Revenue of $470 million, up 22% sequentially

and up 18% year-over-year.

Net income of $15 million, as compared to net

loss of $3 million for the first quarter of 2024 and net income of

$9 million for the second quarter of 2023. Net income margin was 3%

for the second quarter of 2024, compared to (1)% for the first

quarter of 2024.

Adjusted EBITDA1 of $95 million, up 40%

sequentially and up 32% year-over-year. Adjusted EBITDA margin1 of

20%, compared to 18% for the first quarter of 2024.

Increasing full-year 2024 revenue guidance

range to $1.70 to $1.75 billion, and refining full-year 2024

Adjusted EBITDA range to $350 to $375 million, supported by strong

first half of the year performance, positive market outlook, and

the successful early closing of the previously announced Coretrax

acquisition.

Expro Group Holdings N.V. (NYSE: XPRO) (the “Company” or

“Expro”) today reported financial and operational results for the

three and six months ended June 30, 2024.

Second Quarter 2024 Highlights

- Revenue was $470 million compared to revenue of $383 million in

the first quarter of 2024, an increase of $86 million, or 22%.

Revenue sequentially increased across all operating segments, with

the largest contributions from North and Latin America (“NLA”) and

Europe and Sub-Saharan Africa (“ESSA”) segments. Second quarter

operating results include $21 million of revenue attributable to

Coretrax.

- Net income for the second quarter of 2024 was $15 million, or

$0.13 per diluted share, compared to net loss of $3 million, or

$0.02 per diluted share, for the first quarter of 2024. Net income

(loss) margin (defined as net income (loss) as a percentage of

revenue) was 3% for the three months ended June 30, 2024 compared

to (1)% for the three months ended March 31, 2024. Adjusted net

income1 for the second quarter of 2024 was $31 million, or $0.27

per diluted share, compared to adjusted net income for the first

quarter of 2024 of $10 million, or $0.09 per diluted share.

- Adjusted EBITDA for the second quarter was $95 million, a

sequential increase of $27 million, or 40%, primarily attributable

to higher revenue, better activity mix across all operating

segments and contributions from the Coretrax acquisition. Adjusted

EBITDA margin for the second quarter of 2024 and the first quarter

of 2024 was 20% and 18%, respectively.

- Net cash used in operating activities for the second quarter of

2024 was $13 million, a decrease compared to net cash provided by

operating activities of $30 million for the first quarter of 2024,

primarily driven by an increase in net working capital, cash paid

for merger and integration expense, and cash paid for severance and

other expense compared to the prior quarter, partially offset by

the increase in Adjusted EBITDA. Consistent with historical

seasonal patterns, the increase in net working capital is expected

to reverse in the second half of 2024, resulting in an improvement

in net cash provided by operating activities.

1. A non-GAAP measure.

Michael Jardon, Chief Executive Officer, noted “We are pleased

to report another quarter of strong financial performance, with

revenue and Adjusted EBITDA exceeding guidance, including the

impact of the early closing of the Coretrax acquisition. Our

results reflect our commitment to deliver excellence and innovation

across our operations, and positions us for sustained,

through-cycle growth.

“Our strategic position in the international and offshore

markets continues to anchor the business, with increased activity

in mission critical, high value adding services. We continue to

maintain a positive outlook based on the fundamental backdrop and

increased global demand for services and solutions that support

lower-cost, carbon-advantaged incremental production. We believe

activity will continue to increase across geo-markets, with

long-cycle development providing good business momentum,

particularly for our drilling and completions-levered businesses.

In the second quarter, we captured $196 million of contract wins

and our backlog, while modestly down quarter-over-quarter, remains

strong at approximately $2 billion.

“In the second quarter, we completed the previously announced

acquisition of Coretrax, a technology leader in performance

drilling tools and wellbore cleanup, well integrity, and production

optimization solutions. Coretrax has a complementary offering to

Expro with little overlap and broadens the services and solutions

we offer through our Well Construction and Well Intervention &

Integrity product lines, adding significant value to our clients

from innovative technologies that reduce risk and cost, improve

drilling efficiency, extend the life of existing well stock, and

optimize production.

“We are continuing to leverage existing capabilities to grow our

Sustainable Energy Solutions business. Expro’s team in Australia

successfully executed well intervention services for recompletion

of a CO2 injector well for a leading carbon capture, utilization

and storage (CCUS) research organization. This is but one example

of where we are advancing clean energy solutions.

“In April, we also published our third sustainability report,

highlighting Expro’s achievements in 2023, the progress we have

made in working toward our environmental, social and governance

(ESG) objectives, and our commitment to being a citizen of the

world. These efforts resulted in MSCI increasing Expro’s rating

from an “A” to “AA” – the second highest rating.

