Macerich Announces Pricing of Upsized Public Offering of Common Stock

November 26 2024 - 12:19AM

The Macerich Company (NYSE: MAC) (the “Company” or “Macerich”)

announced today that it has priced an underwritten public offering

of 20,000,000 shares of common stock at a price to public of $19.75

per share for expected gross proceeds of approximately $395.0

million. The Company has also granted the underwriters a 30-day

option to purchase up to 3,000,000 additional shares of its common

stock. This reflects an upsizing of the previously announced

offering of 18,000,000 shares of common stock. Subject to customary

closing conditions, the offering is expected to close on November

27, 2024.

The Company intends to use the net proceeds of this offering,

together with cash on hand, including from recent sales under the

Company’s “at the market” offering program, to repay the $478.0

million mortgage loan with a fixed effective interest rate of

approximately 9.0% and which is secured by its Washington Square

property. Pending such use, the Company may invest the net proceeds

in short-term, interest-bearing deposit accounts.

Goldman Sachs & Co. LLC is serving as the lead bookrunner

and representative of the underwriters of the offering. J.P.

Morgan, Deutsche Bank Securities, BMO Capital Markets and TD

Securities are also serving as joint bookrunning managers for the

offering. Copies of the prospectus supplement and accompanying

prospectus relating to these securities may be obtained, when

available, by contacting: Goldman Sachs & Co. LLC, Prospectus

Department, 200 West Street, New York, NY 10282, telephone:

1-866-471-2526, facsimile: 212-902-9316 or by email

at Prospectus-ny@ny.email.gs.com.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy any securities of the Company, nor

shall there be any sale of such securities in any jurisdiction in

which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

jurisdiction. Any such offer or sale will be made only by means of

the prospectus supplement and prospectus forming part of the

effective registration statement relating to these securities.

About the Company

Macerich is a fully integrated, self-managed, self-administered

real estate investment trust (REIT). As a leading owner, operator,

and developer of high-quality retail real estate in densely

populated and attractive U.S. markets, Macerich’s portfolio is

concentrated in California, the Pacific Northwest,

Phoenix/Scottsdale, and the Metro New York to Washington, D.C.

corridor. Developing and managing properties that serve as

community cornerstones, Macerich currently owns 45 million square

feet of real estate, consisting primarily of interests in 41 retail

centers.

Forward-Looking Information

Information set forth in this press release contains

“forward-looking statements” (within the meaning of the federal

securities laws, Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended), which reflect the Company’s expectations regarding future

events and plans, including, but not limited to, statements

regarding the closing of the offering, the underwriters’ option to

purchase additional shares of common stock and the Company’s

anticipated use of net proceeds from the offering. Generally, the

words “expects,” “anticipates,” “projects,” “intends,” “plans,”

“believes,” “seeks,” “estimates,” “scheduled,” “predicts,” “may,”

“will,” “should,” “could,” variations of such words and similar

expressions identify forward-looking statements. The

forward-looking statements are based on information currently

available to us and involve a number of known and unknown

assumptions, risks, uncertainties and other factors, which may be

difficult to predict and beyond the control of the Company, which

could cause actual results to differ materially from those

contained in the forward-looking statements. The following factors,

among others, could cause actual results to differ from those set

forth in the forward-looking statements: the Company’s ability to

close the offering including that the closing of the aforementioned

offering is subject to, among other things, standard closing

conditions and customary rights of the underwriters to terminate

the underwriting agreement due to any material adverse change in

the financial markets in the United States or the international

financial markets, any outbreak of hostilities or escalation

thereof or other calamity or crisis or any change or development

involving a prospective change in national or international

political, financial or economic conditions; the actual use of

proceeds therefrom; and other risks and uncertainties detailed from

time to time in the Company’s filings with the Securities and

Exchange Commission (the “SEC”), which are available at the SEC’s

website at www.sec.gov. The Company disclaims any obligation to

publicly update or revise any forward-looking statements contained

in this press release whether as a result of changes in underlying

assumptions or factors, new information, future events or

otherwise, except as required by law.

INVESTOR CONTACT: Samantha Greening, AVP, Investor Relations,

Samantha.Greening@macerich.com

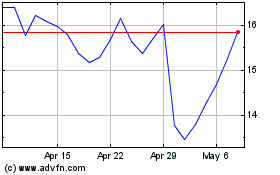

Macerich (NYSE:MAC)

Historical Stock Chart

From Nov 2024 to Dec 2024

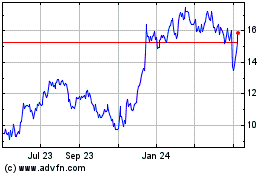

Macerich (NYSE:MAC)

Historical Stock Chart

From Dec 2023 to Dec 2024