false

0001509470

0001509470

2024-08-07

2024-08-07

0001509470

SSSS:CommonStockParValue0.01PerShareMember

2024-08-07

2024-08-07

0001509470

SSSS:Sec6.00NotesDue2026Member

2024-08-07

2024-08-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 7, 2024

SURO CAPITAL CORP.

(Exact name of registrant as specified in its charter)

| Maryland |

1-35156 |

27-4443543 |

(State or other jurisdiction of

incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

640 Fifth Avenue

12th Floor

New York, NY 10019

(Address of principal executive offices and zip

code)

Registrant’s telephone number, including

area code: (212) 931-6331

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class: |

Trading symbol: |

Name of each exchange on which

registered: |

| Common Stock, par value $0.01 per share |

SSSS |

Nasdaq Global Select Market |

| 6.00% Notes due 2026 |

SSSSL |

Nasdaq Global Select Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.¨

| Item 2.02. |

Results of Operations and Financial Condition. |

On August 7, 2024, SuRo Capital

Corp. (the “Company”) issued a press release announcing its financial results for the fiscal quarter ended June 30, 2024 (the

“Press Release”). A copy of the Press Release is included as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated

into this Item 2.02 by reference.

The information disclosed

under this Item 2.02, including the information set forth in Exhibit 99.1 hereto, is being “furnished” and shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or

otherwise. The information in this Item 2.02 shall not be incorporated by reference into any registration statement or other document

pursuant to the Securities Act of 1933, as amended, or into any filing or other document pursuant to the Exchange Act, except as otherwise

expressly stated in any such filing.

| Item 9.01. |

Financial Statements and Exhibits. |

* The press release attached hereto as Exhibit 99.1 is “furnished”

and not “filed,” as described in Item 2.02 of this Current Report on Form 8-K.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| Date: August 7, 2024 |

SURO CAPITAL CORP. |

| |

|

| |

|

| |

By: |

/s/ Allison Green |

| |

|

Allison Green |

| |

|

Chief Financial Officer, Chief Compliance Officer,

Treasurer and Corporate Secretary |

Exhibit 99.1

SuRo Capital Corp. Reports Second Quarter 2024

Financial Results

Net Asset Value of $6.94 Per Share as of June 30,

2024

Executed Purchase Agreement for 6.50% Convertible

Notes Due 2029

Board Approved Note Repurchase Program Up To

$35.0 Million

NEW YORK, NY, August 7, 2024 (GLOBE NEWSWIRE)

– SuRo Capital Corp. (“SuRo Capital”, the “Company”, “we”, “us”, and “our”)

(Nasdaq: SSSS) today announced its financial results for the quarter ended June 30, 2024. Net assets totaled approximately

$162.3 million, or $6.94 per share, at June 30, 2024, as compared to $7.17 per share at March 31, 2024 and $7.35 per share

at June 30, 2023.

“The second quarter was broadly positive

for the U.S. economy and equity markets as investors became increasingly confident in the prospect of rate cuts later in the year. However,

as of late last week, the market has become volatile due to a confluence of domestic and global factors leading to a sharp change in

investor sentiment. Despite these fluctuations in the broader public markets, in the second quarter, private technology companies continued

to see increasing interest from investors,” said Mark Klein, Chairman and Chief Executive Officer of SuRo Capital.

Mr. Klein continued, “As we have previously

mentioned, with nearly $55.0 million in investable capital, we remain incredibly enthusiastic about our investment pipeline. During the

second quarter, we completed a $10.0 million investment in Canva, Inc., a leading design software and collaboration platform with

over 170 million monthly users, and a $15.0 million investment in CW Opportunity 2 LP, an SPV invested in CoreWeave, Inc., an AI

cloud computing provider offering a suite of NVIDIA GPUs on top of its fast and flexible infrastructure. We believe that these investments

strengthen our already well-positioned existing portfolio for the re-opening of the IPO window.”

