false

--12-31

0001839285

0001839285

2024-10-21

2024-10-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported)

October 21, 2024

HEALTHCARE TRIANGLE, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-40903 |

|

84-3559776 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

7901

Stoneridge Dr., Suite 220 Pleasanton, CA 94588

(Address of principal executive offices)

(925)-270-4812

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock, par value $0.00001 per share |

|

HCTI |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive Agreement.

Asset Transfer Agreement

On October 21, 2024, the Healthcare Triangle,

Inc. (the “Company”) acquired substantially all of the business, assets, and operations relating to cloud and technology domain

(the “Acquired Assets”) of SecureKloud Technologies, Inc., (“Parent”), a Nevada corporation. The Acquired Assets

include all of Parent’s cloud and technology domain and substantial business interests in the field, that currently form part of

the Parent’s Business. The Acquired Assets were acquired by the Company under an Asset Transfer Agreement, dated October 21, 2024,

between the Company, and the Parent (the “Asset Transfer Agreement”).

The consideration for the Acquired Assets consisted

of the issuance of 1,600,000 shares of newly designated Series B Convertible Preferred Stock (“Series B Preferred Stock”)

of the Company, which is/are convertible each into 10 common shares of the Company, at the holder’s option (subject to shareholder’s

approval), for a total consideration of at $4.50 per share of Series B Preferred Stock valuing the transferred assets at USD 7.20 million.

The consideration

The Asset Transfer Agreement also contained customary

representations, warranties, indemnities, and covenants. The closing of the said transaction occurred at the Parent’s place of business

on October 22, 2024.

The description in this report of the Asset Transfer

Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of such agreement attached hereto

as Exhibit 10.1, respectively, which are incorporated by reference herein.

Item 2.03. Creation of a Direct Financial Obligation

or an Obligation under an Off-Balance Sheet Arrangement of the Registrant.

The information related to the issuance, sale and exchange of the Series

B Convertible Preferred Stock contained in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

Item 2.04 Triggering Events That Accelerate

or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement.

As disclosed on the Company’s current report

on Form 8-K, filed with the SEC on September 10, 2024, the received a notice of default from Seacoast Business Funding, a division of

Seacoast National Bank (“Seacoast”) with respect to the Purchasing Agreement by and between the Company and Seacoast dated

May 2, 2022 (“Purchasing Agreement”).

The Company was updated and informed on October 21, 2024 that Seacoast

was waiving the foregoing event of Default as of October 18, 2024, and that the Company is now in compliance with the internal terms of

the Purchasing Agreement.

Item 3.02. Unregistered Sales of Equity Securities.

The information related to the issuance, sale and exchange of the Series

B Convertible Preferred Stock contained in Item 5.03 of this Current Report on Form 8-K is incorporated herein by reference.

As described in Item 1.01, pursuant to the terms

of the Asset Transfer Agreement, the Company has issued shares of Series B Convertible Preferred Stock to the Parent. This issuance, and

sale is and will be exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”), pursuant

to Section 4(a)(2) of the Securities Act or Regulation D promulgated thereunder. The Parent is an “accredited investors” as

defined in Rule 501 of the Securities Act and that the Series B Convertible Preferred Stock is being acquired for investment purposes

and not with a view to, or for sale in connection with, any distribution thereof, and appropriate legends will be affixed to any certificates

evidencing shares of the Series B Convertible Preferred Stock or shares of the Common Stock issued in connection with any future conversion

of the Series B Convertible Preferred Stock.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On October 22, 2024, in relation to the Asset

Transfer Agreement, the Company filed a Certificate of Designations of Preferences, Rights and Limitations of Series B Convertible

Preferred Stock (the “Series B Certificate of Designations”) with the Secretary of State of the State of Delaware to

establish the preferences, limitations and relative rights of the Series B Convertible Preferred Stock (the “Series

B Convertible Preferred Stock”).

The material terms of the Series B Convertible Preferred Stock are

summarized below.

Description of the Series B Convertible Preferred Stock

Conversion Rights

Each share of Series B Convertible Preferred Stock has a

stated value of $4.50 and is convertible into 10 shares of the Company’s common stock, par value $0.00001 per share (the “Common

Stock”) at the option of the holder, after the Stockholder Approval (as may be required by the applicable rules and regulations

of The Nasdaq Stock Market LLC (or any successor entity).

Voting Rights

The holders of the Series B Convertible Preferred Stock are

not entitled to vote with the Common Stock.

Dividend Rights

The holders of the Series B Convertible

Preferred Stock are not entitled to receive dividends paid on the Company's Common Stock.

Liquidation Rights

In the event of liquidation, dissolution, or winding

up of the Company, the holders of Series B Convertible Preferred Stock will be entitled to receive the amount of cash, securities

or other property to which such holder would be entitled to receive with respect to such shares of Series B Convertible Preferred Stock

if such shares had been converted to Common Stock

The foregoing description of the Series B Certificate

of Designations does not purport to be complete and is subject to, and is qualified in its entirety by reference to, the full text of

the document which is attached hereto as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Forward Looking Statements

This Current Report contains forward-looking statements

that involve risks and uncertainties intended to be covered by the safe harbor for “forward-looking statements” provided by

the Private Securities Litigation Reform Act of 1995, as amended. All statements other than statements of current or historical fact contained

in this Current Report, including statements regarding the Company’s expected timeline for compliance with the Nasdaq’s Corporate

Governance Rules, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “should,”

“estimate,” “expect,” “intend,” “may,” “plan,” “project,” “will,”

and similar expressions, as they relate to the Company, are intended to identify forward-looking statements. The Company has based these

forward-looking statements on the current expectations about future events held by management. While the Company believes these expectations

are reasonable, such forward-looking statements are inherently subject to risks and uncertainties, many of which are beyond the Company’s

control. The Company’s actual future results may differ materially from those discussed here for various reasons. Given these uncertainties,

you should not place undue reliance on these forward-looking statements. The forward-looking statements included in this Current Report

are made only as of the date hereof. We do not undertake any obligation to update any such statements or to publicly announce the results

of any revisions to any of such statements to reflect future events or developments.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Healthcare Triangle, Inc. |

| |

|

| Date: October 25, 2024 |

By: |

/s/ Thyagarajan Ramachandran |

| |

Name: |

Thyagarajan Ramachandran |

| |

Title: |

Chief Financial Officer |

4

Exhibit 3.1

HEALTHCARE TRIANGLE, INC.

