Quanterix Corpfalse000150327400015032742024-08-082024-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 8, 2024

QUANTERIX CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-38319 | 20-8957988 |

(State or other jurisdiction

of incorporation) | (Commission File Number) | (IRS Employer

Identification No.) |

| | | | | |

900 Middlesex Turnpike | |

Billerica, MA | 01821 |

(Address of principal executive offices) | (Zip Code) |

(617) 301-9400

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which

registered |

| Common Stock, $0.001 par value per share | | QTRX | | The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging Growth Company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On August 8, 2024, Quanterix Corporation (“Quanterix”) issued a press release announcing its financial results for the second quarter ended June 30, 2024 (the “Earnings Release”). A copy of the Earnings Release is furnished as Exhibit 99.1 and is incorporated herein by reference.

The information in this Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits

| | | | | | | | |

Exhibit

No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| QUANTERIX CORPORATION |

| | |

| By: | /s/ Vandana Sriram |

| | Vandana Sriram |

| | Chief Financial Officer |

Date: August 8, 2024

Exhibit 99.1

Quanterix Releases Financial Results for the Second Quarter of 2024

BILLERICA, Mass. – August 8, 2024 - Quanterix Corporation (NASDAQ: QTRX), a company fueling scientific discovery through ultra-sensitive biomarker detection, today announced financial results for the second quarter ended June 30, 2024.

“Our research business once again delivered strong performance in the second quarter, growing double digits,” said Masoud Toloue, Chief Executive Officer of Quanterix. “Demand for Simoa sensitivity continues, as highlighted by a 35% increase in Accelerator service revenue compared to the corresponding prior year period, as customers are able to access our technology without impacting their capital expenditure budgets. For the balance of 2024, we expect to continue to execute against our strategy: delivering new menu for our research customers, innovating toward a new platform, and building the infrastructure for blood-based Alzheimer’s Diagnostics.”

Second Quarter Financial Highlights

•Revenue of $34.4 million, an increase of 10.8% compared to $31.0 million in the corresponding prior year period.

•GAAP gross margin of 58.3%, as compared to 61.7% in the prior year period. Non-GAAP gross margin of 52.3% as compared to 56.4% in the corresponding prior year period.

•Net loss of $9.5 million, an increase of $3.4 million compared to the corresponding prior year period.

•Net cash usage in the quarter was $5.1 million, and the Company ended the period with $299.5 million of cash, cash equivalents, marketable securities, and restricted cash.

Operational and Business Highlights

•The Company presented data at the Alzheimer’s Association International Conference (AAIC), demonstrating successful validation of a multi-marker approach for Alzheimer’s disease detection. The findings showed a multi-marker test with an algorithm improved diagnostic certainty compared to a stand-alone p-Tau 217 test, reducing the test’s intermediate zone three-fold from 31.2% to 10.5%, while maintaining overall accuracy above 90%.

•The Company announced four new partnerships to provide access to Alzheimer’s disease diagnostic testing. These partners consist of three large domestic hospital systems, Mt. Sinai, Banner Health, and UCSF, and a leading laboratory in China, KingMed Diagnostics.

•Utilizing data produced using the Company’s Accelerator lab services, the biotechnology company Annexon Biosciences reported that they demonstrated positive topline results for their pivotal phase 3 trial in Guillain-Barre Syndrome. As part of the trial, Annexon reported that they demonstrated their therapy ANX005 reduced levels of neurofilament light (Nf-L) between weeks two and four of therapy.

2024 Full Year Business Outlook

The Company has revised its 2024 revenue guidance range to $134 million to $138 million, compared to $139 million to $144 million previously due to what remains a constrained capital funding environment. This revenue range excludes revenue from Lucent Diagnostics testing, which we expect to be immaterial for 2024. The Company continues to expect GAAP gross margin percentage to be in the range of 57%-61%, and non-GAAP gross margin percentage in the range of 51%-55%. Finally, the Company anticipates 2024 cash usage (change in cash, cash equivalents, marketable securities, and restricted cash) to be at the higher end of its prior cash usage range of $25 million to $30 million.

