false

0001707910

0001707910

2024-11-06

2024-11-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or Section 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of Earliest Event Reported): November 6, 2024

| REBORN

COFFEE, INC. |

| (Exact

name of registrant as specified in its charter) |

| Delaware |

|

001-41479 |

|

47-4752305 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

| 580

N. Berry Street, Brea, CA |

|

92821 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(714)

784-6369

(Registrant’s

telephone number)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Securities Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which

registered |

| Common

Stock, $0.0001 par value per share |

|

REBN |

|

The

Nasdaq Stock Market LLC

(Nasdaq Capital Market) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On

November 6, 2024, Reborn Coffee, Inc. (the “Company”) entered into a share purchase agreement (the “Purchase Agreement”)

with Bbang Ssaem Co. Ltd. (d/b/a Bbang Ssaem Bakery Café Korea) (the “Seller”), pursuant to which the Company purchased

166,000 shares of capital stock (the “Shares”) of the Seller. Following the acquisition of the Shares, the Company will own

approximately 58% of the total outstanding shares of capital stock of the Seller.

As

consideration for purchase of the Shares, the Company agreed to pay to the Seller an aggregate total of $1,000,000, payable as follows:

(i) $200,000 in cash by December 31, 2024; and (ii) $800,000 in shares of the Company’s common stock, par value $0.0001 per share

(“Common Stock”), to be issued on January 31, 2025 at the lowest daily VWAP price over the five trading days immediately

prior to January 31, 2025 (the “Consideration Shares”). The Purchase Agreement also contains customary representations, warranties,

indemnification provisions and closing conditions including the required audit of the Seller as required by applicable regulations the

Company is subject to.

The

Seller is a bakery chain founded in 2019 which offers traditional pastries, bread, cakes, desserts and cookies and various beverages

to customers. The Seller currently has 31 locations across South Korea.

The

foregoing description of the Purchase Agreement does not

purport to be a complete description of the rights and obligations of the parties thereunder and is qualified in its entirety by reference

to the full text of such agreement, a copy of which is attached hereto as Exhibit 2.1 to this Current Report on Form 8-K.

Item

2.01 Completion of Acquisition or Disposition of Assets

The

information set forth in the “Item 1.01 Entry into a Material Definitive Agreement” above is incorporated into this Item

2.01 by reference. On November 6, 2024, the Company closed

the on the transactions contemplated by the Purchase Agreement described in Item 1.01 above.

Item

3.02 Unregistered Sales of Equity Securities

The

information set forth in “Item 1.01 Entry into a Material Definitive Agreement” relating to the issuance of the Consideration

Shares is incorporated by reference herein in its entirety. When

issued, the Consideration Shares will not have been registered under the Securities Act

of 1933, as amended (the “Securities Act”), and cannot be offered or sold in the United States absent effective registration

or an applicable exemption from registration requirements. The Company will issue the Consideration

Shares in reliance upon the exemption from registration provided by Section 4(a)(2) of the Securities Act. This Current Report on Form

8-K shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall such securities be offered or sold in the

United States absent registration or an applicable exemption from the registration requirements and certificates evidencing such shares

contain a legend stating the same.

Item

9.01 Financial Statements and Exhibits

(a)

Financial statements of businesses acquired.

The

financial statements required by Item 9.01 with respect to the acquisition described in Item 2.01 are not being filed herewith but will

be filed by amendment to this Current Report on Form 8-K no later than 71 calendar days after the date on which this Current Report on

Form 8-K was required to be filed pursuant to Item 2.01.

(b)

Pro forma financial information.

The

pro forma financial information required by Item 9.01 with respect to the acquisition described in Item 2.01 above is not being furnished

herewith but will be furnished by amendment to this Current Report on Form 8-K no later than 71 calendar days after the date on which

this Current Report on Form 8-K was required to be filed pursuant to Item 2.01.

(d)

Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated:

January 2, 2025

| |

REBORN

COFFEE, INC. |

| |

|

|

| |

By: |

/s/

Jay Kim |

| |

Name: |

Jay

Kim |

| |

Title: |

Chief

Executive Officer |

2

Exhibit 2.1

REBORN

COFFEE, INC.

AND

BBANG

SSAEM CO., LTD.