CERTIFICATE OF DESIGNATIONS, RIGHTS AND PREFERENCES

OF

SERIES B CONVERTIBLE PREFERRED STOCK

Pursuant to Section 151 of

the Delaware General Corporation Law, Healthcare Triangle, Inc., a Delaware corporation (the “Corporation”), DOES HEREBY

CERTIFY:

WHEREAS, the Amended

and Restated Certificate of Incorporation of the Corporation, as amended (the “Certificate of Incorporation”), provides

for a class of its authorized stock known as preferred stock, comprised of 10,000,000 shares, $0.00001 par value per share (the “Preferred

Stock”), issuable from time to time in one or more series;

WHEREAS, the Board

of Directors is authorized by the provisions of the Certificate of Incorporation to fix the powers, designations, preferences and relative,

participating, optional or other rights, if any, and the qualifications, limitations or restrictions thereof, if any, including dividend

rights, dividend rate, voting rights, conversion rights, rights and terms of redemption and liquidation preferences, of any series of

Preferred Stock and the number of shares constituting any such series;

NOW, THEREFORE, BE IT RESOLVED,

that pursuant to this authority granted to and vested in the Board of Directors in accordance with the provisions of the Certificate of

Incorporation, the Board of Directors hereby adopts this Certificate of Designations, Rights, and Preferences (the “Certificate

of Designation”) for the purpose of creating a series of Convertible Preferred Stock of the Corporation designated as Series

B Preferred Stock, par value $0.00001 per share (the “Series B Convertible Preferred Stock”), and hereby states the

designation and number of shares, and fixes the relative rights, powers and preferences, and qualifications, limitations and restrictions

of the Series B Preferred Stock as follows:

Section 1. Designation, Amount, Par Value and

Stated Value. The series of preferred stock designated herein is Series B Convertible Preferred Stock and the number of shares so

designated is One Million Six Hundred Thousand (1,600,000) shares. Each registered holder of Series B Convertible Preferred Stock is referred

to herein as a “Holder.” Each share of Series B Convertible Preferred Stock has a par value of $0.00001 per share.

The Series B Convertible Preferred Stock shall have a stated value of $4.50 per share (the “Stated Value”).

Section 2. No Maturity, Sinking Fund, Mandatory

Redemption. Except as otherwise provided herein, the Series B Convertible Preferred Stock has no stated maturity and will not

be subject to any sinking fund for the payment of the redemption price or mandatory redemption, and will remain outstanding indefinitely

unless the Series B Convertible Preferred Stock is redeemed or otherwise repurchased in accordance with this Certificate of Designations.

The Corporation is not required to set aside funds to redeem the Series B Convertible Preferred Stock.

Section 3. Ranking. With respect to

payment of dividends and distribution of assets upon liquidation, dissolution, or winding up of the Corporation, whether voluntary or

involuntary, the Series B Convertible Preferred Stock will rank: (i) senior to all other classes or series of capital stock of the Corporation

now existing or hereafter authorized, classified or reclassified, and (ii) junior to all Indebtedness of the Corporation now existing

or hereafter authorized (including Indebtedness convertible into Common Stock).

Section 4. Dividends. The holders of the

Series B Convertible Preferred Stock shall not be entitled to receive dividends paid on the Corporation's Common Stock.

Section 5. Liquidation Preference. Upon

liquidation, dissolution or winding up of the Corporation (a “Liquidation”), whether voluntary or involuntary, each

Holder shall be entitled to receive the amount of cash, securities or other property to which such holder would be entitled to receive

with respect to such shares of Series B Convertible Preferred Stock if such shares had been converted to Common Stock immediately prior

to such Liquidation, subject to the preferential rights of holders of any senior securities of the Corporation.

Section 6. Conversion.

| (a) | Conversions at Option of Holder. On or after the Stockholder

Approval Date, each share of Series B Convertible Preferred Stock shall, at the option of the Holder, be convertible into ten (10) (the

“Conversion Amount”)shares of the Company’s common stock, par value $0.00001 per share (the “Common Stock”).

Holders shall effect conversions by providing the Corporation with the form of conversion notice attached hereto as Annex A (a “Notice

of Conversion”), duly completed and executed. Each Notice of Conversion shall specify the number of shares of Series B Convertible

Preferred Stock to be converted, the number of shares of Series B Convertible Preferred Stock owned prior to the requested conversion,

the number of shares of Series B Convertible Preferred Stock owned subsequent to the requested conversion and the date on which such

conversion is to be effected (the “Conversion Date”), which date may not be prior to the date the applicable Holder

delivers such Notice of Conversion to the Corporation. If no Conversion Date is specified in a Notice of Conversion, the Conversion Date

shall be the Business Day that the Corporation receives the Notice of Conversion. Provided the Corporation’s transfer agent is

participating in the Depository Trust Company (“DTC”) Fast Automated Securities Transfer program and the applicable

Conversion Shares are either registered for resale or eligible for resale without restriction pursuant to Rule 144 of the Securities

Act, the Notice of Conversion may specify, at the Holder’s election, whether the applicable Conversion Shares shall be credited

to the account of the Holder’s prime broker with DTC through its Deposit Withdrawal Agent Commission system (a “DWAC Delivery”).

The calculations set forth in the Notice of Conversion shall control in the absence of manifest or mathematical error. |

“Stockholder Approval”

means such approval as may be required by the applicable rules and regulations of The Nasdaq Stock Market LLC (or any successor entity)

from the stockholders of the Company to consent to the conversion of all of the shares of Series B Convertible Preferred Stock into shares

of Common Stock pursuant to Section 6 of this Certificate of Designation.

