incredibly strong billing platform, highly

scalable analytic enterprise solutions, a flexible messaging

platform and a strong team with proven successful execution. It is

the right time for me to retire as CEO and to transition into the

role of Chairperson of the Board, and I intend to continue to hold

my shareholder position for the foreseeable future. After we

completed a selection process, the Board of Directors has nominated

Mr. Ariel Glassner for the CEO position. Mr. Glassner brings over

25 years of leadership experience and his career includes CEO roles

at startup companies during the last five years. Mr. Glassner

shaped his expertise in Telco solutions during his 15-year tenure

at Amdocs, leading the implementation of complex solutions for

major telecommunication operators. He played a pivotal role in

driving revenues and overseeing transactions, and is also a

graduate of the Amdocs Excellent Leaders program.

“We built MIND around a culture of integrity and

innovation that will continue to serve our employees and customers

for years to come. We own great technology, and have a team that is

ready to deliver a bright and secure future for our customers. I am

confident that Ariel will preserve the same values and believe he

is the right leader to take MIND to new heights.”

Cash Position Our cash

position, including short-term deposits and marketable securities,

was $14.6 million as of June 30, 2024, compared with $15 million as

of June 30, 2023.

As previously announced, the Board declared on

March 8, 2024, a cash dividend of $0.24 per share before

withholding tax. The dividend sum of approximately $4.9 million was

distributed in April 2024.

Revenue Distribution for Q2

2024Europe represented 53% (including the messaging

segment revenues in Germany that represented 36%), the Americas

represented 42%, and the rest of the world represented 5% of total

revenues.

Customer care and billing software totaled $2.9

million, or 56% of total revenues, enterprise messaging and payment

solutions were $1.9 million, or 36% of total revenues and

enterprise call accounting software totaled $0.5 million, or 8% of

total revenues.

Maintenance and additional services totaled $5.2

million, or 98% of total revenues, while licenses were $0.1

million, or 2% of total revenues.

Revenue Distribution for the First Six

Months of 2024Europe represented 56% (including the

messaging segment revenues in Germany that represented 38%), the

Americas represented 38%, and the rest of the world represented 6%

of total revenues.

Customer care and billing software totaled $5.9

million, or 53% of total revenues, enterprise messaging and payment

solutions were $4.2 million, or 38% of total revenues and

enterprise call accounting software totaled $0.9 million, or 9% of

total revenues.

Maintenance and additional services totaled

$10.9 million, or 99% of total revenues, while licenses were $0.1

million, or 1% of total revenues.

About MINDMIND CTI Ltd. is a

leading provider of convergent end-to-end billing and customer care

product-based solutions for service providers, unified

communications analytics and call accounting solutions for

enterprises as well as enterprise messaging solutions. MIND

provides a complete range of billing applications for any business

model (license, SaaS, managed service or complete outsourced

billing service) for Wireless, Wireline, Cable, IP Services and

Quad-play carriers. A global company, with over twenty-five years

of experience in providing solutions to carriers and enterprises,

MIND operates from offices in Israel, Romania, Germany and the

United States.

Cautionary Statement for Purposes of the "Safe

Harbor" Provisions of the Private Securities Litigation Reform Act

of 1995: All statements other than historical facts included in the

foregoing press release regarding the Company's business strategy

are "forward-looking statements", including estimations relating to

the impact of the political situation in Ukraine, expectations of

the results of the Company’s business optimization initiative,

integration of the company’s acquisitions and its projected outlook

and results of operations. These statements are based on

management's beliefs and assumptions and on information currently

available to management. Forward-looking statements are not

guarantees of future performance, and actual results may materially

differ. The forward-looking statements involve risks,

uncertainties, and assumptions, including, but not limited to,

economic conditions in our key markets, as well as the risks

discussed in the Company's annual report and other filings with the

United States Securities Exchange Commission. The Company does not

undertake to update any forward-looking information.

For more information please

contact:Andrea DrayMIND C.T.I. Ltd.Tel:

+972-4-993-6666investor@mindcti.com

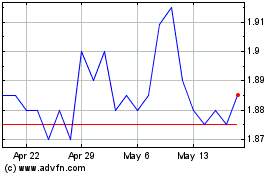

MIND C T I (NASDAQ:MNDO)

Historical Stock Chart

From Dec 2024 to Jan 2025

MIND C T I (NASDAQ:MNDO)

Historical Stock Chart

From Jan 2024 to Jan 2025