false000152576900015257692024-04-022024-04-02

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 3, 2025

DAVE & BUSTER’S ENTERTAINMENT, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-35664 | 35-2382255 |

(State of incorporation) | (Commission File Number) | (IRS Employer Identification Number) |

| | |

1221 S. Belt Line Rd., Suite 500 Coppell, TX 75019 |

| (Address of principal executive offices) |

Registrant’s telephone number, including area code: (214) 357-9588

Check the appropriate box if the Form 8-K filing is intended to simultaneously satisfy the reporting obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act |

☐ | Soliciting material pursuant to Rule 14a-12 of the Exchange Act |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) Exchange Act |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) Exchange Act |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock $0.01 par value | | PLAY | | NASDAQ Stock Market LLC |

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 1 – Registrant's Business and Operations

Item 1.01. Entry into a Material Definitive Agreement.

Letter Agreement with Hill Path Capital LP, et al.

On January 30, 2025, Dave & Buster’s Entertainment, Inc. (the “Company”), James Chambers, Scott I. Ross and Hill Path Capital LP (“Hill Path”) entered into a Letter Agreement (the “Letter Agreement”).

Pursuant to the Letter Agreement, the Company agreed that the board of directors of the Company (the “Board”) would appoint Scott I. Ross (the “Designee”, and together with James Chambers, the "Designees") to the Board effective January 30, 2025. As set forth in the Letter Agreement, the Company further agreed to nominate the Designees for election to the Board at its 2025 annual stockholder meeting (the “2025 Annual Meeting”) and use its reasonable best efforts to cause the election of the Designees to the Board at the 2025 Annual Meeting, consistent with the Company’s efforts to elect other Company nominees.

Concurrently with the appointment of the Designee to the Board, the Company has agreed that the Board will appoint the Designee to the Board’s Nominating and Corporate Governance Committee and Finance Committee.

Under the Letter Agreement, Hill Path agreed to vote its shares at the 2025 Annual Meeting (i) in favor of the Company’s director nominees, (ii) in a manner consistent with the recommendations of the Board with respect to the approval of the Company’s proposals regarding (a) the omnibus incentive plan, (b) executive compensation, and (c) the appointment of the Board’s recommended independent auditor and (iii) against any third-party nominations or proposals not recommended by the Board. In connection with the foregoing, until the end of the 2025 Annual Meeting, Hill Path agreed not to transfer any voting rights in respect of any of its shares unless and until it transfers beneficial ownership of such shares.

In the Letter Agreement, Hill Path and the Company agreed to adjust the definition of “Restricted Period” for certain purposes under that certain Amended and Restated Cooperation Agreement, dated July 11, 2022, by and among the Company, James Chambers and Hill Path (the “Cooperation Agreement”), to mean the later of (i) the date that is ten (10) days after such time as no Hill Path Designee (as defined in the Cooperation Agreement) serves as a member of the Board and (ii) the one-year anniversary of the date of the Letter Agreement.

A copy of the Letter Agreement is furnished with this Current Report on Form 8-K as Exhibit 10.1 and is incorporated herein by reference.

Section 5 -– Corporate Governance and Management

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 30, 2025, the Board appointed Scott I. Ross, 44, to the Board and to the Nominating and Corporate Governance Committee and Finance Committee of the Board, in each case effective January 30, 2025, and in accordance with the terms of the Letter Agreement, as described in Item 1.01 hereof, and filed as an exhibit herewith.

Other than as described in Item 1.01 hereof, there are no arrangements or understandings between Mr. Ross and any other person pursuant to which he was appointed as a director. Following Mr. Ross’s appointment to the Board, the size of the Board will be eight directors. Additionally, with Mr. Ross’s appointment to the Nominating and Corporate Governance Committee, members of such Committee are now Jennifer Storms (Chair), Michael J. Griffith, Gail Mandel, Scott I. Ross, and Atish Shah; with Mr. Ross’s appointment to the Finance Committee of the Board, the members of such Committee are now Hamish A. Dodds (Chair), James Chambers, Scott I. Ross, and Kevin M. Sheehan.

