false

0000858470

0000858470

2024-12-28

2024-12-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d)

of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 28, 2024

COTERRA

ENERGY INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

1-10447 |

04-3072771 |

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

Three Memorial City Plaza

840 Gessner Road, Suite 1400

Houston, Texas |

77024 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant's telephone number, including area

code: (281) 589-4600

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions: |

| |

|

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of exchange on which registered |

| Common Stock, par value $0.10 per share |

|

CTRA |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

| Item 1.01. |

Entry Into a Material Definitive Agreement. |

As previously reported in the Current Report on

Form 8-K filed by Coterra Energy Inc., a Delaware corporation (the “Company”), with the Securities and Exchange Commission

on November 15, 2024, the Company has entered into a Membership Interest Purchase Agreement (the “FME Purchase Agreement”), dated as of

November 12, 2024, by and among Franklin Mountain Energy Holdings, LP, a Delaware limited partnership, Franklin Mountain Energy Holdings

2, LP, a Delaware limited partnership, and Franklin Mountain GP2, LLC, a Texas limited liability company, the Company, Cimarex Energy

Co., a Delaware corporation, and, solely in its capacity as Seller Representative (as defined therein), FMEH (collectively, the “Parties”).

On December 28, 2024, the Parties entered

into the First Amendment to Membership Interest Purchase Agreement (the “Amendment”) in order to include approximately

1,650 net royalty acres owned by Sandia Minerals, LLC, which were previously Excluded Assets (as defined in the FME Purchase

Agreement), in the transactions contemplated by the FME Purchase Agreement and to increase the cash consideration payable thereunder

by $43 million. The foregoing description is qualified in its entirety by reference to the full text of the FME Purchase Agreement and

the Amendment, which are filed as Exhibit 10.1 and Exhibit 10.2, respectively, to this Current Report on Form 8-K.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

Exhibit

No. |

|

Description |

| 10.1 |

|

Membership Interest Purchase Agreement, dated as of November 12, 2024, by and among Franklin Mountain Energy Holdings, LP, Franklin Mountain Energy Holdings 2, LP, and Franklin Mountain GP2, LLC, as sellers, solely in its capacity as Seller Representative, Franklin Mountain Energy Holdings, LP, Cimarex Energy Co., as purchaser, and Coterra Energy Inc., as purchaser parent (incorporated herein by reference to Exhibit 10.1 of the Company’s Current Report on Form 8-K filed with the SEC on November 15, 2024).

|

| 10.2 |

|

First Amendment to Membership Interest Purchase Agreement, dated as of December 28, 2024, but effective for all purposes as of November 12, 2024, by and among Franklin Mountain Energy Holdings, LP, Franklin Mountain Energy Holdings 2, LP, and Franklin Mountain GP2, LLC, as sellers, solely in its capacity as Seller Representative, Franklin Mountain Energy Holdings, LP, Cimarex Energy Co., as purchaser, and Coterra Energy Inc., as purchaser parent. |

| 104 |

|

Cover Page Interactive Data File (formatted as Inline XBRL). |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

COTERRA ENERGY INC. |

| |

|

| Date: December 31, 2024 |

By: |

/s/ Marcus G. Bolinder |

| |

Name: |

Marcus G. Bolinder |

| |

Title: |

Corporate Secretary |

Exhibit 10.2

Execution

Version

FIRST AMENDMENT TO MEMBERSHIP INTEREST PURCHASE

AGREEMENT

This First Amendment to Membership

Interest Purchase Agreement (this “Amendment”) is dated as of December 28, 2024 (the “Amendment

Date”) but is effective for all purposes as of November 12, 2024 (the “Execution Date”) and

is entered into by and among Franklin Mountain Energy Holdings, LP, a Delaware limited partnership (“FMEH”),

Franklin Mountain Energy Holdings 2, LP, a Delaware limited partnership (“FMEH2”), and Franklin Mountain GP2,

LLC, a Texas limited liability company (“FMGP2”, and together with FMEH and FMEH2, “Sellers”

and each individually, a “Seller”), Coterra Energy Inc., a Delaware corporation (“Purchaser Parent”),

Cimarex Energy Co., a Delaware corporation (“Purchaser”), and, solely in its capacity as Seller Representative

hereunder, FMEH. Sellers and Purchaser are sometimes referred to herein individually as a “Party” and, collectively,

as the “Parties”. Capitalized terms used herein but not defined shall have the meanings ascribed to them in

the Agreement (as defined below).