For additional information on the non-GAAP financial measures included in this press release, please see “Use of Non-GAAP Financial Measures” and “Reconciliation of GAAP to Non-GAAP Financial Measures” below.

Conference Call

In conjunction with this announcement, the Company will host a conference call on August 8, 2024 at 4:30 p.m. E.T. Click here to register for the conference call and obtain your dial-in number and passcode.

Interested investors can also listen to the live webcast from the Event Details page in the Investors section of the Quanterix website at http://www.quanterix.com. An archived webcast replay will be available on the Company’s website for one year.

Financial Highlights

Quanterix Corporation

Consolidated Statements of Operations

(Unaudited, amounts in thousands except per share data)

| | | | | | | | | | | |

| Three Months Ended June 30, |

| 2024 | | 2023 |

| Revenues: | | | |

| Product revenue | $ | 19,887 | | | $ | 19,692 | |

| Service and other revenue | 13,511 | | | 10,552 | |

| Collaboration and license revenue | 729 | | | 629 | |

| Grant revenue | 254 | | | 156 | |

| Total revenues | 34,381 | | | 31,029 | |

| Costs of goods sold and services: | | | |

| Cost of product revenue | 8,851 | | | 7,236 | |

| Cost of service and other revenue | 5,472 | | | 4,655 | |

| Total costs of goods sold and services | 14,323 | | | 11,891 | |

| Gross profit | 20,058 | | | 19,138 | |

| Operating expenses: | | | |

| Research and development | 8,104 | | | 5,946 | |

| Selling, general and administrative | 24,135 | | | 21,591 | |

| Other lease costs | 927 | | | 1,162 | |

| Total operating expenses | 33,166 | | | 28,699 | |

| Loss from operations | (13,108) | | | (9,561) | |

| Interest income | 3,681 | | | 3,886 | |

Other income (expense), net | (9) | | | (154) | |

| Loss before income taxes | (9,436) | | | (5,829) | |

| Income tax expense | (37) | | | (235) | |

| Net loss | $ | (9,473) | | | $ | (6,064) | |

| | | |

| Net loss per common share, basic and diluted | $ | (0.25) | | | $ | (0.16) | |

| | | |

| Weighted-average common shares outstanding, basic and diluted | 38,338 | | 37,494 |

Quanterix Corporation

Consolidated Balance Sheets

(Unaudited, amounts in thousands)

| | | | | | | | | | | |

| June 30, 2024 | | December 31, 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 47,002 | | | $ | 174,422 | |

| Marketable securities | 249,853 | | | 146,902 | |

| Accounts receivable, net of allowance for expected credit losses | 31,784 | | | 25,414 | |

| Inventory | 28,363 | | | 22,365 | |

| Prepaid expenses and other current assets | 8,724 | | | 9,291 | |

| Total current assets | 365,726 | | | 378,394 | |

| Restricted cash | 2,607 | | | 2,604 | |

| Property and equipment, net | 18,205 | | | 17,926 | |

| Intangible assets, net | 4,981 | | | 6,034 | |

| Operating lease right-of-use assets | 17,399 | | | 18,251 | |

| Other non-current assets | 2,370 | | | 1,802 | |

| Total assets | $ | 411,288 | | | $ | 425,011 | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 7,273 | | | $ | 5,048 | |

| Accrued compensation and benefits | 9,044 | | | 13,659 | |

| Accrued expenses and other current liabilities | 6,577 | | | 6,041 | |

| Deferred revenue | 10,121 | | | 9,468 | |

| Operating lease liabilities | 4,524 | | | 4,241 | |

| Total current liabilities | 37,539 | | | 38,457 | |

| Deferred revenue, net of current portion | 928 | | | 1,227 | |

| Operating lease liabilities, net of current portion | 35,052 | | | 37,223 | |

| Other non-current liabilities | 1,017 | | | 1,177 | |

| Total liabilities | 74,536 | | | 78,084 | |

| Total stockholders’ equity | 336,752 | | | 346,927 | |

| Total liabilities and stockholders’ equity | $ | 411,288 | | | $ | 425,011 | |

Quanterix Corporation

Consolidated Statements of Cash Flows

(Unaudited, amounts in thousands)

