false000010337900001033792024-10-012024-10-010000103379us-gaap:CommonStockMember2024-10-012024-10-010000103379vfc:A4125SeniorNotesDue2026Member2024-10-012024-10-010000103379vfc:A0250SeniorNotesDue2028Member2024-10-012024-10-010000103379vfc:A4250SeniorNotesDue2029Member2024-10-012024-10-010000103379vfc:A0625SeniorNotesDue2032Member2024-10-012024-10-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 1, 2024

| | |

|

V. F. Corporation |

(Exact Name of Registrant as Specified in Charter) |

| | | | | | | | |

| Pennsylvania | 1-5256 | 23-1180120 |

(State or Other Jurisdiction

of Incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| | | | | |

| 1551 Wewatta Street | |

Denver, Colorado | 80202 |

| (Address of Principal Executive Offices) | (Zip Code) |

(720) 778-4000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, without par value, stated capital $.25 per share | VFC | New York Stock Exchange |

| 4.125% Senior Notes due 2026 | VFC26 | New York Stock Exchange |

| 0.250% Senior Notes due 2028 | VFC28 | New York Stock Exchange |

| 4.250% Senior Notes due 2029 | VFC29 | New York Stock Exchange |

| 0.625% Senior Notes due 2032 | VFC32 | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.01. Completion of Acquisition or Disposition of Assets.

On October 2, 2024, V.F. Corporation ("VF") filed a Current Report on Form 8-K (the "Original 8-K") to disclose that, among other things, the previously announced sale of its Supreme® brand business ("Supreme") was completed on October 1, 2024.

In the Original 8-K, VF indicated that the pro forma financial information required by Item 9.01(b) of Form 8-K would be filed no later than October 7, 2024, which is the fourth business day following completion of the Supreme sale. This Current Report on Form 8-K (the "Current Report") is being filed to provide such pro forma financial information.

Item 9.01. Financial Statements and Exhibits.

(b) Unaudited Pro Forma Condensed Consolidated Financial Information

The following unaudited pro forma condensed consolidated financial statements of VF reflecting the sale of Supreme are filed as Exhibit 99.1 to this Current Report and are incorporated herein by reference:

•Unaudited Pro Forma Condensed Consolidated Balance Sheet as of June 29, 2024;

•Unaudited Pro Forma Condensed Consolidated Statements of Operations for the three months ended June 29, 2024 and for the years ended March 30, 2024, April 1, 2023 and April 2, 2022;

•Notes to the Unaudited Pro Forma Condensed Consolidated Financial Statements.

(d) Exhibits.

| | | | | |

| Exhibit No. | Description |

| |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | | V.F. CORPORATION | |

| | | (Registrant) | |

| | | | | |

| | | | | |

| | | By: | /s/ Paul Vogel | |

| | | Paul Vogel | |

| | | Executive Vice President and Chief Financial Officer | |

| | | | | |

| Date: | October 3, 2024 | | | | |

| | | | | |

Exhibit 99.1

VF CORPORATION

Unaudited Pro Forma Condensed Consolidated Financial Information

On October 2, 2024, V.F. Corporation ("VF" or the "Company") filed a Current Report on Form 8-K with the Securities and Exchange Commission ("SEC") to disclose that, among other things, the previously announced sale of its Supreme® brand business ("Supreme") was completed on October 1, 2024 (the "Closing Date"). As previously disclosed in the Current Report on Form 8-K filed by VF with the SEC on July 17, 2024, the Company entered into a Stock and Asset Purchase Agreement (the "Purchase Agreement"), dated July 16, 2024, between the Company and EssilorLuxottica S.A. ("Buyer"). Pursuant to the Purchase Agreement, VF agreed to sell Supreme to the Buyer for $1.5 billion, subject to customary adjustments for cash, indebtedness, working capital and transaction expenses as set forth in the Purchase Agreement. The Company expects to receive net cash proceeds of approximately $1.475 billion from the sale, subject to post-closing adjustments. As contractually obligated, the Company will repay its delayed draw Term Loan ("DDTL") within ten business days of the receipt of net cash proceeds.

