0000912615false00009126152025-02-262025-02-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) February 26, 2025

URBAN OUTFITTERS, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

|

|

|

Pennsylvania |

|

000-22754 |

|

23-2003332 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

5000 South Broad Street, Philadelphia, PA |

|

19112 |

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code (215) 454-5500

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Shares, par value $.0001 per share |

|

URBN |

|

NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule l2b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On February 26, 2025, Urban Outfitters, Inc. (the “Company”) issued an earnings release, which is attached hereto as Exhibit 99.1 and incorporated herein by reference. The earnings release disclosed material non-public information regarding the Company’s earnings for the three and twelve months ended January 31, 2025.

|

|

Item 9.01. |

Financial Statements and Exhibits |

- 1 -

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

URBAN OUTFITTERS, INC. |

|

|

|

|

|

|

|

Date: February 27, 2025 |

|

|

|

By: |

|

/s/ Melanie Marein-Efron |

|

|

|

|

|

|

|

|

Melanie Marein-Efron |

|

|

|

|

|

|

|

|

Chief Financial Officer |

- 2 -

Exhibit 99.1

URBAN OUTFITTERS, INC.

Fourth Quarter Results

Philadelphia, PA – February 26, 2025

|

|

|

|

|

For Immediate Release |

|

Contact: |

|

Oona McCullough |

|

|

|

|

Executive Director of Investor Relations |

|

|

|

|

(215) 454-4806 |

URBN Reports Record Q4 Sales and FY'25 Profits

PHILADELPHIA, PA, February 26, 2025 – Urban Outfitters, Inc. (NASDAQ:URBN), a leading lifestyle products and services company which operates a portfolio of global consumer brands including the Anthropologie, Free People, FP Movement, Urban Outfitters and Nuuly brands, today announced net income of $120.3 million and earnings per diluted share of $1.28 for the three months ended January 31, 2025. For the year ended January 31, 2025, net income was a record $402.5 million and earnings per diluted share were $4.26.

For the three months ended January 31, 2025 and 2024, adjusted net income was $98.1 million and $65.8 million, respectively, and adjusted earnings per diluted share were $1.04 and $0.69, respectively. For the years ended January 31, 2025 and 2024, adjusted net income was $383.9 million and $304.6 million, respectively, and adjusted earnings per diluted share were $4.06 and $3.23, respectively. Adjusted net income and earnings per diluted share for the three months ended January 31, 2025, excludes a release of income tax reserves. Adjusted net income and earnings per diluted share for the year ended January 31, 2025, excludes store impairment and lease abandonment charges and a release of income tax reserves. Adjusted net income and earnings per diluted share for the three months and year ended January 31, 2024, excludes store impairment and lease abandonment charges, an asset impairment charge and a change in revenue recognition method for Nuuly. See "Reconciliation of Non-GAAP Financial Measures" included at the end of this release.

Total Company net sales for the three months ended January 31, 2025, increased 10.1% to a record $1.64 billion. Total Company net sales for the three months ended January 31, 2025, increased 9.4% compared to total Company adjusted net sales for the three months ended January 31, 2024. Total Retail segment net sales increased 6.3%, with comparable Retail segment net sales increasing 5.1%. The increase in Retail segment comparable net sales was driven by high single-digit positive growth in digital channel sales and low single-digit positive growth in retail store sales. Comparable Retail segment net sales increased 8.3% at Anthropologie and 8.0% at Free People and decreased 3.5% at Urban Outfitters. Subscription segment net sales increased by 78.4%. Subscription segment net sales increased by 55.6% compared to Subscription segment adjusted net sales for the three months ended January 31, 2024. The Subscription segment adjusted net sales increase was primarily driven by a 53.5% increase in average active subscribers in the current quarter versus the prior year quarter. Wholesale segment net sales increased 26.2% driven by a 27.0% increase in Free People wholesale sales due to an increase in sales to specialty customers and department stores.

For the year ended January 31, 2025, total Company net sales increased 7.7% to a record $5.55 billion. Total Company net sales for the year ended January 31, 2025, increased 7.6% compared to total Company adjusted net sales for the year ended January 31, 2024. Total Retail segment net sales increased 4.7%, with comparable Retail segment net sales increasing 3.4%. The increase in Retail segment comparable net sales was driven by mid single-digit positive growth in digital channel sales and low single-digit positive growth in retail store sales. Comparable Retail segment net sales increased 8.9% at Free People and 7.7% at Anthropologie and decreased 8.7% at Urban Outfitters. Subscription segment net sales increased by 60.4%. Subscription segment net sales increased by 56.8% compared to Subscription segment adjusted net sales for the year ended January 31, 2024. The Subscription segment adjusted net sales increase was primarily driven by a 51.3% increase in average active subscribers in the current year versus the prior year period. Wholesale segment net sales increased 15.5% driven by a 17.9% increase in Free People wholesale sales due to an increase in sales to specialty customers and department stores, partially offset by a decrease in Urban Outfitters wholesale sales.

“We are pleased to announce record Q4 revenues and full-year profits,” said Richard A. Hayne, Chief Executive Officer. “Our success was driven by strength across all three segments – Retail, Subscription and Wholesale. We believe these results demonstrate the effectiveness of our strategic initiatives and give us confidence in URBN's continued success,” finished Mr. Hayne.

