0001874178FALSERivian Automotive, Inc. / DE00018741782025-02-202025-02-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

February 20, 2025

Date of Report (date of earliest event reported)

___________________________________

Rivian Automotive, Inc.

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Delaware (State or other jurisdiction of incorporation) | 001-41042 (Commission File Number) | 47-3544981 (IRS Employer Identification Number) |

14600 Myford Road Irvine, California 92606 |

(Address of principal executive offices) (Zip code) |

(888) 748-4261 |

(Registrant's telephone number, including area code) |

| N/A |

(Former name or former address, if changed since last report) |

___________________________________ |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | | | | | | | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

| | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

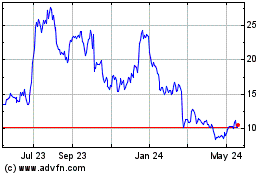

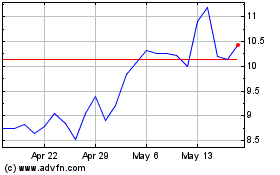

| Class A common stock, $0.001 par value per share | | RIVN | | The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 - Results of Operations and Financial Condition.

On February 20, 2025, Rivian Automotive, Inc. (the “Company”) announced its financial results for the fourth quarter and full year ended December 31, 2024. The full text of the press release (the “Press Release”) and shareholder letter (the “Letter”) issued in connection with the announcement are furnished as Exhibits 99.1 and 99.2, respectively, to this Current Report on Form 8-K. In the Press Release and the Letter, the Company also announced that it will be holding an audio webcast on February 20, 2025 at 2:00pm PT / 5:00pm ET to discuss its financial results for the fourth quarter and year ended December 31, 2024.

The Company is making reference to non-GAAP financial information in the Press Release, the Letter, and the audio webcast. A reconciliation of these non-GAAP financial measures to their nearest GAAP equivalents is provided in the Press Release and the Letter, respectively.

The information furnished pursuant to Item 2.02 of this Current Report on Form 8-K, including Exhibits 99.1 and 99.2 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing, except as expressly set forth by specific reference in such filing.

Item 9.01 - Financial Statements and Exhibits.

(d) Exhibits:

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| |

| | |

| RIVIAN AUTOMOTIVE, INC. |

| | |

Date: February 20, 2025 | By: | /s/ Claire McDonough |

| Name: | Claire McDonough |

| Title: | Chief Financial Officer |

| | |

Rivian Releases Fourth Quarter and Full Year 2024 Financial Results

•Achieved Q4 2024 gross profit of $170 million

•Closed Joint Venture with Volkswagen Group and loan from the Department of Energy which provides up to $10 billion of incremental capital*

•$729 million improvement in Q4 2024 Adjusted EBITDA compared to Q4 2023**

•Over 1 billion Amazon packages delivered by EDVs

Irvine, California, February 20, 2025: Rivian Automotive, Inc. (NASDAQ: RIVN) today announced fourth quarter and full year 2024 financial results. Rivian reported a gross profit of $170 million in the fourth quarter of 2024, primarily driven by improvements in variable costs, revenue per delivered unit, and fixed costs. Rivian expects these improvements to benefit it over the long-term and position the company well to achieve modest gross profit for 2025. Rivian achieved record revenues in the fourth quarter of 2024 driven by the sale of regulatory credits and software and services revenue growth as well as increasing R1 average selling prices with the increased availability of its Tri-Motor offering.

In the fourth quarter, Rivian produced 12,727 vehicles at its manufacturing facility in Normal, Illinois and delivered 14,183 vehicles. For the full-year 2024, Rivian produced 49,476 vehicles and delivered 51,579.

During the fourth quarter of 2024, Rivian and Volkswagen Group closed their joint venture, Rivian and Volkswagen Group Technology (the “Joint Venture”). With a total deal size of up to $5.8 billion, including $3.5 billion of proceeds expected to be received over the next several years, the Joint Venture plans to bring next-generation electrical architecture and best-in-class software technology for Rivian and Volkswagen Group future electric vehicles, starting with the R2. Furthermore, Rivian closed a loan agreement with the U.S. Department of Energy’s (DOE) Loan Programs Office (LPO) for up to $6.6 billion (including $6 billion of principal and approximately $600 million of capitalized interest). The loan is expected to support the construction of Rivian’s next U.S. manufacturing facility in Georgia, which aims to create approximately 7,500 jobs in the local area. The capital associated with the Joint Venture and DOE loan, in addition to Rivian’s current cash, cash equivalents, and short-term investments, is expected to provide the capital resources to fund operations through the ramp of R2 in Normal, as well as the midsize platform in Georgia - enabling a path to positive free cash flow and meaningful scale.

Rivian’s commercial van offering continues to progress. In 2024 more than 1 billion packages were delivered by Amazon in the Rivian Electric Delivery Van (EDV) in the U.S. alone. Earlier this month, Rivian opened sales for its commercial van to fleets of all sizes in the U.S. The Rivian Commercial Van is the platform on which Amazon’s custom EDV is based, and is designed from the ground up, prioritizing safety, driver comfort, total cost of ownership and sustainability.

RJ Scaringe, Founder and CEO, Rivian said:

“This quarter we achieved positive gross profit and removed $31,000 in automotive cost of goods sold per vehicle delivered in Q4 2024 relative to Q4 2023. Our focus on cost efficiency across the business is critical for the launch of our mass market product, R2. The R2 bill of materials is approximately 95% sourced and is expected to be approximately half that of the

improved R1 bill of materials. I couldn't be more excited about R2, and I believe the combination of capabilities and cost efficiencies along with the amazing level of excitement from customers will make R2 a truly transformational product for Rivian."

External factors could impact Rivian's 2025 expectations, including changes to government policies and regulations and a challenging demand environment. Rivian’s guidance represents management's current view on potential adjustments to incentives, regulations, and tariff structures.

| | | | | |

| 2025 Guidance | |

| Vehicles Delivered | 46,000 - 51,000 |

| Adj. EBITDA | $(1,700) million - $(1,900) million |

| Capital Expenditures | $1,600 million - $1,700 million |

Rivian will host an audio webcast to discuss the company’s results and provide a business update at 2:00pm PT / 5:00pm ET on Thursday, February 20, 2025. The link to the webcast will be available at https://rivian-q4-earnings-webcast-2025.open-exchange.net/registration.

*$10B for potential future funds incremental to the $2 billion of funds already received in association with the Joint Venture. Receipt of funds is subject to certain conditions and milestones, as discussed further in Rivian’s Current Reports on Form 8-K filed on November 12, 2024 and January 16, 2025.

