false

--12-31

Q2

0001568969

0001568969

2024-01-01

2024-06-30

0001568969

2024-08-12

0001568969

2024-06-30

0001568969

2023-12-31

0001568969

2024-04-01

2024-06-30

0001568969

2023-04-01

2023-06-30

0001568969

2023-01-01

2023-06-30

0001568969

us-gaap:PreferredStockMember

2023-12-31

0001568969

us-gaap:CommonStockMember

2023-12-31

0001568969

APYP:SharesToBeIssuedMember

2023-12-31

0001568969

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001568969

us-gaap:RetainedEarningsMember

2023-12-31

0001568969

us-gaap:ParentMember

2023-12-31

0001568969

us-gaap:NoncontrollingInterestMember

2023-12-31

0001568969

us-gaap:PreferredStockMember

2024-01-01

2024-06-30

0001568969

us-gaap:CommonStockMember

2024-01-01

2024-06-30

0001568969

APYP:SharesToBeIssuedMember

2024-01-01

2024-06-30

0001568969

us-gaap:AdditionalPaidInCapitalMember

2024-01-01

2024-06-30

0001568969

us-gaap:RetainedEarningsMember

2024-01-01

2024-06-30

0001568969

us-gaap:ParentMember

2024-01-01

2024-06-30

0001568969

us-gaap:NoncontrollingInterestMember

2024-01-01

2024-06-30

0001568969

us-gaap:PreferredStockMember

2024-06-30

0001568969

us-gaap:CommonStockMember

2024-06-30

0001568969

APYP:SharesToBeIssuedMember

2024-06-30

0001568969

us-gaap:AdditionalPaidInCapitalMember

2024-06-30

0001568969

us-gaap:RetainedEarningsMember

2024-06-30

0001568969

us-gaap:ParentMember

2024-06-30

0001568969

us-gaap:NoncontrollingInterestMember

2024-06-30

0001568969

us-gaap:PreferredStockMember

2022-12-31

0001568969

us-gaap:CommonStockMember

2022-12-31

0001568969

APYP:SharesToBeIssuedMember

2022-12-31

0001568969

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001568969

us-gaap:RetainedEarningsMember

2022-12-31

0001568969

us-gaap:ParentMember

2022-12-31

0001568969

us-gaap:NoncontrollingInterestMember

2022-12-31

0001568969

2022-12-31

0001568969

us-gaap:PreferredStockMember

2023-01-01

2023-06-30

0001568969

us-gaap:CommonStockMember

2023-01-01

2023-06-30

0001568969

APYP:SharesToBeIssuedMember

2023-01-01

2023-06-30

0001568969

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-06-30

0001568969

us-gaap:RetainedEarningsMember

2023-01-01

2023-06-30

0001568969

us-gaap:ParentMember

2023-01-01

2023-06-30

0001568969

us-gaap:NoncontrollingInterestMember

2023-01-01

2023-06-30

0001568969

us-gaap:PreferredStockMember

2023-06-30

0001568969

us-gaap:CommonStockMember

2023-06-30

0001568969

APYP:SharesToBeIssuedMember

2023-06-30

0001568969

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001568969

us-gaap:RetainedEarningsMember

2023-06-30

0001568969

us-gaap:ParentMember

2023-06-30

0001568969

us-gaap:NoncontrollingInterestMember

2023-06-30

0001568969

2023-06-30

0001568969

us-gaap:PreferredStockMember

2024-03-31

0001568969

us-gaap:CommonStockMember

2024-03-31

0001568969

APYP:SharesToBeIssuedMember

2024-03-31

0001568969

us-gaap:AdditionalPaidInCapitalMember

2024-03-31

0001568969

us-gaap:RetainedEarningsMember

2024-03-31

0001568969

us-gaap:ParentMember

2024-03-31

0001568969

us-gaap:NoncontrollingInterestMember

2024-03-31

0001568969

2024-03-31

0001568969

us-gaap:PreferredStockMember

2024-04-01

2024-06-30

0001568969

us-gaap:CommonStockMember

2024-04-01

2024-06-30

0001568969

APYP:SharesToBeIssuedMember

2024-04-01

2024-06-30

0001568969

us-gaap:AdditionalPaidInCapitalMember

2024-04-01

2024-06-30

0001568969

us-gaap:RetainedEarningsMember

2024-04-01

2024-06-30

0001568969

us-gaap:ParentMember

2024-04-01

2024-06-30

0001568969

us-gaap:NoncontrollingInterestMember

2024-04-01

2024-06-30

0001568969

us-gaap:PreferredStockMember

2023-03-31

0001568969

us-gaap:CommonStockMember

2023-03-31

0001568969

APYP:SharesToBeIssuedMember

2023-03-31

0001568969

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001568969

us-gaap:RetainedEarningsMember

2023-03-31

0001568969

us-gaap:ParentMember

2023-03-31

0001568969

us-gaap:NoncontrollingInterestMember

2023-03-31

0001568969

2023-03-31

0001568969

us-gaap:PreferredStockMember

2023-04-01

2023-06-30

0001568969

us-gaap:CommonStockMember

2023-04-01

2023-06-30

0001568969

APYP:SharesToBeIssuedMember

2023-04-01

2023-06-30

0001568969

us-gaap:AdditionalPaidInCapitalMember

2023-04-01

2023-06-30

0001568969

us-gaap:RetainedEarningsMember

2023-04-01

2023-06-30

0001568969

us-gaap:ParentMember

2023-04-01

2023-06-30

0001568969

us-gaap:NoncontrollingInterestMember

2023-04-01

2023-06-30

0001568969

APYP:SleepXLtdMember

2024-06-30

0001568969

APYP:NexenseTechnologiesUSAIncMember

2021-12-31

0001568969

APYP:NexenseTechnologiesUSAIncMember

2024-01-01

2024-06-30

0001568969

us-gaap:NoncontrollingInterestMember

APYP:TanoomaLtdMember

2020-12-31

0001568969

APYP:TanoomaLtdMember

us-gaap:NoncontrollingInterestMember

2024-06-30

0001568969

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2023-12-31

0001568969

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2023-12-31

0001568969

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

2023-12-31

0001568969

us-gaap:FairValueMeasurementsRecurringMember

2023-12-31

0001568969

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2024-06-30

0001568969

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2024-06-30

0001568969

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

2024-06-30

0001568969

us-gaap:FairValueMeasurementsRecurringMember

2024-06-30

0001568969

2023-01-01

2023-12-31

0001568969

us-gaap:MonteCarloModelMember

2024-01-01

2024-06-30

0001568969

us-gaap:MonteCarloModelMember

2023-01-01

2023-12-31

0001568969

us-gaap:MonteCarloModelMember

2024-06-30

0001568969

us-gaap:MonteCarloModelMember

2023-12-31

0001568969

APYP:PlutusWarrantsMember

2024-06-30

0001568969

APYP:PlutusWarrantsMember

2024-01-01

2024-06-30

0001568969

APYP:WarrantOneMember

2023-12-31

0001568969

APYP:WarrantTwoMember

2023-12-31

0001568969

APYP:WarrantThreeMember

2023-12-31

0001568969

APYP:WarrantOneMember

2024-06-30

0001568969

APYP:WarrantTwoMember

2024-06-30

0001568969

APYP:ConsultantsAndEmployeesMember

2024-01-01

2024-06-30

0001568969

APYP:ConsultantsAndEmployeesMember

2023-12-31

0001568969

APYP:ConsultantsAndEmployeesMember

2024-06-30

0001568969

APYP:ChiefFinancialOfficerAndAdvisorMember

2024-04-01

2024-06-30

0001568969

APYP:ChiefFinancialOfficerAndAdvisorMember

2023-04-01

2023-06-30

0001568969

APYP:ConsultantMember

2024-05-13

2024-05-13

0001568969

APYP:ConsultantMember

2024-05-13

0001568969

APYP:ConsultantMember

2024-04-01

2024-06-30

0001568969

us-gaap:CommonStockMember

APYP:BorisMolchadskyMember

2024-05-14

0001568969

us-gaap:CommonStockMember

APYP:AsafPoratMember

2024-05-14

0001568969

us-gaap:CommonStockMember

APYP:AdiShemerMember

2024-05-14

0001568969

us-gaap:CommonStockMember

APYP:BorisMolchadskyMember

2024-05-14

2024-05-14

0001568969