SHARE

PURCHASE AGREEMENT

THIS

SHARE PURCHASE AGREEMENT is entered into, on the day of November 6, 2024, by and between:

| 1. | Reborn

Coffee, Inc., a California corporation with a principal office lateced at 580 N Berry

St., Brea, CA 92821 (hereinafter referred to as the “Buyer”); and |

| 2. | Bbang

Ssaem Co., Ltd., a South Korea corporation with a fictitious name of Bbang Ssaem Bakery

Café Korea, with a principal office located at 6th FL, 59-5, Magokjungang-ro,

Gangseo-gu, Seoul, Republic of Korea (hereinafter referred to as the “Seller”

and where the context so permits, Seller, and Buyer are hereinafter individually referred

to as “Party” and collectively as “Parties”). |

RECITALS:

| 1. | The

Seller is a corporation duly organized and existing under the laws of the Republic of Korea

with its registered office at 6th FL, 59-5, Magokjungang-ro, Gangseo-gu, Seoul,

Republic of Korea, having issued and outstanding 120,000 ordinary shares which represents

100% of the total issued and outstanding equity of the Seller immediately prior to the execution

of this agreement. |

| 2. | The

Seller desires to issue additional 166,000 shares (the “Shares”) to the Buyer,

which will ultimately make the Buyer own 58% of total outstanding shares, 286,000, of the

Seller after the issuance of the Shares. |

| 3. | The

Buyer has agreed to acquire the Shares at a purchase price of USD 1,000,000 (the “Consideration”)

subject to certain terms and conditions as set out herein. |

| 4. | In

accordance with the terms and conditions of this Agreement, the Seller desire to issue and

transfer the Shares to the Buyer, and the Buyer desires to acquire the Shares from the Seller. |

NOW

THEREFORE, in consideration of the premises contained herein, the Parties agree as follows:

| 1.1. | The

Recitals and all schedules attached hereto shall form an integral part of this Agreement

and shall be read with it as one unit. |

| 1.2. | The

capitalized terms have the following meanings unless inconsistent with the context of this

Agreement or otherwise defined in this Agreement: |

| “Accounting Standards” |

mean the International Financial Reporting Standards; |

| |

|

| “Agreement” |

means this share purchase agreement and its schedules together with any variations or amendments to the same as may be agreed in writing from time to time by the Parties; |

| “Assets” |

mean all the assets and property owned or used by the Company in connection with the Business, including, but not limited to, goodwill and Intellectual Property Rights as determined in accordance with the Accounting Standards; |

| |

|

| “Board” |

means the board of directors of the Company (as defined below) from time to time; |

| |

|

| “Business” |

means the commercial activities for which the Company is established; |

| |

|

| “Business Day” |

means any day banks are open in California; |

| |

|

| “Company” |

means Bbang Ssaem Co., Ltd., an incorporated South Korea company with EIN 587-87-01472 duly organized and existing under the laws of the South Korea with its registered office at 6th FL, 59-5, Magokjungang-ro, Gangseo-gu, Seoul, Republic of Korea; |

| |

|

| “Competent Authority” |

means any governmental or municipal authority or similar institutions; |

| |

|

| “Confidential Information” |

means any information: |

| |

|

| |

(a) relating to the Business, the Company, the transaction or the terms or existence of this Agreement; or |

| |

|

| |

(b) disclosed by either Party to the other on the express basis that such information is confidential; or |

| |

|

| |

(c) which might reasonably be expected by either Party to be confidential in nature, |

| |

|

| |

provided that where information relates exclusively to one Party, nothing in this Agreement shall require that Party to maintain confidentiality in respect of that Information; |

| |

|

| “Consideration” |

means the total consideration for the issuance and acquisition

of the Shares as more particularly described in clause 2.2; |

| “Encumbrances” |

mean any mortgage, charge, pledge, lien, assignment, option, restriction, claim, right of pre-emption, right of first refusal, third party right or interest, other encumbrance, adverse right or security interest of any kind, and any other preferential arrangement (including title transfer and retention arrangements) having a similar effect; |