“Expro remains focused on achieving excellent results for our

customers and is well positioned for continued improvement in

profitability, free cash flow and shareholder returns during what

we expect will be a multi-year growth phase for energy services. We

remain positive on the outlook for the international and offshore

energy markets and we are comfortable increasing full-year 2024

guidance range for expected revenues to between $1,700 million and

$1,750 million (versus prior guidance of between $1,600 million and

$1,700 million) and refining full-year 2024 guidance range for

Adjusted EBITDA to between $350 million and $375 million (versus

prior guidance of between $325 million and $375 million). Third

quarter revenue is expected to be between $410 million and $430

million, implying sequential and year-on-year revenue growth of

(11)% and 14%, respectively, with Adjusted EBITDA margin expected

to be in a range of 21% to 22%. Our expectation for a sequential

decrease in revenue followed by a fourth quarter rebound largely

reflects our strong second quarter results, commencing the

operations and maintenance phase of our Congo production solutions

project, and the expected start-up and completion of other

projects.”

Notable Awards and

Achievements

In the NLA region, we have seen further success in

commercializing our SeaCure® technology, which is designed to

provide optimal cement placement during the slurry pumping process

when the cementing unit shut down, preventing fluid contamination

that could have occurred without the SeaCure® solution.

Good business momentum is continuing in the ESSA region. Our

team in Ghana completed a 21 well development campaign using

Expro’s subsea landing strings. This job has run for 3 ½ years and

was completed with no injuries, no service quality events, no high

potential safety incidents, along with sustained operational uptime

of 99.7% across the entire campaign.

In the MENA region, Expro commenced operations for a major well

test contract onshore Middle East. The five-year contract requires

the mobilization of four trailer mounted conventional testing units

and four trailer mounted multi-phase meters, along with 150

incremental personnel.

Lastly, in APAC, we successfully completed our 100th job

globally with SeaCure®, marking a significant milestone. The job

was completed as part of a project in Australia consisting of a

five-well subsea batch campaign, highlighting Expro's expertise in

providing comprehensive solutions for complex offshore operations.

The technology was originally developed by DeltaTek, which Expro

acquired in February 2023.

Segment Results

Unless otherwise noted, the following discussion compares the

quarterly results for the second quarter of 2024 to the results for

the first quarter of 2024.

North and Latin America (NLA)

Revenue for the NLA segment was $157 million for the three

months ended June 30, 2024, an increase of $27 million, or 20%,

compared to $130 million for the three months ended March 31, 2024.

The increase was primarily due to higher revenue from all product

lines, in particular from higher well construction activity in the

U.S., Guyana and Trinidad and higher well flow management activity

in the U.S. and Argentina. The increase was supplemented by $5

million of additional revenue as a result of the Coretrax

acquisition.

Segment EBITDA for the NLA segment was $44 million, or 28% of

revenues, during the three months ended June 30, 2024, an increase

of $10 million, or 29%, compared to $34 million, or 26% of

revenues, during the three months ended March 31, 2024. The

increase in Segment EBITDA and Segment EBITDA margin was

attributable to higher activity and more favorable activity mix

during the three months ended June 30, 2024.

Europe and Sub-Saharan Africa (ESSA)

Revenue for the ESSA segment was $168 million for the three

months ended June 30, 2024, an increase of $47 million, or 38%,

compared to $122 million for the three months ended March 31, 2024.

The increase in revenues was primarily driven by increased subsea

well access revenue in Angola and higher well flow management

revenue in Congo. The increase was supplemented by $4 million of

additional revenue as a result of the Coretrax acquisition.

Segment EBITDA for the ESSA segment was $35 million, or 21% of

revenues, for the three months ended June 30, 2024, an increase of

$10 million, or 39%, compared to $25 million, or 21% of revenues,

for the three months ended March 31, 2024. The increase in Segment

EBITDA and Segment EBITDA margin was attributable to a combination

of a more favorable activity mix and increased activities on higher

margin services during the three months ended June 30, 2024.

Middle East and North Africa (MENA)

Revenue for the MENA segment was $81 million for the three

months ended June 30, 2024, an increase of $10 million, or 14%,

compared to $71 million for the three months ended March 31, 2024.

The increase in revenue was driven by $10 million of Coretrax

revenue, partially offset by a slight decline in revenue across

other product lines.

Segment EBITDA for the MENA segment was $29 million, or 35% of

revenues, for the three months ended June 30, 2024, an increase of

$4 million, or 17%, compared to $25 million, or 34% of revenues,

for the three months ended March 31, 2024. The increase in Segment

EBITDA and Segment EBITDA margin was primarily due to increased

activity on higher-margin projects and more favorable activity mix

during the three months ended June 30, 2024, including impacts of

the Coretrax acquisition.

