Form 8-K - Current report

July 26 2024 - 5:15AM

Edgar (US Regulatory)

false

0001575828

0001575828

2024-07-25

2024-07-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 25, 2024

Expro Group Holdings N.V.

(Exact Name of Registrant as Specified in Charter)

|

The Netherlands

|

001-36053

|

98-1107145

|

|

(State or Other Jurisdiction

|

(Commission

|

(IRS Employer

|

|

of Incorporation)

|

File Number)

|

Identification No.)

|

|

1311 Broadfield Blvd., Suite 400

Houston, TX

|

77084

|

|

(Address of Principal Executive Offices)

|

(Zip code)

|

(713) 463-9776

(Registrant’s telephone number, including area code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 210.14d-2(b))

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, €0.06 nominal value

|

XPRO

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

As previously disclosed, Expro Group Holdings N.V. (the “Company”) completed the acquisition of CTL UK Holdco Limited, a company incorporated and registered in England and Wales (“Coretrax”), for (i) cash equal to $75 million and (ii) 6,750,000 shares of common stock, €0.06 nominal value per share, of the Company (the “Shares”), pursuant to the Agreement relating to the sale and purchase of CTL UK Holdco Limited, dated February 13, 2024 (as amended, the “Stock Purchase Agreement”), by and among the Company, Expro Holdings UK 3 Limited and BP INV4 Holdco Ltd and the other sellers party thereto (collectively, the “Sellers”). In connection with the acquisition of Coretrax, the Company issued 500,000 Shares into an escrow arrangement. On July 5, 2024, the lock-up transfer restrictions expired with respect to approximately 3,125,000 Shares.

On July 25, 2024, the Company entered into a Deed of Amendment (the “Amendment”) to the Stock Purchase Agreement with the sellers party thereto, pursuant to which, among other things, (i) the lock-up transfer restrictions were released with respect to the remaining approximately 3,125,000 Shares, (ii) all obligations relating to the true up payments and completion statement under the Stock Purchase Agreement were released and (iii) the escrow agent was instructed to (A) sell a sufficient number of Escrow Shares on behalf of the Sellers to generate proceeds of $8 million, (B) transfer such proceeds to the Company and (C) transfer the remaining Escrow Shares to the Sellers.

A copy of the Amendment is filed with this Current Report on Form 8-K as Exhibit 2.1. The foregoing description of the Amendment does not purport to be complete and is qualified in its entirety by reference to the Amendment filed herewith.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit No.

|

Description

|

|

2.1

|

|

| |

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Dated: July 26, 2024

|

Expro Group Holdings N.V. |

|

|

|

|

|

|

By:

|

/s/ John McAlister

|

|

|

|

John McAlister

|

|

|

|

General Counsel and Secretary

|

Exhibit 2.1

DATE: 25 JULY 2024

DEED OF AMENDMENT

Among

SELLER REPRESENTATIVES

and

EXPRO GROUP HOLDINGS N.V.

and

KENNY MURRAY

and

BRICE MARC BOUFFARD

and

MICHAEL ANTHONY DE RHUNE

THIS DEED IS MADE ON 25 JULY 2024

AMONG:

|

(1)

|

BP INV4 HOLDCO LTD a company incorporated and registered in England and Wales with number 11701047 which has its registered office at International House, 36-38 Cornhill, London, EC3V 3NG, United Kingdom (the “Institutional Seller”);

|

|

(2)

|

EXPRO GROUP HOLDINGS N.V., a public company (naamloze vennootschap) incorporated and existing under Dutch law, having its registered office (statutaire zetel) in Amsterdam, The Netherlands and its office address at Mastenmakersweg 1, Den Helder,1786PB, The Netherlands, registered with the trade register of the chamber of commerce under number 34241787 (the “Purchaser”);

|

|

(3)

|

JOHN PAUL FRASER of 3 Union Place, Montrose, DD10 8QB (“First Management Representative”);

|

|

(4)

|

SCOTT BENZIE of Princes House, Jermyn Street, London, England, SW1Y 6DN (“Second Management Representative”);

|

|

(5)

|

KENNY MURRAY of Sport City, Victory Heights, Novelia, Street 1, Villa 50, Dubai, United Arab Emirates;

|

|

(6)

|

BRICE MARC BOUFFARD of Johan van Oldenbarneveltlaan 74, 2582, NW Den Haag, The Netherlands; and

|

|

(7)

|

MICHAEL ANTHONY DE RHUNE of 4 Stevens Lane, Claygate, Esher, Surrey, United Kingdom, KT10 0TE,

|

(each a “Party” and together, the “Parties”).

