UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

TENDER OFFER STATEMENT UNDER SECTION 14(D)(1)

OR 13(E)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

ASPEN TECHNOLOGY, INC.

(Name of Subject Company (Issuer))

EMERSON ELECTRIC CO.

(Names of Filing Persons (Offeror))

Common Stock, Par Value $0.0001 Per Share

(Title of Class of Securities)

045327103

(Cusip Number of Class of Securities)

Michael Tang

Senior Vice President, Secretary & General

Counsel

Emerson Electric Co.

8000 West Florissant Avenue

St. Louis, MO 63136

314-553-2000

(Name, Address and Telephone Number of Person Authorized

to

Receive Notices and Communications on Behalf of Filing Persons)

With copies to:

Phillip R. Mills

Davis Polk & Wardwell LLP

450 Lexington Avenue

New York, NY 10017

(212) 450-4618 |

Cheryl Chan

Davis Polk & Wardwell LLP

450 Lexington Avenue

New York, NY 10017

(212) 450-4503 |

| ☒ | Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to

designate any transactions to which the statement relates:

| ☒ | third-party tender offer subject to Rule 14d-1. |

| ☐ | issuer tender offer subject to Rule 13e-4. |

| ☒ | going-private transaction subject to Rule 13e-3. |

| ☐ | amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing

is a final amendment reporting the results of the tender offer. ☐

If applicable, check the appropriate

box(es) below to designate the appropriate rule provision(s) relied upon:

☐

Rule 13e–4(i) (Cross-Border Issuer Tender Offer)

☐

Rule 14d–1(d) (Cross-Border Third-Party Tender Offer)

This filing

relates solely to preliminary communications made before the commencement of a potential tender offer by Emerson Electric Co., a Missouri

corporation (“Parent”), directly or through a wholly-owned subsidiary, to acquire all of the issued and outstanding

shares of common stock, par value $0.0001 per share, of Aspen Technology, Inc., a Delaware corporation (the “Company”),

that are not already owned by Parent.

FORWARD-LOOKING STATEMENTS

This Schedule TO contains forward-looking statements

related to Emerson, AspenTech and the proposed acquisition by Emerson of the outstanding shares of common stock of AspenTech that Emerson

does not already own. These forward-looking statements are subject to risks, uncertainties and other factors. All statements other than

statements of historical fact are statements that could be deemed forward-looking statements, including all statements regarding the intent,

belief or current expectation of the companies and members of their senior management team. Forward-looking statements include, without

limitation, statements regarding the business combination and related matters, prospective performance and opportunities, post-closing

operations and the outlook for the companies’ businesses, including, without limitation, future financial results, synergies, growth

potential, market profile, business plans and expanded portfolio; the competitive ability and position of the combined company; filings

and approvals relating to the proposed transaction; the ability to complete the proposed transaction and the timing thereof;

difficulties or unanticipated expenses in connection with integrating the companies; and any assumptions underlying any of the foregoing.

Investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties

and are cautioned not to place undue reliance on these forward-looking statements. Actual results may differ materially from those currently

anticipated due to a number of risks and uncertainties. Risks and uncertainties that could cause the actual results to differ from expectations

contemplated by forward-looking statements include: (1) the risk that a transaction with AspenTech may not be agreed with the AspenTech

special committee; (2) the risk that the non-waivable condition that the requisite majority of the holders of AspenTech common stock which

are unaffiliated with Emerson tender in or approve the proposed transaction is not met; (3) the risk that a transaction with AspenTech

may not otherwise be consummated; (4) uncertainties as to the timing of the transaction; (5) unexpected costs, charges or expenses

resulting from the proposed transaction; (6) uncertainty of the expected financial performance of AspenTech following completion

of the proposed transaction; (7) failure to realize the anticipated benefits of the proposed transaction; (8) inability to retain

and hire key personnel; (9) potential litigation or regulatory approval requirements in connection with the proposed transaction or other

settlements or investigations that may affect the timing or occurrence of the contemplated transaction or result in significant costs

of defense, indemnification and liability; (10) evolving legal, regulatory and tax regimes; (11) changes in economic, financial,

political and regulatory conditions, in the United States and elsewhere, and other factors that contribute to uncertainty and volatility,

natural and man-made disasters, civil unrest, pandemics, geopolitical uncertainty, and conditions that may result from legislative, regulatory,

trade and policy changes associated with the current or subsequent U.S. administration; (12) the ability of Emerson and AspenTech

to successfully recover from a disaster or other business continuity problem due to a hurricane, flood, earthquake, terrorist attack,

war, pandemic, security breach, cyber-attack, power loss, telecommunications failure or other natural or man-made event, including the

ability to function remotely during long-term disruptions; (13) the impact of public health crises, such as pandemics and epidemics and

any related company or governmental policies and actions to protect the health and safety of individuals or governmental policies or actions

to maintain the functioning of national or global economies and markets, including any quarantine, “shelter in place,” “stay

at home,” workforce reduction, social distancing, shut down or similar actions and policies; (14) actions by third parties, including

government agencies; (15) potential adverse reactions or changes to business relationships resulting from the announcement of the proposal

or completion of the transaction; (16) the risk that disruptions from the proposed transaction will harm Emerson’s and AspenTech’s

business, including current plans and operations; and (17) other risk factors as detailed from time to time in the companies’ periodic

reports filed with the U.S. Securities and Exchange Commission (the “SEC”), including current reports on Form 8-K,

quarterly reports on Form 10-Q and annual reports on Form 10-K. All forward-looking statements are based on information currently available

to Emerson, and Emerson assumes no obligation and disclaim any intent to update any such forward-looking statements.

ADDITIONAL INFORMATION AND WHERE TO FIND IT

This Schedule TO relates to a proposal that Emerson

has made for an acquisition by Emerson of all of the shares of issued and outstanding common stock of AspenTech not already owned by Emerson.

In furtherance of this proposal and subject to future developments, Emerson may file one or more tender offer statements or other documents

with the SEC. This Schedule TO is not a substitute for any tender offer statement or other document Emerson may file with the SEC in connection

with the proposed transaction.

Investors are urged to read the tender offer statements

and/or other documents filed with the SEC carefully in their entirety if and when they become available, as they will contain important

information about the proposed transaction. Investors will be able to obtain free copies of these documents (if and when available) and

other documents filed with the SEC by Emerson through the website maintained by the SEC at http://www.sec.gov.

