0001690820false12/3100016908202024-06-032024-06-030001690820us-gaap:CommonClassAMember2024-06-032024-06-030001690820us-gaap:PreferredStockMember2024-06-032024-06-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 3, 2024

CARVANA CO.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

Delaware | | 001-38073 | | 81-4549921 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | |

| | 300 E. Rio Salado Parkway | | |

| Tempe | Arizona | 85281 | |

| | (Address of principal executive offices, including zip code) | | |

(602) 922-9866

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, Par Value $0.001 Per Share | CVNA | New York Stock Exchange |

| Preferred Stock Purchase Rights | - | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.02 Termination of a Material Definitive Agreement.

On June 3, 2024, Carvana Co. (the “Company”) determined that the Amended and Restated Section 382 Rights Agreement (the “Tax Asset Preservation Plan”), dated as of July 18, 2023, by and between the Company and Equiniti Trust Company, LLC, as successor in interest to American Stock Transfer & Trust Company, LLC, a New York limited liability trust company, as rights agent, is no longer necessary for the preservation of material valuable Tax Attributes (as defined therein) and set a Final Expiration Date under the Tax Asset Preservation Plan of June 4, 2024. As a result, the rights under the Tax Asset Preservation Plan expired and the Tax Asset Preservation Plan terminated at the close of business on June 4, 2024.

Item 3.03 Material Modification to Rights of Security Holders.

The information set forth under Item 1.02 of this Current Report on Form 8-K is incorporated into this Item 3.03 by reference.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

In connection with the termination of the Tax Asset Preservation Plan, the Company filed a Certificate of Elimination with the Secretary of State of the State of Delaware on June 5, 2024, eliminating and returning to authorized but undesignated shares, its shares of Series B Preferred Stock. The Certificate of Elimination eliminated all provisions in the Certificate of Designations of Series B Preferred Stock previously filed by the Company with the Secretary of State of the State of Delaware on January 17, 2023, which had set forth the rights, powers and preferences of the Series B Preferred Stock issuable upon exercise of the rights under the Tax Asset Preservation Plan.

The foregoing is a summary of the terms of the Certificate of Elimination. The summary does not purport to be complete and is qualified in its entirety by reference to the Certificate of Elimination, a copy of which is attached as Exhibit 3.1 hereto and incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

On June 6, 2024, management of the Company will present at the William Blair 44th Annual Growth Stock Conference. During the presentation, management will communicate the following:

•During the second quarter of 2024 through June 6, 2024, the Company repurchased and cancelled $250 million face principal amount, or approximately 24% of the then outstanding 9.0%/12.0% Cash/PIK Senior Secured Notes due 2028, for an aggregate purchase price of $259 million, equating to a weighted average purchase price of 103.4%, or a weighted average purchase price of 100.4%, inclusive of the benefit of reducing accrued PIK interest.

•During the second quarter of 2024 through June 6, 2024, the Company sold approximately 3 million shares of its Class A Common Stock under the Company’s “at-the-market offering” program at an average price of $114.85 per share, for gross proceeds of approximately $350 million.

•The Company reaffirms the second quarter outlook provided on May 1, 2024 that the Company expects a sequential increase in its year-over-year growth rate in retail units and a sequential increase in Adjusted EBITDA.

This Current Report on Form 8-K shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be an offer, solicitation or sale of such securities in any state in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such state.

The information furnished pursuant to Item 7.01 of this Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Forward-Looking Statements.

This Current Report on Form 8-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements reflect Carvana’s current expectations and projections with respect to, among other things, its financial condition, results of operations and future performance. These statements may be preceded by, followed by or include the words “aim,” “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “intend,” “likely,” “outlook,” “plan,” “potential,” “project,” “projection,” “seek,” “can,” “could,” “may,” “should,” “would,” “will,” the negatives thereof and other words and terms of similar meaning.

