0001460602

false

0001460602

2023-09-29

2023-09-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): September

29, 2023

ORGENESIS

INC.

(Exact

name of registrant as specified in its charter)

| Nevada

|

|

001-38416 |

|

98-0583166

|

| (State

or Other Jurisdiction |

|

(Commission

File |

|

(IRS

Employer |

| of

Incorporation) |

|

Number) |

|

Identification

No.) |

20271

Goldenrod Lane, Germantown, MD 20876

(Address

of principal executive offices) (Zip Code)

Registrant’s

telephone number, including area code: (480) 659-6404

Not

Applicable

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

ORGS |

|

The

Nasdaq Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b -2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On

September 29, 2023, Koligo Therapeutics Inc. (“Borrower”), a subsidiary of Orgenesis Inc. (the “Company”) entered

into a convertible loan agreement (the “Convertible Loan Agreement”) with Sai Traders (the “Lender,” and together

with the Borrower, the “Parties”), pursuant to which the Lender agreed to loan the Borrower up to $25,000,000 (the “Convertible

Loan”). The Convertible Loan shall consist of an Initial Installment of $1,500,000 (“Initial Installment”), and at

the election of the Borrower thereafter while the Convertible Loan remains outstanding, Borrower may issue up to an additional $23,500,000

(“Subsequent Installments”). Interest is calculated at 10% per annum (based on a 365-day year) of all outstanding principal

borrowings and is payable, along with the principal (collectively the “Outstanding Amount”), on or before December 1, 2027

(the “Maturity Date”). The Loan Amount may be prepaid by the Borrower in whole or in part at any time without penalty.

Under

the terms of the Convertible Loan Agreement, at the option of the Lender at the Maturity Date or any time prior, the Outstanding Amount

may be convertible, in whole or in part, into the number of shares of Common Stock of the Company equal to the quotient obtained by dividing

(x) the Outstanding Amount by (y) the Conversion Price. The “Initial Installment Conversion Price” for the Outstanding Amount

relating to the Initial Installment shall be a price per share of Common Stock equal to $2.50. The “Subsequent Installment Conversion

Price” for the Outstanding Amount relating to the Subsequent Installment(s) shall be a price per share of Common Stock equal to

$3.50. Lender agrees that it shall not deliver a notice of conversion that upon effect results in the holder to beneficially own

more than 19.99% of the then outstanding shares of Orgenesis Inc. Common Stock. Lender may elect to, instead of the conversion of the

Outstanding Amount into Common shares of Orgenesis Inc, convert the entire Outstanding Amount into the securities of Borrower pursuant

to a the first issuance of equity of the Borrower under which the Borrower raises at least $5,000,000 in gross proceeds (“Qualified

Financing”) at a price per share equal to 75% of the price per share paid for each share of the equity securities purchased for

cash by the investors in such a Qualified Financing. In the event of the Borrower being listed on a public securities exchange, Lender

shall have the option to convert the Outstanding Amount at a 25% premium to the volume weighted average price of the Borrower’s

equity over the preceding five (5) days as reported by Bloomberg (“5-Day VWAP”), provided that any such conversion shall

not result in the Lender to beneficially own more than 19.99% of the then beneficial shares of the Borrower. In the event of an acquisition

of the Borrower (“Acquisition”), prior to the closing of such acquisition, Lender shall have the option to convert the

Outstanding Amount into equity securities of the Borrower at a price equivalent to seventy five percent (75%) of the price

paid by such buyer to acquire the Borrower.

The

Convertible Loan Agreement contains certain specified events of default, the occurrence of which would entitle the Lender to immediately

demand repayment of all loan obligations. Such events of default include, among others, the commencement of bankruptcy or insolvency

proceedings against the Borrower, breaches of any covenants or representations and warranties by the Borrower in any material respect,

and failure to make payments under the Convertible Loan Agreement when due.

The

Convertible Loan Agreement and the Equity Securities issuable upon conversion of the Convertible Loan Agreement have not been registered

under the Securities Act of 1933, as amended (the “Securities Act”) and will be issued in reliance upon the exemption from

registration contained in Section 4(a)(2) of the Securities Act.