This Schedule TO shall not constitute an offer to

sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any jurisdiction. A

solicitation and an offer to buy shares of AspenTech will be made only pursuant to an offer to purchase and related materials that Emerson

may file with the SEC.

Any information concerning AspenTech contained in

this Schedule TO has been taken from, or based upon, publicly available information. Although Emerson does not have any information that

would indicate that any information contained in this Schedule TO that has been taken from such documents is inaccurate or incomplete,

Emerson does not take any responsibility for the accuracy or completeness of such information.

EXHIBIT INDEX

Exhibit 99.1

Emerson Electric Co. Q4 2024 Earnings

Call Transcript

November 5, 2024

Corporate Participants

Colleen Mettler – Vice President, Investor Relations

Lal Karsanbhai – President and Chief Executive Officer

Michael Baughman – Chief Financial Officer, Executive Vice President

Ram Krishnan – Chief Operating Officer, Executive Vice Presidents

Conference Call Participants

Andy Kaplowitz – Citigroup

Deane Dray – RBC Capital Markets

Nigel Coe – Wolfe Research

Steve Tusa – JP Morgan

Andrew Orbin – Bank of America

Jeff Sprague – Vertical Research

Joe O’Dea – Wells Fargo

Julian Mitchell - Barclays

Prepared Remarks

Operator

Good morning, everyone, and welcome to the strategic announcement of

Q4 and full year 2024 earnings conference call. All participants will be in a listen only mode. Should you need assistance, please signal

a conference specialist by pressing the star key followed by zero. After today's presentation, there will be an opportunity to ask questions.

To ask your question, you may press star, then one on your touchtone telephone. To withdraw your question, you may press star and two.

Please also note, today's event is being recorded. At this time, I'd like to turn the conference call over to our host, Colleen Mettler,

Vice President of Investor Relations at Emerson. Please go ahead.

Colleen Mettler

Good morning and thank you for joining us for Emerson’s Strategic

Announcement and Fourth Quarter and Full Year 2024 Earnings Conference Call. This morning, I am joined by President and Chief Executive

Officer, Lal Karsanbhai; Chief Financial Officer, Mike Baughman; and Chief Operating Officer, Ram Krishnan.

As always, I encourage everyone to follow along with both slide presentations

we have prepared this morning which are available on our website. Please join me on slide two. This presentation may include forward looking

statements which contain a degree of business risk and uncertainty. Please take time to read the Safe Harbor statement and note on non-GAAP

measures.

Please turn to slide three. Today we have two presentations that we

will discuss. We will first go through our strategic announcement presentation, and then we will go through our 2024 financial results

and guide for fiscal ‘25. I will now pass the call over to Emerson’s President and CEO, Lal Karsanbhai, to discuss the strategic

actions we announced to complete our portfolio transformation.

Lal Karsanbhai

Thank you, Colleen. Good morning, everyone.

Please turn to slide four. 2024 was an exciting year where we closed

our National Instruments acquisition, did excellent work driving synergies and integration and celebrated 80 years as a company listed

on the New York Stock Exchange. Operationally, we performed at a high level, and will go through our results in a few minutes.

2025 is a milestone year for Emerson as we commemorate our 135th year

as a company. This longevity is only possible due to the talent, dedication and innovative spirit of our Emerson employees through the

decades, and I'm grateful for their continued contributions. Emerson has undergone many transformations during this storied history, and

I'm excited to announce our final steps to complete our portfolio transformation, which started three and a half years ago.

Our intent has been unwavering in the execution of our vision to create

a cohesive industrial technology portfolio. Transformation and evolution have been hallmarks of past Emerson generations. Buck Persons,

Chuck Knight and David Farr all had visions and reinvented this great company. And now, this is a trademark of this management team that

I have the privilege to lead.

Please turn to slide five. First, Emerson has made a proposal to acquire

the remaining shares of AspenTech for $240 per share in cash, which values AspenTech at an EBITDA multiple consistent to our original

transaction. Given our position as a 57% shareholder of AspenTech, our proposal must be made public and filed under our 13D reporting

obligations as and when delivered to AspenTech. We were prohibited from engaging in any take-private discussions with AspenTech ahead

of such public disclosure. Now that our proposal has been made public, we look forward to engaging privately with a special committee

of AspenTech’s board to reach a definitive agreement that will benefit both Emerson and AspenTech shareholders.

If we reach an agreement with the special committee, Emerson’s

proposal is that the transaction be effected by a tender offer that would be subject to a non-waivable condition that at least a majority

of the AspenTech common stock held by minority stockholders be tendered in accordance with the MSW framework.

I wish to emphasize that, in our capacity as a stockholder of AspenTech,

we are only interested in acquiring the shares of the company that we do not currently own. And accordingly, we have no interest in a

disposition or sale of our holdings in the company. This is an exciting opportunity to bring two exceptional companies fully together

and unlock significant value creation potential for shareholders, employees and customers.

Since completing our initial investment in 2022, our partnership with

AspenTech has been highly productive and has advanced our capabilities in software defined automation. The success of our operating partnership

with AspenTech over the last two years gives us confidence that the time is right to bring Emerson and AspenTech together. The combination

of Emerson and AspenTech would advance key initiatives, create new opportunities through full integration as a single company, and further

accelerate Emerson’s industrial software strategy.

Additionally, as a single company leveraging the proven Emerson Management

System, we expect there to be immediate additional cost synergies from the transaction. Finally, we believe the transaction and the simplified

structure would make it easier for our investors to value and model our company.

Second, we have commenced a process to explore strategic alternatives,

including a cash sale, for our Safety & Productivity business to maximize shareholder value. This segment, which includes Emerson’s

legacy tools businesses, is approximately 8% of 2024 revenue and comprises the remaining businesses

not related to automation in Emerson’s portfolio. This business

has industry leading margins and cash flow but does not fit our automation thematic.

Third, we announced that we are increasing our return of capital to

shareholders with plans to repurchase approximately $2 billion of common stock in fiscal 2025 and expect to complete $1 billion by the

end of the fiscal first quarter. Together with the dividend, we expect to return approximately 100% of our guided free cash flow in 2025

to shareholders. The repurchase underscores Emerson's commitment to driving shareholder returns as we believe the current multiple does

not accurately reflect Emerson’s strong outlook, significant free cash flow generation and benefits of the strategic actions announced

today. It's important to note that post-transactions we expect to maintain our A2/A credit rating.