“We are pleased to announce our Board of

Directors has approved a repurchase program of up to $35.0 million for our 6.00% Notes due 2026. Additionally, the Board approved up

to $75.0 million of private 6.50% Convertible Notes due 2029, with an initial issuance of up to $25.0 million. We believe the refinancing

of a portion of our current debt to a longer-dated convertible instrument with favorable terms strengthens our balance sheet,”

Mr. Klein continued.

“As we have consistently demonstrated,

SuRo Capital is committed to initiatives that enhance shareholder value, and we believe the market is currently undervaluing our portfolio.

Given the discount our stock has traded at compared to net asset value per share, we believe our recently completed Modified Dutch Auction

Tender Offer was an efficient and accretive deployment of capital,” concluded Mr. Klein.

Investment Portfolio as of June 30, 2024

At June 30, 2024, SuRo Capital held positions

in 39 portfolio companies – 35 privately held and 4 publicly held, some of which may be subject to certain lock-up provisions –

with an aggregate fair value of approximately $182.9 million. The Company’s top five portfolio company investments accounted for

approximately 49% of the total portfolio at fair value as of June 30, 2024.

Top Five Investments as of June 30, 2024

| Portfolio

Company ($ in millions) | |

Cost Basis | | |

Fair Value | | |

% of Total

Portfolio | |

| Learneo, Inc. | |

$ | 15.0 | | |

$ | 29.0 | | |

| 15.9 | % |

| Blink Health, Inc. | |

| 15.0 | | |

| 19.9 | | |

| 10.9 | |

| CW Opportunity 2 LP | |

| 15.0 | | |

| 15.0 | | |

| 8.2 | |

| ServiceTitan, Inc. | |

| 10.0 | | |

| 14.4 | | |

| 7.9 | |

| Locus Robotics Corp. | |

| 10.0 | | |

| 11.0 | | |

| 6.0 | |

| Total | |

$ | 65.0 | | |

$ | 89.3 | | |

| 48.8 | % |

Note: Total may not sum due to rounding.

Second Quarter 2024 Investment Portfolio Activity

During the three months ended June 30, 2024,

SuRo Capital made the following investments:

| Portfolio

Company | |

Investment | |

Transaction

Date | |

Amount |

| Canva, Inc. | |

Common Shares | |

4/17/2024 | |

$10.0 million |

| CW

Opportunity 2 LP(1) | |

Class A Interest | |

5/7/2024 | |

$15.0 million |

| (1) | CW Opportunity 2 LP is a special purpose

vehicle that is invested in the Series C Preferred Shares of CoreWeave, Inc. |

During the three months ended June 30, 2024,

SuRo Capital exited or received proceeds from the following investments, excluding short-term US treasuries:

| Portfolio

Company | |

Transaction

Date | |

Net

Proceeds | |

Realized

Gain |

| Architect

Capital PayJoy SPV, LLC(1) | |

6/28/2024 | |

$10.0 million | |

$- |

| True Global Ventures 4 Plus Pte Ltd | |

6/28/2024 | |

$0.2 million | |

$- |

| (1) | On June 28, 2024, SuRo Capital

redeemed its Membership Interest in Architect Capital PayJoy SPV, LLC. |

Subsequent to quarter-end through August 7,

2024, SuRo Capital exited or received proceeds from the following investments:

| Portfolio Company | |

Transaction

Date | |

Quantity | |

Average

Net

Share Price(1) | |

Net

Proceeds | |

Realized Gain |

| PSQ

Holdings, Inc. (d/b/a PublicSquare) – Public Common Shares(2) | |

Various | |

220,000 | |

$2.87 | |

$0.6 million | |

$0.5 million |

| (1) | The average net share price is the net share price realized after

deducting all commissions and fees on the sale(s), if applicable. |

| (2) | As of August 7, 2024, SuRo Capital

held 1,756,032 remaining PSQ Holdings, Inc. (d/b/a PublicSquare) public common shares. |