“Stockholder Approval Date”

means the date on which Stockholder Approval is obtained.

| (b) | Mechanics of Conversion |

| i. | Reservation of Shares Issuable Upon Conversion. The Corporation covenants that it will at all times

reserve and keep available out of its authorized and unissued shares of Common Stock for the sole purpose of issuance upon conversion

of the Series B Convertible Preferred Stock, free from preemptive rights or any other actual contingent purchase rights of Persons other

than the Holders of the Series B Convertible Preferred Stock, not less than such aggregate number of shares of the Common Stock as shall

be issuable (taking into account the adjustments of Section 7) upon the conversion of all outstanding shares of Series B Convertible Preferred

Stock. The Corporation covenants that all shares of Common Stock that shall be so issuable shall, upon issue, be duly authorized, validly

issued, fully paid and nonassessable. |

| ii. | Fractional Shares. No fractional shares or scrip representing fractional shares of Common Stock

shall be issued upon the conversion of the Series B Convertible Preferred Stock. As to any fraction of a share which a Holder would otherwise

be entitled to receive upon such conversion, the Corporation shall round up to the next whole share. |

| iii. | Transfer Taxes. The issuance of certificates for shares of the Common Stock upon conversion of

the Series B Convertible Preferred Stock shall be made without charge to any Holder for any documentary stamp or similar taxes that may

be payable in respect of the issue or delivery of such certificates, provided that the Corporation shall not be required to pay any tax

that may be payable in respect of any transfer involved in the issuance and delivery of any such certificate upon conversion in a name

other than that of the registered Holder(s) of such shares of Series B Convertible Preferred Stock and the Corporation shall not be required

to issue or deliver such certificates unless or until the Person or Persons requesting the issuance thereof shall have paid to the Corporation

the amount of such tax or shall have established to the satisfaction of the Corporation that such tax has been paid. |

| (c) | Status as Stockholder. Upon each Conversion Date (i) the

shares of Series B Convertible Preferred Stock being converted shall be deemed converted into shares of Common Stock, and (ii) the

Holder’s rights as a holder of such converted shares of Series B Convertible Preferred Stock shall cease and terminate, excepting

only the right to receive certificates for such shares of Common Stock and to any remedies provided herein or otherwise available at

law or in equity to such Holder because of a failure by the Corporation to comply with the terms of this Certificate of Designation.

In all cases, the holder shall retain all of its rights and remedies for the Corporation’s failure to convert Series B Convertible

Preferred Stock. |

Section 7. Certain Adjustments.

| (a) | Stock Dividends and Stock Splits. If the Corporation,

at any time while this Series B Convertible Preferred Stock is outstanding: (A) pays a stock dividend or otherwise makes a distribution

or distributions payable in shares of Common Stock (which, for avoidance of doubt, shall not include any shares of Common Stock issued

by the Corporation upon conversion of this Series B Convertible Preferred Stock) with respect to the then outstanding shares of Common

Stock; (B) subdivides outstanding shares of Common Stock into a larger number of shares; or (C) combines (including by way of a reverse

stock split) outstanding shares of Common Stock into a smaller number of shares, then the Conversion Amount shall be multiplied by a

fraction of which the numerator shall be the number of shares of Common Stock (excluding any treasury shares of the Corporation) outstanding

immediately before such event and of which the denominator shall be the number of shares of Common Stock outstanding immediately after

such event (excluding any treasury shares of the Corporation). Any adjustment made pursuant to this Section 7(a) shall become

effective immediately after the record date for the determination of stockholders entitled to receive such dividend or distribution and

shall become effective immediately after the effective date in the case of a subdivision or combination. |

| (b) | Calculations. All calculations under this Section

7 shall be made to the nearest cent or the nearest 1/100th of a share, as the case may be. For purposes of this Section 7,

the number of shares of Common Stock deemed to be issued and outstanding as of a given date shall be the sum of the number of shares

of Common Stock (excluding any treasury shares of the Corporation) issued and outstanding. |

Section 8. Miscellaneous.

| (a) | Notices. Any and all notices or other communications

or deliveries to be provided by the Holders hereunder including, without limitation, any Notice of Conversion, shall be in writing and

delivered personally, by e-mail, or sent by a nationally recognized overnight courier service, addressed to the Corporation, or such

other address as the Corporation may specify for such purposes by notice to the Holders delivered in accordance with this Section. Any

and all notices or other communications or deliveries to be provided by the Corporation hereunder shall be in writing and delivered personally,

by e-mail, or sent by a nationally recognized overnight courier service addressed to each Holder at the e-mail address or mailing address

of such Holder appearing on the books of the Corporation, or if no such e-mail address or mailing address appears on the books of the

Corporation, at the principal place of business of such Holder. Any notice or other communication or deliveries hereunder shall be deemed

given and effective on the earliest of (i) the date of transmission, if such notice or communication is delivered via facsimile at the

facsimile number specified in this Section prior to 5:30 p.m. (New York City time) on any date, (ii) the date immediately following the

date of transmission, if such notice or communication is delivered via e-mail at the e-mail address specified in this Section between

5:30 p.m. and 11:59 p.m. (New York City time) on any date, (iii) the second Business Day following the date of mailing, if sent by nationally

recognized overnight courier service, or (iv) upon actual receipt by the party to whom such notice is required to be given. |

| (b) | Lost or Mutilated Series B Convertible Preferred Stock

Certificate. If a Holder’s Series B Convertible Preferred Stock certificate shall be mutilated, lost, stolen or destroyed,

the Corporation shall execute and deliver, in exchange and substitution for and upon cancellation of a mutilated certificate, or in lieu

of or in substitution for a lost, stolen or destroyed certificate, a new certificate for the shares of Series B Convertible Preferred

Stock so mutilated, lost, stolen or destroyed, but only upon receipt of evidence of such loss, theft or destruction of such certificate,

and of the ownership thereof, reasonably satisfactory to the Corporation and, in each case, customary and reasonable indemnity, if requested.

Applicants for a new certificate under such circumstances shall also comply with such other reasonable regulations and procedures and

pay such other reasonable third-party costs as the Corporation may prescribe. |

| (c) | Waiver. Any waiver by the Corporation or a Holder

of a breach of any provision of this Certificate of Designation shall not operate as or be construed to be a waiver of any other breach

of such provision or of any breach of any other provision of this Certificate of Designation or a waiver by any other Holders. The failure

of the Corporation or a Holder to insist upon strict adherence to any term of this Certificate of Designation on one or more occasions

shall not be considered a waiver or deprive that party (or any other Holder) of the right thereafter to insist upon strict adherence

to that term or any other term of this Certificate of Designation. Any waiver by the Corporation or a Holder must be in writing. Notwithstanding

any provision in this Certificate of Designation to the contrary, any provision contained herein and any right of the holders of Series

B Convertible Preferred Stock granted hereunder may be waived as to all shares of Series B Convertible Preferred Stock (and the Holders

thereof) upon the written consent of the Holders of not less than a majority of the shares of Series B Convertible Preferred Stock then

outstanding, unless a higher percentage is required by the DGCL, in which case the written consent of the holders of not less than such

higher percentage shall be required. |

| (d) | Severability. If any provision of this Certificate

of Designation is invalid, illegal or unenforceable, the balance of this Certificate of Designation shall remain in effect, and if any

provision is inapplicable to any Person or circumstance, it shall nevertheless remain applicable to all other Persons and circumstances.