Please turn to slide six. AspenTech is a leading industrial software

company that delivered $1.1 billion in revenue and $941 million in ACV in 2024. AspenTech’s process simulation and optimization

software delivers efficiency and productivity gains in mission critical environments for its global customer base, including top EPC,

utilities, chemicals and energy companies.

AspenTech’s innovative software product capabilities are critical

to helping these customers address the dual challenge of maximizing production output while also achieving sustainability goals by enabling

digital transformation at scale to optimize asset performance across its lifecycle.

Their software portfolio includes their heritage AspenTech businesses

as well as the two businesses we contributed to the initial deal, SSE and DGM. Today, Emerson’s leading automation solutions and

AspenTech industrial software capabilities provide our customers with an unparalleled portfolio of offerings. Our future vision as an

integrated company would accelerate innovation to deliver significant value and move the industry forward.

Please turn to slide seven. We believe bringing AspenTech fully under

Emerson's ownership at this time would enable us to combine technology capabilities to rapidly accelerate our vision of moving the control

system landscape to a software defined enterprise automation architecture.

In today's typical manufacturing facility, there are clear delineations

between different levels of the automation technology stack. Field devices send data through a variety of communication protocols into

control hardware and embedded software in a distributed control system that runs the production and safety operations in the facility.

This automation loop is the traditional strength of the Emerson portfolio.

AspenTech’s optimization software sits on top of this architecture,

providing design, operations and maintenance suites to improve overall plant performance. Today, even within a single plant, field devices

and control hardware typically come from multiple manufacturers with a complex web of connections that are designed to provide data up

the stack to specific departments. For example, production and maintenance data are separately managed for those departments. This inherently

siloed approach limits customers’ ability to drive maximum efficiency, uptime and reliability in their operations.

With a fully aligned portfolio and technology roadmap, and use of the

latest technological developments that Emerson is pioneering, we believe we can move the industry to a software-defined approach in which

field devices from all manufacturers feed data seamlessly into edge controllers that make use of a unified data fabric, democratizing

operational data. That data fabric would then be available to a suite of control and optimization software modules that will vary depending

on specific customer needs. We call the full suite of software modules Emerson's Enterprise Operations Platform, which will run production

into our safety, reliability and optimization at the site, regionally, and eventually at the enterprise level for all our customers.

Please turn to slide eight. Our customers continue to evolve their production

to improve efficiency and apply the latest technologies to operational footprints. While today they continue to value the traditional

benefits of the automation technology stack, including security, reliability and redundancy, they are increasingly looking to benefit

from new technologies that enable step changes in the productivity and longevity of facilities and production assets.

Emerson’s Enterprise Operations Platform will connect the field,

edge, and cloud across manufacturers to provide customers with the flexibility to manage the operations of assets from individual sites

to the broader enterprise in whatever way is best for their needs. We will deploy this capability in phases, moving from foundational

integration of our various software modules to site level and then eventually enterprise-wide control and optimization.

Full alignment of technology roadmaps between Emerson and AspenTech

is crucial to realizing this vision. We believe this approach will move the existing $30 billion control system and optimization software

TAM from its current construct of one-third software, two-thirds hardware and services for a predominantly software based market growing

high single digits with a significant proportion of recurring revenue.

Please turn to slide nine. The breadth and depth of Emerson's and AspenTech’s

software capabilities across engineering and design, operations, asset performance and data management is unparalleled in our space, providing

a broad set of customers with unique value across the full lifecycle of their assets. Customers use our suite of applications to design

and simulate their processes, control and optimize production to maximize throughput and quality, proactively monitor their capital assets

and take action before an issue emerges, and more effectively utilize the wide variety of structured and unstructured data that they generate.

By fully integrating AspenTech within Emerson, we’ll be able to align our technology roadmaps more effectively and rapidly, thereby

accelerating achievement of our vision of software defined automation and delivering significant value to our customers.

Please turn to slide ten. Across the key capabilities required to offer

customers an Enterprise Operations Platform, we believe the combination of Emerson and AspenTech would have unique offerings relative

to our leading automation competitors, as well as to nontraditional players like ERP and cloud providers.

In particular, our extensive experience integrating software modules

into our distributed control system suite, our leading approach to zero trust cybersecurity, and our insights into native connectivity

with field devices enable us to provide compelling value to our customers.

For total clarity, AspenTech’s suite of optimization software

solutions would continue to be actively sold on top of third party control systems as they are today.

Turning to slide 11. We believe this transaction would create significant

value for our shareholders as well. We see meaningful opportunities to leverage Emerson's Management System to improve operating margins,

cash flow and innovation productivity, as we have demonstrated with Test & Measurement.

The primary areas for synergy targets include corporate costs and G&A

where we would strive to streamline duplicative functions, leverage a regional best cost model, consolidate facilities and use Emerson’s

scale to reduce third party spend. For R&D, we can enhance the productivity of spend and leverage common capabilities while supporting

accelerated investment as we build out the enterprise operations platform. We believe the transaction will meet Emerson return thresholds

and we expect the impact to adjusted earnings per share to be neutral in fiscal 2025 with synergies.

Please turn to slide 12. Now is the right time to acquire all outstanding

shares of common stock of AspenTech. The combination of Emerson and AspenTech would accelerate the achievement of our software defined

automation strategy and provide unparalleled value to customers.

As a single company leveraging the proven Emerson Management System,

there would be immediate additional cost efficiencies from the transaction in addition to opportunities to enhance operational performance

at AspenTech.

Lastly, a single integrated company reduces structural complexity for

our investors. We are excited by the opportunity to bring AspenTech fully into Emerson.

Please turn to slide 13. Our second announcement this morning is that

we have commenced the review of strategic alternatives for the Safety & Productivity business, including a cash sale.

This business is a $1.4 billion global manufacturer of professional

plumbing and electrical tools, as well as wet/dry and commercial vacuums with leading gross margins and strong free cash flow generation.

Safety & Productivity is a technology-based business with premium brands, including RIDGID, Klauke and Greenlee, that is exposed to

attractive growth drivers such as reshoring and domestic manufacturing, but is not aligned to our strategic roadmap.

