Metals Acquisition Limited ARBN 671 963 198 (NYSE: MTAL; ASX:

MAC)

In accordance with ASX Listing Rule 3.13.3, please see attached

the Chair address to be delivered by Patrice Merrin, Chair and the

CEO presentation to be delivered by Mick McMullen, Chief Executive

Officer and Director at the Metals Acquisition Limited ARBN 671 963

198 (NYSE: MTAL; ASX: MAC), a private limited company incorporated

under the laws of Jersey, Channel Islands 2024 Annual General

Meeting to be held at 5:00pm (New York time) today and 9.00am

(Sydney time) November 22, 2024.

This announcement is authorised for release by Chris Rosario and

Trevor Hart, Joint Company Secretaries.

About Metals Acquisition Limited

Metals Acquisition Limited (NYSE: MTAL; ASX:MAC) is a company

focused on operating and acquiring metals and mining businesses in

high quality, stable jurisdictions that are critical in the

electrification and decarbonization of the global economy.

Chair Address -

Patrice Merrin

On behalf of the Metals Acquisition Limited Board and our

dedicated management team I would like to welcome you to the 2024

Annual General Meeting of Metals Acquisition Limited (MAC or

Company).

As we reflect on the significant developments at MAC since we

acquired the CSA Copper Mine in June 2023, I am filled with pride

and optimism for our journey ahead. Our teams, both at site and in

corporate, have worked tirelessly to reinvigorate the asset.

The safety of our teams remains our highest priority. Our

efforts in this regard have been unwavering, allowing us to

navigate challenges while protecting the wellbeing of our

workforce. We will continue to prioritise the safety of our

people.

2024 has been an exceptional year for MAC, our focus this year

was to simplify our capital structure and deleverage our balance

sheet; deliver strong production and operational improvements; and

continue building shareholder value.

We advanced this milestone by successfully listing on the ASX

and raising A$325 million. This achievement underscores the

confidence our new shareholders have in our vision and strategy.

The market shares this same view as we continued to establish

global visibility through the inclusion in the Russell 3000 Index,

the S&P/ASX 300 Index and more recently the MSCI Global Small

Miners index.

Furthermore, in early May, we successfully executed the

redemption of warrants, and in October we completed a A$150 million

equity raise. With these additional resources, we have optimized

our balance sheet and are well-equipped to explore both organic and

inorganic growth opportunities, solidifying MACs position in the

mining sector.

Our strategic investment with Polymetals Resources Limited

exemplifies our commitment to collaboration within the Cobar Basin.

The CSA Copper Mine appears to host high grade zinc mineralisation

near surface and adjacent to existing development. This partnership

is a logical way of securing a processing option for any zinc ore

we might mine without distracting our operations from the core

business of mining and recovering copper.

As we look ahead, our commitment to environmental, social, and

governance (ESG) stewardship remains steadfast. We recognize the

responsibility we bear in ensuring the sustainable and responsible

development of mineral resources, operating safely in collaboration

with local communities. We look forward to publishing our inaugural

sustainability report in Q1 2025.

During the year we strengthened our team and welcomed Leanne

Heywood, Anne Templeman-Jones and Mohit Rungta to our Board of

Directors and Morne Engelbrecht as our CFO. Their experience and

dedication will be instrumental as we navigate the complexities of

our business landscape.

As we look ahead, we are committed to becoming a +50 ktpa copper

producer by 2026. Our growth projects, including the expansion of

the mine to incorporate QTS South Upper and the Ventilation

project, are key to achieving this goal.

Our disciplined M&A strategy continues to guide us as we

evaluate prospects that will allow us to acquire and operate assets

in stable mining jurisdictions. These initiatives are essential for

maximizing value and achieving our long-term goal of becoming a

leading player in the electrification and decarbonization of the

global economy.

We are excited about the future of MAC as we continue to refine

our operational strategies and expand our resource base.

In closing, I would like to express my gratitude to our

dedicated team for their exceptional efforts and to all our

shareholders for your continued support. Together, we are

well-positioned to achieve our goals and drive shareholder

value.

