RNS Number:6122E

Dart Group PLC

15 June 2006

For immediate release 15 June 2006

DART GROUP PLC

PRELIMINARY RESULTS FOR YEAR ENDED 31 MARCH 2006 (UNAUDITED)

Dart Group PLC, the aviation services and distribution group, announces its

preliminary results for the year ended 31 March 2006.

CHAIRMAN'S STATEMENT

I am pleased to report on the Group's trading for the year ended 31 March 2006.

Profit before tax, goodwill amortisation and exceptional items, amounted to

#14.7m (2005 - #13.9m). Profit before tax after goodwill amortisation and

exceptional items amounted to #15.0m (2005 - #8.4m). Turnover was #319.6m (2005

- #268.0m). Earnings per share before the amortisation of goodwill and

exceptional items were 28.90p (2005 - 27.96p), whilst earnings per share after

goodwill and exceptional items were 32.26p (2005 - 16.32p). The Board is

recommending a final dividend of 5.18p (2005 - 4.70p), taking the total dividend

for the year to 7.43p (2005 - 6.74p), an increase of 10.2%. The dividend, if

approved, will be payable on 18 August 2006 to shareholders on the register on

23 June 2006.

During the year, the Group acquired three Boeing 757-200 aircraft and a further

Boeing 737-300 series Quick Change aircraft. In total, capital expenditure

amounted to #48.6m (2005 - #51.6m). As at 31 March 2006 the Group's net debt

amounted to #5.5m (net cash at 31 March 2005 of #2.4m). Gearing as at 31 March

2006 was 9% (2005 - ungeared).

In excess of 80% of the 2006/07 Jet2.com fuel requirements have been hedged at

average rates lower than the current market price. A small amount of fuel has

been hedged in respect of the 2007/08 requirement. Neither Jet2.com's contract

charter operations nor Fowler Welch-Coolchain currently has any material

exposure to oil price risk as this is substantially covered in their commercial

contracts.

The net exceptional credit of #0.8m comprises the profit on the sale of the

Benair companies of #3.7m, offset by the cost of ceasing Airbus A300

"Eurofreighter" night freight operations, together with a provision for

relocating key operational departments from Bournemouth International Airport to

Leeds Bradford International Airport.

On 15 August 2005 the Company transferred its share listing from the main market

of the London Stock Exchange to AIM. In the light of the significant increase in

the market price of the Company's ordinary shares over recent years, we are

proposing to split the ordinary shares into four. We believe that this will

make the ordinary shares more marketable, particularly for the small

shareholder. Subject to the passing of the necessary shareholder resolution at

the Company's AGM to be held on 3 August 2006, it is, therefore, proposed

that, with effect from the close of business on 3 August 2006, each issued and

unissued ordinary share of 5 pence in the capital of the Company be sub-divided

into four new ordinary shares of 1.25 pence each. Further information will be

mailed to shareholders in due course.

On 31 August 2005 the Group sold its freight forwarding business, Benair Freight

International, and has now entered into a contract for the sale of its Channel

Islands business, Channel Express (CI) Limited. Following the completion of this

sale, which is dependent on Jersey regulatory approval, the Company's business

will comprise Jet2.com, the scheduled low-cost airline based in the north of

England, and Fowler Welch-Coolchain, our UK specialist temperature-controlled

distribution business which has recently been enlarged by the acquisition of the

business and assets of R F Fielding Cheshire Limited, whose main business of non

temperature-controlled distribution is based in Stockport, Greater Manchester.

The activities of the trading companies are more fully described in the Review

of Operations that follows this statement.

Jet2.com

Jet2.com now flies to 26 destinations from six bases in the North of England,

Scotland and Northern Ireland. The company also operates night time mail

services with six "Quick Change" and one freighter Boeing 737-300 aircraft for

Royal Mail and has an important passenger charter programme. The company's main

operating base is Leeds Bradford International Airport and the decision has been

taken to relocate the majority of the operational infrastructure, from our

current offices in Bournemouth, to Leeds Bradford. This is a major undertaking

and change for the many people affected. I am pleased to say that the majority

of the company's senior management and about one third of other staff will make

the move. The recruitment and training of replacements is obviously a

considerable task and we are extremely grateful for everyone's help and

determination to make the transition a success.