us-gaap:CommonStockMember

APYP:AsafPoratMember

2024-05-14

2024-05-14

0001568969

2024-05-14

2024-05-14

0001568969

APYP:OfficerAndDirectorMember

2024-04-01

2024-04-01

0001568969

APYP:AdiShemerMember

2024-06-30

0001568969

APYP:AdiShemerMember

srt:MinimumMember

2024-01-01

2024-06-30

0001568969

srt:ChiefFinancialOfficerMember

us-gaap:SubsequentEventMember

2024-07-31

2024-07-31

0001568969

srt:ChiefFinancialOfficerMember

us-gaap:SubsequentEventMember

2024-08-04

2024-08-04

0001568969

srt:ChiefFinancialOfficerMember

us-gaap:SubsequentEventMember

2024-08-04

0001568969

APYP:AdiShemerMember

us-gaap:SubsequentEventMember

2024-08-07

0001568969

APYP:AdiShemerMember

us-gaap:SubsequentEventMember

2024-08-07

2024-08-07

0001568969

us-gaap:SubsequentEventMember

APYP:MrRonMeklerMember

2024-08-07

0001568969

us-gaap:SubsequentEventMember

APYP:MrTalWeitzmanMember

2024-08-07

0001568969

us-gaap:SubsequentEventMember

APYP:PlutusMember

2024-08-07

2024-08-07

0001568969

APYP:MrNeilKlineAndMrRonMeklerMember

2023-08-01

2023-08-31

0001568969

APYP:MrNeilKlineAndMrRonMeklerMember

2023-07-31

2023-07-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

APYP:Integer

iso4217:ILS

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-Q

MARK

ONE

☒

Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

for

the Quarterly Period ended June 30, 2024; or

☐

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

for

the transition period from ________ to ________

Commission

File Number: 000-55403

APPYEA,

Inc.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

46-1496846 |

| (State

or other jurisdiction of |

|

(I.R.S.

Employer |

| incorporation

or organization) |

|

Identification

No.) |

| 16

Natan Alterman St, Gan Yavne, Israel |

|

|

| (Address

of principal executive offices) |

|

Zip

Code |

(800)

674-3561

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| N/A |

|

N/A |

|

N/A |

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data

File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding

12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company,

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☐ |

Smaller

reporting company |

☒ |

| |

|

Emerging

growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As

of August 12, 2024, there were outstanding 475,203,251 shares of the registrant’s common stock, par value $0.0001 per share.

APPYEA,

INC.

Form

10-Q

June

30, 2024

APPYEA

INC. AND ITS SUBSIDIARIES

CONDENSED

CONSOLIDATED FINANCIAL STATEMENTS

AS

OF JUNE 30, 2024

APPYEA

INC. AND ITS SUBSIDIARIES

CONDENSED

CONSOLIDATED FINANCIAL STATEMENTS

AS

OF JUNE 30, 2024

INDEX

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

APPYEA

INC.

CONDENSED

CONSOLIDATED BALANCE SHEETS

(U.S.

dollars in thousands)

| | |

June

30, | | |

December

31, | |

| | |

2024 | | |

2023 | |

| | |

Unaudited | | |

Audited | |

| ASSETS | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and

cash equivalents | |

| 158 | | |

| 222 | |

| Other accounts receivables | |

| 17 | | |

| 42 | |

| Government institutions | |

| 9 | | |

| - | |

| Inventory | |

| 13 | | |

| 14 | |

| Total current assets | |

| 197 | | |

| 278 | |

| | |

| | | |

| | |

| Non-current assets | |

| | | |

| | |

| Property and equipment,

net | |

| 2 | | |

| 3 | |

| Intangible assets, net | |

| 260 | | |

| 193 | |

| Total non-current assets | |

| 262 | | |

| 196 | |

| | |

| | | |

| | |

| Total

assets | |

| 459 | | |

| 474 | |

| | |

| | | |

| | |

LIABILITIES

AND DEFICIENCY | |

| | | |

| | |

| Current

liabilities | |

| | | |

| | |

| Trade payables | |

| 22 | | |

| 51 | |

| Other accounts payable | |

| 291 | | |

| 694 | |

| Short-term loans from

related party | |

| 78 | | |

| 79 | |

| Convertible loans at

amortized cost | |

| 826 | | |

| 796 | |

| Convertible loans –

At fair value | |

| 1,398 | | |

| 1,203 | |

| Financial liability

at fair value | |

| - | | |

| 204 | |

| Total current liabilities | |

| 2,615 | | |

| 3,027 | |

| | |

| | | |

| | |

| Total liabilities | |

| 2,615 | | |

| 3,027 | |

| | |

| | | |

| | |

DEFICIENCY | |

| | | |

| | |

| AppYea Inc. Stockholders’

Deficiency: | |

| | | |

| | |

| Convertible preferred

stock, $0.0001 par value | |

| - | | |

| - | |

| Common stock, $0.0001

par value | |

| 45 | | |

| 31 | |

| Shares to be issued | |

| 333 | | |

| 559 | |

| Additional Paid in Capital | |

| 4,869 | | |

| 3197 | |

| Accumulated deficit | |

| (7,389 | ) | |

| (6,326 | ) |

| Total AppYea Inc. stockholders’

deficiency | |

| (2,142 | ) | |

| (2,539 | ) |

| Non-controlling interests | |

| (14 | ) | |

| (14 | ) |

| | |

| | | |

| | |

| Total

Deficiency | |

| (2,156 | ) | |

| (2,553 | ) |

| | |

| | | |

| | |

| Total

liabilities and deficiency | |

| 459 | | |

| 474 | |

The

accompanying notes are an integral part of the financial statements.

APPYEA

INC.

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(U.S.

dollars in thousands)

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

For

the period of three months

ended June 30, | | |

For

the period of six months

ended June 30, | |

| | |

| | |

| | |

| | |

| |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

Unaudited | | |

Unaudited | |

| | |

| | |

| | |

| | |

| |

| Revenues | |

| 2 | | |

| - | | |

| 15 | | |

| - | |

| Cost of sales | |

| 3 | | |

| - | | |

| 6 | | |

| - | |

| Gross profit (loss) | |

| (1 | ) | |

| - | | |

| 9 | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Research and development expenses | |

| 96 | | |

| 7 | | |

| 156 | | |

| 16 | |

| Sales and marketing expenses | |

| 103 | | |

| 2 | | |

| 157 | | |

| 2 | |

| General and administrative expenses | |

| 205 | | |

| 440 | | |

| 499 | | |

| 867 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating loss | |

| (405 | ) | |

| (449 | ) | |

| (803 | ) | |

| (885 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Change in fair value of convertible loans and

warrant liability | |

| 716 | | |

| 95 | | |

| (108 | ) | |

| 261 | |

| Financial (expenses) income, net | |

| (130 | ) | |

| 12 | | |

| (152 | ) | |

| (7 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net profit (loss) | |

| 181 | | |

| (342 | ) | |

| (1,063 | ) | |

| (631 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net profit (loss) attributable

to AppYea Inc. | |

| 181 | | |

| (342 | ) | |

| (1,063 | ) | |

| (631 | ) |

Profit

(loss) per Common Share | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| Diluted | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

Weighted

Average number of Common Shares Outstanding basic and diluted | |

| 453,450,254 | | |

| 234,943,286 | | |

| 416,858,606 | | |

| 230,272,456 | |

The

accompanying notes are an integral part of the financial statements.