If it shall be found that any amount deemed interest due hereunder violates the applicable law governing usury, the applicable rate of

interest due hereunder shall automatically be lowered to equal the maximum rate of interest permitted under applicable law. |

| (e) | Next Business Day. Whenever any payment or other obligation

hereunder shall be due on a day other than a Business Day, such payment shall be made on the next succeeding Business Day. |

| (f) | Headings. The headings contained herein are for convenience

only, do not constitute a part of this Certificate of Designation and shall not be deemed to limit or affect any of the provisions hereof. |

| (g) | Status of Converted Series B Convertible Preferred Stock.

If any shares of Series B Convertible Preferred Stock shall be converted or reacquired by the Corporation, such shares shall resume the

status of authorized but unissued shares of preferred stock and shall no longer be designated as Series B Convertible Preferred Stock. |

IN WITNESS WHEREOF, the Corporation has

caused this Certificate of Designation to be duly executed on its behalf by its undersigned Chief Financial Officer as of October 22,

2024.

| |

By: |

/s/ Ramachandran Thyagarajan |

| |

|

Name: |

Ramachandran Thyagarajan |

| |

|

Title: |

Chief Financial Officer |

ANNEX A

NOTICE OF CONVERSION

(TO BE EXECUTED BY THE REGISTERED HOLDER

IN ORDER TO CONVERT SHARES OF SERIES B CONVERTIBLE PREFERRED STOCK)

1. The

undersigned Holder hereby irrevocably elects to convert the number of shares of Series B Convertible Preferred Stock indicated below,

represented by stock certificate No(s). (the “Preferred Stock Certificates”), into shares of common stock, par

value $0.00001 per share (the “Common Stock”), of Healthcare Triangle, Inc., a Delaware corporation (the

“Corporation”), as of the date written below. If securities are to be issued in the name of a person other than

the undersigned, the undersigned will pay all transfer taxes payable with respect thereto. Capitalized terms utilized but not defined

herein shall have the meaning ascribed to such terms in that certain Certificate of Designations, Rights and Preferences of Series B Convertible

Preferred Stock (the “Certificate of Designation”) filed by the Corporation on October 22, 2024.

2. Conversion

calculations:

| Date to Effect Conversion: _______________________________________________________________________ |

| |

| Number of shares of Series B Convertible Preferred Stock owned prior to Conversion: _______________________ |

| |

| Number of shares of Series B Convertible Preferred Stock to be Converted: ________________________________ |

| |

| Number of shares of Common Stock to be Issued:_____________________________________________________ |

| |

| Address for delivery of physical certificates: _________________________________________________________ |

| |

| or for DWAC Delivery: |

| |

| DWAC Instructions: |

| |

| Broker no: ____________________________________________________________________________________ |

| |

| Account no: ___________________________________________________________________________________ |

| |

| [HOLDER] |

|

| |

|

| By: |

|

|

| Name: |

|

|

| Title: |

|

|

| Date: |

|

|

Exhibit 10.1

ASSET

TRANSFER AGREEMENT

October

21, 2024

ASSET TRANSFER AGREEMENT

This ASSET TRANSFER AGREEMENT (the “Agreement”)

is entered into as of October 21, 2024 (“Execution Date”) by and between:

| (1) | SecureKloud Technologies, Inc ., a Nevada corporation, having its registered office at 666 Plainsboro

Road, Suite 448, Plainsboro, NJ 08536, USA (the “Seller” which expression shall unless

repugnant to the context or meaning thereof, mean and include its successors and administrators); and |

| (2) | Healthcare Triangle, Inc., a Delaware corporation, having its principal office at 7901, Stoneridge

Drive, Suite 220, Pleasanton, CA 94588 (hereinafter referred to as the “Purchaser” which expression shall unless

repugnant to the context or meaning thereof, mean and include its successors and administrators). |

(The Seller and the Purchaser are individually

referred to in this Agreement as a “Party” and together as the “Parties”).

RECITALS:

WHEREAS: the Seller is a leading global

information technology business transformation, secure cloud solutions and managed services provider headquartered in Plainsboro, NJ providing

solutions – SMAC (Social, Mobile, Analytics and Cloud) for seamless connectivity between consumers, small, mid-size and large enterprises,

(the “Business”);

WHEREAS: The Seller

wishes to sell, transfer, convey and assign to the Purchaser, and the Purchaser wishes to purchase from the Seller the business, assets,

and operations relating to cloud and technology domain that currently form part of the Seller’s Business (the “Transferred

Assets”), as a whole and as a going concern in exchange for the issuance by the Purchaser to the Seller of 1,600,000 shares

of the Purchaser’s Series B Convertible Preferred Stock, the Certificate of Designations Rights and Preferencecs of which is set

forth on Exhibit A (the “Preferred Stock”), on and subject to the terms and subject to the conditions specified in this

Agreement (the “Purchaser Equity”).

WHEREAS: The Purchaser and Seller have

passed appropriate board resolutions authorizing the execution, delivery and performance of this Agreement and the transactions contemplated

hereby and authorizing their respective representatives to execute all documentation and undertake all actions in relation thereto; and

WHEREAS: The Seller and the Purchaser wish

to record in this Agreement the terms of the proposed transfer of the Transferred Assets in consideration for the issuance of the Purchaser

Equity by the Purchaser to the Seller.

AGREEMENT:

NOW THEREFORE, THE PARTIES

AGREE AS FOLLOWS:

1. AGREEMENT

TO SELL AND PURCHASE

1.1 Subject

to the other provisions of this Agreement, the Seller hereby sells, conveys, transfers and assigns the Transferred Assets to the Purchaser,

as a whole, and as a going concern, in consideration for the issuance to the Seller of the Purchaser Equity, in the manner and on

the terms specified in this Agreement.

1.2 Subject

to the other provisions of this Agreement, and based on the representations of the Seller contained in this Agreement (“Representations”),

the Purchaser hereby purchases from the Seller the Transferred Assets in consideration for the issuance to the Seller of the Purchaser

Equity of 1,600,000 shares at $4.50 per share valuing the transferred assets at USD 7.20 million, in the manner and on the terms

specified in this Agreement.

1.3 The

consideration of USD 7.20 million is payable in equity, subject to applicable withholding, in the form of applicable number of shares

of Buyer’s capital stock calculated based on the average of the VWAPs for the 30 Trading Days immediately prior to the Closing Date

(the “Closing Equity Consideration”).

