RioCan Real Estate Investment Trust (“RioCan" or the "Trust”)

(TSX: REI.UN) announced today its financial results for the three

months and year ended December 31, 2024.

- High demand locations generate new leasing spreads of 36.7%

for 2024; blended leasing spreads of 18.7%

- Record-breaking committed occupancy at 98.0%; retail

committed occupancy at high water mark of 98.7%

- 98% completion of the 372 expected Fourth Quarter

condominium and townhouse interim closings to date

- Adjusted Debt to Adjusted EBITDA improved to 8.98x from

9.28x at the end of the prior year

"RioCan had another exceptional year, continuing its trend of

achieving its operational and financial objectives, reaching record

occupancy and leasing spreads”, said Jonathan Gitlin, President and

CEO of RioCan. "RioCan is well positioned to capitalize on the

favourable retail real estate fundamentals in the under supplied

Canadian market. Our recent Unit buybacks and the Board of

Trustees’ decision to increase our distribution for the fourth

consecutive year demonstrate confidence in our core business and

our team’s ability to maximize asset value while strategically

managing capital."

Financial

Highlights

Three months ended December

31

Years ended December 31

(in millions, except where otherwise

noted, and per unit values)

2024

2023

2024

2023

FFO Adjusted per unit - diluted 1

$

0.47

$

0.44

$

1.81

$

1.77

FFO per unit - diluted 1

$

0.45

$

0.44

$

1.78

$

1.77

Net income (loss) per unit - diluted

$

0.42

$

(0.39)

$

1.58

$

0.13

As at

December 31, 2024

December 31, 2023

Net book value per unit

$

25.16

$

24.76

- Full year FFO Adjusted per unit was $1.81, an increase of $0.04

per unit or 2.3% compared to the prior year. This growth resulted

from strong operating performance and completed developments,

partially offset by reduced NOI related to the sale of lower growth

commercial properties. Higher residential inventory gains and

increases in interest income were offset by higher interest

expense.

- Net income per unit for the year of $1.58, was $1.45 per unit

higher than the prior year. In addition to the FFO items described

above, net income included a $29.4 million reduction in the fair

value of investment properties, compared to a fair value loss of

$450.4 million in the prior year, contributing $1.40 per unit to

the year-over-year increase.

- Adjusted Debt to Adjusted EBITDA1 improved to 8.98x, FFO Payout

Ratio1 was 61.9% and Liquidity1 was $1.7 billion.

1. A non-GAAP measurement. For reconciliations and the basis of

presentation of RioCan's non-GAAP measures, refer to the Basis of

Presentation and Non-GAAP Measures section in this News Release.

Distribution increase and

Outlook

- RioCan's Board of Trustees approved a 4.3% increase to the

monthly distribution to Unitholders from $0.0925 to $0.0965 per

unit commencing with the February 2025 distribution, payable on

March 7, 2025 to Unitholders of record as at February 28, 2025.

This brings RioCan's annualized distribution to $1.16 per unit

marking its fourth consecutive annual distribution increase.

- Based on our FFO guidance for 2025, we expect to maintain a

payout ratio within our long-term target range of 55%-65%:

Outlook 2025 (i)

FFO per unit (ii)

$1.89 to $1.92

FFO Payout Ratio

~ 60%

Commercial Same Property NOI growth (ii)

1

~3.5%

(i)

The Trust continuously reviews its

longer-term targets in the context of ever-evolving macroeconomic

and business environments. This Outlook assumes normalized economic

conditions and does not reflect any potential negative impact of

tariffs, which could significantly alter economic conditions and

market dynamics.

(ii)

Refer to the Outlook section of

the Management Discussion and Analysis for the year ended December

31, 2024 for further details.

1.

A non-GAAP measurement. For

reconciliations and the basis of presentation of RioCan's non-GAAP

measures, refer to the Basis of Presentation and Non-GAAP Measures

section in this News Release. FFO Adjusted excludes $0.5 million

net debt prepayment costs and $7.9 million restructuring costs from

FFO. FFO is a non-GAAP measurement.

Selected Financial and Operational

Highlights (i)

(in millions, except where otherwise

noted, and percentages)

Three months ended December

31

Years ended December 31

2024

2023

2024

2023

Occupancy - committed (ii)

98.0 %

97.4 %

98.0 %

97.4 %

Retail occupancy - committed (ii)

98.7 %

98.4 %

98.7 %

98.4 %

Blended leasing spread

25.5 %

9.0 %

18.7 %

10.7 %

New leasing spread

52.5 %

13.2 %

36.7 %

14.7 %

Renewal leasing spread

17.6 %

8.7 %

13.1 %

9.8 %

Development Completions - sq. ft. in

thousands (iii)

43.0

272.0

180.0

599.0

Development Spending (iv) 1

$

85.1

$

94.4

$

349.4

$

399.9

As at

December 31, 2024

December 31, 2023

Liquidity (iv) 1

$

1,694

$

1,964

Adjusted Debt to Adjusted EBITDA (iv)

1

8.98x

9.28x

Unencumbered Assets (iv) 1

$

8,201

$

8,090

(i)

Includes commercial portfolio only.