The sale of Supreme constitutes a significant disposition for purposes of Item 2.01 of Form 8-K. VF has also determined that the sale of Supreme has met the criteria under Accounting Standards Codification 205-20, Presentation of Financial Statements - Discontinued Operations ("ASC 205-20") to be classified as a discontinued operation, as the sale represents a strategic shift that will have a significant effect on VF's operations and financial results. Accordingly, the Company will account for Supreme as a discontinued operation beginning in its Quarterly Report on Form 10-Q for the quarter ended September 28, 2024. The Company's estimates for discontinued operations as presented in the attached pro forma condensed consolidated financial information are preliminary and actual results could differ from these estimates as the Company finalizes the discontinued operations accounting to be reported in VF's Quarterly Report on Form 10-Q for the quarter ended September 28, 2024, as well as VF's Annual Report on Form 10-K for the year ending March 29, 2025.

The unaudited pro forma condensed consolidated financial statements presented below consist of an Unaudited Pro Forma Condensed Consolidated Balance Sheet as of June 29, 2024 and Unaudited Pro Forma Condensed Consolidated Statements of Operations for the three months ended June 29, 2024 and for the years ended March 30, 2024, April 1, 2023 and April 2, 2022.

The following unaudited pro forma condensed consolidated financial information is intended to show how the sale of Supreme might have affected the historical financial statements of the Company if the transaction had been completed at an earlier time as indicated herein. The unaudited pro forma condensed consolidated financial statements have been prepared in accordance with Article 11 of Regulation S-X and were derived from the Company’s historical consolidated financial statements and are being presented to give effect to the sale of Supreme. The unaudited pro forma condensed consolidated financial statements and the accompanying notes should be read in conjunction with:

i.The audited historical financial statements of the Company, the accompanying notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in the Company’s Annual Report on Form 10-K for the year ended March 30, 2024 filed with the SEC on May 23, 2024; and

ii.The unaudited interim historical consolidated financial statements of the Company, the accompanying notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in the Company’s Quarterly Report on Form 10-Q for the three months ended June 29, 2024 filed with the SEC on August 7, 2024.

The unaudited pro forma condensed consolidated financial statements are based on available information and assumptions that the Company’s management believes are reasonable as of the date of this filing. The Unaudited Pro Forma Condensed Consolidated Balance Sheet as of June 29, 2024 adjusts the Company’s assets, liabilities, and stockholders' equity to reflect the sale of Supreme as of June 29, 2024. The Unaudited Pro Forma Condensed Consolidated Statements of Operations for the three months ended June 29, 2024 and for the years ended March 30, 2024, April 1, 2023 and April 2, 2022 reflect Supreme as a discontinued operation for all periods presented. In addition, the Unaudited Pro Forma Condensed Consolidated Balance Sheet as of June 29, 2024 and the Unaudited Pro Forma Condensed Consolidated Statements of Operations for the three months ended June 29, 2024 and for the year ended March 30, 2024, reflect certain "Pro Forma Adjustments" that are incremental to those related to the sale of Supreme and discontinued operations presentation of Supreme, as discussed above. The Pro Forma Adjustments in the unaudited pro forma condensed consolidated balance sheet and the unaudited pro forma condensed consolidated statements of operations are reflected as if the transaction had occurred on June 29, 2024 and April 2, 2023, respectively.

The unaudited pro forma condensed consolidated financial information is provided for informational purposes only and does not purport to represent the Company’s actual financial condition or results of operations had the Supreme sale occurred on the dates indicated nor does it project the Company’s results of operations or financial condition for any future period or date. The Company has prepared the unaudited pro forma condensed financial information based on available information using certain assumptions that it believes are reasonable. As a result, the actual results reported by the Company in periods following the Supreme sale may differ materially from this unaudited pro forma condensed financial information.

VF CORPORATION

Pro Forma Condensed Consolidated Balance Sheet

(Unaudited)

(In thousands, except share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of June 29, 2024 |

| | Historical VF

(as reported) | | Sale of Supreme

(A) | | Notes | | Pro Forma Adjustments

(C) | | Notes | | Pro Forma VF |

| ASSETS | | | | | | | | | | | | |

| Current assets | | | | | | | | | | | | |

| Cash and equivalents | | $ | 637,420 | | | $ | 1,475,368 | | | (i) | | $ | (1,475,368) | | | (vi) | | $ | 637,420 | |

| Accounts receivable, net | | 1,055,571 | | | (6,203) | | | | | — | | | | | 1,049,368 | |

| Inventories | | 2,110,598 | | | (50,870) | | | | | — | | | | | 2,059,728 | |

| Other current assets | | 545,542 | | | (25,867) | | | | | — | | | | | 519,675 | |

| Total current assets | | 4,349,131 | | | 1,392,428 | | | | | (1,475,368) | | | | | 4,266,191 | |

| Property, plant and equipment, net | | 794,212 | | | (34,401) | | | | | — | | | | | 759,811 | |