** A reconciliation of non-GAAP financial measures to the most comparable GAAP measure is provided below.

| | | | | | | | | | | | | | |

| Consolidated Balance Sheets |

|

| (in millions, except per share amounts) | | | |

| | | | |

| | | | | | | | | | | | | | |

| Assets | | December 31, 2023 | | December 31, 2024 |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 7,857 | | | $ | 5,294 | |

| Short-term investments | | 1,511 | | | 2,406 | |

| Accounts receivable, net | | 161 | | | 443 | |

| Inventory | | 2,620 | | | 2,248 | |

| Other current assets | | 164 | | | 192 | |

| Total current assets | | 12,313 | | | 10,583 | |

| Property, plant, and equipment, net | | 3,874 | | | 3,965 | |

| Operating lease assets, net | | 356 | | | 416 | |

| Other non-current assets | | 235 | | | 446 | |

| Total assets | | $ | 16,778 | | | $ | 15,410 | |

| | | | |

| Liabilities and Stockholders’ Equity | | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 981 | | | $ | 499 | |

| Accrued liabilities | | 1,145 | | | 835 | |

| | | | |

| | | | |

| Current portion of deferred revenues, lease liabilities, and other liabilities | | 361 | | | 917 | |

| Total current liabilities | | 2,487 | | | 2,251 | |

| Long-term debt | | 4,431 | | | 4,441 | |

| Non-current lease liabilities | | 324 | | | 379 | |

| Other non-current liabilities | | 395 | | | 1,777 | |

| Total liabilities | | 7,637 | | | 8,848 | |

| Commitments and contingencies | | | | |

| Stockholders' equity: | | | | |

| Preferred stock, $0.001 par value; 10 shares authorized and 0 shares issued and outstanding as of December 31, 2023 and 2024 | | — | | | — | |

| Common stock, $0.001 par value; 3,508 and 3,508 shares authorized and 968 and 1,131 shares issued and outstanding as of December 31, 2023 and 2024, respectively | | 1 | | | 1 | |

| Additional paid-in capital | | 27,695 | | | 29,866 | |

| Accumulated deficit | | (18,558) | | | (23,305) | |

| Accumulated other comprehensive income (loss) | | 3 | | | (4) | |

| Noncontrolling interest | | — | | | 4 | |

| Total stockholders' equity | | 9,141 | | | 6,562 | |

| | | | |

| Total liabilities and stockholders' equity | | $ | 16,778 | | | $ | 15,410 | |

| | | | | | | | | | | | | | |

Consolidated Statements of Operations 1 |

| | | | |

| (in millions, except per share amounts) |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| | 2023 | | 2024 | | 2023 | | 2024 |

| Automotive | | $ | 1,208 | | | $ | 1,520 | | | $ | 4,132 | | | $ | 4,486 | |

| Software and services | | 107 | | | 214 | | | 302 | | | 484 | |

| Total revenues | | 1,315 | | | 1,734 | | | 4,434 | | | 4,970 | |

| Automotive | | 1,819 | | | 1,410 | | | 6,150 | | | 5,693 | |

| Software and services | | 102 | | | 154 | | | 314 | | | 477 | |

| Total cost of revenues | | 1,921 | | | 1,564 | | | 6,464 | | | 6,170 | |

| Gross profit | | (606) | | | 170 | | | (2,030) | | | (1,200) | |

| Operating expenses | | | | | | | | |

| Research and development | | 526 | | | 374 | | | 1,995 | | | 1,613 | |

| Selling, general, and administrative | | 449 | | | 457 | | | 1,714 | | | 1,876 | |

| | | | | | | | |

| Total operating expenses | | 975 | | | 831 | | | 3,709 | | | 3,489 | |

| Loss from operations | | (1,581) | | | (661) | | | (5,739) | | | (4,689) | |

| Interest income | | 131 | | | 83 | | | 522 | | | 385 | |

| Interest expense | | (73) | | | (81) | | | (220) | | | (318) | |

| Loss on convertible notes, net | | — | | | (82) | | | — | | | (112) | |

| Other income (expense), net | | 2 | | | 1 | | | 6 | | | (7) | |

| Loss before income taxes | | (1,521) | | | (740) | | | (5,431) | | | (4,741) | |

| Provision for income taxes | | — | | | (3) | | | (1) | | | (5) | |

| Net loss | | $ | (1,521) | | | $ | (743) | | | $ | (5,432) | | | $ | (4,746) | |

| Less: Net income attributable to noncontrolling interest | | — | | | 1 | | | — | | | 1 | |

| Net loss attributable to common stockholders | | $ | (1,521) | | | $ | (744) | | | $ | (5,432) | | | $ | (4,747) | |

| Net loss attributable to common stockholders, basic and diluted | | $ | (1,521) | | | $ | (744) | | | $ | (5,432) | | | $ | (4,747) | |

| Net loss per share attributable to common stockholders, basic and diluted | | $ | (1.58) | | | $ | (0.70) | | | $ | (5.74) | | | $ | (4.69) | |

| Weighted-average common shares outstanding, basic and diluted | | 963 | | | 1,058 | | | 947 | | | 1,013 | |

1 The prior periods have been recast to conform to current period presentation. |

| | | | | | | | |

| | | | | | | | | | | | | | |

Consolidated Statements of Cash Flows 1 |

| | | | |

| (in millions) |

| | | | |

| | | | | | | | | | | | | | | | |

| | | | Years Ended December 31, |

| | | | 2023 | | 2024 |

| Cash flows from operating activities: | | | | | | |

| Net loss | | | | $ | (5,432) | | | $ | (4,746) | |

| Depreciation and amortization | | | | 937 | | | 1,031 | |

| Stock-based compensation expense | | | | 821 | | | 692 | |

| | | | | | |

| Loss on convertible notes, net | | | | — | | | 112 | |

| Inventory LCNRV write-downs and losses on firm purchase commitments | | | | 107 | | | — | |

| Other non-cash activities | | | | 115 | | | 28 | |

| Changes in operating assets and liabilities: | | | | | | |

| Accounts receivable, net | | | | (59) | | | (282) | |

| Inventory | | | | (1,604) | | | 307 | |

| Other assets | | | | (146) | | | (221) | |

| | | | | | |

| Accounts payable and accrued liabilities | | | | 105 | | | (572) | |

| Deferred revenue | | | | 149 | | | 1,619 | |

| Other liabilities | | | | 141 | | | 316 | |

| | | | | | |

| Net cash used in operating activities | | | | (4,866) | | | (1,716) | |

| | | | | | |

| Cash flows from investing activities: | | | | | | |

| Purchases of short-term investments | | | | (2,410) | | | (4,392) | |

| Maturities of short-term investments | | | | 925 | | | 3,553 | |

| | | | | | |

| Capital expenditures | | | | (1,026) | | | (1,141) | |

| | | | | | |

| Net cash used in investing activities | | | | (2,511) | | | (1,980) | |

| | | | | | |

| Cash flows from financing activities: | | | | | | |

| | | | | | |

| Proceeds from issuance of capital stock including employee stock purchase plan | | | | 61 | | | 64 | |