| |

|

| “Closing Date” |

means November 6, 2024; |

| |

|

| “General Assembly” |

means the meeting of the general assembly of the shareholders; |

| |

|

| “Execution Date” |

means the date on which this Agreement is entered into; |

| |

|

| “Balance” |

means that unpaid part of the Consideration which is payable

under clause 2.2(c); |

| |

|

| “Intellectual Property Rights” |

mean rights in trademarks, rights in designs, patents, copyright, moral rights, database rights, rights in know-how and all other intellectual property rights in each case whether registered or unregistered, together with applications for the grant of any of these rights, and together also with all rights or forms of protection having equivalent or similar effect to any of the foregoing which |

| |

|

| “Liabilities” |

may subsist anywhere in the world;

mean all costs, expenses, losses, damages, claims, proceedings, awards, fines, orders and other liabilities (including reasonable legal and other professional fees and expenses) whenever arising or brought as determined in accordance with the Accounting Standards and any other liabilities whether disclosed or not; |

| |

|

| “Material Adverse Change” |

means any material change in the Business, operations, Assets, Liabilities, financial condition, licenses, permits of the Company which adversely affect the value of the Shares; |

| “Regulations” |

means the regulations of the Company as amended from time to time; |

| |

|

| “Recitals” |

means the recitals to this Agreement; |

| |

|

| “Revised Company Documents” |

mean document(s) issued by the Registry General and any relevant Competent Authorities in California to the Buyer’s satisfaction evidencing Buyer as the owner of all of the Shares; |

| |

|

| “Shares” |

means all the Shares of the Company equivalent to 58 percent of its Share Capital; |

| |

|

| “Share” |

means a share in the capital of the Company; |

| |

|

| “Share Capital” |

means the entire issued share capital of the Company as amended from time to time; |

| |

|

| “Registry General” |

means the Registrar General’s Department under the Ministry of Justice and Attorney General; |

| |

|

| “US Dollars” or “USD”

|

mean the lawful currency for the time being of the United States of America; |

| 1.3. | In

this Agreement, unless there is something in the subject or content inconsistent with such

construction or unless it is otherwise expressly provided: |

| (a) | words

importing one gender include every gender and words importing the singular include the plural

and vice versa; |

| (b) | words

importing persons include corporations and vice versa and include their respective heirs,

personal representatives, successors in title or permitted assignees, as the case may be; |

| (c) | any

reference to a recital, paragraph, sub-paragraph, clause, sub-clause, schedule, annex or

party shall be to a recital, paragraph, sub-paragraph, clause, sub-clause, schedule, annex

or party of, or to, this Agreement and any reference to this Agreement or any of the provisions

hereof shall include all amendments and modifications made to this agreement from time to

time in force; |

| (d) | any

reference to “writing” or cognate expressions includes any communication effected

by facsimile transmission, electronic mail or other comparable means; |

| (e) | any

reference to a “day”, “week”, “month” or “year”

is to that day, week, month or year in accordance with the Gregorian calendar; and |

| (f) | if

any period of time is specified from a given day, or the day of a given act or event, it

is to be calculated exclusive of that day and if any period of time ends on a day which is

not a Business Day, then that period is to be deemed to expire on the next following Business

Day. |

| 2.1. | The

Seller shall issue with full title guarantee and the Buyer will acquire the Shares, free

of any and all Encumbrances and with all rights attached to them in accordance with terms

and conditions of this Agreement. |

| 2.2. | The

Consideration, for the issuance of the Shares, shall be paid as follows; provided, however,

that the Consideration is set based on the estimated Total Valuation Price, which is subject

to adjustment upon the due diligence and audit performed by Buyer during the Due Diligence

Period pursuant to clause 2.7: |

| (a) | Buyer

shall pay $200,000 in cash to Seller by December 31, 2024; |

| (b) | Buyer

shall pay $800,000 of common shares issued at the lowest daily VWAP price over the previous

5 trading days on January 31, 2025 to Seller; and |

| (c) | As

a result, the total purchase price, as the Consideration, which Buyer shall pay, is USD 1,000,000. |

| 2.3. | Payment

of the cash Consideration shall be made to such bank account as the Seller shall notify to

the Buyer on or before the date of each designated date above. |

| 2.4. | Notwithstanding

the acquisition of the Shares by the Buyer, the Buyer shall not be responsible for any past

and/or present obligations or liabilities of Seller individually or the Seller in their indiviudal

capacity, and the Seller is solely liable to any obligations or liablities caused prior to

the Execution Date. |

| 2.5. | The

Seller acknowledges that the Buyer has entered into this Agreement in reliance on the Seller’s