APPYEA

INC.

CONDENSED

CONSOLIDATED STATEMENTS OF CHANGES IN DEFICIENCY

(U.S.

dollars in thousands except share data)

| | |

Number | | |

Amount | | |

Number | | |

Amount | | |

issued | | |

Paid

in Capital | | |

Deficit | | |

Total | | |

interests | | |

Deficiency | |

| | |

Preferred

Stock | | |

Common

Stock | | |

Shares

to be | | |

Additional | | |

Accumulated | | |

| | |

Non-controlling | | |

Total | |

| | |

Number | | |

Amount | | |

Number | | |

Amount | | |

issued | | |

Paid

in Capital | | |

Deficit | | |

Total | | |

interests | | |

Deficiency | |

| | |

Unaudited | |

| Balance

as of January 1, 2024 | |

| 258,745 | | |

| - | | |

| 328,836,657 | | |

| 31 | | |

| 559 | | |

| 3,197 | | |

| (6,326 | ) | |

| (2,539 | ) | |

| (14 | ) | |

| (2,553 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of Shares | |

| - | | |

| - | | |

| 60,143,100 | | |

| 6 | | |

| (220 | ) | |

| 597 | | |

| - | | |

| 383 | | |

| - | | |

| 383 | |

| Shares to be issued to service

providers | |

| - | | |

| - | | |

| - | | |

| - | | |

| 25 | | |

| - | | |

| - | | |

| 25 | | |

| | | |

| 25 | |

| Shares to be issued to investors | |

| - | | |

| - | | |

| - | | |

| - | | |

| 75 | | |

| - | | |

| - | | |

| 75 | | |

| - | | |

| 75 | |

| Share issuance upon conversion

of Preferred stock | |

| (28,147 | ) | |

| - | | |

| 42,217,500 | | |

| 4 | | |

| - | | |

| (4 | ) | |

| - | | |

| | | |

| - | | |

| - | |

| Share issuance upon conversion of Convertible notes | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Share issuance upon conversion of Convertible notes, shares | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares to be issued upon

warrant exercise | |

| - | | |

| - | | |

| - | | |

| - | | |

| 118 | | |

| | | |

| | | |

| 118 | | |

| | | |

| 118 | |

| Share issuance from of stock

payable | |

| - | | |

| - | | |

| 23,756,853 | | |

| 2 | | |

| (238 | ) | |

| 236 | | |

| - | | |

| - | | |

| - | | |

| - | |

| Shares to be issued | |

| - | | |

| - | | |

| - | | |

| - | | |

| 14 | | |

| - | | |

| - | | |

| 14 | | |

| - | | |

| 14 | |

| Options exercise | |

| | | |

| | | |

| 20,249,141 | | |

| 2 | | |

| | | |

| (2 | ) | |

| - | | |

| - | | |

| - | | |

| - | |

| option Issuance upon conversion

of debt to related party | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 338 | | |

| | | |

| 338 | | |

| | | |

| 338 | |

| Share based compensation

to investors | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 118 | | |

| - | | |

| 118 | | |

| | | |

| 118 | |

| Share based compensation | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 389 | | |

| | | |

| 389 | | |

| - | | |

| 389 | |

| Net

loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (1,063 | ) | |

| (1,063 | ) | |

| - | | |

| (1,063 | ) |

| Balance

as of June 30, 2024 | |

| 230,598 | | |

| - | | |

| 475,203,251 | | |

| 45 | | |

| 333 | | |

| 4,869 | | |

| (7,389 | ) | |

| (2,142 | ) | |

| (14 | ) | |

| (2,156 | ) |

| | |

Preferred

Stock | | |

Common

Stock | | |

Shares

to be | | |

Additional | | |

Accumulated | | |

| | |

Non-controlling | | |

Total | |

| | |

Number | | |

Amount | | |

Number | | |

Amount | | |

issued | | |

Paid

in Capital | | |

Deficit | | |

Total | | |

interests | | |

Deficiency | |

| | |

Unaudited | |

| Balance

as of January 1, 2023 | |

| 300,000 | | |

| - | | |

| 220,930,798 | | |

| 21 | | |

| 27 | | |

| 1,912 | | |

| (4,509 | ) | |

| (2,549 | ) | |

| (14 | ) | |

| (2,563 | ) |

| Share issuance upon conversion

of Convertible notes | |

| - | | |

| - | | |

| 19,390,359 | | |

| 1 | | |

| - | | |

| 242 | | |

| - | | |

| 243 | | |

| - | | |

| 243 | |

| Shares to be issued | |

| - | | |

| - | | |

| - | | |

| - | | |

| 47 | | |

| - | | |

| - | | |

| 47 | | |

| - | | |

| 47 | |

| Share based compensation | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 562 | | |

| - | | |

| 562 | | |

| - | | |

| 562 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (631 | ) | |

| (631 | ) | |

| - | | |

| (631 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance

as of June 30, 2023 | |

| 300,000 | | |

| - | | |

| 240,321,157 | | |

| 22 | | |

| 74 | | |

| 2,716 | | |

| (5,140 | ) | |

| (2,328 | ) | |

| (14 | ) | |

| (2,342 | ) |

APPYEA

INC.

CONDENSED

CONSOLIDATED STATEMENTS OF CHANGES IN DEFICIENCY

(U.S.

dollars in thousands except share data)

| | |

Preferred

Stock | | |

Common

Stock | | |

Shares

to be | | |

Additional | | |

Accumulated | | |

| | |

Non-controlling | | |

Total | |

| | |

Number | | |

Amount | | |

Number | | |

Amount | | |

issued | | |

Paid

in Capital | | |

Deficit | | |

Total | | |

interests | | |

Deficiency | |

| | |

Unaudited | |

| Balance

as of April 1, 2024 | |

| 230,598 | | |

| - | | |

| 431,697,257 | | |

| 41 | | |

| 657 | | |

| 3,719 | | |

| (7,570 | ) | |

| (3,153 | ) | |

| (14 | ) | |

| (3,167 | ) |

| Issuance of Shares | |

| | | |

| | | |

| | | |

| | | |

| (218 | ) | |

| 218 | | |

| | | |

| | | |

| | | |

| | |

| Options exercise | |

| | | |

| | | |

| 19,749,141 | | |

| 2 | | |

| | | |

| (2 | ) | |

| - | | |

| - | | |

| - | | |

| - | |

| Shares to be issued | |

| - | | |

| - | | |

| - | | |

| - | | |

| 14 | | |

| - | | |

| - | | |

| 14 | | |

| - | | |

| 14 | |

| Shares to be issued upon

warrant exercise | |

| | | |

| | | |

| | | |

| | | |

| 118 | | |

| | | |

| | | |

| 118 | | |

| - | | |

| 118 | |

| Share based compensation

to investors | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 118 | | |

| | | |

| 118 | | |

| - | | |

| 118 | |

| Share issuance from of stock

payable | |

| | | |

| | | |

| 23,756,853 | | |

| 2 | | |

| (238 | ) | |

| 236 | | |

| | | |

| | | |

| - | | |

| - | |

| Share based compensation | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 242 | | |

