via IBN -- Mullen Automotive Inc. (NASDAQ: MULN) (“Mullen” or the

“Company”), an electric vehicle (“EV”) manufacturer, today

announces financial results for the three months ended Dec. 31,

2024, and a current business update.

Commenting on the results for the three months that ended Dec.

31, 2024, and recent Company highlights, CEO and chairman David

Michery stated: “For the quarter, we invoiced for over $4.4M and

received $6M for vehicles delivered, which is our strongest quarter

to date. Bollinger is now moving with speed and attaining solid

commercial sales results. Mullen Commercial also has solid momentum

and continues to build on Class 1 and 3 sales opportunities across

the U.S. We’ve recently reduced our expenses even further and are

continuing our focus on growing our sales and customer base across

America. We’ve also recently furthered our efforts around U.S.

battery production capabilities with the additional purchase of

battery line equipment from Nikola Corporation (“Nikola”),

advancing our commitment to U.S. battery assembly and

production.”

FY2025-Q1 Highlights

Mullen Commercial – Troy,

Michigan Class 1 and 3 Commercial Vehicles

- Sale and order activity for Mullen commercial EVs in the last

quarter include:

- Mr. Appliance® of Owings Mills, Maryland, announced purchase of

the Mullen ONE EV cargo van, marking the Company’s first venture

into the home service vertical.

- Westland Floral purchased the Mullen THREE, Class 3 EV trucks

for the floral and nursery vertical.

- Associated Coffee, a San Francisco Bay Area coffee distributor,

purchased the Mullen THREE, Class 3 EV trucks for local coffee and

snack deliveries.

- Two leading California universities in Los Angeles and the San

Francisco Bay Area placed Class 1 EV cargo van orders, furthering

the Company’s commercial EV adoption across college

campuses.

- Ride-and-drive events, conducted in the last quarter to

increase awareness in many verticals, include AltWheels Fleet Day,

Zeem SeaTac EV Fleet Ride & Drive, ZEV Tour – Clean Fleet

Experience, NTEA Commercial Upfitting Summit, Fleet Forward

Conference and Zero Emissions Showcase.

- Mullen announced that Emerald Transportation Solutions, a

premier commercial refrigeration vehicle upfitter, is working with

the Papé Group to develop an advanced reefer upfit for the Mullen

THREE, a Class 3 all-electric truck.

Bollinger Motors – Oak Park,

Michigan Class 4 Commercial Truck

- Bollinger Motors delivered 20 B4

trucks recognizing additional revenues of $2.8 million.

- Bollinger expanded its national

sales and service network to include over 50 sales and service

locations including TEC Equipment, Affinity Truck Center, Anderson

Motors, Bergey’s Truck Centers, Broadway Ford Truck Center,

Nacarato Truck Centers, and Nuss Truck and Equipment.

- The Bollinger B4 Class 4 electric trucks are available for

government fleets through its partnership with National Auto Fleet

Group under the Sourcewell contract agreement

#032824-NAF.

- In November 2024, the 2025 Bollinger B4 became eligible for New

York State’s New York Truck Voucher Incentive Program, an incentive

for commercial electric vehicles from the New York State Energy and

Research Development Authority providing up to a $100,000 cash

voucher incentive on the all-electric B4 truck.

- Robert Bollinger, founder of Bollinger Motors, provided

Bollinger with $10 million in non-dilutive long-term debt financing

to support Bollinger’s production ramp-up and sale of the B4, Class

4 EV truck.

Battery Technology – Fullerton,

California

- The Company announced continued progress for battery production

in Fullerton, California, with three battery lines installed in

support of U.S.-made battery components and manufacturing. Lines

include:

- High volume standard battery chemistry line.

- Low volume standard chemistry R&D line.

- Low volume solid-state polymer R&D line.

- On Dec. 17, 2024, Mullen Automotive submitted a modified plan

to the U.S. Department of Energy (“DOE”) that incorporates its

facilities in Mishawaka, Indiana, and Fullerton, California, for

U.S.-based battery and pack production. In total, Mullen is seeking

$55 million in matching DOE funds to support the U.S. manufacturing

capabilities.

