false000150327400015032742024-11-112024-11-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 11, 2024

QUANTERIX CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-38319 | 20-8957988 |

(State or other jurisdiction

of incorporation) | (Commission File Number) | (IRS Employer

Identification No.) |

| | | | | |

900 Middlesex Turnpike | |

Billerica, MA | 01821 |

(Address of principal executive offices) | (Zip Code) |

(617) 301-9400

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which

registered |

| Common Stock, $0.001 par value per share | | QTRX | | The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging Growth Company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On November 12, 2024, Quanterix Corporation (the “Company”) issued a press release announcing selected preliminary financial results for the third quarter ended September 30, 2024 and the need to restate certain previously issued financial statements as further described in Item 4.02 below (the “Press Release”). A copy of the Press Release is furnished as Exhibit 99.1 and is incorporated herein by reference.

The information contained in paragraph three (inclusive of the table) of Item 4.02(a) and in Exhibit 99.1 of this Current Report on Form 8-K is incorporated into this Item 2.02 by reference. The information incorporated by reference into this Item 2.02 is intended to be furnished under Item 2.02 and shall not be deemed “filed” under Item 2.02 for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 4.02 Non-Reliance on Previously Issued Financial Statements or a Related Audit Report or a Completed Interim Review.

(a)On November 11, 2024, the Audit Committee of the Board of Directors of the Company, based on the recommendation of the Company’s management and after discussion with the Company’s independent registered public accounting firm, Ernst & Young LLP (“EY”), concluded that the Company’s previously issued audited consolidated financial statements as of December 31, 2023 and 2022 and for each of the three years in the period ended December 31, 2023, and its unaudited consolidated financial statements for the quarterly and year-to-date (as applicable) periods ended March 31, 2022, June 30, 2022, September 30, 2022, March 31, 2023, June 30, 2023, September 30, 2023, March 31, 2024, and June 30, 2024 (collectively, the “Non-Reliance Periods”), should no longer be relied upon.

As previously reported and as discussed in more detail below, the Company has identified and continues its efforts to remediate material weaknesses in its internal control over financial reporting relating to, among others, the operating effectiveness of internal control associated with the accounting for inventory valuation. In connection with these remediation efforts, and while performing closing procedures for the third quarter of 2024, management identified an error related to the capitalization of labor and overhead costs applied to prior periods going back to at least 2021, which impacted the valuation of inventory. This error relates to a design deficiency in the Company’s internal control over financial reporting related to the accounting for inventory valuation. The cumulative effect of this error, when taken together with unrelated immaterial errors identified by the Company in prior periods, resulted in the need for material adjustments to previously issued financial statements. The Audit Committee therefore concluded that it is appropriate to restate the financial statements included in the applicable Quarterly Reports on Form 10-Q and Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”) for the Non-Reliance Periods (the “Restatement”) in order to correct all known errors in accounting.

The Company currently estimates that the corrections to be made as part of the Restatement will result in the following impacts to gross profit and operating loss:

| | | | | | | | | | | |

| GAAP Gross Profit Increase | | Operating Loss Increase/(Decrease) |

| Year ended December 31, 2021 | $1.6 million | | $(0.6) million |

| Year ended December 31, 2022 | $0.4 million | | $0.5 million |

| Year ended December 31, 2023 | $2.1 million | | $(2.3) million |

These preliminary figures are based on currently available information and are unaudited and subject to adjustment. The supplemental schedules included in the Press Release provide additional information regarding the preliminary anticipated impact of the Restatement, but the information in the supplemental schedules is similarly based on currently available information and is unaudited and subject to adjustment. The Company does not expect the errors to result in any material impact on the previously reported amounts for cash or total revenues in any completed fiscal period.

The Restatement is not anticipated to have a material impact on the Company’s revenue growth or cash usage. However, the Company’s internal review is ongoing and there can be no assurance that the actual effects of the Restatement will be only as described above and in the supplemental schedules.