RECITALS:

|

(A)

|

The Parties are party to a share purchase agreement dated 13 February 2024 as amended on 15 May 2024 and 8 July 2024 (the “Agreement”).

|

|

(B)

|

Pursuant to clause 25 of the Agreement, no variation can be made to the Agreement unless it is in writing and signed by or on behalf of the Seller Representatives, the Purchaser and Kenny Murray.

|

|

(C)

|

Pursuant to clause 19.1, the First Management Representative is appointed as the representative of the First Management Sellers and the Second Management Representative is appointed as the representative of the Second Management Sellers.

|

|

(D)

|

The Parties have therefore agreed to amend the terms of the Agreement as provided below in order to: (i) effect the release of the Escrow Shares; (ii) bring forward the lock up date of the Lock Up Expiry 2 Shares and the Lock Up Expiry 3 Shares, (iii) discharge and release obligations relating to the True Up Payment Amount, GBP True Up Purchaser Amount and GBP True Up Seller Amount; (iv) release obligations relating to the Completion Statement; and (v) amend mechanics relating to the Escrow Shares.

|

IT IS AGREED as follows:

|

1.1

|

Expressions defined in the Agreement shall (unless the context otherwise requires) have those meanings when used in this deed.

|

|

1.2

|

The provisions of clauses 1.2 to 1.6 inclusive (Definitions and Interpretation) of the Agreement shall (unless the context otherwise requires) apply to this deed as if set out in full and as if all references to the Agreement were references to this deed.

|

|

2.1

|

The Agreement shall be amended as follows and shall for all purposes be deemed to have been in such amended form when the original unamended Agreement was first constituted:

|

| |

(i)

|

the following words shall be inserted into clause 1.1 as a new definition: ““Expro Escrow Sale” has the meaning given to it in paragraph 5 of Schedule 6;”;

|

| |

(ii)

|

the words “means the next Business Day falling 120 calendar days after the Completion Date” shall be deleted from the definition of “Lock Up Expiry 2” in clause 1.1 of the Agreement and shall be replaced with the words “means 25 July 2024”;

|

| |

(iii)

|

the words “means the next Business Day falling 150 calendar days after the Completion Date” shall be deleted from the definition of “Lock Up Expiry 3” in clause 1.1 of the Agreement and shall be replaced with the words “means 25 July 2024”;

|

| |

(iv)

|

clause 3.1 of the Agreement shall be deleted and a new clause 3.1 shall be inserted into the Agreement as follows: “The total purchase price for the Shares (“Consideration”) shall be an amount equal to (A) the Completion Payment Amount; plus (B) the Completion Subscription Shares; less (C) the Expro Escrow Sale amount.”;

|

| |

(v)

|

a new clause shall be inserted into the Agreement as clause 3.17 of the Agreement as follows: “The transfer of (a) the Expro Escrow Sale amount to the Purchaser; and (b) such number of Escrow Shares to the Sellers , in each case in accordance with paragraph 5 of Schedule 6, constitutes full and final settlement of the Consideration and, subject to clauses 3.14 and 3.15 and paragraph 8 of Schedule 3, there shall be no further adjustment to the Consideration by way of any True Up Payment Amount, Balancing Amount, GBP True Up Purchaser Amount or GBP True Up Seller Amount or otherwise. The Purchaser and the Sellers hereby irrevocably and unconditionally waive any and all rights and claims they may have or may arise under this deed, the Agreement or otherwise in relation to any such adjustment to the Consideration.”;

|

| |

(vi)