WHEREAS, Sellers, Purchaser,

and FMEH (in its capacity as Seller Representative) entered into that certain Membership Interest Purchase Agreement dated as of the Execution

Date (as the same may be amended, restated, supplemented or otherwise modified from time to time, the “Agreement”);

and

WHEREAS, the Parties desire

to amend the Agreement in certain respects, as set forth herein.

NOW, THEREFORE, for good and

valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:

1. The

fourth Recital of the Agreement is hereby deleted in its entirety and replaced in its entirety with the following two Recitals:

WHEREAS,

the issued and outstanding Interests of Sandia Minerals LLC, a New Mexico limited liability company (“Sandia”

and all of the issued and outstanding Interests of Sandia, the “Sandia Interests”), are owned 100% by FMRI;

WHEREAS,

the issued and outstanding Interests of Franklin Mountain Royalty Investments 3, LLC, a Delaware limited liability company (“FMRI3”),

are owned (a) 99.9% by FMEH2 and (b) 0.1% by FMGP2 (FME, FME2, FME3, FMRI, FMRI3, and Sandia are referred to herein individually

as a “Company” and all of the issued and outstanding Interests of each Company (other than Sandia), collectively,

are referred to herein as the “Subject Interests”); and

2. The

first sentence of Section 2.2 of the Agreement is hereby deleted in its entirety and replaced in its entirety with the following:

The

total consideration to be paid by Purchaser for the Subject Interests (the “Purchase Price”) shall consist

of (a) $1,543,000,000 in cash (the “Cash Consideration”); and (b) 40,894,925 shares of Purchaser Parent

Common Stock (the “Stock Consideration”).

3. The

first sentence of Section 2.4(d) of the Agreement is hereby deleted in its entirety and replaced in its entirety with the following:

Notwithstanding anything to

the contrary herein: (i) for purposes of any Adjustment Amount included in the Preliminary Settlement Statement, all adjustments

shall be made (A) sixty and seven tenths percent (60.7%) to the Stock Consideration based on a price of $24.45 per share and (B) thirty

nine and three tenths percent (39.3%) the Cash Consideration, the intent of the Parties to apply such adjustments to the Stock Consideration

and the Cash Consideration pro rata; provided that to the extent the Purchase Price is adjusted pursuant to Section 2.4(a)(i) as

a result of Title Defects affecting the Sandia Assets, such adjustment shall be made one hundred percent (100%) to the Cash Consideration;

and (ii) for purposes of any Adjustment Amount included in the Final Settlement Statement, any positive or negative adjustment will

be paid or settled by the Parties in cash.

4. The

following sentence is added as clause (g) of Section 4.3 of the Agreement:

(g) FMRI

is the direct owner, holder of record and beneficial owner of the Sandia Interests, free and clear of all Encumbrances, restrictions on

transfer or other encumbrances other than those Encumbrances, restrictions or other encumbrances arising pursuant to or described in this

Agreement, the Organizational Documents of Sandia as in effect as of the Execution Date or applicable securities Laws.

5. Section 4.15

of the Agreement is hereby deleted in its entirety and replaced in its entirety with the following:

Section 4.15 Special

Warranty of Title. Each Company represents and warrants Defensible Title to each of the Wells, Leases, and Mineral Interests

unto Purchaser against every Person whomsoever lawfully claims the same or any part thereof by, through or under a Company or its Affiliates

(including Sellers), but not otherwise, subject, however, to the Permitted Encumbrances (the “Special Warranty”).