| Proceeds from issuance of convertible notes | | | | 3,195 | | | 1,000 | |

| | | | | | |

| Proceeds from funding of 50% interest in Rivian and VW Group Technology, LLC | | | | — | | | 79 | |

| Purchase of capped call options | | | | (108) | | | — | |

| | | | | | |

| Other financing activities | | | | (18) | | | (7) | |

| Net cash provided by financing activities | | | | 3,130 | | | 1,136 | |

| | | | | | |

| Effect of exchange rate changes on cash and cash equivalents | | | | 5 | | | (3) | |

| Net change in cash | | | | (4,242) | | | (2,563) | |

| Cash, cash equivalents, and restricted cash—Beginning of period | | | | 12,099 | | | 7,857 | |

| Cash, cash equivalents, and restricted cash—End of period | | | | $ | 7,857 | | | $ | 5,294 | |

| | | | | | |

| Supplemental disclosure of cash flow information: | | | | | | |

| Cash paid for interest | | | | $ | 169 | | | $ | 279 | |

| Supplemental disclosure of non-cash investing and financing activities: | | | | | | |

| Capital expenditures included in liabilities | | | | $ | 374 | | | $ | 423 | |

| Capital stock issued to settle bonuses | | | | $ | 137 | | | $ | 179 | |

| Conversion of convertible notes | | | | $ | — | | | $ | 1,133 | |

| | | | | | |

| | | | | | |

| | | | | | |

1 The prior periods have been recast to conform to current period presentation.

| | | | | | | | | | | | | | |

| Reconciliation of Non-GAAP |

| Financial Measures |

| | | | |

| (in millions) |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA1 | | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2023 | | 2024 | | 2023 | | 2024 |

| | | | | | | | |

| Net loss attributable to common shareholders | | $ | (1,521) | | | $ | (744) | | | $ | (5,432) | | | $ | (4,747) | |

| Interest income, net | | (58) | | | (2) | | | (302) | | | (67) | |

| Provision for income taxes | | — | | | 3 | | | 1 | | | 5 | |

| Depreciation and amortization | | 270 | | | 218 | | | 937 | | | 1,031 | |

| Stock-based compensation expense | | 215 | | | 154 | | | 821 | | | 692 | |

| Other (income) expense, net | | (2) | | | (1) | | | (6) | | | 7 | |

| Loss on convertible note, net | | — | | | 82 | | | — | | | 112 | |

| | | | | | | | |

| Cost of revenue efficiency initiatives | | 60 | | | — | | | 95 | | | 193 | |

| Restructuring expenses | | — | | | — | | | 42 | | | 30 | |

| Asset impairments and write-offs | | 30 | | | — | | | 55 | | | 30 | |

Joint venture formation expenses and other items2 | | — | | | 13 | | | — | | | 25 | |

| Adjusted EBITDA (non-GAAP) | | $ | (1,006) | | | $ | (277) | | | $ | (3,789) | | | $ | (2,689) | |

| | | | | | | | |

1 The prior periods have been recast to conform to current period presentation. |

2 Defined in Non-GAAP Financial Measures below. |

Forward-Looking Statements:

This press release and statements that are made on our earnings call contain forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this press release and made on our earnings call that do not relate to matters of historical fact should be considered forward-looking statements, including without limitation statements regarding our future operations, initiatives and business strategy, including expected cost reduction initiatives, our future financial results, vehicle profitability and future gross profits, our future capital expenditures, the underlying trends in our business (including customer preferences and expectations, and potential tailwinds for 2025), our market opportunity, and our potential for growth, our production ramp and manufacturing capacity expansion and anticipated production levels, our expected future production and deliveries, scaling our service infrastructure, our expected future products and technology and product enhancements (including the launches of R2 and R3), potential expansion of commercial van sales, future revenue opportunities, including with respect to the emerging autonomous driving market, our joint venture with Volkswagen Group, including the expected benefits from the partnership and future VW investments, and other expected incremental available capital pursuant to agreements with VW and the U.S. Department of Energy. These statements are neither promises nor guarantees and involve known and unknown risks, uncertainties, and other important factors that may cause our actual results, performance,

or achievements to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements, including, but not

limited to: our history of losses as a growth-stage company and our limited operating history; we may underestimate or not effectively manage our capital expenditures and costs; that we will require additional financing and capital to support our business; our ability to maintain strong demand for our vehicles and attract and retain a large number of consumers; our ability to grow sales of our commercial vehicles, risks relating to the highly competitive automotive market, including competitors that may take steps to compete more effectively against us; consumers’ willingness to adopt electric vehicles; risks associated with our joint venture with Volkswagen Group, risks associated with additional strategic alliances or acquisitions, that we may experience significant delays in the manufacture and delivery of our vehicles; that our long-term results depend on our ability to successfully introduce and market new products and services; that we have experienced and could continue to experience cost increases or disruptions in supply of raw materials or other components used in our vehicles; our dependence on suppliers and volatility in pricing of components and raw materials; our ability to accurately estimate the supply and demand for our vehicles and predict our manufacturing requirements; our ability to scale our business and manage future growth effectively; our ability to maintain our relationship with one customer that has generated a significant portion of our revenues; that we are highly dependent on the services and reputation of our Founder and Chief Executive Officer; our ability to offer attractive financing and leasing options; that we may not succeed in maintaining and strengthening our brand; that our focus on delivering a high-quality and engaging Rivian experience may not maximize short-term financial results; risks relating to our distribution model; that we rely on complex machinery, and production involves a significant degree of risk and uncertainty; that our operations, IT systems and vehicles rely on highly technical software and hardware that could contain errors or defects; that we may not successfully develop the complex software and technology systems in coordination with the Volkswagen Group joint venture and our other vendors needed to produce our vehicles; inadequate access to charging stations and not being able to realize the benefits of our charging networks; risks related to our use of lithium-ion battery cells; that we have limited experience servicing and repairing our vehicles; that the automotive industry is rapidly evolving and may be subject to unforeseen changes; risks associated with advanced driver assistance systems technology; the unavailability, reduction or elimination of government and economic incentives and credits for electric vehicles; that we may not be able to obtain the government grants, loans, and other incentives, including regulatory credits, for which we apply or on which we rely; that vehicle retail sales depend heavily on affordable interest rates and availability of credit; insufficient warranty reserves to cover warranty claims; that future field actions, including product recalls, could harm our business; risks related to product liability claims; risks associated with international operations; our ability to attract and retain key employees and qualified personnel; our ability to maintain our culture; that our business may be adversely affected by labor and union activities; that our financial results may vary significantly from period to period; that we have incurred a significant amount of debt and expect to incur significant additional indebtedness; risks related to third-party vendors for certain product and service offerings; potential conflicts of interest involving our principal stockholders or their affiliates; risks associated with exchange rate and interest rate fluctuations; that breaches in data security, failure of technology systems, cyber-attacks or other security or privacy-related incidents could harm our business; risks related to our use of artificial intelligence technologies; risk of intellectual property infringement claims; that our use of open source software in our

applications could subject our proprietary software to general release; our ability to prevent unauthorized use of our intellectual property; risks related to governmental regulation and legal proceedings; delays, limitations and risks related to permits and approvals required to operate or expand operations; our internal control over financial reporting; effect

of trade tariffs or other trade barriers; and the other factors described in our filings with the SEC. These factors could cause actual results to differ materially from those indicated by the forward-looking statements made in this press release. Any such forward looking statements represent management’s estimates as of the date of this press release. While we may elect to update such forward-looking statements at some point in the future, except as may be required by law, we disclaim any obligation to do so, even if subsequent events cause our views to change.