Net sales by brand and segment for the three and twelve-month periods were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Twelve Months Ended |

|

|

January 31, |

|

|

January 31, |

|

|

2025 |

|

|

2024 |

|

|

2025 |

|

|

2024 |

|

Net sales by brand |

|

|

|

|

|

|

|

|

|

|

|

Anthropologie(1) |

$ |

743,030 |

|

|

$ |

679,524 |

|

|

$ |

2,426,438 |

|

|

$ |

2,233,070 |

|

Free People(2) |

|

410,618 |

|

|

|

362,266 |

|

|

|

1,460,295 |

|

|

|

1,298,974 |

|

Urban Outfitters |

|

360,192 |

|

|

|

372,566 |

|

|

|

1,247,742 |

|

|

|

1,352,073 |

|

Nuuly |

|

112,524 |

|

|

|

63,080 |

|

|

|

378,394 |

|

|

|

235,859 |

|

Menus & Venues |

|

9,756 |

|

|

|

8,758 |

|

|

|

37,797 |

|

|

|

33,261 |

|

Total Company |

$ |

1,636,120 |

|

|

$ |

1,486,194 |

|

|

$ |

5,550,666 |

|

|

$ |

5,153,237 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales by segment |

|

|

|

|

|

|

|

|

|

|

|

Retail Segment |

$ |

1,454,996 |

|

|

$ |

1,368,742 |

|

|

$ |

4,896,694 |

|

|

$ |

4,678,698 |

|

Subscription Segment(3) |

|

112,524 |

|

|

|

63,080 |

|

|

|

378,394 |

|

|

|

235,859 |

|

Wholesale Segment |

|

68,600 |

|

|

|

54,372 |

|

|

|

275,578 |

|

|

|

238,680 |

|

Total Company |

$ |

1,636,120 |

|

|

$ |

1,486,194 |

|

|

$ |

5,550,666 |

|

|

$ |

5,153,237 |

|

Adjusted net sales by brand and segment for the three and twelve-month periods were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Twelve Months Ended |

|

|

January 31, |

|

|

January 31, |

|

|

2025 |

|

|

2024 |

|

|

2025 |

|

|

2024 |

|

Adjusted net sales by brand |

|

|

|

|

|

|

|

|

|

|

|

Anthropologie(1) |

$ |

743,030 |

|

|

$ |

679,524 |

|

|

$ |

2,426,438 |

|

|

$ |

2,233,070 |

|

Free People(2) |

|

410,618 |

|

|

|

362,266 |

|

|

|

1,460,295 |

|

|

|

1,298,974 |

|

Urban Outfitters |

|

360,192 |

|

|

|

372,566 |

|

|

|

1,247,742 |

|

|

|

1,352,073 |

|

Nuuly |

|

112,524 |

|

|

|

72,309 |

|

|

|

378,394 |

|

|

|

241,315 |

|

Menus & Venues |

|

9,756 |

|

|

|

8,758 |

|

|

|

37,797 |

|

|

|

33,261 |

|

Total Company |

$ |

1,636,120 |

|

|

$ |

1,495,423 |

|

|

$ |

5,550,666 |

|

|

$ |

5,158,693 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted net sales by segment |

|

|

|

|

|

|

|

|

|

|

|

Retail Segment |

$ |

1,454,996 |

|

|

$ |

1,368,742 |

|

|

$ |

4,896,694 |

|

|

$ |

4,678,698 |

|

Subscription Segment(3) |

|

112,524 |

|

|

|

72,309 |

|

|

|

378,394 |

|

|

|

241,315 |

|

Wholesale Segment |

|

68,600 |

|

|

|

54,372 |

|

|

|

275,578 |

|

|

|

238,680 |

|

Total Company |

$ |

1,636,120 |

|

|

$ |

1,495,423 |

|

|

$ |

5,550,666 |

|

|

$ |

5,158,693 |

|

(1)Anthropologie includes the Anthropologie and Terrain brands.

(2)Free People includes the Free People and FP Movement brands.

(3)The Subscription segment (formerly known as the Nuuly segment) includes the Nuuly brand, which is primarily a monthly women's apparel subscription rental service.

For the three months ended January 31, 2025, the gross profit rate increased by 304 basis points compared to the three months ended January 31, 2024, and gross profit dollars increased 21.5% to $527.7 million from $434.2 million. For the three months ended January 31, 2025, the gross profit rate as a percentage of net sales increased by 203 basis points compared to the adjusted gross profit rate as a percentage of adjusted net sales in the three months ended January 31, 2024. Adjusted gross profit dollars increased by 16.8% to $527.7 million from $451.9 million. The increase in adjusted gross profit rate was primarily due to improved Retail segment markdowns driven by lower markdowns at Urban Outfitters, which were partially offset by an increase at Free People. The increase in adjusted gross profit dollars was due to higher adjusted net sales and the improved adjusted gross profit rate.

For the year ended January 31, 2025, the gross profit rate increased by 142 basis points compared to the year ended January 31, 2024, and gross profit dollars increased 12.3% to $1.93 billion from $1.72 billion. For the year ended January 31, 2025, the adjusted gross profit rate as a percentage of net sales increased by 122 basis points compared to the adjusted gross profit rate as a percentage of adjusted net sales in the year ended January 31, 2024. Adjusted gross profit dollars increased by 11.5% to $1.93 billion from $1.73 billion. The increase in adjusted gross profit rate for the year ended January 31, 2025, was primarily due to higher initial merchandise markups for all segments primarily driven by Company cross-functional initiatives. The increase in adjusted gross profit dollars was due to higher adjusted net sales and the improved adjusted gross profit rate.

As of January 31, 2025, total inventory increased by $70.9 million, or 12.9%, compared to total inventory as of January 31, 2024. Total Retail segment inventory increased 10.1%. Retail segment comparable inventory increased 11.3%. Wholesale segment inventory increased 43.7%. The increase in inventory for both segments was to support increased sales and planned early receipts.