| | | | | | | | | | | | |

| Six Months Ended June 30, | |

| 2024 | | 2023 | |

| Cash flows from operating activities: | | | | |

| Net loss | $ | (19,545) | | | $ | (12,167) | | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | |

| Depreciation and amortization expense | 3,124 | | | 2,845 | | |

| Credit losses on accounts receivable | 676 | | | 324 | | |

| Accretion of marketable securities | (3,619) | | | — | | |

| Operating lease right-of-use asset amortization | 840 | | | 1,002 | | |

| Stock-based compensation expense | 10,493 | | | 8,095 | | |

| Other operating activity | (13) | | | 548 | | |

| Changes in assets and liabilities: | | | | |

| Accounts receivable | (7,242) | | | (5,750) | | |

| Inventory | (6,011) | | | (1,181) | | |

| Prepaid expenses and other current assets | 597 | | | (527) | | |

| Other non-current assets | (596) | | | (965) | | |

| Accounts payable | 2,054 | | | (631) | | |

| Accrued compensation and benefits, accrued expenses, and other current liabilities | (4,390) | | | (1,326) | | |

| Deferred revenue | 354 | | | 1,666 | | |

| Operating lease liabilities | (1,876) | | | (730) | | |

| Other non-current liabilities | 39 | | | (72) | | |

| Net cash used in operating activities | (25,115) | | | (8,869) | | |

| Cash flows from investing activities: | | | | |

| Purchases of marketable securities | (189,344) | | | — | | |

| Proceeds from maturities of marketable securities | 89,229 | | | — | | |

| Purchases of property and equipment | (2,105) | | | (784) | | |

| Net cash used in investing activities | (102,220) | | | (784) | | |

| Cash flows from financing activities: | | | | |

| Proceeds from common stock issued under stock plans | 2,421 | | | 777 | | |

| Payments for employee taxes withheld on stock-based compensation awards | (2,150) | | | (87) | | |

| Net cash provided by financing activities | 271 | | | 690 | | |

| Net decrease in cash, cash equivalents, and restricted cash | (127,064) | | | (8,963) | | |

| Effect of exchange rate changes on cash, cash equivalents, and restricted cash | (353) | | | (163) | | |

| Cash, cash equivalents, and restricted cash at beginning of period | 177,026 | | | 341,337 | | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 49,609 | | | $ | 332,211 | | |

Use of Non-GAAP Financial Measures

To supplement our financial statements presented on a U.S. GAAP basis, we present non-GAAP gross profit, non-GAAP gross margin, non-GAAP total operating expenses, and non-GAAP loss from operations. These non-GAAP measures are calculated by including shipping and handling costs for product sales within cost of product revenue instead of within selling, general and administrative expenses. We use these non-GAAP measures to evaluate our operating performance in a manner that allows for meaningful period-to-period comparison and analysis of trends in our business and our competitors. We believe that presentation of these non-GAAP measures provides useful information to investors in assessing our operating performance within our industry and to allow comparability to the presentation of other companies in our industry where shipping and handling costs are included in cost of goods sold for products. The non-GAAP financial information presented here should be considered in conjunction with, and not as a substitute for, the financial information presented in accordance with U.S. GAAP.

Set forth below is a reconciliation of non-GAAP gross profit, non-GAAP gross margin, non-GAAP total operating expenses, and non-GAAP loss from operations to their most directly comparable GAAP financial measures.