6. The

first sentence of Section 6.12 of the Agreement is hereby deleted in its entirety and replaced in its entirety with the following:

Notwithstanding anything to

the contrary contained herein, the Parties acknowledge that upon the Closing, Sellers shall retain the sole right to the use of the names

“FME”, “Franklin Mountain Energy,” “Sandia” and any variants thereof, together with any service marks,

trademarks, trade names, identifying symbols, logos, emblems or signs containing, comprising or used in connection with such names, including

any name or mark confusingly similar thereto and the goodwill associated therewith (collectively, the “Seller Marks”).

7. The

definition of “Closing Stock Consideration” in the Agreement is hereby deleted in its entirety and replaced in its entirety

with the following:

“Closing

Stock Consideration” means the estimate of the Adjusted Stock Consideration specified in the Preliminary Settlement Statement

delivered in accordance with Section 2.6 (inclusive of any adjustments agreed to by the Parties in accordance with Section 2.6,

if applicable).

8. The

following definition of “Sandia” is hereby added to Appendix A of the Agreement:

“Sandia”

has the meaning set forth in the Recitals of this Agreement.

9. The

following definition of “Sandia Assets” is hereby added to Appendix A of the Agreement:

“Sandia

Assets” means all of Sandia’s right, title, and interest in and to the Assets.

10. The

following definition of “Sandia Interests” is hereby added to Appendix A of the Agreement:

“Sandia

Interests” has the meaning set forth in the Recitals of this Agreement.

11. Exhibit A-2

to the Agreement is hereby amended to include, at the bottom of the original Exhibit A-2, the contents set forth on Exhibit A-2

attached hereto.

12. Exhibit A-3

to the Agreement is hereby amended to include, at the bottom of the original Exhibit A-3, the contents set forth on Exhibit A-3

attached hereto.

13. Exhibit C

to the Agreement is hereby deleted in its entirety and replaced in its entirety with Exhibit C attached hereto.

14. Schedule

4.3(a) to the Agreement is hereby deleted in its entirety and replaced in its entirety with Schedule 4.3(a) attached

hereto.

15. Schedule

4.12(a) to the Agreement is hereby amended to include, at the bottom of the original Schedule 4.12(a), the contents set forth on

Schedule 4.12(a) attached hereto.

16. Schedule

4.27 to the Agreement is hereby deleted in its entirety and replaced in its entirety with Schedule 4.27 attached hereto.

17. Schedule

4.39 to the Agreement is hereby deleted in its entirety and replaced in its entirety with Schedule 4.39 attached hereto.

18. Schedule

6.4 to the Agreement is hereby amended by deleting Item #1 in its entirety.

19. Schedule

6.18 to the Agreement is hereby deleted in its entirety and replaced in its entirety with Schedule 6.18 attached hereto.

20. Schedule

12.4 to the Agreement is hereby deleted in its entirety and replaced in its entirety with Schedule 12.4 attached hereto.

21. Schedule

EA to the Agreement is hereby amended by deleting Item #1 in its entirety.

22. Except

to the limited extent amended hereby, the Agreement shall continue in full force and effect, and the Parties ratify and confirm the Agreement

as specifically amended hereby. After giving effect to this Amendment, any references in the Agreement to “this Agreement”

or to the words “hereof” or “hereunder” or words of similar import, and all references to the Agreement in any

and all agreements, instruments, documents, notes, certificates and other writings of every kind or nature (other than in this Amendment

or as otherwise expressly provided), shall mean the Agreement as amended by this Amendment, whether or not this Amendment is expressly

referenced. All references in the Agreement to “Execution Date,” “the date hereof” or “the date of this

Agreement” shall refer to November 12, 2024.

23. Sections

14.2 (Counterparts), 14.5 (Governing Law; Waiver of Jury Trial), 14.8 (Entire Agreement), 14.11 (Construction), 14.12 (Limitation on Damages),

and 14.16 (Severability) of the Agreement shall apply mutatis mutandis to this Amendment.