| Intangible assets, net | | 2,571,765 | | | (801,000) | | | | | — | | | | | 1,770,765 | |

| Goodwill | | 1,360,782 | | | (717,562) | | | | | — | | | | | 643,220 | |

| Operating lease right-of-use assets | | 1,332,950 | | | (72,047) | | | | | — | | | | | 1,260,903 | |

| Other assets | | 1,132,523 | | | 71,291 | | | +, (ii) | | — | | | | | 1,203,814 | |

| TOTAL ASSETS | | $ | 11,541,363 | | | $ | (161,291) | | | | | $ | (1,475,368) | | | | | $ | 9,904,704 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | | | | | | |

| Current liabilities | | | | | | | | | | | | |

| Short-term borrowings | | $ | 263,709 | | | $ | — | | | | | $ | (250,000) | | | (vi) | | $ | 13,709 | |

| Current portion of long-term debt | | 1,749,601 | | | — | | | | | (1,224,272) | | | (vi) | | 525,329 | |

| Accounts payable | | 1,157,755 | | | (21,519) | | | | | — | | | | | 1,136,236 | |

| Accrued liabilities | | 1,237,909 | | | (22,445) | | | (iii) | | (1,096) | | | (vi) | | 1,214,368 | |

| Total current liabilities | | 4,408,974 | | | (43,964) | | | | | (1,475,368) | | | | | 2,889,642 | |

| Long-term debt | | 3,940,668 | | | — | | | | | — | | | | | 3,940,668 | |

| Operating lease liabilities | | 1,167,415 | | | (67,232) | | | | | — | | | | | 1,100,183 | |

| Other liabilities | | 636,401 | | | (2,417) | | | | | — | | | | | 633,984 | |

| Total liabilities | | 10,153,458 | | | (113,613) | | | | | (1,475,368) | | | | | 8,564,477 | |

| Stockholders’ equity | | | | | | | | | | | | |

| Preferred Stock, par value $1; shares authorized, 25,000,000; no shares outstanding at June 2024 | | — | | | — | | | | | — | | | | | — | |

| Common Stock, stated value $0.25; shares authorized, 1,200,000,000; shares outstanding at June 2024 - 389,181,642 | | 97,295 | | | — | | | | | — | | | | | 97,295 | |

| Additional paid-in capital | | 3,580,175 | | | — | | | | | — | | | | | 3,580,175 | |

| Accumulated other comprehensive loss | | (1,053,627) | | | 86,539 | | | (iv) | | — | | | | | (967,088) | |

| Retained earnings (accumulated deficit) | | (1,235,938) | | | (134,217) | | | (v) | | — | | | | | (1,370,155) | |

| Total stockholders’ equity | | 1,387,905 | | | (47,678) | | | | | — | | | | | 1,340,227 | |

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | | $ | 11,541,363 | | | $ | (161,291) | | | | | $ | (1,475,368) | | | | | $ | 9,904,704 | |

+ Includes deferred income tax balances that reflect VF's consolidated netting by jurisdiction.

See notes to unaudited pro forma condensed consolidated financial statements.

VF CORPORATION

Pro Forma Condensed Consolidated Statements of Operations

(Unaudited)

(In thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 29, 2024 |

| | Historical VF

(as reported) | | Discontinued Operations of Supreme

(B) | | | | Pro Forma Adjustments

(C) | | Notes | | Pro Forma VF |

| Net revenues | | $ | 1,907,301 | | | $ | (138,241) | | | | | $ | — | | | | | $ | 1,769,060 | |

| Costs and operating expenses | | | | | | | | | | | | |

| Cost of goods sold | | 915,643 | | | (52,261) | | | | | — | | | | | 863,382 | |

| Selling, general and administrative expenses | | 1,086,551 | | | (57,853) | | | | | — | | | | | 1,028,698 | |

| Impairment of goodwill and intangible assets | | 145,000 | | | (145,000) | | | | | — | | | | | — | |

| Total costs and operating expenses | | 2,147,194 | | | (255,114) | | | | | — | | | | | 1,892,080 | |

| Operating loss | | (239,893) | | | 116,873 | | | | | — | | | | | (123,020) | |

| Interest expense, net | | (55,677) | | | 14,730 | | | | | 5,576 | | | (vii) | | (35,371) | |

| Other income (expense), net | | (1,950) | | | 464 | | | | | — | | | | | (1,486) | |

| Loss before income taxes | | (297,520) | | | 132,067 | | | | | 5,576 | | | | | (159,877) | |