Mr. Ross is the Founder and Managing Partner of Hill Path Capital. Mr. Ross was previously a Partner at Apollo Management (which he joined in 2004) where he focused on private equity and debt investments in the lodging, leisure, entertainment, consumer and business services sectors. Prior to Apollo, Mr. Ross was a member of the Principal Investment Area in the Merchant Banking Division of Goldman, Sachs & Co. and a Member of the Principal Finance Group in the Fixed Income, Currencies, and Commodities Division of Goldman, Sachs & Company. Mr. Ross was employed by Shumway Capital Partners from August 2008 to September 2009. Mr. Ross currently serves as the Chairman of the Board of Directors of United Parks & Resorts, Inc. (the parent company of SeaWorld, Busch Gardens, Discovery

Cove, and Sesame Place) and as a Director on the Board of Directors of The ONE Group Hospitality, Inc. (the parent company of STK, Benihana, and other restaurant brands). Mr. Ross has previously served on the Board of Directors of Diamond Eagle Acquisition Corp., Great Wolf Resorts, Inc., EVERTEC, Inc. and CEC Entertainment, Inc. (the parent company of Chuck E. Cheese and Peter Piper Pizza). Mr. Ross graduated magna cum laude from Georgetown University with a B.A. degree in Economics and was elected to Phi Beta Kappa.

Mr. Ross’s compensation for his service as non-employee director will be consistent with that of the Company’s other non-employee directors as set forth in the Company’s definitive Proxy Statement filed on May 8, 2024, with the Securities and Exchange Commission. Mr. Ross is not a party to any transaction that would require disclosure under Item 404(a) of Regulation S-K other than the Letter Agreement described in Item 1.01 hereof.

Section 7 – Regulation FD

Item 7.01. Regulation FD Disclosure.

On February 3, 2025, the Company issued a press release announcing the appointment of Mr. Ross to the Board of the Company, among other things. A copy of the press release is furnished with this Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference.

The information furnished under this item, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Exchange Act or the Securities Act of 1933, as amended, except as expressly set forth by specific reference in such a filing.

Section 9 – Financial Statements and Exhibits

Item 9.01. Financial Statements and Exhibits

(d)Exhibits.

| | | | | | | | |

| | |

| | |

| 104 | Cover Page Interactive Data File (the Cover Page Interactive Data File is embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| DAVE & BUSTER’S ENTERTAINMENT, INC. |

| | |

Date: February 3, 2025 | By: | /s/ Rodolfo Rodriguez, Jr. |

| Rodolfo Rodriguez, Jr. |

| Senior Vice President, Chief Legal Officer and Secretary |

Exhibit 10.1

LETTER AGREEMENT

January 30, 2025

Dave & Buster’s Entertainment, Inc.

1221 S. Belt Line Rd., Suite 500

Coppell, TX 75019

Hill Path Capital LP

150 East 58th Street, 33rd Floor

New York, New York 10155

Ladies and Gentlemen:

This letter agreement (this “Agreement”) is being entered into in connection with that certain Cooperation Agreement, dated as of December 18, 2020, as amended and restated on July 11, 2022 (the “Cooperation Agreement”), by and between (i) James Chambers and Hill Path Capital LP and (ii) Dave & Buster’s Entertainment, Inc. (the “Company”). Capitalized terms not defined in this Agreement shall have the meanings given to such terms in the Cooperation Agreement. Except as specifically modified and amended by this Agreement, the Cooperation Agreement shall remain in full force and effect in accordance with its terms.

The parties to this Agreement agree that:

1.Immediately upon execution of this Agreement, the Board shall appoint Scott I. Ross (together with James Chambers, the “Hill Path Designees”) to serve on the Board.

2.For purposes of the Cooperation Agreement, the term “Hill Path Designee” shall be deemed to include both Hill Path Designees.

3.For purposes of this Agreement and the Cooperation Agreement, the term “Expiration Date” shall mean the date that is ten (10) days after such time as no Hill Path Designees serve as members of the Board.