(ii)

Information presented as at respective

periods then ended.

(iii)

At RioCan's ownership. Represents net

leasable area (NLA) of property under development completions.

Excludes NLA of residential inventory completions.

(iv)

At RioCan's proportionate share.

- Leasing Spreads: In 2024, RioCan achieved a record

blended leasing spread of 18.7% with a new leasing spread of 36.7%

and a renewal leasing spread of 13.1%. Leasing momentum grew

steadily throughout the year, culminating in a strong Fourth

Quarter performance and four consecutive quarters of double-digit

leasing spreads.

- Occupancy: Strong demand for space in RioCan's premium

portfolio drove committed occupancy and retail committed occupancy

to record highs of 98.0% and 98.7%.

- Leasing Progress: 4.8 million square feet were leased in

2024, including 1.5 million square feet of new leases. Our ongoing

initiatives to continuously improve tenant quality and the

productivity of our shopping centres, included the following:

- seven new grocery leases, three of which transformed retail

assets into highly valued grocery-anchored centres;

- a 135,000 square foot lease with Canadian Tire in the GTA;

and

- 40,000 square feet leased to Royal Bank of Canada including

office space and a store front unit formally occupied by a fashion

tenant at Yonge Eglinton Centre.

An additional land lease for a 158,000 square

foot Costco was finalized at RioCan Centre Burloak, replacing less

resilient fashion-focused tenants with a strong, serviced-base

anchor.

- Same Property NOI: Commercial Same Property NOI

excluding provision1 improved in the fourth quarter to 3.5% as the

benefits of backfills at higher rents and leasing began to

contribute. We expect this positive trend to continue in 2025. For

2024, the increase of 2.2% over the prior year was below our

long-term target of 3.0% mainly due to 261,000 square feet of

vacancies earlier in the year.

- RioCan Living - Residential Rental: Residential rental

operations generated $29.2 million of NOI, an increase of $7.7

million or 36.1% over last year. Residential Same Property NOI1

grew by 5.1% over the prior year. The 13 operating buildings have a

fair value of $0.9 billion. Upon completion of construction at

FourFifty The WellTM in the second quarter of 2024, capitalization

of related costs ceased, leading to a short-term negative FFO

impact of $2.1 million in 2024. We expect a positive contribution

in 2025 as the NOI from the property ramps up.

- RioCan Living - Residential Inventory: On a

proportionate share basis, approximately $73.3 million of sales

revenue and $12.0 million of residential inventory gains were

generated on the interim closing of 356 units in the Fourth

Quarter. As a condition of interim occupancy, purchasers must show

proof of sufficient funds to close the transaction once the

buildings are registered. As of February 18, 2025, 98% of the 372

expected Fourth Quarter condominium and townhouse interim

occupancies were completed.

- Approximately $534 million of sales revenue is expected from

the remaining units in the five active condominium construction

projects. Approximately $427 million of this expected revenue, or

85% of units, has been pre-sold. These pre-sales are expected to

close between 2025 and 2026 and are pursuant to legally binding

contracts. They were primarily executed at prices below current

market values, with an average deposit of 20%, motivating buyers to

complete their purchases.

- During 2024, the Trust sold 25.0% of its interest in the 11YV

project through two transactions, reducing its interest in the

project to 12.5% and generating gains of $23.9 million. These

transactions accelerated $180 million of the approximate $800

million of total condominium and townhouse sales revenue expected

at the beginning of 2024, mitigating our exposure to condominiums

and preserving capital as purchasers assume the costs-to-complete

and debt obligations.

- Restructuring: As part of its ongoing responsible cost

management and resource optimization, RioCan reduced its workforce

by 9.5% resulting in a $7.9 million charge in 2024 or $0.03 FFO per

unit. This charge is excluded from FFO Adjusted per unit. We

anticipate annualized cash savings of approximately $8 million,

with a net G&A impact of approximately $4 million.

- Development Completions: For the full year, $225.8

million or 180,000 square feet of properties under development were

transferred to income producing properties. In Q2 2024, the

Wellington Market opened, significantly increasing foot traffic at

The WellTM.

- Capital Recycling: As of February 18, 2025, closed, firm

and conditional dispositions totalled $189.3 million. Closed

dispositions in 2024 totaled $132.7 million, including the sale of

Strada, a co-owned residential property in downtown Toronto. Other

closed dispositions in 2024 included an enclosed centre, a

cinema-anchored property and several lower-growth assets as we

continue to recycle capital into more accretive uses.

- Normal Course Issuer Bid (NCIB): Subsequent to year end,

the Trust acquired and cancelled 3.2 million Units at a weighted

average price of $18.51 per unit for a cost of $60.0 million.