| | | |

| 242 | | |

| - | | |

| 242 | |

| option Issuance upon conversion of debt to related

party | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 338 | | |

| | | |

| 338 | | |

| | | |

| 338 | |

| Net

income | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 181 | | |

| 181 | | |

| - | | |

| 181 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance

as of June 30, 2024 | |

| 230,598 | | |

| - | | |

| 475,203,251 | | |

| 45 | | |

| 333 | | |

| 4,869 | | |

| (7,389 | ) | |

| (2,142 | ) | |

| (14 | ) | |

| (2,156 | ) |

| | |

Preferred

Stock | | |

Common

Stock | | |

Shares

to be | | |

Additional | | |

Accumulated | | |

| | |

Non-controlling | | |

Total | |

| | |

Number | | |

Amount | | |

Number | | |

Amount | | |

issued | | |

Paid

in Capital | | |

Deficit | | |

Total | | |

interests | | |

Deficiency | |

| | |

Unaudited | |

| Balance

as of April 1, 2023 | |

| 300,000 | | |

| - | | |

| 229,565,414 | | |

| 22 | | |

| 28 | | |

| 2,351 | | |

| (4,798 | ) | |

| (2,397 | ) | |

| (14 | ) | |

| (2,411 | ) |

| Balance | |

| 300,000 | | |

| - | | |

| 229,565,414 | | |

| 22 | | |

| 28 | | |

| 2,351 | | |

| (4,798 | ) | |

| (2,397 | ) | |

| (14 | ) | |

| (2,411 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Share issuance upon conversion

of Convertible notes | |

| - | | |

| - | | |

| 10,755,743 | | |

| - | | |

| | | |

| 83 | | |

| - | | |

| 83 | | |

| - | | |

| 83 | |

| Shares to be issued | |

| - | | |

| - | | |

| - | | |

| - | | |

| 46 | | |

| | | |

| - | | |

| 46 | | |

| - | | |

| 46 | |

| Share based compensation | |

| - | | |

| - | | |

| - | | |

| - | | |

| | | |

| 282 | | |

| - | | |

| 282 | | |

| - | | |

| 282 | |

| Net

loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| | | |

| - | | |

| (342 | ) | |

| (342 | ) | |

| - | | |

| (342 | ) |

| Net

income (loss) | |

| - | | |

| - | | |

| - | | |

| - | | |

| | | |

| - | | |

| (342 | ) | |

| (342 | ) | |

| - | | |

| (342 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance

as of June 30, 2023 | |

| 300,000 | | |

| - | | |

| 240,321,157 | | |

| 22 | | |

| 74 | | |

| 2,716 | | |

| (5,140 | ) | |

| (2,328 | ) | |

| (14 | ) | |

| (2,342 | ) |

| Balance

| |

| 300,000 | | |

| - | | |

| 240,321,157 | | |

| 22 | | |

| 74 | | |

| 2,716 | | |

| (5,140 | ) | |

| (2,328 | ) | |

| (14 | ) | |

| (2,342 | ) |

The

accompanying notes are an integral part of the financial statements.

APPYEA

INC.

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(U.S.

dollars in thousands)

| | |

2024 | | |

2023 | |

| | |

For

The six Months Ended | |

| | |

June

30, | |

| | |

2024 | | |

2023 | |

| | |

Unaudited | |

| Cash flows from operating

activities: | |

| | | |

| | |

| Net loss | |

| (1,063 | ) | |

| (631 | ) |

| Adjustments to reconcile

net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 12 | | |

| 12 | |

| Share based compensation | |

| 430 | | |

| 570 | |

| Change in fair value of

convertible loans and warrant liability and financial expenses, net | |

| 108 | | |

| (261 | ) |

| Financial expenses, net | |

| 152 | | |

| - | |

| Changes in operating assets

and liabilities: | |

| | | |

| | |

| Other accounts recivables | |

| 16 | | |

| (24 | ) |

| Inventory | |

| (1 | ) | |

| - | |

| Accounts payable | |

| (53 | ) | |

| 76 | |

| Accounts payables – related party | |

| (43 | ) | |

| 66 | |

| Net cash used in operating

activities | |

| (442 | ) | |

| (192 | ) |

| Cash flows from investing

activities: | |

| | | |

| | |

| Research and development expenses capitalization | |

| (78 | ) | |

| - | |

| Net cash used in investing activities | |

| (78 | ) | |

| - | |

| | |

| | | |

| | |

| Cash flows from financing

activities: | |

| | | |

| | |

Proceeds from issuance of

Common Stock

| |

| 456 | | |

| - | |

Proceeds on account of

Shares to be issued

| |

| - | | |

| 40 | |

Proceeds

from convertible Note received, net of issuance expenses

| |

| - | | |

| 141 | |

| | |

| | | |

| | |

| Net cash provided by financing activities | |

| 456 | | |

| 181 | |

| | |

| | | |

| | |

| Foreign exchange on Cash and cash equivalents | |

| - | | |

| 2 | |

Change

in cash and cash equivalents | |

| (64 | ) | |

| (9 | ) |

| Cash and cash equivalents at beginning of period | |

| 222 | | |

| 60 | |

| | |

| | | |

| | |

| Cash and cash equivalents at end of period | |

| 158 | | |

| 51 | |

| | |

| | | |

| | |

| Non-cash investing and financing

activities | |

| | | |

| | |

| Related partied debt conversion to option for

common stock | |

| 338 | | |

| - | |

The

accompanying notes are an integral part of the financial statements.

APPYEA

INC.

NOTES

TO THE FINANCIAL STATEMENTS

NOTE

1 - GENERAL

AppYea,

Inc. (“AppYea”, “the Company”, “we” or “us”) was incorporated in the State of South Dakota

on November 26, 2012 to engage in the acquisition, purchase, maintenance and creation of mobile software applications. The Company is

in the development stage with no significant revenues and no significant operating history. On November 1, 2021 the Company was redomiciled

in the State of Nevada.

The

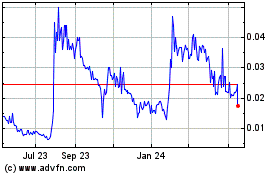

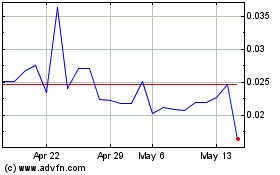

Company’s common stock is traded on the OTC Markets, OTCQB tier, under the symbol “APYP”.

SleepX

LTD is a company formed under the laws of the State of Israel and a wholly owned subsidiary of the Company (“SleepX”). SleepX

is a research and development company that has developed a proprietary product for monitoring and treating sleep apnea and snoring. The

technology is protected by several international patents and the Company started serial production in 2023. Subject to raising working

capital, of which no assurance can be provided, the Company intends to focus on further development and commercialization of its products.

SleepX

has incorporated, together with an unrelated third party, a privately held company under the laws of the State of Israel named Ta-nooma

Ltd. (“Ta-nooma”). Ta-nooma has developed sleeping monitoring technology for which patent applications were filed and has

no revenue from operations. Since its incorporation and as of the financial statements date, Sleepx holds 66.7% of the voting interest

of Ta-nooma.

Strategic

Development

The

company flagship product is AppySleep – A Biofeedback snoring treatment wristband, combined with the AppySleep App (“AppySleep”).

The

AppySleep product is currently in serial manufacturing and commercial stage. The new AppySleep IOS and Android versions were launched

during the third quarter of 2024. During the first 6 months of 2024 the company didn’t invest substantial capital in marketing

AppySleep in order to invest it once the IOS version will be available for download, since the company saw significant demand in the

US market for the AppySleep IOS version.

Financial

position

The

financial statements are presented on a going-concern basis. To date, the Company has not generated any significant revenues, suffered

recurring losses from operations, incurred negative cash flows from operating activities, and is dependent upon external sources for

financing its operations. As of June 30, 2024, the Company had an accumulated deficit of $7,389,000 and a stockholders’ deficiency

of $2,142,000. These matters raise substantial doubt about the Company’s ability to continue as a going concern. The Company intends

to continue to finance its operating activities by raising capital. There are no assurances that the Company will be successful in obtaining

an adequate level of financing needed for its long-term research and development activities on commercially reasonable terms or at all.