Jet2.com currently operates 22 Boeing 737-300 aircraft, which carry 148

passengers, and three larger Boeing 757-200s, which carry 235 passengers. The

Boeing 757 enables us to fly more passengers at a lower seat cost on our more

popular routes and also to fly to more distant winter sun destinations. We

expect to increase both fleets over the coming year.

Jet2.com aims to offer the lowest possible fares to its holiday, city break and

business destinations but also to give a welcoming on-board service which is

enhanced by allocating seats at check-in. Ancillary revenues, including

commissions from hotels, car hire, etc., sold through the website and through

on-board sales are an important source of income and are continually being

developed.

With the growing propensity for people to own overseas properties, take more

frequent holidays and leisure breaks in exciting and attractive European cities

and probably to retire to sunnier climes, we believe that there is huge

potential growth in the leisure air travel market.

Jet2.com is now one of the most recognised air travel brands in the North of

England and we are well positioned to successfully grow this business.

Fowler Welch-Coolchain

The Group's temperature-controlled distribution company, Fowler Welch-Coolchain,

had an encouraging year with increased sales and profits. The improvement in

sales was a reflection of new chilled distribution business for a number of the

UK's major supermarkets and growth in the company's warehousing, storage and

picking operations in both Teynham, Kent, and Spalding, Lincolnshire. In

addition to the fresh produce and chilled distribution business, in Teynham up

to 150,000 cases per week of cheese and pasta are being picked and despatched,

whilst in Spalding the prepared meats business has now reached 375,000 cases per

week. Considerable effort is constantly made to minimise operational costs and

increase network distribution efficiencies by ensuring that vehicles are

efficiently utilised between the company's sites. Pleasingly, one of the major

constraints on growth in the distribution business - a shortage of qualified

drivers - is receding as well-qualified personnel from Eastern Europe are

becoming increasingly available.

Subject to Jersey regulatory approval, the Group's Channel Islands distribution

business has been sold. The Channel Islands business was no longer seen as core

and this disposal frees up management time and resources to concentrate on

developing our UK distribution operations.

On 28 April 2006, the business and assets of R F Fielding Cheshire Limited (In

Administration) were acquired. This company offered warehousing and distribution

of non temperature-controlled goods and is primarily based in Stockport, Greater

Manchester, where it had 160,000 sq.ft. of specialist warehouse premises. It was

a well-established business with a good client base of customers similar to

those of Fowler Welch-Coolchain. The company had run into financial difficulties

and our management saw the opportunity to acquire the business and assets at an

attractive price from the Administrator and to profitably incorporate the

operation into the Fowler Welch-Coolchain network. This acquisition should

contribute in excess of #15m of turnover in ambient distribution in the 2006/07

financial year and will give further opportunities both to increase the

company's lorry fleet loaded miles and to drive down costs as a result of

increased network efficiencies.

Fowler Welch-Coolchain has extensive temperature-controlled, warehousing and

distribution facilities in Spalding and Teynham with a new distribution centre

expected to come on stream in the north east of England, later this financial

year. The new facilities of R F Fielding Cheshire Limited in the North West will

further enhance the company's service levels and competitiveness. We expect

further progress to be made in Fowler Welch-Coolchain in the new financial year,

with growth being seen in all the business segments - temperature-controlled

distribution, ambient distribution and warehousing operations.

Our Staff

Change is always unsettling and the relocation of Jet2.com to Leeds Bradford is

a considerable challenge for all concerned. I believe we have made every effort

with our relocation packages and general assistance to give those that wish to

make the move all possible encouragement. Obviously, there are many who, for

family and other reasons, will be unable to relocate and will, therefore, be

leaving us. We are very grateful to everyone for their contributions in the past

that have brought us to our current position. We look forward to the exciting

opportunities which our northern base brings to those who relocate and our new

colleagues who join us.