Proceeds from the sale of two low growth assets were or will be

used to fund the purchases: RioCan Centre Vaughan, which closed in

Q4 2024 and North Edmonton Cineplex Centre which is firm and

scheduled to close in Q1 2025. These purchases were made pursuant

to the automatic securities purchase plan adopted in connection

with the Trust's 2024/2025 NCIB. The Trust believes that the market

price of its units does not fully reflect the underlying value and

future prospects of its business, making purchasing its own units

an attractive investment opportunity.

- Investing: RioCan issued $190.2 million of new loans

under its real estate lending program in 2024 earning an average

interest rate of 11.0%. Additionally, $42.4 million of existing

loans were repaid. Subsequent to year end, RioCan completed $51.2

million of previously announced acquisitions of residential rental

assets located in Calgary and, in a non-cash deal, acquired its

partner's 75% interest in the condominium lands at RioCan Leaside

Centre in Toronto.

- Balance Sheet and Liquidity: As of December 31, 2024,

the Trust's Adjusted Debt to Adjusted EBITDA ratio improved to

8.98x from 9.28x at the end of 2023, in line with its target range

of 8.0x - 9.0x. The Trust has $1.7 billion of Liquidity to meet its

financial obligations including a fully undrawn $1.25 billion

revolving operating line of credit.

- Financing: The Trust successfully completed its 2024

financing plan, meeting its financial obligations while improving

its debt metrics and financial flexibility. As of December 31,

2024, the weighted average term to maturity of its debt portfolio

was extended to 3.72 years from 2.97 years, and the Ratio of

Unsecured Debt to Total Contractual Debt1 increased to 55.7% from

54.3%, both compared to the end of 2023 and on a proportionate

share basis.

- During the Fourth Quarter, the Trust issued $700.0 million

aggregate principal amount of senior unsecured debentures in two

series at an all-in weighted average interest rate of 4.60% per

annum with a weighted average term to maturity of 5.8 years. The

net proceeds were used to redeem, at par, the $300.0 million Series

AI senior unsecured debentures that carried a coupon of 6.488%, and

repay the $252.0 million drawn balance on the revolving operating

line of credit. The Trust also extended the maturity date of the

$200.0 million non-revolving unsecured credit facility to January

31, 2030 at a hedged annual all-in fixed interest rate of

4.47%.

- Subsequent to year end, the Trust issued $550.0 million of

senior unsecured debentures in two series: $250.0 million floating

rate Series AN senior unsecured debentures which were swapped to

fixed rates, and $300.0 million fixed rate Series AO senior

unsecured debentures. The all-in weighted average interest rate for

the $550.0 million of debentures was 4.05% per annum inclusive of

the interest rate swap, with a weighted average term to maturity of

4.8 years. The net proceeds were used to redeem the $500.0 million

Series AB senior unsecured debentures upon maturity. Additionally,

the Trust repaid $131.5 million of maturing mortgages. These

financing activities improved the Ratio of Unsecured Debt to Total

Contractual Debt to 57.0% and increased the Unencumbered Assets

pool by $286.2 million.

1.

A non-GAAP measurement. For

reconciliations and the basis of presentation of RioCan's non-GAAP

measures, refer to the Basis of Presentation and Non-GAAP Measures

section in this News Release.

Conference Call and

Webcast

Interested parties are invited to participate in a conference

call with management on Wednesday, February 19, 2025 at 10:00 a.m.

(ET). Participants will be required to identify themselves and the

organization on whose behalf they are participating.

To access the conference call, click on the following link to

register at least 10 minutes prior to the scheduled start of the

call: Pre-registration link. Participants who pre-register at any

time prior to the call will receive an email with dial-in

credentials including a login passcode and PIN to gain immediate

access to the live call. Those that are unable to pre-register may

dial-in for operator assistance by calling 1-833-950-0062 and

entering the access code: 155981.

For those unable to participate in the live mode, a replay will

be available at 1-866-813-9403 with access code: 526178.

To access the simultaneous webcast, visit RioCan’s website at

Events and Presentations and click on the link for the webcast.

About RioCan

RioCan is one of Canada’s largest real estate investment trusts.

RioCan owns, manages and develops retail-focused, mixed-use

properties located in prime, high-density transit-oriented areas

where Canadians want to shop, live and work. As at December 31,

2024, our portfolio is comprised of 178 properties with an

aggregate net leasable area of approximately 32 million square feet

(at RioCan's interest). To learn more about us, please visit

www.riocan.com.

Basis of Presentation and Non-GAAP

Measures

All figures included in this News Release are expressed in

Canadian dollars unless otherwise noted. RioCan’s annual audited

consolidated financial statements ("2024 Annual Consolidated

Financial Statements") are prepared in accordance with

International Financial Reporting Standards (IFRS). Financial

information included within this News Release does not contain all

disclosures required by IFRS, and accordingly should be read in

conjunction with the Trust's 2024 Annual Consolidated Financial

Statements and MD&A for the three months and year ended

December 31, 2024, which are available on RioCan's website at

www.riocan.com and on SEDAR+ at www.sedarplus.com.