Second Quarter 2024 Financial Results

| | |

Quarter

Ended

June 30, 2024 | | |

Quarter

Ended

June 30, 2023 | |

| | |

$ in

millions | | |

per

share(1) | | |

$ in

millions | | |

per

share(1) | |

| Net investment loss | |

$ | (3.7 | ) | |

$ | (0.16 | ) | |

$ | (3.8 | ) | |

$ | (0.15 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net realized loss on investments | |

| (0.0 | ) | |

| (0.00 | ) | |

| (13.3 | ) | |

| (0.51 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net change in unrealized appreciation/(depreciation)

of investments | |

| (7.0 | ) | |

| (0.30 | ) | |

| 1.5 | | |

| 0.06 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net

decrease in net assets resulting from operations – basic (2) | |

$ | (10.7 | ) | |

$ | (0.45 | ) | |

$ | (15.6 | ) | |

$ | (0.60 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Repurchase of common stock | |

| (9.4 | ) | |

| 0.20 | | |

| (13.5 | ) | |

| 0.33 | |

| | |

| | | |

| | | |

| | | |

| | |

| Stock-based compensation | |

| 0.6 | | |

| 0.03 | | |

| 0.8 | | |

| 0.03 | |

| | |

| | | |

| | | |

| | | |

| | |

| Decrease

in net asset value(2) | |

$ | (19.4 | ) | |

$ | (0.23 | ) | |

$ | (28.4 | ) | |

$ | (0.24 | ) |

| (1) | Based on basic weighted-average number

of shares outstanding for the relevant period. |

| (2) | Total may not sum due to rounding. |

Weighted-average common basic shares outstanding

were approximately 23.4 million and 26.0 million for the quarters ended June 30, 2024 and 2023, respectively. As of June 30,

there were 23,378,002 shares of the Company’s common stock outstanding.

SuRo Capital’s liquid assets were approximately

$57.6 million as of June 30, 2024, consisting of cash and securities of publicly traded portfolio companies not subject to lock-up

restrictions at quarter-end.

Convertible Note Purchase Agreement

On August 6, 2024, SuRo Capital entered

into a Note Purchase Agreement (the “Note Purchase Agreement”), by and between the Company and the purchaser identified therein

(the “Purchaser”), pursuant to which we may issue up to a maximum of $75.0 million in aggregate principal amount of 6.50%

Convertible Notes due 2029 (the “Convertible Notes”). Pursuant to the Note Purchase Agreement, we agreed to issue and sell,

and the Purchaser agreed to purchase, up to $25.0 million in aggregate principal amount of the Convertible Notes (the “Initial

Notes”). Thereafter, upon mutual agreement between the Company and the Purchaser, we may issue additional Convertible Notes for

sale in subsequent offerings (the “Additional Notes”), or issue additional notes with modified pricing terms (the “New

Notes”), in the aggregate for both the Additional Notes and the New Notes, up to a maximum of $50.0 million in one or more private

offerings. The Purchaser will acquire, and we will issue, up to $25.0 million of the Initial Notes on or about August 14, 2024 (the

“Initial Closing Date”), and thereafter at such time and date as the Purchaser and we mutually agree to purchase and sell

any Additional Notes.

Interest on the Convertible Notes will be paid

quarterly in arrears on March 30, June 30, September 30, and December 30, at a rate of 6.50% per year, beginning

September 30, 2024. The Convertible Notes will mature on August 14, 2029 and may be redeemed in whole or in part at any time

or from time to time at our option on or after August 6, 2027 upon the fulfillment of certain conditions. The Convertible Notes

will be convertible into shares of our common stock at the Purchaser's sole discretion at an initial conversion rate of 129.0323 shares

of our common stock per $1,000 principal amount of the Convertible Notes, subject to adjustment as provided in the Note Purchase Agreement.

The net proceeds from the offering will be used to repay outstanding indebtedness, make investments in accordance with our investment

objective and investment strategy, and for other general corporate purposes. The Note Purchase Agreement includes customary representations,

warranties, and covenants by the Company.