As previously disclosed in the section titled “Part II, Item 9A. Controls and Procedures” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, management concluded that the Company’s internal control over financial reporting was not effective at a reasonable assurance level as of December 31, 2023 due to, among other things, deficiencies in the operating effectiveness of its internal controls associated with the valuation of the Company’s inventory, including excess and obsolescence reserves. Management has been actively engaged in the implementation of remediation efforts to address the previously identified material weaknesses. For further discussion of management’s remediation plan, refer to the section titled “Part II, Item 9A. Controls and Procedures” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, as well as updated discussions in the section titled “Part I, Item 4. Controls and Procedures” of the Company’s Quarterly Reports on Form 10-Q for the quarters ended March 31, 2024 and June 30, 2024.

The Company intends to promptly amend (i) its Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on February 29, 2024 (the “Original Form 10-K”), which amended report will include summarized restated financial information for each of the quarterly periods in 2022 and 2023, and (ii) its Quarterly Reports on Form 10-Q filed with the SEC on each of May 8, 2024 and August 8, 2024 (the “Original Form 10-Qs”), which will include restated financial statements for the corresponding 2023 quarterly and year-to-date periods. In those amended reports, the Company will also revise the Management’s Discussion and Analysis of Financial Condition and Results of Operations sections to reflect the restated financial statements covered by such reports, as necessary. The Company intends to file its Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, which will include restated financial statements for the quarter and year-to-date period ended September 30, 2023, as promptly as possible following the filing of the amended Original Form 10-K and the amended Original Form 10-Qs.

The Audit Committee and Company management have discussed with EY the matters disclosed in this Item 4.02(a).

Cautionary Note Regarding Forward-Looking Statements

This report (including the exhibit hereto) contains forward-looking information within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. Any statements contained herein or in the attached exhibit that do not describe historical facts, including, among others, statements regarding the expected impact of the Restatement, including on the Company’s overall business operations, are based on management’s current expectations and beliefs and are forward-looking statements which involve risks and uncertainties that could cause actual results to differ materially from those discussed in such forward-looking statements. Such risks and uncertainties include, among others, that the Company may have underestimated the scope and impact of the Restatement, risks and uncertainties around the effectiveness of the Company’s internal control over financial reporting, the risk that the Company’s restated financial statements may take longer to complete than expected, as well as those risks and uncertainties identified in the Company’s filings with the U.S. Securities and Exchange Commission (the “Commission”), including its Annual Report on Form 10-K for the fiscal year ended December 31, 2023, its Current Reports on Form 8-K, its Quarterly Reports on Form 10-Q, including for the quarters ended March 31, 2024 and June 30, 2024, and in any subsequent filings with the SEC, which are available at the SEC’s website at www.sec.gov. Any such risks and uncertainties could materially and adversely affect the Company’s results of operations, its profitability and its cash flows, which would, in turn, have a significant and adverse impact on the Company’s stock price. The Company cautions you not to place undue reliance on any forward-looking statements, which speak only as of the date they are made. The Company disclaims any obligation to publicly update or revise any such statements to reflect any change in expectations or in events, conditions or circumstances on which any such statements may be based, or that may affect the likelihood that actual results will differ from those set forth in the forward-looking statements. As noted above, investors are cautioned that the financial statements for the Non-Reliance Periods, and, as a result, related investor communications, should no longer be relied upon; such communications include earnings releases, press releases, shareholder communications, investor presentations and other communications describing relevant portions of the financial statements for the Non-Reliance Periods.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| QUANTERIX CORPORATION |

| | |

| By: | /s/ Vandana Sriram |

| | Vandana Sriram |

| | Chief Financial Officer |

Date: November 12, 2024

Quanterix Releases Preliminary Financial Results for the Third Quarter of 2024

Sixth Consecutive Quarter of Double-Digit Growth

Reaffirms Full Year 2024 Outlook

BILLERICA, Mass. - November 12, 2024 - Quanterix Corporation (NASDAQ: QTRX), a company fueling scientific discovery through ultra-sensitive biomarker detection, today announced preliminary financial results for the third quarter ended September 30, 2024 and reaffirmed its full year 2024 guidance. The Company also disclosed the need to restate certain prior period financial statements to correct non-cash errors related to those periods.