Consistent with RioCan’s management framework, management uses

certain financial measures to assess RioCan’s financial

performance, which are not in accordance with generally accepted

accounting principles (GAAP) under IFRS. Funds From Operations

(“FFO”), FFO Adjusted, FFO per unit, FFO Adjusted per unit,

Net Operating Income ("NOI"), Same Property NOI, Commercial Same

Property NOI ("Commercial SPNOI"), Commercial Same Property NOI

excluding provision, Residential Same Property NOI ("Residential

SPNOI"), Development Spending, Ratio of Unsecured Debt to Total

Contractual Debt, Liquidity, Adjusted Debt to Adjusted EBITDA,

RioCan's Proportionate Share, Unencumbered Assets as well as

other measures that may be discussed elsewhere in this News

Release, do not have a standardized definition prescribed by IFRS

and are, therefore, unlikely to be comparable to similar measures

presented by other reporting issuers. RioCan supplements its IFRS

measures with these Non-GAAP measures to aid in assessing the

Trust’s underlying performance and reports these additional

measures so that investors may do the same. Non-GAAP measures

should not be considered as alternatives to net income or

comparable metrics determined in accordance with IFRS as indicators

of RioCan’s performance, liquidity, cash flow, and profitability.

For full definitions of these measures, please refer to the

"Non-GAAP Measures” section in RioCan’s MD&A for the three

months and year ended December 31, 2024.

The reconciliations for non-GAAP measures included in this News

Release are outlined as follows:

RioCan's Proportionate Share

The following table reconciles the consolidated balance sheets

from IFRS to RioCan's proportionate share basis as at December 31,

2024 and December 31, 2023:

As at

December 31, 2024

December 31, 2023

(thousands of dollars)

IFRS basis

Equity- accounted investments

RioCan's proportionate share

IFRS basis

Equity- accounted investments

RioCan's proportionate share

Assets

Investment properties

$

13,839,154

$

425,690

$

14,264,844

$

13,561,718

$

411,811

$

13,973,529

Equity-accounted investments

408,588

(408,588)

—

383,883

(383,883)

—

Mortgages and loans receivable

470,729

(5,321)

465,408

289,533

(6,707)

282,826

Residential inventory

284,050

337,920

621,970

217,186

407,946

625,132

Assets held for sale

16,707

—

16,707

19,075

—

19,075

Receivables and other assets

262,573

77,571

340,144

246,652

50,681

297,333

Cash and cash equivalents

190,243

9,890

200,133

124,234

14,506

138,740

Total assets

$

15,472,044

$

437,162

$

15,909,206

$

14,842,281

$

494,354

$

15,336,635

Liabilities

Debentures payable

$

4,088,654

$

—

$

4,088,654

$

3,240,943

$

—

$

3,240,943

Mortgages payable

2,851,602

160,701

3,012,303

2,740,924

158,292

2,899,216

Lines of credit and other bank loans

383,658

198,682

582,340

879,246

231,963

1,111,209

Accounts payable and other liabilities

589,792

77,779

667,571

543,398

104,099

647,497

Total liabilities

$

7,913,706

$

437,162

$

8,350,868

$

7,404,511

$

494,354

$

7,898,865

Equity

Unitholders’ equity

7,558,338

—

7,558,338

7,437,770

—

7,437,770

Total liabilities and equity

$

15,472,044

$

437,162

$

15,909,206

$

14,842,281

$

494,354

$

15,336,635

The following tables reconcile the consolidated statements of

income (loss) from IFRS to RioCan's proportionate share basis for

the three months and years ended December 31, 2024 and 2023:

Three months ended December 31,

2024

Three months ended December 31,

2023

(thousands of dollars)

IFRS basis

Equity- accounted investments

RioCan's proportionate share

IFRS basis

Equity- accounted investments

RioCan's proportionate share

Revenue

Rental revenue

$

293,327

$

8,231

$

301,558

$

276,510

$

8,124

$

284,634

Residential inventory sales

59,670

18,902

78,572

13,789

11,365

25,154

Property management and other service

fees

4,606

(375)

4,231

6,611

—

6,611

357,603

26,758

384,361

296,910

19,489

316,399

Operating costs

Rental operating costs

Recoverable under tenant leases

101,997

923

102,920

94,445

881

95,326

Non-recoverable costs

10,989

693

11,682

7,397

605

8,002

Residential inventory cost of sales

48,644

16,764

65,408

8,994

9,117

18,111

161,630

18,380

180,010

110,836

10,603

121,439

Operating income

195,973

8,378

204,351

186,074

8,886

194,960

Other income (loss)

Interest income

12,301

568

12,869

6,401

618

7,019

Income (loss) from equity-accounted

investments

3,977

(3,977)