We also welcome the staff of R F Fielding Cheshire Limited to Fowler

Welch-Coolchain. We have been very pleased by the enthusiasm with which they

have embraced the recent changes and believe that together we can build an

increasingly successful distribution business.

Outlook

I am more confident than ever for the continued growth of the Group. Of course,

each of the separate businesses is in very competitive sectors. However, I

believe we have the expertise, management, staff and assets to be increasingly

successful in each. Current trading is in line with our budget and expectations.

Philip Meeson

Chairman

15 June 2006

For further information about Dart Group PLC and its subsidiary companies please

visit our website, www.dartgroup.co.uk

REVIEW OF OPERATIONS

Jet2.com

During the year to 31 March, 2006, the Group increased its owned aircraft fleet

to 21 Boeing 737-300 aircraft, which carry 148 passengers, and three Boeing

757-200s, which carry 235 passengers. Since the year end two further Boeing

757-200s have been purchased. Of the Boeing 737-300s, six are "Quick Change"

versions, allowing the seats to be removed and containers of mail to be loaded

within 40 minutes, for Royal Mail's "Postal Air Network".

On 3 February 2006, the company flew its last Airbus A300 "Eurofreighter" cargo

flight between Bergamo and Cologne on behalf of United Parcel Service for whom

we had been operating European air cargo services since 1988. Following notice

of the termination of this business, it was decided to dispose of our two

remaining Airbus A300s.

The first Airbus A300 was sold on 18 October 2005 and a contract has now been

entered into to dispose of the second aircraft. Overall, the disposal of both

aircraft, with their associated spares is expected to exceed book value,

although some costs were incurred in relation to staff redundancies. We are very

pleased that many of the Airbus A300 aircrew successfully transferred to the

company's other aircraft types.

In January 2006, Jet2.com established its head office at Leeds Bradford

International Airport. Operational staff are now progressively transferring from

the former headquarters in Bournemouth. Currently, the majority of the company's

senior management and about one third of other staff have indicated their

willingness to relocate. Considerable recruitment is under way in Yorkshire with

a very encouraging response. In October 2005, the company's contracted-out call

centre operation was transferred from Yorkshire to New Delhi, India, which has

proved very successful and this will be followed by the company's purchase

ledger function, which is expected to expand materially as the business grows.

During the financial year, Jet2.com flew 2.25 million passengers from its

northern bases to 26 European destinations. 16 destinations were flown from

Leeds Bradford International Airport during the summer of 2005 with additional

new routes to Menorca, Milan Bergamo, Pisa, Rome, Dusseldorf and Lanzarote being

added for summer 2006. 14 destinations were served from Manchester with further

services to Rome, Ibiza, Palma and Tenerife also being added in 2006. Belfast

services to Barcelona, Prague and Leeds Bradford have been expanded with the

addition of Murcia, Blackpool and Pisa. From Edinburgh services to Pisa have

been added to Manchester and Murcia.

Jet2.com commenced operations from Newcastle International Airport on 27 April,

2006 with services announced to Amsterdam, Bergen, Murcia, Pisa, Tenerife, Cork

and Menorca. Services from Blackpool International Airport were commenced on 6

April, 2006 with flights to Alicante, Murcia, Palma and Belfast. New routes from

Blackpool to Malaga, Amsterdam, Faro, Prague and Tenerife have already been

announced for 2007 when the company will have three Boeing 737-300s based at

that airport. For details of the company's route structure please visit our

website at www.jet2.com.

This concentration of operations gives Jet2.com real strength in the North. The

advertising budget is, therefore, focused and very effective. Our aim is to make

Jet2.com the premier airline for leisure travel to and from the North.

We believe that passengers appreciate the real efforts our staff take to make

them welcome on our flights. Whilst we aim to offer the lowest fares we also

strive to provide a friendly service. Seats are allocated at check in and every

effort is made to ensure a pleasant experience that our customers will want to

repeat. We particularly value the very high standard of training in customer

care that our experienced team give to cabin staff.