Warranties, and the representations, warranties and undertakings on the part of the Seller’s

set out in this Agreement. |

| 2.6. | The

Buyer acknowledges that the Seller has entered into this Agreement in reliance on the Buyer’s

Warranties, and the representations, warranties and undertakings on the part of the Seller’s

set out in this Agreement. |

| 2.7. | Buyer

shall conduct due diligence of the Company’s financial, legal standing and business

operations commencing on the Closing Date for a period of 75 days (the “Due Diligence

Period”). During the Due Diligence Period, the Seller agrees to fully cooperate with

Buyer to satisfy all audit and other regulatory requirements of Buyer in connection with

the audit of the Company’s financial statements. Based on the financial results of

the audit of the Company, the parties shall negotiate in good faith to adjust the Consideration

based on a Total Valuation Price reasonably determined by Buyer as reflected in the audit

of the Company. |

| 3. | representations

and warranties and Undertakings |

| 3.1. | Each

Party hereby represents and warrants to the other that the execution and delivery by it of

this Agreement and the performance of its obligations are enforceable against it in accordance

with its terms. |

| 3.2. | Each

Party undertakes to the other that it shall take all practicable steps including without

limitation, the exercise of votes it directly or indirectly controls at meetings of the Board

and the General Assembly of the Company to ensure that the terms and conditions of this Agreement

are complied with in full, and that it shall do all such other acts and things as may reasonably

be necessary or desirable to implement this Agreement. |

| 3.3. | In

the performance of its obligations under this Agreement, each the Party shall comply with

all applicable laws and regulations of any governmental entity or body. |

| 4. | Seller’s

WARRANTIES AND BUYER’S WARRANTIES |

The

Seller and the Buyer agree that the sale of Shares shall be subject to the warranties set out in Schedule 2 (“Seller’s

Warranties and Buyer’s Warranties”).

| 5. | INDEMNITIES

AND SET-OFF |

| 5.1. | The

Seller hereby undertakes to indemnify, and to keep indemnified, the Buyer and/or the Company,

on first written demand of the Buyer, against all losses or liabilities (including, in particular,

damages, legal and other professional fees and costs, penalties and expenses) which may be

suffered or incurred by the Buyer and/or the Company which arise directly or indirectly from

any of the following: |

| (a) | breach

of any terms, promises, covenants or agreements of this Agreement by the Seller; |

| (b) | non-disclosure

of all or any material information by the Seller to the Buyer in relation to the transactions

contemplated herein; |

| (c) | any

misrepresentation or fraud by the Seller under this Agreement; or |

| (d) | breach

of any of the Seller’s Warranties by the Seller or any of the representation and warranties

as contained in this Agreement being untrue or inaccurate. |

| 5.2. | The

Seller’s indemnity obligations to the Buyer under this clause 6 and/or any of

his liabilities to the Buyer in connection with this Agreement may be set off against the

Buyer’s obligations to pay the Consideration to the Seller. |

| 5.3. | The

Buyer hereby agrees to indemnifies, on first written demand of the Seller, and hold the Seller

harmless from any and all losses, damages, costs, liabilities and expenses, including, without

limitation, reasonable attorneys’ fees (and those fees incurred upon any appeals) incurred

or suffered by the Seller as a result of the breach by the Buyer of any of the representations

and warranties contained in this Agreement, the failure by the Buyer to comply with any of

the covenants contained in this Agreement or any other default by the Buyers under the terms

of this Agreement or, after the Closing, the failure by the Buyer to comply with any of the

terms, covenants, conditions or other provisions in any of the Competent Authorities or any

other default by the Buyer under any of the Permits (as defined in schedule 1). Clause

3.2(b) hereof sets forth the damages which the Seller is entitled to receive as a result

of the Buyer’s failure to close the purchase and sale transaction and this clause

6.3 applies only to other breaches by the Buyer. Clause 3.2(b) hereof only limits

the Seller’s rights hereunder for the Buyer’s failure to close the purchase and

sale transaction. This Buyer’s indemnity provision shall survive the Closing hereunder. |

The

Tax Effective date shall be December 31, 2024. Except as otherwise stated herein each Party shall bear its respective tax obligations

arising from the transactions contemplated herein.