There is no deadline or definitive timetable set for the completion

of the strategic alternatives process or assurance the process will result in any transaction.

Please turn to slide 14. We are focused on our value creation roadmap,

and at the successful completion of these strategic actions, we will have created a highly attractive $16 billion global industrial technology

company with a comprehensive portfolio of software defined and hardware advantaged automation solutions.

Our cohesive portfolio generates strong profitability and cash, and

our growth platforms are aligned to underlying secular market trends which will deliver significant growth going forward to support our

4% to 7% through-the-cycle organic growth framework.

Industrial software is our largest growth platform, and software represents

approximately 14% of post-transaction sales, which is well positioned to increase as we drive the software content in our business higher.

ACV, which is an operating metric used to gauge the underlying health

of software businesses, is $1.4 billion and grew at 10% year over year.

We will simplify the reporting segments with these transactions moving

from 7 to 5 as we intend to consolidate AspenTech into Control Systems & Software.

We have conviction in the profit and growth potential of this premier

collection of industrial technology assets centered on an automation sematic, and we are excited to deliver further growth, margin expansion

and shareholder value creation.

The AspenTech proposal was made public today pursuant to regulatory

obligations, and we have walked you through our plan and why we are pursuing this transaction now. The next steps in both of the portfolio

transactions announced today will be done privately. We do not intend to make any further public statements or announcements regarding

the proposal or review of the strategic alternatives until such time as a definitive agreement is reached or if further disclosure is

appropriate. We will not be taking or answering any questions on the AspenTech proposal today or until such time is appropriate.

I will now turn the call over to Mike Baughman to review our 2024 results

and 2025 guidance.

Michael Baughman

Thanks, Lal, and good morning everyone.

We will now go to the next presentation, shifting the call to the earnings

press release and discuss our 2024 financial results and 2025 guidance.

We will also share with you what we are seeing in our funnel and end

markets.

Please join me on slide 16. We continue to deliver on our value creation

framework. As you can see in this chart, 2024 was another excellent year that met or exceeded guidance.

Underlying sales grew 6% and operating leverage was 47%, both in line

with August guidance. Adjusted EPS was $5.49, at the high end of August guidance, and free cash flow was $2.9 billion, which exceeded

our guidance.

Quarterly underlying orders growth exited the year at 2% and our full

year growth was also 2%. This orders growth was led by our process and hybrid businesses, which were up mid-single digits for the year.

Discrete Automation orders were down mid-single digits for the year but turned positive in Q4 as we expected.

Though not included in the underlying for 2024, Test & Measurement

orders in the quarter were down 7% but improved two points sequentially, and we remain optimistic about a recovery in this business in

2025.

Additionally, we executed approximately $435 million of share repurchase,

above the August guidance, as we saw an opportunity to buy our 2025 dilution in advance at an attractive valuation.

Our 2024 performance was another year of strong operating results and

demonstrates the power of our transformed higher growth, higher margin portfolio.

Please turn to slide 17, where I where I will provide additional color

on our 2024 performance.

Underlying sales growth of 6% was led by our process and hybrid businesses,

which were up high single digits for the year. Intelligent Devices grew 5%, while Software & Control grew 8% and price contributed

two points of growth. Asia, Middle East and Africa led the growth, up 8% with exceptional performance from the Middle East and Africa,

led by strong project activity in LNG and chemical. China was down 3% for the year as chemical and discrete were slow amidst weak demand.

Europe was up 7% with sustained strength in LNG, sustainability and decarbonization and life sciences. Americas also performed well, up

4%, led by power, LNG, metals and mining and life sciences. Test & Measurement, which was excluded from the underlying metric, contributed

$1.46 billion to our net sales, down 12% for the year, and within our expectations.

Following our typical seasonality, backlog decreased in Q4 from Q3 and

we exited the year at $7.2 billion. Excluding T&M from this backlog figure, our backlog grew $150 million driven by process and hybrid

investments that were slightly offset by the decline in our discrete and other businesses.

Adjusted segment EBITA margin was 26%, up 100 basis points from the

prior year due to favorable price cost and cost reductions. Operating leverage, which excludes Test & Measurement in 2024, was 47%,

reflecting the strong operational execution and profitability of our business. Test & Measurement delivered

an adjusted segment EBITA margin of 24%, including the realization of

$100 million of synergies and a 130 basis point favorable impact from the timing of the acquisition’s close in Q1.

Adjusted earnings per share came in at $5.49, up 24% from 2023. Operations

contributed $1.06 of growth, with a $0.01 offset in nonoperating items. Test & Measurement exceeded initial expectations and delivered

$0.45 as increased and accelerated synergies offset lower than originally expected sales volume. AspenTech contributed $0.35, slightly

above our expectations of $0.32 to $0.34.

Finally, Emerson delivered stronger than expected free cash flow of

$2.9 billion, up 23% year on year, despite a headwind of approximately $235 million from acquisition related costs and higher capex.

Higher earnings and inventory improvements drove the year-on-year improvement

in cash. Free cash flow margin for the year was 16.6%, a 110 basis point improvement from the prior year.

Please turn to slide 18. Before discussing 2025’s guidance, I'd

like to review the exceptional financial performance of the company over the last three years.

Our portfolio transformation began in late 2021 and the gray bar shows

the pre-transformation results for that year. The blue bars represent the results for the company we have today inclusive of Safety &

Productivity from 2021 through 2024.

We have delivered three years of underlying sales growth at the high

end or above of our long range framework of 4% to 7% through the cycle, which demonstrates a structurally improved and more cohesive Emerson

that is aligned to secular growth drivers.

Our differentiated technology and innovation leadership are evident

in the remarkable gross margin performance. In 2024, we delivered gross margins of 50.8% for the year, a record for Emerson and up nearly

1,000 basis points from our pre-transformation portfolio in 2021. We have also significantly improved adjusted segment EBITA, closing

2024 at a record high of 26%.

Our higher margin portfolio, coupled with the processes driven by our

updated Emerson Management System, has enabled several consecutive years of outsized leverage performance. All of this has produced three

consecutive years of adjusted earnings per share growth over 20%.

We are proud of the leading industrial technology company we created

and our accomplishments over the last three years. As we take the final steps in our portfolio transformation, we are energized to continue

creating shareholder value.