Our cabin staff are rewarded for on-board sales success which, in addition to

the commissions the company receives for sales of car hire, hotels, insurance,

etc. via the web site, make up our ancillary revenues. The ancillary revenue

team is led by a dedicated Business Director, thereby giving the appropriate

attention to this most important income stream.

We will continue to grow both our fleets. We believe that the Boeing 737-300 has

excellent economics for short distance flights, whilst the Boeing 757-200 gives

competitive seat rates for longer distances and will allow the company a wider

offering of winter sun destinations. This aircraft's economics are competitive

and its excellent performance characteristics enable operations to a wide

variety of regional airports.

Every weekday night, the company's six Boeing 737 "Quick Change" aircraft are

reconfigured to carry post for Royal Mail. This is a vital service which enables

Royal Mail to meet its next day delivery obligations over longer distances. The

operation of the aircraft by day and by night obviously produces higher

utilisation to the advantage of both Jet2.com and Royal Mail. Additional

utilisation of our passenger aircraft is also achieved by our successful charter

operations on behalf of other airlines, holiday companies, sporting groups and

celebrities. This is an important revenue stream which is continually being

developed by our enthusiastic team.

Fowler Welch-Coolchain

Fowler Welch-Coolchain is one of the UK's leading temperature-controlled

distribution businesses specialising in the distribution of fresh produce and

chilled foods on behalf of UK supermarkets, other multiple retailers and their

suppliers.

On 28 April, 2006 the Group acquired the business and assets of R F Fielding

Cheshire Limited (In Administration), a business specialising in non

temperature-controlled (ambient) distribution to major retailers, directly or on

behalf of manufacturers and suppliers and to various secondary wholesalers. This

acquisition, through its strategically located 160,000 sq.ft. warehouse in

Stockport, Greater Manchester, not only gives Fowler Welch-Coolchain a

competitively based entry into this market but will also allow the company to

generate further network efficiencies by more efficient vehicle utilisation. The

new ambient business should contribute in the order of #15m of sales in a full

year. The company plans to use this acquisition as a platform to grow its

ambient distribution business.

The Group has agreed to sell its Channel Islands distribution business to a

third party specialising in Channel Islands distribution. Contracts have been

exchanged but the deal is subject to Jersey regulatory approval, which is hoped

to be forthcoming by the end of June 2006. The Board considered that the Channel

Islands distribution business was no longer core and that the management's focus

needed to be on growing the UK mainland distribution business.

The major part of Fowler Welch-Coolchain's business remains chilled distribution

of produce and prepared foods to the regional distribution centres of UK

supermarkets and international transport primarily from Holland. New business

was won during the year from a number of the UK major supermarkets.

A key area of growth during the financial year was our warehousing, storage and

picking operations in both Teynham, Kent, and Spalding, Lincolnshire. Not only

does this provide value added income to our warehousing operations it also

results in substantial increased traffic into our distribution network. In

Spalding, we were pleased to gain warehousing and distribution business from

Bernard Matthews and in Kent we gained important business in respect of the

storage and distribution of imported cheese and pasta. Although both these

operations were subject to start up costs in the first half, operational

efficiencies have now been achieved and the increased costs were eliminated in

the second half. A new warehousing computer system will be implemented in 2006/

07 to cater for the growth in this sector of our business.

The company has a successful warehouse and distribution operation based in

Gateshead, Tyne and Wear. Negotiations are now taking place to acquire

substantially larger premises, which will be particularly suited to this

operation, giving us greater presence in the North East of England where, we

believe, there are considerable business opportunities.

Until recently a considerable constraint on the UK road transport industry has

been the availability of suitably qualified heavy goods vehicle drivers.

Following the accession of Poland and other Eastern European countries to the EC

and the British Government's wise decision to admit those countries' workers to

the UK labour market, this shortage has been alleviated. Whilst their driving

licences are accepted in the UK, Fowler Welch-Coolchain has trained mainly

Polish drivers to a higher standard. In conjunction with Lincoln University, the

company has set up a training scheme to improve their spoken English and

understanding of UK driving practices and our customers' needs.