Asia Pacific (APAC)

Revenue for the APAC segment was $63 million for the three

months ended June 30, 2024, an increase of $3 million, or 5%,

compared to $60 million for the three months ended March 31, 2024.

The increase in revenue was due to increased well construction

activity in Malaysia and Australia and well flow management

activity in Thailand supplemented by $2 million of additional

revenue as a result of the Coretrax acquisition, partially offset

by lower subsea well access activity in China and Australia.

Segment EBITDA for the APAC segment was $15 million, or 24% of

revenues, for the three months ended June 30, 2024, an increase of

$4 million compared to $11 million, or 18% of revenues, for the

three months ended March 31, 2024. The increase in Segment EBITDA

is attributable primarily to higher activity.

Other Financial

Information

The Company’s capital expenditures totaled $36 million in the

second quarter of 2024, of which approximately 90% were used for

the purchase and manufacture of equipment to directly support

customer-related activities and approximately 10% for other

property, plant and equipment, inclusive of software costs. Expro

plans for capital expenditures in the range of approximately $65

million to $75 million for the remainder of 2024.

As of June 30, 2024, Expro’s consolidated cash and cash

equivalents, including restricted cash, totaled $135 million. The

Company had outstanding long-term borrowings of $121 million as of

June 30, 2024. The Company’s total liquidity as of June 30, 2024

was $271 million. Total liquidity includes $136 million available

for drawdowns as loans under the Company’s revolving credit

facility.

Expro’s provision for income taxes for both the second quarter

of 2024 and the first quarter of 2024 was approximately $14 million

and $12 million. The Company’s effective tax rate on a U.S.

generally accepted accounting principles (“GAAP”) basis for the

three months ended June 30, 2024 also reflects liability for taxes

in certain jurisdictions that tax on an other than pre-tax profits

basis, including so-called “deemed profits” regimes.

On May 15, 2024, the Company established an incremental facility

under its Amended and Restated Facility Agreement, in order to

increase its existing $250 million revolving credit facility by an

additional $90 million in commitments, to a total of $340 million.

The incremental facility has the same terms and conditions as the

existing facility provided under the Amended and Restated Facility

Agreement. The incremental facility is available for the same

general corporate purposes as the existing facility provided under

the Amended and Restated Facility Agreement, including

acquisitions. On May 15, 2024, the Company drew down on the new

facility in the amount of approximately $76 million to partially

finance the Coretrax acquisition.

The financial measures provided that are not presented in

accordance with GAAP are defined and reconciled to their most

directly comparable GAAP measures. Please see “Use of Non-GAAP

Financial Measures” and the reconciliations to the nearest

comparable GAAP measures.

Additionally, downloadable financials are available on the

Investor section of www.expro.com.

Conference Call

The Company will host a conference call to discuss second

quarter 2024 results on Thursday, July 25, 2024, at 10:00 a.m.

Central Time (11:00 a.m. Eastern Time).

Participants may also join the conference call by dialing:

U.S.: +1 (833) 470-1428 International: +1

(404) 975-4839 Access ID: 661580

To listen via live webcast, please visit the Investor section of

www.expro.com.

The second quarter 2024 Investor Presentation is available on

the Investor section of www.expro.com.

An audio replay of the webcast will be available on the Investor

section of the Company’s website approximately three hours after

the conclusion of the call and will remain available for a period

of two weeks.

To access the audio replay telephonically:

Dial-In: U.S. +1 (866) 813-9403 or +1 (929)

458-6194 Access ID: 302382 Start Date: July 25, 2024, 1:00 p.m. CT

End Date: August 8, 2024, 10:59 p.m. CT

A transcript of the conference call will be posted to the

Investor relations section of the Company’s website as soon as

practicable after the conclusion of the call.

ABOUT EXPRO

Working for clients across the entire well life cycle, Expro is

a leading provider of energy services, offering cost-effective,

innovative solutions and what the Company considers to be

best-in-class safety and service quality. The Company’s extensive

portfolio of capabilities spans well construction, well flow

management, subsea well access, and well intervention and integrity

solutions.

With roots dating to 1938, Expro has more than 8,000 employees

and provides services and solutions to leading exploration and

production companies in both onshore and offshore environments in

approximately 60 countries.

For more information, please visit: www.expro.com and connect

with Expro on X @ExproGroup and LinkedIn @Expro.

Forward-Looking

Statements

This release contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934. All statements, other

than statements of historical facts, included in this release that

address activities, events or developments that the Company

expects, believes or anticipates will or may occur in the future

are forward-looking statements. Without limiting the generality of

the foregoing, forward-looking statements contained in this release

include statements, estimates and projections regarding the

Company’s future business strategy and prospects for growth, cash

flows and liquidity, financial strategy, budget, projections,

guidance, operating results, environmental, social and governance

goals, targets and initiatives, estimates and projections regarding

the benefits of the Coretrax acquisition, and the Company’s ability

to achieve the anticipated synergies as a result of the Coretrax

acquisition. These statements are based on certain assumptions made

by the Company based on management’s experience, expectations and

perception of historical trends, current conditions, anticipated

future developments and other factors believed to be appropriate.