The

foregoing summary of the Convertible Loan Agreement does not purport to be complete and is subject to, and qualified in its entirety

by, the full text of such document attached as Exhibit 10.1 to this Current Report on Form 8-K, which is incorporated herein by reference.

Item

2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The

information required by this Item 2.03 is included under Item 1.01 of this Current Report on Form 8-K.

Item

3.02. Unregistered Sales of Equity Securities.

The

information required by this Item 3.02 is included under Item 1.01 of this Current Report on Form 8-K.

Item

9.01. Financial Statements and Exhibits.

The

exhibit listed in the following Exhibit Index is filed as part of this Current Report on Form 8-K.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

ORGENESIS

INC. |

| |

|

| Date:

October 5, 2023 |

By: |

/s/

Elliot Maltz |

| |

|

Elliot

Maltz |

| |

|

Chief

Financial Officer, Treasurer and |

| |

|

Secretary |

Exhibit

10.1

Execution Version

CONVERTIBLE

LOAN AGREEMENT

THIS

CONVERTIBLE LOAN AGREEMENT (this “Agreement”) is made as of the 29th day of September, 2023 (“Effective

Date”), by and between Sai Traders, having an address at 3rd Floor, ALTIUS, 1, OLYMPIA TECHNOLOGY PARK, Guindy, SIDCO Industrial

Estate, Chennai, Tamil Nadu 600032 (“Lender”), and Koligo Therapeutics, Inc., a Kentucky corporation., of 2113

State Street New Albany, IN 47150 and wholly-owned subsidiary of Orgenesis Inc. ( “Borrower”) (Lender, together with

Borrower, each a “Party” and together, the “Parties”).

WHEREAS,

Lender desires to provide financing by way of a loan to the Borrower to be used by the Borrower for working capital and ongoing operations,

and the Borrower desires to receive such financing to be used by the Borrower for working capital and ongoing operations;

NOW,

THEREFORE, in consideration of the premises and the mutual covenants herein contained, and other good and valuable consideration the

receipt and sufficiency of which is hereby acknowledged, the Parties hereby agree as follows:

1.

Funding. Lender will provide financing in form of a convertible loan under the terms of this Agreement in the amount of up to

Twenty Five Million US Dollars ($25,000,000) (the “Convertible Loan”) in accordance with the terms hereof. The Borrower shall

accept such funding and shall use the proceeds for working capital and on-going operations. The Convertible Notes shall consist of an

Initial Installment of One Million Five Hundred US Dollars ($1,500,000) (“Initial Installment”), and at the election

of the Borrower thereafter while the Convertible Notes remain outstanding, Borrower may issue up to Twenty Three Million Five Hundred

US Dollars ($23,500,000) in an additional Convertible Loan (“Subsequent Installments”).

2. Loan; Closing.

(a)

Terms of Loan. The Lender shall lend the Convertible Loan to the Borrower, and the Borrower shall borrow the Convertible Loan

from the Lender. The Convertible Loan or parts thereof of principal outstanding at any time shall bear simple interest at the rate of

ten percent (10%) per annuum (based upon a 365-day year). Unless otherwise converted into equity pursuant to the terms of this

Agreement, all outstanding principal borrowings of the Convertible Loan, and all accrued but unpaid interest thereon (collectively, the

“Outstanding Amount”), shall become due and payable on December 1, 2027 (the “Maturity Date”) without

any action required from the Lender. If requested by the Borrower, the Maturity Date may be extended by the Lender in the Lender’s

sole and absolute discretion and any such extension(s) shall be in writing signed by both Parties. The Outstanding Amount under this

Convertible Loan may be prepaid by the Borrower in whole or in part at any time without penalty.

(b)

The Closing. At the closing of the Initial Installment, and any and each Subsequent Installment, the Lender and the Borrower shall

each deliver a fully executed version of this Agreement to the other Party (the “Closing”). Within 2 days after the

Closing, the Lender shall transfer the Convertible Loan by wire to the bank account of the Borrower in accordance with wiring instructions

provided by the Borrower to the Lender prior to the Closing and detailed below in Section 10(g).

3.

Use of Proceeds. The Borrower shall use the Convertible Loan to fund the working capital and ongoing operations (“Purpose”).

Borrower may also be subject to a three percent (3%) fee on each such transfer or proceeds from Lender to Borrower (“Transfer

Fee”).

