false

--09-30

0001499961

0001499961

2025-02-13

2025-02-13

0001499961

muln:CommonStockParValue0.001Member

2025-02-13

2025-02-13

0001499961

muln:RightsToPurchaseSeriesA1JuniorParticipatingPreferredStockMember

2025-02-13

2025-02-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

| Date of Report (Date of earliest event reported): |

February 13, 2025 |

|

MULLEN AUTOMOTIVE INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-34887 |

|

86-3289406 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

1405 Pioneer Street, Brea, California 92821

(Address, including zip code, of principal executive offices)

| Registrant’s telephone number, including area code |

(714) 613-1900 |

|

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 |

|

MULN |

|

The Nasdaq Stock Market, LLC

(Nasdaq Capital Market) |

| Rights to Purchase Series A-1 Junior Participating Preferred Stock |

|

None |

|

The Nasdaq Stock Market, LLC

(Nasdaq Capital Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 3.03 |

Material Modification To Rights of Security Holders. |

The information set forth in Item 5.03 below is

incorporated by reference herein in response to this Item.

|

Item 5.03 |

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

On January 31, 2025, Mullen Automotive Inc. (the

“Company”) held a Special Meeting of Stockholders, which approved a proposal to authorize a reverse stock split of

the common stock, par value $0.001 per share (the “Common Stock”) of the Company at a ratio within the range of 1-for-2

to 1-for-100, as determined by the Board of Directors of the Company (the “Board”).

The Board approved a one-for-sixty (1-for-60)

reverse stock split ratio and, on February 14, 2025, the Company filed a Certificate of Amendment (the “Amendment”)

to its Second Amended and Restated Certificate of Incorporation with the Secretary of State of the State of Delaware to effect the reverse

stock split of its Common Stock (the “Reverse Stock Split”). The Reverse Stock Split became effective on February 18,

2025 at 12:01 am Eastern Time (the “Effective Time”).

As a result of the Reverse Stock Split, at the

Effective Time, every sixty (60) shares of the Company’s pre-Reverse Stock Split Common Stock combined and automatically became

one (1) share of Common Stock. The Company’s Common Stock began trading on a split-adjusted basis when the Nasdaq Stock Market opened

for trading on February 18, 2025. The Common Stock will continue to trade on the Nasdaq Stock Market under the existing symbol “MULN”,

but with a new CUSIP number of 62526P604. The Reverse Stock Split did not change the authorized number of shares or the par value of the

Common Stock nor modify any voting rights of the Common Stock.

Also, at the Effective Time, the number of

shares of Common Stock issuable upon conversion or exercise of notes, warrants, preferred stock, options and other convertible

securities, as well as any commitments to issue securities, that provide for adjustments in the event of a reverse stock split will

be appropriately adjusted pursuant to their applicable terms for the Reverse Stock Split. If applicable, the conversion price for

each outstanding note and for each outstanding share of preferred stock and the exercise price for each outstanding warrant will be

increased, pursuant to their terms, in inverse proportion to the 1-for-60 split ratio such that upon conversion or exercise, the

aggregate conversion price for conversion of each note or preferred stock and the aggregate exercise price payable by the warrant

holder to the Company for shares of Common Stock subject to such warrant will remain approximately the same as the aggregate

conversion or exercise price, as applicable, prior to the Reverse Stock Split. Furthermore, pursuant to the terms of the

Company’s 2022 Equity Incentive Plan, as amended, shares of Common Stock reserved for future issuance are not subject to adjustment

as a result of the Reverse Stock Split.

No fractional shares will be issued in connection

with the Reverse Stock Split. All shares of Common Stock that are held by a stockholder will be aggregated subsequent to the Reverse Stock

Split and each fractional share resulting from such aggregation held by a stockholder will be rounded up to the next whole share on a

participant level.

Our transfer agent, Continental Stock Transfer

& Trust Company, is acting as the exchange agent for the Reverse Stock Split. Registered stockholders holding pre-split shares of

the Company’s Common Stock electronically in book-entry form are not required to take any action to receive post-split shares. Stockholders

owning shares via a broker, bank, trust or other nominee will have their positions automatically adjusted to reflect the Reverse Stock

Split, subject to such broker’s particular processes, and will not be required to take any action in connection with the Reverse

Stock Split.