“Quanterix continues to build on our strong momentum, achieving our sixth consecutive quarter of double-digit growth. We are pleased to reaffirm our full year 2024 outlook, which is especially notable given the muted growth that continues to impact the tools space,” said Masoud Toloue, Chief Executive Officer of Quanterix. “With a focus on disciplined execution of our strategic priorities, we are expanding the Quanterix portfolio of innovative products and services, empowering our customers to break new ground in research, and lead advancements in Alzheimer’s diagnostics.”

Preliminary Third Quarter 2024 Financial Highlights

•Revenue of $35.7 million, an increase of 13% compared to $31.6 million in the corresponding prior year period, as preliminarily restated.

•GAAP gross margin of 58.9% and Non-GAAP gross margin of 53.4%.

•Net cash usage in the quarter was $3.3 million. The Company ended the period with $296.1 million of cash, cash equivalents, marketable securities, and restricted cash.

These preliminary financial results are based on current best available information and are unaudited and subject to adjustment, including in connection with the finalization of the restated financial statements as further described below. The Company expects to report its final results for the third quarter of 2024, which could vary from the preliminary financial results disclosed in this press release, in its Quarterly Report on Form 10-Q, following the filing of the restated financial statements, as further described below.

Third Quarter Operational and Business Highlights

•The Company announced the launch of LucentAD Complete, a multi-marker test for Alzheimer’s Disease (AD) detection. The test leverages a proprietary algorithm to generate an AD score by analyzing five Alzheimer’s disease-related biomarkers (p-Tau 217, Aβ42/40, NfL, GFAP), offering significantly improved amyloid classification and reducing inconclusive results by up to three-fold compared to traditional single-marker tests.

•In September 2024, Mt. Sinai Health System announced that they would be deploying blood-based biomarkers as early detection tools across primary and specialty care settings. Mt. Sinai will be examining p-Tau 217, as well as NfL and GFAP using our assays through a grant from the Davos Alzheimer’s Collaborative.

•The Company continues to advance its innovation rate and this quarter released a new series of ultra-sensitive 4-marker panels in neurology and immunology, as well as an extracellular vesicle profiling tool kit, which has research applications in multiple disease areas.

•The Company added two members to its Board of Directors, Jeff Elliott, former CFO of Exact Sciences, and Ivana Magovčević-Liebisch, Ph.D., J.D., President and CEO of Vigil Neuroscience.

2024 Full Year Business Outlook

The Company reaffirms its 2024 revenue guidance range of $134 million to $138 million. This revenue range excludes revenue from Lucent Diagnostics testing, which is expected to be immaterial for 2024. The Company also reaffirmed that it expects its research-use only business (excluding Diagnostics) to achieve cash flow breakeven when it reaches revenue between $170 and $190 million.

The Company continues to expect GAAP gross margin percentage to be in the range of 57%-61%, and non-GAAP gross margin percentage to be in the range of 51%-55%. The Company continues to anticipate 2024 cash usage (change in cash, cash equivalents, marketable securities, and restricted cash) to be approximately $30 million.

For additional information on the preliminary non-GAAP financial measures included in this press release, please see “Use of Non-GAAP Financial Measures,” “Preliminary Restated Non-GAAP Measures” and “Preliminary Restated GAAP to Non-GAAP Reconciliation” below.

Restatement of Historical Financial Results

As previously reported, the Company has identified and continues its efforts to remediate a material weakness in its internal control over financial reporting relating to the operating effectiveness of internal controls associated with the accounting for inventory valuation.

In connection with these remediation efforts, and while performing closing procedures for the third quarter 2024, management identified an error related to the capitalization of labor and overhead costs applied to prior periods, which impacted the valuation of inventory. This error relates to a design deficiency in the Company’s internal control over financial reporting related to the accounting for inventory valuation. The cumulative effect of this error, when taken together with unrelated immaterial errors identified by the Company in prior periods, resulted in the need for material adjustments to previously issued financial statements.