Note Repurchase Program

On August 6, 2024, SuRo Capital’s

Board of Directors approved a discretionary note repurchase program (the “Note Repurchase Program”) which allows the Company

to repurchase up to 46.67%, or $35.0 million in aggregate principal amount, of our 6.00% Notes due 2026 through open market purchases,

including block purchases, in such manner as will comply with the provisions of the Investment Company Act of 1940, as amended (the "1940

Act") and the Securities Exchange Act of 1934, as amended (the "Exchange Act"). As of August 7, 2024, we had not

repurchased any of the 6.00% Notes due 2026 under the Note Repurchase Program.

Modified Dutch Auction Tender Offer

On February 14, 2024, our Board of Directors

authorized a modified Dutch Auction tender offer (the “Tender Offer”) to purchase up to 2.0 million shares of our common

stock at a price per share not less than $4.00 and not greater than $5.00 in $0.10 increments, using available cash. In accordance with

the Tender Offer, following the expiration of the Tender Offer at 5:00 P.M. Eastern Time on April 1, 2024, the Company repurchased

2,000,000 shares at a price of $4.70 per share, representing 7.9% of its outstanding shares. The per share purchase price of properly

tendered shares represents 65.6% of net asset value per share as of March 31, 2024.

Share Repurchase Program

Under the Share Repurchase Program, the Company

may repurchase its outstanding common stock in the open market, provided it complies with the prohibitions under its insider trading

policies and procedures and the applicable provisions of the 1940 Act and the Exchange Act.

Since inception of the Share Repurchase Program

in August 2017, SuRo Capital has repurchased over 6.0 million shares of its common stock for an aggregate purchase price of approximately

$39.3 million. This does not include repurchases under various tender offers during this time period. The dollar value of shares that

may yet be purchased by SuRo Capital under the Share Repurchase Program is approximately $20.7 million. The Share Repurchase Program

is authorized through October 31, 2024.

Conference Call and Webcast

Management will hold a conference call and webcast

for investors at 2:00 p.m. PT (5:00 p.m. ET) on August 7, 2024. The conference call access number for U.S. participants

is 866-580-3963, and the conference call access number for participants outside the U.S. is +1 786-697-3501. The conference ID number

for both access numbers is 6397974. Additionally, interested parties can listen to a live webcast of the call from the "Investor

Relations" section of SuRo Capital’s website at www.surocap.com. An archived replay of the webcast will also be available

for 12 months following the live presentation.

A replay of the conference call may be accessed

until 5:00 p.m. PT (8:00 p.m. ET) on August 14, 2024 by dialing 866-583-1035 (U.S.) or +44 (0) 20 3451 9993 (International)

and using conference ID number 6397974.

Forward-Looking Statements

Statements included herein, including statements

regarding SuRo Capital's beliefs, expectations, intentions, or strategies for the future, may constitute "forward-looking statements".

SuRo Capital cautions you that forward-looking statements are not guarantees of future performance and that actual results or developments

may differ materially from those projected or implied in these statements. All forward-looking statements involve a number of risks and

uncertainties, including the impact of any market volatility that may be detrimental to our business, our portfolio companies, our industry,

and the global economy, that could cause actual results to differ materially from the plans, intentions, and expectations reflected in

or suggested by the forward-looking statements. Risk factors, cautionary statements, and other conditions which could cause SuRo Capital's

actual results to differ from management's current expectations are contained in SuRo Capital's filings with the Securities and Exchange

Commission. SuRo Capital undertakes no obligation to update any forward-looking statement to reflect events or circumstances that may

arise after the date of this press release.

About SuRo Capital Corp.

SuRo Capital Corp. (Nasdaq: SSSS) is a

publicly traded investment fund that seeks to invest in high-growth, venture-backed private companies. The fund seeks to create a portfolio

of high-growth emerging private companies via a repeatable and disciplined investment approach, as well as to provide investors with

access to such companies through its publicly traded common stock. SuRo Capital is headquartered in New York, NY and has offices in San

Francisco, CA. Connect with the company on X, LinkedIn, and at www.surocap.com.

Contact

SuRo Capital Corp.