Financial Results for the Three Months

Ended Dec. 31, 2024

Losses and non-cash

expenses

The net loss attributable to common shareholders

after preferred dividends was $114.9 million, or $661.33 net loss

per share, for the three months ended Dec. 31, 2024, as compared to

a net loss attributable to common shareholders after preferred

dividends of $61.4 million, or $91,940.42 loss per share, for the

three months ended Dec. 31, 2023 (giving retroactive effect to

reverse stock splits, including 1:60 reverse stock split that was

made effective on Feb. 18, 2025).

Major part of the losses during the three months

ended Dec. 31, 2024, related to non-cash expenses: $91.0 million or

79% of the loss for the three months ended Dec. 31, 2024, versus

$23.3 million or 38% of the loss for the three months ended Dec.

31, 2023.

| |

|

Three months ended Dec. 31 |

| |

|

2024 |

|

2023 |

|

Non-cash expenses and gains during the

period: |

|

|

|

|

|

|

|

|

| Revaluation of warrants and

derivative liabilities |

|

$ |

34,629,786 |

|

|

$ |

6,728,981 |

|

| Other financing costs -

initial recognition of warrants |

|

|

16,078,622 |

|

|

|

— |

|

| Stock-based compensation |

|

|

18,591,750 |

|

|

|

13,903,416 |

|

| Amortization of debt discount

and other non-cash interest expense |

|

|

17,678,751 |

|

|

|

160,664 |

|

| Depreciation and

amortization |

|

|

4,745,928 |

|

|

|

4,343,960 |

|

| Loss/(gain) on extinguishment

of debt |

|

|

(1,553,771 |

) |

|

|

— |

|

| Write-down of inventory to net

realizable value |

|

|

838,765 |

|

|

|

— |

|

| Deferred income taxes |

|

|

— |

|

|

|

(1,726,238 |

) |

| Other gains |

|

|

— |

|

|

|

(125,990 |

) |

| Total non-cash

expenses and gains |

|

$ |

91,009,831 |

|

|

$ |

23,284,793 |

|

| |

|

|

|

|

|

|

|

|

Revenue

During the three months ended Dec. 31, 2024, we invoiced

for 58 vehicles valued at $4.4 million,

received $6.0 million in cash and recorded $2.9

million in revenues. The difference between invoiced

amounts and revenues was due to the Company continuing to

defer the revenue recognition on most of Mullen commercial

vehicles invoiced until invoices are paid and the return

provision on the vehicles is nullified by dealer’s sale of the

vehicle to the end user.

In September 2024, our Bollinger segment achieved a major

milestone, launching production of the first B4 commercial trucks.

For the three months ended Dec. 31, 2024, the Bollinger segment

completed the sale of 20 units and recognized revenues

of $2.8 million.

|

Invoiced during the 3 months ended Dec. 31, 2024 (dollars

in thousands) |

|

Vehicle type |

|

Units invoiced |

|

|

Amount invoiced |

|

|

Cash received |

|

|

Revenue recognized |

|

Mullen 3 (UU) |

|

|

11 |

|

|

|

706 |

|

|

|

2,852 |

|

|

|

32 |

| Mullen Urban Delivery

(UD1) |

|

|

27 |

|

|

|

885 |

|

|

|

248 |

|

|

|

— |

| Bollinger B4 |

|

|

20 |

|

|

|

2,777 |

|

|

|

2,777 |

|

|

|

2,777 |

| Destination freight charges

and other services |

|

|

— |

|

|

|

— |

|

|

|

112 |

|

|

|

112 |

| Total |

|

|

58 |

|

|

$ |

4,368 |

|

|

$ |

5,988 |

|

|

$ |

2,920 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liquidity

We had total cash (including restricted cash) of

$2.7 million on Dec. 31, 2024, versus $10.7 million

on Sept. 30, 2024. The working capital as of Dec. 31,

2024, was negative $186.2 million, or $41.2 million

if adding back derivative liabilities and other liabilities

expected to be settled in common stock.