The Audit Committee of the Board of Directors and management therefore concluded that it is appropriate to restate the Company’s audited consolidated financial statements as of December 31, 2023 and 2022 and for each of the three years in the period ended December 31, 2023, and its unaudited consolidated financial statements for the quarterly and year-to-date (as applicable) periods ended March 31, 2022, June 30, 2022, September 30, 2022, March 31, 2023, June 30, 2023, September 30, 2023, March 31, 2024 and June 30, 2024 (the “Restatement”) in order to correct all known errors in accounting in the financial statements for such periods. The Company intends, as promptly as possible, to complete the Restatement and to file with the Securities and Exchange Commission amendments to the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, and its Quarterly Reports on Form 10-Q for the first and second quarters of 2024 and to file its Quarterly Report on Form 10-Q for the third quarter of 2024. Although there can be no assurance, the Company’s goal is to complete the Restatement and all required filings by the end of 2024.

The Company currently estimates that the corrections to be made as part of the Restatement will result in the following impact to gross profit and operating loss:

| | | | | | | | | | | |

| GAAP Gross Profit Increase | | Operating Loss Increase/(Decrease) |

| Year ended December 31, 2021 | $1.6 million | | $(0.6) million |

| Year ended December 31, 2022 | $0.4 million | | $0.5 million |

| Year ended December 31, 2023 | $2.1 million | | $(2.3) million |

These preliminary figures are based on currently available information and are unaudited and subject to adjustment. The supplemental schedules in this press release provide additional information regarding the preliminary anticipated impact of the Restatement, but such additional information is also based on currently available information and is unaudited and subject to adjustment. The Company does not expect the errors to result in any material impact on the previously reported amounts for total revenues or cash in any completed fiscal period.

The Company expects to delay the filing of its Quarterly Report on Form 10-Q for the third quarter of 2024, in order to complete the Restatement and will file a Form 12b-25 with the Securities and Exchange Commission. Additional information regarding the Restatement and the preliminary anticipated effect of the Restatement on the Company’s previously reported financial information is included in the Company’s Current Report on Form 8-K (and exhibits) filed on November 12, 2024.

Conference Call

In conjunction with this announcement, the Company will host a conference call on November 12, 2024, at 4:30 PM E.T. Click here to register for the conference call with a webcast link. For audio use the following dial-in number and passcode: USA & Canada – Toll-Free (800) 715-9871 Conference ID: 2720617.

Interested investors can also listen to the live webcast from the Event Details page in the Investors section of the Quanterix at https://ir.quanterix.com. An archived webcast replay will be available on the Company’s website for one year.

Supplemental Schedules

Preliminary Restated GAAP Financials

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| FY21 | FY22 | Q1FY23 | Q2FY23 | Q3FY23 | Q4FY23 | FY23 | Q1FY24 | Q2FY24 | Q3FY24 |

| As Reported | | | | | | | | | | |

| Revenue | 110.6 | 105.5 | 28.5 | 31.0 | 31.3 | 31.5 | 122.4 | 32.1 | 34.4 | 35.7 |

| | | | | | | | | | |

| Gross Profit $ | 61.7 | 46.8 | 16.9 | 19.1 | 17.8 | 16.8 | 70.6 | 19.6 | 20.1 | 21.1 |

| Gross Profit % | 55.8 | % | 44.4 | % | 59.5 | % | 61.7 | % | 56.8 | % | 53.2 | % | 57.7 | % | 61.2 | % | 58.3 | % | 58.9 | % |

| | | | | | | | | | |

| Operating Expense | 120.3 | 148.5 | 26.3 | 28.7 | 31.6 | 33.8 | 120.3 | 33.6 | 33.2 | 32.3 |

| | | | | | | | | | |

| Operating Loss | (58.6) | (101.7) | (9.4) | (9.6) | (13.8) | (17.0) | (49.7) | (14.0) | (13.1) | (11.2) |

