Vivos Therapeutics Announces Pricing of $4.3 Million Registered Direct Offering of Common Stock Priced At-The-Market Under Nasdaq Rules

September 19 2024 - 6:00AM

Vivos Therapeutics, Inc. (“Vivos” or the “Company”)

(NASDAQ: VVOS), a leading medical device and technology

company specializing in the development and commercialization of

highly effective proprietary treatments for sleep related breathing

disorders (including all severities of obstructive sleep apnea

(OSA) in adults and moderate to severe in children), announced

today that it has entered into definitive securities purchase

agreements with institutional investors for the issuance and sale

of an aggregate of 1,363,812 shares of its common stock at a

purchase price of $3.15 per share in a registered direct offering

priced at-the-market under the rules of the Nasdaq Stock Market. No

common stock purchase warrants are being issued in this offering.

The closing of the offering is expected to occur on

or about September 20, 2024, subject to the satisfaction of

customary closing conditions.

H.C. Wainwright & Co. is acting as the

exclusive placement agent for the offering.

The gross proceeds to the Company from the offering

are expected to be approximately $4.3 million, before deducting the

placement agent's fees and other offering expenses payable by the

Company. The Company currently intends to use the net proceeds from

the offering for working capital and general corporate

purposes.

The securities described above are being offered

and sold by the Company pursuant to a “shelf” registration

statement on Form S-3 (Registration No. 333-262554), including a

base prospectus, previously filed with the Securities and Exchange

Commission (“SEC”) on February 7, 2022, and declared effective by

the SEC on February 14, 2022. The securities to be issued in the

registered direct offering are being offered only by means of a

prospectus, including a prospectus supplement, forming a part of

the effective registration statement. A final prospectus supplement

and the accompanying base prospectus relating to, and describing

the terms of, the registered direct offering will be filed with the

SEC and will be available on the SEC's website located

at http://www.sec.gov. Electronic copies of the final

prospectus supplement and the accompanying base prospectus relating

to the registered direct offering, when available, may also be

obtained by contacting H.C. Wainwright & Co., LLC at 430 Park

Avenue, 3rd Floor, New York, NY 10022, by phone at (212) 856-5711

or e-mail at placements@hcwco.com.

This press release does not constitute an offer to

sell or the solicitation of an offer to buy these securities, nor

shall there be any sale of these securities in any state or other

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to the registration or qualification under the

securities laws of any such state or jurisdiction.

About Vivos Therapeutics,

Inc.

Vivos Therapeutics, Inc. (NASDAQ: VVOS) is a

medical technology company focused on developing and

commercializing innovative diagnostic and treatment methods for

patients suffering from breathing and sleep issues arising from

certain dentofacial abnormalities such as obstructive sleep apnea

(OSA) and snoring in adults and children. The Vivos Method

(comprised of Vivos’ Complete Airway Repositioning and/or Expansion

(CARE) and other oral appliance therapy combined with adjunctive

therapies) represents the first clinically effective nonsurgical,

noninvasive, nonpharmaceutical, and cost-effective solution for

treating mild to severe OSA in adults and moderate to severe OSA in

children. It has proven effective in over 45,000 patients treated

worldwide by more than 2,000 trained dentists.

The Vivos Method includes treatment regimens that

employ the proprietary CARE appliance therapy and other

appliances that alter the size, shape, and position of the soft

tissues that comprise a patient’s upper airway and/or palate. The

Vivos Method opens airway space and may significantly reduce

symptoms and conditions associated with mild-to-severe OSA in

adults and moderate to severe OSA in children, such as lowering

Apnea Hypopnea Index scores. Vivos also employs a marketing and

distribution model where it collaborates with sleep-treatment

providers to offer patients OSA treatment options and help promote

sales of its appliances.

Cautionary Note Regarding Forward-Looking

Statements

This press release and statements of the Company’s

management made in connection therewith contain “forward-looking

statements” (as defined in Section 27A of the Securities Act of

1933, as amended, and Section 21E of the Securities Exchange Act of

1934, as amended) concerning future events, including statements

related to the completion of the registered direct offering, the

satisfaction of customary closing conditions related to the

registered direct offering and the intended use of proceeds from

the registered direct offering. Words such as “may”, “should”,

“expects”, “projects,” “intends”, “plans”, “believes”,

“anticipates”, “hopes”, “estimates”, “goal” and variations of such

words and similar expressions are intended to identify

forward-looking statements. These statements involve significant

known and unknown risks and are based upon several assumptions and

estimates, which are inherently subject to significant

uncertainties and contingencies, many of which are beyond Vivos’

control. Actual results (including the actual results of the

initiatives described herein on Vivos’ future revenues and results

of operations or the anticipated benefits of the Company’s new

marketing and distribution model described herein) may differ

materially and adversely from those expressed or implied by such

forward-looking statements. Factors that could cause actual results

to differ materially include, but are not limited to: (i) the risk

that Vivos may be unable to implement revenue, sales and marketing

strategies that increase revenues, (ii) the risk that some patients

may not achieve the desired results from using Vivos’ products,

(iii) risks associated with regulatory scrutiny of and adverse

publicity in the sleep apnea treatment sector; (iv) the risk that

Vivos may be unable to secure additional financings on reasonable

terms when needed, if at all or maintain its Nasdaq listing and (v)

other risk factors described in Vivos’ filings with

the Securities and Exchange Commission (“SEC”). Vivos’

filings can be obtained free of charge on the SEC’s website

at www.sec.gov. Except to the extent required by law, Vivos

expressly disclaims any obligations or undertaking to release

publicly any updates or revisions to any forward-looking statements

contained herein to reflect any change in Vivos’ expectations with

respect thereto or any change in events, conditions, or

circumstances on which any statement is based.

Vivos Investor Relations and Media

Contact:

Bradford Amman, CFOinvestors@vivoslife.com

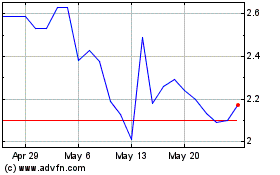

Vivos Therapeutics (NASDAQ:VVOS)

Historical Stock Chart

From Dec 2024 to Jan 2025

Vivos Therapeutics (NASDAQ:VVOS)

Historical Stock Chart

From Jan 2024 to Jan 2025