To finance the business, we received $8.8

million during the three months ended Dec. 31, 2024,

issuing senior secured convertible notes and warrants.

Furthermore, the Company received $1 million proceeds in accordance

with the equity line of credit agreement. Also, Bollinger Motors,

Inc., our majority-owned subsidiary, received a $10 million

long-term loan, providing additional capital to support the

production and sale of Bollinger’s Class 4 EV truck, the B4. This

loan is secured by part of the assets of Bollinger Motors and

repayment of the principal is due by Oct. 30, 2026.

During the three months ended Dec. 31, 2024, the

Company did not use any cash to settle its debt. A major part

of Senior secured convertible notes (with a principal of $17.2

million) that were outstanding on Sept. 30, 2024, as well as

accumulated interest (in amount of $1.2 million), have been

converted into shares of common stock. Also, the Company

reached an agreement with holders of matured notes and loan

advances in amount of $2.7 million, as well as accumulated

interest in amount of approximately $1.8 million, that the

liabilities would be settled by issuance of shares of common stock

of the Company worth of $3 million. The liability was fully settled

by December 2024 and the transaction resulted in recognition of

gain on extinguishment of $1.5 million.

The total cash spent (Operating and

Investing cash flows) during the three months ended Dec. 31,

2024, and 2023, was $27.8 million and $66.8 million,

respectively, which represents a decrease of

$39.0 million, or 58.4%. As it was announced

previously, the Company intends to maintain its momentum of

reducing the cash outflow by cutting operating costs and

restructuring liabilities.

| |

|

Three months ended Dec. 31, |

| |

|

2024 |

|

|

2023 |

|

Net loss |

|

$ |

(118,797,845 |

) |

|

|

$ |

(63,993,379 |

) |

| Non-cash adjustments (see

table above for details) |

|

|

91,009,831 |

|

|

|

|

23,284,793 |

|

| Changes in working

capital |

|

|

2,223,601 |

|

|

|

|

(19,182,967 |

) |

|

Net cash used in operating activities |

|

|

(25,564,413 |

) |

|

|

|

(59,891,553 |

) |

|

Net cash used in investing activities |

|

|

(2,220,984 |

) |

|

|

|

(6,865,681 |

) |

|

Cash spent |

|

$ |

(27,785,397 |

) |

|

|

$ |

(66,757,234 |

) |

| |

|

|

|

|

|

|

|

|

|

Financial statements

Following are our unaudited Condensed

Consolidated Balance Sheets for the three months ended Dec. 31,

2024, and the year ended Sept. 30, 2024, Condensed Consolidated

Statements of Operations and Condensed Consolidated Statements of

Cash Flows for the three months ended Dec. 31, 2024 and 2023.

|

MULLEN AUTOMOTIVE INC. |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(unaudited) |

| |

| |

|

Dec. 31, 2024 |

|

Sept. 30, 2024 |

|

ASSETS |

|

|

|

|

|

|

|

|

|

CURRENT ASSETS |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

2,325,190 |

|

|

$ |

10,321,827 |

|

|

Restricted cash |

|

|

418,451 |

|

|

|

426,851 |

|

|

Inventory |

|

|

41,770,397 |

|

|

|

37,503,112 |

|

|

Prepaid expenses and other current assets |

|

|

15,297,034 |

|

|

|

14,798,553 |

|

|

Accounts receivable |

|

|

98,855 |

|

|

|

124,295 |

|

|

TOTAL CURRENT ASSETS |

|

|

59,909,927 |

|

|

|

63,174,638 |

|

|

|

|

|

|

|

|

|

|

|

|

Property, plant, and equipment, net |

|

|

80,796,898 |

|

|

|

82,180,266 |

|

|

Intangible assets, net |

|

|

26,172,956 |

|

|

|

27,056,030 |

|

|

Right-of-use assets |

|

|

2,955,081 |

|

|

|

3,041,485 |

|

|

Other noncurrent assets |

|

|

3,182,235 |

|

|

|

3,178,870 |

|

|

TOTAL ASSETS |

|

$ |

173,017,097 |

|

|

$ |

178,631,289 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS' EQUITY (DEFICIT) |