For the three months ended January 31, 2025, selling, general and administrative expenses increased by $31.9 million, or 8.6%, compared to the three months ended January 31, 2024. Selling, general and administrative expenses leveraged 33 basis points as a percentage of net sales and expressed as a percentage of adjusted net sales leveraged 18 basis points compared to the three months ended January 31, 2024. The leverage in selling, general and administrative expenses as a rate to adjusted net sales was primarily related to a leverage in store payroll expenses due to the Retail segment stores net sales growth. The dollar growth in selling, general and administrative expenses was primarily related to increased marketing expenses to support customer growth and increased sales in the Retail and Subscription segments, as well as increased store payroll expenses to support the Retail segment stores net sales growth.

For the year ended January 31, 2025, selling, general and administrative expenses increased by $113.7 million, or 8.5%, compared to the year ended January 31, 2024. Selling, general and administrative expenses deleveraged 19 basis points as a percentage of net sales and expressed as a percentage of adjusted net sales deleveraged 22 basis points compared to the year ended January 31, 2024. The deleverage in selling, general and administrative expenses as a rate to adjusted net sales was primarily related to increased marketing expenses to support customer growth and increased sales in the Retail and Subscription segments. The dollar growth in selling, general and administrative expenses was primarily related to increased marketing expenses to support customer growth and increased sales in the Retail and Subscription segments, as well as increased store payroll expenses to support the Retail segment stores net sales growth.

The Company’s effective tax rate for the three months ended January 31, 2025, was 8.1%, compared to 25.4% in the three months ended January 31, 2024. The Company's effective tax rate for the year ended January 31, 2025 was 19.5%, compared to 24.6% in the year ended January 31, 2024. The decrease in the effective tax rate for the three months and year ended January 31, 2025, was primarily due to the tax benefit from the release of a portion of our income tax reserves as a result of a lapse of the statute of limitations for federal tax purposes. The adjusted effective tax rate for the three months ended January 31, 2025, was 25.0%, compared to 25.3% for the three months ended January 31, 2024. The Company’s adjusted effective tax rate for the year ended January 31, 2025, was 23.9%, compared to 24.6% in the year ended January 31, 2024.

Net income for the three months ended January 31, 2025, was $120.3 million and earnings per diluted share were $1.28. Adjusted net income for the three months ended January 31, 2025 was $98.1 million and adjusted earnings per diluted share were $1.04. Net income for the year ended January 31, 2025, was a record $402.5 million and earnings per diluted share were $4.26. Adjusted net income for the year ended January 31, 2025, was $383.9 million and adjusted earnings per diluted share were $4.06.

On June 4, 2019, the Company’s Board of Directors authorized the repurchase of 20 million common shares under a share repurchase program. During the twelve months ended January 31, 2025, the Company repurchased and subsequently retired 1.2 million shares for approximately $52 million. As of January 31, 2025, 18.0 million common shares were remaining under the program.

During the twelve months ended January 31, 2025, the Company opened a total of 57 new retail locations including: 37 Free People stores (including 25 FP Movement stores), 13 Anthropologie stores and 7 Urban Outfitters stores; and closed 30 retail locations including: 14 Urban Outfitters stores, 11 Anthropologie stores and 5 Free People stores.

Urban Outfitters, Inc. offers lifestyle-oriented general merchandise and consumer products and services through a portfolio of global consumer brands comprised of 255 Urban Outfitters stores in the United States, Canada and Europe and websites; 239 Anthropologie stores in the United States, Canada and Europe, catalogs and websites; 230 Free People stores

(including 63 FP Movement stores) in the United States, Canada and Europe, catalogs and websites, 9 Menus & Venues restaurants, 7 Urban Outfitters franchisee-owned stores and 2 Anthropologie franchisee-owned stores as of January 31, 2025. Free People, FP Movement and Urban Outfitters wholesale sell their products through department and specialty stores worldwide, digital businesses and the Company’s Retail segment. Nuuly is primarily a women's apparel subscription rental service which offers a wide selection of rental product from the Company's own brands, third-party brands and one-of-a-kind vintage pieces.

A conference call will be held today to discuss fourth quarter results and will be webcast at 5:00 pm. ET at: https://edge.media-server.com/mmc/p/g8t6it8j/.

As used in this document, unless otherwise defined, "Anthropologie" refers to the Company's Anthropologie and Terrain brands and "Free People" refers to the Company's Free People and FP Movement brands.

This news release is being made pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Certain matters contained in this release may contain forward-looking statements. When used in this release, the words “project,” “believe,” “plan,” “will,” “anticipate,” “expect” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Any one, or all, of the following factors could cause actual financial results to differ materially from those financial results mentioned in the forward-looking statements: overall economic and market conditions (including current levels of inflation) and worldwide political events and the resultant impact on consumer spending patterns and our pricing power, the difficulty in predicting and responding to shifts in fashion trends, changes in the level of competitive pricing and promotional activity and other industry factors, the effects of the implementation of the United Kingdom's withdrawal from membership in the European Union (commonly referred to as “Brexit”), including currency fluctuations, economic conditions and legal or regulatory changes, any effects of war, including geopolitical instability, impacts of the conflict in the Middle East and impacts of the war between Russia and Ukraine and from related sanctions imposed by the United States, European Union, United Kingdom and others, terrorism and civil unrest, natural disasters, severe or unseasonable weather conditions (including as a result of climate change) or public health crises (such as the coronavirus (COVID-19)), labor shortages and increases in labor costs, raw material costs and transportation costs, availability of suitable retail space for expansion, timing of store openings, risks associated with international expansion, seasonal fluctuations in gross sales, response to new concepts, our ability to integrate acquisitions, risks associated with digital sales, our ability to maintain and expand our digital sales channels, any material disruptions or security breaches with respect to our technology systems, the departure of one or more key senior executives, import risks (including any shortage of transportation capacities or delays at ports), changes to U.S. and foreign trade policies (including the enactment of tariffs, border adjustment taxes or increases in duties or quotas), the unexpected closing or disruption of, or any damage to, any of our distribution centers, our ability to protect our intellectual property rights, failure of our manufacturers and third-party vendors to comply with our social compliance program, risks related to environmental, social and governance activities, changes in our effective income tax rate, changes in accounting standards and subjective assumptions, regulatory changes and legal matters and other risks identified in our filings with the Securities and Exchange Commission. The Company disclaims any intent or obligation to update forward-looking statements even if experience or future changes make it clear that actual results may differ materially from any projected results expressed or implied therein.