Save

as required by law or any governmental or regulatory organization, no announcement or circular concerning the agreements contained herein

or any matter ancillary to it and no disclosure of the terms of this Agreement will be made by either Party except with the prior written

approval of the other Party.

| 8.1. | Any

notice or other communication given in connection with this Agreement will be in writing

and will be delivered personally or sent by courier delivery service or by fax to the recipient’s

address set out in this Agreement or to such other address which the recipient has notified

in writing to the sender not less than seven (7) Business Days before the notice is dispatched. |

| 8.2. | Any

notice or other formal communication given under this Agreement may be delivered or sent

by courier delivery or fax to the party to be served at its address as follows: |

BBANG

SSAEM CO., LTD.

6th

FL, 59-5, Magokjungang-ro

Gangseo-gu,

Seoul, Republic of Korea

Marked

for the attention of: Mr. Jong Hyun Oh, CEO

REBORN

COFFEE INC.

580

N. Berry Street

Brea,

CA 92821, U.S.A.

Marked

for the attention of: Jay Kim, CEO

or

at such other address or email address as it may have notified to the other Party in accordance with this clause 9.

| 8.3. | A

notice or other communication is deemed given: |

| (a) | if

delivered personally, upon delivery at the address provided for in this Agreement; or |

| (b) | if

sent by courier delivery service, on the second Business Day after being picked up by the

courier delivery service; or |

| (c) | if

sent by fax, on completion of its transmission to the fax number provided for in this Agreement, |

provided

that, if it is delivered personally or sent by fax on a day which is not a Business Day or after 5 p.m. on a Business Day, it will instead

be deemed to have been given or made on the next Business Day.

| 9.1. | Neither

Party may assign the benefit of or any of its rights under this Agreement without the prior

written consent of the other Party such consent not to be unreasonably withheld or delayed. |

| 9.2. | This

Agreement will be binding and ensure for the benefit of the personal representative, successors

in title and permitted assigns of each of the Parties, and references to the Parties will

be construed accordingly. |

| 10.1. | Each

Party will do, or procure the doing of, all acts and things and execute, or procure the execution

of all documents as are necessary to give full effect to the terms of this Agreement. |

| 10.2. | Failure

or delay by any Party in exercising any right or remedy under this Agreement will not in

any circumstances operate as a waiver of it, nor will any single or partial exercise of any

right or remedy in any circumstances preclude any other or further exercise of it or the

exercise of any other right or remedy. |

| 10.3. | Any

waiver of any breach of, or any default under, any of the terms of this Agreement will not

be deemed a waiver of any subsequent breach or default and will in no way affect the other

terms of this Agreement. |

| 10.4. | The

rights and remedies expressly provided for by this Agreement will not exclude any rights

or remedies provided by law. |

| 10.5. | No

variation of this Agreement will be valid unless it is in writing and signed by or on behalf

of each Party but no variation will require the consent of the Company. |

| 10.6. | The

illegality, invalidity or unenforceability of any clause or part of this Agreement will not

affect the legality, validity or enforceability of the remainder. |

| 10.7. | The

Parties hereby warrant and confirm that they have full authority and power to enter into

and perform the obligations assumed by them under this Agreement. |

| 10.8. | Notwithstanding

anything to the contrary contained in any constitutional document of the corporate entities

mentioned herein or any other document the terms of this Agreement shall prevail between

the Parties. |

Unless

otherwise provided, each Party shall bear their own costs in connection with the negotiation, preparation, execution and performance

of this Agreement and any documents referred to in it.

The

Parties agree to maintain the terms of this Agreement, identity and personal information of the Parties, and all conversations and exchanged

information (including the Confidential Information) in relation to each other, the Company, strictly confidential, with the exception

of any required disclosure for compliance with applicable and enforceable laws or regulations.

| 13. | BINDING

NATURE OF THE AGREEMENT |

The

terms set out in this Agreement are intended to be legally binding and shall so bind the Parties.