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

47,860,411 |

|

|

$ |

41,335,509 |

|

|

Accrued expenses and other current liabilities |

|

|

46,637,723 |

|

|

|

51,612,166 |

|

|

Derivative liabilities |

|

|

136,989,818 |

|

|

|

79,742,180 |

|

|

Liability to issue shares |

|

|

8,015,361 |

|

|

|

1,771,025 |

|

|

Lease liabilities, current portion |

|

|

2,981,613 |

|

|

|

2,893,967 |

|

|

Notes payable, current portion |

|

|

3,219,147 |

|

|

|

5,399,777 |

|

|

Refundable deposits |

|

|

409,272 |

|

|

|

417,674 |

|

|

TOTAL CURRENT LIABILITIES |

|

|

246,113,345 |

|

|

|

183,172,298 |

|

|

Notes payable, net of current portion |

|

|

10,000,000 |

|

|

|

— |

|

|

Liability to issue shares, net of current portion |

|

|

— |

|

|

|

356,206 |

|

|

Lease liabilities, net of current portion |

|

|

11,113,091 |

|

|

|

11,648,662 |

|

|

TOTAL LIABILITIES |

|

$ |

267,226,436 |

|

|

$ |

195,177,166 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

STOCKHOLDERS' EQUITY (DEFICIT) |

|

|

|

|

|

|

|

|

|

Preferred stock; $0.001 par value; 126,263,159 preferred shares

authorized; |

|

|

|

|

|

|

|

|

|

Preferred Series D; 84,572,538 shares authorized; 363,097 and

363,097 shares issued and outstanding at Dec. 31, 2024, and Sept.

30, 2024, respectively (preference in liquidation of $159,000 and

$159,000 at Dec. 31, 2024. and Sep. 30, 2024, respectively) |

|

|

363 |

|

|

|

363 |

|

|

Preferred Series C; 24,874,079 shares authorized; 458 and 458

shares issued and outstanding at Dec. 31, 2024, and Sept. 30, 2024,

respectively (preference in liquidation of $4,049 and $10,696,895

at Dec. 31, 2024, and Sept. 30, 2024, respectively) |

|

|

— |

|

|

|

— |

|

|

Preferred Series A; 83,859 shares authorized; 648 and 648 shares

issued and outstanding at Dec. 31, 2024, and Sept. 30, 2024,

respectively (preference in liquidation of $836 and $836 at Dec.