###

(Tables follow)

URBAN OUTFITTERS, INC.

Condensed Consolidated Statements of Income

(amounts in thousands, except share and per share data)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Twelve Months Ended |

|

|

January 31, |

|

|

January 31, |

|

|

2025 |

|

|

2024 |

|

|

2025 |

|

|

2024 |

|

Net sales |

$ |

1,636,120 |

|

|

$ |

1,486,194 |

|

|

$ |

5,550,666 |

|

|

$ |

5,153,237 |

|

Cost of sales (excluding store impairment and lease abandonment charges) |

|

1,108,439 |

|

|

|

1,041,526 |

|

|

|

3,619,395 |

|

|

|

3,425,958 |

|

Store impairment and lease abandonment charges |

|

— |

|

|

|

10,483 |

|

|

|

4,601 |

|

|

|

11,875 |

|

Gross profit |

|

527,681 |

|

|

|

434,185 |

|

|

|

1,926,670 |

|

|

|

1,715,404 |

|

Selling, general and administrative expenses |

|

402,367 |

|

|

|

370,445 |

|

|

|

1,452,906 |

|

|

|

1,339,205 |

|

Asset impairment |

|

— |

|

|

|

6,404 |

|

|

|

— |

|

|

|

6,404 |

|

Income from operations |

|

125,314 |

|

|

|

57,336 |

|

|

|

473,764 |

|

|

|

369,795 |

|

Other income, net |

|

5,592 |

|

|

|

6,689 |

|

|

|

26,408 |

|

|

|

11,812 |

|

Income before income taxes |

|

130,906 |

|

|

|

64,025 |

|

|

|

500,172 |

|

|

|

381,607 |

|

Income tax expense |

|

10,605 |

|

|

|

16,274 |

|

|

|

97,710 |

|

|

|

93,933 |

|

Net income |

$ |

120,301 |

|

|

$ |

47,751 |

|

|

$ |

402,462 |

|

|

$ |

287,674 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per common share: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

1.30 |

|

|

$ |

0.51 |

|

|

$ |

4.34 |

|

|

$ |

3.10 |

|

Diluted |

$ |

1.28 |

|

|

$ |

0.50 |

|

|

$ |

4.26 |

|

|

$ |

3.05 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

92,279,466 |

|

|

|

92,786,380 |

|

|

|

92,684,127 |

|

|

|

92,697,751 |

|

Diluted |

|

94,259,134 |

|

|

|

94,805,976 |

|

|

|

94,448,046 |

|

|

|

94,327,785 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AS A PERCENTAGE OF NET SALES |

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

100.0 |

% |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

100.0 |

% |

Cost of sales (excluding store impairment and lease abandonment charges) |

|

67.7 |

% |

|

|

70.1 |

% |

|

|

65.2 |

% |

|

|

66.5 |

% |

Store impairment and lease abandonment charges |

|

— |

|

|

|

0.7 |

% |

|

|

0.1 |

% |

|

|

0.2 |

% |

Gross profit |

|

32.3 |

% |

|

|

29.2 |

% |

|

|

34.7 |

% |

|

|

33.3 |

% |

Selling, general and administrative expenses |

|

24.6 |

% |

|

|

24.8 |

% |

|

|

26.2 |

% |

|

|

26.0 |

% |

Asset impairment |

|

— |

|

|

|

0.5 |

% |

|

|

— |

|

|

|

0.1 |

% |

Income from operations |

|

7.7 |

% |

|

|

3.9 |

% |

|

|

8.5 |

% |

|

|

7.2 |

% |

Other income, net |

|

0.3 |

% |

|

|

0.4 |

% |

|

|

0.5 |

% |

|

|

0.2 |

% |

Income before income taxes |

|

8.0 |

% |

|

|

4.3 |

% |

|

|

9.0 |

% |

|

|

7.4 |

% |

Income tax expense |

|

0.6 |

% |

|

|

1.1 |

% |

|

|

1.7 |

% |

|

|

1.8 |

% |

Net income |

|

7.4 |

% |

|

|

3.2 |

% |

|

|

7.3 |

% |

|

|

5.6 |

% |

URBAN OUTFITTERS, INC.