*Non-GAAP Financial Measures

In addition to our results determined in accordance with generally accepted accounting principles in the United States (“GAAP”), we review financial measures that are not calculated and presented in accordance with GAAP (“non-GAAP financial measures”). We believe our non-GAAP financial measures are useful in evaluating our operating and cash performance. We use the following non-GAAP financial information, collectively, to evaluate our ongoing operations and for internal planning and forecasting purposes. We believe that non-GAAP financial information, when taken collectively, may be helpful to investors, because it focuses on underlying operating results and trends, provides consistency and comparability with past financial performance, and assists in comparisons with other companies, some of which use similar non-GAAP financial information to supplement their GAAP results. The non-GAAP financial information is presented for supplemental informational purposes only, should not be considered a substitute for financial information presented in accordance with GAAP, and may be different from similarly titled non-GAAP measures used by other companies. A reconciliation of each historical non-GAAP financial measure to the most directly comparable financial measure stated in accordance with GAAP is provided above. Reconciliations of forward-looking non-GAAP financial measures are not provided because we are unable to provide such reconciliations without unreasonable effort due to the uncertainty regarding, and potential variability of, certain items, such as stock-based compensation expense and other costs and expenses that may be incurred in the future. Investors are encouraged to review the related GAAP financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures.

Our non-GAAP financial measures include adjusted EBITDA, defined as net loss before interest expense (income), net, provision for income taxes, depreciation and amortization, stock-based compensation, other expense (income), net, and special items. Our management team ordinarily excludes special items from its review of the results of ongoing operations. Special items is comprised of (i) cost of revenue efficiency initiatives which include costs incurred as we transition between major vehicle programs, cost incurred for negotiations with major suppliers regarding changing demand forecasts or design modifications, and other costs for enhancing our capital and cost optimization, (ii) restructuring expenses for significant actions taken, (iii) significant asset impairments and write-offs, and (iv) other items that we do not necessarily

consider to be indicative of earnings from ongoing operating activities, including loss (gain) on convertible note, net, and joint venture formation expenses.

About Rivian:

Rivian (NASDAQ: RIVN) is an American automotive manufacturer that develops and builds category-defining electric vehicles as well as software and services that address the entire lifecycle of the vehicle. The company creates innovative and technologically advanced products that are designed to excel at work and play with the goal of accelerating the global transition to zero-emission transportation and energy. Rivian vehicles are built in the United States and are sold directly to consumer and commercial customers. Whether taking families on new adventures or electrifying fleets at scale, Rivian vehicles all share a common goal — preserving the natural world for generations to come.

Learn more about the company, products, and careers at www.rivian.com.

Contacts:

Investors: ir@rivian.com

Media: Harry Porter: media@rivian.com

| | | | | | | | |

| Q4 2024 Shareholder Letter | © 2025 Rivian. All rights reserved. 2 |

| | | | | |

|

|

The significant progress made against our core value drivers in 2024 will be foundational to Rivian’s long term success. Throughout the year, the team was laser focused on driving improvement in cost and operational efficiencies, technology leadership, and customer experience. Thank you to our employees, customers, suppliers, partners, communities, and shareholders who made our 2024 accomplishments possible and for their continued support for our vision.

In the fourth quarter of 2024 we hit an important milestone, achieving our first quarter of positive gross profit. As we outlined in early 2024, the key drivers to achieving positive gross profit included improvements in variable costs, revenue per unit delivered, and fixed costs. Our variable cost reductions were driven by the launch of our second generation R1 vehicles, which included significant engineering design optimizations, supply chain driven cost reductions, and improvement in commodity costs. We delivered record revenues in the fourth quarter of 2024 driven by the sale of regulatory credits and software and services revenue growth as well as increasing R1 average selling prices with the increased availability of our Tri-Motor offering. We also made meaningful progress implementing greater operational efficiencies in our Normal plant. We expect these improvements to benefit Rivian over the long-term and position us to achieve modest gross profit for 2025.

|

| | | | | | | | |

| Q4 2024 Shareholder Letter | © 2025 Rivian. All rights reserved. 3 |

| | | | | |

|

|

During the year, we unveiled the R2 and R3, underpinned by our midsize platform, launched the second generation of our flagship R1 platform, validated Rivian’s technology leadership with the establishment of Rivian and Volkswagen Group Technology LLC, and took significant steps to further strengthen our balance sheet.

Our midsize platform is expected to address global market segments and is designed to build upon our industry-leading technology platform as well as our focus on reducing manufacturing complexity and delivering cost efficiency. The recent transition to our second-generation R1 vehicles has dramatically improved our cost structure while also incorporating new technologies which will serve as the foundation for our midsize platform, including our zonal network architecture, in-house software stack, and Rivian Autonomy Platform, positioning R2 for a robust launch in the first half of 2026.

We believe our long-term competitive advantage is our product and brand differentiation through vertically integrated technology as well as our direct to customer sales and service model. Our vertically integrated technologies include our zonal network architecture and associated in-vehicle electronic control units, improved software stack, Rivian Autonomy Platform, and our propulsion platform. Product performance benefits from the ability to control and continually enhance virtually every aspect of our vehicle’s software, digital experience, and driving dynamics. We believe this capability is increasingly being recognized by customers; and has helped Rivian earn some of the industry’s most coveted owner experience awards.