31, 2024, and Sept. 30, 2024, respectively) |

|

|

1 |

|

|

|

1 |

|

|

Common stock; $0.001 par value; 5,000,000,000 shares authorized at

Dec. 31, 2024, and Sept. 30, 2024; 404,334 and 76,288 shares issued

and outstanding at Dec. 31, 2024, and Sept. 30, 2024,

respectively |

|

|

404 |

|

|

|

76 |

|

|

Additional paid-in capital |

|

|

2,331,034,194 |

|

|

|

2,290,664,472 |

|

|

Accumulated deficit |

|

|

(2,434,109,495 |

) |

|

|

(2,319,220,938 |

) |

|

TOTAL STOCKHOLDERS' EQUITY (DEFICIT) ATTRIBUTABLE TO THE

COMPANY'S STOCKHOLDERS |

|

|

(103,074,533 |

) |

|

|

(28,556,026 |

) |

|

Noncontrolling interest |

|

|

8,865,194 |

|

|

|

12,010,149 |

|

|

TOTAL STOCKHOLDERS' EQUITY (DEFICIT) |

|

|

(94,209,339 |

) |

|

|

(16,545,877 |

) |

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY

(DEFICIT) |

|

$ |

173,017,097 |

|

|

$ |

178,631,289 |

|

|

MULLEN AUTOMOTIVE INC. |

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

(unaudited) |

| |

| |

|

Three months ended Dec. 31, |

| |

|

2024 |

|

2023 |

|

|

|

|

|

|

|

|

|

|

| Revenue from sale of

vehicles |

|

$ |

2,920,485 |

|

|

$ |

— |

|

| Cost of revenues |

|

|

6,588,933 |

|

|

|

— |

|

| Gross

loss |

|

|

(3,668,448 |

) |

|

|

— |

|

| |

|

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

| General and

administrative |

|

$ |

36,484,409 |

|

|

$ |

43,234,052 |

|

| Research and development |

|

|

11,282,375 |

|

|

|

16,169,967 |

|

| Loss from

operations |

|

|

(51,435,232 |

) |

|

|

(59,404,019 |

) |

| |

|

|

|

|

|

|

|

|

| Other income

(expense): |

|

|

|

|

|

|

|

|

| Other financing costs -

initial recognition of warrants |

|

|

(16,078,622 |

) |

|

|

— |

|

| Gain/(loss) on warrants and

derivative liability revaluation |

|

|

(34,629,786 |

) |

|

|

(6,728,981 |

) |

| Gain/(loss) on extinguishment

of debt |

|

|

1,553,771 |

|

|

|

— |

|

| Interest expense |

|

|

(18,665,369 |

) |

|

|

(258,023 |

) |

| Other income, net |

|

|

457,993 |

|

|

|

671,406 |

|

| Total other income

(expense) |

|

|

(67,362,013 |

) |

|

|

(6,315,598 |

) |

| Net loss before income

tax benefit |

|

$ |

(118,797,245 |

) |

|

$ |

(65,719,617 |

) |

| |

|

|

|

|

|

|

|

|

| Income tax benefit/

(provision) |

|

|

(600 |

) |

|

|

1,726,238 |

|

| Net loss |

|

|

(118,797,845 |

) |

|

|

(63,993,379 |

) |

| |

|

|

|

|

|

|

|

|

| Net loss attributable to

noncontrolling interest |

|

|

(3,909,288 |

) |

|

|

(2,598,481 |

) |

| Net loss attributable

to stockholders |

|

$ |

(114,888,557 |

) |

|

$ |

(61,394,898 |

) |

| |

|

|

|

|

|

|

|

|

| Waived/(accrued) accumulated

preferred dividends and other capital transactions with preferred

stockholders |

|

|

(24,728 |

) |

|

|

(21,303 |

) |

| |

|

|

|

|

|

|

|

|

| Net loss attributable

to common stockholders after preferred dividends and other capital

transactions with preferred stockholders |

|

$ |

(114,913,285 |

) |

|

$ |

(61,416,201 |

) |

| |

|

|

|

|

|

|

|

|

| Net Loss per Share |

|

$ |

(661.33 |

) |

|

$ |

(91,940.42 |

) |

| |

|

|

|

|

|

|

|

|

| Weighted average shares

outstanding, basic and diluted |

|

|

173,762 |

|

|

|

668 |

|

|

MULLEN AUTOMOTIVE INC. |

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS |

|

(unaudited) |

| |

| |

|

Three Months Ended Dec. 31, |

| |

|

2024 |

|

2023 |

|

Cash Flows from Operating Activities |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(118,797,845 |