|

the words: “on the later of the date upon which any (i) True Up Payment Amount (if any); or (ii) Balancing Amount (if any) is required to be settled by the Purchaser, it being agreed that any such expiry shall occur only after such True Up Payment Amount or Balancing Amount (as the case may be) has been settled in accordance with the terms of this Agreement” in clause 13.4 of the Agreement shall be deleted and replaced by the words “on the date on which the transfer of the Escrow Shares has been made to the Sellers (or such other person(s)) in accordance with paragraph 5 of Schedule 6”;

|

| |

(vii)

|

a new clause shall be inserted into the Agreement as clause 15.9 of the Agreement, as follows: “Notwithstanding anything to the contrary in this Agreement, the parties agree and acknowledge that where the Purchaser gives or agrees to (as the case may be) any waiver, release, discharge, notice or amendment in respect of this Agreement, Holdings 3 shall be deemed to have also given or agreed to (as the case may be) such waiver, release, notice or amendment.”; and

|

| |

(viii)

|

a new paragraph shall be inserted into the Agreement as paragraph 5 of Schedule 6 of the Agreement, as follows:

|

“5. RELEASE OF ESCROW

Notwithstanding anything to the contrary in this Agreement, the parties shall instruct the Escrow Agent to: (A) sell such number of Escrow Shares into the market in increments of approximately 100,000 Consideration Shares per trading day (or, on the final trading day of such sales, such lesser amount as required to make the payment to the Purchaser referred to in this subclause (A)), such sales to commence on 29 July 2024 (or such other date or in such other manner as agreed in writing between the Institutional Seller and the Purchaser), until such sales have generated an amount required to pay USD 8,000,000 to the Purchaser, and promptly thereafter instruct the Escrow Agent to pay USD 8,000,000 to the Purchaser (“Expro Escrow Sale”); and (B) in respect of the remaining Escrow Shares which are not sold pursuant to the Expro Escrow Sale, within 2 Business Days after the sale of the last of the Escrow Shares required to be sold pursuant to the Expro Escrow Sale, transfer such Escrow Shares to the Sellers in accordance with the Allocation Schedule. Each of the parties shall use all reasonable endeavours to procure that the Escrow Shares are sold or transferred in accordance with this paragraph 5. For the avoidance of doubt, any remaining amounts held by or on behalf of the Escrow Agent after the payment to the Purchaser under subclause (A) above shall belong and be transferred to the Sellers.

|

2.2

|

Each of the Institutional Seller, the First Management Representative (on behalf of himself and the First Management Sellers), the Second Management Representative (on behalf of himself and the Second Management Sellers), Kenny Murray and Brice Bouffard hereby irrevocably and unconditionally waive their respective rights, and irrevocably and unconditionally discharge and release the Purchaser from its obligations, under:

|

| |

(i)

|

the definitions of “Balancing Amount”, “GBP True Up Purchaser Amount”, “GBP True Up Seller Amount” and “True Up Payment Amount” in clause 1.1 of the Agreement;

|

| |

(ii)

|

clauses 3.8 to 3.11 (inclusive) and clause 3.13 of the Agreement;

|

| |

(iii)

|

Schedule 4 of the Agreement;

|

| |

(iv)

|

Schedule 5 of the Agreement;

|

| |

(v)

|

Schedule 6 (save for: (i) the words above paragraph 1; and (ii) paragraph 5) of the Agreement; and

|

| |

(vi)

|

Schedule 7 of the Agreement.

|

|

2.3

|

The Purchaser hereby irrevocably and unconditionally waives its rights, and irrevocably and unconditionally discharges and releases the Sellers from their respective obligations, under:

|

| |

(i)

|

the definitions of “Balancing Amount”, “GBP True Up Purchaser Amount”, “GBP True Up Seller Amount” and “True Up Payment Amount” in clause 1.1 of the Agreement;

|

| |

(ii)

|

clauses 3.8 to 3.11 (inclusive) and clause 3.13 of the Agreement;

|

| |

(iii)

|

Schedule 4 of the Agreement;

|

| |

(iv)

|

Schedule 5 of the Agreement;

|

| |

(v)

|

Schedule 6 (save for: (i) the words above paragraph 1; and (ii) paragraph 5) of the Agreement; and

|

| |

(vi)

|

Schedule 7 of the Agreement.