| | | | | | | | | | |

| GAAP Adjustments | | | | | | | | | | |

| Revenue | 0.0 | 0.0 | 0.0 | (0.2) | 0.2 | 0.0 | 0.0 | 0.0 | 0.1 | 0.0 |

| Gross Profit $ | 1.6 | 0.4 | (0.9) | 0.4 | 1.1 | 1.5 | 2.1 | (0.8) | 1.5 | 0.0 |

| Operating Expense | 1.0 | 0.9 | 0.2 | (0.5) | 0.7 | (0.7) | (0.3) | 0.0 | (0.1) | 0.0 |

| Operating Loss | 0.6 | (0.5) | (1.1) | 0.9 | 0.5 | 2.2 | 2.3 | (0.8) | 1.6 | 0.0 |

| | | | | | | | | | |

| Restated | | | | | | | | | | |

| Revenue | 110.6 | 105.5 | 28.5 | 30.8 | 31.6 | 31.5 | 122.4 | 32.1 | 34.4 | 35.7 |

| | | | | | | | | | |

| Gross Profit $ | 63.3 | 47.2 | 16.0 | 19.5 | 18.9 | 18.3 | 72.7 | 18.8 | 21.6 | 21.1 |

| Gross Profit % | 57.3 | % | 44.7 | % | 56.3 | % | 63.4 | % | 59.9 | % | 57.8 | % | 59.4 | % | 58.7 | % | 62.7 | % | 58.9 | % |

| | | | | | | | | | |

| Operating Expense | 121.3 | 149.4 | 26.6 | 28.2 | 32.2 | 33.1 | 120.1 | 33.6 | 33.1 | 32.3 |

| | | | | | | | | | |

| Operating Loss | (58.0) | (102.2) | (10.6) | (8.7) | (13.3) | (14.8) | (47.4) | (14.8) | (11.5) | (11.2) |

Use of Non-GAAP Financial Measures

To supplement the preliminary restated financial statements presented on a U.S. GAAP basis, the Company also presents preliminary restated non-GAAP gross profit, non-GAAP gross margin, non-GAAP total operating expenses, and non-GAAP loss from operations. These non-GAAP measures are calculated by including shipping and handling costs for product sales within cost of product revenue instead of within selling, general, and administrative expenses. The Company uses these non-GAAP measures to evaluate its operating performance in a manner that allows for meaningful period-to-period comparison and analysis of trends in its business and its competitors. The Company believes that presentation of these non-GAAP measures provides useful information to investors in assessing the Company’s operating performance within its industry and to allow comparability to the presentation of other companies in its industry where shipping and handling costs are included in cost of goods sold for products. The non-GAAP financial information presented here should be considered in conjunction with, and not as a substitute for, the financial information presented in accordance with U.S. GAAP.

Set forth below is the preliminary restated non-GAAP gross profit, non-GAAP gross margin, non-GAAP total operating expenses, and non-GAAP loss from operations and a reconciliation of these preliminary restated non-GAAP measures to their most directly comparable preliminary restated GAAP financial measures.

Preliminary Restated Non-GAAP Measures

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| FY21 | FY22 | Q1FY23 | Q2FY23 | Q3FY23 | Q4FY23 | FY23 | Q1FY24 | Q2FY24 | Q3FY24 |

| As Reported (Non-GAAP) | | | | | | | | | | |

| Revenue | 110.6 | 105.5 | 28.5 | 31.0 | 31.3 | 31.5 | 122.4 | 32.1 | 34.4 | 35.7 |

| | | | | | | | | | |

| Gross Profit $ | 54.8 | 39.6 | 15.1 | 17.5 | 15.2 | 14.7 | 62.5 | 17.5 | 18.0 | 19.1 |

| Gross Profit % | 49.6 | % | 37.5 | % | 53.1 | % | 56.4 | % | 48.6 | % | 46.5 | % | 51.1 | % | 54.5 | % | 52.3 | % | 53.4 | % |