|

| |

| | | | | | | | |

| Q4 2024 Shareholder Letter | © 2025 Rivian. All rights reserved. 4 |

| | | | | |

|

| In the fourth quarter of 2024 we made significant progress against our key value drivers: Drive towards profitability •Achieved $170 million positive gross profit in the fourth quarter 2024, with $110 million from the automotive segment and $60 million from the software and services segment •Software and services segment-level gross margin was 28% in the fourth quarter 2024 •Fourth quarter revenue increased $419 million year-over-year, partially supported by a $260 million increase in automotive regulatory credit sales Optimize operational efficiency •Fourth quarter operating expenses declined by 15% year-over-year while expanding our sales and service infrastructure •Removed $31,000 of automotive cost of revenues per vehicle delivered compared to the fourth quarter of 2023 Extend technology leadership •Created a joint venture, Rivian and VW Group Technology, LLC, with a total deal size of up to $5.8 billion including $3.5 billion of proceeds expected to be received over the next several years; we believe this is a validation of our industry-leading technology •Enhanced our Connect+ offering, launched during the third quarter of 2024, by adding new features such as Google Cast, YouTube and SiriusXM; we are pleased with the customer reaction so far, with the majority of our customers continuing to subscribe to Connect+ after the end of a 60-day free trial period Focus on demand generation and enhancing the customer experience •Continued to expand our commercial footprint, increasing our brand and top of funnel awareness. In the fourth quarter of 2024 we provided over 27,000 demo drives and grew our service footprint to 71 service centers, over 600 mobile service vehicles, 22 experiential spaces, and 666 Rivian Adventure Network chargers •Began opening the Rivian Adventure Network to non-Rivian customers, engaging customers from other EV brands while increasing our ability to generate revenue long term — designed and manufactured by Rivian, the vertical integration of charging software and hardware in our Rivian Adventure Network chargers allows for a seamless and reliable end-to-end customer experience with charger uptime in the fourth quarter of 98% •Customers continue to love our brand, with Rivian earning the highest owner satisfaction score by a leading consumer publication for the second year, with 86% of owners saying they would buy a Rivian again; R1T has recently been named “Edmunds Top Rated Truck in 2025” •Our commitment to vehicle safety has also been recognized, with both the R1T and R1S receiving the TOP SAFETY PICK+ award from the IIHS — Notably, the 2025 model year R1S stands out as the only Large SUV to achieve the TOP SAFETY PICK+ designation

|

| | | | | | | | |

| Q4 2024 Shareholder Letter | © 2025 Rivian. All rights reserved. 5 |

| | | | | |

|

|

Production and Deliveries

In the fourth quarter of 2024, we produced 12,727 and delivered 14,183 vehicles. On a full-year 2024 basis we produced 49,476 vehicles and delivered 51,579.

As previously stated, the fourth quarter of 2024 was impacted by a shortage of a shared component within our Enduro motor system. We do not expect the component shortage to impact operations in 2025.

We produced more Tri-Motor R1 vehicles and commercial vans as a mitigating factor to the supply constraints. Despite typical seasonality, we delivered additional EDVs to Amazon during the fourth quarter of 2024. As a result of the increased deliveries to Amazon in the fourth quarter, we expect to deliver a lower volume of EDVs in 2025 as compared to 2024.

|

| | | | | | | | |

| Q4 2024 Shareholder Letter | © 2025 Rivian. All rights reserved. 6 |

| | | | | |

|

|

Software

Enhancements to Connect+, a service providing media, connectivity, Wi-Fi hotspot and live security to each Rivian continue with the introduction of Google Cast (making thousands of apps available to stream) and a native YouTube app. These services provide a unique customer experience and ensure the newest streaming options are available to enjoy in-vehicle. New Rivian customers have a 60-day free trial to Connect+ to enjoy the full suite of features including Google Cast, YouTube, Gear Guard live cam, and native access to their favorite music streaming apps.

We continue to see a positive customer reaction to this offering, with the majority of our customers choosing to subscribe to Connect+ after the end of their 60-day free trial period.

|

| | | | | | | | |

| Q4 2024 Shareholder Letter | © 2025 Rivian. All rights reserved. 7 |

| | | | | |

|

|

Rivian Autonomy Platform

In the future, we expect the majority of passenger vehicle trips will be either partially or fully autonomous, highlighting the importance for Rivian to control the autonomous stack in our vehicles. By developing the Rivian Autonomy Platform in-house, we maintain the freedom to evolve our capabilities with minimal constraints imposed by suppliers.

The capability of our second generation R1 is supported by a top-of-the-line sensor suite with 55 megapixels of high dynamic-range imaging backed up by 5 advanced radars, combining high resolution camera data with the active sensing provided by radar. This is supported by powerful compute, providing the onboard computing horsepower to run trillions of inference operations to maximize the utility of these sensors. By utilizing real-world fleet data and simulation, our customers benefit from improving driver assistance features and capabilities which are updated about every four weeks. Less than a year since the introduction of our second generation R1, our vehicles incorporate learned behavior from real-world customer driving which will become fundamental to our feature releases in 2025 and beyond.

While we anticipate the change in autonomy will occur over years, we believe that accelerating progress meets customer expectations and creates enduring long term value for Rivian. Towards this end, our paid Rivian Autonomy Platform+ will offer Enhanced Highway Assist allowing drivers a hands free option in certain driving situations. All second generation R1 owners will receive a free trial. By the end of 2025, we plan to expand the availability of our second generation R1 capability to cover the vast majority of miles driven with a mixture of urban and highway driving. Our autonomy platform is focused on not just enhancing safety but truly giving people their time and energy back when driving. We believe this approach will help drive demand for our products.

|

| | | | | | | | |

| Q4 2024 Shareholder Letter | © 2025 Rivian. All rights reserved. 8 |

| | | | | |

|

|

R2

Our teams remain focused on progressing R2 and sourcing the R2 bill of materials in line with our cost targets. We recently completed our first tooling trials for some of the key stamped body panels. The R2 body has been heavily optimized around cost with a focus on minimizing complexity. For example, the R2 utilizes a number of large high-pressure die castings to eliminate parts and connection points.

We recently completed winter testing on our first R2 development vehicles. We are also expanding the manufacturing facility in Normal with the building well underway and incorporation of manufacturing equipment and tooling. |

| Experience Management Module (XMM) |

| |

| | | | | | | | |

| Q4 2024 Shareholder Letter | © 2025 Rivian. All rights reserved. 9 |

| | | | | |

|

|

Service

We remain focused on building a vertically integrated vehicle repair and maintenance value chain that allows us to rapidly iterate with a closed loop approach to our vehicle quality and customer experience. Our focus on service is in two key areas; leveraging generative AI to enhance the customer experience and expanding our physical footprint. Leveraging our integrated software and electrical hardware technology, Rivian’s suite of vehicle sensors combined with our diagnostics platform offer the ability for Rivian to proactively access and in some cases resolve many issues remotely.

Our technology roadmap for our vehicle repair and maintenance business has been built around AI. The current digital ecosystem, built on top of our vertically integrated hardware stack, has enabled digital scheduling, repair workload, workflow management and over-the-air (OTA) diagnostics while building pipelines across the entire ecosystem including vehicle data, customer concerns, diagnostic data, repair history, technician capacity and capability, and service asset capacity. We expect that our generative AI will allow us to automate or greatly reduce administrative overhead on all non-repair tasks. Our technology roadmap gives us confidence in our ability to improve customer experience, optimize time for our technicians, and drive vehicle repair and maintenance services to profitability.