|

|

3.1

|

This deed is supplemental to the Agreement and shall be read and construed as one instrument together with the Agreement. Except as amended by this deed, the Agreement shall continue in full force and effect. If there is any inconsistency or conflict between the terms of this deed and the Agreement, the terms of this deed shall prevail.

|

|

3.2

|

Notwithstanding any other provision of this deed, the provisions of this deed shall be without prejudice to any rights or claims of any Party arising under the terms of the Agreement prior to the date of this deed.

|

|

4.1

|

The provisions in clauses 15, 17, 21, 22, 24, 26, 27, 28, 29 and 30 of the Agreement shall apply to this deed mutatis mutandis as if set out in full herein.

|

|

4.2

|

It is agreed and acknowledged that this deed is intended to benefit each of the Sellers who shall be entitled to enforce the benefit of any term of this deed. Subject to the forgoing, any person who is not a Party to this deed shall not have any right under the Contracts (Rights of Third Parties) Act 1999 to enforce any term of this deed.

|

[Schedules follow the signature pages]

SIGNATURE PAGES

IN WITNESS WHEREOF these presents consisting of this page and the preceding page are executed as follows and delivered on the date specified above:

|

Executed as a deed by

BP INV4 HOLDCO LTD

acting by two authorised signatories

|

)

)

)

)

)

)

|

/s/ Mark Chaichian

Authorised Signatory

/s/ Nicholas Gee

Authorised Signatory

|

|

Executed as a deed by

EXPRO GROUP HOLDINGS N.V.

acting by its authorised signatory

|

)

)

)

)

)

)

)

)

|

s/ John McAlister

Authorised Signatory

25 July 2024

Date

|

|

Executed as a deed by

JOHN KENNETH FRASER MURRAY

in the presence of

|

)

)

)

|

/s/ John Kenneth Fraser Murray

|

/s/ Jennifer Murray

Signature of witness

Name Jennifer Murray

Address Villa 50 Street 1

Novelia Victory Heights Dubai

|

Executed as a deed by

JOHN PAUL FRASER

in the presence of

|

)

)

)

|

/s/ John Paul Fraser

|

/s/ Claire Coltart

Signature of witness

Name Claire Coltart

Address 48 Concraig Gardens, Kingswell,

Aberdeen

|

Executed as a deed by

SCOTT ANTHONY BENZIE

in the presence of

|

)

)

)

|

/s/ Scott Anthony Benzie

|

/s/ Pamela Woodson

Signature of witness

Name Pamela Woodson

Address 12227 FM 529

Houston, Texas 77041

|

Executed as a deed by

BRICE MARC BOUFFARD

in the presence of

|

)

)

)

|

/s/ Brice Marc Bouffard

|

/s/ Helene Bouffard

Signature of witness

Name Helene Bouffard

Address J van Oldenbarneveltlaan 74,

2582 NW DEN HAAG

|

Executed as a deed by

MICHAEL ANTHONY DE RHUNE

in the presence of

|

)

)

)

|

/s/ Michael Anthony De Rhune

|

/s/ Andrew Rennie

Signature of witness

Name Andrew Rennie

Address 32 Desswood Place

Aberdeen, AB25 2DH

v3.24.2

Document And Entity Information

|

Jul. 25, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Expro Group Holdings N.V.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jul. 25, 2024

|

| Entity, Incorporation, State or Country Code |

P7

|

| Entity, File Number |

001-36053

|

| Entity, Tax Identification Number |

98-1107145

|

| Entity, Address, Address Line One |

1311 Broadfield Blvd.

|

| Entity, Address, Address Line Two |

Suite 400

|

| Entity, Address, City or Town |

Houston

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

77084

|

| City Area Code |

713

|

| Local Phone Number |

463-9776

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, €0.06 nominal value

|

| Trading Symbol |

XPRO

|

| Security Exchange Name |

NYSE

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001575828

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

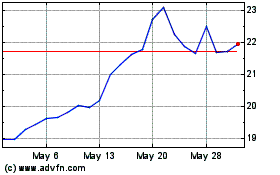

Expro Group Holdings NV (NYSE:XPRO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Expro Group Holdings NV (NYSE:XPRO)

Historical Stock Chart

From Nov 2023 to Nov 2024