Gemfields Resources Plc

Final results for the year ended 30 June 2008

21 December 2007

Gemfields Resources Plc ("Gemfields" or "the Company", Ticker "GEM") is pleased

to report its final results for the year ended 30 June 2008.

Highlights

* Acquisition of the Kagem Emerald Mine

* Raising of �30,000,000 through the placing of 66,666,667 ordinary shares

* Increase in mining capacity.

The Chairman's Statement and the primary financial statements are set out

below. The full financial statements have been sent to shareholders and they

can also be viewed on the company's website at www.gemfields.co.uk.

Enquiries:

Gemfields +44 (0)20 7016 9416

Richard James, CFO richard.james@gemfields.co.uk

Canaccord Adams Limited

Mike Jones/Tarica Mpinga +44 (0)20 7050 6500

Chairman's statement

__________________________________________________________________________________________

Dear Shareholder,

Welcome to the consolidated financial statements for Gemfields Resources PLC

("the Company"). A great deal has been achieved in the year ended 30 June 2008.

Highlights

* Acquisition of the Kagem Emerald Mine

* Raising of �30,000,000 through the placing of 66,666,667 ordinary shares

* Increase in mining capacity.

Acquisitions

* Kagem Emerald Mine

On 5 June 2008 Gemfields acquired a group of companies from Rox Limited ("Rox",

a Pallinghurst Resources portfolio company) giving it control over a 75%

interest in the Kagem emerald mine in Zambia. The Kagem mine is the largest

emerald mine in Zambia and one of the most attractive emerald operating assets

in Africa, having produced 6.5 million carats pa in the last three years.

Rox also granted to Gemfields an option to acquire a portfolio of in excess of

15 licences and licence applications for gemstone exploration in Madagascar

held through its subsidiary Oriental Mining S.a.r.l. This option has since been

exercised by the Company.

In addition, Faberg� Limited, another Pallinghurst Resources portfolio company,

granted Gemfields an option to acquire a worldwide and exclusive 15 year

licence to use the Faberg� brand name in respect of coloured gemstones

(excluding diamonds). This option has also now been exercised.

Under the Kagem transaction, Gemfields acquired Greentop International Inc.

("Greentop") (a BVI company) and Krinera Group SA ("Krinera") (a Panamanian

company), the holding companies through which Rox's interest in the Kagem mine

is held (via intermediate holding companies). In consideration for the

acquisition of Greentop and Krinera and the grant of the options, Gemfields

issued to Rox 137,910,340 new ordinary shares in the Company which constituted

56% of Gemfields' issued share capital after implementation of the transaction.

Kagem has a long and demonstrated history of producing high quality emeralds

and Gemfields believes that its production levels can be significantly

improved. Kagem has in excess of 350 employees and a modern processing plant.

While Kagem's licence area is extensive and includes five emerald bearing

belts, production to date has focused on a single pit known as "FF-F10" which

lies on the Fwaya-Fwaya belt.

* Jagoda Pink Tourmaline Mine

The option to acquire Jagoda expired on 31 March 2008. Exploration had been

carried out throughout the period of the option but the results proved

inconclusive as to whether it would be possible to establish a commercially

viable operation at the mine. Gemfields therefore decided not to exercise the

option and the US$100,000 paid for it has been written off in the financial

statements.

Placing of Shares

At the same time as the Kagem acquisition, the Company raised a further �

30,000,000 with a placing of 66,666,667 ordinary shares at �0.45 per share to

institutional investors.

Operations

* Mbuva-Chibolele Emerald Mine

The directors decided to cease production at Mbuva-Chibolele from the end of

the first quarter of 2008. It was decided that all mining management and staff

resources and also machinery should be devoted to Kagem for the time being

given its proven history of production which suggests that greater yields will

be achieved.

The intention is possibly still to return to Mbuva-Chibolele at some stage in

the future. The directors anticipate that the selling prices of emeralds could

improve over time as a result of Gemfields' overall marketing and coloured

gemstone strategy and this could make Mbuva-Chibolele profitable. However,

given that no time-frame can be predicted as yet with regards to a return to

production at this mine, it has been decided to provide for the full amount of

the Mbuva-Chibolele asset in the financial statements.

* Kamakanga Emerald Mine and NRERA Prospecting Licences

With the Group's emerald focus turning to Kagem for the foreseeable future, in

terms of both operations and exploration, it has been decided to also fully

write off the Kamakanga Mine and the NRERA prospecting licences in the

financial statements.