Overall the market place remains tough and competitive with little scope for

price increases and the need to be ever vigilant about costs remains. Our

agreements with our customers generally allow increases in fuel to be passed on

to them so the company has limited exposure in this respect. We believe that as

business volumes grow economies of scale will enable us to increase our

competitiveness in the marketplace.

Fowler Welch-Coolchain has had a good start to the new financial year and is

well-positioned to successfully win new business as the opportunities present

themselves. Maximising the back haul opportunity arising from the company's

recent acquisition and managing the integration of the new business into Fowler

Welch-Coolchain's existing national network is one of our key objectives for the

new year.

For further information contact:

Dart Group PLC Tel: 01202 597676

Philip Meeson, Mobile: 07785 258666

Group Chairman and Chief Executive

Mike Forder, Mobile: 07721 865850

Group Finance Director

Group Profit And Loss Account (unaudited)

for the year ended 31 March 2006

Notes 2006 2006 2006 2005 2005 2005

Before Exceptional Total Before Exceptional Total

exceptional items exceptional items (restated)

items items

(note 5) (restated) (note 5)

#m #m #m #m #m #m

Turnover 1

Continuing operations 310.1 - 310.1 246.0 - 246.0

Discontinued operations 9.5 - 9.5 22.0 - 22.0

-------- -------- -------- -------- -------- -------

319.6 - 319.6 268.0 - 268.0

-------- -------- -------- -------- -------- -------

Net Operating Expenses

Excluding goodwill amortisation (305.4) (6.2) (311.6) (254.0) (8.2) (262.2)

Goodwill amortisation (0.5) - (0.5) (0.5) - (0.5)

-------- -------- -------- -------- -------- -------

Net Operating Expenses (305.9) (6.2) (312.1) (254.5) (8.2) (262.7)

-------- -------- -------- -------- -------- -------

Operating Profit

Continuing operations 13.3 (6.2) 7.1 12.8 (8.2) 4.6

Discontinued operations 0.4 - 0.4 0.7 - 0.7

-------- -------- -------- -------- -------- -------

13.7 (6.2) 7.5 13.5 (8.2) 5.3

Profit on disposal of discontinued operations - 3.7 3.7 - - -

Profit on disposal of fixed assets - 3.3 3.3 - 0.8 0.8

Net interest received/(paid)

(including exchange gains) 0.5 - 0.5 (0.1) 2.4 2.3

-------- -------- -------- -------- -------- -------

Profit on ordinary activities

before taxation 14.2 0.8 15.0 13.4 (5.0) 8.4

Taxation (4.7) 0.9 (3.8) (4.3) 1.5 (2.8)

-------- -------- -------- -------- -------- -------

Profit for the year 9.5 1.7 11.2 9.1 (3.5) 5.6

-------- -------- -------- -------- -------- -------

Earnings per share - total

- basic 27.47p 32.26p 26.52p 16.32p

- diluted 27.27p 32.02p 26.34p 16.21p

Earnings per share

- continuing operations

- basic 26.68p 20.84p 24.96p 14.76p

- diluted 26.49p 20.69p 24.79p 14.66p

Earnings per share

- discontinued operations

- basic 0.78p 11.41p 1.56p 1.56p

- diluted 0.78p 11.33p 1.55p 1.55p

Statement of Total Recognised Gains and Losses (unaudited)

2006 2005

#m #m

---------- ---------

Profit on ordinary activities after taxation 11.2 5.6

Exchange gain on foreign equity investment - 0.1

---------- ---------

Total recognised gains and losses relating to the year 11.2 5.7

---------- ---------

Balance Sheet (unaudited)

at 31 March 2006

Group

2006 2005

(restated)