This

Agreement constitutes the entire understanding and agreement between the Parties and supersedes and replaces any and all arrangements,

representations, statements, understanding or agreements between them relating to the subject matter of this Agreement whether written

or oral, or which would be implied by the correspondence or conduct of the Parties.

| 15. | GOVERNING

LAW AND JURISDICTION |

| 15.1. | This

Agreement and any disputes or claims arising out of or in connection with its subject matter

shall be governed by and construed in accordance with the laws of the California. |

| 15.2. | Any

controversy, dispute or claim arising out of or relating to this Agreement or breach thereof

shall first be settled through good faith negotiation between the Parties. If the dispute

cannot be settled through negotiation, the Parties agree to attempt in good faith to settle

the dispute by mediation or arbitration administered by the Judicial Arbitration & Mediation

Service (“JAMS”). Any such mediation or arbitration shall take place in Orange

County, California, at a time and place to be selected by the mediator or arbitrator. The

Parties to the mediation or arbitration may have all rights and powers afforded to a civil

litigant in California Superior Court, including the ability to conduct full discovery and

shall be governed by the rules of civil procedure for actions filed in California Superior

Courts as set forth in California Code of Civil Procedure (“CCP”). The Parties

shall evenly divide the cost of the mediator or arbitrator’s fees. This provision shall

only operate to require mediation or arbitration of claims for money damages. Should a party

wish to seek injunctive or other non-monetary relief, those claims shall be brought in a

court of competent jurisdiction. |

| 16.1. | Time

is of the essence and performance of this Agreement in respect to all provisions of this

Agreement that specify a time for performance, and failure to comply with this provision

shall be a material breach of this Agreement. |

The

original Ensligh version of this Agreement shall prevail in all respects, and in the event of any inconsistenct between translated versions

and the English version, the English version shall take precedence. The translated versions of this Agreement are provided for reference

purposes only and has no legal force or effect.

[Remainder

of page intentionally left blank; signature page to follow.]

IN

WITNESS WHEREOF the Parties have executed this Agreement on the day and year first above written.

| Seller: |

|

Buyer: |

| |

|

|

| Bbang Ssaem Co., Ltd. |

|

Reborn Coffee, Inc. |

| |

|

|

| /s/

Jong Hyun Oh |

|

/s/ Jay Kim |

| Jong Hyun Oh, CEO |

|

Jay Kim, CEO |

SCHEDULE

1

CLOSING

DATE

Part

A: SELLER’S OBLIGATIONS

At

the Closing Date, the Seller shall:

| (a) | produce

and/or deliver to the corresponding Buyer: |

| (i) | a

copy of the current duly attested Regulations of the Company and copies of all amendments

made thereto; |

| (ii) | all

the original or copy of current licenses and registration certificates of the Company; |

| (iii) | the

original current certificate of incorporation of the Company; |

| (iv) | paid

invoices for parts, raw materials and services for the Annual Overhaul as well as all relevant

support documents indicating the actual cost of such parts, raw materials, and services; |

| (v) | the

original share certificates representing the Shares; and |

| (vi) | details

of the bank account in which the Consideration is to be remitted by the Buyer |

| (vii) | letters

of resignations of the directors and the secretary from their respective offices in the Company,

with a written acknowledgement from each of them in such form as the Buyer requires that

each of them has no claim, against the Company in respect of breach of contract, compensation

for loss of office, redundancy or unfair dismissal or on any other grounds whatsoever. |

| (viii) | A

written shareholders’ resolution by the Seller appointing the designated persons of

Buyer as directors of the Company; |

| (ix) | Written

board resolutions authorizing and approving the following matters: |

| ● | approving

the transfer of the Shares; and |

| ● | any

other matter others required for the valid completion of the transactions contemplated in

this agreement. |

| (b) | attend

or have his authorized attorney attend relevant Competent Authorities, with the Buyer or

its authorized attorney to finalize, prepare, execute and deliver all of the applications,

forms, resolutions and documentation required to procure the issue of the Revised Company

Documents, including the payment of any applicable fees and execution of the shares transfers

in favor of the Buyer in respect of all of the Shares (the “Share Transfer Forms”). |