4. Events of Default.

(a)

The following shall constitute events of default (each an “Event of Default”):

i.

filing of a petition in bankruptcy or the commencement of any proceedings under any bankruptcy laws by or against the Borrower, which

filing or proceeding is not dismissed within ninety (90) days after the filing or commencement thereof, or if the Borrower shall completely

cease or suspend the conduct of its usual business or if the Borrower shall become, , insolvent and admits in writing that it is unable

to pay its debts or liabilities as they fall due;

ii.

breaches any material covenant by the Borrower (other than a payment covenant) which is not cured within 30 days of receipt of written

notice of such breach;

iii.

an order, judgment or decree shall be entered, without the application, approval or consent of the Borrower by any court of competent

jurisdiction, approving a petition seeking reorganization of the Borrower or appointing a receiver, trustee or liquidator of the Borrower

or of all or a substantial part of its assets, and such order, judgment or decree shall continue unstayed and in effect for any period

of ninety (90) consecutive days;

iv.

Borrower fails to repay principal when due or interest and such failure continues for ten business days of the Borrower’s receipt

of written notice from the Lender; and

v.

Borrower breaches any representation or warranty under this Agreement in any material respect.

(b)

If, at any time, an Event of Default shall occur, all obligations under this Agreement shall become immediately due and payable without

presentment, demand or protest, all of which are hereby waived by the Borrower.

5.

Representations and Warranties. The Borrower represents and warrants to the Lender (and to the extent identified below, the Lender

represents and warrants to the Borrower) as follows:

(a)

The Borrower is duly formed, validly existing and in good standing under the laws of Kentucky. The Borrower has full power and authority

to consummate the transactions contemplated hereunder, and the consummation of such transactions and the performance of this Agreement

by the Borrower does not violate the provisions of any applicable law, and will not result in any material breach of, or constitute a

material default under any agreement or instrument to which the Borrower is a party or under which the Borrower is bound.

(b)

The execution and performance of this Agreement by the Borrower has been duly authorized by all necessary actions. This Agreement has

been duly executed and delivered by the Borrower and the Lender and this Agreement is the legal, valid, and binding obligation of the

Borrower and the Lender, and is fully enforceable against the Borrower and the Lender according to its terms.

(c)

All of the shares of the Borrower after its establishment to be issued to the Lender upon the conversion of the amounts outstanding of

the Convertible Loan shall be, when issued, duly authorized, validly issued, fully paid, non-assessable free and clear of all liens,

pledges, security interests, charges and encumbrances.

(d)

There is no existing lien, encumbrance, security interest, indebtedness, mortgage or third-party rights of any kind that are, or could

be, ranked senior in nature to the amounts outstanding of the Convertible Loan other than any lien arising by operation of law.

(e)

The securities and shares of Common Stock of Orgenesis Inc. issuable upon conversion hereunder are being acquired for the Lender’s

own account, not as nominee or agent, and not with a view to, or for resale in connection with, any distribution or public offering thereof

within the meaning of the 1933 Act.

(f)

The Lender has such knowledge and experience in financial or business matters that it is capable of evaluating the merits and risks of

the investment in connection with the transactions contemplated in this Agreement. Such Lender has, in connection with its decision to

purchase the securities hereunder, relied only upon the representations and warranties contained herein. Further, each Lender has had

such opportunity to obtain additional information and to ask questions of, and receive answers from, the Borrower, concerning the terms

and conditions of the investment and the business and affairs of the Borrower, as such Lender considers necessary in order to form an

investment decision.

(g)

The Lender is an “accredited investor” as such term is defined in Rule 501(a) of the rules and regulations promulgated under

the 1933 Act. The Lender is not purchasing the securities hereunder as a result of any advertisement, article, notice or other communication

regarding the securities published in any newspaper, magazine or similar media or broadcast over the television or radio or presented

at any seminar or any other general solicitation or general advertisement.