The foregoing description is qualified in its

entirety by the full text of the Amendment, which is filed as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated herein

by reference.

|

Item 7.01 |

Regulation FD Disclosure |

On February 13, 2025, the Company issued a press

release regarding the Reverse Stock Split. The press release is attached as Exhibit 99.1 hereto and is hereby incorporated herein by reference.

The information in this Item 7.01 shall not

be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)

nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities

Act”), except as shall be expressly set forth by specific reference in such filing.

The information provided in Item 5.03 is hereby

incorporated by reference.

The Company has a registration statement on Form

S-1 (File No. 333-282516) and

registration statements on Form S-8 (File No. 333-276539,

333-274113, 333-267417,

333-266787 and 333-282274)

on file with the Securities and Exchange Commission (the “SEC”). SEC regulations permit the Company to incorporate

by reference future filings made with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, prior to the termination

of the offerings covered by registration statements filed on Form S-1 or Form S-8. The information incorporated by reference is considered

to be part of the prospectus included within each of those registration statements. Information in this Item 8.01 of this Current Report

on Form 8-K is therefore intended to be automatically incorporated by reference into each of the active registration statements listed

above, thereby amending them. Pursuant to Rule 416(b) under the Securities Act, the amount of undistributed shares of Common Stock deemed

to be covered by the effective registration statements of the Company described above are proportionately reduced as of the Effective

Time to give effect to the Reverse Stock Split.

|

Item 9.01. |

Financial Statements and Exhibits |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

MULLEN AUTOMOTIVE INC. |

| |

|

|

| Date: February 18, 2025 |

By: |

/s/ David Michery |

| |

|

David Michery |

| |

|

Chief Executive Officer |

Exhibit 3.1

CERTIFICATE

OF AMENDMENT

OF

SECOND

AMENDED AND RESTATED

CERTIFICATE

OF INCORPORATION

OF

MULLEN

AUTOMOTIVE INC.

(a

Delaware corporation)

MULLEN

AUTOMOTIVE INC., a corporation organized and existing under the laws of the State of Delaware (the “Corporation”), hereby

certifies as follows:

FIRST:

The name of the Corporation is Mullen Automotive Inc. The original Certificate of Incorporation of the Corporation was filed on October

2, 2012. The Second Amended and Restated Certificate of Incorporation of the Corporation was filed on November 5, 2021 and amended on

March 8, 2022, July 26, 2022, September 19, 2022, October 17, 2022, November 14, 2022, January 30, 2023, May 3, 2023, August 10, 2023,

December 20, 2023, May 1, 2024, May 31, 2024 and September 16, 2024 (collectively, the “Current Certificate”).

SECOND:

Pursuant to Section 242(b) of the Delaware General Corporation Law (the “DGCL”) the Board of Directors of the Corporation

has duly adopted, and the outstanding stock entitled to vote thereon, have approved the amendments to the Current Certificate set forth

in this Certificate of Amendment.

THIRD:

Pursuant to Section 242 of the DGCL, Section A of Article III of the Current Certificate is hereby amended and restated as follows:

A.

(I) Classes of Stock. This corporation is authorized to issue two classes of stock to be designated, respectively, common stock and preferred

stock. The total number of shares that this corporation is authorized to issue is Five Billion Five Hundred Million (5,500,000,000).

The total number of shares of common stock authorized to be issued is Five Billion (5,000,000,000), par value $0.001 per share (the “Common

Stock”). The total number of shares of preferred stock authorized to be issued is Five Hundred Million (500,000,000), par value

$0.001 per share (the “Preferred Stock”), of which Two Hundred Thousand (200,000) shares are designated as “Series

A Preferred Stock”, Twelve Million (12,000,000) shares are designated as “Series B Preferred Stock”, Forty Million

(40,000,000) shares are designated as “Series C Preferred Stock”, Four Hundred Thirty-Seven Million Five Hundred Thousand

One (437,500,001) shares are designated as “Series D Preferred Stock” and Seventy Six Thousand Nine Hundred Fifty (76,950)

shares are designated as “Series E Preferred Stock.”

(II)

Reverse Stock Split. Upon the effectiveness of the certificate of amendment first inserting this paragraph (II) (the “Effective

Time”), each two (2) to one hundred (100) shares of Common Stock outstanding immediately prior to the Effective Time shall be automatically

combined into one (1) outstanding share of Common Stock of the corporation, without any further action by the corporation or the holder

thereof, the exact ratio within the 2 to 100 range to be determined by the Board of Directors of the corporation prior to the Effective

Time and publicly announced by the corporation. Each certificate that immediately prior to the Effective Time represented shares of Common

Stock (“Old Certificates”) shall thereafter represent that number of shares of Common Stock into which the shares of Common

Stock represented by the Old Certificate shall have been combined, subject to any elimination of fractional share interests.