(212) 931-6331

IR@surocap.com

SURO CAPITAL CORP. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF ASSETS

AND LIABILITIES (UNAUDITED)

| | |

June 30, 2024 | | |

December 31, 2023 | |

| ASSETS | |

| | | |

| | |

| Investments at fair value: | |

| | | |

| | |

| Non-controlled/non-affiliate investments (cost of $195,251,769 and $160,994,161, respectively) | |

$ | 161,548,344 | | |

$ | 147,167,535 | |

| Non-controlled/affiliate investments (cost of $32,733,009 and $32,775,940, respectively) | |

| 19,386,536 | | |

| 24,931,333 | |

| Controlled investments (cost of $8,764,352 and $18,771,097, respectively) | |

| 1,970,000 | | |

| 11,982,381 | |

| Total Portfolio Investments | |

| 182,904,880 | | |

| 184,081,249 | |

| Investments in U.S. Treasury bills (cost of $0 and $63,792,704, respectively) | |

| — | | |

| 63,810,855 | |

| Total Investments (cost of $236,749,130 and $276,333,902, respectively) | |

| 182,904,880 | | |

| 247,892,104 | |

| Cash | |

| 54,379,773 | | |

| 28,178,352 | |

| Escrow proceeds receivable | |

| 71,044 | | |

| 309,293 | |

| Interest and dividends receivable | |

| 83,844 | | |

| 132,607 | |

| Deferred financing costs | |

| 561,075 | | |

| 594,726 | |

| Prepaid expenses and other assets(1) | |

| 282,555 | | |

| 494,602 | |

| Total Assets | |

| 238,283,171 | | |

| 277,601,684 | |

| LIABILITIES | |

| | | |

| | |

| Accounts payable and accrued expenses(1) | |

| 2,002,539 | | |

| 346,308 | |

| Dividends payable | |

| 44,700 | | |

| 152,523 | |

| 6.00% Notes due December 30, 2026(2) | |

| 73,923,741 | | |

| 73,745,207 | |

| Total Liabilities | |

| 75,970,980 | | |

| 74,244,038 | |

| | |

| | | |

| | |

| Net Assets | |

$ | 162,312,191 | | |

$ | 203,357,646 | |

| NET ASSETS | |

| | | |

| | |

| Common stock, par value $0.01 per share (100,000,000 authorized; 23,378,002 and 25,445,805 issued and outstanding, respectively) | |

$ | 233,780 | | |

$ | 254,458 | |

| Paid-in capital in excess of par | |

| 240,145,859 | | |

| 248,454,107 | |

| Accumulated net investment loss | |

| (11,182,638 | ) | |

| (4,304,111 | ) |

| Accumulated net realized loss on investments, net of distributions | |

| (12,802,458 | ) | |

| (12,348,772 | ) |

| Accumulated net unrealized appreciation/(depreciation) of investments | |

| (54,082,352 | ) | |

| (28,698,036 | ) |

| Net Assets | |

$ | 162,312,191 | | |

$ | 203,357,646 | |

| Net Asset Value Per Share | |

$ | 6.94 | | |

$ | 7.99 | |

| (1) | This balance includes a right of use asset

and corresponding operating lease liability, respectively. |

| (2) | As of June 30, 2024, the 6.00% Notes

due December 30, 2026 (the "6.00% Notes due 2026") (effective interest rate

of 6.53%) had a face value $75,000,000. As of December 31, 2023, the 6.00% Notes due

2026 (effective interest rate of 6.53%) had a face value $75,000,000. |

SURO CAPITAL CORP. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

| | |

Three Months Ended June 30, | | |

Six Months Ended June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| INVESTMENT INCOME | |

| | | |

| | | |

| | | |

| | |

| Non-controlled/non-affiliate investments: | |

| | | |

| | | |

| | | |

| | |

| Interest income(1) | |

$ | 290,750 | | |

$ | 40,394 | | |

$ | 532,757 | | |

$ | 89,869 | |

| Dividend income | |

| — | | |

| 63,145 | | |

| 21,875 | | |

| 126,290 | |

| Controlled investments: | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 376,667 | | |