—

(7,190)

7,190

—

Fair value gain (loss) on investment

properties, net

2,004

(1,855)

149

(222,921)

(13,506)

(236,427)

Investment and other income (loss),

net

3,782

(282)

3,500

4,459

(25)

4,434

22,064

(5,546)

16,518

(219,251)

(5,723)

(224,974)

Other expenses

Interest costs, net

66,040

2,723

68,763

58,940

3,108

62,048

General and administrative

19,070

37

19,107

15,459

23

15,482

Internal leasing costs

3,262

—

3,262

3,156

—

3,156

Transaction and other costs

4,017

72

4,089

6,945

32

6,977

92,389

2,832

95,221

84,500

3,163

87,663

Income (loss) before income

taxes

$

125,648

$

—

$

125,648

$

(117,677)

$

—

$

(117,677)

Current income tax recovery

—

—

—

(18)

—

(18)

Net income (loss)

$

125,648

$

—

$

125,648

$

(117,659)

$

—

$

(117,659)

Year ended December 31, 2024

Year ended December 31, 2023

(thousands of dollars)

IFRS basis

Equity- accounted investments

RioCan's proportionate share

IFRS basis

Equity- accounted investments

RioCan's proportionate share

Revenue

Rental revenue

$

1,137,127

$

32,672

$

1,169,799

$

1,091,105

$

33,609

$

1,124,714

Residential inventory sales

84,483

166,952

251,435

13,789

63,222

77,011

Property management and other service

fees

17,916

(1,320)

16,596

18,977

—

18,977

1,239,526

198,304

1,437,830

1,123,871

96,831

1,220,702

Operating costs

Rental operating costs

Recoverable under tenant leases

397,042

3,453

400,495

374,149

3,549

377,698

Non-recoverable costs

37,147

2,723

39,870

26,320

2,338

28,658

Residential inventory cost of sales

64,389

137,710

202,099

8,994

49,476

58,470

498,578

143,886

642,464

409,463

55,363

464,826

Operating income

740,948

54,418

795,366

714,408

41,468

755,876

Other income (loss)

Interest income

42,469

2,163

44,632

25,131

2,559

27,690

Income from equity-accounted

investments

38,507

(38,507)

—

18,383

(18,383)

—

Fair value loss on investment properties,

net

(29,353)

(3,582)

(32,935)

(450,408)

(14,123)

(464,531)

Investment and other income (loss),

net

17,531

(2,769)

14,762

8,501

(339)

8,162

69,154

(42,695)

26,459

(398,393)

(30,286)

(428,679)

Other expenses

Interest costs, net

257,544

11,544

269,088

208,948

11,339

220,287

General and administrative

59,847

86

59,933

60,367

56

60,423

Internal leasing costs

13,293

—

13,293

11,919

—

11,919

Transaction and other costs

6,747

93

6,840

9,344

(213)

9,131

337,431

11,723

349,154

290,578

11,182

301,760

Income before income taxes

$

472,671

$

—

$

472,671

$

25,437

$

—

$

25,437

Current income tax recovery

(794)

—

(794)

(13,365)

—

(13,365)

Net income

$

473,465

$

—

$

473,465

$

38,802

$

—

$

38,802

NOI and Same Property NOI

The following table reconciles operating income to NOI and Same

Property NOI to NOI for the three months and years ended December

31, 2024 and 2023:

Three months ended December

31

Years ended December 31

(thousands of dollars)

2024

2023

2024

2023

Operating Income

$

195,973

$

186,074

$

740,948

$

714,408

Adjusted for the following:

Property management and other service

fees

(4,606)

(6,611)

(17,916)

(18,977)

Residential inventory gains

(11,026)

(4,795)

(20,094)

(4,795)

Operational lease revenue from ROU assets,

net (i)

3,889

1,638

9,218

6,717

NOI

$

184,230

$

176,306

$

712,156

$

697,353

(i)

Includes $2.1 million straight-line rent

from operational lease revenue from ROU assets for three months and

year ended December 31, 2024.

Three months ended December

31

Years ended December 31

(thousands of dollars)

2024

2023

2024

2023

Commercial

Commercial Same Property NOI

$

150,744

$

147,307

$

588,278

$

581,360

NOI from income producing properties:

Acquired (i)

903

69

5,060

1,780

Disposed (i)

1,726

5,504

8,382

27,250

2,629

5,573

13,442

29,030

NOI from completed commercial

developments

10,916

9,033

42,739

31,380

NOI from properties under de-leasing

(ii)

5,415

5,239

20,297

22,955

Lease cancellation fees

1,591

70

4,817

5,253

Straight-line rent adjustment (iii)

5,226

2,638

13,359

5,898

NOI from commercial properties

176,521

169,860

682,932

675,876

Residential

Residential Same Property NOI

5,362

5,426

18,008

17,139

NOI from income producing properties:

Acquired (i)

500

—

3,733

1,063

Disposed (i)

73

145

547

695

573

145

4,280

1,758

NOI from completed residential

developments

1,774

875

6,936

2,580

NOI from residential rental

7,709

6,446

29,224

21,477

NOI

$

184,230

$

176,306

$

712,156

$

697,353

(i)

Includes properties acquired or disposed

of during the periods being compared.

