false

0000007332

0000007332

2024-09-26

2024-09-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): September 26, 2024

SOUTHWESTERN ENERGY COMPANY

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-08246 |

|

71-0205415 |

(State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

10000 Energy Drive

Spring, TX 77389

(Address of principal executive offices) (Zip Code)

(832) 796-1000

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

x

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, Par Value $0.01 |

|

SWN |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Item 8.01 Other Events.

On September 26, 2024, Southwestern Energy Company,

a Delaware corporation (NYSE: SWN) (“Southwestern”) and Chesapeake Energy Corporation, an Oklahoma corporation (NASDAQ:

CHK) (“Chesapeake”) issued a joint press release announcing that the waiting period under the Hart-Scott-Rodino Antitrust

Improvements Act of 1976, in relation to the pending combination between Southwestern and Chesapeake, expired at 11:59 ET September 24,

2024. A copy of the press release is attached as Exhibit 99.1 hereto and incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Forward-Looking Statements

This communication contains “forward-looking

statements” within the meaning of the federal securities laws. Forward-looking statements may be identified by words such as “anticipates,”

“believes,” “cause,” “continue,” “could,” “depend,” “develop,”

“estimates,” “expects,” “forecasts,” “goal,” “guidance,” “have,”

“impact,” “implement,” “increase,” “intends,” “lead,” “maintain,”

“may,” “might,” “plans,” “potential,” “possible,” “projected,”

“reduce,” “remain,” “result,” “scheduled,” “seek,” “should,” “will,”

“would” and other similar words or expressions. The absence of such words or expressions does not necessarily mean the statements

are not forward-looking. Forward-looking statements are not statements of historical fact and reflect the current views of Chesapeake

and Southwestern about future events. These forward-looking statements include, but are not limited to, statements regarding the proposed

transaction between Chesapeake and Southwestern, the expected closing of the proposed transaction and the timing thereof and the proforma

combined company and its operations, strategies and plans, synergies and anticipated future performance. Information adjusted for the

proposed transaction should not be considered a forecast of future results. Although we believe our forward-looking statements are reasonable,

statements made regarding future results are not guarantees of future performance and are subject to numerous assumptions, uncertainties

and risks that are difficult to predict. Forward-looking statements are based on current expectations, estimates and assumptions that

involve a number of risks and uncertainties that could cause actual results to differ materially from those projected.

Actual outcomes and results may differ

materially from the results stated or implied in the forward-looking statements included in this communication due to a number of factors,

including, but not limited to: the occurrence of any event, change or other circumstances that could give rise to the termination of the

definitive agreement; the risk that the parties may not be able to satisfy the conditions to the proposed transaction in a timely manner

or at all; risks related to the disruption of management time from ongoing business operations due to the proposed transaction; the risk

that any announcements relating to the proposed transaction could have adverse effects on the market price of Chesapeake’s common

stock or Southwestern’s common stock; the risk of any unexpected costs or expenses resulting from the proposed transaction; the

outcome of existing litigation and the risk of any further litigation relating to the proposed transaction; the risk that the proposed

transaction and its announcement could have an adverse effect on the ability of Chesapeake and Southwestern to retain and hire key personnel,

on the ability of Chesapeake to attract third-party customers and maintain its relationships with derivatives counterparties and on Chesapeake’s

operating results and businesses generally; the risk that problems may arise in successfully integrating the businesses of the companies,

which may result in the combined company not operating as effectively and efficiently as expected; the risk that the combined company

may be unable to achieve synergies or other anticipated benefits of the proposed transaction or it may take longer than expected to achieve

those synergies or benefits and other important factors that could cause actual results to differ materially from those projected; the

volatility in commodity prices for crude oil and natural gas, the presence or recoverability of estimated reserves; the ability to replace

reserves; environmental risks, drilling and operating risks, including the potential liability for remedial actions or assessments under

existing or future environmental regulations and litigation; exploration and development risks; the effect of future regulatory or legislative

actions on the companies or the industry in which they operate, including the risk of new restrictions with respect to oil and natural

gas development activities; the risk that the credit ratings of the combined business may be different from what the companies expect;

the ability of management to execute its plans to meet its goals and other risks inherent in Chesapeake’s and Southwestern’s

businesses; public health crises, such as pandemics and epidemics, and any related government policies and actions; the potential disruption

or interruption of Chesapeake’s or Southwestern’s operations due to war, accidents, political events, civil unrest, severe

weather, cyber threats, terrorist acts, or other natural or human causes beyond Chesapeake’s or Southwestern’s control; and

the combined company’s ability to identify and mitigate the risks and hazards inherent in operating in the global energy industry.