6. Conversion.

(a)

At the option of the Lender, at the Maturity Date or at any time and from time to time, the Outstanding Amount shall be convertible,

in whole or in part, into the number of shares of Common Stock of Orgenesis Inc., the parent company of Koligo Therapeutics Inc., equal

to the quotient obtained by dividing (x) the Outstanding Amount by (y) the Conversion Price. The “Initial Installment Conversion

Price” for the Outstanding Amount relating to the Initial Installment shall be a price per share of Common Stock equal to $2.50;

subject to proportional adjustment in the event of a Common Stock share-split. He “Subsequent Installment Conversion Price”

for the Outstanding Amount relating to the Subsequent Installment(s) shall be a price per share of Common Stock equal to $3.50; subject

to proportional adjustment in the event of a Common Stock share-split. The Lender may effect one or more conversions by delivering to

the Borrower a written notice (each, a “Notice of Conversion”), specifying therein the Outstanding Amount and accrued

interest, if any, to be converted, and the date on which such conversion shall be effected (such date, the “Conversion Date”).

If no Conversion Date is specified in a Notice of Conversion, the Conversion Date shall be the date that such Notice of Conversion is

deemed delivered hereunder. Following the applicable Conversion Date, a Conversion completed pursuant to this Section 2(a)(i) shall have

the effect of reducing the Outstanding Amount in amount equal to the Convertible Loan set forth in the corresponding Notice of Conversion.

Lender agrees that it shall not deliver a Notice of that upon effect results in the holder to beneficially own more than 19.99% of the

then outstanding shares of Orgenesis Inc. Common Stock. For the avoidance of doubt, the Borrower may reject or modify, upon mutual agreement

of Borrower and Lender, a Notice of Conversion duly delivered by the Lender if such conversion would result in the Lender to beneficially

own more than 19.99% of the then outstanding shares of Orgenesis Inc. Common Stock. The Parties shall maintain records showing the total

Outstanding Amount converted and the date of each such Conversion.

(b)

Lender may elect to, instead of the conversion of the Outstanding Amount as per section 6(a) into Common shares of Orgenesis Inc, convert

the entire Outstanding Amount into the securities of Borrower pursuant to a the first issuance of equity of the Borrower under which

the Borrower raises at least $5,000,000 in gross proceeds (“Qualified Financing”) at a price per share equal to seventy

five percent (75%) of the price per share paid for each share of the equity securities purchased for cash by the investors in such a

Qualified Financing. The equity issued upon said conversion shall have all preferential and associated rights with the highest class

of equity issued in such Qualified Financing. In the event of the Borrower being listed on a public securities exchange, Lender shall

have the option to submit a Notice of Conversion to convert the Outstanding Amount at a 25% premium to the volume weighted average price

of the Borrower’s equity over the preceding five (5) days as reported by Bloomberg (“5-Day VWAP”), provided

that any such conversion shall not result in the Lender to beneficially own more than 19.99% of the then beneficial shares of the Borrower.

In the event of an acquisition of the Borrower (“Acquisition”), prior to the closing of such acquisition, Lender shall

have the option to convert outstanding principal and accrued interest into equity securities of the Borrower at a price equivalent to

seventy five percent (75%) of the price paid by such buyer to acquire the Borrower. Borrower shall provide notice to Lender in anticipation

of such Qualified Financing at least five (5) days prior to the closing of such Qualified Financing or Acquisition.

(c)

Upon the conversion pursuant to Section 6(a) above, the rights of repayment of the Outstanding Amount shall be extinguished, and the

Lender shall surrender this Agreement. As soon as practicable the Borrower into whose shares the Outstanding Amount is converted, shall

issue and deliver to the Lender a capital contribution certificate.

(d)

The shares issued upon conversion of the Outstanding Amount, free from preemptive rights or any other actual contingent purchase rights

of persons other than the Lender.

(e)

The conversion of the Outstanding Amount into equities shall be made without charge to the Lender for any documentary stamp or similar

taxes upon conversion.