(ii)

NOI from limited number of properties

undergoing significant de-leasing in preparation for redevelopment

or intensification.

(iii)

It includes $2.1 million straight-line

rent from operational lease revenue from ROU assets for three

months and year ended December 31, 2024.

Three months ended December

31

Years ended December 31

(thousands of dollars)

2024

2023

2024

2023

Commercial Same Property NOI

$

150,744

$

147,307

$

588,278

$

581,360

Residential Same Property NOI

5,362

5,426

18,008

17,139

Same Property NOI

$

156,106

$

152,733

$

606,286

$

598,499

Commercial Same Property NOI excluding provision

Three months ended December

31

Years ended December 31

(thousands of dollars)

2024

2023

2024

2023

Commercial Same Property NOI

$

150,744

$

147,307

$

588,278

$

581,360

Add (exclude):

Same property provision for (recovery of)

for credit losses

884

(837)

147

(5,344)

Commercial Same Property NOI excluding

provision

$

151,628

$

146,470

$

588,425

$

576,016

FFO

The following table reconciles net income (loss) attributable to

Unitholders to FFO for the three months and years ended December

31, 2024 and 2023:

Three months ended December

31

Years ended December 31

(thousands of dollars, except where

otherwise noted)

2024

2023

2024

2023

Net income (loss) attributable to

Unitholders

$

125,648

$

(117,659)

$

473,465

$

38,802

Add back (deduct):

Fair value (gains) losses, net

(2,004)

222,921

29,353

450,408

Fair value losses included in

equity-accounted investments

1,855

13,506

3,584

14,124

Internal leasing costs

3,262

3,156

13,293

11,919

Transaction (gains) losses on investment

properties, net (i)

(1,345)

1,147

534

1,182

Transaction gains on equity-accounted

investments

—

(14)

(52)

(83)

Transaction costs on sale of investment

properties

2,435

5,094

3,666

5,601

ERP implementation costs

—

3,503

5,368

12,032

ERP amortization

(484)

—

(1,302)

—

Change in unrealized fair value on

marketable securities

—

(1,846)

(4,648)

865

Current income tax recovery

—

(18)

(794)

(13,365)

Operational lease revenue from ROU

assets

3,534

1,283

7,814

5,116

Operational lease expenses from ROU assets

in equity-accounted investments

(18)

(16)

(69)

(55)

Capitalized interest related to

equity-accounted investments (ii):

Capitalized interest related to properties

under development

110

134

426

219

Capitalized interest related to

residential inventory

1,386

1,699

5,333

4,516

FFO

$

134,379

$

132,890

$

535,971

$

531,281

Add back (deduct):

Debt prepayment cost, net

912

—

455

—

Restructuring costs

7,202

24

7,852

1,368

FFO Adjusted

$

142,493

$

132,914

$

544,278

$

532,649

FFO per unit - basic

$

0.45

$

0.44

$

1.78

$

1.77

FFO per unit - diluted

$

0.45

$

0.44

$

1.78

$

1.77

FFO Adjusted per unit - diluted

$

0.47

$

0.44

$

1.81

$

1.77

Weighted average number of Units -

basic (in thousands)

300,469

300,417

300,464

300,392

Weighted average number of Units -

diluted (in thousands)

300,524

300,417

300,473

300,479

FFO for last four quarters

$

535,971

$

531,281

Distributions paid for last four

quarters

$

332,011

$

321,414

FFO Payout Ratio

61.9%

60.5%

(i)

Represents net transaction gains or losses

connected to certain investment properties during the period.

(ii)

This amount represents the interest

capitalized to RioCan's equity-accounted investment in WhiteCastle

New Urban Fund 2, LP, WhiteCastle New Urban Fund 3, LP, WhiteCastle

New Urban Fund 4, LP, WhiteCastle New Urban Fund 5, LP,

RioCan-Fieldgate JV, RC (Queensway) LP, RC (Leaside) LP - Class B,

PR Bloor Street LP and RC Yorkville LP. This amount is not

capitalized to development projects under IFRS but is allowed as an

adjustment under REALPAC’s definition of FFO.

