Imperial Metals Corporation (the “Company”)

(TSX:III) reports that Newcrest Mining Limited (ASX, TSX, PNGX:

NCM) has released a Mineral Resource estimate for the Red Chris

mine. Red Chris is operated by Newcrest under a Joint Venture

Agreement with Imperial. Since becoming operator in August

2019, Newcrest has embarked on an extensive work program to define

the potential of block cave mining beneath the existing open pit

operation. Activities have included:

- additional exploration and resource definition drilling;

- resource optimization for both open pit and underground mining

scenarios;

- commencing a Pre-Feasibility Study (PFS) to support the

potential development of an underground block cave;

- commencing construction of the box cut (portal) for the

exploration decline.

This Mineral Resource estimate is a key input

into the Red Chris PFS which Newcrest expects to release by the end

of September 2021. The initial Newcrest Ore Reserve estimate for

Red Chris is also expected to be released within the same time

frame.

MINERAL RESOURCE ESTIMATE

This Mineral Resource estimate for Red Chris

assumes bulk open pit mining and bulk block cave underground

mining. For further disclosure, refer to Newcrest’s news release

dated March 31, 2021 at newcrest.com.

The initial Mineral Resource estimate for Red

Chris published by Newcrest is reported as a Measured and Indicated

Mineral Resource and an Inferred Mineral Resource in accordance

with the Australasian Code for Reporting of Exploration Results,

Mineral Resources and Ore Reserves 2012 (JORC Code). Refer to

Appendix 1 as provided on imperialmetals.com for information

relating to data collection and resource estimation. There are no

material differences between the definitions of Mineral Resources

under the 2014 CIM Definition Standards for Mineral Resources and

Mineral Reserves and the equivalent definitions in the JORC

Code.

JORC and CIM Comparison

Mineral Resources and Ore Reserves are

classified using the JORC Code. The confidence categories assigned

under the JORC Code were reconciled to the confidence categories in

the Canadian Institute of Mining, Metallurgy and Petroleum (CIM)

Definition Standards – for Mineral Resources and Mineral Reserves

May 2014 (the CIM Definition Standards). As the confidence category

definitions are the same, no modifications to the confidence

categories were required.

There are differences in terminology from JORC

compared to the CIM Definition Standards. Terminology differences

are the term “Ore Reserves” in the JORC Code is equivalent to

“Mineral Reserves” using the CIM Definition Standards, and the term

“Proved Ore Reserves” in the JORC Code is equivalent to “Proven

Mineral Reserves” using the CIM Definition Standards. There are no

other material differences between JORC and the CIM Definition

Standards.

Note that NI 43-101 reporting requirements do

not allow for Inferred Mineral Resources to be added to other

Mineral Resource categories. Therefore, Measured and Indicated

Mineral Resources have been reported separately from Inferred

Mineral Resources.

Mineral Resources that are not Ore Reserves do

not have demonstrated economic viability. Due to lower certainty,

the inclusion of Mineral Resources should not be regarded as a

representation that such amounts can necessarily be totally

economically exploited, and investors are cautioned not to place

undue reliance upon such figures.

Measured and Indicated Mineral

Resources

- 980Mt @ 0.41 g/t gold and 0.38% copper for 13Moz contained gold

and 3.7Mt contained copper, including:

- Open Pit – 310Mt @ 0.28 g/t gold and 0.34% copper for 2.7Moz

contained gold and 1.0Mt contained copper

- Underground – 670Mt @ 0.46 g/t gold and 0.40% copper for 10Moz

contained gold and 2.7Mt contained copper

Newcrest’s Measured and Indicated Mineral

Resource estimate reflects its strategy of defining high value

Mineral Resources that will support the development of a high

margin underground block cave at Red Chris.

Inferred Mineral Resources

- 190Mt @ 0.31 g/t gold and 0.30% copper for 1.9Moz contained

gold and 0.57Mt contained copper, including:

- Open Pit – 11Mt @ 0.23 g/t gold and 0.27% copper for 0.084Moz

contained gold and 0.031Mt contained copper

- Underground – 180Mt @ 0.32 g/t gold and 0.30% copper for 1.8Moz

contained gold and 0.54Mt contained copper

Newcrest’s Inferred Mineral Resource estimate

reflects its focus of operating a higher value, smaller open pit

and developing a larger underground mine. Growth drilling to

further define Inferred Mineral Resources for bulk extractable

underground mining options is currently underway. Newcrest expects

to publish the results from these activities within its upcoming

exploration reports.