) |

|

$ |

(63,993,379 |

) |

| Adjustments to reconcile net

loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

|

Stock-based compensation |

|

|

18,591,750 |

|

|

|

13,903,416 |

|

|

Revaluation of warrants and derivative liabilities |

|

|

34,629,786 |

|

|

|

6,728,981 |

|

|

Other financing costs - initial recognition of warrants |

|

|

16,078,622 |

|

|

|

— |

|

|

Amortization of debt discount and other non-cash interest

expense |

|

|

17,678,751 |

|

|

|

160,664 |

|

|

Depreciation and amortization |

|

|

4,745,928 |

|

|

|

4,343,960 |

|

|

Loss/(gain) on extinguishment of debt |

|

|

(1,553,771 |

) |

|

|

— |

|

|

Write-down of inventory to net realizable value |

|

|

838,765 |

|

|

|

— |

|

|

Deferred income taxes |

|

|

— |

|

|

|

(1,726,238 |

) |

|

Other gains |

|

|

— |

|

|

|

(125,990 |

) |

| |

|

|

|

|

|

|

|

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

25,440 |

|

|

|

671,750 |

|

|

Inventories |

|

|

(5,106,050 |

) |

|

|

(13,912,516 |

) |

|

Prepaids and other assets |

|

|

3,363,323 |

|

|

|

(1,781,132 |

) |

|

Accounts payable |

|

|

6,266,401 |

|

|

|

1,317,232 |

|

|

Accrued expenses and other liabilities |

|

|

(1,963,992 |

) |

|

|

(3,044,392 |

) |

|

Right-of-use assets and lease liabilities |

|

|

(361,521 |

) |

|

|

(2,433,909 |

) |

|

Net cash used in operating activities |

|

|

(25,564,413 |

) |

|

|

(59,891,553 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash Flows from Investing Activities |

|

|

|

|

|

|

|

|

|

Purchase of equipment |

|

|

(2,220,984 |

) |

|

|

(6,865,681 |

) |

|

Net cash used in investing activities |

|

|

(2,220,984 |

) |

|

|

(6,865,681 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash Flows from Financing Activities |

|

|

|

|

|

|

|

|

|

Proceeds from issuance of notes payable with detachable

warrants |

|

|

8,763,225 |

|

|

|

— |

|

|

Proceeds from issuance of notes payable by subsidiary |

|

|

10,000,000 |

|

|

|

— |

|

|

Issuance of stock under equity line of credit |

|

|

1,017,135 |

|

|

|

— |

|

|

Net cash provided by financing activities |

|

|

19,780,360 |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

Change in cash |

|

|

(8,005,037 |

) |

|

|

(66,757,234 |

) |

|

Cash and restricted cash (in amount of $426,851), beginning of

period |

|

|

10,748,678 |

|

|

|

155,696,470 |

|

|

Cash and restricted cash (in amount of $418,451), ending of

period |

|

$ |

2,743,641 |

|

|

$ |

88,939,236 |

|

| |

|

|

|

|

|

|

|

|

|

Supplemental disclosure of Cash Flow

information: |

|

|

|

|

|

|

|

|

|

Cash paid for interest |

|

$ |

250,000 |

|

|

$ |

— |

|

| |

|

|

|

|

|

|

|

|

|

Supplemental Disclosure for Non-Cash

Activities: |

|

|

|

|

|

|

|

|

|

Amount to be received from investor for warrants and notes |

|

$ |

5,000,000 |

|

|

$ |

— |

|

|

Convertible notes and interest - conversion to common stock |

|

|

16,667,250 |

|

|

|

— |

|

|

Extinguishment of debt and interest (in exchange for own common

stock) |

|

|

4,553,771 |

|

|

|

— |

|

|

Exercise of warrants recognized earlier as liabilities |

|

|

3,954,023 |

|

|

|

50,877,669 |

|

|

Change in noncontrolling interest upon additional investments into

subsidiary |

|

|

509,517 |

|

|

|

— |

|

|

Right-of-use assets obtained in exchange of operating lease

liabilities |

|

|

— |

|

|

|

8,932,159 |

|

| |

|

|

|

|

|

|

|

|

About Mullen

Mullen Automotive (NASDAQ: MULN) is a Southern California-based

automotive company building the next generation of commercial

electric vehicles (“EVs”) with two United States-based vehicle

plants located in Tunica, Mississippi, (120,000 square feet) and

Mishawaka, Indiana (650,000 square feet). In August 2023, Mullen

began commercial vehicle production in Tunica. As of January 2024,

both the Mullen ONE, a Class 1 EV cargo van, and Mullen THREE, a

Class 3 EV cab chassis truck, are California Air Resource Board

(“CARB”) and EPA certified and available for sale in the U.S. The

Company’s commercial dealer network consists of seven dealers,

which includes Papé Kenworth, Pritchard EV, National Auto Fleet

Group, Ziegler Truck Group, Range Truck Group, Eco Auto, and Randy

Marion Auto Group, providing sales and service coverage in key West

Coast, Midwest, Pacific Northwest, New England, and Mid-Atlantic

markets.