Development Spending

Total Development Spending for the three months and years ended

December 31, 2024 and 2023 is as follows:

Three months ended December

31

Years ended December 31

(thousands of dollars)

2024

2023

2024

2023

Development expenditures on balance

sheet:

Properties under development

$

36,459

$

52,267

$

164,658

$

244,260

Residential inventory

34,447

26,875

128,214

127,118

RioCan's share of Development Spending

from equity-accounted joint ventures

14,175

15,223

56,512

28,568

Total Development Spending

$

85,081

$

94,365

$

349,384

$

399,946

Three months ended December

31

Years ended December 31

(thousands of dollars)

2024

2023

2024

2023

Mixed-use projects

$

70,261

$

83,271

$

309,440

$

346,956

Retail in-fill projects

14,820

11,094

39,944

52,990

Total Development Spending

$

85,081

$

94,365

$

349,384

$

399,946

Total Contractual Debt

The following table reconciles total debt to Total Contractual

Debt as at December 31, 2024 and December 31, 2023:

As at

December 31, 2024

December 31, 2023

(thousands of dollars)

IFRS basis

Equity- accounted investments

RioCan's proportionate share

IFRS basis

Equity- accounted investments

RioCan's proportionate share

Debentures payable

$

4,088,654

$

—

$

4,088,654

$

3,240,943

$

—

$

3,240,943

Mortgages payable

2,851,602

160,701

3,012,303

2,740,924

158,292

2,899,216

Lines of credit and other bank loans

383,658

198,682

582,340

879,246

231,963

1,111,209

Total debt

$

7,323,914

$

359,383

$

7,683,297

$

6,861,113

$

390,255

$

7,251,368

Less:

Unamortized debt financing costs, premiums

and discounts on origination and debt assumed, and

modifications

(35,490)

(526)

(36,016)

(24,019)

(484)

(24,503)

Total Contractual Debt

$

7,359,404

$

359,909

$

7,719,313

$

6,885,132

$

390,739

$

7,275,871

Unsecured and Secured Debt

The following table reconciles Total Unsecured and Secured Debt

to Total Contractual Debt as at December 31, 2024 and December 31,

2023:

As at

December 31, 2024

December 31, 2023

(thousands of dollars, except where

otherwise noted)

IFRS basis

Equity- accounted investments

RioCan's proportionate share

IFRS basis

Equity- accounted investments

RioCan's proportionate share

Total Unsecured Debt

$

4,300,000

$

—

$

4,300,000

$

3,950,000

$

—

$

3,950,000

Total Secured Debt

3,059,404

359,909

3,419,313

2,935,132

390,739

3,325,871

Total Contractual Debt

$

7,359,404

$

359,909

$

7,719,313

$

6,885,132

$

390,739

$

7,275,871

Percentage of Total Contractual Debt:

Unsecured Debt

58.4 %

55.7 %

57.4 %

54.3 %

Secured Debt

41.6 %

44.3 %

42.6 %

45.7 %

Liquidity

As at December 31, 2024, RioCan had approximately $1.7 billion

of Liquidity as summarized in the following table:

As at

December 31, 2024

December 31, 2023

(thousands of dollars)

IFRS basis

Equity- accounted investments

RioCan's proportionate share

IFRS basis

Equity- accounted investments

RioCan's proportionate share

Undrawn revolving unsecured operating line

of credit

$

1,250,000

$

—

$

1,250,000

$

1,250,000

$

—

$

1,250,000

Undrawn construction lines and other bank

loans

146,024

97,892

243,916

385,715

189,563

575,278

Cash and cash equivalents

190,243

9,890

200,133

124,234

14,506

138,740

Liquidity

$

1,586,267

$

107,782

$

1,694,049

$

1,759,949

$

204,069

$

1,964,018

Adjusted EBITDA

The following table reconciles consolidated net income

attributable to Unitholders to Adjusted EBITDA:

Year ended

December 31, 2024

December 31, 2023

(thousands of dollars)

IFRS basis

Equity- accounted investments

RioCan's proportionate share

IFRS basis

Equity- accounted investments

RioCan's proportionate share

Net income attributable to Unitholders

$

473,465

$

—

$

473,465

$

38,802

$

—

$

38,802

Add (deduct) the following items:

Income tax recovery:

Current

(794)

—

(794)

(13,365)

—

(13,365)

Fair value losses on investment

properties, net

29,353

3,582

32,935

450,408

14,123

464,531

Change in unrealized fair value on

marketable securities (i)

(4,648)

—

(4,648)

865

—

865

Internal leasing costs

13,293

—

13,293

11,919

—

11,919

Non-cash unit-based compensation

expense

10,385

—

10,385

10,154

—

10,154

Interest costs, net

257,544

11,544

269,088

208,948

11,339

220,287

Debt prepayment cost, net

455

—

455

—

—

—

Restructuring costs

7,852

—

7,852

1,368

—

1,368

ERP implementation costs

5,368

—

5,368

12,032

—

12,032

Depreciation and amortization

1,450

—

1,450

2,632

—

2,632

Transaction losses (gains) on the sale of

investment properties, net (ii)

2

(52)

(50)

1,180

(83)

1,097

Transaction costs on investment

properties

3,672

1

3,673

5,606

1

5,607

Operational lease revenue (expenses) from

ROU assets

7,814

(69)

7,745

5,116

(55)

5,061

Adjusted EBITDA

$

805,211

$

15,006

$

820,217

$

735,665

$

25,325

$

760,990

(i)

The fair value gains and losses on

marketable securities may include both the change in unrealized

fair value and realized gains and losses on the sale of marketable

securities. By adding back the change in unrealized fair value on

marketable securities, RioCan effectively continues to include

realized gains and losses on the sale of marketable securities in

Adjusted EBITDA and excludes unrealized fair value gains and losses

on marketable securities in Adjusted EBITDA.