1.4 Without

prejudice to the generality of the foregoing, and subject to Clause 1.4 below, the term “Transferred Assets”

as used in this Agreement shall include all assets of the Business involved in cloud and technology domain, including, without limitation,

each of the following:

(i) All

assets (business contracts and employees) owned by the Seller identified in Schedule 1.3(i): Transferred Tangible Assets to this

Agreement (collectively, the “Transferred Tangible Assets”), free and clear of any liens, pledges, charges, mortgages,

defects in title, objections, security interests, claims, options, rights of first offer or refusal, hypothecations, restrictions on transfer,

or other encumbrances of any kind (“Encumbrances”)

(ii) all

immigration-related interests, obligations and liabilities of the Seller as the original petitioning employer, including but not limited

to those obligations, liabilities, and undertakings arising from and under attestations contained in the Labor Condition Applications

(LCAs) filed with the U.S. Department of Labor for H-1B petitions filed by the Seller;

(iii) All

agreements, contracts, franchises, insurance policies, leases, property licenses, purchase orders, software licenses, software escrow

agreements, technology licenses understandings, or arrangements relating to the Seller’s cloud and technology business (“Arrangements”)

entered into by the Seller for or in connection with the Seller’s cloud and technology business (“Transferred Contracts”)

and listed and identified in Schedule 1.3(iii): Transferred Contracts to this Agreement;

(iv) Subject

to obtaining approvals of any third parties as may be required, all Arrangements entered into by the Seller for or in connection with

the Seller’s cloud and technologycloud and technology business (“Future Transferred Contracts”) and listed and

identified in Schedule 1.3(iv):: Future Transferred Contracts to this Agreement, which Future Transferred Contracts shall be deemed

assigned automatically and immediately upon receipt of the appropriate approvals of any third parties, as required;

(v) All

government and regulatory permits, licenses, concessions, or other similar consents held by the Seller for or in connection with the Seller’s

cloud and technology business (“Permits”), if and to the extent such Permits are valid and subsisting on the Closing

Date and are capable of being transferred or assigned in accordance with applicable law, as listed and identified in Schedule 1.3(v):

Permits to this Agreement;

(vi) The

release from employment by the Seller of the employees connected with the Seller’s cloud and technology business, who have been

offered employment by the Purchaser as on the Closing Date, who have accepted such employment, and who are identified in Schedule 1.3(vi):

Transferred Employees to this Agreement (“Transferred Employees”);

(vii) All

business and financial records and documents connected with or relating to the Seller’s cloud and technology business, including

vouchers, invoices, books of accounts, tax records, tax returns, notices, filings, and all other documents and records (whether proprietary,

confidential or otherwise) used for or in connected with the Seller’s cloud and technology business (“Business Records”),

owned, or controlled by the Seller or its agents, including any tax advisors, accountants, auditors or legal advisors.

1.5 Notwithstanding

anything contained in any other provision of this Agreement, the Seller’s cloud and technology business specifically and expressly

excludes any and all libilities and obligations associated with the Seller’s Business and outstanding on the date hereof, other

than those listed on Schedule 1.4: Transferred Liabilities.

2. [RESERVED]

3. TAX

MATTERS AND OTHER COSTS

3.1 The

Purchaser shall issue the Purchaser Equity to the Seller, in accordance with Clause 2 of this Agreement, for a transfer of the

Transferred Assets, as a whole and on a going concern basis only, and accordingly the Parties agree that no goods and services tax, sales

tax or customs duty or similar tax, or surcharge thereon shall be payable by the Purchaser to the Seller in connection with the sale of

the Transferred Assets. If any goods and services tax, sales tax or customs duty or similar tax, or surcharge thereon is payable on the

sale of the Transferred Assets, then such tax (other than any tax on the Seller’s income or the Seller’s capital gains) shall

be borne by the Seller.

3.2 Where

any tax is required to be withheld or deducted at source on any payment by any Party pursuant to this Agreement, the payor shall be entitled

to withhold or deduct the same at source, as required by law, provided that the payor shall issue the recipient thereof with necessary

certificates of such withholding or deduction at source in accordance with applicable law, and within the time periods stipulated.

3.3 The

Seller shall bear all income and capital gains taxes payable by the Seller on account of the sale of the Transferred Assets pursuant to

this Agreement.

3.4 The

Purchaser shall bear the applicable taxes levied by any authorities whatsoever payable in connection with any deed or document required

to be executed in relation to the conveyance or assignment, as the case may be, of any property included in the Transferred Assets.

3.5 Each

Party shall bear the costs and charges of its own professional and legal advisors.

4. CLOSING

4.1 Closing

shall take place at the Seller’s place of business on October 22, 2024, at 5:00 pm PST.

4.2 At

Closing, the Seller shall execute and deliver the Assignment Deed, in substantially the form attached as Exhibit B hereto.

4.3 At

Closing, the Parties shall complete each of the actions and steps required to complete the sale of the Transferred from the Seller to

the Purchaser and the issuance of Purchaser Equity to Seller.

5. REPRESENTATIONS

AND WARRANTIES

5.1 Each

Party represents and warrants to the other as follows.

(i) It

has all requisite power and authority to enter into and perform all its obligations under this Agreement.

(ii) It

has taken all actions, obtained all regulatory, corporate and contractual authorizations, and submitted all notices or filings required

to be submitted, for it to validly enter into this Agreement and perform all its obligations under this Agreement.

(iii) The

execution and delivery of, or the performance of obligations under, this Agreement do not violate or conflict with any statute, rule,

regulation, directive, other law, judgment, order, decree or award applicable to it or to any provision of its constituent documents,

or any agreement, contract, promise, covenant, undertaking, representation or warranty, applicable to or made by it.

(iv) This

Agreement constitutes legal, valid and binding obligations, enforceable against it in accordance with its terms.

5.2 The

Seller hereby represents to the Purchaser, that to the best of its knowledge, each of the Representations set out in Schedule 5.2:

Representations to this Agreement is true, materially accurate, and not misleading, as on the date of this Agreement and as on the

Closing Date. Provided that such Representations are made subject to the following:

(i) The

Representations are qualified to the extent such qualifications have been expressly set out in the disclosure schedule set out in Disclosure

Schedule to this Agreement (“Disclosure Schedule”), in substantially the form attached as Exhibit C

hereto;

(ii) Where

any Representation is stated to be made to the Seller’s best knowledge, or where any Representation is similarly qualified, such

Representation has been

(iii) made

and shall be deemed to have been made after the exercise of reasonable diligence by the Seller;

(iv) Any

Representation made expressly as of a specific date is true and correct as of that specific date only;

(v) Any

Representation that addresses any specific circumstances or facts does not allow recourse to a general statement;

(vi) Each

Representation is separate and independent and, save as expressly provided to the contrary, shall not be limited by inference from any

other Representation or any other term of this Agreement.