Condensed Consolidated Balance Sheets

(amounts in thousands, except share data)

(unaudited)

|

|

|

|

|

|

|

|

|

January 31, |

|

|

January 31, |

|

|

2025 |

|

|

2024 |

|

ASSETS |

|

|

|

|

|

Current assets: |

|

|

|

|

|

Cash and cash equivalents |

$ |

290,481 |

|

|

$ |

178,321 |

|

Marketable securities |

|

319,949 |

|

|

|

286,744 |

|

Accounts receivable, net of allowance for doubtful accounts

of $1,384 and $1,465, respectively |

|

74,014 |

|

|

|

67,008 |

|

Inventory |

|

621,146 |

|

|

|

550,242 |

|

Prepaid expenses and other current assets |

|

187,206 |

|

|

|

200,188 |

|

Total current assets |

|

1,492,796 |

|

|

|

1,282,503 |

|

Property and equipment, net |

|

1,331,077 |

|

|

|

1,286,541 |

|

Operating lease right-of-use assets |

|

942,666 |

|

|

|

920,396 |

|

Marketable securities |

|

410,208 |

|

|

|

314,152 |

|

Other assets |

|

342,733 |

|

|

|

307,617 |

|

Total Assets |

$ |

4,519,480 |

|

|

$ |

4,111,209 |

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

Accounts payable |

$ |

295,767 |

|

|

$ |

253,342 |

|

Current portion of operating lease liabilities |

|

227,149 |

|

|

|

226,645 |

|

Accrued expenses, accrued compensation and other

current liabilities |

|

552,763 |

|

|

|

514,218 |

|

Total current liabilities |

|

1,075,679 |

|

|

|

994,205 |

|

Non-current portion of operating lease liabilities |

|

871,209 |

|

|

|

851,853 |

|

Other non-current liabilities |

|

101,088 |

|

|

|

152,611 |

|

Total Liabilities |

|

2,047,976 |

|

|

|

1,998,669 |

|

|

|

|

|

|

|

Shareholders’ equity: |

|

|

|

|

|

Preferred shares; $.0001 par value, 10,000,000 shares

authorized, none issued |

|

— |

|

|

|

— |

|

Common shares; $.0001 par value, 200,000,000 shares

authorized, 92,281,748 and 92,787,522 shares issued and

outstanding, respectively |

9 |

|

|

9 |

|

Additional paid-in-capital |

|

15,067 |

|

|

|

37,943 |

|

Retained earnings |

|

2,503,068 |

|

|

|

2,113,735 |

|

Accumulated other comprehensive loss |

|

(46,640 |

) |

|

|

(39,147 |

) |

Total Shareholders’ Equity |

|

2,471,504 |

|

|

|

2,112,540 |

|

Total Liabilities and Shareholders’ Equity |

$ |

4,519,480 |

|

|

$ |

4,111,209 |

|

URBAN OUTFITTERS, INC.

Condensed Consolidated Statements of Cash Flows

(amounts in thousands)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

Twelve Months Ended |

|

|

|

January 31, |

|

|

|

2025 |

|

|

2024 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net income |

|

$ |

402,462 |

|

|

$ |

287,674 |

|

Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

115,425 |

|

|

|

102,487 |

|

Non-cash lease expense |

|

|

214,605 |

|

|

|

202,265 |

|

(Benefit) provision for deferred income taxes |

|

|

(2,966 |

) |

|

|

24,711 |

|

Share-based compensation expense |

|

|

31,039 |

|

|

|

30,508 |

|

Amortization of tax credit investment |

|

|

17,224 |

|

|

|

15,906 |

|

Store impairment and lease abandonment charges |

|

|

4,601 |

|

|

|

11,875 |

|

Asset impairment |

|

|

— |

|

|

|

6,404 |

|

Loss on disposition of property and equipment, net |

|

|

1,641 |

|

|

|

309 |

|

Changes in assets and liabilities: |

|

|

|

|

|

|

Receivables |

|

|

(7,319 |

) |

|

|

3,708 |

|

Inventory |

|

|

(72,945 |

) |

|

|

38,785 |

|

Prepaid expenses and other assets |

|

|

(17,471 |

) |

|

|

(53,532 |

) |

Payables, accrued expenses and other liabilities |

|

|

59,690 |

|

|

|

74,185 |

|

Operating lease liabilities |

|

|

(243,152 |

) |

|

|

(235,874 |

) |

Net cash provided by operating activities |

|

|

502,834 |

|

|

|

509,411 |

|

Cash flows from investing activities: |

|

|

|

|

|

|

Cash paid for property and equipment |

|

|

(182,581 |

) |

|

|

(199,625 |

) |

Cash paid for marketable securities |

|

|

(542,944 |

) |

|

|

(649,389 |

) |

Sales and maturities of marketable securities |

|

|

416,756 |

|

|

|

347,366 |

|

Initial cash payment for tax credit investment |

|

|

— |

|

|

|

(20,000 |

) |

Net cash used in investing activities |

|

|

(308,769 |

) |

|

|

(521,648 |

) |

Cash flows from financing activities: |

|

|

|

|

|

|

Proceeds from the exercise of stock options |

|

|

851 |

|

|

|

594 |

|

Share repurchases related to share repurchase program |

|

|

(52,262 |

) |

|

|

— |

|

Share repurchases related to taxes for share-based awards |

|

|

(15,402 |

) |

|

|

(8,407 |

) |

Tax credit investment liability payments |

|

|

(10,301 |

) |

|

|

(4,319 |

) |

Net cash used in financing activities |

|

|

(77,114 |

) |

|

|

(12,132 |

) |

Effect of exchange rate changes on cash and cash equivalents |

|

|

(4,791 |

) |

|

|

1,430 |

|

Increase (decrease) in cash and cash equivalents |

|

|

112,160 |

|

|

|

(22,939 |

) |

Cash and cash equivalents at beginning of period |

|

|

178,321 |

|

|

|

201,260 |

|

Cash and cash equivalents at end of period |

|

$ |

290,481 |

|

|

$ |

178,321 |

|

Important Information Regarding Non-GAAP Financial Measures

In addition to evaluating the financial condition and results of our operations in accordance with U.S. generally accepted accounting principles (“GAAP”), from time to time our management evaluates and analyzes results and any impact on the Company of certain events outside of normal, or “core,” business and operations, by considering adjusted financial measures not prepared in accordance with GAAP. Examples of items that we consider non-core include store impairment and lease abandonment charges, a release of income tax reserves, an asset impairment charge and a change in revenue recognition method for Nuuly. In order to improve the transparency of our disclosures, provide a meaningful presentation of results from our core business operations and improve period-over-period comparability, we have included certain adjusted financial measures for fiscal 2025 and 2024 that exclude the impact of these non-core business items.