Forward-looking statements are not guarantees of performance.

Although the Company believes the expectations reflected in its

forward-looking statements are reasonable and are based on

reasonable assumptions, no assurance can be given that these

assumptions are accurate or that any of these expectations will be

achieved (in full or at all) or will prove to have been correct.

Moreover, such statements are subject to a number of assumptions,

risks and uncertainties, many of which are beyond the control of

the Company, which may cause actual results to differ materially

from those implied or expressed by the forward-looking statements.

Such assumptions, risks and uncertainties include the amount,

nature and timing of capital expenditures, the availability and

terms of capital, the level of activity in the oil and gas

industry, volatility of oil and gas prices, unique risks associated

with offshore operations (including the ability to recover, and to

the extent necessary, service and/or economically repair any

equipment located on the seabed), political, economic and

regulatory uncertainties in international operations, the ability

to develop new technologies and products, the ability to protect

intellectual property rights, the ability to employ and retain

skilled and qualified workers, the level of competition in the

Company’s industry, global or national health concerns, including

health epidemics, the possibility of a swift and material decline

in global crude oil demand and crude oil prices for an uncertain

period of time, future actions of foreign oil producers such as

Saudi Arabia and Russia, inflationary pressures, the impact of

current and future laws, rulings, governmental regulations,

accounting standards and statements, and related interpretations,

and other guidance.

Such assumptions, risks and uncertainties also include the

factors discussed or referenced in the “Risk Factors” section of

the Company’s Annual Report on Form 10-K for the year ended

December 31, 2023 filed with the SEC, as well as other risks and

uncertainties set forth from time to time in the reports the

Company files with the SEC. Any forward-looking statement speaks

only as of the date on which such statement is made, and the

Company undertakes no obligation to correct or update any

forward-looking statement, whether as a result of new information,

future events, historical practice or otherwise, except as required

by applicable law, and we caution you not to rely on them

unduly.

Use of Non-GAAP Financial

Measures

This press release and the accompanying schedules include the

non-GAAP financial measures of Adjusted EBITDA, Adjusted EBITDA

margin, contribution, contribution margin, support costs, adjusted

net income (loss), and adjusted net income (loss) per diluted

share, which may be used periodically by management when discussing

financial results with investors and analysts. The accompanying

schedules of this press release provide a reconciliation of these

non-GAAP financial measures to their most directly comparable

financial measure calculated and presented in accordance with GAAP.

These non-GAAP financial measures are presented because management

believes these metrics provide additional information relative to

the performance of the business. These metrics are commonly

employed by financial analysts and investors to evaluate the

operating and financial performance of Expro from period to period

and to compare such performance with the performance of other

publicly traded companies within the industry. You should not

consider Adjusted EBITDA, Adjusted EBITDA margin, contribution,

contribution margin, support costs, adjusted net income (loss) and

adjusted net income (loss) per diluted share in isolation or as a

substitute for analysis of Expro’s results as reported under GAAP.

Because Adjusted EBITDA, Adjusted EBITDA margin, contribution,

contribution margin, support costs, adjusted net income (loss) and

adjusted net income (loss) per diluted share may be defined

differently by other companies in the industry, the presentation of

these non-GAAP financial measures may not be comparable to

similarly titled measures of other companies, thereby diminishing

their utility.

Expro defines Adjusted EBITDA as net income (loss) adjusted for

(a) income tax expense, (b) depreciation and amortization expense,

(c) severance and other expense, (d) merger and integration

expense, (e) gain on disposal of assets, (f) other (income)

expense, net, (g) stock-based compensation expense, (h) foreign

exchange (gains) losses and (i) interest and finance (income)

expense, net. Adjusted EBITDA margin reflects Adjusted EBITDA

expressed as a percentage of total revenue.

Contribution is defined as total revenue less cost of revenue

excluding depreciation and amortization expense, adjusted for

indirect support costs and stock-based compensation expense

included in cost of revenue. Contribution margin is defined as

contribution divided by total revenue, expressed as a percentage.

Support costs is defined as indirect costs attributable to

supporting the activities of the operating segments, research and

engineering expenses and product line management costs included in

cost of revenue, excluding depreciation and amortization expense,

and general and administrative expense, excluding depreciation and

amortization expense, which represent costs of running the

corporate head office and other central functions, including

logistics, sales and marketing and health and safety, and does not

include foreign exchange gains or losses and other non-routine

expenses.