5.3 The

Seller shall not do, allow or procure to be done, any act or omission that would constitute a breach of any Representation, or that would

make any Representation false, incomplete, inaccurate or misleading if they were so given.

5.4 The

Seller covenants to disclose promptly to the Purchaser in writing, immediately upon becoming aware of the same, any matter, event, or

circumstance (including any omission to act) that may arise or become known between the date of this Agreement and the Closing Date and

that would render any Representation to be inaccurate or incomplete or that relate to the occurrence of any material adverse event.

6. CONFIDENTIALITY

6.1 For

purposes of this Agreement, Confidential Information means all scientific, technical, trade, financial or business information

or materials that are either proprietary or not publicly known that any Party (Discloser) may from time to time disclose or otherwise

make available to the other Party (Recipient) in connection with or pursuant to this Agreement. Without prejudice to the generality

of the foregoing, Confidential Information includes the provisions of this Agreement, and information and materials related to any activities

of the Discloser whether or not such information is marked or identified as confidential or proprietary. Provided that in relation to

any and all Confidential Information connected in any manner with the Transferred Assets, the Seller shall be deemed the Discloser of

such Confidential Information prior to the Closing Date, and the Purchaser shall be deemed the Discloser of such Confidential Information

after the Closing Date (notwithstanding the earlier disclosure of such information by the Seller to the Purchaser).

6.2 Notwithstanding

anything contained in Clause 6.1, Confidential Information shall not include information that:

(i) at

the time of disclosure, is known publicly or thereafter becomes known publicly through no fault attributable to the Recipient;

(ii) becomes

available to the Recipient from a third party that is not legally prohibited from disclosing such information, provided such information

was not acquired from the Discloser;

(iii) was

developed by the Recipient independently of information obtained from the Discloser, as shown by the Recipient’s written records

that predate the receipt of such information from the Discloser;

(iv) was

already known to the Recipient before receipt from the Discloser, as shown by the Recipient’s written records that predate the receipt

of such information from the Discloser; or

(v) is

released with the prior written consent of the Discloser.

6.3 A

disclosure of Confidential Information made by or on behalf of the Discloser, including by its employees, agents, consultants, affiliates

or associates, as well as disclosure by any means (whether written or oral) or through any medium, and any disclosure made prior or subsequent

to the date of this Agreement shall be deemed to be a disclosure of Confidential Information for purposes of this Agreement.

6.4 Each

Discloser hereby represents, warrants and covenants that it is entitled to and will be entitled to disclose all Confidential Information

disclosed pursuant to or in connection with this Agreement.

6.5 The

Recipient hereby covenants to do each of the following for a period of two (2) years following the earlier of (a) the Closing Date or

(b) the expiry or termination of this Agreement for any reason:

(i) Keep

all Confidential Information in strict confidence, with at least the same level of care as it applies to keeping its own personal, financial

or proprietary information confidential, and in any event no less than reasonable care to prevent the unauthorized disclosure or use of

any Confidential Information;

(ii) Not

use, modify, create any derivative works from, or otherwise deal in any Confidential Information, except when the Recipient is required

to do so solely in connection with this Agreement, and then only as specified by the Discloser;

(iii) Not

disclose any Confidential Information to any other persons or entities except persons who need access to the Confidential Information

in connection with this Agreement, and who are bound by equivalent obligations of confidentiality; and

(iv) Notify

the Discloser in writing immediately upon discovery of any unauthorized use or disclosure of any Confidential Information and reasonably

cooperate with the Discloser to prevent any unauthorized disclosure or use of the Confidential Information and to mitigate any losses

arising from such unauthorized disclosure or use.

Provided that if the Recipient

is required to disclose any Confidential Information by reason of a legal requirement or by the order of a judicial or administrative

authority or by the listing requirements of a recognized stock exchange on which the securities of the Recipient are publicly traded,

the Recipient, to the extent reasonably practicable, shall send to the Discloser prior notice of such requirement in order to allow the

Discloser reasonable opportunity to oppose such process or to obtain protective or confidential treatment of the Confidential Information,

and to the extent that a protective order or other legal protection is not obtained by the Discloser, the Recipient shall disclose only

that portion of the information that is legally required to be disclosed.

6.6 Subject

to the other provisions of this Clause 6, the Recipient shall be liable for any breach of its covenants in Clause 6.5 by

any person to whom any Confidential Information is disclosed or provided by the Recipient, and the Recipient undertakes to take any and

all necessary actions, at its own cost and expense, to prevent or remedy such breach.

6.7 Upon

expiration or termination of this Agreement or earlier upon receipt of a written request from the Discloser, the Recipient shall cease

all use of the Confidential Information and promptly return to the Discloser all documents and materials of the Discloser that relate

to or contain any Confidential Information without retaining copies thereof, except for one (1) copy that may be made and retained by

the Recipient solely for record-keeping and purposes of assuring continued compliance with its obligations under this Agreement.

6.8 Unless

otherwise expressly provided in this Agreement, the disclosure of Confidential Information shall not of itself grant the Recipient any

right, title or interest in the Confidential Information, except the limited right to use the Confidential Information solely for the

purposes specified pursuant to and in accordance with this Agreement.

6.9 The

Recipient acknowledges and agrees that the Discloser is not making and shall not be deemed to have made any implied representations or

warranties regarding the accuracy or completeness of any Confidential Information, but nothing contained in this Clause 6 shall

affect any Representation or any other express representation or warranty made with regard to the accuracy or completeness of any Confidential

Information.

6.10 The

Parties agree that in addition to any other rights or remedies available under this Agreement, in the event of any breach or any threatened

breach of any obligations under this Clause 6 where such breach or threatened breach is in any way attributable to the Recipient,

monetary damages do not provide a sufficient remedy, and the Discloser shall be entitled to an injunction restraining and to seek specific

performance by the Recipient of any obligation under this Clause 6.