Other unpredictable or unknown factors not discussed in this communication could also have material adverse effects on forward-looking

statements. Such factors are difficult to predict and may be beyond Chesapeake’s or Southwestern’s control, and may also include

other risks and uncertainties including those detailed in Chesapeake’s annual reports on Form 10-K, quarterly reports on Form 10-Q

and current reports on Form 8-K that are available on its website at http://investors.chk.com/ and on the Securities and Exchange Commission’s

(the “SEC”) website at http://www.sec.gov, and those detailed in Southwestern’s annual reports on Form 10-K,

quarterly reports on Form 10-Q and current reports on Form 8-K that are available on Southwestern’s website at https://ir. swn.com/CorporateProfile/default.aspx

and on the SEC’s website at http://www.sec.gov. Forward-looking statements are based on the estimates and opinions of management

at the time the statements are made. Chesapeake and Southwestern undertake no obligation to publicly correct or update the forward-looking

statements in this communication, in other documents, or on their respective websites to reflect new information, future events or otherwise,

except as required by applicable law. All such statements are expressly qualified by this cautionary statement. Readers are cautioned

not to place undue reliance on these forward-looking statements that speak only as of the date hereof.

IMPORTANT ADDITIONAL INFORMATION AND WHERE

TO FIND IT

In connection with the proposed transaction,

Chesapeake filed a Registration Statement on Form S-4 (the “Registration Statement”) with the SEC that also constitutes

a prospectus of Chesapeake common stock. The Registration Statement was declared effective on May 17, 2024, at which time Chesapeake filed

a final prospectus and Southwestern filed a definitive proxy statement. Chesapeake and Southwestern commenced mailing of the definitive

joint proxy statement/prospectus (the “Proxy Statement/Prospectus”) to their respective shareholders on or about May

17, 2024. Each party may also file other relevant documents regarding the proposed transaction with the SEC. This communication is not

a substitute for the Proxy Statement/Prospectus or for any other document that Southwestern or Chesapeake has filed or may file in the

future with the SEC in connection with the proposed transaction. INVESTORS ARE URGED TO CAREFULLY READ THE FORM S-4, THE PROXY STATEMENT/PROSPECTUS

AND ALL OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS,

AS THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT CHESAPEAKE, SOUTHWESTERN, THE PROPOSED TRANSACTION,

THE RISKS RELATED THERETO AND RELATED MATTERS.

Investors and security holders may obtain

free copies of the Form S-4 and the Proxy Statement/Prospectus, as well as other filings containing important information about Chesapeake

or Southwestern, without charge at the SEC’s Internet website (http://www.sec.gov). Copies of the documents filed with the SEC by

Chesapeake may be obtained free of charge on Chesapeake’s website at http://investors.chk.com/. Copies of the documents filed with

the SEC by Southwestern may be obtained free of charge on Southwestern’s website at https://ir.swn.com/CorporateProfile/default.aspx.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

SOUTHWESTERN ENERGY COMPANY |

| |

|

| Dated: September 26, 2024 |

By: |

/s/ Chris Lacy |

| |

Name: |

Chris Lacy |

| |

Title: |

Senior Vice President, General Counsel & Secretary |

Exhibit 99.1

|

NEWS RELEASE |

Chesapeake

Energy Corporation and Southwestern Energy Company Combination Expected to Close in the First Week of October

Hart-Scott-Rodino Act waiting period has expired

Company to be rebranded as Expand Energy and

trade on NASDAQ under “EXE” ticker symbol

OKLAHOMA

CITY/SPRING, September 26, 2024 – Chesapeake Energy Corporation (NASDAQ: CHK) and Southwestern Energy Company (NYSE:

SWN) today announced the waiting period in connection with the companies’ pending combination under the Hart-Scott-Rodino Antitrust

Improvements Act of 1976 (“HSR Act”) has expired. The companies expect the merger to close in the first week of October.