CEO Address – Mick

McMullen

Good morning/evening everyone, and welcome to Metals Acquisition

Limited’s (MAC or Company) Annual General Meeting for

2024. It’s a pleasure to address our shareholders, board members,

and valued employees who continue to contribute to MAC’s success in

the global copper mining sector.

Since our acquisition of the CSA mine in June 2023 we have been

working tirelessly to optimise operations and the Company is proud

of what we have achieved.

Since acquiring CSA we have paid down around US$168 million in

interest-bearing liabilities, underscoring our commitment to

financial discipline and a stronger balance sheet. In the third

quarter of 2024, we achieved a copper production of 10,159 tonnes

with an impressive grade of 4%, putting us firmly on track to reach

our full-year guidance range of 38-43kt. Our efforts have also

positioned us with a clear pathway toward producing over 50kt of

copper annually within the next two years.

This ongoing performance, combined with strategic de-leveraging,

places MAC in a position of resilience and strength.

Our commitment to cost efficiency is evident, with Q3 C1 cash

costs at US$1.90 per pound, representing a 6% reduction from Q2.

This reflects both our efforts to control operational costs and the

benefits of our recent improvements at the CSA site.

As of the end of Q3, MAC held approximately US$81 million in

cash, with an additional US$25 million undrawn revolving facility,

creating a pro-forma liquidity of around US$226 million. This

financial flexibility empowers us to pursue strategic opportunities

that align with our long-term growth plans.

Our efforts in exploration have continued to yield promising

results, with recent drilling confirming high-grade copper targets.

We invested US$2.1 million in exploration during Q3 alone, and our

drilling projects have upgraded both inferred and mineralized

material, expanding our resources and reserves at CSA. This

continued resource growth solidifies our long-life copper exposure,

with significant reserve increases achieved in 2024.

To support our production targets, we launched several capital

projects, including a ventilation project that will enhance CSA’s

production capacity to over 50kt annually. These projects are not

only critical for our production but also reinforce our commitment

to safe and sustainable operations.

Safety and sustainability are at the core of MAC’s operations.

Following an increase in Total Recordable Injury Frequency Rate in

Q2, we implemented additional proactive measures and are pleased to

report a slight reduction in Q3. This includes strengthened field

leadership and enhanced safety inspections to ensure a safe work

environment across all levels of the operation.

On the environmental front, I’m proud to report that our annual

return to the Environmental Protection Authority had no reportable

incidents, pollution events, or license breaches. We’re exploring

further options to optimize and reduce the environmental impact of

our Tailings Storage Facilities as we continue our responsible

mining approach.

Looking ahead, MAC’s strategic priorities remain focused on

operational excellence, growth, and value creation for

shareholders. We are on track to reach a production rate exceeding

50kt per year by 2026, with the continued strength of our balance

sheet and liquidity enabling us to consider further M&A

activities that fit our operational expertise and are located in

stable, high-quality jurisdictions.

In conclusion, 2024 has been a year of progress and

achievement.

MAC is well-positioned to continue delivering value to our

shareholders while advancing our operational and sustainability

goals. I am confident in our pathway to growth, our financial

resilience, and our commitment to responsible and efficient copper

production.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241121970569/en/

Mick McMullen Chief Executive Officer & Director Metals

Acquisition Limited investors@metalsacqcorp.com

Morne Engelbrecht Chief Financial Officer Metals Acquisition

Limited

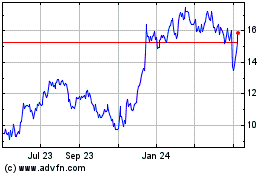

Macerich (NYSE:MAC)

Historical Stock Chart

From Jan 2025 to Feb 2025

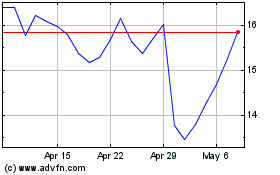

Macerich (NYSE:MAC)

Historical Stock Chart

From Feb 2024 to Feb 2025