Forward-looking statements include all statements that are not historical facts, including expectations regarding forecasted results and financial and operational goals. Such forward-looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. Among these factors are risks related to: the larger automotive ecosystem, including consumer demand, global supply chain challenges, and other macroeconomic issues; our substantial indebtedness; our history of losses and ability to maintain profitability in the future; the seasonal and other fluctuations in our quarterly operating results; the highly competitive industry in which we participate; the changes in prices of new and used vehicles; and the other risks identified under the “Risk Factors” section in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

There is no assurance that any forward-looking statements will materialize. You are cautioned not to place undue reliance on forward-looking statements, which reflect expectations only as of this date. Carvana does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments, or otherwise.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Exhibit No. | Description |

| |

| |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Date: | June 6, 2024 | | | CARVANA CO. | |

| | | | | | |

| | | | | By: | /s/ Mark Jenkins | |

| | | | | Name: | Mark Jenkins | |

| | | | | Title: | Chief Financial Officer | |

| | | | | | | |

CERTIFICATE OF ELIMINATION

of

SERIES B PREFERRED STOCK

of

CARVANA CO.

Pursuant to Section 151(g) of the Delaware General Corporation Law

Carvana Co. (the “Corporation”), a corporation organized and existing under the General Corporation Law of the State of Delaware (the “DGCL”), hereby certifies as follows:

FIRST: That pursuant to the authority vested in the Board of Directors of the Corporation (the “Board”) in accordance with the provisions of the Amended and Restated Certificate of Incorporation of the Corporation (as amended from time to time, the “Certificate of Incorporation”), the Board previously adopted resolutions creating and authorizing a series of 200,000 shares of preferred stock, par value $0.01 per share, of the Corporation designated as Series B Preferred Stock (the “Series B Preferred Stock”), subject to the Certificate of Designations of Series B Preferred Stock (the “Certificate of Designations”), as filed with the Secretary of State of the State of Delaware on January 17, 2023.

SECOND: That none of the authorized shares of the Series B Preferred Stock is outstanding and none will be issued by the Corporation pursuant to the Certificate of Designations.

THIRD: That pursuant to the authority conferred upon the Board pursuant to the Certificate of Incorporation, on June 3, 2024, the Board duly adopted the following resolutions by unanimous written consent, approving the elimination of the Series B Preferred Stock:

WHEREAS, the Board previously adopted resolutions creating and authorizing a series of preferred stock designated as Series B Preferred Stock, subject to the Certificate of Designations, as filed with the Secretary of State of the State of Delaware on January 17, 2023;

WHEREAS, none of the authorized shares of the Series B Preferred Stock is outstanding and none will be issued by the Corporation pursuant to the Certificate of Designations; and

WHEREAS, the Board has determined that it is advisable and in the best interests of the Corporation and its stockholders to eliminate the Series B Preferred Stock (the “Elimination”).

NOW, THEREFORE, BE IT RESOLVED, that the Elimination hereby is authorized, approved, and adopted in all respects; and

FURTHER RESOLVED, that the officers of the Corporation are, and each hereby is, authorized by and on behalf of the Corporation to prepare, execute, and deliver to the Secretary of State of the State of Delaware a Certificate of Elimination as required by the DGCL in order to effect the cancellation and elimination of the Series B Preferred Stock, and any and all additional documents required to be filed therewith.

FOURTH: That, in accordance with Section 151(g) of the DGCL, the Certificate of Incorporation, as effective immediately prior to the filing of this Certificate of Elimination, is hereby amended to eliminate all references to the Series B Preferred Stock.

[Signature Page Follows]

IN WITNESS WHEREOF, the undersigned, a duly authorized officer of the Corporation, has executed and subscribed this Certificate of Elimination and does affirm the foregoing as true under the penalties of perjury on this 5th day of June 2024.

| | | | | | | | | | | | | | |

| | | | |

| CARVANA CO. |

| |

| By: | | /s/ Paul Breaux |

| | Name: | | Paul Breaux |

| | Title: | | Vice President, General Counsel and Secretary |

[Signature Page to Certificate of Elimination]

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityListingsLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_PreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

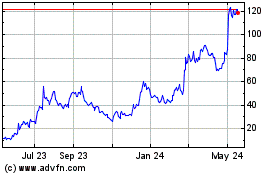

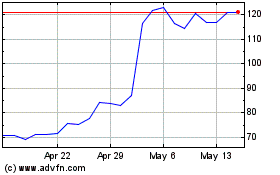

Carvana (NYSE:CVNA)

Historical Stock Chart

From May 2024 to Jun 2024

Carvana (NYSE:CVNA)

Historical Stock Chart

From Jun 2023 to Jun 2024