If the Company will not have sufficient liquidity resources, the Company may not be able to continue the development of its product candidates

or may be required to implement cost reduction measures and may be required to delay part of its development programs.

The

financial statements do not include any adjustments for the values of assets and liabilities and their classification that may be necessary

in the event that the Company is no longer able to continue its operations as a “going concern”.

APPYEA

INC.

NOTES

TO THE FINANCIAL STATEMENTS

NOTE

2 - SIGNIFICANT ACCOUNTING POLICIES

The

interim financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America

(“U.S. GAAP”). The interim financial statements do not include a full disclosure as required in annual financial statements

and should be read with the annual financial statements of the Company as of December 31, 2023 from which the accompanying condensed

consolidated balance sheet dated December 31, 2023, was derived. The accounting policies implemented in the interim financial statements

are consistent with the accounting policies implemented in the annual financial statements as of December 31, 2023, except of the following

accounting pronouncement adopted by the Company.

Recently

Issued Accounting Pronouncements

Effective

January 1, 2024, the Company adopted ASU 2020-06, “Debt – Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives

and Hedging – Contracts in Entity’s Own Equity (Subtopic 815-40)” (“ASU 2020-06”), which is intended to

address issues identified as a result of the complexity associated with applying GAAP for certain financial instruments with characteristics

of liabilities and equity. For convertible instruments, ASU 2020-06 reduces the number of accounting models for convertible debt instruments

and convertible preferred stocks, and enhances information transparency by making targeted improvements to the disclosures for convertible

instruments and earnings-per-share guidance on the basis of feedback from financial statement users. The adoption of this new accounting

guidance did not have an effect on the consolidated financial statements.

Effective

January 1, 2023, the Company adopted ASU 2016-13, “Financial Instruments-Credit Losses (Topic 326),” referred to herein as

ASU 2016-13, which significantly changes how entities will account for credit losses for most financial assets and certain other instruments

that are not measured at fair value through net income. ASU 2016-13 replaced the existing incurred loss model with an expected credit

loss model that requires entities to estimate an expected lifetime credit loss on most financial assets and certain other instruments.

Under ASU 2016-13 credit impairment is recognized as an allowance for credit losses, rather than as a direct write-down of the amortized

cost basis of a financial asset. The impairment allowance is a valuation account deducted from the amortized cost basis of financial

assets to present the net amount expected to be collected on the financial asset. Once the new pronouncement is adopted by the Company,

the allowance for credit losses must be adjusted for management’s current estimate at each reporting date. The new guidance provides

no threshold for recognition of impairment allowance. Therefore, entities must also measure expected credit losses on assets that have

a low risk of loss. For instance, trade receivables that are either current or not yet due may not require an allowance reserve under

current generally accepted accounting principles, but under the new standard, the Company will have to estimate an allowance for expected

credit losses on trade receivables under ASU 2016-13. The Company determined the adoption of this new accounting guidance and the effect

on its financial statements throughout the period until implementation, and have no impact on the financial statements.

APPYEA

INC.

NOTES

TO THE FINANCIAL STATEMENTS

NOTE

2 - SIGNIFICANT ACCOUNTING POLICIES (continued):

In

December 2023, the FASB issued ASU 2023-09 “Income Taxes (Topic 740): Improvements to Income Tax Disclosures” related to

improvements to income tax disclosures. The amendments in this update require enhanced jurisdictional and other disaggregated disclosures

for the effective tax rate reconciliation and income taxes paid. The amendments in this update are effective for fiscal years beginning

after December 15, 2024. The adoption of this pronouncement is not expected to have a material impact on the Company’s financial

statements.

Use

of Estimates in Preparation of Financial Statements

The

preparation of consolidated financial statements in conformity with U.S. GAAP accounting principles requires management to make estimates

and assumptions. The Company’s management believes that the estimates, judgments, and assumptions used are reasonable based upon

information available at the time they are made. These estimates, judgments and assumptions can affect the reported amounts of assets

and liabilities and disclosure of contingent assets and liabilities at the dates of the financial statements, and the reported amounts

of expenses during the reporting period. Actual results could differ from those estimates.

Revenue

Recognition

The

Company recognizes revenue under ASC 606, Revenue Recognition at the amount to which it expects to be entitled when control of the products

or services is transferred to its customers.

We

determine revenue recognition through the following steps: (1) identification of the contract with a customer; (2) identification of

the performance obligations in the contract; (3) determination of the transaction price; (4) allocation of the transaction price to the

performance obligations in the contract; and (5) recognition of revenue when, or as, a performance obligation is satisfied.

Our

contracts are typically governed by a customer purchase order. The contract generally specifies the delivery of what constitutes a single

performance obligation. If an arrangement involves multiple performance obligations, the items are analyzed to determine the separate

units of accounting, whether the items have value on a standalone basis and whether there is objective and reliable evidence of their

standalone selling price. The total contract transaction price is allocated to the identified performance obligations based upon the

relative standalone selling prices of the performance obligations. The standalone selling price is based on an observable price for services

sold to other comparable customers.

As

discussed in more detail below, revenue is recognized when a customer obtains control of promised goods or services under the terms of

a contract and is measured as the amount of consideration, we expect to receive in exchange for transferring goods or providing services.

We do not have any material extended payment terms, as payment is due at or shortly after the time of the sale. Sales, value-added and

other taxes collected concurrently with revenue producing activities are excluded from revenue.

A

contract liability is recognized as deferred revenue when we invoice customers, or receive customer cash payments, in advance of satisfying

the related performance obligation(s) under the terms of a contract. Deferred revenue is recognized as revenue when we have satisfied

the related performance obligation.

We

have one main revenue stream: wristband sales, with the AppySleep App. For this revenue stream, our performance obligations are satisfied

at a point in time, and therefore, revenue is recognized at point in time when a customer takes control of the good or asset created

by the service. Factors that may indicate transfer of control are when we have the right to receive payment for the good or service,

when the legal title of the asset has been transferred, physical possession of the asset has been transferred, the customer obtains the

APPYEA

INC.

NOTES

TO THE FINANCIAL STATEMENTS

NOTE

2 - SIGNIFICANT ACCOUNTING POLICIES (continued):

significant

risks and rewards of ownership of the asset, and the customer accepts the asset. For customers, control is transferred upon delivery.

We

leverage drop-ship shipments with our partners and suppliers to deliver wristbands to our customers without having to physically hold

the inventory at our warehouses, thereby increasing efficiency and reducing costs. We recognize revenue for drop-ship arrangements on

a gross basis as the principal in the transaction when the product is received by the customer because we control the product prior to

transfer to the customer. We also assume primary responsibility for the fulfillment in the arrangement, we assume inventory risk if something

were to happen to the hardware during shipping, we set the price of the product charged to the customer.

The

Company intend to recognize records reductions to Products net sales related to future product returns, price protection and other customer

incentive programs based on the Company’s expectations and historical experience. Currently, the returns are reduced from sales.

NOTE

3 - RELATED PARTY BALANCES AND TRANSACTIONS

A.

Short-term loans from related parties

During

2021, SleepX borrowed from Nexense Technologies USA. Inc., a Delaware corporation which is majority owned by Boris Molchadsky, the Company’s

Chairman. an aggregate amount of $47,623. According to the agreement, the loan shall be repaid in the event that the Company’s

profits are sufficient to repay the aggregate loan amount and upon such terms and in such installments as shall be determined by the

Board. The loan shall bear interest at an annual rate equal to the minimum rate approved by applicable law in Israel (5.18% in 2024).

During

2020, the minority shareholder of Ta-nooma advanced a loan to Ta-nooma in the amount of NIS 115,725. The loan does not carry any interest

expense and the repayment terms have yet to be determined. As of June 30, 2024, the loan balance amounted to NIS 115,725 ($30,786).

B.