#m #m

-------- --------

Fixed assets

Intangible assets 6.8 7.3

Tangible assets 131.5 99.3

-------- --------

138.3 106.6

Current assets

Stock 7.5 4.6

Debtors 23.8 25.5

Cash at bank and in hand 26.0 27.4

-------- --------

57.3 57.5

Current liabilities

Creditors: amounts falling due

within one year (98.3) (88.6)

-------- --------

Net current liabilities (41.0) (31.1)

-------- --------

Total assets less current liabilities 97.3 75.5

Creditors: amounts falling due after

more than one year (28.0) (19.4)

Provisions for liabilities and charges (10.0) (6.2)

-------- --------

Net assets 59.3 49.9

-------- --------

Capital and reserves

Called up share capital 1.7 1.7

Share premium account 8.6 8.0

Profit and loss account 49.0 40.2

-------- --------

Shareholders' funds - equity interests 2 59.3 49.9

-------- --------

Group Cash Flow Statement (unaudited)

for the year ended 31 March 2006

2006 2005

Note #m #m

-------- --------

Net cash inflow from operating activities 3 40.3 68.3

Returns on investment and servicing of finance (1.6) (0.1)

Taxation (5.2) (1.4)

Capital expenditure and financial investment (45.5) (49.1)

Acquisitions and Disposals 4.0 -

Equity dividends paid (2.4) (2.2)

-------- --------

Cash (outflow) / inflow before financing (10.4) 15.5

Financing 7.5 (2.2)

-------- --------

(Decrease) / increase in cash in the year (2.9) 13.3

-------- --------

Reconciliation of net cash flow to movement in net (debt) / cash

Note 2006 2005

#m #m

-------- --------

(Decrease) / increase in cash in the year (2.9) 13.3

Cash (inflow) / outflow from the (increase) / decrease

in net debt in the year (6.2) 2.5

-------- --------

Change in net debt resulting from cash flows (9.1) 15.8

Exchange differences 1.2 1.6

Net debt at 1 April 2.4 (15.0)

-------- --------

Net (debt) / cash at 31 March (5.5) 2.4

-------- --------

NOTES

1. Turnover

Analyses of profit before taxation and net assets between the different segments

of the Group are not given as, in the opinion of the directors, such analyses

would be seriously prejudicial to the commercial interests of the Group.

2006 2005

#m #m

Distribution

- continuing operations 115.7 100.1

Aviation Services

- continuing operations 194.4 145.9

- discontinued operations 9.5 22.0

------- -------

319.6 268.0

------- -------

Turnover arising :

- Continuing operations

Within the United Kingdom and the Channel Islands 184.8 185.2

Between the United Kingdom and Mainland Europe 125.3 60.8

- Discontinued operations

Within the United Kingdom and the Channel Islands 9.1 21.0

Within the Far East 0.4 1.0

------- -------

319.6 268.0

------- -------

2. Reconciliation of movements in shareholders' funds

Group

2006 2005

(restated)

#m #m

Profit for the year 11.2 5.6

Dividends paid in the year (2.4) (2.2)

------- -------

8.8 3.4

Currency translation differences - 0.1

Issue of shares under share option schemes 0.6 0.3

------- -------

Net addition to

shareholders' funds 9.4 3.8

Opening shareholders' funds 49.9 46.1

(originally #48.3m before adding prior year adjustment of

#1.6m)

------- -------

Closing shareholders' funds 59.3 49.9

------- -------

The prior year adjustment is explained in note 6.

3. Reconciliation of operating profit to net cash flow from operating activities

2006 2005

#m #m

Operating Profit 7.6 5.3

Depreciation and impairment 16.6 31.2

Amortisation of goodwill 0.5 0.5

Profit / (Loss) on disposal of fixed assets - (0.1)

(Increase) in stock (2.9) (2.4)

Decrease in debtors 1.7 5.7

Increase in creditors 16.8 28.1

------- -------

Net cash inflow from operating activities 40.3 68.3

------- -------

4. Earnings per share

The calculation of basic earnings per share is based on earnings before

exceptional items for the year ended 31 March 2006 of #9.5m (2005 - #9.1m) and

on 34,617,401 shares (2005 - 34,396,934) being the weighted average number of

shares in issue for the year.