FOURTH:

On January 30, 2025, the Board of Directors of the Corporation determined that each sixty (60) shares of the Corporation’s Common

Stock, par value $0.001 per share, outstanding immediately prior to the Effective Time shall automatically be combined into one (1) validly

issued, fully paid and non-assessable share of Common Stock, par value $0.001 per share. The Corporation publicly announced this ratio

on February 13, 2025.

FIFTH:

This certificate of amendment shall become effective at 12:01 a.m. (local time in Wilmington, Delaware) on February 18, 2025.

[Remainder

of Page Intentionally Left Blank]

IN

WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment to be signed by its duly authorized officer this day of February,

2025, and the foregoing facts stated herein are true and correct.

| |

By: |

/s/ David Michery |

| |

Name: |

David

Michery |

| |

Title: |

Chief

Executive Officer, President |

Exhibit 99.1

Mullen

Automotive Inc. Announces Reverse Stock Split

Effective Feb. 18, 2025

BREA,

Calif., Feb. 13, 2025 -- via IBN -- Mullen Automotive Inc. (NASDAQ: MULN) (“Mullen” or the “Company”),

an electric vehicle (“EV”) manufacturer, announced today that it will effect a 1-for-60 reverse stock split (“Reverse

Stock Split”) of its common stock, par value $0.001 per share (“Common Stock”), that will become effective on Feb.

18, 2025, at 12:01 a.m. Eastern Time. The Common Stock will continue to trade on The Nasdaq Capital Market (“Nasdaq”) under

the existing symbol MULN and will begin trading on a split-adjusted basis when the market opens on Feb. 18, 2025. The new CUSIP number

for the Common Stock following the Reverse Stock Split will be 62526P604.

The

Reverse Stock Split is primarily intended to bring the Company into compliance with the $1.00 minimum bid price requirement for maintaining

its listing on Nasdaq. There is no guarantee the Company will meet the minimum bid price requirement.

At

the Company’s Special Meeting of Stockholders held on Jan. 31, 2025, the Company’s stockholders approved a proposal to authorize

a reverse stock split of the Company’s Common Stock, at a ratio within the range of 1-for-2 to 1-for-100. The Company’s board

of directors approved a 1-for-60 reverse split ratio, and the Company will file a Certificate of Amendment to its Second Amended and

Restated Certificate of Incorporation to effect the Reverse Stock Split effective Feb. 18, 2025.

The

1-for-60 Reverse Stock Split will automatically combine and convert 60 current shares of the Company’s Common Stock into one issued

and outstanding share of Common Stock. Proportional adjustments also will be made to outstanding equity awards, warrants and convertible

notes, and certain existing agreements pursuant to their terms; however, pursuant to the terms of the Company’s 2022 Equity Incentive

Plan, as amended, the number of shares then reserved for issuance under such plan will not be adjusted based upon the Reverse Stock Split

ratio. Proportionate adjustments will also be made to the per share conversion price of the Company’s series of preferred stock,

pursuant to their respective terms. The Reverse Stock Split will not change the par value of the Common Stock nor the authorized number

of shares of Common Stock, preferred stock or any series of preferred stock.

No

fractional shares will be issued in connection with the Reverse Stock Split. All fractional shares will be rounded up to the nearest

whole share. The Reverse Stock Split will affect all stockholders uniformly and will not alter any stockholder’s percentage interest

in the Company’s equity (other than as a result of the rounding of shares to the nearest whole share in lieu of issuing fractional

shares).

The

Company’s transfer agent, Continental Stock Transfer & Trust Company, will serve as exchange agent for the Reverse Stock Split.

Registered stockholders holding pre-split shares of the Company’s Common Stock electronically in book-entry form are not required

to take any action to receive post-split shares. Stockholders owning shares via a broker, bank, trust or other nominee will have their

positions automatically adjusted to reflect the Reverse Stock Split, subject to such broker’s particular processes, and will not

be required to take any action in connection with the Reverse Stock Split.