Table 1 – 31 December 2020 Gold Measured and Indicated

Mineral Resource

|

Red Chris Gold (100%) |

Measured Resource |

Indicated Resource |

Measured and Indicated Mineral Resource |

|

Gold Measured and Indicated Mineral

Resources |

Dry Tonnes (million) |

Gold Grade(g/t Au) |

Insitu Gold (million ounces) |

Dry Tonnes (million) |

Gold Grade (g/t Au) |

Insitu Gold (million ounces) |

Dry Tonnes (million) |

Gold Grade (g/t Au) |

Insitu Gold (million ounces) |

|

Red Chris Open Pit (incl.stockpiles) |

9.8 |

0.15 |

0.048 |

300 |

0.28 |

2.7 |

310 |

0.28 |

2.7 |

|

Red Chris Underground |

- |

- |

- |

670 |

0.46 |

10 |

670 |

0.46 |

10 |

|

Total Red Chris Province |

9.8 |

0.15 |

0.048 |

970 |

0.41 |

13 |

980 |

0.41 |

13 |

Table 2 – 31 December 2020 Gold Inferred Mineral

Resource

|

Red Chris Gold (100%) |

Inferred Mineral Resource |

|

|

|

Gold Inferred Mineral Resources |

Dry Tonnes (million) |

Gold Grade(g/t Au) |

Insitu Gold (million ounces) |

|

|

|

|

|

|

|

Red Chris Open Pit (incl.stockpiles) |

11 |

0.23 |

0.084 |

|

|

|

|

|

|

|

Red Chris Underground |

180 |

0.32 |

1.8 |

|

|

|

|

|

|

|

Total Red Chris Province |

190 |

0.31 |

1.9 |

|

|

|

|

|

|

NOTE: Data is reported to two significant

figures to reflect appropriate precision in the estimate and this

may cause some apparent discrepancies in totals. Data represents

100% of the Mineral Resource for Red Chris. Imperial’s joint

venture interest in the Mineral Resource is 30%.

Table 3 – 31 December 2020 Copper Measured and Indicated

Mineral Resource

|

Red Chris Copper (100%) |

Measured Resource |

Indicated Resource |

Measured and Indicated Mineral Resource |

|

Copper Measured and IndicatedMineral

Resources |

Dry Tonnes (million) |

Copper Grade(% Cu) |

Insitu Copper(million ounces) |

Dry Tonnes (million) |

Copper Grade (% Cu) |

Insitu Copper (million ounces) |

Dry Tonnes (million) |

Copper Grade (% Cu) |

Insitu Copper (million ounces) |

|

Red Chris Open Pit (incl.stockpiles) |

9.8 |

0.23 |

0.023 |

300 |

0.34 |

1.0 |

310 |

0.34 |

1.0 |

|

Red Chris Underground |

- |

- |

- |

670 |

0.40 |

2.7 |

670 |

0.40 |

2.7 |

|

Total Red Chris Province |

9.8 |

0.23 |

0.023 |

970 |

0.38 |

3.7 |

980 |

0.38 |

3.7 |

Table 4 – 31 December 2020 Copper Inferred Mineral

Resource

|

Red Chris Copper (100%) |

Inferred Mineral Resource |

|

|

|

Copper Inferred Mineral Resources |

Dry Tonnes (million) |

Copper Grade(% Cu) |

Insitu Copper(million ounces) |

|

|

|

|

|

|

|

Red Chris Open Pit (incl.stockpiles) |

11 |

0.27 |

0.031 |

|

|

|

|

|

|

|

Red Chris Underground |

180 |

0.30 |

0.54 |

|

|

|

|

|

|

|

Total Red Chris Province |

190 |

0.30 |

0.57 |

|

|

|

|

|

|

NOTE: Data is reported to two significant

figures to reflect appropriate precision in the estimate and this

may cause some apparent discrepancies in totals. Data represents

100% of the Mineral Resource for Red Chris. Imperial’s joint

venture interest in the Mineral Resource is 30%.

Exploration Potential

Newcrest’s resource definition drilling to date

has focused on the East Zone which has enhanced its understanding

of high grade continuity while allowing critical metallurgical and

geotechnical data to be collected to support the PFS and the

initial Newcrest Ore Reserve estimate.