The Company defines adjusted net income (loss) as net income

(loss) before merger and integration expense, severance and other

expense, stock-based compensation expense, and gain on disposal of

assets, adjusted for corresponding tax benefits of these items. The

Company defines adjusted net income (loss) per diluted share as net

income (loss) per diluted share before merger and integration

expense, severance and other expense, stock-based compensation

expense, and gain on disposal of assets, adjusted for corresponding

tax benefits of these items, divided by diluted weighted average

common shares.

Please see the accompanying financial tables for a

reconciliation of these non-GAAP measures to their most directly

comparable GAAP measures.

EXPRO GROUP HOLDINGS

N.V.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In thousands, except share

data)

(Unaudited)

Three Months Ended

Six Months Ended

June 30,

March 31,

June 30,

June 30,

June 30,

2024

2024

2023

2024

2023

Total revenue

$

469,642

$

383,489

$

396,917

$

853,131

$

736,196

Operating costs and expenses:

Cost of revenue, excluding depreciation

and amortization expense

(366,520

)

(308,487

)

(318,948

)

(675,007

)

(608,595

)

General and administrative expense,

excluding depreciation and amortization expense

(26,225

)

(19,213

)

(16,186

)

(45,438

)

(29,471

)

Depreciation and amortization expense

(40,647

)

(40,146

)

(37,235

)

(80,793

)

(71,972

)

Merger and integration expense

(8,789

)

(2,161

)

(1,377

)

(10,950

)

(3,515

)

Severance and other income (expense)

236

(5,062

)

(2,663

)

(4,826

)

(3,590

)

Total operating cost and expenses

(441,945

)

(375,069

)

(376,409

)

(817,014

)

(717,143

)

Operating income

27,697

8,420

20,508

36,117

19,053

Other income (expense), net

334

485

(1,462

)

819

(2,411

)

Interest and finance expense, net

(3,666

)

(3,152

)

(17

)

(6,818

)

(1,315

)

Income before taxes and equity in

income of joint ventures

24,365

5,753

19,029

30,118

15,327

Equity in income of joint ventures

4,856

3,858

2,805

8,714

5,241

Income before income taxes

29,221

9,611

21,834

38,832

20,568

Income tax expense

(13,935

)

(12,288

)

(12,539

)

(26,223

)

(17,624

)

Net income (loss)

$

15,286

$

(2,677

)

$

9,295

$

12,609

$

2,944

Net income (loss) per common

share:

Basic

$

0.13

$

(0.02

)

$

0.09

$

0.11

$

0.03

Diluted

$

0.13

$

(0.02

)

$

0.08

$

0.11

$

0.03

Weighted average common shares

outstanding:

Basic

113,979,860

110,176,460

108,662,509

112,078,160

108,758,078

Diluted

114,923,702

110,176,460

109,381,977

113,688,752

109,975,739

EXPRO GROUP HOLDINGS

N.V.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands)

(Unaudited)

June 30,

December 31,

2024

2023

Assets

Current assets

Cash and cash equivalents

$

133,459

$

151,741

Restricted cash

1,994

1,425

Accounts receivable, net

533,735

469,119

Inventories

171,493

143,325

Income tax receivables

30,307

27,581

Other current assets

79,693

58,409

Total current assets

950,681

851,600

Property, plant and equipment, net

535,538

513,222

Investments in joint ventures

75,431

66,402

Intangible assets, net

321,144

239,716

Goodwill

342,576

247,687

Operating lease right-of-use assets

71,549

72,310

Non-current accounts receivable, net

8,590

9,768

Other non-current assets

11,070

12,302

Total assets

$

2,316,579

$

2,013,007

Liabilities and stockholders’

equity

Current liabilities

Accounts payable and accrued

liabilities

$

334,464

$

326,125

Income tax liabilities

51,852

45,084

Finance lease liabilities

2,242

1,967

Operating lease liabilities

17,454

17,531

Other current liabilities

93,866

98,144

Total current liabilities

499,878

488,851

Long-term borrowings

121,065

20,000

Deferred tax liabilities, net

47,704

22,706

Post-retirement benefits

7,070

10,445

Non-current finance lease liabilities

15,093

16,410

Non-current operating lease

liabilities

54,300

54,976

Uncertain tax positions

68,303

59,544

Other non-current liabilities

43,972

44,202

Total liabilities

857,385

717,134

Common stock

8,481

8,062

Treasury stock

(69,048

)

(64,697

)

Additional paid-in capital

2,064,089

1,909,323

Accumulated other comprehensive income

22,196

22,318

Accumulated deficit

(566,524

)

(579,133

)