| | | | | | | | | | |

| Operating Expense | 113.4 | 141.3 | 24.5 | 27.1 | 29.0 | 31.7 | 112.2 | 31.5 | 31.1 | 30.3 |

| | | | | | | | | | |

| Operating Loss | (58.6) | (101.7) | (9.4) | (9.6) | (13.8) | (17.0) | (49.7) | (14.0) | (13.1) | (11.2) |

| | | | | | | | | | |

| Adjustments | | | | | | | | | | |

| Revenue | 0.0 | 0.0 | 0.0 | (0.2) | 0.2 | 0.0 | 0.0 | 0.0 | 0.1 | 0.0 |

| Gross Profit $ | 0.6 | (0.3) | (0.9) | 0.4 | 1.1 | 1.5 | 2.1 | (0.8) | 1.5 | 0.0 |

| Operating Expense | 0.0 | 0.2 | 0.2 | (0.5) | 0.7 | (0.7) | (0.3) | 0.0 | (0.1) | 0.0 |

| Operating Loss | 0.6 | (0.5) | (1.1) | 0.9 | 0.5 | 2.2 | 2.3 | (0.8) | 1.6 | 0.0 |

| | | | | | | | | | |

| Restated (Non-GAAP) | | | | | | | | | | |

| Revenue | 110.6 | 105.5 | 28.5 | 30.8 | 31.6 | 31.5 | 122.4 | 32.1 | 34.4 | 35.7 |

| | | | | | | | | | |

| Gross Profit $ | 55.4 | 39.3 | 14.2 | 17.9 | 16.3 | 16.2 | 64.6 | 16.7 | 19.5 | 19.1 |

| Gross Profit % | 50.1 | % | 37.2 | % | 49.9 | % | 58.2 | % | 51.8 | % | 51.1 | % | 52.8 | % | 52.0 | % | 56.7 | % | 53.4 | % |

| | | | | | | | | | |

| Operating Expense | 113.4 | 141.5 | 24.8 | 26.6 | 29.6 | 31.0 | 112.0 | 31.5 | 31.0 | 30.3 |

| | | | | | | | | | |

| Operating Loss | (58.0) | (102.2) | (10.6) | (8.7) | (13.3) | (14.8) | (47.4) | (14.8) | (11.5) | (11.2) |

Preliminary Restated GAAP to Non-GAAP Reconciliation

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| FY21 | FY22 | Q1FY23 | Q2FY23 | Q3FY23 | Q4FY23 | FY23 | Q1FY24 | Q2FY24 | Q3FY24 |

| Preliminary Restated GAAP gross profit | 63.3 | 47.2 | 16.0 | 19.5 | 18.9 | 18.3 | 72.7 | 18.8 | 21.6 | 21.1 |

| Shipping and handling costs | (7.9) | (7.9) | (1.8) | (1.6) | (2.6) | (2.1) | (8.1) | (2.1) | (2.1) | (2.0) |

| Preliminary Restated Non-GAAP gross profit | 55.4 | 39.3 | 14.2 | 17.9 | 16.3 | 16.2 | 64.6 | 16.7 | 19.5 | 19.1 |

| | | | | | | | | | |

| GAAP Revenue | 110.6 | 105.5 | 28.5 | 30.8 | 31.6 | 31.5 | 122.4 | 32.1 | 34.4 | 35.7 |

| Gross margin (gross profit as a % of GAAP revenue) | 57.3 | % | 44.7 | % | 56.3 | % | 63.4 | % | 59.9 | % | 57.8 | % | 59.4 | % | 58.7 | % | 62.7 | % | 58.9 | % |

| Non-GAAP gross margin (non-GAAP gross profit as a % of GAAP revenue) | 50.1 | % | 37.2 | % | 49.9 | % | 58.2 | % | 51.8 | % | 51.1 | % | 52.8 | % | 52.0 | % | 56.7 | % | 53.4 | % |

