Ipsen delivers strong sales momentum in the first nine months of 2024 and increases its full-year guidance

October 23 2024 - 12:00AM

UK Regulatory

Ipsen delivers strong sales momentum in the first nine months of

2024 and increases its full-year guidance

PARIS, FRANCE, 23 October 2024

- Ipsen (Euronext: IPN; ADR: IPSEY), a global specialty-care

biopharmaceutical company, today presents its performance for the

year to date and the third quarter of 2024.

|

YTD 2024 |

YTD 2023 |

% change |

Q3

2024 |

Q3

2023 |

% change |

|

€m |

€m |

Actual |

CER1 |

€m |

€m |

Actual |

CER1 |

|

Oncology |

1 829,8 |

1 744,1 |

4,9% |

5,8% |

604,0 |

574,5 |

5,1% |

5,6% |

|

Neuroscience |

536,4 |

489,0 |

9,7% |

11,8% |

181,9 |

164,8 |

10,4% |

10,1% |

|

Rare Disease |

129,7 |

76,0 |

70,7% |

71,3% |

50,8 |

33,2 |

53,1% |

54,4% |

|

Total Sales |

2 495,9 |

2 309,1 |

8,1% |

9,2% |

836,6 |

772,4 |

8,3% |

8,6% |

Highlights

- Total-sales growth in the year to

date of 9.2% at CER1, or 8.1%

as reported, with notable performances from

Dysport® (abobotulinumtoxinA),

Cabometyx® (cabozantinib) and

Bylvay® (odevixibat), with

robust Somatuline®

(lanreotide) sales, as well as the increasing contribution from the

launches of Iqirvo®

(elafibranor) in 2L PBC2 and

Onivyde® (irinotecan) in 1L

mPDAC3

- Regulatory

approvals in the E.U. of Iqirvo and

Kayfanda® (odevixibat)

- Increased 2024

financial guidance: total-sales growth greater than 8.0% at

CER1 (prior guidance:

greater than 7.0% at CER1);

core operating margin greater than 31.0% of total sales (prior

guidance: greater than 30.0%)

“Since the launch of our strategy in 2020, we

have enjoyed uninterrupted growth. This quarter was no exception

and was accompanied by further progress in the pipeline”, commented

David Loew, Chief Executive Officer. “We have also continued to

launch across several indications and lines of therapy, including

the recent rollouts of Iqirvo and Onivyde, which are progressing

well. Supported by the performance so far this year, we are further

increasing our 2024 sales and margin guidance.”

“We have built a track record of delivery,

grounded in a strong foundation of external innovation, commercial

excellence and our ongoing mission to offer more choices for

patients.”

Full-year 2024 guidance

Based on the strong performance in the third quarter, Ipsen has

further increased its financial guidance for 2024:

- Total-sales growth greater than

8.0%, at constant currency (prior guidance of greater than 7.0%).

Based on the average level of exchange rates in September 2024, an

adverse impact on total sales of around 1.5% from currencies

is expected

- Core operating margin greater than

31.0% of total sales (prior guidance of greater than

30.0%)

Pipeline update

In September 2024, the European Commission

conditionally approved Iqirvo 80mg tablets for the treatment of PBC

in combination with ursodeoxycholic acid (UDCA) in adults with an

inadequate response to UDCA, or as a monotherapy in patients unable

to tolerate UDCA. Iqirvo was approved in the same setting by the

U.S. FDA in June 2024.

In September 2024, the European Commission also

approved Kayfanda as a treatment for pruritus in children from as

young as six months of age who have Alagille syndrome (ALGS).

Odevixibat, under the brand name Bylvay, is already marketed in the

E.U. for the treatment of progressive familial intrahepatic

cholestasis (PFIC), and in the U.S. and E.U. for PFIC, and in the

U.S. for ALGS.

In the same month, final results from the

CABINET Phase III trial were presented at the 2024 European Society

for Medical Oncology Congress and were published in the New England

Journal of Medicine, reinforcing the efficacy benefits of Cabometyx

in advanced neuroendocrine tumors. It was announced at that time

that Ipsen had submitted an extension of indication Marketing

Authorization to the European Medicines Agency.