| Income tax benefit | | (38,634) | | | 25,208 | | | | | 1,433 | | | (viii) | | (11,993) | |

| Net loss | | $ | (258,886) | | | $ | 106,859 | | | | | $ | 4,143 | | | | | $ | (147,884) | |

| Net loss per common share | | | | | | | | | | | | |

| Basic | | $ | (0.67) | | | | | | | | | | | $ | (0.38) | |

| Diluted | | $ | (0.67) | | | | | | | | | | | $ | (0.38) | |

| Weighted average shares outstanding | | | | | | | | | | | | |

| Basic | | 388,741 | | | | | | | | | | | 388,741 | |

| Diluted | | 388,741 | | | | | | | | | | | 388,741 | |

See notes to unaudited pro forma condensed consolidated financial statements.

VF CORPORATION

Pro Forma Condensed Consolidated Statements of Operations

(Unaudited)

(In thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Year Ended March 30, 2024 |

| | Historical VF

(as reported) | | Discontinued Operations of Supreme

(B) | | | | Pro Forma Adjustments

(C) | | Notes | | Pro Forma VF |

| Net revenues | | $ | 10,454,667 | | | $ | (538,989) | | | | | $ | — | | | | | $ | 9,915,678 | |

| Costs and operating expenses | | | | | | | | | | | | |

| Cost of goods sold | | 5,017,445 | | | (214,067) | | | | | — | | | | | 4,803,378 | |

| Selling, general and administrative expenses | | 4,963,718 | | | (215,049) | | | | | (2,184) | | | (ix) | | 4,746,485 | |

| Impairment of goodwill and intangible assets | | 507,566 | | | — | | | | | — | | | | | 507,566 | |

| Total costs and operating expenses | | 10,488,729 | | | (429,116) | | | | | (2,184) | | | | | 10,057,429 | |

| Operating income (loss) | | (34,062) | | | (109,873) | | | | | 2,184 | | | | | (141,751) | |

| Interest expense, net | | (223,408) | | | 57,729 | | | | | 8,896 | | | (vii) | | (156,783) | |

| Other income (expense), net | | 23,785 | | | 908 | | | | | — | | | | | 24,693 | |

| Income (loss) before income taxes | | (233,685) | | | (51,236) | | | | | 11,080 | | | | | (273,841) | |

| Income tax expense | | 735,197 | | | (1,641) | | | | | 2,851 | | | (viii) | | 736,407 | |

| Net income (loss) | | $ | (968,882) | | | $ | (49,595) | | | | | $ | 8,229 | | | | | $ | (1,010,248) | |

| Net loss per common share | | | | | | | | | | | | |

| Basic | | $ | (2.49) | | | | | | | | | | | $ | (2.60) | |

| Diluted | | $ | (2.49) | | | | | | | | | | | $ | (2.60) | |

| Weighted average shares outstanding | | | | | | | | | | | | |

| Basic | | 388,360 | | | | | | | | | | | 388,360 | |

| Diluted | | 388,360 | | | | | | | | | | | 388,360 | |

See notes to unaudited pro forma condensed consolidated financial statements.

VF CORPORATION

Pro Forma Condensed Consolidated Statements of Operations

(Unaudited)

(In thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Year Ended April 1, 2023 |

| | Historical VF

(as reported) | | Discontinued Operations of Supreme

(B) | | | | | | | | Pro Forma VF |

| Net revenues | | $ | 11,612,475 | | | $ | (523,116) | | | | | | | | | $ | 11,089,359 | |

| Costs and operating expenses | | | | | | | | | | | | |

| Cost of goods sold | | 5,515,796 | | | (222,869) | | | | | | | | | 5,292,927 | |

| Selling, general and administrative expenses | | 5,033,977 | | | (236,282) | | | | | | | | | 4,797,695 | |

| Impairment of goodwill and intangible assets | | 735,009 | | | (735,009) | | | | | | | | | — | |

| Total costs and operating expenses | | 11,284,782 | | | (1,194,160) | | | | | | | | | 10,090,622 | |

| Operating income (loss) | | 327,693 | | | 671,044 | | | | | | | | | 998,737 | |

| Interest expense, net | | (164,632) | | | 20,972 | | | | | | | | | (143,660) | |

| Other income (expense), net | | (119,774) | | | 2,487 | | | | | | | | | (117,287) | |

| Income (loss) before income taxes | | 43,287 | | | 694,503 | | | | | | | | | 737,790 | |