4.In connection with the Company’s 2025 annual meeting of stockholders (the “2025 Annual Meeting”), the Nominating and Corporate Governance Committee of the Board and the Board will nominate the Hill Path Designees for election as director nominees of the Company and the Company shall use reasonable best efforts to cause the election of the Hill Path Designees to the Board at the 2025 Annual Meeting consistent with the Company’s efforts to elect the other Company nominees.

5.Notwithstanding Section 2 of the Cooperation Agreement, in connection with the 2025 Annual Meeting, Hill Path and its Affiliates shall vote all Voting Securities beneficially owned by them that they have the right to vote as of the record date for the 2025 Annual Meeting (i) in favor of the election of each of the Company’s director nominees, (ii) in a manner consistent with the recommendations of the Board with respect to the approval of the Company’s proposals regarding (a) the omnibus incentive plan, (b) executive compensation, and (c) the appointment of the Board’s recommended independent auditor and (iii) against any third-party nominations or proposals not recommended by the Board. Hill Path agrees that until the completion of the 2025

Annual Meeting, it and its Affiliates will not, directly or indirectly, sell, assign, lease, pledge, grant, dispose of or otherwise transfer, in any manner (or enter into any agreement or arrangement to effect any of the foregoing), any voting rights in respect of any Voting Securities beneficially or otherwise owned or controlled thereby, to any Person (other than any Affiliates of Hill Path), unless and until Hill Path and/or such Affiliate transfers beneficial ownership of such Voting Securities to such Person.

6.Notwithstanding Section 4 of the Cooperation Agreement and irrespective of the Expiration Date, (a) in connection with the 2025 Annual Meeting, Hill Path and the other Restricted Persons shall not take any of the actions set forth in Sections 4(a) and (e) of the Cooperation Agreement (subject to the provisos set forth therein and other than in their capacities as directors of the Company, as applicable) and (b) for purposes of Section 4(b) of the Cooperation Agreement, the Restricted Period shall be deemed to be the period from the date of the Cooperation Agreement until the later of (x) the Expiration Date and (y) the one-year anniversary of the date of this Agreement.

7.Section 6, Section 8 (other than clause (c) thereof) and Sections 9 through 18 (inclusive) of the Cooperation Agreement are hereby incorporated by reference as if fully set forth herein, mutatis mutandis.

[Signature Pages Follow]

If the terms of this Letter Agreement are in accordance with your understanding, please sign below and this Letter Agreement will constitute a binding agreement among us.

DAVE & BUSTER’S ENTERTAINMENT, INC.

By: /s/ Rodolfo Rodriguez, Jr.

Name: Rodolfo Rodríguez, Jr.

Title: Chief Legal Officer

Acknowledged and agreed to (including on behalf of the Affiliates of the below) as of the date first written above:

JAMES CHAMBERS

/s/ James Chambers

SCOTT I. ROSS

/s/ Scott I. Ross

HILL PATH CAPITAL LP

By: Hill Path Holdings LLC, its General Partner

/s/ Scott I. Ross

Name: Scott I. Ross

Title: Managing Partner

[Signature Page to Letter Agreement]

Exhibit 99.1

Dave & Buster’s Announces Appointment of Scott Ross to Board of Directors

DALLAS, February 3, 2025 (GLOBE NEWSWIRE) -- Dave & Buster's Entertainment, Inc., (NASDAQ: PLAY), ("Dave & Buster's" or "the Company") today announced the appointment of Scott Ross, Managing Partner of Hill Path Capital, to the Company’s Board of Directors, effective January 30, 2025.

“On behalf of the Board, we are pleased to welcome Scott to our team,” said Kevin Sheehan, Board Chair and Interim Chief Executive Officer. “Scott has a proven track record of working closely with management teams and boards to help create substantial value for all stakeholders. He brings valuable insights and capabilities given his financial background, his extensive experience investing in and overseeing consumer and entertainment businesses and his perspective as a significant shareholder of Dave & Buster’s.”