(ii)

Includes transaction gains and losses

realized on the disposition of investment properties.

Adjusted Debt to Adjusted EBITDA Ratio

Adjusted Debt to Adjusted EBITDA is calculated as follows:

Year ended

December 31, 2024

December 31, 2023

(thousands of dollars, except where

otherwise noted)

IFRS basis

Equity- accounted investments

RioCan's proportionate share

IFRS basis

Equity- accounted investments

RioCan's proportionate share

Adjusted Debt to Adjusted

EBITDA

Average total debt outstanding

$

7,103,232

$

365,916

$

7,469,148

$

6,879,087

$

317,231

$

7,196,318

Less: average cash and cash

equivalents

(89,937)

(10,307)

(100,244)

(120,952)

(11,408)

(132,360)

Average Total Adjusted Debt

$

7,013,295

$

355,609

$

7,368,904

$

6,758,135

$

305,823

$

7,063,958

Adjusted EBITDA (i)

$

805,211

$

15,006

$

820,217

$

735,665

$

25,325

$

760,990

Adjusted Debt to Adjusted

EBITDA

8.71

8.98

9.19

9.28

(i)

Adjusted EBITDA is reconciled in the

immediately preceding table.

Unencumbered Assets

The tables below summarize RioCan's Unencumbered Assets as at

December 31, 2024 and December 31, 2023:

As at

December 31, 2024

December 31, 2023

(thousands of dollars, except where

otherwise noted)

IFRS basis

Equity- accounted investments

RioCan's proportionate share

IFRS basis

Equity- accounted investments

RioCan's proportionate share

Investment properties

$

13,839,154

$

425,690

$

14,264,844

$

13,561,718

$

411,811

$

13,973,529

Less: Encumbered investment properties

5,704,034

359,465

6,063,499

5,531,177

352,425

5,883,602

Unencumbered Assets

$

8,135,120

$

66,225

$

8,201,345

$

8,030,541

$

59,386

$

8,089,927

Forward-Looking

Information

This News Release contains forward-looking information within

the meaning of applicable Canadian securities laws. This

information reflects RioCan’s objectives, our strategies to achieve

those objectives, as well as statements with respect to

management’s beliefs, estimates and intentions concerning

anticipated future events, results, circumstances, performance or

expectations that are not historical facts. Forward-looking

information can generally be identified by the use of

forward-looking terminology such as “outlook”, “objective”, “may”,

“will”, “would”, “expect”, “intend”, “estimate”, “anticipate”,

“believe”, “should”, “plan”, “continue”, or similar expressions

suggesting future outcomes or events. Such forward-looking

information reflects management’s current beliefs and is based on

information currently available to management. All forward-looking

information in this News Release is qualified by these cautionary

statements. Forward-looking information is not a guarantee of

future events or performance and, by its nature, is based on

RioCan’s current estimates and assumptions, which are subject to

numerous risks and uncertainties, including those described in the

“Risks and Uncertainties” section in RioCan's MD&A for the

three months and year ended December 31, 2024 and in our most

recent Annual Information Form, which could cause actual events or

results to differ materially from the forward-looking information

contained in this News Release. Although the forward-looking

information contained in this News Release is based upon what

management believes are reasonable assumptions, there can be no

assurance that actual results will be consistent with this

forward-looking information.

The forward-looking statements contained in this News Release

are made as of the date hereof, and should not be relied upon as

representing RioCan’s views as of any date subsequent to the date

of this News Release. Management undertakes no obligation, except

as required by applicable law, to publicly update or revise any

forward-looking information, whether as a result of new

information, future events or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250218171565/en/

RioCan Real Estate Investment Trust Dennis Blasutti Chief

Financial Officer 416-866-3033 | www.riocan.com

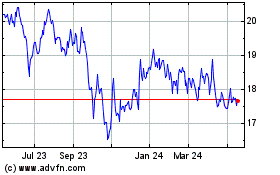

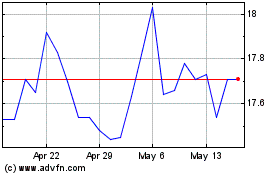

RioCan Real Estate Inves... (TSX:REI.UN)

Historical Stock Chart

From Feb 2025 to Mar 2025

RioCan Real Estate Inves... (TSX:REI.UN)

Historical Stock Chart

From Mar 2024 to Mar 2025