Total stockholders’ equity

1,459,194

1,295,873

Total liabilities and stockholders’

equity

$

2,316,579

$

2,013,007

EXPRO GROUP HOLDINGS

N.V.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

Six Months Ended June

30,

2024

2023

Cash flows from operating

activities:

Net income

$

12,609

$

2,944

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization expense

80,793

71,972

Equity in income of joint ventures

(8,714

)

(5,241

)

Stock-based compensation expense

12,420

9,748

Elimination of unrealized (loss) gain on

sales to joint ventures

(315

)

450

Changes in fair value of contingent

consideration

(6,172

)

-

Deferred taxes

(618

)

(6,823

)

Unrealized foreign exchange losses

(gains)

5,413

(1,820

)

Changes in assets and liabilities:

Accounts receivable, net

(33,756

)

(17,004

)

Inventories

(7,521

)

(1,440

)

Other assets

(14,127

)

(14,878

)

Accounts payable and accrued

liabilities

(11,129

)

31,919

Other liabilities

(12,805

)

(25,722

)

Income taxes, net

3,432

2,994

Dividends from joint ventures

-

2,754

Other

(2,745

)

(3,172

)

Net cash provided by operating

activities

16,765

46,681

Cash flows from investing

activities:

Capital expenditures

(67,107

)

(57,968

)

Payment for acquired business, net of cash

acquired

(32,458

)

(7,536

)

Proceeds from disposal of assets

2,900

2,013

Net cash used in investing

activities

(96,665

)

(63,491

)

Cash flows from financing

activities:

Release of collateral deposits, net

557

494

Proceeds from borrowings

117,269

-

Repayment of borrowings

(44,351

)

-

Repurchase of common stock

-

(10,011

)

Payment of withholding taxes on

stock-based compensation plans

(4,352

)

(2,835

)

Repayment of financed insurance

premium

(3,203

)

(4,277

)

Repayment of finance leases

(1,042

)

(1,164

)

Net cash provided by (used in)

financing activities

64,878

(17,793

)

Effect of exchange rate changes on cash

and cash equivalents

(2,691

)

(2,986

)

Net decrease to cash and cash

equivalents and restricted cash

(17,713

)

(37,589

)

Cash and cash equivalents and restricted

cash at beginning of period

153,166

218,460

Cash and cash equivalents and

restricted cash at end of period

$

135,453

$

180,871

Supplemental disclosure of cash flow

information:

Cash paid for income taxes, net of

refunds

$

22,672

$

21,644

Cash paid for interest, net

5,629

546

Change in accounts payable and accrued

expenses related to capital expenditures

6,306

2,809

EXPRO GROUP HOLDINGS

N.V.

SELECTED OPERATING SEGMENT

DATA

(In thousands)

(Unaudited)

Segment Revenue and Segment Revenue as Percentage of Total

Revenue:

Three Months Ended

Six Months Ended

June 30,

March 31,

June 30,

June 30,

June 30,

2024

2024

2023

2024

2023

NLA

$

156,990

34

%

$

130,389

34

%

$

134,830

34

%

$

287,379

34

%

$

261,058

36

%

ESSA

168,431

36

%

121,746

32

%

138,062

35

%

290,177

34

%

251,710

34

%

MENA

81,429

17

%

71,494

19

%

59,163

15

%

152,923

18

%

110,108

15

%

APAC

62,792

13

%

59,860

15

%

64,862

16

%

122,652

14

%

113,320

15

%

Total

$

469,642

100

%

$

383,489

100

%

$

396,917

100

%

$

853,131

100

%

$

736,196

100

%

Segment EBITDA(1), Segment EBITDA Margin(2)

, Adjusted

EBITDA and Adjusted EBITDA Margin(3)

:

Three Months Ended

Six Months Ended

June 30,

March 31,

June 30,

June 30,

June 30,

2024

2024

2023

2024

2023

NLA

$

44,474

28

%

$

34,377

26

%

$

36,703

27

%

$

78,851

27

%

$

68,577

26

%

ESSA

34,997

21

%

25,201

21

%

34,964

25

%

60,198

21

%

55,749

22

%

MENA

28,611

35

%

24,538

34

%

18,491

31

%

53,149

35

%

33,059

30

%

APAC

15,248

24

%

10,786

18

%

3,452

5

%

26,034

21

%

754

1

%

Total Segment EBITDA

123,330

94,902

93,610

218,232

158,139

Corporate costs(4)

(33,636

)

(31,300

)

(24,810

)

(64,936

)

(49,891

)

Equity in income of joint ventures

4,856

3,858

2,805

8,714

5,241

Adjusted EBITDA

$

94,550

20

%

$

67,460

18

%

$

71,605

18

%

$

162,010

19

%

$

113,489

15

%

(1)

Expro evaluates its business segment

operating performance using Segment Revenue, Segment EBITDA and

Segment EBITDA margin. Expro’s management believes Segment EBITDA

and Segment EBITDA margin are useful operating performance measures

as they exclude transactions not related to its core operating

activities, corporate costs and certain non-cash items and allows

Expro to meaningfully analyze the trends and performance of its

core operations by segment as well as to make decisions regarding

the allocation of resources to segments.