(f)

The Lender understands that the securities of Borrower or shares of Common Stock of Orgenesis Inc., as applicable, issuable upon conversion

of the Outstanding Amount will be “restricted securities” within the meaning of Rule 144 under the Securities Act of 1933,

as amended (the “1933 Act”) and may not be sold, pledged, assigned or transferred and must be held indefinitely in

the absence of (i) an effective registration statement under the 1933 Act and applicable state securities laws with respect thereto or

(ii) an available exemption from, or in a transaction not subject to, the registration requirements of the 1933 Act as evidenced by an

opinion of counsel satisfactory to the Borrower that such registration is not required. The certificates for the securities of Borrower

or shares of Common Stock of Orgenesis Inc., as applicable, issuable upon conversion of the Outstanding Amount shall bear the following

or similar legend (in addition to such other restrictive legends as are required or deemed advisable under any applicable law or any

other agreement to which the Borrower is a party):

“THE

SECURITIES REPRESENTED HEREBY HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”),

OR UNDER THE SECURITIES LAWS OF ANY STATES. THESE SECURITIES ARE SUBJECT TO RESTRICTIONS ON TRANSFERABILITY AND RESALE AND MAY NOT BE

SOLD, DISTRIBUTED, OFFERED, PLEDGED, ENCUMBERED, ASSIGNED OR OTHERWISE TRANSFERRED EXCEPT AS PERMITTED UNDER THE SECURITIES ACT AND THE

APPLICABLE STATE SECURITIES LAWS, PURSUANT TO REGISTRATION, AN AVAILABLE EXEMPTION THEREFROM, OR A TRANSACTION NOT SUBJECT TO THE REGISTRATION

REQUIREMENTS OF THE SECURITIES ACT OR UNDER THE SECURITIES LAWS OF ANY STATES. UNLESS SOLD PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT

UNDER THE SECURITIES ACT, THE ISSUER OF THESE SECURITIES MAY REQUIRE AN OPINION OF COUNSEL IN FORM AND SUBSTANCE SATISFACTORY TO THE

ISSUER TO THE EFFECT THAT ANY PROPOSED TRANSFER OR RESALE IS IN COMPLIANCE WITH THE SECURITIES ACT AND ANY APPLICABLE STATE SECURITIES

LAWS.”

(g)

The Lender consents to the Borrower making a notation on its records or giving instructions to any transfer agent of the securities of

Borrower or shares of Common Stock of Orgenesis Inc. in order to implement the restrictions on transfer set forth and described herein.

7.

Waiver; Non-Negotiable. The Borrower, for itself and each of its legal representatives, hereby waives presentment for payment,

demand, right of setoff, notice of nonpayment, notice of dishonor, protest of any dishonor, notice of protest and protest of this Agreement,

and all other notices in connection with the delivery, acceptance, performance, default or enforcement of the obligations under this

Agreement. This Agreement is non-negotiable.

8.

No Security Interest. At all times, the Outstanding Amount shall rank, and shall be deemed, senior to any and all indebtedness

of the Borrower unless otherwise subordinated by the Lender in writing in the Lender’s sole and absolute discretion. The Borrower

hereby agree, covenant and undertake not to permit any indebtedness, lien, encumbrance, mortgage or third party right of any kind to

become senior to the Outstanding Amount other than any lien arising by operation of law and in the ordinary course of business.

9.

Further Assurances. The Parties shall perform such further acts and execute such further documents as may reasonably be necessary

to carry out and give full effect to the provisions of this Agreement.

10. Miscellaneous.

(a) Entire Agreement; Amendments. This Agreement constitutes the entire understanding of the Parties hereto with respect to the subject

matter hereof and supersedes all prior written and oral understandings of such parties with regard thereto. This Agreement may be modified,

amended, or any term hereof waived with the written consent of the Borrower and the Lender. Any amendment effected in accordance with

this Section 10(a) shall be binding upon all Parties and their respective successors and assignees.

(b)

Governing Law; Jurisdiction. This Agreement shall be governed by and construed according to the laws of the State of New York

without regard to the conflict of laws provisions thereof. Any dispute arising under or in relation to this Agreement shall be resolved

by arbitration administered by the American Arbitration Association with the International Arbitration Rules of the American Arbitration

Association for the time being in force on the commencing date of the arbitration. The place of the arbitration is the New York City.

The tribunal shall be composed of one arbitrator mutually acceptable to the Parties, or barring such acceptance, by the American Arbitration

Association. The language of the arbitration shall be English.

(c)

Notices. All notices and other communications required or permitted hereunder to be given to a Party to this Agreement shall be

in writing and shall be telecopied or mailed by registered or certified mail, postage prepaid, or otherwise delivered by hand or by messenger.