Please turn to slide 20. I would now like to talk a little bit about

our funnel and what we are seeing in our served markets.

We continue to see strong project activity with our large project funnel

exiting the year at $11.2 billion, up approximately $200 million from Q3.

Customers are continuing to invest in areas aligned to our growth platforms.

LNG, life sciences and sustainability and decarbonization drove the increase versus the prior quarter. The three-year visibility of projects

within the funnel, the size of the funnel and the continued growth gives us confidence that we are in a capital formation cycle where

our customers need automation content to meet their complex objectives.

We performed well in the quarter, winning approximately $400 million

of project content with nearly 60% in our growth platforms. Wins in LNG, chemical and sustainability and decarbonization led the conversion

in the quarter, and I'd like to highlight a few notable wins. First,

Emerson was selected to provide our leading instruments to the Porthos carbon capture and storage project in the North Sea. Porthos will

store approximately 37 million tons of CO2 transported from the Port of Rotterdam from customers such as Air Liquide, Air Products, Exxon

Mobil and Shell.

Next, Emerson was chosen to automate a new world class petrochemical

complex in Saudi Arabia. Emerson will provide control and safety systems and software, asset management software and valves.

Third, Emerson was recently awarded a large enterprise contract for

Test & Measurement software with a semiconductor company that is a leader in the GPU space driving the proliferation of AI. This

multi-year contract will support an enterprise-wide semiconductor and electronics production analytics platform to help maximize this

customer's production capacity and product quality. Emerson will provide our Optimal+ Production Analytics platform, along with local

customer engineering, operations and support capabilities.

Both large project and MRO business performed well in the year, with

MRO representing 64% of sales. Emerson serves an expansive set of customers in diverse industries, demonstrating our relevance across

the process, hybrid and discrete landscapes.

Our top 20 direct customers made up only approximately 9% of sales,

with the largest being around $180 million. Emerson has consistently proven it can capture price in the market, driven in part by the

long tail of the customers we serve.

Turning to slide 21, we will now discuss our outlook for 2025.

We expect process and hybrid markets to be resilient with moderating

growth, discrete markets to turn positive, and sales growth in all world areas. We are seeing customers continue to invest in digitalization

and automation technology to enhance plant efficiency, reliability, output and sustainability.

We expect sustained demand in process and hybrid markets with the capital

cycle remaining constructive as shown in our project funnel, with projects continuing to move forward at a healthy pace.

We expect MRO to continue to perform well with stable demand in North

America and Europe. The demand in both capital projects and MRO is driven by secular trends of energy security and affordability, sustainability

and decarbonization, nearshoring and digital transformation. And we continue to see strong activity across many verticals led by LNG and

other energy transition segments, life sciences, power and metals and mining.

Overall, we expect our process and hybrid businesses to grow in the

mid-single digits for the year. We are still looking for a meaningful recovery in discrete market demand in the first half of 2025, which

we expect will lead to a second half sales recovery and mid single digit sales growth for the year.

The majority of our discrete served markets appear to have bottomed

and we have seen positive indicators of early-stage recovery in semiconductor, industrial and factory automation markets. However, automotive

markets, particularly EV, remain weak and we will continue to watch these closely.

Additionally, our Test & Measurement business will benefit from

further synergy actions in the year, and we are now targeting $200 million by year three from our previous target of $185 million due

to faster execution of our overall synergy plan.

We anticipate growth in all world areas led by Middle East and Africa,

India, Southeast Asia and Mexico from continued investment in energy and energy transition projects. We expect China to return to growth

by the second half after being down low single digits in 2024, as we expect investments in self-reliance

programs and sustainability to continue, coupled with recovery in discrete

markets as we begin to lap easier comps.

North America is expected to grow in the low single digits, aided by

LNG, life sciences, and a strong outlook for power generation, transmission and distribution due to the significant demand growth for

electricity related to A.I. and data centers.

Finally, we expect we expect mid single digit growth in Europe from

continued investments in the energy transition.

Please join me on slide 22 for details on our guidance for the first

quarter and full year 2025.

It should be noted that our 2025 guidance is based on the current company

without the impact of today's announced portfolio actions. We have provided the relevant Safety & Productivity contribution of the

guide to help investors size the potential impact of the strategic review of that business, and we have continued to detail our expectations

for our 57% ownership stake in AspenTech.

Underlying sales are expected to grow 3% to 5% in the year. Safety &

Productivity growth is expected to be approximately flat for the year, and because it is only about 8% of total Emerson sales, it is not

expected to have a material impact on the overall growth rate for the year when it exits our results.

Operating leverage, which now includes Test & Measurement, is expected

to be in the mid-40s. We expect adjusted earnings per share for the year to be between $5.85 and $6.05. AspenTech’s contribution

is expected to be $0.44 to $0.46 for the year, and Safety & Productivity is expected to contribute approximately $0.48.

Full year free cash flow is expected to be $3.2 billion to $3.3 billion,

with approximately $0.2 billion from Safety & Productivity. For the first quarter, we expect underlying sales to increase 2% to 3%,

with leverage in the mid-50s. We expect adjusted EPS of $1.25 to $1.30, of which $0.10 to $0.11 comes from AspenTech.

As discussed earlier, we expect approximately $2 billion of share repurchase

for the year, and the current plan is to complete $1 billion in the first quarter.

Finally, we expect dividend payments to be approximately $1.2 billion

and our tax rate to be approximately 22% for the year.

Please turn to slide 23.

Emerson remains committed to disciplined capital allocation and is increasing

return of capital to shareholders in 2025 as we complete our portfolio transformation.

We continue to have four primary capital allocation priorities. The

first is reinvestment in the business, and Emerson spent approximately 8% of sales on RD&E in 2024, and we expect a similar level

of spend in 2025. Both Test & Measurement and AspenTech spent around 20% of their sales on RD&E and growth opportunities in these

businesses, which is a reflection of our commitment to realize these growth opportunities.

As discussed previously, we are increasing our share repurchases to

approximately $2 billion and expect around $1 billion in the first quarter. We are also entering our 69th year of increased dividends

per share and this quarter we increased the quarterly dividend per share to 52 and three-quarters cents. Capital

returned to shareholders through the dividend and share repurchase is

expected to be approximately 100% of free cash flow in 2025.