We believe these adjusted financial measures are important indicators of our recurring results of operations because they exclude items that may not be indicative of, or are unrelated to, our underlying results of operations and provide a useful baseline for analyzing trends in our underlying business. Management uses adjusted financial measures for planning, forecasting and evaluating business and financial performance.

Non-GAAP financial measures should be viewed as supplementing, and not as an alternative or substitute for, the Company’s financial results prepared in accordance with GAAP. Certain of the items that may be excluded or included in non-GAAP financial measures may be significant items that could impact the Company’s financial position, results of operations or cash flows and should therefore be considered in assessing the Company’s actual and future financial condition and performance. These adjusted financial measures are not consistent with GAAP and may not be calculated the same as similarly titled measures used by other companies.

|

|

|

|

|

|

|

|

|

|

|

|

|

URBAN OUTFITTERS, INC. |

Reconciliation of Non-GAAP Financial Measures |

(amounts in thousands, except per share data) |

(unaudited) |

|

|

|

|

|

|

|

|

|

|

Reconciliation of Total Company Adjusted Net Sales: |

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

January 31, |

|

2025 |

|

|

2024 |

|

$'s |

|

|

% Change |

|

|

$'s |

|

|

|

|

|

|

|

|

|

|

|

|

Net sales (GAAP) |

$ |

1,636,120 |

|

|

|

10.1 |

% |

|

$ |

1,486,194 |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

Change in revenue recognition method for Nuuly (a) |

|

— |

|

|

|

|

|

|

9,229 |

|

|

Adjusted net sales (Non-GAAP) |

$ |

1,636,120 |

|

|

|

9.4 |

% |

|

$ |

1,495,423 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Twelve Months Ended |

|

January 31, |

|

2025 |

|

|

2024 |

|

$'s |

|

|

% Change |

|

|

$'s |

|

|

|

|

|

|

|

|

|

|

|

|

Net sales (GAAP) |

$ |

5,550,666 |

|

|

|

7.7 |

% |

|

$ |

5,153,237 |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

Change in revenue recognition method for Nuuly (a) |

|

— |

|

|

|

|

|

|

5,456 |

|

|

Adjusted net sales (Non-GAAP) |

$ |

5,550,666 |

|

|

|

7.6 |

% |

|

$ |

5,158,693 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Subscription Segment Adjusted Net Sales: |

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

January 31, |

|

2025 |

|

|

2024 |

|

$'s |

|

|

% Change |

|

|

$'s |

|

|

|

|

|

|

|

|

|

|

|

|

Net sales (GAAP) |

$ |

112,524 |

|

|

|

78.4 |

% |

|

$ |

63,080 |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

Change in revenue recognition method for Nuuly (a) |

|

— |

|

|

|

|

|

|

9,229 |

|

|

Adjusted net sales (Non-GAAP) |

$ |

112,524 |

|

|

|

55.6 |

% |

|

$ |

72,309 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Twelve Months Ended |

|

January 31, |

|

2025 |

|

|

2024 |

|

$'s |

|

|

% Change |

|

|

$'s |

|

|

|

|

|

|

|

|

|

|

|

|

Net sales (GAAP) |

$ |

378,394 |

|

|

|

60.4 |

% |

|

$ |

235,859 |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

Change in revenue recognition method for Nuuly (a) |

|

— |

|

|

|

|

|

|

5,456 |

|

|

Adjusted net sales (Non-GAAP) |

$ |

378,394 |

|

|

|

56.8 |

% |

|

$ |

241,315 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

URBAN OUTFITTERS, INC. |

|

|

|

Reconciliation of Non-GAAP Financial Measures |

|

|

|

(amounts in thousands, except per share data) |

|

|

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Total Company Adjusted Gross Profit: |

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

January 31, |

|

|

2025 |

|

|

2024 |

|

|

$'s |

|

% of Net Sales |

|

|

$'s |

|

% of Net Sales |

|

% of Adj. Net Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit (GAAP) |

$ |

527,681 |

|

|

32.3 |

% |

|

$ |

434,185 |

|

|

29.2 |

% |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

Change in revenue recognition method for Nuuly (a) |

|

— |

|

|

|

|

|

7,220 |

|

|

|

|

|

Store impairment and lease abandonment charges (b) |

|

— |

|

|

|

|

|

10,483 |

|

|

|

|

|

Adjusted gross profit (Non-GAAP) |

$ |

527,681 |

|

|

32.3 |

% |

|

$ |

451,888 |

|

|

|

|

30.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Twelve Months Ended |

|

|

January 31, |

|

|

2025 |

|

|

2024 |

|

|

$'s |

|

% of Net Sales |

|

|

$'s |

|

% of Net Sales |

|

% of Adj. Net Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit (GAAP) |

$ |

1,926,670 |

|

|

34.7 |

% |

|

$ |

1,715,404 |

|

|

33.3 |

% |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

Change in revenue recognition method for Nuuly (a) |

|

— |

|

|

|

|

|

4,268 |

|

|

|

|

|

Store impairment and lease abandonment charges (b) |

|

4,601 |

|

|

|

|

|

11,875 |

|

|

|

|

|

Adjusted gross profit (Non-GAAP) |

$ |

1,931,271 |

|

|

34.8 |

% |

|

$ |

1,731,547 |

|

|

|

|

33.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

URBAN OUTFITTERS, INC. |

|

|

|

Reconciliation of Non-GAAP Financial Measures |

|

|

|

(amounts in thousands, except per share data) |

|

|

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Total Company Adjusted Income from Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