Balances with related parties

SCHEDULE

OF BALANCE WITH RELATED PARTIES

| | |

June

30, 2024 | | |

December

31, 2023 | |

| | |

In

U.S. dollars in thousands | |

| | |

| | |

| |

| Liabilities: | |

| | | |

| | |

| Employees and payroll accruals | |

| 59 | | |

| 498 | |

| Related party payables | |

| 42 | | |

| 129 | |

| Short term loans | |

| 78 | | |

| 79 | |

APPYEA

INC.

NOTES

TO THE FINANCIAL STATEMENTS

NOTE

3 - RELATED PARTY BALANCES AND TRANSACTIONS (continued):

C.

Transactions with related parties

SCHEDULE OF TRANSACTION WITH RELATED PARTIES

| | |

2024 | | |

2023 | |

| | |

For

the six months ended June

30, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| | |

In

U.S. dollars in thousands | |

| Expenses: | |

| | | |

| | |

| Salaries and related cost (including

stock-based compensation in the amount of $330 and $526, respectively) | |

| 445 | | |

| 614 | |

| Management fees | |

| - | | |

| 90 | |

Both

the Chairman and the chief financial officer are directors in the Company and do not receive compensation for their directorship roles.

Company’s Bylaws provide that a director or officer shall be indemnified and held harmless by the Corporation, to the fullest extent

permitted by the laws of the State of Nevada.

NOTE

4 - CONVERTIBLE LOANS AND WARRANTS

The

following table summarizes fair value measurements by level as of June 30, 2024 and December 31, 2023 measured at fair value on a recurring

basis:

SCHEDULE OF FAIR VALUE RECURRING BASIS

| December

31, 2023 | |

Level

1 | | |

Level

2 | | |

Level

3 | | |

Total | |

| | |

U.S.

dollars in thousands | |

| Assets | |

| | | |

| | | |

| | | |

| | |

| None | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Liabilities | |

| | | |

| | | |

| | | |

| | |

Convertible Loans

At fair

value | |

| - | | |

| - | | |

| 1,203 | | |

| 1,203 | |

| Financial liability | |

| | | |

| - | | |

| 204 | | |

| 204 | |

| June 30,

2024 | |

Level

1 | | |

Level

2 | | |

Level

3 | | |

Total | |

| | |

U.S.

dollars in thousands | |

| Assets | |

| | | |

| | | |

| | | |

| | |

| None | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Liabilities | |

| | | |

| | | |

| | | |

| | |

Convertible Loans

At fair value | |

| - | | |

| - | | |

| 1,398 | | |

| 1,398 | |

APPYEA

INC.

NOTES

TO THE FINANCIAL STATEMENTS

NOTE

4 - CONVERTIBLE LOANS AND WARRANTS (cont.)

The

Convertible Loans changes consist of the following as of June 30, 2024 and December 31, 2023:

SCHEDULE OF CONVERTIBLE LOANS AT FAIR VALUE

| | |

June

30, 2024 | | |

December

31, 2023 | |

| | |

Convertible

Loans at Fair Value | |

| | |

June

30, 2024 | | |

December

31, 2023 | |

| | |

U.S.

dollars in thousands | |

| Opening Balance,

(including short term loans from related party which is also convertible) | |

| 1,203 | | |

| 2,257 | |

| Additional convertible loans

(a) | |

| - | | |

| 153 | |

| | |

| | | |

| | |

| Conversion of convertible

loan (b) | |

| - | | |

| (243 | ) |

| Decrease of notes purchased | |

| - | | |

| (530 | ) |

| Change

in fair value of convertible loans liability | |

| 195 | | |

| (434 | ) |

| Closing

balance | |

| 1,398 | | |

| 1,203 | |

The

estimated fair values of the Convertible loans were measured according to the Monte Carlo Model using the following assumptions

SCHEDULE

OF FAIR VALUES OF WARRANTS AND CONVERTIBLE LOAN ASSUMPTION USED

| | |

As of June 30, | | |

As of December 31, | |

| | |

2024 | | |

2023 | |

| Expected term (in years) | |

| 1.0 | | |

| 0.5 | |

| Expected average (Monte Carlo) volatility | |

| 197 | % | |

| 213 | % |

| Expected dividend yield | |

| - | | |

| - | |

| Risk-free interest rate | |

| 5.09 | % | |

| 5.26 | % |

| WACC | |

| 27 | % | |

| 27 | % |

*

During the quarter the company came to an agreement with the holder of certain loans to extend the maturity date of the loans and the

standstill conversion period to June 30, 2025. In exchange for the extension, the lender was granted a two-year option to purchase five

million shares, at an exercise price of $0.0001. The company recorded $117,580 in expenses for the option grant.

APPYEA

INC.

NOTES

TO THE FINANCIAL STATEMENTS

NOTE

4 - CONVERTIBLE LOANS AND WARRANTS (cont.)

The

following table summarizes information relating to outstanding and exercisable warrants as of December 31, 2023:

SUMMARIZES RELATING TO OUTSTANDING AND EXERCISABLE WARRANTS

| Warrants

Outstanding and Exercisable | | |

| |

| Number of | | |

Weighted Average Remaining | | |

Weighted Average | | |

Valuation as of | |

| Warrants | | |

Contractual

life (in years) | | |

Exercise

Price | | |

December

31, 2023 | |

| | 8,334 | | |

| 2.16 | | |

| 0.6 | | |

$ | 23 | |

| | 32,500 | | |

| 2.61 | | |

| 0.6 | | |

$ | 116 | |

| | 7,000,000 | | |

| 0.46 | | |

| 0.015 | | |

$ | 203,718 | |

The

following table summarizes information relating to outstanding warrants as of June 30, 2024:

| Warrants

Outstanding | | |

| |

| Number of | | |

Weighted Average Remaining | | |

Weighted Average | | |

Valuation as of | |

| Warrants | | |

Contractual

life (in years) | | |

Exercise

Price | | |

June

30, 2024 | |

| | | | |

| | | |

| | | |

| | |

| | 8,334 | | |

| 1.91 | | |

| 0.6 | | |

$ | 23 | |

| | 32,500 | | |

| 2.36 | | |

| 0.6 | | |

$ | 116 | |

At

the end of the second quarter the 7,000,000 warrants of Plutus were converted into 4,989,494 shares, with value of $117,752 according

to closing price on 06.30.2024. (Note 7 in the consolidated financial statements as of December 31, 2023). The change in the fair value of the warrant during the six months ended 6.30.2024 was recorded in Change

in fair value of convertible loans and warrant liability.

The

Convertible Loans at amortized cost changes consist of the following as of June 30, 2024 and December 31, 2023:

SCHEDULE

OF CONVERTIBLE LOANS AMORTIZED COST

| | |

June

30, 2024 | | |

December

31, 2023 | |

| | |

U.S.

dollars in thousands | |

| Opening balance | |

| 796 | | |

| - | |

| Transition from convertible loans measured

at fair value to measurement at amortized cost | |

| - | | |

| 530 | |

| Beneficial conversion feature | |

| - | | |

| (66 | ) |

| Financial expenses related to transition

from fair value measurement to amortized cost | |

| - | | |

| 304 | |

| Accrued interest

through profit or loss | |

| 30 | | |

| 28 | |

| Closing balance | |

| 826 | | |

| 796 | |

APPYEA

INC.