Upon closing, the combined company

will be the largest natural gas producer in the U.S. and assume the name Expand Energy Corporation. It will commence public trading on

the NASDAQ under the ticker symbol “EXE” at the open of trading the day after closing.

“The world is short

energy,” said Nick Dell’Osso, Chesapeake’s President and Chief Executive Officer. “With a premium scaled

position across leading natural gas basins in the United States, a peer-leading returns program and a resilient financial

foundation, Expand Energy is uniquely positioned to compete on an international scale to expand America’s energy reach and

deliver opportunity for the world’s energy customers.”

About the Companies

Headquartered in Oklahoma City,

Chesapeake Energy Corporation is powered by dedicated and innovative employees who are focused on discovering and responsibly developing

leading positions in top U.S. oil and gas plays. With a goal to achieve net zero GHG emissions (Scope 1 and 2) by 2035, Chesapeake is

committed to safely answering the call for affordable, reliable, lower carbon energy.

Southwestern Energy Company is

a leading U.S. producer and marketer of natural gas and natural gas liquids focused on responsibly developing large-scale energy assets

in the nation's most prolific shale gas basins. SWN's returns-driven strategy strives to create sustainable value for its stakeholders

by leveraging its scale, financial strength, and operational execution.

Forward-Looking Statements

This press release contains

“forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements may be identified

by words such as “anticipates,” “believes,” “cause,” “continue,” “could,”

“depend,” “develop,” “estimates,” “expects,” “forecasts,” “goal,”

“guidance,” “have,” “impact,” “implement,” “increase,” “intends,”

“lead,” “maintain,” “may,” “might,” “plans,” “potential,” “possible,”

“projected,” “reduce,” “remain,” “result,” “scheduled,” “seek,”

“should,” “will,” “would” and other similar words or expressions. The absence of such words or expressions

does not necessarily mean the statements are not forward-looking. Forward-looking statements are not statements of historical fact and

reflect the current views of Chesapeake Energy Corporation (“Chesapeake”) and Southwestern Energy Company (“Southwestern”)

about future events. These forward-looking statements include, but are not limited to, statements regarding the proposed transaction between

Chesapeake and Southwestern, the expected closing of the proposed transaction and the timing thereof and the proforma combined company

and its operations, strategies and plans, synergies and anticipated future performance. Information adjusted for the proposed transaction

should not be considered a forecast of future results. Although we believe our forward-looking statements are reasonable, statements made

regarding future results are not guarantees of future performance and are subject to numerous assumptions, uncertainties and risks that

are difficult to predict. Forward-looking statements are based on current expectations, estimates and assumptions that involve a number

of risks and uncertainties that could cause actual results to differ materially from those projected.

| |

|

|

| CHK INVESTOR CONTACT: |

CHK MEDIA CONTACT: |

SWN INVESTOR CONTACT: |

|

|

Chris Ayres

(405) 935-8870

ir@chk.com |

Brooke Coe

(405) 935-8878

media@chk.com |

Brittany Raiford

(832) 796-7906

brittany_raiford@swn.com |

|

Actual outcomes and results

may differ materially from the results stated or implied in the forward-looking statements included in this press release due to a number

of factors, including, but not limited to: the occurrence of any event, change or other circumstances that could give rise to the termination

of the definitive agreement; the risk that the parties may not be able to satisfy the conditions to the proposed transaction in a timely

manner or at all; risks related to the disruption of management time from ongoing business operations due to the proposed transaction;

the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of Chesapeake’s

common stock or Southwestern’s common stock; the risk of any unexpected costs or expenses resulting from the proposed transaction;

the outcome of existing litigation and the risk of any further litigation relating to the proposed transaction; the risk that the proposed

transaction and its announcement could have an adverse effect on the ability of Chesapeake and Southwestern to retain and hire key personnel,

on the ability of Chesapeake to attract third-party customers and maintain its relationships with derivatives counterparties and on Chesapeake’s

operating results and businesses generally; the risk that problems may arise in successfully integrating the businesses of the companies,

which may result in the combined company not operating as effectively and efficiently as expected; the risk that the combined company

may be unable to achieve synergies or other anticipated benefits of the proposed transaction or it may take longer than expected to achieve

those synergies or benefits and other important factors that could cause actual results to differ materially from those projected; the

volatility in commodity prices for crude oil and natural gas, the presence or recoverability of estimated reserves; the ability to replace