January 31, |

|

|

2025 |

|

|

2024 |

|

|

$'s |

|

% of Net Sales |

|

|

$'s |

|

% of Net Sales |

|

% of Adj. Net Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from operations (GAAP) |

$ |

125,314 |

|

|

7.7 |

% |

|

$ |

57,336 |

|

|

3.9 |

% |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

Change in revenue recognition method for Nuuly (a) |

|

— |

|

|

|

|

|

7,220 |

|

|

|

|

|

Store impairment and lease abandonment charges (b) |

|

— |

|

|

|

|

|

10,483 |

|

|

|

|

|

Asset impairment charge (c) |

|

— |

|

|

|

|

|

6,404 |

|

|

|

|

|

Adjusted income from operations (Non-GAAP) |

$ |

125,314 |

|

|

7.7 |

% |

|

$ |

81,443 |

|

|

|

|

5.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Twelve Months Ended |

|

|

January 31, |

|

|

2025 |

|

|

2024 |

|

|

$'s |

|

% of Net Sales |

|

|

$'s |

|

% of Net Sales |

|

% of Adj. Net Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from operations (GAAP) |

$ |

473,764 |

|

|

8.5 |

% |

|

$ |

369,795 |

|

|

7.2 |

% |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

Change in revenue recognition method for Nuuly (a) |

|

— |

|

|

|

|

|

4,268 |

|

|

|

|

|

Store impairment and lease abandonment charges (b) |

|

4,601 |

|

|

|

|

|

11,875 |

|

|

|

|

|

Asset impairment charge (c) |

|

— |

|

|

|

|

|

6,404 |

|

|

|

|

|

Adjusted income from operations (Non-GAAP) |

$ |

478,365 |

|

|

8.6 |

% |

|

$ |

392,342 |

|

|

|

|

7.6 |

% |

|

|

|

|

|

|

|

|

|

|

URBAN OUTFITTERS, INC. |

Reconciliation of Non-GAAP Financial Measures |

(amounts in thousands, except per share data) |

(unaudited) |

|

|

|

|

|

|

|

|

Reconciliation of Total Company Adjusted Income Tax Expense and Adjusted Effective Tax Rate: |

|

Three Months Ended |

|

January 31, |

|

2025 |

|

2024 |

|

$'s |

|

|

|

$'s |

|

|

|

|

|

|

|

|

|

|

Income before income taxes (GAAP) |

$ |

130,906 |

|

|

|

$ |

64,025 |

|

|

Adjustments: |

|

|

|

|

|

|

|

Change in revenue recognition method for Nuuly (a) |

|

— |

|

|

|

|

7,220 |

|

|

Store impairment and lease abandonment charges (b) |

|

— |

|

|

|

|

10,483 |

|

|

Asset impairment charge (c) |

|

— |

|

|

|

|

6,404 |

|

|

Adjusted income before income taxes (Non-GAAP) |

$ |

130,906 |

|

|

|

$ |

88,132 |

|

|

|

|

|

|

|

|

|

|

Income tax expense (GAAP) |

$ |

10,605 |

|

|

|

$ |

16,274 |

|

|

Adjustments: |

|

|

|

|

|

|

|

Provision for income taxes on adjustments (d) |

|

— |

|

|

|

|

6,054 |

|

|

Release of income tax reserves (e) |

|

22,172 |

|

|

|

|

— |

|

|

Adjusted income tax expense (Non-GAAP) |

$ |

32,777 |

|

|

|

$ |

22,328 |

|

|

|

|

|

|

|

|

|

|

Effective income tax rate (GAAP) |

|

8.1 |

% |

|

|

|

25.4 |

% |

|

Adjustments |

16.9 |

|

|

|

(0.1) |

|

|

Adjusted effective income tax rate (Non-GAAP) |

|

25.0 |

% |

|

|

|

25.3 |

% |

|

|

|

|

|

|

|

|

|

|

Twelve Months Ended |

|

January 31, |

|

2025 |

|

2024 |

|

$'s |

|

|

|

$'s |

|

|

|

|

|

|

|

|

|

|

Income before income taxes (GAAP) |

$ |

500,172 |

|

|

|

$ |

381,607 |

|

|

Adjustments: |

|

|

|

|

|

|

|

Change in revenue recognition method for Nuuly (a) |

|

— |

|

|

|

|

4,268 |

|

|

Store impairment and lease abandonment charges (b) |

|

4,601 |

|

|

|

|

11,875 |

|

|

Asset impairment charge (c) |

|

— |

|

|

|

|

6,404 |

|

|

Adjusted income before income taxes (Non-GAAP) |

$ |

504,773 |

|

|

|

$ |

404,154 |

|

|

|

|

|

|

|

|

|

|

Income tax expense (GAAP) |

$ |

97,710 |

|

|

|

$ |

93,933 |

|

|

Adjustments: |

|

|

|

|

|

|

|

Provision for income taxes on adjustments (d) |

|

966 |

|

|

|

|

5,663 |

|

|

Release of income tax reserves (e) |

|

22,172 |

|

|

|

|

— |

|

|

Adjusted income tax expense (Non-GAAP) |

$ |

120,848 |

|

|

|

$ |

99,596 |

|

|

|

|

|

|

|

|

|

|

Effective income tax rate (GAAP) |

|

19.5 |

% |

|

|

|

24.6 |

% |

|

Adjustments |

4.4 |

|

|

|

0.0 |

|

|

Adjusted effective income tax rate (Non-GAAP) |

|

23.9 |

% |

|

|

|

24.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

URBAN OUTFITTERS, INC. |

|

|

|

Reconciliation of Non-GAAP Financial Measures |

|

|

|

(amounts in thousands, except per share data) |

|

|

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Total Company Adjusted Net Income and Adjusted Diluted EPS: |