Business development

In August 2024, Ipsen entered into an agreement

to sell its rare pediatric disease Priority Review Voucher. As part

of the agreement, Ipsen received a cash payment of $158m in the

third quarter.

In October 2024, Eton Pharmaceuticals entered

into an agreement with Ipsen to acquire Increlex®

(mecasermin injection). The transaction is expected to close before

the end of 2024.

Arbitration proceedings with Galderma

As of 30 September 2024, two arbitration

proceedings initiated by Galderma against Ipsen at the

International Chamber of Commerce (ICC) were ongoing. The first

dispute, initiated by Galderma in 2021, pertains to the territorial

scope of the commercial partnership related to Azzalure®

(abobotulinumtoxinA) and Dysport under an agreement signed in 2007

in the E.U., in certain Eastern European countries, and in Central

Asia. The Tribunal of the ICC Internal Court of Arbitration issued

a final award, in October 2024, dismissing most, if not all, of

Galderma's claims in this first arbitration and ordered that

Galderma bear the majority of the legal fees and arbitration costs

incurred by Ipsen.

A second dispute was initiated by Galderma in November 2023,

related to the validity of Ipsen’s 2023 termination of a joint

R&D collaboration agreement entered into in 2014 under the

parties’ respective early-stage neurotoxin programs, including the

development of IPN10200. At this stage, Ipsen cannot reasonably

predict any potential financial impact from this final remaining

arbitration process, for which it intends to fully defend and

vindicate its rights.

Conference call

A conference call and webcast for investors and

analysts will begin today at 2pm CET. Participants can access the

call and its details by registering here; webcast details can be

found here.

Calendar

Ipsen intends to publish its full-year and fourth-quarter

results on 13 February 2025.

Notes

All financial figures are in € millions

(€m). The performance shown in this announcement covers the

nine-month period to 30 September 2024 (YTD 2024) and the

three-month period to 30 September 2024

(Q3 2024), compared to the nine-month period to 30 September

2023 (YTD 2023) and the three-month period to 30 September

2023 (Q3 2023), respectively. Commentary is based on the

performance in

YTD 2024, unless stated otherwise.

About Ipsen

Ipsen is a global biopharmaceutical company with

a focus on bringing transformative medicines to patients in three

therapeutic areas: Oncology, Rare Disease and Neuroscience. Our

pipeline is fuelled by external innovation and supported by nearly

100 years of development experience and global hubs in the U.S.,

France and the U.K. Our teams in more than 40 countries and our

partnerships around the world enable us to bring medicines to

patients in more than 100 countries.

Ipsen is listed in Paris (Euronext: IPN) and in

the U.S. through a Sponsored Level I American Depositary Receipt

program (ADR: IPSEY). For more information,

visit ipsen.com.

Ipsen contacts

Investors

- Craig

Marks

+44 (0)7584 349 193

- Nicolas

Bogler +33

6 52 19 98 92

Media

- Jennifer

Smith-Parker +44 (0) 7843 137 764

- Anne

Liontas

+33 7 67 34 72 96

1 At constant exchange rates (CER), which excludes

any foreign-exchange impact by recalculating the performance for

the relevant period by applying the exchange rates used for the

prior period.

2 Second-line primary biliary cholangitis.

3 First-line metastatic pancreatic ductal

adenocarcinoma.

- Ipsen - YTD 2024 sales announcement

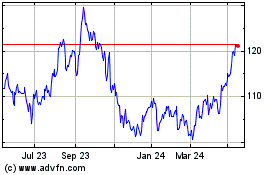

Ipsen (EU:IPN)

Historical Stock Chart

From Dec 2024 to Jan 2025

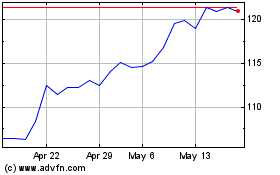

Ipsen (EU:IPN)

Historical Stock Chart

From Jan 2024 to Jan 2025