On Sept. 7, 2022, Bollinger Motors, of Oak Park, Michigan,

became a majority-owned EV truck company of Mullen Automotive.

Bollinger Motors has passed numerous milestones including its B4,

Class 4 electric truck production launch on Sept. 16, 2024, and the

development of a world-class dealer and service network with over

50 locations across the United States.

To learn more about the Company, visit

www.MullenUSA.com.

Forward-Looking Statements

Certain statements in this press release that

are not historical facts are forward-looking statements within the

meaning of Section 27A of the Securities Exchange Act of 1934, as

amended. Any statements contained in this press release that are

not statements of historical fact may be deemed forward-looking

statements. Words such as "continue," "will," "may," "could,"

"should," "expect," "expected," "plans," "intend," "anticipate,"

"believe," "estimate," "predict," "potential" and similar

expressions are intended to identify such forward-looking

statements. All forward-looking statements involve significant

risks and uncertainties that could cause actual results to differ

materially from those expressed or implied in the forward-looking

statements, many of which are generally outside the control of

Mullen and are difficult to predict. Examples of such risks and

uncertainties include, but are not limited to whether sales demand

and traction for its vehicles will continue, whether federal, state

and other electric vehicle incentive programs will continue, the

outcome of the Company’s application to DOE for $55 million in

matching DOE funds to support its U.S. manufacturing capabilities

and whether the Company will be successful with its battery

development initiatives or meet its projected battery production,

certification and sales timelines. Additional examples of such

risks and uncertainties include but are not limited to: (i)

Mullen’s ability (or inability) to obtain additional financing in

sufficient amounts or on acceptable terms when needed; (ii)

Mullen's ability to maintain existing, and secure additional,

contracts with manufacturers, parts and other service providers

relating to its business; (iii) Mullen’s ability to successfully

expand in existing markets and enter new markets; (iv) Mullen’s

ability to successfully manage and integrate any acquisitions of

businesses, solutions or technologies; (v) unanticipated operating

costs, transaction costs and actual or contingent liabilities; (vi)

the ability to attract and retain qualified employees and key

personnel; (vii) adverse effects of increased competition on

Mullen’s business; (viii) changes in government licensing and

regulation that may adversely affect Mullen’s business; (ix) the

risk that changes in consumer behavior could adversely affect

Mullen’s business; (x) Mullen’s ability to protect its intellectual

property; and (xi) local, industry and general business and

economic conditions. Additional factors that could cause actual

results to differ materially from those expressed or implied in the

forward-looking statements can be found in the most recent annual

report on Form 10-K, quarterly reports on Form 10-Q and current

reports on Form 8-K filed by Mullen with the Securities and

Exchange Commission. Mullen anticipates that subsequent events and

developments may cause its plans, intentions and expectations to

change. Mullen assumes no obligation, and it specifically disclaims

any intention or obligation, to update any forward-looking

statements, whether as a result of new information, future events

or otherwise, except as expressly required by law. Forward-looking

statements speak only as of the date they are made and should not

be relied upon as representing Mullen’s plans and expectations as

of any subsequent date.

Contact:

Mullen Automotive, Inc.+1 (714) 613-1900www.MullenUSA.com

Corporate CommunicationsIBNAustin,

Texaswww.InvestorBrandNetwork.com512.354.7000

OfficeEditor@InvestorBrandNetwork.com

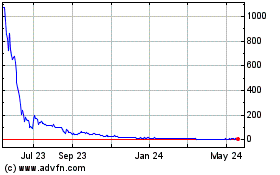

Mullen Automotive (NASDAQ:MULN)

Historical Stock Chart

From Jan 2025 to Feb 2025

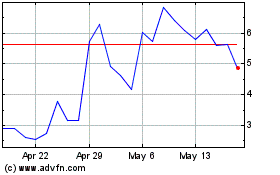

Mullen Automotive (NASDAQ:MULN)

Historical Stock Chart

From Feb 2024 to Feb 2025