(2)

Expro defines Segment EBITDA margin as

Segment EBITDA divided by Segment Revenue, expressed as a

percentage.

(3)

Expro defines Adjusted EBITDA margin as

Adjusted EBITDA divided by total revenue, expressed as a

percentage.

(4)

Corporate costs include the costs of

running our corporate head office and other central functions that

support the operating segments, including research, engineering and

development, logistics, sales and marketing and health and safety

and are not attributable to a particular operating segment.

EXPRO GROUP HOLDINGS

N.V.

REVENUE BY AREAS OF

CAPABILITIES AND SELECTED CASH FLOW INFORMATION

(In thousands)

(Unaudited)

Revenue by areas of

capabilities:

Three Months Ended

Six Months Ended

June 30,

March 31,

June 30,

June 30,

June 30,

2024

2024

2023

2024

2023

Well construction

$

148,476

32

%

$

120,030

31

%

$

143,719

36

%

$

268,507

31

%

$

271,984

37

%

Well management(1)

321,166

68

%

263,459

69

%

253,198

64

%

584,624

69

%

464,212

63

%

Total

$

469,642

100

%

$

383,489

100

%

$

396,917

100

%

$

853,131

100

%

$

736,196

100

%

Supplementary information on specific amounts included in cash

provided by operating activities:

Three Months Ended

Six Months Ended

June 30,

March 31,

June 30,

June 30,

June 30,

2024

2024

2023

2024

2023

Net cash (used in) provided by

operating activities

$

(13,173

)

$

29,938

$

25,358

$

16,765

$

46,681

Cash paid for interest, net

2,719

2,910

(420

)

5,629

546

Cash paid for merger and integration

expense

9,712

2,280

9,076

11,992

11,400

Cash paid for severance and other

expense

6,334

3,148

1,999

9,482

4,571

(1) Well management consists of

well flow management, subsea well access, and well intervention and

integrity.

EXPRO GROUP HOLDINGS

N.V.

GROSS PROFIT, GROSS MARGIN,

CONTRIBUTION, CONTRIBUTION MARGIN AND SUPPORT COSTS

(In thousands)

(Unaudited)

Gross Profit, Contribution(1), Gross Margin and

Contribution Margin(2):

Three Months Ended

Six Months Ended

June 30,

March 31,

June 30,

June 30,

June 30,

2024

2024

2023

2024

2023

Total revenue

$

469,642

$

383,489

$

396,917

$

853,131

$

736,196

Less: Cost of revenue, excluding

depreciation and amortization

(366,520

)

(308,487

)

(318,948

)

(675,007

)

(608,595

)

Less: Depreciation and amortization

related to cost of revenue

(40,571

)

(40,070

)

(37,074

)

(80,641

)

$

(71,831

)

Gross profit

62,551

34,932

40,895

97,483

55,770

Add: Indirect costs (included in cost of

revenue)

69,645

68,434

56,605

138,079

121,426

Add: Stock-based compensation expenses

2,785

1,646

2,049

4,431

3,423

Add: Depreciation and amortization related

to cost of revenue

40,571

40,070

37,074

80,641

71,831

Contribution

$

175,552

$

145,082

$

136,623

$

320,634

$

252,450

Gross margin

13

%

9

%

10

%

11

%

8

%

Contribution margin

37

%

38

%

34

%

38

%

34

%

Support Costs(4):

Three Months Ended

Six Months Ended

June 30,

March 31,

June 30,

June 30,

June 30,

2024

2024

2023

2024

2023

Cost of revenue, excluding depreciation

and amortization expense

366,520

308,487

318,948

$

675,007

$

608,595

Direct costs (excluding depreciation and

amortization expense)(3)

(294,090

)

(238,407

)

(260,294

)

(532,497

)

(483,746

)

Stock-based compensation expense

(2,785

)

(1,646

)

(2,049

)

(4,431

)

(3,423

)

Indirect costs (included in cost of

revenue)

69,645

68,434

56,605

138,079

121,426

General and administrative expense

(excluding depreciation and amortization expense, foreign exchange,

and other non-routine costs)

16,034

13,046

11,288

29,080

22,788

Total support costs

$

85,679

$

81,480

$

67,893

$

167,159

$

144,214

Total support costs as a percentage of

revenue

18

%

21

%

17

%

20

%

20

%

(1)

Expro defines Contribution as Total

Revenue less Cost of Revenue, excluding depreciation and

amortization expense, adjusted for indirect support costs and

stock-based compensation expense included in Cost of Revenue.