“Dave & Buster’s is a high-quality business and an iconic brand with a huge fan base and tremendous and obvious near and long-term upside,” said Scott Ross. “I am excited to work with Kevin, the rest of the Board and the management team to help drive meaningful growth and value for all stakeholders. The Company clearly has the right strategic plan that I am confident will lead to significant increases in revenue, cash flow and shareholder value.”

About Scott Ross

Mr. Ross is the Founder and Managing Partner of Hill Path Capital. Mr. Ross was previously a Partner at Apollo Management where he focused on private equity and debt investments in the lodging, leisure, entertainment, consumer and business services sectors. Prior to Apollo, Mr. Ross worked at Goldman, Sachs & Co. and was a member of the Principal Investment Area in the Merchant Banking Division and of the Principal Finance Group in the Fixed Income, Currencies, and Commodities Division. Mr. Ross currently serves as the Chairman of the Board of Directors of United Parks & Resorts, Inc. (the parent company of SeaWorld, Busch Gardens, Discovery Cove, and Sesame Place) and as a Director on the Board of Directors of The ONE Group Hospitality, Inc. (the parent company of STK, Benihana, and other restaurant brands). Mr. Ross has previously served on the Board of Directors of Diamond Eagle Acquisition Corp., Great Wolf Resorts, Inc., EVERTEC, Inc. and CEC Entertainment, Inc. (the parent company of Chuck E. Cheese’s and Peter Piper Pizza). Mr. Ross graduated magna cum laude from Georgetown University with a B.A. degree in Economics and was elected to Phi Beta Kappa.

About Dave & Buster’s Entertainment, Inc.

Founded in 1982 and headquartered in Coppell, Texas, Dave & Buster's Entertainment, Inc., is the owner and operator of 232 venues in North America that offer premier entertainment and dining experiences to guests through two distinct brands: Dave & Buster’s and Main Event. The Company has 171 Dave & Buster’s branded stores in 43 states, Puerto Rico, and Canada and offers guests the opportunity to "Eat Drink Play and Watch," all in one location. Each store offers a full menu of entrées and appetizers, a complete selection of alcoholic and non-alcoholic beverages, and an extensive assortment of entertainment attractions centered around playing games and watching live sports and other televised events. The Company also operates 61 Main Event branded stores in 22 states across the country, and offers state-of-the-art bowling, laser tag, hundreds of arcade games and virtual reality, making it the perfect place for families to connect and make memories. For more information about each brand, visit daveandbusters.com and mainevent.com.

For Investor Relations Inquiries:

Cory Hatton, VP Investor Relations & Treasurer

Dave & Buster’s Entertainment, Inc.

Cory.Hatton@daveandbusters.com

v3.25.0.1

Cover

|

Apr. 02, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 03, 2025

|

| Entity File Number |

001-35664

|

| Entity Registrant Name |

DAVE & BUSTER’S ENTERTAINMENT, INC.

|

| Entity Central Index Key |

0001525769

|

| Entity Tax Identification Number |

35-2382255

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1221 S. Belt Line Rd.,

|

| Entity Address, Address Line Two |

Suite 500

|

| Entity Address, City or Town |

Coppell

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75019

|

| City Area Code |

214

|

| Local Phone Number |

357-9588

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock $0.01 par value

|

| Trading Symbol |

PLAY

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

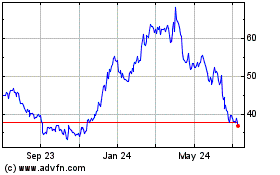

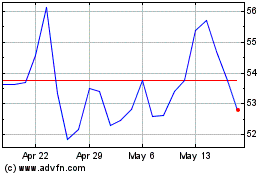

Dave and Busters Enterta... (NASDAQ:PLAY)

Historical Stock Chart

From Mar 2025 to Apr 2025

Dave and Busters Enterta... (NASDAQ:PLAY)

Historical Stock Chart

From Apr 2024 to Apr 2025