Over the past three years, we have been focused on portfolio transformation

and allocated capital primarily to strategic M&A and paying down debt. We have also returned $6.5 billion to shareholders through

dividends and share buybacks during that time.

After the successful completion of the actions announced today, we expect

our net debt to adjusted EBITDA ratio to be under two and well within the credit rating agencies metrics to maintain our A2/A credit ratings.

As we move forward beyond 2025, we plan to maintain our A2/A credit ratings.

The company's expected future free cash flows and debt capacity within

the range of the A2/A metrics provides sufficient flexibility to continue meaningful returns of capital to shareholders and execution

of strategic bolt on acquisitions.

Finally, I would like to echo Lal's earlier comments and thank all the

Emerson employees whose efforts are the real force behind these excellent financial results. It's your dedication to our company and our

customers that will drive our customer success and our shareholders’ returns.

I will now pass the call back to Colleen.

Colleen Mettler

Thank you, Mike. As we turn to Q&A, I will ask that you please limit

your question to one so we can get to as many folks as possible. Please also limit your questions to those related to the quarter and

outlook with respect to Emerson. I'd like to remind you of Lal's earlier comments. We will not be addressing questions on the portfolio

announcements beyond the information we shared today in our slides, prepared remarks and press release materials. We will update the market

as and when appropriate or required with respect to the AspenTech proposal and the Safety & Productivity strategic review.

With that, I will now turn it over to the operator to start the Q&A.

Questions & Answers

Operator

Ladies and gentlemen, at this time we will begin the question and answer

session. To ask a question, you may press star and then one using a touchtone telephone. If you are using a speakerphone, we do ask that

you please pick up the handset prior to pressing the keys to ensure the best sound quality. To withdraw your questions, you may press

star and 2. Again, that is star and then one to join the question queue. We'll pause momentarily to assemble the roster.

And our first question today comes from Andy Kaplowitz from Citigroup.

Please go ahead with your question.

Andy Kaplowitz, Citigroup

Good morning, everyone. Congrats on the announcements today.

Lal Karsanbhai

Good morning, Andy.

Andy Kaplowitz, Citigroup

Lal, so, $7.2 billion of total backlog at the end of Q4 is down a little

bit, as you said it would be, but your pipeline new awards were up. So, can you talk about how you're thinking about Emerson’s overall

book to bill for ’25? Do you think you could grow backlog? Could you elaborate on what end markets could continue to drive process

and hybrid markets to support your mid-single digit growth expectations in ‘25?

Lal Karsanbhai

Yeah, Andy. Look, certainly the backlog coming down from Q3 is part

of our seasonality as we see these higher volumes being shipped in Q4. We believe the $7.2 billion is a very healthy level and supportive

of the guide for next year. So, my expectation is as I think about the order environment that we expressed today and the sales environment

is a book to bill of one into 2025. So, really no meaningful change there and really well positioned.

Andy Kaplowitz, Citigroup

And then process and hybrid, Lal, it seems like you actually had more

new wins in Q4 than Q3. Did you see re-acceleration? Just stability? Like what are you seeing in those markets?

Lal Karsanbhai

Look, I think the projects continue to move in the right direction.

As you know, LNG took a little bit of a pause in new awards in North America but continued to expand globally and in Africa and the Middle

East predominantly, which was critical for us. We continue to see very strong sustainability and decarbonization activity in Europe, life

science activity globally, and power generation, particularly in the United States and Europe, to support the data center requirements

that are out there. So, I feel very optimistic that we close the year in the mid-single digits on process and hybrid and that we have

a strong outlook going into next year.

Andy Kaplowitz, Citigroup

Congrats again on the announcements.

Operator

Our next question comes from Deane Dray from RBC Capital Markets. Please

go ahead with your question.

Deane Dray, RBC Capital Markets

Thank you. Good morning, everyone.

Lal Karsanbhai

Good morning, Deane.

Deane Dray, RBC Capital Markets

Hey, I'll add my congratulations. There's a lot of moving parts, but

the slides were really helpful, and the commentary. Look, this is a bit of the dog that didn't bark, but you didn't talk about any sort

of customer

delays, pushouts, any hesitancy about committing on approval process

for projects. Did you see any of that, and then, just separately, what's going into the assumptions about the second half recovery in

China? Are you seeing any green shoots, any specifics other than like an easier comp?

Ram Krishnan

Yeah. Hey, Deane, Ram here. We did not see any delays from customers.

Certainly nothing in the Middle East or North America or Europe. You know, all of the project shipments that we had baked into our Q4

plan shipped. So, we are not sensing any of that, and the capital cycle remains pretty strong for us in energy, energy transition, power,

LNG. So, the pace of business in process and hybrid continues. Obviously, the discrete recovery is what we're watching. Orders turning

positive for our Discrete Automation business in Q4 is certainly a positive for us, and we're confident that Test & Measurement will

see continued momentum going into 2025. And then what was your second piece of your question?

Deane Dray, RBC Capital Markets

China.

Ram Krishnan

You know, in terms of China, you know, obviously, the power segment

in China is pretty good for us. It's really discrete and chemical recovery. Our hope is obviously there's a lot of stimulus. There are

certainly some green shoots we’re seeing in the chemical space, we expect to manifest in the first half. It'll come down to the

pace of discrete recovery, which we're anticipating to happen in the second half of 2025. So that kind of shapes up our China plan, low-

to mid-single-digit growth for next year.

Deane Dray, RBC Capital Markets

Thank you.

Operator

Our next question comes from Nigel Coe from Wolfe Research. Please go

ahead with your question.

Nigel Coe, Wolfe Research

Thanks. Good morning. Lots to unpack here, that's for sure. So just

on that last part, the DA kind of trends in the first half of next year, do you think that – are you confident that we are going

to be sort of narrowing the declines in the first half of fiscal ‘25 from the exit rate from ‘24? And this is not a question

on the transaction, but just maybe just clarify, when you talk about EPS neutrality, is that pro forma total synergies, i.e. not captured

in FY25 or what would be actually physically captured in FY25?