The Brownfields Exploration program is focused

on the discovery of additional zones of higher grade mineralization

within the Red Chris porphyry corridor, including targets outside

of the Mineral Resource. A total of 109,177 metres of drilling from

92 drill holes have been drilled since Newcrest acquired its

interest in the joint venture. Drilling continues to return

significant intercepts across the entire porphyry corridor.

Brownfields exploration drilling activities are

currently focused on the following three areas:

In the East Zone, drilling continues to confirm

the potential for additional high grade mineralization south of the

South Boundary Fault. The South Boundary Fault currently defines

the southern extent of mineralization across the East Zone, Main

Zone and Gully Zone.

In the Main Zone, drilling has confirmed the

potential for further higher grade mineralization which could

support additional mineral resources, beneath and to the south west

of the open pit. The mineralization is located immediately adjacent

to the South Boundary Fault and is open at depth and along strike.

Drilling to define the extent and continuity of this potential high

grade mineralization is underway.

At East Ridge, located adjacent to the East

Zone, Newcrest’s first hole discovered a new zone of higher grade

mineralization. The style of mineralization and grade tenor is

similar to that seen in the high grade pods from the East Zone. The

intercept, a 300 metre step out east of the East Zone, is located

south of the South Boundary Fault and is open in all directions and

extends the eastern side of the porphyry corridor. Drilling to

define the extent and continuity of this high grade mineralization

is underway.

Plan view and cross section maps are available

on imperialmetals.com.

Qualified Person

Greg Gillstrom, P.Eng., Imperial Senior

Geological Engineer, is the designated Qualified Person for the

purpose of National Instrument 43-101. Mr. Gillstrom has reviewed

and verified the scientific and technical information in this news

release.

---

About Imperial

Imperial is a Vancouver based exploration, mine

development and operating company. The Company, through its

subsidiaries, owns a 30% interest in the Red Chris mine, and a 100%

interest in both the Mount Polley and Huckleberry copper mines in

British Columbia. Imperial also holds a 45.3% interest in the

Ruddock Creek lead/zinc property.

Company Contacts

Brian Kynoch | President |

604.669.8959Jim Miller-Tait | Vice President

Exploration | 604.488.2676 Sabine Goetz

| Shareholder Communications |

604.488.2657 | investor@imperialmetals.com

Cautionary Note Regarding

Forward-Looking Statements

Certain information contained in this news

release are not statements of historical fact and are

“forward-looking” statements. Forward-looking statements relate to

future events or future performance and reflect Company

management’s expectations or beliefs regarding future events and

include, but are not limited to, statements regarding the Company’s

expectations with respect to mineral resource estimates at the Red

Chris mine; expectations and timing regarding a pre-feasibility

study initiated by Newcrest and the release of ore reserve

estimates and current and planned drilling programs at Red

Chris.

In certain cases, forward-looking statements can

be identified by the use of words such as "plans", "expects" or

"does not expect", "is expected", "outlook", "budget", "scheduled",

"estimates", "forecasts", "intends", "anticipates" or "does not

anticipate", or "believes", or variations of such words and phrases

or statements that certain actions, events or results "may",

"could", "would", "might" or "will be taken", "occur" or "be

achieved" or the negative of these terms or comparable terminology.

By their very nature forward-looking statements involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of the Company to be

materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements.

In making the forward-looking statements in this

release, the Company has applied certain factors and assumptions

that are based on information currently available to the Company as

well as the Company’s current beliefs and assumptions. These

factors and assumptions and beliefs and assumptions include, the

risk factors detailed from time to time in the Company’s interim

and annual financial statements and management’s discussion and

analysis of those statements, all of which are filed and available

for review on SEDAR at sedar.com. Although the Company has

attempted to identify important factors that could cause actual

actions, events or results to differ materially from those

described in forward-looking statements, there may be other factors

that cause actions, events or results not to be as anticipated,

estimated or intended, many of which are beyond the Company’s

ability to control or predict. There can be no assurance that

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking statements and all

forward-looking statements in this news release are qualified by

these cautionary statements.

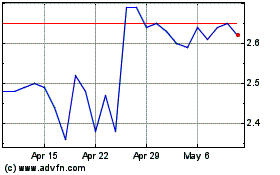

Imperial Metals (TSX:III)

Historical Stock Chart

From Nov 2024 to Dec 2024

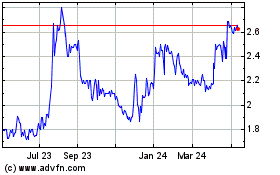

Imperial Metals (TSX:III)

Historical Stock Chart

From Dec 2023 to Dec 2024