|

|

|

|

Three Months Ended |

|

|

January 31, |

|

|

2025 |

|

|

2024 |

|

|

$'s |

|

% of Net Sales |

|

|

$'s |

|

% of Net Sales |

|

% of Adj. Net Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (GAAP) |

$ |

120,301 |

|

|

7.4 |

% |

|

$ |

47,751 |

|

|

3.2 |

% |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

Change in revenue recognition method for Nuuly (a) |

|

— |

|

|

|

|

|

7,220 |

|

|

|

|

|

Store impairment and lease abandonment charges (b) |

|

— |

|

|

|

|

|

10,483 |

|

|

|

|

|

Asset impairment charge (c) |

|

— |

|

|

|

|

|

6,404 |

|

|

|

|

|

Provision for income taxes on adjustments (d) |

|

— |

|

|

|

|

|

(6,054 |

) |

|

|

|

|

Release of income tax reserves (e) |

|

(22,172 |

) |

|

|

|

|

— |

|

|

|

|

|

Adjusted net income (Non-GAAP) |

$ |

98,129 |

|

|

6.0 |

% |

|

$ |

65,804 |

|

|

|

|

4.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

Diluted EPS (GAAP) |

$ |

1.28 |

|

|

|

|

$ |

0.50 |

|

|

|

|

|

Adjustments, net of tax |

|

(0.24 |

) |

|

|

|

|

0.19 |

|

|

|

|

|

Adjusted diluted EPS (Non-GAAP) |

$ |

1.04 |

|

|

|

|

$ |

0.69 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Twelve Months Ended |

|

|

January 31, |

|

|

2025 |

|

|

2024 |

|

|

$'s |

|

% of Net Sales |

|

|

$'s |

|

% of Net Sales |

|

% of Adj. Net Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (GAAP) |

$ |

402,462 |

|

|

7.3 |

% |

|

$ |

287,674 |

|

|

5.6 |

% |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

Change in revenue recognition method for Nuuly (a) |

|

— |

|

|

|

|

|

4,268 |

|

|

|

|

|

Store impairment and lease abandonment charges (b) |

|

4,601 |

|

|

|

|

|

11,875 |

|

|

|

|

|

Asset impairment charge (c) |

|

— |

|

|

|

|

|

6,404 |

|

|

|

|

|

Provision for income taxes on adjustments (d) |

|

(966 |

) |

|

|

|

|

(5,663 |

) |

|

|

|

|

Release of income tax reserves (e) |

|

(22,172 |

) |

|

|

|

|

— |

|

|

|

|

|

Adjusted net income (Non-GAAP) |

$ |

383,925 |

|

|

6.9 |

% |

|

$ |

304,558 |

|

|

|

|

5.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

Diluted EPS (GAAP) |

$ |

4.26 |

|

|

|

|

$ |

3.05 |

|

|

|

|

|

Adjustments, net of tax |

|

(0.20 |

) |

|

|

|

|

0.18 |

|

|

|

|

|

Adjusted diluted EPS (Non-GAAP) |

$ |

4.06 |

|

|

|

|

$ |

3.23 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) During the three months ended January 31, 2024, the Company changed the revenue recognition method for Nuuly from recognizing the monthly subscription fee revenue in the period the customer is billed to recognizing over the monthly period over which the customer’s subscription fee pertains. The Company also changed the period over which it amortizes rental product to align with the change in revenue recognition method. The impact for the three months ended January 31, 2024, was a reduction in “Net sales” of $9,229 and a reduction in “Cost of sales” of $2,009, resulting in a net reduction of $7,220 in “Gross profit.” The impact for the year ended January 31, 2024 was a reduction in "Net sales" of $5,456 and a reduction in "Cost of sales" of $1,188, resulting in a net reduction of $4,268 in "Gross profit." |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(b) Store impairment charges relate to one retail location during the twelve months ended January 31, 2025, and 11 and 15 retail locations during the three and twelve months ended January 31, 2024, respectively. The Company also recorded lease abandonment charges for one retail location during the twelve months ended January 31, 2025 and two retail locations during the three months ended January 31, 2024. |

|

|

|

|

|

|

|

|

|

|

|

|

|

(c) The asset impairment charge relates to the write-off of “Property and equipment, net” of the Nuuly Thrift marketplace during the three and twelve months ended January 31, 2024, which the Company wound down in fiscal 2025. |

|

|

|

|

|

|

|

|

|

|

|

|

|

(d) The income tax impact of non-GAAP adjustments is calculated using the estimated tax rate in effect for the respective non-GAAP adjustments. |

|

|

|

|

|

|

|

|

|

|

|

|

|

(e) The Company recorded a one-time tax benefit for the release of a portion of our income tax reserves as a result of a lapse of the statute of limitations for federal tax purposes. |

|

|

|

|

|

|

|

|

|

|

|

|

|

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

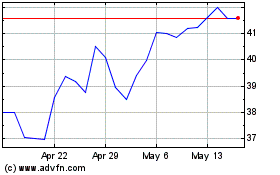

Urban Outfitters (NASDAQ:URBN)

Historical Stock Chart

From Feb 2025 to Mar 2025

Urban Outfitters (NASDAQ:URBN)

Historical Stock Chart

From Mar 2024 to Mar 2025