Part

B: BUYER’S OBLIGATION

At

the Closing Date, Buyer shall:

| (a) | produce

and/or deliver to the Seller all the applications, forms, resolutions and documentation as

required for the Buyer to acquire the Shares in its name; or as may be deemed necessary by

the Buyer, all of which must be validly completed and executed by Buyer’s authorized

signatory in accordance with applicable laws and regulations (collectively, the “Permits”); |

| (b) | cooperate

with the Seller in good faith to ensure the orderly transition of the Company from the Seller

to the Buyer by immediately procuring the issue of the Revised Company Documents, recording

required documents, and commencing operational transitions to minimize disruption to the

Company business; and |

| (c) | attend

or have its authorized attorney attend relevant Competent Authorities, with the Seller or

his authorized attorney to finalize, prepare, execute and deliver all of the applications,

forms, resolutions and documentation required to procure the issue of the Revised Company

Documents, including the payment of any applicable fees and execution of the Share Transfer

Forms. |

SCHEDULE

2

SELLER’S

WARRANTIES AND BUYER’S WARRANTIES

A.

SELLER’S WARRANTIES

Except

as otherwise disclosed in this Agreement (including without limitation Sections 3.5 and 3.6 of this Agreement), each Seller individually

represents and warrants, as of the Closing Date, that the sale and purchase of the Shares under this Agreement shall be subject to the

following warranties:

| a. | The

Seller is the exclusive legal and beneficial owner of the Shares and such title is free and

clear of all Encumbrances of any kind whatsoever. |

| b. | The

Seller has full legal right, power, authority and capacity to sell, assign, transfer and

convey or to cause the sale, assignment and transfer of the Shares pursuant to this Agreement. |

| c. | The

issuance to the Buyer of the Shares will transfer the Shares to the Buyer with all rights

and title thereto. |

| d. | The

Shares are validly issued and registered and fully paid. |

| a. | The

Company is a limited liability company duly organized and validly existing under the laws

of South Korea and has full power and authority to own its respective property and to carry

on the Business. |

| b. | The

Seller is not aware of, and has not directly or indirectly taken, any action to delete the

registration of the Company, to have a receiver or administrative receiver (or any person

occupying an analogous position or office in any relevant jurisdiction) appointed in respect

of the Company or in respect of the whole or any part of the Assets or undertaking of the

Company or to have an order made or petition presented for the dissolution or winding up

of the Company or for the appointment of a liquidator. |

| a. | The

Share Capital of the Company as stated in Recitals is complete and accurate and are fully

paid. |

| b. | The

Shares are legally issued by the Seller free from any Encumbrance or any claim to, or contract

to grant, any Encumbrance. |

| c. | The

Company has not allotted or issued any Shares nor has entered any contract that requires

or may require the Company to allot or issue any share or loan capital, and the Company has

not allotted or issued any securities which are convertible into share or loan capital. |

The

Company has good and marketable title to each Asset. There are no Encumbrances over any of the Assets, and the Company has not agreed

to create any Encumbrances over the Assets or any part of them.

There

are no amounts owing to any employees of the Company, other than remuneration accrued (but not yet due for payment) in respect of the

calendar month in which this Agreement is executed.

The

Company has not, in relation to the Business, received notice from a Competent Authority of any breach by it of any regulation including

any competition, anti-trust, anti-restrictive trade practice or consumer protection law, rule or regulation anywhere in the world or

of any investigation, enquiry, report or order by or by reference to any regulatory authority under any such law, rule or regulation.

Neither

the Company, nor any person for whose acts or omissions it may be vicariously liable:

| (i) | is

engaged in, subject to or threatened by any litigation, administrative, mediation or arbitration proceedings in relation to the Business

or the Assets or any of them; or |

| (ii) | is

the subject of any investigation, inquiry or enforcement proceedings by any governmental, administrative or regulatory body. |

No

order has been made or petition presented, meeting convened or resolution passed for the winding up of the Company, nor has any receiver

been appointed or any distress, execution or other process been levied in respect of the Business or the Assets or any of them and no

events have occurred which would justify any such proceedings.

| 9. | Intellectual

Property Rights |

The

Seller has no knowledge of activities involved in the conduct of the Business infringe any Intellectual Property Rights of any third

party.

The

books of accounts and financial statements of the Company that have been furnished to the Buyer is true and accurate and fairly represent

the financial conditions and the result of the operations of the Company for each fiscal year to which they pertain.