The diluted earnings per share is based on earnings before exceptional items for

the year ended 31 March 2006 of #9.5m (2005 - #9.1m) and on 34,872,011 ordinary

shares (2005 - 34,628,280) calculated as follows:

2006 2005

000's 000's

Basic weighted average number of shares 34,617 34,397

Dilutive potential ordinary shares:

Employee share options 255 231

------- -------

34,872 34,628

------- -------

5. Exceptional Items

2006 2005

#m #m

Operating items

Re-organisation costs (2.2) -

A300 closure costs (0.7) -

Impairment of fixed assets (3.3) (8.2)

Profit on disposal of fixed assets and investments

Gain on disposal of F27 fleet - 0.8

Gain on disposal of A300 3.3 -

Profit on disposal of discontinued operations 3.7 -

Net interest including exchange gains - 2.4

------- -------

Net exceptional items before taxation 0.8 (5.0)

------- -------

The reorganisation cost relates to the move of the Jet2.com operational

departments from Bournemouth International Airport to Leeds Bradford

International Airport. A decision has been taken to withdraw from Airbus A300

freighter operations which has resulted in redundancy and other closure costs.

One of the two remaining Airbus A300 aircraft was sold prior to 31 March 2006,

whilst an exchange of contracts has taken place for the sale of the last Airbus

A300.

6. Accounting Policy Changes

FRS 21 Events after the balance sheet date

During the year the Group adopted FRS 21 Events after the balance sheet date

which superseded SSAP 17. Under the new standard, final dividends payable are

recognised only in the period in which they are approved in the Annual General

Meeting and therefore become a liability and interim dividends are recognised in

the period in which they are paid, whereas under SSAP 17 dividends were accrued

for when proposed. This change in accounting policy has lead to a reduction in

Creditors: amounts due within one year and an increase in net assets of #1.6

million as at 31 March 2005. The profit for the year ended 31 March 2005 has

not been affected.

FRS 25 Financial instruments: Disclosure and presentation

During the year the Group adopted the presentation aspects of FRS 25 Financial

Instruments: Disclosure and presentation. As a result, dividends payable are

shown as a movement in reserves instead of an appropriation within the profit

and loss account. This change in accounting policy has not resulted in any

change to the profit for the year ended 31 March 2005 or the balance sheet as at

that date.

As the Group has not yet adopted FRS 26 Financial instruments: Measurement, it

has also not yet adopted the disclosure aspects of FRS 25.

7. The financial information set out in the announcement does not constitute the

Group's statutory accounts for the financial years ended 31 March 2006 or 2005.

The financial information for the year ended 31 March 2005 is derived from the

statutory accounts for that year, which have been delivered to the Registrar of

Companies. The statutory accounts for the year ended 31 March 2006, which will

include restated figures for 2005, are still subject to audit by KPMG Audit Plc,

but will be finalised on the basis of the financial information presented by the

directors in this preliminary announcement, and will be delivered to the

Registrar of Companies following the Group's Annual General Meeting.

8. The proposed final dividend of 5.18p per share will, if approved, be payable

on 18 August 2006 to shareholders on the Company's register at the close of

business on 23 June 2006.

9. The 2006 Annual Report and Accounts (together with the Auditors Report) will

be posted to shareholders no later than 10 July 2006. The Annual General Meeting

will be held on 3 August 2006.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR MGGMVLDRGVZM

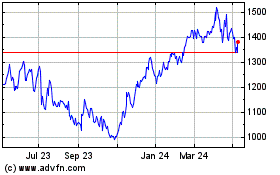

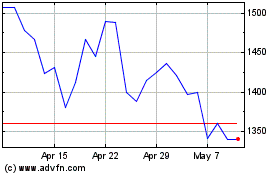

Jet2 (LSE:JET2)

Historical Stock Chart

From Jun 2024 to Jul 2024

Jet2 (LSE:JET2)

Historical Stock Chart

From Jul 2023 to Jul 2024