TIDMGCM

RNS Number : 8089W

GCM Resources PLC

22 August 2022

22 August 2022

GCM Resources plc

("GCM" or the "Company")

(AIM:GCM)

Project Update and Extension of Consultancy Agreement

GCM Resources plc, an AIM quoted mining and energy company,

provides a project update and, announces that, further to its

announcement of 4 September 2019, it has agreed a further extension

of the consultancy agreement (the "Consultancy Agreement") with DG

Infratech Pte Ltd, a Bangladeshi controlled company ("DGI" or the

"Consultant") , for an additional two years, on similar terms as

previously announced. Details of the key terms of the extended

Agreement are set out at the conclusion of this announcement.

Principal terms of the Consultancy Agreement:

Under the terms of the Consultancy Agreement, the Consultant

shall continue to provide the Company with advisory, management,

lobbying and consultancy services in relation to the Company's

business, namely to achieve the approval for and development of the

Coal Project and the Power Projects, and in thus doing so to

deliver approvals and the necessary cooperation from all

stakeholders to develop the Coal Project and the Power

Projects.

In return for its services, the Consultant shall receive the

following fees:

- A monthly retainer of GBP15,000 from 1 January 2022, payable

quarterly in arrears by the issuance of 363,636 new ordinary shares

of 1 pence each in the capital of the Company ("New Ordinary

Shares") at 4.125 pence per share, with no other financial payments

nor reimbursement of expenses, unless agreed by the Company in

advance.

- Upon completion of certain key milestones, the Consultant will

receive share-based success fees in lieu of any cash payment. The

milestones and related payments are as follows:

o receipt of the written approval of the Coal Project's Scheme

of Development , for which the Consultant shall receive a success

fee equal to 5% of the issued capital of the Company at the time of

issue;

o receipt of the written approval in respect of each group of

the Power Plants, for which the Consultant shall receive a success

fee equal to 2% of the issued capital of the Company at the time of

issue (i.e., up to 6% in total) ; and

o commencement of development of the Coal Project , for which

the Consultant shall receive a success fee equal to 4% of the

issued capital of the Company at the time of issue.

With the exception of the monthly retainer, the Consultant will

be restricted from disposing of any New Ordinary Shares received

under the consulting agreement for a period of six months from

issue.

Each milestone specified in the Consultancy Agreement represents

a significant step towards developing the proposed multi-billion

dollar Coal Project and Power Project.

The Board is acutely aware of the potential dilution arising

from the Consultancy Agreement. However, in the opinion of the

Company, the value of the services provided by the Consultant is

expected to significantly exceed the fees incurred if successful.

Accordingly, the Board has concluded that entering into the

Consultancy Agreement is beneficial for GCM and in the best

interests of the Company's shareholders as a whole.

Project Update:

Developing countries that are largely dependent on imported

fuels began to experience financial strain brought on by the

vagaries of the international energy market as the industrial world

recovered from the COVID Pandemic. The Ukraine situation has

dramatically escalated energy supply and cost problems and the

situation is likely to remain protracted. GCM's proposed Phulbari

Coal and Power Project would, in the view of the Board, enable the

Government and People of Bangladesh the opportunity to circumvent

some of the impacts of the world energy market turmoil by utilising

its own energy resource in the Phulbari Coal Basin. The annual

savings for Bangladesh in terms of coal price compared to imported

options and Foreign Exchange Reserves would in the view of the

Board be very significant. Additional benefits may include large

scale solar power development in parallel with coal mining and

potentially a reduction in greenhouse gases due to Phulbari coal

being higher energy than imported coal, meaning less coal being

consumed per kilowatt-hour of electrical energy production and the

need to ship coal thousands of kilometres from overseas mines is

avoided . The Bangladesh Government is reporting difficulties,

particularly with cost, in importing coal and gas for power plants.

GCM has opened up discussions with Government representatives to

establish a modality for progressing the Project.

GCM's Chief Executive Officer, Datuk Michael Tang PJN,

stated:

"I am delighted to continue to engage the services of DG

Infratech and look forward to working with them to drive

significant progress in pursuit of our goals."

"Our primary objective remains to deliver an impact project for

the people of Bangladesh, providing low cost and sustainable

electricity in the country. We have explored options with our

international development partners and believe the entire Phulbari

Geologic Basin should be declared an "Energy Park" of national

significance for Bangladesh. It is rich in natural energy resources

and power generating potentials, capable of supporting over 4,500MW

Solar Power and over 6,600MW thermal power, and in parallel

potentially producing significant volumes of valuable industrial

mineral co-products from the overburden material removed to access

the coal."

"The Company's economic interests and DG Infratech's are

aligned: to achieve successful progression of the proposed Phulbari

Coal and Power Project with its enabled Energy Park. I am confident

that the Consultancy Agreement will assist the Company unlock

significant value for our shareholders in time to come."

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No596/2014 which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended ("MAR"). Upon the publication of this announcement

via a Regulatory Information Service, this inside information is

now considered to be in the public domain.

For further information:

GCM Resources plc WH Ireland Ltd

Keith Fulton James Joyce

Finance Director Andrew De Andrade

+44 (0) 20 7290 1630 +44 (0) 20 7220 1666

GCM Resources plc

Tel: +44 (0) 20 7290 1630

info@gcmplc.com; www.gcmplc.com

About GCM Resources

GCM Resources plc (LON:GCM), the AIM listed mining and energy

company, has identified a high-quality coal resource of 572 million

tonnes (JORC 2004 compliant) at the Phulbari Coal and Power Project

(the "Project") in north-west Bangladesh.

Utilising the latest highly energy efficient power generating

technology, the Phulbari coal mine is capable of supporting over

6,000MW power generation. GCM is awaiting approval from the

Government of Bangladesh to develop the Project. The Company,

together with credible, internationally recognised strategic

partners, has a strategy of positioning its proposed coal to supply

power plants at the mine-mouth and other coal-fired power projects

in Bangladesh. GCM aims to deliver a practical power solution to

provide the cheapest electricity in the country, in a manner

amenable to the Government of Bangladesh.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDMZGZRZZLGZZM

(END) Dow Jones Newswires

August 22, 2022 08:21 ET (12:21 GMT)

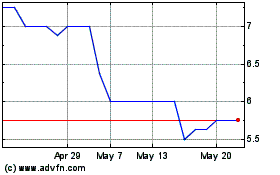

GCM Resources (AQSE:GCM.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

GCM Resources (AQSE:GCM.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025