Any notice sent in accordance with this Agreement shall be effective (i) if mailed, seven (7) business days after mailing to the address

set forth each Party’s signature below, (ii) if sent by messenger, upon delivery, and (iii) if sent via email, upon transmission

and electronic confirmation of receipt or (if transmitted and received on a non-business day) on the first business day following transmission

and electronic confirmation of receipt. Additionally, a copy of each notice sent or delivered to Borrower (which does not constitute

a notice) shall be sent or delivered to Mark Cohen, Pearl Cohen Zedek Latzer LLP, Times Square Tower, 7 Times Square, 19th Floor, New

York, NY 10036.

(d)

Assignment; Waiver. This Agreement may not be assigned by the Borrower without the prior written consent of the Lender. The Lender

may not assign this Agreement without the prior written consent of the Borrower. This Agreement shall be binding upon the successors,

assigns and representatives of each Party. No delay or omission to exercise any right, power, or remedy accruing to any Party upon any

breach or default under this Agreement, shall be deemed a waiver of any other breach or default theretofore or thereafter occurring.

All remedies, either under this Agreement or by law or otherwise afforded to any of the Parties, shall be cumulative and not alternative.

(e)

Severability. If any provision of this Agreement is held by a court of competent jurisdiction to be unenforceable under applicable

law, then such provision shall be excluded from this Agreement and the remainder of this Agreement shall be interpreted as if such provision

were so excluded and shall be enforceable in accordance with its terms; provided, however, that in such event this Agreement shall be

interpreted so as to give effect, to the greatest extent consistent with and permitted by applicable law, to the meaning and intention

of the excluded provision as determined by such court of competent jurisdiction.

(f)

Counterparts. This Agreement may be executed in any number of counterparts, each of which shall be deemed an original but all

of which together shall constitute one and the same instrument.

(g)

No-Short. Lender acknowledges and agrees that Lender, including any of its affiliates, has never engaged in any short-selling,

arbitrage, derivative or hedging transaction with the respect to the Common Stock of Orgenesis Inc. Lender further agrees it shall not

engage in any short-selling, arbitrage, derivative or hedging transaction with the respect to the Common Stock of Orgenesis Inc. while

this Agreement is outstanding.

(h)

If any provision of this Agreement is held by a court of competent jurisdiction to be unenforceable under applicable law, then such provision

shall be excluded from this Agreement and the remainder of this Agreement shall be interpreted as if such provision were so excluded

and shall be enforceable in accordance with its terms; provided, however, that in such event this Agreement shall be interpreted so as

to give effect, to the greatest extent consistent with and permitted by applicable law, to the meaning and intention of the excluded

provision as determined by such court of competent jurisdiction.

(i) Borrower bank account wire instructions:

Account

Name: Koligo Therapeutics Inc.

Account

number: 619955930

ABA

Routing: 021000021

Swift

Code: CHASUS33

Bank:

JPMorgan Chase

[Remainder

of Page Intentionally Left Blank]

IN

WITNESS WHEREOF, the Parties have executed this Loan Agreement as of the date first above written.

| LENDER |

|

| |

|

| SAI TRADERS |

|

| |

|

| By: |

/s/

Nithya Rajendiran |

|

| Name: |

Nithya Rajendiran |

|

| Address: |

3rd Floor, ALTIUS, 1, |

|

| |

OLYMPIA TECHNOLOGY |

|

| |

PARK, Guindy, SIDCO |

|

| |

Industrial Estate, Chennai, |

|

| |

Tamil Nadu 600032 |

|

| |

|

| THE BORROWER |

|

| |

|

| KOLIGO

THERAPEUTICS INC. |

|

| |

|

| By: |

/s/

Vered Caplan |

|

| Name: |

Vered Caplan |

|

| Title: |

Chief Executive Officer |

|

| Address: |

|

|

[Signature

page to the Convertible Loan Agreement between Koligo Therapeutics Inc. and Lender]

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

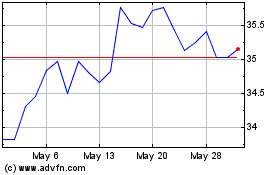

Innovator Ibd Breakout O... (AMEX:BOUT)

Historical Stock Chart

From Feb 2025 to Mar 2025

Innovator Ibd Breakout O... (AMEX:BOUT)

Historical Stock Chart

From Mar 2024 to Mar 2025