7. INDEMNIFICATION

7.1 Subject

to the other provisions of this Clause 7, from and after the Closing, the Seller shall indemnify the Purchaser and save and hold

the Purchaser harmless against any and all judgments, awards, liabilities, losses, costs or damages, including reasonable fees and expenses

of attorneys, accountants and other professional advisors, actually incurred, whether involving a dispute solely among the Parties or

otherwise, and any costs, including reasonable fees and expenses of attorneys, accountants and other professional advisors, incurred in

investigating, defending or settling any claim, action or cause of action (“Losses”) suffered, incurred or paid, directly

or indirectly, by any of them as a result of, arising out of or related to any third party claims made against the Purchaser as a result

of:

(i) any

failure of any Representation of the Seller, in each case as qualified and modified by the relevant Disclosure Letter, to be true and

correct in all material respects, in accordance with the provisions hereof; and/or

(ii) any

breach of any covenant by the Seller in this Agreement.

7.2 The

Representations contained in this Agreement, including the Disclosure Schedule and any document delivered pursuant to this Agreement,

shall survive Closing until the date that is twenty-four (24) months after the Closing Date.

8. TERMINATION

This Agreement may not be terminated

except by mutual consent of the Parties recorded in writing and then only on such terms as shall be recorded.

9. MISCELLANEOUS

9.1 The

section and clause headings and captions used in this Agreement are for convenience and identification only; otherwise, they form no part

of this Agreement and do not affect its interpretation or construction.

9.2 References

to sections, clauses or schedules without further specification are references to sections and clauses of this Agreement.

9.3 References

to this Agreement include all sections, clauses and schedules in this Agreement and all recitals to this Agreement, as amended from time

to time in writing by the Parties in accordance with the provisions of this Agreement.

9.4 Any

reference to a statute or any provision of a statute includes a reference to that statute or provision and any rule, regulation, notification,

circular, or direction made or issued pursuant to that statute or provision, as may be from time to time modified or re-enacted, whether

prior to or after the date of this Agreement.

9.5 References

to the singular include references to the plural and vice versa.

9.6 Words

denoting one grammatical gender include references to all grammatical genders.

9.7 When

the term “include”, “including” or “including in particular” is used in this Agreement, such use means

“include without limitation”, “including without limitation” and “including in particular and without limitation”

respectively.

9.8 The

laws of the State in California shall govern all matters arising out of or relating to this Agreement, including, its validity, interpretation,

construction, performance, expiry, termination and enforcement.

9.9 Any

controversy, claim, or dispute arising out of or in connection with this Agreement, including any question regarding its existence, validity

or termination, shall be settled by arbitration administered by the American Arbitration Association in accordance with its arbitration

rules, and judgment on the award rendered by the arbitrator may be entered in any court having jurisdiction thereof. A notice of, or request

for, arbitration will not operate to stay, postpone or rescind the effectiveness of any demand for performance.

9.10 Subject

to the provisions of Clause 9.9, the Parties hereby confirm that the courts in Alameda County, California have jurisdiction over

the Parties in connection with this Agreement.

9.11 Any

notice, communication, document or other instrument required to be given under this Agreement shall be in writing and given by sending

it by recognized courier with acknowledgement of receipt requested, or by electronic mail to the addresses specified below, or such other

addresses as have been previously notified by each Party to the other in accordance with the provisions of this Clause 9.11.

IF TO THE PURCHASER:

Healthcare Triangle, Inc.

Address: 7901 Stoneridge Dr, Suite 220

Pleasanton, CA 94588

Attn: Ramachandran Thyagarajan

Tel.: 708-289-5111

Email: rt@healthcaretriangle.com

IF TO THE SELLER:

SecureKloud Technologies, Inc.

Address: 666 Plainsboro Road, Suite 448, Plainsboro,

NJ 08536, USA

Attn: Suresh Venkatachari

Tel.: 781-354-0843

Email: sureshv@securekloud.com

Any notice, direction or other

instrument required or permitted to be given under this Agreement shall be deemed to have been validly and effectively given (i) if

sent by recognized courier with acknowledgement of receipt requested, then on the date of such delivery or receipt if such date is a working

day in the city where the recipient’s address is located or otherwise on the next working day, or (ii) if transmitted by electronic

mail, then on the working day (in the city where the recipient’s address is located) following the date of transmission.

9.12 This

Agreement contains all the promises, agreements, conditions and understandings between the Parties with respect to the subject matter

of this Agreement, and supersedes all prior or contemporaneous promises, agreements, conditions and understandings, whether oral or written,

with respect to such subject matter.

9.13 Each

Party agrees to execute and deliver all further instruments and documents and to perform all other acts that may be reasonably necessary

or expedient to further the purposes of this Agreement. Each Party will not, directly or indirectly, permit or condone any action or engage

in any omission or inaction that might cause any undertaking or covenant, or any representation or warranty not to be satisfied or fulfilled,

including any action or inaction that might cause any undertaking, covenant, representation or warranty not to be true, correct and accurate

during the term of or the term required under this Agreement.

9.14 This

Agreement may be executed in one or more counterparts, all of which together shall constitute one and the same instrument. Any Party may

enter into this Agreement by executing a counterpart, and a delivery by email to the other Party of a scanned copy of any such executed

counterpart shall be deemed to constitute delivery of the original counterpart.

9.15 No

amendment of, supplement to or suspension of this Agreement shall be effective unless it is in writing and duly executed by both Parties.

9.16 No

Party, without the prior written consent of the other Party, may assign to any other person any of its rights, or delegate or sub-contract

to any other person, the performance of any of its obligations arising under or related to this Agreement.

9.17 This

Agreement binds and benefits the successors and permitted assigns of each Party. Without prejudice to the foregoing, this Agreement does

not confer any enforceable rights or remedies upon any person other than the Parties.

9.18 Nothing

in this Agreement shall or shall be deemed to constitute a partnership between the Parties or to constitute any Party as the agent of

the other Party for any purpose.

9.19 A

Party shall not make or publish any announcement or press release concerning or connected with this Agreement, without the prior written

consent of the other Party, unless otherwise required by law.

9.20 No

provision of this Agreement shall be construed against a Party on the ground that it or its agents or advisors drafted such provision.

9.21 If

any provision of this Agreement should be or become entirely or partly invalid or unenforceable, such invalidity or unenforceability shall

not affect the validity or enforceability of any other provision of this Agreement. Any invalid or unenforceable provision shall be regarded

as replaced by such valid and enforceable provision that as closely as possible reflects the economic purpose that the Parties hereto

had pursued with the invalid or unenforceable provision.