NOTES

TO THE FINANCIAL STATEMENTS

NOTE

5 - STOCK BASED COMPENSATION

| A. | The

table below depicts the number of options granted to employees and service providers: |

SCHEDULE

OF NUMBER OF OPTIONS

| | |

Six

months ended June 30, 2024 | |

| | |

| | |

Weighted

average exercise price | |

| | |

Number

of options | | |

in

USD | |

| | |

| | |

| |

| Options outstanding at January 1, 2024 | |

| 61,849,647 | | |

$ | 0.0007 | |

| Options granted during the period | |

| 18,900,000 | | |

$ | 0.0016 | |

| Options purchased during the period (Note 6B) | |

| 6,959,685 | | |

$ | 0.0001 | |

| Options exercised during

the period* | |

| (20,296,548 | ) | |

$ | 0.0001 | |

| Options outstanding

at the end of period | |

| 67,412,785 | | |

$ | 0.0011 | |

| Options exercisable

at the end of period | |

| 30,794,094 | | |

$ | 0.0015 | |

For

the three months ended June 30, 2024 and 2023 the company recognized expenses, to such options, in the amount of $361,005 and $147,000,

respectively. The expense is non-cash stock-based compensation expense resulting from options awards to the Chief Executive Officer,

Chief Financial Officer and advisors The expense represents the aggregate grant date fair value for the option awards granted and vested

during the fiscal years presented, determined in accordance with FASB ASC Topic 718.

APPYEA

INC.

NOTES

TO THE FINANCIAL STATEMENTS

NOTE

6 - SIGNIFICANT EVENTS DURING THE PERIOD

| A. | On

May 13, 2024, Mr. Neil Kline announced his resignation from the board of directors of the Company. Contemporaneously, Mr. Kline

signed an advisor agreement with the company to serve as an advisor of the Board, and provide services related to the development of

company future products, creating marketing tools for company needs, and assist with filings and projects of the company. As

consideration for his Services, the company will issue to Consultant three million (3,000,000)

shares of Company common stock par value $0.0001

per share, which shall vest as follows, subject to the continued provision of services by the Consultant: (i)

750,000 upon execution of the agreement, and the balance of 2,250,000 shares in four (4) equal monthly instalment of 562,500 shares,

beginning with the quarter ending September 30, 2024. The Company recognized during the

quarter an expense of $14,175

for the first issuance of shares. |

| B. | On

May 14, 2024, the Board of the Company (the “Board”) approved the conversion of outstanding amounts owed to its officers

and directors for unpaid compensation for options of the Company’s common stock, as follows: Boris Molchadsky, the Company

chairman, and Asaf Porat, the Company CFO, agreed to convert a portion of their unpaid compensation into options for shares of the

Company’s common stock at a per share conversion rate of $0.07

and $0.04,

respectively, and Adi Shemer, the Company CEO, has agreed to convert the entire unpaid compensation to him into options for shares

of the Company’s common stock at per share conversation rate of $0.04,

in each case under a Company compensation Plan to be approved by the Company and its shareholders and qualified under Sections 102

and 3(i) of the Israeli tax authorities (such being the “Qualified Equity Interests”). There remains outstanding unpaid

compensation to each of Mr. Molchadsky and Porat in the amount of $70,000

and $50,000,

respectively. It was agreed that the unpaid compensation which was not converted would be paid in 20 equal monthly instalments,

subject to payment of payroll, social security and other taxes, commencing on the 30th day following the earlier to occur of (i) the

closing of an equity raise by the Company with proceeds to the Company of at least $1.5

million, (ii) the completion of seven consecutive (7) months positive cash flow for the Company in such amount as will allow the

Company to cover its operating expenses and (iii) termination of employment by the Company of for any reason other than cause. As of

April 1, 2024 the Company converted the outstanding amounts of $338,023

related to its officers and directors and issued 6,959,685

options, which are exercisable with an exercise ratio of 1:1. |

| C. | In

addition, the Board approved the issuance of stock option to purchase 6,000,000 shares of

the Company’s common stock, at a per share exercise price of $0.0001, to Adi Shemer,

the Company CEO. Under his terms of his employment agreement, Mr. Shemer is entitled to these

options following the issuance by the Company of at least 100 million shares of common stock

in respect of third-party investments in the Company, which was satisfied in February 2024.

The options will vest in full on July 1, 2024. For the six-month ended June 30, 2024 the

Company recorded an expense related to the issuance of $197,966. |

| |

D. |

On August 11, 2022, a lawsuit

was filed in the Tel Aviv Magistrate’s Court against our Chairman and majority shareholder, Boris Molchadsky, G.P.I.S Ltd., an

entity controlled by Mr. Molchadsky, Nexsense, Inc. (the former shareholder of SleepX Ltd.) and SleepX, Ltd., our subsidiary (collectively,

the “Defendants”) [Civil lawsuit number 25441-08-22]. The suit was filed by a fund operating out of Israel. A copy of the

claim was served to the defendants only six months after it was submitted to court, on February 21, 2023. The lawsuit is based on the

alleged breach of partnership and loan agreements as well as other related allegations, including violation of agreements reached in

a mediation proceeding that took place in 2015. On July 24, 2023, the Defendants (except for Nexsense, Inc.) filed a statement of defense,

denying the allegations and argued that the claim should be dismissed, due to the statute of limitations, lack of cause of action,

lack of jurisdiction, delay in filing the claim, and respecting SleepX, also due to the lack of legal rivalry between SleepX and the

plaintiff. |

Recently,

the Magistrate’s Court in Tel Aviv accepted the request regarding lack of material jurisdiction, and the claim was then transferred

to the economic department of the District Court in Tel Aviv.

A

preliminary hearing was held on February 14, 2024. The presiding judge did not rule on the preliminary pleadings and urged the parties

to attempt mediation before the ruling. The parties are considering different mediators

(which must be mutually agreed to) and following the selection of a mediator, the parties will schedule a date for the mediation.

APPYEA

INC.

NOTES

TO THE FINANCIAL STATEMENTS

NOTE

6 - SIGNIFICANT EVENTS DURING THE PERIOD (continued):

The

Company cannot, at this stage, know the effects, if any, of these actions on its subsidiary SleepX and / or the Company, and accordingly,

no provision was recorded.

NOTE

7 - SUBSEQUENT EVENTS

| A. | During

July 2024 the Company uploaded its newly developed cloud-based app to Google Play and Apple

Store. |

| B. | In

July 2024, the Company agreed to change the employment terms of its CFO to part-time and decrease the salary and future options

he’s entitled to. The CFO exercised 5,449,686

vested options into 5,422,438

shares in a cashless mechanism. |

| C. | On

August 4, 2024, the Company engaged with a shareholder of the company in a consulting agreement

with a monthly cash payment of NIS 60,000 (Approximately $15,790) of which NIS 20,000 per

month to be paid at the discretion of the Company’s Chief Executive Officer based on

the Company’s then cash flow requirements. The shareholder and Company agreed that

if the shareholder were to purchase from Plutus the notes held by it (Note 7 in the consolidated

financial statements as of December 31, 2023) then the shareholder shall have the option,

in the exercise of its discretion, to adjust the per share conversion price to $0.006 or

retain current terms. |

On

August 7, 2024, the Board approved the issuance of a stock option to purchase 6,000,000

shares of the Company’s common stock, at a per share exercise price of $0.0001,

to Adi Shemer, the Company Chief Executive Officer. The options will vest in full on June 30, 2025. In addition, on August 7, 2024,

the Board also approved the issuance of options for an additional 10

million shares to Mr. Shemer, as a bonus for his contribution to the business. The options are exercisable at a per share purchase

price of $0.0001.

In addition, the Board approved the issuance of a

stock option to purchase 1,000,000 shares of the Company’s common stock, at a per share exercise price of $0.0001, to Mr. Ron Mekler,

the company independent board member, and issuance at the same terms of issuance of a stock option to purchase 500,000 of the Company’s

common stock to Mr. Tal Weitzman, the company software solutions service provider.

The Board also confirmed the issuance of

4,989,494 shares to Plutus (Note 4).

The Board confirmed changing the exercise

price of the 500,000 stock options issued to Mr. Neil Kline and Mr. Ron Mekler in August 2023 from $0.01 to $0.0001.

| ITEM

2. |

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Forward-looking

Statements

This

Quarterly Report on Form 10-Q contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform

Act of 1995 and other Federal securities laws, and is subject to the safe-harbor created by such Act and laws. In some cases, you can

identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,”

“intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,”

“potential” or “continue,” the negative of such terms, or other variations thereon or comparable terminology.