| 318,425 | | |

| 811,667 | | |

| 554,425 | |

| Interest income from U.S. Treasury bills | |

| 359,936 | | |

| 950,254 | | |

| 1,189,145 | | |

| 1,900,716 | |

| Total Investment Income | |

| 1,027,353 | | |

| 1,372,218 | | |

| 2,555,444 | | |

| 2,671,300 | |

| OPERATING EXPENSES | |

| | | |

| | | |

| | | |

| | |

| Compensation expense | |

| 2,198,509 | | |

| 2,117,872 | | |

| 4,383,827 | | |

| 4,254,626 | |

| Directors’ fees | |

| 167,825 | | |

| 161,661 | | |

| 338,938 | | |

| 322,226 | |

| Professional fees | |

| 586,825 | | |

| 916,579 | | |

| 1,315,384 | | |

| 1,907,413 | |

| Interest expense | |

| 1,214,267 | | |

| 1,214,267 | | |

| 2,428,534 | | |

| 2,427,553 | |

| Income tax expense | |

| 52,794 | | |

| 90,826 | | |

| 54,894 | | |

| 620,606 | |

| Other expenses | |

| 462,758 | | |

| 676,353 | | |

| 912,394 | | |

| 1,165,981 | |

| Total Operating Expenses | |

| 4,682,978 | | |

| 5,177,558 | | |

| 9,433,971 | | |

| 10,698,405 | |

| Net Investment Loss | |

| (3,655,625 | ) | |

| (3,805,340 | ) | |

| (6,878,527 | ) | |

| (8,027,105 | ) |

| Realized Gain/(Loss) on Investments: | |

| | | |

| | | |

| | | |

| | |

| Non-controlled/non-affiliated investments | |

| (22,867 | ) | |

| (2,325,175 | ) | |

| (507,008 | ) | |

| (2,135,832 | ) |

| Non-controlled/affiliate investments | |

| — | | |

| (10,945,024 | ) | |

| 60,067 | | |

| (10,945,024 | ) |

| Controlled investments | |

| (6,745 | ) | |

| — | | |

| (6,745 | ) | |

| — | |

| Net Realized Loss on Investments | |

| (29,612 | ) | |

| (13,270,199 | ) | |

| (453,686 | ) | |

| (13,080,856 | ) |

| Change in Unrealized Appreciation/(Depreciation) of Investments: | |

| | | |

| | | |

| | | |

| | |

| Non-controlled/non-affiliated investments | |

| (3,481,638 | ) | |

| (12,152,800 | ) | |

| (19,876,809 | ) | |

| (14,216,377 | ) |

| Non-controlled/affiliate investments | |

| (3,485,172 | ) | |

| 11,220,424 | | |

| (5,501,871 | ) | |

| 9,900,060 | |

| Controlled investments | |

| 864 | | |

| 2,387,891 | | |

| (5,636 | ) | |

| 14,420,763 | |

| Net Change in Unrealized Appreciation/(Depreciation) of Investments | |

| (6,965,946 | ) | |

| 1,455,515 | | |

| (25,384,316 | ) | |

| 10,104,446 | |

| Net Change in Net Assets Resulting from Operations | |

$ | (10,651,183 | ) | |

$ | (15,620,024 | ) | |

$ | (32,716,529 | ) | |

$ | (11,003,515 | ) |

| Net Change in Net Assets Resulting from Operations per Common Share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (0.45 | ) | |

$ | (0.60 | ) | |

$ | (1.34 | ) | |

$ | (0.41 | ) |

| Diluted(2) | |

$ | (0.45 | ) | |

$ | (0.60 | ) | |

$ | (1.34 | ) | |

$ | (0.41 | ) |

| Weighted-Average Common Shares Outstanding | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 23,410,235 | | |

| 25,952,447 | | |

| 24,401,863 | | |

| 27,158,786 | |

| Diluted(2) | |

| 23,410,235 | | |

| 25,952,447 | | |

| 24,401,863 | | |

| 27,158,786 | |

| (1) | Includes interest income earned on cash. |

| (2) | For the three and six months ended June 30,

2024 and June 30, 2023, there were no potentially dilutive securities outstanding. |

