SSE Fiscal Year 2021 Pretax Profit Soared on Disposals -- Update

May 26 2021 - 2:24AM

Dow Jones News

--SSE's bottom-line profit surged last year, driven by

exceptional gains from asset disposals

--Underlying performance offset the coronavirus hit and was in

line with expectations

--Renewable power generation fell 11% on adverse weather

By Jaime Llinares Taboada

SSE PLC on Wednesday reported an improved profit for the fiscal

year, reflecting exceptional gains on disposals that more than

offset the negative impact of the coronavirus pandemic.

The Scotland-based power-generation and networks company made a

pretax profit of 2.52 billion pounds ($3.56 billion) for the year

to March 31, up from GBP587.6 million for fiscal 2020.

The continuing disposal program of noncore assets delivered

GBP877.6 million of exceptional net gains in the period, and more

than GBP1.4 billion of cash proceeds to date, SSE said.

Adjusted operating profit rose 1% to GBP1.51 billion, broadly in

line with the GBP1.52 billion market consensus--taken from FactSet

and based on nine analysts' forecasts. This included a GBP170

million hit related to the coronavirus pandemic, toward the lower

end of the guided range.

SSE posted a 25% adjusted operating profit drop for its local

distribution networks' segment to GBP267.3 million, and a GBP24.0

million loss for the business energy unit. The transmission

infrastructure division's earnings were broadly flat on year.

Adjusted operating profit from the renewables division jumped 29%

on disposal gains, even although green power generation declined

11% on adverse weather conditions.

The thermal division--which includes mainly gas-fired

stations--had a strong performance in the year, SSE said, with

electricity output up 1.6% and earnings up 5.1% at GBP160.5

million.

"In 2020-21 we have proven the underlying resilience of our

business model, continued to simplify our business mix to sharpen

our net zero focus and realise value, and developed highly

attractive growth opportunities," Chief Executive Alistair

Phillips-Davies said.

The FTSE 100 group intends to recommend a final dividend of 56.6

pence a share, bringing the full-year distribution to 81.0

pence--up from 80.0 pence a year earlier and in line with the

five-year dividend plan.

For fiscal 2022, SSE didn't provide guidance but said it expects

the impact from the Covid-19 to be mainly restricted to its

enterprise and business energy unit.

In addition, the company said it expects to complete the

disposals of its contracting and rail assets by the end of June,

and the gas production assets by the end of calendar 2021. It also

expects to start a disposal process for its interest in

gas-distribution firm SGN during this summer.

Write to Jaime Llinares Taboada at jaime.llinares@wsj.com;

@JaimeLlinaresT

(END) Dow Jones Newswires

May 26, 2021 03:16 ET (07:16 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

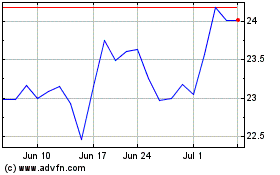

SSE (PK) (USOTC:SSEZY)

Historical Stock Chart

From Feb 2025 to Mar 2025

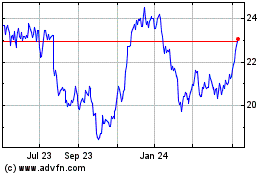

SSE (PK) (USOTC:SSEZY)

Historical Stock Chart

From Mar 2024 to Mar 2025