(2)

Contribution margin is defined as

Contribution as a percentage of Revenue.

(3)

Direct costs include personnel costs,

sub-contractor costs, equipment costs, repairs and maintenance,

facilities, and other costs directly incurred to generate

revenue.

(4)

Support costs includes indirect costs

attributable to support the activities of the operating segments,

research and engineering expenses and product line management costs

included in Cost of revenue, excluding depreciation and

amortization expense, and General and administrative expenses

representing costs of running our corporate head office and other

central functions including logistics, sales and marketing and

health and safety and does not include foreign exchange gains or

losses and other non-routine expenses.

EXPRO GROUP HOLDINGS

N.V.

NON-GAAP FINANCIAL MEASURES

AND RECONCILIATION

(In thousands)

(Unaudited)

Adjusted EBITDA Reconciliation and Adjusted EBITDA Margin:

Three Months Ended

Six Months Ended

June 30,

March 31,

June 30,

June 30,

June 30,

2024

2024

2023

2024

2023

Total revenue

$

469,642

$

383,489

$

396,917

$

853,131

$

736,196

Net income (loss)

$

15,286

$

(2,677

)

$

9,295

$

12,609

$

2,944

Income tax expense

13,935

12,288

12,539

26,223

17,624

Depreciation and amortization expense

40,647

40,146

37,235

80,793

71,972

Severance and other (income) expense

(236

)

5,062

2,663

4,826

3,590

Merger and integration expense

8,789

2,161

1,377

10,950

3,515

Other (income) expense, net

(334

)

(485

)

1,462

(819

)

2,411

Stock-based compensation expense

7,350

5,070

5,577

12,420

9,748

Foreign exchange loss

5,447

2,743

1,440

8,190

370

Interest and finance expense, net

3,666

3,152

17

6,818

1,315

Adjusted EBITDA

$

94,550

$

67,460

$

71,605

$

162,010

$

113,489

Net income (loss) margin

3

%

(1

)%

2

%

1

%

0

%

Adjusted EBITDA margin

20

%

18

%

18

%

19

%

15

%

EXPRO GROUP HOLDINGS

N.V.

NON-GAAP FINANCIAL MEASURES

AND RECONCILIATION

(In thousands, except per

share amounts)

(Unaudited)

Reconciliation of Adjusted Net

Income:

Three Months Ended

Six Months Ended

June 30,

March 31,

June 30,

June 30,

June 30,

2024

2024

2023

2024

2023

Net income (loss)

$

15,286

$

(2,677

)

$

9,295

$

12,609

$

2,944

Adjustments:

Merger and integration expense

8,789

2,161

1,377

10,950

3,515

Severance and other (income) expense

(236

)

5,062

2,663

4,826

3,590

Stock-based compensation expense

7,350

5,070

5,577

12,420

9,748

Total adjustments, before taxes

15,903

12,293

9,617

28,196

16,853

Tax benefit

(75

)

(9

)

(32

)

(84

)

(43

)

Total adjustments, net of taxes

15,828

12,284

9,585

28,112

16,810

Adjusted net income

$

31,114

$

9,607

$

18,880

$

40,721

$

19,754

Reconciliation of Adjusted Net Income

per Diluted Share:

Three Months Ended

Six Months Ended

June 30,

March 31,

June 30,

June 30,

June 30,

2024

2024

2023

2024

2023

Net income (loss)

$

0.13

$

(0.02

)

$

0.08

$

0.11

$

0.03

Adjustments:

Merger and integration expense

0.08

0.02

0.01

0.10

0.03

Severance and other (income) expense

(0.00

)

0.05

0.02

0.04

0.03

Stock-based compensation expense

0.06

0.05

0.05

0.11

0.09

Total adjustments, before taxes

0.14

0.11

0.09

0.25

0.15

Tax benefit

(0.00

)

(0.00

)

(0.00

)

(0.00

)

(0.00

)

Total adjustments, net of taxes

0.14

0.11

0.09

0.25

0.15

Adjusted net income

$

0.27

$

0.09

$

0.17

$

0.36

$

0.18

As reported diluted weighted average

common shares outstanding

114,923,702

110,176,460

109,381,977

113,688,752

109,975,739

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240725903635/en/

Chad Stephenson – Director Investor Relations +1 (713)

463-9776 InvestorRelations@expro.com

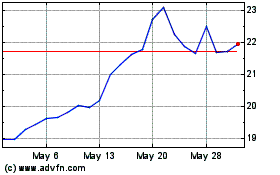

Expro Group Holdings NV (NYSE:XPRO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Expro Group Holdings NV (NYSE:XPRO)

Historical Stock Chart

From Nov 2023 to Nov 2024