* Kariba Amethyst Mine

Production at Kariba has continued throughout the period although it has been

lower than previous years. However the privatisation agreement to purchase a

further 26% of the joint venture remains unsigned by the Government of Zambia.

The Group has requested an explanation regarding the delay and will make a

decision on Kariba's future once this has been received.

* Kagem

Gemfields was awarded a management contract by Hagura Mining Ltd ("Hagura") on

1 November 2007 to manage and operate Kagem in advance of the acquisition.

Hagura is the direct owner of the Kagem mine.

Several steps were taken during the year to improve operations at Kagem

including the following:

* A mining contract was awarded to speed up the removal of a backlog in

waste;

* The in-house mining machinery has undergone a major overhaul to increase

capacity;

* Mining capacity has already risen significantly by the use of Gemfields

equipment from the Mbuva-Chibolele operation;

* Management has been revamped and strengthened. Staffing levels in various

departments have been rationalised in numbers and skills by recruitment,

promotions and terminations;

* The security department has undergone a complete revamp with the

introduction of expatriate security personnel;

* An infrastructure upgrade on the mine is in progress with additional

buildings, a training centre for personnel and various facilities being

erected;

* Exploration drilling is in progress to further define the resources of the

FF-F10 pit and other prospects.

* An upgrade of the treatment plant has taken place to increase its capacity.

Result

No emerald sales took place during the period. This decision was taken by the

directors in order to build up a larger inventory of emeralds than what was

offered at previous sales.

The result for the year has been adversely affected by the impairment of

Mbuva-Chibolele, Kamakanga, the NRERA prospecting licences and the Jagoda

option. The lack of sales during the period is due to the directors' decision

to build up a larger inventory of emeralds as explained above. The decrease in

production costs compared to the prior year was due to the scaling down and

then ceasing of operations at Mbuva-Chibolele. The increase in corporate costs

was due to the Group's expanding infrastructure and the acquisition of Kagem.

Tanzanite One Limited

Subsequent to the year end, Gemfields began a stakebuilding exercise in

Tanzanite One Limited (T1). The exercise saw Gemfields purchase 11,668,330

shares in T1. This was funded by the placing of 14,712,143 new Gemfields shares

at a price of 29p per share to Rox Limited.

The stakebuilding exercise culminated in a tender offer for 30,754,970 T1

shares on 21 October 2008. The offer was oversubscribed within four days of its

announcement but not all conditions of it were satisfied so the offer lapsed.

Gemfields has no current intention of making any revised or further offer for

T1.

Outlook

* The anticipated quality of the Kagem resource is expected to improve the

performance of Gemfields.

* Exploration drilling at the Kagem property has produced encouraging

preliminary results.

* Subsequent to year end, the Company has opened its new cutting and

polishing facility in Jaipur, India. The higher quality emeralds from Kagem

will be processed here with the first parcel having already been sent.

* The Company also plans to actively pursue its strategy of integrating the

supply chain and improving the marketing of coloured gemstones during the

coming year. It is anticipated that these efforts will increase the selling

prices achieved for coloured gemstones significantly therefore enhancing

Gemfields' margins.

* Negotiations are continuing for further acquisitions as Gemfields looks to

expand into other coloured gemstones.

Graham Mascall

19 December 2008

Gemfields Resources PLC

Consolidated income statement

for the year ended 30 June 2008

Note 2008 2007

US$'000 US$'000

Revenue - 1,796

Mining and production costs (3,024) (5,865)

________ ________

Gross loss (3,024) (4,069)

Other operating income 739 186

Administrative expenses

Impairment 25 (19,500) -

Depreciation 9 (3,002) (1,520)

Other administrative expenses (6,370) (2,323)

Total Administrative expenses (28,872) (3,843)

________ ________

Loss from operations 3 (31,157) (7,726)

________ ________

Finance income 5 935 763

Finance expenses 5 (419) -

Share of loss in joint venture - (188)

________ ________

Loss before taxation (30,641) (7,151)

________ ________

Tax credit/(expense) 6 433 (116)

________ ________

Loss for the year (30,208) (7,267)

________ ________

Attributable to:

Equity shareholders of the parent (29,330) (7,267)

Minority interest (878) -

________ ________

(30,208) (7,267)

________ ________

Loss per share

Basic and diluted 7 US$(0.25) US$(0.07)

All amounts relate to continuing

activity.