We continue to expand our service network in preparation for the launch of R2. We plan to open an additional 30 new service locations in 2025, incremental to the 71 service centers in operation. In addition, our fleet of over 600 mobile service vans allow our technicians to perform the majority of vehicle repair and maintenance services on site for additional convenience. Within our service centers, we will continue to iterate Rivian developed tooling, service center design, and operational flows to scale with R2 alongside our current products. These improvements allow repairs to be completed quicker while scaling utilization of existing physical assets.

Our focus is to improve the customer experience and ultimately reduce the wait times customers experience for service. We believe 2025 will be a big step forward in this aim and position us well for the R2 launch in the first half of 2026.

|

| | | | | | | | |

| Q4 2024 Shareholder Letter | © 2025 Rivian. All rights reserved. 10 |

| | | | | |

|

|

Commercial Vans

In 2024, Amazon achieved an important milestone with Electric Delivery Vans (EDVs) delivering more than one billion packages to customers in the U.S. This achievement showcases the transformative impact of our partnership and the scalability of our technology, furthering our mission to accelerate the global transition to zero-emission transportation and energy. Amazon now has over 20,000 EDVs on the road, and we are proud to support Amazon's efforts to build a more sustainable delivery network.

Our Rivian Commercial Van (RCV) business continues to expand. Since launching our Amazon fleet, we have received interest from a variety of trades and delivery services which are now able to start the purchase process through our website. We believe an all-electric fleet based on differentiated Rivian technology provides the capabilities and features to maximize uptime and lower costs for a wide range of industries.

|

| | | | | | | | |

| Q4 2024 Shareholder Letter | © 2025 Rivian. All rights reserved. 11 |

| | | | | |

|

|

Improving Profitability

We generated $170 million of gross profit in the fourth quarter 2024, a $776 million improvement as compared to the fourth quarter 2023. The key drivers of this improvement: •Variable costs: The launch of our second generation R1 allowed us to benefit from reduced material costs from engineering design changes, commercial supplier negotiations, and lower raw material costs. •Revenue: We saw a significant increase in revenue from the sale of regulatory credits as well as revenue recognized from the sale of software and services. Additionally, the introduction of our Tri-Motor R1 variant led to an increase in average R1 vehicle selling prices which was offset by a higher mix of commercial vans in the fourth quarter. •Fixed and semi-fixed costs: The improvement in our vehicle profitability also led towards a reduction in our ending inventory lower of cost or net realizable value (LCNRV) and liabilities for losses on firm purchase commitments.

|

| | | | | | | | |

| Q4 2024 Shareholder Letter | © 2025 Rivian. All rights reserved. 12 |

| | | | | | | | | | | |

|

|

2025 Outlook

Over the course of the fiscal year 2025, we remain focused on our key value drivers: •Drive towards profitability •Optimize operational efficiency •Technology leadership •Demand generation and enhancing the customer experience

We believe external factors could impact our 2025 expectations, including changes to government policies and regulations, and a challenging demand environment. While uncertainties persist, we remain focused on executing against our key value drivers and are confident in electrifying the world in the long term. Our guidance represents management's current view on potential adjustments to incentives, regulations, and tariff structures.

Given some of the factors mentioned above, we have provided a range of potential 2025 outcomes. |

| 2025 Guidance | | |

| Vehicles Delivered | 46,000 - 51,000 | |

| Adj. EBITDA | $(1,700) million - $(1,900) million | |

| Capital Expenditures | $1,600 million - $1,700 million | |

| We expect to achieve a modest gross profit for the full year 2025. |

| | | | | | | | |

| Q4 2024 Shareholder Letter | © 2025 Rivian. All rights reserved. 13 |

| | | | | |

| Presentation | During the fourth quarter of 2024, in conjunction with growth in revenues from software and services and establishing Rivian and VW Group Technology, LLC, there was a change in the composition of Rivian’s segments. As a result of this change, we analyze the results of the business through the following reportable segments: Automotive and Software and Services.

The financial results of the Rivian and VW Group Technology, LLC joint venture, a separate legal entity that is a variable interest entity, are consolidated into our financial statements, including revenue for services provided by the joint venture to further develop, customize, and enhance Rivian’s vehicle electrical architecture technology and software for use in future vehicle programs. |

| Revenue | Automotive Total automotive revenues for the fourth quarter of 2024 were $1,520 million, primarily driven by the delivery of 14,183 vehicles. During the year ended December 31, 2024, total automotive revenues were $4,486 million, supported by vehicle deliveries of 51,579.

Total revenues from the sale of regulatory credits were $299 million for the quarter and $325 million for the fiscal year 2024.

Software and Services Total software and services revenues for the fourth quarter of 2024 were $214 million, primarily driven by remarketing sales, repair and maintenance services, and new vehicle electrical architecture and software development services provided by the joint venture. During the year ended December 31, 2024, total software and services revenues were $484 million.

Part of the consideration received, and upcoming payments Rivian expects to receive, associated with the closing of the joint venture will be combined into a single performance obligation to develop, customize, and enhance vehicle electrical architecture technology and software for use on certain of Volkswagen Group’s future vehicle programs and recognized as revenue. This consideration associated with the closing of the Joint Venture totals $1.96 billion, which we expect to recognize in revenue over approximately four years, with the amount of revenue recognized each period gradually increasing over time as the joint venture ramps its operations and progresses toward completing the performance obligation.

Total consolidated revenues were $1,734 million for the fourth quarter of 2024, and $4,970 million for the year ended December 31, 2024.

|

| | | | | | | | |

| Q4 2024 Shareholder Letter | © 2025 Rivian. All rights reserved. 14 |

| | | | | |

| Gross Profit | Automotive We generated positive automotive gross profit of $110 million for the fourth quarter of 2024, compared to $(611) million for the same quarter in 2023. For the year 2024, we generated negative automotive gross profit of $(1,207) million, as compared to $(2,018) million in 2023.

Software and Services We generated positive software and services gross profit of $60 million for the fourth quarter of 2024, compared to $5 million for the same quarter in 2023. For the year 2024, we generated positive software and services gross profit of $7 million, as compared to $(12) million in 2023.

For the year 2024, we generated total consolidated negative gross profit of $(1,200) million, as compared to $(2,030) million in 2023. |

Operating Expenses

and Operating Loss | Total operating expenses in the fourth quarter of 2024 decreased to $831 million, as compared to $975 million in the same period last year.

In the fourth quarter of 2024, we recognized a non-cash, stock-based compensation expense within operating expenses of $138 million as compared to $194 million in the fourth quarter of 2023 and depreciation and amortization expense within operating expenses of $73 million as compared to $75 million million in the fourth quarter of 2023.

Research and development (R&D) expense in the fourth quarter of 2024 was $374 million, as compared to $526 million in the same period last year. The decrease was primarily due to a $40 million decrease in stock-based compensation expense and a $37 million decrease in engineering, design, and development costs and other related project costs.