About

Mullen

Mullen

Automotive (NASDAQ: MULN) is a Southern California-based automotive company building the next generation of commercial EVs with two United

States-based vehicle plants located in Tunica, Mississippi, (120,000 square feet) and Mishawaka, Indiana (650,000 square feet). In August

2023, Mullen began commercial vehicle production in Tunica. As of January 2024, both the Mullen ONE, a Class 1 EV cargo van, and Mullen

THREE, a Class 3 EV cab chassis truck, are California Air Resource Board (“CARB”) and EPA certified and available for sale

in the U.S. The Company has also recently expanded its commercial dealer network to seven dealers, which includes Pape Kenworth, Pritchard

EV, National Auto Fleet Group, Ziegler Truck Group, Range Truck Group, Eco Auto, and Randy Marion Auto Group, providing sales and service

coverage in key West Coast, Midwest, Pacific Northwest, New England and Mid-Atlantic markets.

To

learn more about the Company, visit www.MullenUSA.com.

Forward-Looking

Statements

Certain

statements in this press release that are not historical facts are forward-looking statements within the meaning of Section 27A of the

Securities Exchange Act of 1934, as amended. Any statements contained in this press release that are not statements of historical fact

may be deemed forward-looking statements. Words such as “continue,” “will,” “may,” “could,”

“should,” “expect,” “expected,” “plans,” “intend,” “anticipate,”

“believe,” “estimate,” “predict,” “potential” and similar expressions are intended to

identify such forward-looking statements. All forward-looking statements involve significant risks and uncertainties that could cause

actual results to differ materially from those expressed or implied in the forward-looking statements, many of which are generally outside

the control of Mullen and are difficult to predict. Examples of such risks and uncertainties include but are not limited to how Mullen’s

stock will perform after the Reverse Stock Split, Mullen’s ability to timely implement the Reverse Stock Split, the success of

the Reverse Stock Split, and Mullen’s ability to regain compliance with Nasdaq Listing standards. Additional examples of such risks

and uncertainties include but are not limited to: (i) Mullen’s ability (or inability) to obtain additional financing in sufficient

amounts or on acceptable terms when needed; (ii) Mullen’s ability to maintain existing, and secure additional, contracts with manufacturers,

parts and other service providers relating to its business; (iii) Mullen’s ability to successfully expand in existing markets and

enter new markets; (iv) Mullen’s ability to successfully manage and integrate any acquisitions of businesses, solutions or technologies;

(v) unanticipated operating costs, transaction costs

and actual or contingent liabilities; (vi) the ability to attract and retain qualified

employees and key personnel; (vii) adverse effects of increased competition on Mullen’s business; (viii) changes in government

licensing and regulation that may adversely affect Mullen’s business; (ix) the risk that changes in consumer behavior could adversely

affect Mullen’s business; (x) Mullen’s ability to protect its intellectual property; and (xi) local, industry and general

business and economic conditions. Additional factors that could cause actual results to differ materially from those expressed or implied

in the forward-looking statements can be found in the most recent annual report on Form 10-K, quarterly reports on Form 10-Q and current

reports on Form 8-K filed by Mullen with the Securities and Exchange Commission. Mullen anticipates that subsequent events and developments

may cause its plans, intentions and expectations to change. Mullen assumes no obligation, and it specifically disclaims any intention

or obligation, to update any forward-looking statements, whether as a result of new information, future events, or otherwise, except

as expressly required by law. Forward-looking statements speak only as of the date they are made and should not be relied upon as representing

Mullen’s plans and expectations as of any subsequent date.

Contact:

Mullen

Automotive Inc.

+1

(714) 613-1900

www.MullenUSA.com

Corporate

Communications:

InvestorBrandNetwork

(IBN)

Los Angeles, California

www.InvestorBrandNetwork.com

310.299.1717 Office

Editor@InvestorBrandNetwork.com

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=muln_CommonStockParValue0.001Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=muln_RightsToPurchaseSeriesA1JuniorParticipatingPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

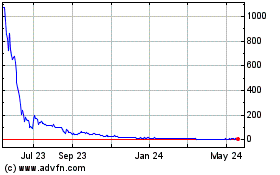

Mullen Automotive (NASDAQ:MULN)

Historical Stock Chart

From Jan 2025 to Feb 2025

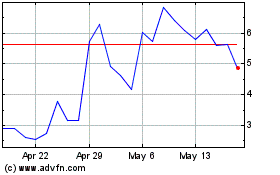

Mullen Automotive (NASDAQ:MULN)

Historical Stock Chart

From Feb 2024 to Feb 2025