[Signature Page Follows]

IN

WITNESS WHEREOF, this Amendment has been signed by each of the Parties on the Amendment Date.

| |

SELLERS |

| |

|

| |

Franklin Mountain Energy Holdings,

LP |

| |

|

| |

By: Franklin Mountain Energy GP, LLC,

its General Partner |

| |

|

| |

By: |

/s/ Scott Weaver |

| |

Name: Scott Weaver |

| |

Title: Vice President |

| |

|

| |

Franklin Mountain Energy Holdings

2, LP |

| |

|

| |

By: Franklin Mountain Energy GP 2,

LLC, its General Partner |

| |

|

| |

By: |

/s/ Scott Weaver |

| |

Name: Scott Weaver |

| |

Title: Vice President |

| |

|

| |

Franklin Mountain GP2, LLC |

| |

|

| |

By: |

/s/ Scott Weaver |

| |

Name: Scott Weaver |

| |

Title: Vice President |

[Signature

Page to First Amendment to Membership Interest Purchase Agreement]

IN

WITNESS WHEREOF, this Amendment has been signed by each of the Parties on the Amendment Date.

| |

Purchaser |

| |

|

| |

Cimarex Energy Co. |

| |

|

| |

By: |

/s/ Shannon E. Young III |

| |

Name: Shannon E. Young III |

| |

Title: Executive Vice President and Chief Financial Officer |

| |

|

| |

Purchaser Parent |

| |

|

| |

Coterra Energy Inc. |

| |

|

| |

By: |

/s/ Shannon E. Young III |

| |

Name: Shannon E. Young III |

| |

Title: Executive Vice President and Chief Financial

Officer |

[Signature

Page to First Amendment to Membership Interest Purchase Agreement]

IN

WITNESS WHEREOF, this Amendment has been signed by each of the Parties on the Amendment Date.

| |

Seller Representative |

| |

|

| |

Franklin Mountain Energy Holdings,

LP, solely in its capacity as Seller Representative hereunder |

| |

|

| |

By: Franklin Mountain Energy GP, LLC, its General

Partner |

| |

|

| |

By: |

/s/ Scott Weaver |

| |

Name: Scott Weaver |

| |

Title: Vice President |

[Signature

Page to First Amendment to Membership Interest Purchase Agreement]

Exhibit A-2

WELLS SUPPLEMENT

[See Attached.]

Exhibit A-3

MINERAL INTERESTS SUPPLEMENT

[See Attached.]

Exhibit C

To that certain Membership Interest Purchase

Agreement dated November 12, 2024, by and among Franklin Mountain Energy Holdings, LP, Franklin Mountain Energy Holdings 2, LP, and

Franklin Mountain GP2, LLC, as Sellers, and Cimarex Energy Co., as Purchaser, Coterra Energy Inc., as Purchaser Parent, and Franklin Mountain

Energy Holdings, LP., as Seller Representative

FORM OF EXCLUDED ASSET ASSIGNMENT

[See Attached.]

v3.24.4

Cover

|

Dec. 28, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 28, 2024

|

| Entity File Number |

1-10447

|

| Entity Registrant Name |

COTERRA

ENERGY INC.

|

| Entity Central Index Key |

0000858470

|

| Entity Tax Identification Number |

04-3072771

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

Three Memorial City Plaza

|

| Entity Address, Address Line Two |

840 Gessner Road

|

| Entity Address, Address Line Three |

Suite 1400

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77024

|

| City Area Code |

281

|

| Local Phone Number |

589-4600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.10 per share

|

| Trading Symbol |

CTRA

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

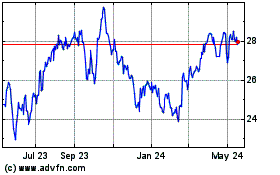

Coterra Energy (NYSE:CTRA)

Historical Stock Chart

From Dec 2024 to Jan 2025

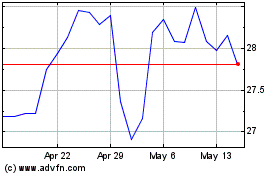

Coterra Energy (NYSE:CTRA)

Historical Stock Chart

From Jan 2024 to Jan 2025