[The remainder of this page has been deliberately

left blank. The signature page and schedules follow]

IN

WITNESS WHEREOF, the Parties have executed and delivered this Agreement effective as of the day and year first written above.

| |

SELLER: |

| |

|

|

| |

SecureKloud Technologies, INC. |

| |

|

|

| |

By: |

|

| |

Name: |

PK Chandrasekher |

| |

Title: |

Vice President |

| |

|

|

| |

Address: |

666 Plainsboro Road, Suite 448, |

| |

|

Plainsboro, NJ 08536, USA |

| |

Email: |

pk@securekloud.com@securekloud.com |

| |

|

|

| |

PURCHASER: |

| |

|

|

| |

HEALTHCARE TRIANGLE, INC. |

| |

|

|

| |

By: |

|

| |

Name: |

Ramachandran Thyagarajan |

| |

Title: |

Chief Financial Officer |

| |

|

|

| |

Address: |

7901 Stoneridge Dr, |

| |

|

Suite 220, Pleasanton, CA 94588 |

| |

Email: |

rt@healthcaretriangle.com |

EXHIBIT A

CERTIFICATE OF DESIGNATIONS,

RIGHTS AND PREFERENCES OF SERIES B CONVERTIBLE PREFERRED STOCK

EXHIBIT B

FORM OF ASSIGNMENT DEED

This Assignment Deed (Deed) is made on

October 22, 2024, by SecureKloud Technologies, Inc. (Assignor), a company incorporated under the laws of Nevada, in favor

of Healthcare Triangle, Inc., a Delaware corporation, (Assignee).

WHEREAS,

on Ocytober 22, 2024, the parties above-named entered into an Asset Transfer Agreement (Agreement), whereby in connection with

the sale of the Transferred Assets (as defined in said Agreement) on a going concern, the Assignor agreed to sell, convey, transfer and

assign to the Assignee, the following, inter alia, in accordance with and subject to the terms and conditions specified in the

Agreement: Transferred Contracts, Transferred Future Contracts, Permits, Transferred Employees, and Business Records.

AND

WHEREAS, in accordance with said Agreement and for the consideration specified therein, the Assignor hereby effects such sale,

conveyance, transfer and assignment of the Transferred Contracts, Transferred Future Contracts, Permits Transferred Employees, and Business

Records to the Assignee.

NOW,

THEREFORE, THIS DEED WITNESSETH AS FOLLOWS:

| 1. | By these presents, and to the extent permitted by applicable law or the underlying Permit, Transferred

Contract or Transferred Future Contract, the Assignor hereby sells, transfers, conveys and assigns to the Assignee, all its right, title

and interest in the Permits, Transferred Contracts and the Transferred Future Contracts, in accordance with the provisions of the Agreement,

including full power to cause the Assignee’s name to be substituted for the Assignor’s name in connection therewith and to

deal with the same in such manner as the Assignee deems fit. |

| 2. | By these presents, the Assignor hereby sells, transfers, conveys and assigns, as applicable, to the Assignee,

all its right, title and interest in and to the Transferred Contract or Transferred Future Contract and the Business Records, in accordance

with the provisions of the Agreement, including full power to cause the Assignee’s name to be substituted for the Assignor’s

name in connection therewith and to deal with the same in such manner as the Assignee deems fit. |

| 3. | The Assignor hereby covenants to do all such acts and things and execute all other necessary documents

and depose to or provide any declarations or oaths and render all assistance to the Assignee as may be necessary or desirable for the

Assignee to protect, establish, vest or enforce the Assignee’s right, title and interest in respect of all or any of the foregoing,

sold, conveyed, transferred, or assigned, as the case may be, pursuant to this Deed. |

| 4. | The Assignor hereby undertakes to not publish, release or in any way make available to third parties any

of the foregoing or any documents or other records connected therewith without the prior written consent of the Assignee, unless required

to do so by law or the order of a court or governmental authority. |

| 5. | The Assignor hereby confirms and covenants that on and from the date of this Deed, it does not and shall

not retain any rights, title or interest in any of the foregoing or any documents or other records connected therewith, except for the

right to retain one (1) photocopy thereof solely for the purposes of record keeping and ensuring compliance with the provisions of this

Deed and the Agreement. |

| 6. | All terms used in this Deed and not defined herein shall have the meanings specified in the Agreement. |

| 7. | This Deed and all matters connected with or related to this document shall be subject to the provisions

of the Agreement, which provisions are hereby incorporated into this Deed by reference. |

[Signature page follows]

IN WITNESS WHEREOF, the Parties have executed

and delivered this Agreement effective as of the day and year first written above.

| |

ASSIGNOR: |

| |

|

|

| |

SecureKloud Technologies, Inc. |

| |

|

|

| |

By: |

|

| |

Name: |

PK Chandrasekher |

| |

Title: |

Vice President |

| |

|

|

| |

Address: |

666 Plainsboro Road, |

| |

|

Suite 448, Plainsboro, |

| |

|

NJ 08536, USA |

| |

Email: |

pk@securekloud.com |

| |

|

|

| |

AGREED AND ACKNOWLEDGED: |

| |

|

|

| |

ASSIGNEE: |

| |

|

|

| |

HEALTHCARE TRIANGLE, INC. |

| |

|

|

| |

By: |

|

| |

Name: |

Ramachandran Thyagarajan |

| |

Title: |

Chief Financial Officer |

| |

|

|

| |

Address: |

7901 Stoneridge Dr., Suite 220 |

| |

|

Pleasanton, CA 94588 |

| |

Email: |

rt@healthcaretriangle.com |

v3.24.3

Cover

|

Oct. 21, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 21, 2024

|

| Current Fiscal Year End Date |

--12-31

|

| Entity File Number |

001-40903

|

| Entity Registrant Name |

HEALTHCARE TRIANGLE, INC.

|

| Entity Central Index Key |

0001839285

|

| Entity Tax Identification Number |

84-3559776

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

7901

Stoneridge Dr.

|

| Entity Address, Address Line Two |

Suite 220

|

| Entity Address, City or Town |

Pleasanton

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94588

|

| City Area Code |

925

|

| Local Phone Number |

270-4812

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.00001 per share

|

| Trading Symbol |

HCTI

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

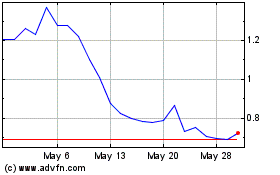

Healthcare Triangle (NASDAQ:HCTI)

Historical Stock Chart

From Feb 2025 to Mar 2025

Healthcare Triangle (NASDAQ:HCTI)

Historical Stock Chart

From Mar 2024 to Mar 2025