reserves; environmental risks, drilling and operating risks, including the potential liability for remedial actions or assessments under

existing or future environmental regulations and litigation; exploration and development risks; the effect of future regulatory or legislative

actions on the companies or the industry in which they operate, including the risk of new restrictions with respect to oil and natural

gas development activities; the risk that the credit ratings of the combined business may be different from what the companies expect;

the ability of management to execute its plans to meet its goals and other risks inherent in Chesapeake’s and Southwestern’s

businesses; public health crises, such as pandemics and epidemics, and any related government policies and actions; the potential disruption

or interruption of Chesapeake’s or Southwestern’s operations due to war, accidents, political events, civil unrest, severe

weather, cyber threats, terrorist acts, or other natural or human causes beyond Chesapeake’s or Southwestern’s control; and

the combined company’s ability to identify and mitigate the risks and hazards inherent in operating in the global energy industry.

Other unpredictable or unknown factors not discussed in this press release could also have material adverse effects on forward-looking

statements. Such factors are difficult to predict and may be beyond Chesapeake’s or Southwestern’s control, and may also include

other risks and uncertainties including those detailed in Chesapeake’s annual reports on Form 10-K, quarterly reports on Form 10-Q

and current reports on Form 8-K that are available on its website at http://investors.chk.com/ and on the SEC’s website at http://www.sec.gov,

and those detailed in Southwestern’s annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K

that are available on Southwestern’s website at https://ir. swn.com/CorporateProfile/default.aspx and on the SEC’s website

at http://www.sec.gov. Forward-looking statements are based on the estimates and opinions of management at the time the statements are

made. Chesapeake and Southwestern undertake no obligation to publicly correct or update the forward-looking statements in this press release,

in other documents, or on their respective websites to reflect new information, future events or otherwise, except as required by applicable

law. All such statements are expressly qualified by this cautionary statement. Readers are cautioned not to place undue reliance on these

forward-looking statements that speak only as of the date hereof.

IMPORTANT ADDITIONAL

INFORMATION AND WHERE TO FIND IT

In connection with the

proposed transaction, Chesapeake filed a Registration Statement on Form S-4 (the “Registration Statement”) with the SEC that

also constitutes a prospectus of Chesapeake common stock. The Registration Statement was declared effective on May 17, 2024, at which

time Chesapeake filed a final prospectus and Southwestern filed a definitive proxy statement. Chesapeake and Southwestern commenced mailing

of the definitive joint proxy statement/prospectus (the “Proxy Statement/Prospectus”) to their respective shareholders on

or about May 17, 2024. Each party may also file other relevant documents regarding the proposed transaction with the SEC. This communication

is not a substitute for the Proxy Statement/Prospectus or for any other document that Southwestern or Chesapeake has filed or may file

in the future with the SEC in connection with the proposed transaction. INVESTORS ARE URGED TO CAREFULLY READ THE FORM S-4, THE PROXY

STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS

TO THOSE DOCUMENTS, AS THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT CHESAPEAKE, SOUTHWESTERN,

THE PROPOSED TRANSACTION, THE RISKS RELATED THERETO AND RELATED MATTERS.

Investors and security

holders may obtain free copies of the Form S-4 and the Proxy Statement/Prospectus, as well as other filings containing important information

about Chesapeake or Southwestern, without charge at the SEC’s Internet website (http://www.sec.gov). Copies of the documents filed

with the SEC by Chesapeake may be obtained free of charge on Chesapeake’s website at http://investors.chk.com/. Copies of the documents

filed with the SEC by Southwestern may be obtained free of charge on Southwestern’s website at https://ir.swn.com/CorporateProfile/default.aspx.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

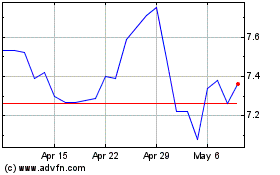

Southwestern Energy (NYSE:SWN)

Historical Stock Chart

From Oct 2024 to Nov 2024

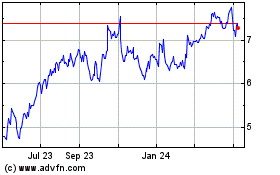

Southwestern Energy (NYSE:SWN)

Historical Stock Chart

From Nov 2023 to Nov 2024