Selling, general, and administrative (SG&A) expense in the fourth quarter of 2024 was $457 million, as compared to $449 million in the same period last year.

Total operating expenses were $3,489 million in 2024 as compared to $3,709 million for 2023.

We experienced a loss from operations in the fourth quarter of 2024 totaling $(661) million, as compared to $(1,581) million in the same period last year. For the year 2024, we recorded a loss from operations of $(4,689) million as compared to $(5,739) million in 2023. |

| Adjusted Operating Expenses¹ | Adjusted R&D expenses¹ for the fourth quarter of 2024 was $277 million as compared to $388 million for the same period last year.

Adjusted SG&A expenses¹ for the fourth quarter of 2024 was $343 million as compared to $318 million for the same period last year.

Total adjusted operating expenses¹ for the fourth quarter of 2024 were $620 million as compared to $706 million for the same period last year. For the year 2024, total adjusted operating expenses¹ were $2,572 million compared to $2,697 million in 2023.

|

| Net Loss | Net loss for the fourth quarter of 2024 was $(743) million as compared to $(1,521) million for the same period last year. For the year 2024, we recorded a net loss of $(4,746) million as compared to $(5,432) million in 2023. The decreased losses were primarily driven by improvements in gross profit across both segments, resulting from an increase in sales of automotive regulatory credits and reductions in the cost of raw materials and product components, as well as new vehicle electrical architecture and software development services provided by the joint venture. |

| Adjusted EBITDA¹ | Adjusted EBITDA¹ for the fourth quarter of 2024 was $(277) million as compared to $(1,006) million for the same period last year. The decreased Adjusted EBITDA¹ loss for the fourth quarter of 2024 as compared to the fourth quarter of 2023 was driven by positive gross profit. For the year 2024, Adjusted EBITDA¹ was $(2,689) million as compared to $(3,789) million in 2023. |

| ¹A reconciliation of non-GAAP financial measures to the most comparable GAAP measure is provided later in this letter. |

| | | | | | | | |

| Q4 2024 Shareholder Letter | © 2025 Rivian. All rights reserved. 15 |

| | | | | |

Net Cash Used in Operating Activities | Net cash from operating activities for the fourth quarter of 2024 was $1,183 million as compared to $(1,107) million for the same period last year. Net cash used in operating activities for the year 2024 was $(1,716) million as compared to $(4,866) million in 2023. |

| Capital Expenditures | Capital expenditures for the fourth quarter of 2024 were $327 million, as compared to $298 million for the same period last year. For the year 2024, capital expenditures were $1,141 million as compared to $1,026 million in 2023. Current year spend was higher due to the ongoing expansion of our manufacturing facility in Normal. |

| Liquidity and Free Cash Flow¹ | We ended the fourth quarter of 2024 with $7,700 million in cash, cash equivalents, and short-term investments. Including the capacity under our asset-based revolving-credit facility, we ended the fourth quarter of 2024 with $9,063 million of total liquidity.

We define free cash flow¹ as net cash used or provided by operating activities less capital expenditures. The reduction in year-over-year cash used in operating activities discussed above resulted in positive free cash flow¹ of $856 million for the fourth quarter of 2024 as compared to $(1,405) million for the same period last year. Additionally, free cash flow¹ was $(2,857) million for the year 2024 as compared to $(5,892) million in 2023.

|

| Webcast | We will host an audio webcast to discuss our results and provide a business update at 2:00pm PT / 5:00pm ET on Thursday, February 20, 2025. The link to the webcast will be made available on our Investor Relations website at rivian.com/investors.

After the call, a replay will be available at rivian.com/investors for four weeks. |

| ¹A reconciliation of non-GAAP financial measures to the most comparable GAAP measure is provided later in this letter. |

| | | | | | | | |

| Q4 2024 Shareholder Letter | © 2025 Rivian. All rights reserved. 16 |

| | | | | | | | | | | | | | |

| Quarterly Financial Performance |

| | | | |

| (in millions, except production, delivery, gross margin, gross profit per unit delivered, and per share amounts) |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| | December 31, 2023 | | March 31, 2024 | | June 30,

2024 | | September 30,

2024 | | December 31, 2024 |

| Production | | 17,541 | | 13,980 | | 9,612 | | 13,157 | | 12,727 |

| Delivery | | 13,972 | | 13,588 | | 13,790 | | 10,018 | | 14,183 |

| | | | | | | | | | |

| Revenues | | | | | | | | | | |

| Automotive | | $ | 1,208 | | | $ | 1,116 | | | $ | 1,074 | | | $ | 776 | | | $ | 1,520 | |

| Software and services | | 107 | | | 88 | | | 84 | | | 98 | | | 214 | |

Total revenues2 | | $ | 1,315 | | | $ | 1,204 | | | $ | 1,158 | | | $ | 874 | | | $ | 1,734 | |

| Cost of revenues | | | | | | | | | | |

| Automotive | | $ | 1,819 | | | $ | 1,613 | | | $ | 1,515 | | | $ | 1,155 | | | $ | 1,410 | |

| Software and services | | 102 | | | 118 | | | 94 | | | 111 | | | 154 | |

Total cost of revenues2 | | $ | 1,921 | | | $ | 1,731 | | | $ | 1,609 | | | $ | 1,266 | | | $ | 1,564 | |

| Gross profit | | $ | (606) | | | $ | (527) | | | $ | (451) | | | $ | (392) | | | $ | 170 | |

| Gross margin | | (46) | % | | (44) | % | | (39) | % | | (45) | % | | 10 | % |

| | | | | | | | | | |

| | | | | | | | | | |

| Research and development | | $ | 526 | | | $ | 461 | | | $ | 428 | | | $ | 350 | | | $ | 374 | |

| Selling, general, and administrative | | 449 | | | 496 | | | 496 | | | 427 | | | 457 | |

| Total operating expenses | | $ | 975 | | | $ | 957 | | | $ | 924 | | | $ | 777 | | | $ | 831 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Adjusted research and development (non-GAAP)¹ | | $ | 388 | | | $ | 319 | | | $ | 312 | | | $ | 271 | | | $ | 277 | |

| Adjusted selling, general, and administrative (non-GAAP)¹ | | 318 | | | 358 | | | 364 | | | 328 | | | 343 | |

| Total adjusted operating expenses (non-GAAP)¹ | | $ | 706 | | | $ | 677 | | | $ | 676 | | | $ | 599 | | | $ | 620 | |

| | | | | | | | | | |

Adjusted EBITDA (non-GAAP)1,2 | | $ | (1,006) | | | $ | (798) | | | $ | (857) | | | $ | (757) | | | $ | (277) | |