The statements herein and their implications are merely predictions and therefore inherently subject to known and unknown risks, uncertainties,

assumptions and other factors that may cause actual results, performance levels of activity, or our achievements, or industry results

to be materially different from those contemplated by the forward-looking statements. Except as required by law, we undertake no obligation

to release publicly the result of any revision to these forward-looking statements that may be made to reflect events or circumstances

after the date hereof or to reflect the occurrence of unanticipated events. Further information on potential factors that could affect

our business is described under the heading “Risk Factors” in our annual report on Form 10-K for the year ended December

31, 2023 as filed with the Securities and Exchange Commission, or the SEC, on April 1, 2024, as subsequently amended. As used in this quarterly report, the terms

“we”, “us”, “our”, the “Company” and “AppYea” mean AppYea, Inc. and our wholly-owned

subsidiaries Sleepx LTD and Ta-Nooma LTD unless otherwise indicated or as otherwise required by the context.

Overview

AppYea,

Inc. is a digital health company, focused on the development of accurate wearable monitoring solutions to monitor and treat sleep apnea

and snoring and fundamentally improve quality of life.

Our

solutions are based on our proprietary intellectual property portfolio comprised of Artificial Intelligence (AI) and sensing technologies

for the tracking, analysis, and diagnosis of vital signs and other physical parameters during sleep time, offering extreme accuracy at

affordable cost.

AI

is a broad term generally used to describe conditions where a machine mimics “cognitive” functions associated with human

intelligence, such as “learning” and “problem solving. Basic AI includes machine learning, where a machine uses algorithms

to parse data, learn from it, and then make a determination or prediction about a given phenomenon. The machine is “trained”

using large amounts of data that provide it with the ability to learn how to perform the task.

General

Background

Snoring

is a general disorder caused due to repetitive collapsing and narrowing of the upper airway. Individuals with snoring problems are at

increased risk of accidental injury, depression and anxiety, heart disease and stroke. Currently available treatments include surgical

and non-surgical devices.

According

to Fior Markets, a market intelligence company, the Global Anti-Snoring Treatment Market is expected to grow from USD 4.3 billion in

2020 to USD 8.6 billion by 2028, with a 9.07% CAGR between 2021 and 2028. While North America had the largest market share of 28.12%

in 2020, Asia-Pacific region is witnessing significant growth due to the increasing prevalence of obesity and sedentary lifestyles in

emerging economies.

Currently

available anti-snoring devices consist mainly of oral appliances that are recommended for use by patients suffering from snoring or obstructive

sleep apnea. These appliances are put before sleep and have a simple function of pushing either the lower jaw or the tongue forward.

This keeps the epiglottis parted from the uvula and prevents the snoring sound created by the vibration of soft tissues of palate.

Sleep

apnea is a severe sleep condition in which individuals frequently stop breathing in their sleeping, this leads to insufficient oxygen

supply to the brain and the rest of the body which, in turn may lead to critical problems. There are three main types of apnea: (i) Obstructive

Sleep Apnea (“OSA”), the most common form caused by the throat muscles relaxing during sleep; (ii) Central sleep apnea, which

occurs when the brain doesn’t send the proper signals to the muscles that control the breathing; and (iii) complex sleep apnea

syndrome, which occurs when an individual suffers from both OSA and central sleep apnea. While OSA is a common disorder in the elderly

population, affecting approximately 13 to 32% of people aged over 65, sleep apnea can occur at any age and affects approximately 25%

of men and nearly 10% of women.

In

2020, North America dominated the sleep apnea device market, as it accounted for 49% of the revenue, the global market size was valued

at USD 3.7 billion and is expected to expand by 6.2% CAGR, according to a report by Grand View Research Inc., reaching USD 6.1 billion

by 2028.

The

global sleep apnea and snoring market is driven in large part by solutions that can be applied in at home-settings or healthcare settings,

as these tools will drive decisions regarding specific treatments and the associated outlays. However, despite advances in medical imaging

and other diagnostic tools, misdiagnosis remains a common occurrence. We believe that improved diagnoses and outcomes are achievable

through the adoption of AI-based decision support tools.

Our

Products and Product Candidates

Our

initial focus is on the development of supporting solutions utilizing our proprietary platform. Our current business plan focuses on

two principal devices and an App currently in development:

AppySleep

– Biofeedback snoring treatment wristband, combined with the AppySleep App.

The

AppySleep app uses unique algorithms developed by SleepX combined with sensors to monitor physiological parameters during sleep. Based

on real-time reactions, the wristband will vibrate, when necessary, in order to decrease the snoring and regulate breathing by gently

bringing the user to change his sleep position and thus ceasing the snoring event.

The

AppySleep product is currently in serial manufacturing stage and sales. The new AppySleep IOS and Android versions were launched during

the third quarter of 2024.

AppySleep

LAB – Is a medical application, intended for downloading on a smartphone, and used to monitor breathing patterns in the sleep

and identify sleep apnea episodes without direct contact to the user.

The

AppySleep LAB product is to begin final calibration, following which we will file for 510(k) FDA approval.

AppySleep

PRO – is a wristband for the treatment of sleep apnea using biofeedback in combination with AppySleep LAB app. The unique algorithms

of AppySleep LAB, combined with the wristband sensors, monitor sleep apnea events and additional physiological parameters during sleep,

and when necessary, the wristband vibrates according to real time events, in order to decrease and cease sleep apnea events.

The

AppySleep PRO and AppySleep LAB are currently in development stages, following which it would be ready to begin the testing stage in

preparation for filing for FDA approval.

Our

Strategy

We

started marketing of the AppySleep app and wristband in the first quarter of 2024. Concurrently, we plan to file a 510(k) FDA submission

for the AppySleep LAB app for the non-contact diagnosis of sleep apnea during 2025, and an FDA process for AppySleep PRO for the treatment

of sleep apnea during 2026.

Our

goal over the next five years is to establish our technology and related products as the gold standard for the targeted sectors. The

key elements of our strategy are as follows:

Develop

and expand a balanced and diverse pipeline of products and product candidates. Our core platform technologies will include innovative

anti-snoring and sleep apnea related devices and product candidates in various development and clinical stages. We plan to add products

and product candidates to our pipeline by expanding our technologies being developed to additional indications and through investing

in new technologies, products and product candidates. By maintaining this multi-product approach, we aim to provide a broad and comprehensive

product offering, which we believe will result in multiple value inflection events, reduced risks to our potentially business associated

with a particular product or product candidate and increased return on investment. Furthermore, product candidates that we develop may

create attractive collaboration opportunities with diagnostics, medical devices and medical supplies companies.

Maintain

a global, diverse network of specialists to accelerate knowledge synergies and innovation. We will utilize a global network of specialists

to identify large and growing patient populations with significant unmet needs, evaluate and prioritize potential technologies, assist

in designing development plans and diagnostic protocols and determine potential indications of our platform technologies to our target

patient populations in various territories. We believe that maintaining this diverse network of specialists and industry specialists

will allow us to continue to maximize knowledge and cost synergies, utilize shared commercial infrastructure across products, reduce

risks of development and commercialization delays to our overall business and leverage our current and future platform technologies and

technologies for additional products and product candidates.

Establish

distribution channels to maximize the commercial potential of our products. We plan to seek out collaborative arrangements with major

healthcare providers and consumer specialists to facilitate market adoption of our product candidates. We believe that such institutions

are well positioned to directly benefit from improvements in accurate diagnosis and reduction of cost of care associated with the use

of our product candidates. We also believe that the marginal cost of our product candidates compared to potential savings will make it