| Income tax benefit | | (75,297) | | | 57,353 | | | | | | | | | (17,944) | |

| Net income (loss) | | $ | 118,584 | | | $ | 637,150 | | | | | | | | | $ | 755,734 | |

| Earnings per common share | | | | | | | | | | | | |

| Basic | | $ | 0.31 | | | | | | | | | | | $ | 1.95 | |

| Diluted | | $ | 0.31 | | | | | | | | | | | $ | 1.95 | |

| Weighted average shares outstanding | | | | | | | | | | | | |

| Basic | | 387,763 | | | | | | | | | | | 387,763 | |

| Diluted | | 388,370 | | | | | | | | | | | 388,370 | |

See notes to unaudited pro forma condensed consolidated financial statements.

VF CORPORATION

Pro Forma Condensed Consolidated Statements of Operations

(Unaudited)

(In thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Year Ended April 2, 2022 |

| | Historical VF

(as reported) | | Discontinued Operations of Supreme

(B) | | | | | | | | Pro Forma VF |

| Net revenues | | $ | 11,841,840 | | | $ | (561,503) | | | | | | | | | $ | 11,280,337 | |

| Costs and operating expenses | | | | | | | | | | | | |

| Cost of goods sold | | 5,386,393 | | | (232,311) | | | | | | | | | 5,154,082 | |

| Selling, general and administrative expenses | | 4,823,243 | | | (102,601) | | | | | | | | | 4,720,642 | |

| Total costs and operating expenses | | 10,209,636 | | | (334,912) | | | | | | | | | 9,874,724 | |

| Operating income | | 1,632,204 | | | (226,591) | | | | | | | | | 1,405,613 | |

| Interest income (expense), net | | (131,463) | | | (1,127) | | | | | | | | | (132,590) | |

| Loss on debt extinguishment | | (3,645) | | | — | | | | | | | | | (3,645) | |

| Other income (expense), net | | 26,154 | | | 3,869 | | | | | | | | | 30,023 | |

| Income from continuing operations before income taxes | | 1,523,250 | | | (223,849) | | | | | | | | | 1,299,401 | |

| Income tax expense (benefit) | | 306,981 | | | 25 | | | | | | | | | 307,006 | |

| Income from continuing operations | | 1,216,269 | | | (223,874) | | | | | | | | | 992,395 | |

| Earnings per common share - continuing operations | | | | | | | | | | | | |

| Basic | | $ | 3.12 | | | | | | | | | | | $ | 2.54 | |

| Diluted | | $ | 3.10 | | | | | | | | | | | $ | 2.53 | |

| Weighted average shares outstanding | | | | | | | | | | | | |

| Basic | | 390,291 | | | | | | | | | | | 390,291 | |

| Diluted | | 392,411 | | | | | | | | | | | 392,411 | |

See notes to unaudited pro forma condensed consolidated financial statements.

VF CORPORATION

Notes to the Unaudited Pro Forma Condensed Consolidated Financial Statements

The Unaudited Pro Forma Condensed Consolidated Balance Sheet as of June 29, 2024, and the Unaudited Pro Forma Condensed Consolidated Statements of Operations for the three months ended June 29, 2024 and for the years ended March 30, 2024, April 1, 2023 and April 2, 2022, include the following adjustments:

(A)Reflects the sale of Supreme pursuant to the Purchase Agreement, adjustments required to record the estimated cash proceeds (net of transaction costs) received in connection with the sale of Supreme and recognition of the estimated loss on sale in retained earnings (accumulated deficit) as if the transaction had occurred on June 29, 2024.

(i)Estimated net cash proceeds in connection with the sale of Supreme are as follows:

| | | | | | | | |

| Base purchase price | | $ | 1,500,000 | |

| Purchase price adjustment | | (5,499) | |

| Total consideration | | 1,494,501 | |

| Estimated transaction costs | | (19,133) | |

| Net cash proceeds | | $ | 1,475,368 | |

Purchase price adjustment includes items specified in the terms of the Purchase Agreement including preliminary estimates for closing net working capital and closing indebtedness.

(ii)Includes an adjustment of $9.4 million for changes in deferred taxes as a result of the sale of Supreme.

(iii)Includes an adjustment of $19.0 million for tax liabilities associated with the sale of Supreme.

(iv)Reflects the release of currency translation adjustments directly attributable to Supreme in the amount of $86.5 million.