The

Seller will be fully coopreative for the Buyer appointed financial auditors who will perform the financial statement audit for the years

ended December 31, 2022 and 2023, and for the interim period financial statement review for the period ended September 30, 2024. Those

audited and reviewed financial statements must be produced by January 25, 2025 so that the Seller shall be able to disclose its public

filing in the system of US Securities and Exchange Commission.

None

of the Company and Mr. Jung Hyun Oh are subject of, or a party to, any charter, by-laws, mortgage, lien, lease, license, permit, agreement,

contract, instrument, law, rule, ordinance, regulation, order, judgment or decree, or any other restriction of any kind or character,

which could prevent execution and delivery of this Agreement by the Seller, or which could prevent consummation of the transactions contemplated

by this Agreement.

All

the lease agreements held by the Company are valid and subsisting and is in full force and effect and the Company has not received notice

from the landlord (and the Seller is not aware of) any proposed, planned or threatened termination or amendment of any of these leases.

To

the best of the knowledge and belief of the Seller, this Agreement does not contain any untrue statement of a material fact or omits

to state a material fact in respect of the Company or the Shares.

| 14. | No

Claims, Liabilities or Material Adverse Changes |

To

the best of the knowledge of the Seller, there are no payables, claims, Liabilities or indebtedness against the Company (whether accrued,

absolute, contingent or otherwise) including but not limited to any dues towards any governmental authorities, and there are no Material

Adverse Changes.

| 15. | Licenses

and Concessions |

The

Company possesses all licenses, permits, registrations and governmental approvals required to carry on its Business, and all such licenses,

permits, registrations and approvals are in full force and effect.

To

the best of the knowledge and belief of the Seller, the Company and the conduct of the Business are in material compliance with all applicable

laws in any jurisdictions, including laws, regulations or ordinances of South Korea.

The

Seller has not entered into any agreement with any person other than the Buyer to sell the Shares.

| 18. | Tax

and Customs Duties |

There

are no outstanding tax obligations, customs duties, fines or interest on late payments in respect of the same or in respect of any other

government dues owing by the Company.

| 19. | Neither

the execution and delivery of this Agreement, the performance of obligations nor the consummation

of the transactions contemplated hereby will conflict or be inconsistent with any of the

terms, covenants, conditions or provisions of, or constitute a breach or default under or

violation of any agreement to which THE SELLER is a party. |

B.

BUYER’S WARRANTIES

Except

as otherwise disclosed in this Agreement (including without limitation Sections 3.5 and 3.6 of this Agreement), Buyer represents and

warrants, as of the Closing Date, that the sale and purchase of the Shares under this Agreement shall be subject to the following warranties:

1.

SOLE RELIANCE

Except

as expressly set forth in this Agreement, the Buyer represents and warrants that it is relying solely upon its own inspection, investigation

and analyses of the Shares and the Company in purchasing the Shares and is not relying in any way upon any representations, statements,

agreements, warranties, studies, reports, descriptions, guidelines or other information, documentation or material furnished by the Seller

or his representatives, whether oral or written, express or implied, or arising by operation of law, of any nature whatsoever regarding

any of the foregoing matters.

2.

DISCLAIMERS

Except

as expressly set forth in this Agreement, the Buyer represents and warrants that it has independently examined, investigated and inspected

the Shares and the Company, and that it is acquiring the Shares on an “as is,” “where is,” and “with all

faults” basis without representation or warranty by Seller whatsoever including, without limitation, in connection with the Permits.

3.

DEFAULTS

The

Buyer represents and warrants that the execution and delivery of this Agreement and the consummation of the transactions contemplated

hereby will not result in any breach of the terms of, conditions of, or constitute a default under, any instrument or obligation by which

the Buyer is bound, or violates any order, writ, injunction or decree of any court in any litigation to which Buyer is a party.

18

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

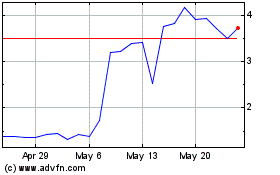

Reborn Coffee (NASDAQ:REBN)

Historical Stock Chart

From Mar 2025 to Apr 2025

Reborn Coffee (NASDAQ:REBN)

Historical Stock Chart

From Apr 2024 to Apr 2025