Gemfields Resources PLC

Consolidated balance sheet

at 30 June 2008

Note 2008 2007

US$'000 US$'000

Non-current assets

Intangible assets 8 - 12,461

Property, plant and equipment 9 268,663 9,713

________ ________

268,663 22,174

________ ________

Current assets

Inventory 11 7,500 2,190

Trade and other receivables 12 1,151 1,051

Cash and cash equivalents 48,078 9,836

________ ________

Total current assets 56,729 13,077

________ ________

Total assets 325,392 35,251

________ ________

Non-current liabilities

Deferred taxation 16 (90,827) (177)

Other non-current liabilities 13 (17,039) -

________ ________

(107,866) (177)

Current liabilities

Trade payables 15 (2,275) (606)

Current tax 15 (329) (11)

Other current liabilities 15 (4,140) ( 1,727)

________ ________

(6,744) (2,344)

________ ________

Total liabilities (114,610) (2,521)

________ ________

________ ________

Total net assets 210,782 32,730

________ ________

Capital and reserves attributable to

equity holders of the parent

Share capital 17 5,904 1,871

Share premium 89,686 33,776

Merger reserve 121,005 10,500

Option reserve 1,111 858

Cumulative translation reserve (7) (7)

Retained earnings (43,568) (14,268)

________ ________

174,131 32,730

Minority interests 36,651 -

________ ________

Total equity 210,782 32,730

________ ________

Gemfields Resources PLC

Consolidated cash flow statement

for the year ended 30 June 2008

Note 2008 2007

US$'000 US$'000

Cash flows from operating activities

Loss for the year (30,208) (7,267)

Depreciation 9 3,002 729

Amortisation - 792

Share-based payments 283 415

Gain on sale of property, plant and - (186)

equipment

Finance income (935) (763)

Finance expense 419

Share of loss in joint venture - 188

Tax expense/(credit) (433) 116

Impairment of property, plant and 9 6,708 -

equipment

Impairment of intangible assets 8,25 12,514 -

Impairment of inventory 278 -

(Increase)/Decrease in trade and other 136 (317)

receivables

Increase/(Decrease) in trade and other (8,293) (367)

payables

(Increase)/Decrease in inventory (2,159) (2,178)

________ ________

Net cash outflow from operating (18,688) (8,838)

activities

Cash flows from investing activities

Acquisition of subsidiary, net of cash 18 (22) -

Interest received 260 524

Purchase of property, plant and (737) (979)

equipment

Sale of property, plant and equipment - 290

Purchase of intangible assets (50) (50)

Exploration and development expenditure (3) (145)

________ ________

Net cash outflow used in investing (552) (360)

activities

Cash flows from financing activities

Issue of ordinary shares (net of issue 57,227 5,918

costs)

Exercise of share options - 4

Finance expense (419) -

________ ________

Net cash inflow from financing 56,808 5,922

activities

Net increase/(decrease) in cash and 37,568 (3,276)

cash equivalents

Cash and cash equivalents at start of 9,836 12,873

period

Exchange differences on translation 674 239

________ ________

Cash and cash equivalents at end of 48,078 9,836

period

________ ________

The financial information contained in this statement does not constitute the

Group's statutory accounts for the years ended 30 June 2008 or 2007, but is

derived from those accounts. Statutory accounts for 2007 have been delivered to

the Registrar of Companies and those for 2008 which were approved by the Board

on 19 December 2008 will also be lodged there following the company's annual

general meeting. The auditors have reported on those accounts; their reports

were unqualified and did not include references to any matters to which the

auditors drew attention by way of emphasis without qualifying their reports.

END

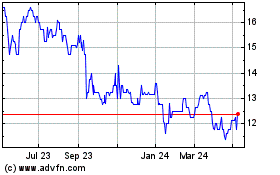

Gemfields (LSE:GEM)

Historical Stock Chart

From Mar 2025 to Apr 2025

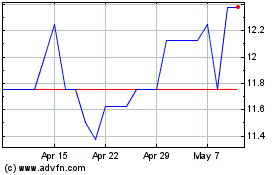

Gemfields (LSE:GEM)

Historical Stock Chart

From Apr 2024 to Apr 2025