(v)Estimated loss on the sale of Supreme, assuming VF completed the sale as of June 29, 2024, is as follows:

| | | | | | | | |

| Net cash proceeds | | $ | 1,475,368 | |

| Net assets sold | | (1,513,476) | |

| Accumulated other comprehensive loss | | (86,539) | |

| Pre-tax loss on sale | | (124,647) | |

| Estimated tax expense | | (9,570) | |

| Estimated after-tax loss on sale | | $ | (134,217) | |

For purposes of the unaudited pro forma condensed consolidated balance sheet, the estimated loss recognized in retained earnings (accumulated deficit) is based on the net carrying value of Supreme as of June 29, 2024 rather than as of the Closing Date of the transaction. As a result, the estimated loss reflected herein may differ materially from the actual loss on the sale of Supreme as of the Closing Date because of the differences in the carrying value of assets and liabilities at the Closing Date.

(B)Reflects the reclassification of the operations of Supreme as a discontinued operation in accordance with ASC 205-20. The Supreme results were adjusted to include costs directly attributed to Supreme and to exclude corporate overhead costs that were previously allocated to Supreme for each period, as they did not meet the discontinued operations criteria.

(C)Reflects additional Pro Forma Adjustments which show how the Supreme sale may have affected VF's historical condensed consolidated balance sheet and condensed consolidated statements of operations as if it occurred on June 29, 2024 and April 2, 2023, respectively.

(vi)Reflects $1.475 billion expected use of cash to pay down debt, including an aggregate $1.0 billion repayment of VF's DDTL required in connection with the Supreme sale, repayment of commercial paper borrowings outstanding on June 29, 2024 of $250.0 million, a $224.3 million partial redemption of VF's 2.400% senior unsecured fixed-rate notes maturing in April 2025 and a $1.1 million payment of accrued interest.

(vii)Reflects the reduction of interest expense related to the repayment of commercial paper borrowings and expected partial redemption of VF's 2.400% senior unsecured fixed-rate notes maturing in April 2025.

(viii)Reflects the estimated income tax impact of the adjustments at the applicable statutory income tax rates in effect within the respective tax jurisdictions during the periods presented.

(ix)In conjunction with the sale of Supreme, VF entered into a transition services agreement ("TSA") with EssilorLuxottica S.A. Under the terms of the TSA, VF will provide certain post-closing accounting, tax, treasury, digital technology, supply chain and human resource services on a transitional basis. The adjustment reflects estimated income of $2.8 million and estimated incremental expenses of $0.6 million from these services over a twelve-month period.

v3.24.3

Cover

|

Oct. 01, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 01, 2024

|

| Entity Registrant Name |

V. F. Corporation

|

| Entity Incorporation, State or Country Code |

PA

|

| Entity File Number |

1-5256

|

| Entity Tax Identification Number |

23-1180120

|

| Entity Address, Address Line One |

1551 Wewatta Street

|

| Entity Address, City or Town |

Denver

|

| Entity Address, State or Province |

CO

|

| Entity Address, Postal Zip Code |

80202

|

| City Area Code |

720

|

| Local Phone Number |

778-4000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0000103379

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, without par value, stated capital $.25 per share

|

| Trading Symbol |

VFC

|

| Security Exchange Name |

NYSE

|

| 4.125% Senior Notes, due 2026 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

4.125% Senior Notes due 2026

|

| Trading Symbol |

VFC26

|

| Security Exchange Name |

NYSE

|

| 0.250% Senior Notes due 2028 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

0.250% Senior Notes due 2028

|

| Trading Symbol |

VFC28

|

| Security Exchange Name |

NYSE

|

| 4.250% Senior Notes, due 2029 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

4.250% Senior Notes due 2029

|

| Trading Symbol |

VFC29

|

| Security Exchange Name |

NYSE

|

| 0.625% Senior Notes due 2032 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

0.625% Senior Notes due 2032

|

| Trading Symbol |

VFC32

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=vfc_A4125SeniorNotesDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=vfc_A0250SeniorNotesDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=vfc_A4250SeniorNotesDue2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=vfc_A0625SeniorNotesDue2032Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

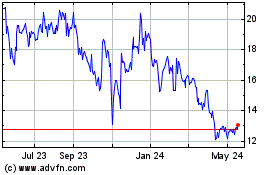

VF (NYSE:VFC)

Historical Stock Chart

From Mar 2025 to Apr 2025

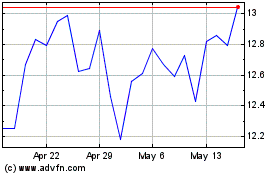

VF (NYSE:VFC)

Historical Stock Chart

From Apr 2024 to Apr 2025