Reconciliation of GAAP to Non-GAAP Financial Measures

Quanterix Corporation

Reconciliation of GAAP Financial Measures to Non-GAAP Financial Measures

(Unaudited, amounts in thousands except percentages)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| GAAP gross profit | $ | 20,058 | | $ | 19,138 | | $ | 39,684 | | $ | 36,064 |

| Shipping and handling costs | (2,075) | | | (1,623) | | | (4,217) | | | (3,451) | |

| Non-GAAP gross profit | $ | 17,983 | | $ | 17,515 | | $ | 35,467 | | $ | 32,613 |

| | | | | | | |

| GAAP revenue | $ | 34,381 | | $ | 31,029 | | $ | 66,447 | | $ | 59,485 |

| GAAP gross margin (gross profit as % of revenue) | 58.3% | | 61.7% | | 59.7% | | 60.6% |

| Non-GAAP gross margin (non-GAAP gross profit as % of revenue) | 52.3% | | 56.4% | | 53.4% | | 54.8% |

| | | | | | | |

| GAAP total operating expenses | $ | 33,166 | | $ | 28,699 | | $ | 66,758 | | $ | 55,045 |

| Shipping and handling costs | (2,075) | | | (1,623) | | | (4,217) | | | (3,451) | |

| Non-GAAP total operating expenses | $ | 31,091 | | $ | 27,076 | | $ | 62,541 | | $ | 51,594 |

| | | | | | | |

| GAAP loss from operations | $ | (13,108) | | | $ | (9,561) | | | $ | (27,074) | | | $ | (18,981) | |

| Non-GAAP loss from operations | $ | (13,108) | | | $ | (9,561) | | | $ | (27,074) | | | $ | (18,981) | |

About Quanterix

From discovery to diagnostics, Quanterix’s ultra-sensitive biomarker detection is driving breakthroughs only made possible through its unparalleled sensitivity and flexibility. The Company’s Simoa technology has delivered the gold standard for earlier biomarker detection in blood, serum or plasma, with the ability to quantify proteins that are far lower than the Level of Quantification of conventional analog methods. Its industry-leading precision instruments, digital immunoassay technology and CLIA-certified Accelerator laboratory have supported research that advances disease understanding and management in neurology, oncology, immunology, cardiology and infectious disease. Quanterix has been a trusted partner of the scientific community for nearly two decades, powering research published in more than 2,900 peer-reviewed journals. Find additional information about the Billerica, Massachusetts-based company at https://www.quanterix.com or follow us on Twitter and LinkedIn.

Forward-Looking Statements

Quanterix’s current financial results, as discussed in this press release, are preliminary and unaudited, and subject to adjustment. This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as "may," "will," "expect," "plan," "anticipate," "estimate," "intend" and similar expressions (as well as other words or expressions referencing future events, conditions or circumstances) are intended to identify forward-looking statements. These forward-looking statements include, but are not limited to, statements about Quanterix’s financial performance, including statements under the header “2024 Full Year Business Outlook” set forth above, and are subject to a number of risks, uncertainties and assumptions. Forward-looking statements in this press release are based on Quanterix’s expectations and assumptions as of the date of this press release. Each of these forward-looking statements involves risks and uncertainties. Factors that may cause Quanterix’s actual results to differ from those expressed or implied in the forward-looking statements in this press release include, but are not limited to, those described in our periodic reports filed with the U.S. Securities and Exchange Commission, including the "Risk Factors" sections contained therein. Except as required by law, Quanterix assumes no obligation to update any forward-looking statements contained herein to reflect any change in expectations, even as new information becomes available.

Contacts

Media:

PAN Communications

Maya Nimnicht

510-334-6273

quanterix@pancomm.com

Investor Relations:

Francis Pruell, Quanterix

(508)-789-1725

ir@quanterix.com

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

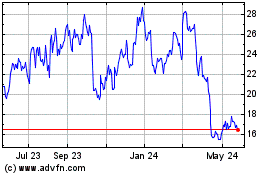

Quanterix (NASDAQ:QTRX)

Historical Stock Chart

From Oct 2024 to Nov 2024

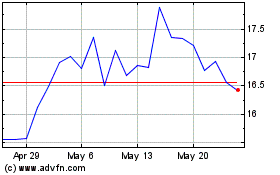

Quanterix (NASDAQ:QTRX)

Historical Stock Chart

From Nov 2023 to Nov 2024