Lal Karsanbhai

Hi, Nigel. Lal here. So I'll take the first part and hand it over to

Baughman on the – on the second question. So, in discrete, certainly we saw discrete turn positive in the fourth quarter, which

was encouraging to see that bottom out and set for recovery as you go through ’25. The elements of discrete in Test & Measurement

sequentially were up as well, quarter over quarter, down 7% orders in the last quarter, but that's a significant improvement. So, we continue

to believe that we're seeing the early shoots, the green shoots of that market recovery, which gives us the confidence in the forecast

that we put for the second half of 2025. Ram, any color?

Ram Krishnan

Yeah. And just to add on the Test & Measurement we’re equally

balanced across four markets: semiconductors, ADG, transportation and our portfolio of business, which addresses a broad spectrum of markets.

Three of the four, we see good momentum that supports the recovery plan that we've laid out to drive growth in the second half of 2025,

orders growth in the first half of ‘25. The transportation piece, which is about 20% of our sales in Test & Measurement, which

is exposed to the EV markets, is one we're watching. That's where we haven't seen the turn. But three out of the four markets have turned.

And if you saw some of the results or order pace reported by some of the players in Test & Measurement in the semi-con space, you

can see that market has turned. So, it's supportive of a broad recovery in the industry.

Michael Baughman

And Nigel, on your second question, just to be clear, you were asking

about the comment with respect to AspenTech being neutral to ’25?

Nigel Coe, Wolfe Research

Yes. Yeah, neutral.

Michael Baughman

Okay. Yeah, great. Let me give you a couple of things to think about

there, and we're obviously not going to talk specifics, but looking at models that have been out there, there are a couple of things to

highlight for everybody. First is synergies, as Lal mentioned, we are expecting synergies to come with this transaction. The second thing

would be the seasonality of the AspenTech business. This is a process we've begun that will be one that takes months, not weeks to complete.

And obviously, as AspenTech talked about on their call yesterday and as their seasonality has traditionally been, it's weighted toward

the back half of the year. And then the third thing that I would point out is that our modeling shows a closing balance sheet with increased

debt, obviously well within the metrics of the A2/A ratings. But we do expect a significant portion of that increased debt to be short

term debt and interest rates while being persistently high at the long end of the curve, we do expect some decreases in the short end

of the curve that we've modeled in.

Nigel Coe, Wolfe Research

Okay. That's helpful. Thanks.

Operator

Our next question comes from Steve Tusa from JPMorgan. Please go ahead

with your question.

Steve Tusa, JP Morgan

Hey, good morning. Just a just a quick one on the on the details. The

backlog you said there was up $150 million sequentially for the core ex-T&M, was that was that sequential or was that year over year?

Michael Baughman

That's year over year.

Steve Tusa, JP Morgan

Okay. Got it. And then sorry, just can you just walk us to that neutral

impact from Aspen for this year?

Lal Karsanbhai

I'll take that one, Steve. No, I'm not going to go into the details.

I've outlined the categories of synergies in my previous comments, but I'm not going to walk through the details of the math there.

Steve Tusa, JP Morgan

Okay. But it is just the core Aspen performance? It's not dependent

on these other transactions and what you do with the balance sheet, it’s really just core Aspen, what you're gaining and then the

synergies, you know, associated with that?

Lal Karsanbhai

Yes, that's correct.

Steve Tusa, JP Morgan

Okay. So just where did the T&M backlog end?

Michael Baughman

$400 million.

Steve Tusa, JP Morgan

$200 million?

Lal Karsanbhai

$400 million. 4-0-0.

Steve Tusa, JP Morgan

Okay, great. Thanks a lot.

Operator

Our next question comes from Andrew Obin from Bank of America. Please

go ahead with your question.

Andrew Orbin, Bank of America

Hi, good morning. You guys highlighted power as a growth vector in ‘25.

I think it's been a while since you've been excited about this. Can you just give us more detail as to what are you seeing in your traditional

power business? Maybe update us what the mix is, and then as a follow up, lots of talk on nuclear upgrades, bringing back mothballed capacity,

SMRs, what exactly is your nuclear exposure? Do you have N certification on your valves, and what are you seeing into 25 on that business?

Thank you.

Lal Karsanbhai

Yeah. Andrew here. So, yes, we did highlight that about two quarters

ago in terms of the acceleration that we're seeing in ower generation, transmission distribution investments, particularly in that case

in North America, driven by data center investment and the requirements for power.

It's been manifested in in three ways that predominately in the marketplace.

Extension of life of existing facilities, the bringing back of certain nuclear facilities which were mothballed years ago, and then the

build out of new combined cycle generating facilities. Alongside of course a very broad investment in the in the grid which now needs

to manage disparate sources of generation that impact what is a very aging infrastructure.

Power generation represents approximately 9% of revenue in the company

today. We have seen order acceleration in that business into the mid to high single digits over the year. That is a very differentiated

performance for our Ovation business, which today serves just about every segment of the power generation market, from traditional power

generation sources to hydro, solar and wind. We expect that to continue as we go forward here in in 2025.

Lastly on AspenTech, certainly the GGM business has seen accelerated

growth driven by the investments in the grid, and we're pretty excited about that. Let's say low teens ACV growth that they’ve talked

about and experience. So together, that's a very significant portfolio of capabilities that we're bringing to a market that is reinvesting

at a relatively high rate.

Andrew Orbin, Bank of America

How big is nuclear as a percent of power?

Ram Krishnan

Nuclear is about 20% of our overall power business. The 9% that Lal

referenced, we have a broad scope of capabilities for the nuclear business, obviously, instrumentation, valves, our control system through

a particular channel and then our solenoid valve category as well. And we have a leading position, particularly in our final control elements

and instrumentation and we have a very, very good presence across all of the nuclear facilities on a global basis. We participate in every

region of the world.

Andrew Orbin, Bank of America

Well, thanks so much. Congratulations, getting a lot done.

Operator

Our next question comes from Jeff Sprague from Vertical Research. Please

go ahead with your question.

Jeff Sprague, Vertical Research

Hey, thank you. Good morning, everyone. It's been busy. One more on

Aspen, it might have been Nigel's original question, but just want to clarify. Obviously, you're not going to own it for the full fiscal

year. You know, a month it's already passed. Does it does the neutral comment assumes kind of mid-year closing or is that a pro forma

for the full year? Can you just clarify that?

Michael Baughman

We're not going to get into specifics around timing, Jeff. But the comment

was intended to be for the year. And as I mentioned, there's obviously a seasonality element to that business that is helpful to the back

half of the year. So not going to get into specific timing.