SURO CAPITAL CORP. AND SUBSIDIARIES

FINANCIAL HIGHLIGHTS (UNAUDITED)

| | |

Three Months Ended June 30, | | |

Six Months Ended June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Per Basic Share Data | |

| | | |

| | | |

| | | |

| | |

| Net asset value at beginning of the year | |

$ | 7.17 | | |

$ | 7.59 | | |

$ | 7.99 | | |

$ | 7.39 | |

| Net investment loss(1) | |

| (0.16 | ) | |

| (0.15 | ) | |

| (0.28 | ) | |

| (0.30 | ) |

| Net realized loss on investments(1) | |

| — | | |

| (0.51 | ) | |

| (0.02 | ) | |

| (0.48 | ) |

| Net change in unrealized appreciation/(depreciation) of investments(1) | |

| (0.30 | ) | |

| 0.06 | | |

| (1.04 | ) | |

| 0.37 | |

| Repurchase of common stock(1) | |

| 0.20 | | |

| 0.33 | | |

| 0.23 | | |

| 0.33 | |

| Stock-based compensation(1) | |

| 0.03 | | |

| 0.03 | | |

| 0.06 | | |

| 0.04 | |

| Net asset value at end of period | |

$ | 6.94 | | |

$ | 7.35 | | |

$ | 6.94 | | |

$ | 7.35 | |

| Per share market value at end of period | |

$ | 4.01 | | |

$ | 3.20 | | |

$ | 4.01 | | |

$ | 3.20 | |

| Total return based on market value(2) | |

| (11.87 | )% | |

| (11.60 | )% | |

| 1.78 | % | |

| (15.79 | )% |

| Total return based on net asset value(2) | |

| (3.21 | )% | |

| (3.16 | )% | |

| (13.14 | )% | |

| (0.54 | )% |

| Shares outstanding at end of period | |

| 23,378,002 | | |

| 25,398,640 | | |

| 23,378,002 | | |

| 25,398,640 | |

| Ratios/Supplemental Data: | |

| | | |

| | | |

| | | |

| | |

| Net assets at end of period | |

$ | 162,312,191 | | |

$ | 186,692,724 | | |

$ | 162,312,191 | | |

$ | 186,692,724 | |

| Average net assets | |

$ | 175,240,305 | | |

$ | 205,097,855 | | |

$ | 188,879,950 | | |

$ | 207,210,870 | |

| Ratio of net operating expenses to average net assets(3) | |

| 10.75 | % | |

| 10.13 | % | |

| 10.04 | % | |

| 10.41 | % |

| Ratio of net investment loss to average net assets(3) | |

| (8.39 | )% | |

| (7.44 | )% | |

| (7.32 | )% | |

| (7.81 | )% |

| Portfolio Turnover Ratio | |

| 5.72 | % | |

| 2.09 | % | |

| 5.84 | % | |

| 3.89 | % |

| (1) | Based on weighted-average number of shares

outstanding for the relevant period. |

| (2) | Total return based on market value is based

upon the change in market price per share between the opening and ending market values per

share in the period, adjusted for dividends and equity issuances. Total return based on net

asset value is based upon the change in net asset value per share between the opening and

ending net asset values per share in the period, adjusted for dividends and equity issuances. |

| (3) | Financial highlights for periods of less

than one year are annualized and the ratios of operating expenses to average net assets and

net investment loss to average net assets are adjusted accordingly. Because the ratios are

calculated for the Company’s common stock taken as a whole, an individual investor’s

ratios may vary from these ratios. |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=SSSS_CommonStockParValue0.01PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=SSSS_Sec6.00NotesDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

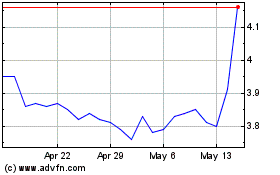

SuRo Capital (NASDAQ:SSSS)

Historical Stock Chart

From Mar 2025 to Apr 2025

SuRo Capital (NASDAQ:SSSS)

Historical Stock Chart

From Apr 2024 to Apr 2025