| | | | | | | | | | |

| Preliminary Restated GAAP total operating expenses | 121.3 | 149.4 | 26.6 | 28.2 | 32.2 | 33.1 | 120.1 | 33.6 | 33.1 | 32.3 |

| Shipping and handling costs | (7.9) | (7.9) | (1.8) | (1.6) | (2.6) | (2.1) | (8.1) | (2.1) | (2.1) | (2.0) |

| Preliminary Restated Non-GAAP total operating costs | 113.4 | 141.5 | 24.8 | 26.6 | 29.6 | 31.0 | 112.0 | 31.5 | 31.0 | 30.3 |

| | | | | | | | | | |

| Preliminary Restated GAAP loss from operations | (58.0) | (102.2) | (10.6) | (8.7) | (13.3) | (14.8) | (47.4) | (14.8) | (11.5) | (11.2) |

| Preliminary Restated Non-GAAP loss from operations | (58.0) | (102.2) | (10.6) | (8.7) | (13.3) | (14.8) | (47.4) | (14.8) | (11.5) | (11.2) |

About Quanterix

From discovery to diagnostics, Quanterix’s ultra-sensitive biomarker detection is driving breakthroughs only made possible through its unparalleled sensitivity and flexibility. The Company’s Simoa technology has delivered the gold standard for earlier biomarker detection in blood, serum or plasma, with the ability to quantify proteins that are far lower than the Level of Quantification of conventional analog methods. Its industry-leading precision instruments, digital immunoassay technology and CLIA-certified Accelerator laboratory have supported research that advances disease understanding and management in neurology, oncology, immunology, cardiology and infectious disease. Quanterix has been a trusted partner of the scientific community for nearly two decades, powering research published in more than 3,100 peer-reviewed journals. Find additional information about the Billerica, Massachusetts-based company at https://www.quanterix.com or follow us on Twitter and LinkedIn.

Forward-Looking Statements

Quanterix’s current financial results, as discussed in this press release, are preliminary and unaudited, and subject to adjustment. This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “may,” “will,” “expect,” “plan,” “anticipate,” “estimate,” “intend” and similar expressions (as well as other words or expressions referencing future events, conditions or circumstances) are intended to identify forward-looking statements. These forward-looking statements include, but are not limited to, statements about Quanterix’s financial performance, including statements under the headers “Preliminary Third Quarter 2024 Financial Highlights,” “2024 Full Year Business Outlook,” “Restatement of Historical Financial Results” and “Supplemental Schedules” set forth above, and are subject to a number of risks, uncertainties and assumptions. Forward-looking statements in this press release are based on Quanterix’s expectations and assumptions as of the date of this press release. Each of these forward-looking statements involves risks and uncertainties. Factors that may cause Quanterix’s actual results to differ from those expressed or implied in the forward-looking statements in this press release include, but are not limited to, that the Company may have underestimated the scope and impact of the Restatement, risks and uncertainties around the effectiveness of the Company’s internal control over financial reporting, the risk that the Company’s restated financial statements may take longer to complete than expected, as well as those described in our periodic reports filed with the U.S. Securities and Exchange Commission, including the “Risk Factors” sections contained therein. Except as required by law, Quanterix assumes no obligation to update any forward-looking statements contained herein to reflect any change in expectations, even as new information becomes available.

Contacts

Media Contact:

Marissa Klaassen

(978) 488-1854

media@quanterix.com

Investor Relations Contact:

Amy Achorn (978) 488-1854

ir@quanterix.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

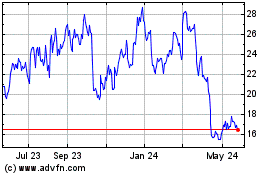

Quanterix (NASDAQ:QTRX)

Historical Stock Chart

From Jan 2025 to Feb 2025

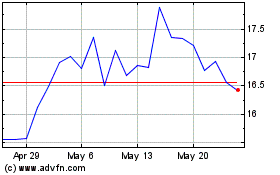

Quanterix (NASDAQ:QTRX)

Historical Stock Chart

From Feb 2024 to Feb 2025