Jeff Sprague, Vertical Research

And then, Lal, it was interesting, your choice of words on Safety &

Productivity. I think exploring an exit, including a cash sale, sort of makes it sound like that's the least attractive option. I assume

there would be a fair amount of leakage on a sale given how long you've owned these assets. Can you give us some context to that? And

have you had an opportunity to maybe explore more creative options, spin, MRT, things like that that wouldn't come with tax leakage?

Lal Karsanbhai

No, look, everything's on the table at this point. I just want to be

fully inclusive of all the opportunities that we're considering. And beyond that, until such time that we deem appropriate, I'm not going

to comment any further on the structure there.

Jeff Sprague, Vertical Research

And I'm sorry, just one quick one. The second half timing of kind of

discrete recovery, does that apply equally, in your view, in terms of both legacy Emerson discrete and T&M, or do you see them on

a little bit different schedules?

Lal Karsanbhai

No, legacy discrete turn positive in the last quarter on orders and

we expect that to be in the cycle and recovering alongside T&M.

Operator

Our next question comes from Joe O'Dea from Wells Fargo. Please go ahead

with your question.

Joe O’Dea, Wells Fargo

Hi. Good morning and congrats on the news this morning. Can you talk

about the evolution toward more software defined automation and the timeline that you envisioned for that and how that gets implemented

across MRO versus brownfield, greenfield? I'm not sure in terms of the challenges in sort of transitioning an operating system towards

software enabled the way you're talking about as opposed to starting fresh. So how we should think about the timeline toward this evolution?

Lal Karsanbhai

Well, you know, it's a journey. You know, what I outlined there, Joe,

is a three-phase approach, starting at the foundational level at the site and that's really what we're seeing today in terms of addressing

the market needs that exist at a customer level. Whether that's digital transformation, this conversion that we've been talking about

for a number of years now of IT and OT, the democratization of data that needs to be available and accessible across departments, asset

optimization, which is incredibly important to drive reliability and safety and ultimately remote or autonomous operations as well.

The second the second level, as you go through that foundation is to

drive it at a site level. And again, some of those technology implications you can probably think about this as each of these steps as

a 3 to

5 year potential journey really depends on the rate of adoption. We're

going to be very intentional in how we engage customers. There will be some that cross that chasm before others and are going to innovate

with the technology.

And then lastly, on the third phase, that's an enterprise level opportunity.

That's really the proof point operating at the site. And those customers that see an opportunity to really drive those levels of efficiency

across the entire fleet of their assets.

Ram Krishnan

Yeah. And just to add to that, you know, our technology roadmap will

have a scalable enterprise operations platform solution that can be applied certainly in brownfield type environments as well as greenfield.

So, we want to limit the applicability of the solution to just greenfield. It's very important to understand that there is significant

number of facilities that will require a digital transformation roadmap and the applicability of the solution to brownfield is an important

element of how we're going to design the architecture.

Joe O’Dea, Wells Fargo

And then just quickly on megaprojects, we've heard a little bit more

discussion of that this quarter. You know, you talk about the pipeline. One of the markets you didn't talk about as much was chemicals

in terms of accelerating. What we track is there could be an acceleration in those starts as well. I guess Aspen still talking about some

challenges there. But just overall in terms of any acceleration on large projects starts next year and then specifically within chemicals.

Ram Krishnan

Yeah, we've seen our chemical activity in the Middle East, for example,

be particularly strong. We do expect chemical and petrochemical in North America post elections, obviously going into next year to return.

We're watching China cautiously. It did slow in China, but we do expect with the stimulation of the economy that has happened that we

will see chemical activity there as well as Southeast Asia. We haven't baked in a huge amount of chemical recovery, to be honest in the

plan. Our plan is really contingent more on energy, energy transition, LNG, sustainability, decarbonization power, life sciences and metals

and mining. If we have a strong presence in chemical, if chemical does surprise us to the positive, particularly in Europe, that's certainly

promising to our 3 to 5 guide and then certainly China.

Operator

And our next question comes from Julian Mitchell from Barclays. Please

go ahead with your question.

Julian Mitchell, Barclays

Hi. Good morning. Just wanted to follow up on the organic sales guidance

for Test & Measurement. I think the total for the year is sort of up 3 to 5. Sounds like process and hybrids up mid-single and discrete

is up I think mid-single as well. So just wanted to sort of check that and what's embedded for Test & Measurement and how we think

about sort of any first half versus second half T&M Dynamics, please?

Ram Krishnan

So, you are correct, mid-single for process hybrid, mid-single for discrete

and for the 3% to 5% plan. Test & Measurement sales is also mid-single, but high single digit orders. We consume backlog this year,

so

our plan is to get orders growing at a faster rate than sales. But sales

guide for Test & Measurement is mid-single digits for 2025 and ramping in the second half.

Julian Mitchell, Barclays

Thanks very much. And then just my second one around synergies, I guess

sort of two pieces of that. One is Test & Measurement, there's $100 million of synergies to go over two years. You know, do we just

assume a slight majority of that in 2025? So, sort of 60 million or so? And really just clarifying from the prior series of questions,

is it fair to say at this point you're not going to provide that kind of synergy run rate assumption for Aspen? Just want to make sure

I didn't miss it from earlier. Thank you.

Lal Karsanbhai

Yeah, Julian. So, yeah, your assumptions on Test & Measurement is

fair. And in terms of absolute, we will provide that color once we have a definitive agreement and we'll lay the details on full year

until that time, no comment on the timing or the scale.

Operator

And ladies and gentlemen, with that, we'll be ending today's question

and answer session as well as today's presentation. We do thank you for joining. Please have a nice day. You may now disconnect your lines.

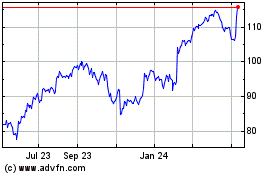

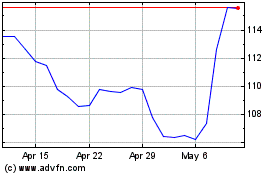

Emerson Electric (NYSE:EMR)

Historical Stock Chart

From Dec 2024 to Dec 2024

Emerson Electric (NYSE:EMR)

Historical Stock Chart

From Dec 2023 to Dec 2024