Cash, cash equivalents, short-term investments, and restricted cash | | $ | 9,368 | | | $ | 7,858 | | | $ | 7,867 | | | $ | 6,739 | | | $ | 7,700 | |

| | | | | | | | | | |

Net cash (used)/provided by operating activities | | $ | (1,107) | | | $ | (1,269) | | | $ | (754) | | | $ | (876) | | | $ | 1,183 | |

| Capital expenditures | | (298) | | | (254) | | | (283) | | | (277) | | | (327) | |

Free cash flow (non-GAAP)1 | | $ | (1,405) | | | $ | (1,523) | | | $ | (1,037) | | | $ | (1,153) | | | $ | 856 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Depreciation and amortization expense | | | | | | | | | | |

| Cost of revenues | | $ | 195 | | | $ | 210 | | | $ | 203 | | | $ | 186 | | | $ | 145 | |

| Research and development | | 19 | | | 18 | | | 18 | | | 20 | | | 18 | |

| Selling, general, and administrative | | 56 | | | 52 | | | 53 | | | 53 | | | 55 | |

| Total depreciation and amortization expense | | $ | 270 | | | $ | 280 | | | $ | 274 | | | $ | 259 | | | $ | 218 | |

| | | | | | | | | | |

| Stock-based compensation expense | | | | | | | | | | |

| Cost of revenues | | $ | 21 | | | $ | 23 | | | $ | 17 | | | $ | 6 | | | $ | 16 | |

| Research and development | | 119 | | | 124 | | | 98 | | | 59 | | | 79 | |

| Selling, general, and administrative | | 75 | | | 86 | | | 79 | | | 46 | | | 59 | |

| Total stock-based compensation expense | | $ | 215 | | | $ | 233 | | | $ | 194 | | | $ | 111 | | | $ | 154 | |

| | | | | | | | | | |

| Inventory write-downs | | | | | | | | | | |

Inventory LCNRV write-downs3 | | $ | 319 | | | $ | 328 | | | $ | 148 | | | $ | 130 | | | $ | 66 | |

Liabilities for losses on firm purchase commitments3 | | 126 | | | 45 | | | 31 | | | 10 | | | 5 | |

Total inventory write-downs and liabilities for losses on firm purchase commitments 3 | | $ | 445 | | | $ | 373 | | | $ | 179 | | | $ | 140 | | | $ | 71 | |

| ¹ A reconciliation of non-GAAP financial measures to the most comparable GAAP measure is provided later in this letter. |

2 The prior periods have been recast to conform to current period presentation. |

3 Amount as of date shown. |

| | | | | | | | |

| Q4 2024 Shareholder Letter | © 2025 Rivian. All rights reserved. 17 |

| | | | | | | | | | | | | | |

| Consolidated Balance Sheets |

|

| (in millions, except per share amounts) | | | |

| | | | |

| | | | | | | | | | | | | | |

| Assets | | December 31, 2023 | | December 31, 2024 |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 7,857 | | | $ | 5,294 | |

| Short-term investments | | 1,511 | | | 2,406 | |

| Accounts receivable, net | | 161 | | | 443 | |

| Inventory | | 2,620 | | | 2,248 | |

| Other current assets | | 164 | | | 192 | |

| Total current assets | | 12,313 | | | 10,583 | |

| Property, plant, and equipment, net | | 3,874 | | | 3,965 | |

| Operating lease assets, net | | 356 | | | 416 | |

| Other non-current assets | | 235 | | | 446 | |

| Total assets | | $ | 16,778 | | | $ | 15,410 | |

| | | | |

| Liabilities and Stockholders’ Equity | | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 981 | | | $ | 499 | |

| Accrued liabilities | | 1,145 | | | 835 | |

| | | | |

| | | | |

| Current portion of deferred revenues, lease liabilities, and other liabilities | | 361 | | | 917 | |

| Total current liabilities | | 2,487 | | | 2,251 | |

| Long-term debt | | 4,431 | | | 4,441 | |

| Non-current lease liabilities | | 324 | | | 379 | |

| Other non-current liabilities | | 395 | | | 1,777 | |

| Total liabilities | | 7,637 | | | 8,848 | |

| Commitments and contingencies | | | | |

| Stockholders' equity: | | | | |

Preferred stock, $0.001 par value; 10 shares authorized and 0 shares issued and outstanding as of December 31, 2023 and 2024 | | — | | | — | |

Common stock, $0.001 par value; 3,508 and 3,508 shares authorized and 968 and 1,131 shares issued and outstanding as of December 31, 2023 and 2024, respectively | | 1 | | | 1 | |

| Additional paid-in capital | | 27,695 | | | 29,866 | |

| Accumulated deficit | | (18,558) | | | (23,305) | |

| Accumulated other comprehensive income (loss) | | 3 | | | (4) | |

| Noncontrolling interest | | — | | | 4 | |

| Total stockholders' equity | | 9,141 | | | 6,562 | |

| | | | |

| Total liabilities and stockholders' equity | | $ | 16,778 | | | $ | 15,410 | |

| | | | | | | | |

| Q4 2024 Shareholder Letter | © 2025 Rivian. All rights reserved. 18 |

| | | | | | | | | | | | | | |

Consolidated Statements of Operations 1 |

| | | | |

| (in millions, except per share amounts) |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| | 2023 | | 2024 | | 2023 | | 2024 |

| Automotive | | $ | 1,208 | | | $ | 1,520 | | | $ | 4,132 | | | $ | 4,486 | |

| Software and services | | 107 | | | 214 | | | 302 | | | 484 | |

| Total revenues | | 1,315 | | | 1,734 | | | 4,434 | | | 4,970 | |

| Automotive | | 1,819 | | | 1,410 | | | 6,150 | | | 5,693 | |

| Software and services | | 102 | | | 154 | | | 314 | | | 477 | |

| Total cost of revenues | | 1,921 | | | 1,564 | | | 6,464 | | | 6,170 | |

| Gross profit | | (606) | | | 170 | | | (2,030) | | | (1,200) | |

| Operating expenses | | | | | | | | |

| Research and development | | 526 | | | 374 | | | 1,995 | | | 1,613 | |

| Selling, general, and administrative | | 449 | | | 457 | | | 1,714 | | | 1,876 | |

| | | | | | | | |

| Total operating expenses | | 975 | | | 831 | | | 3,709 | | | 3,489 | |

| Loss from operations | | (1,581) | | | (661) | | | (5,739) | | | (4,689) | |

| Interest income | | 131 | | | 83 | | | 522 | | | 385 | |

| Interest expense | | (73) | | | (81) | | | (220) | | | (318) | |

| Loss on convertible notes, net | | — | | | (82) | | | — | | | (112) | |

| Other income (expense), net | | 2 | | | 1 | | | 6 | | | (7) | |

| Loss before income taxes | | (1,521) | | | (740) | | | (5,431) | | | (4,741) | |

| Provision for income taxes | | — | | | (3) | | | (1) | | | (5) | |

| Net loss | | $ | (1,521) | | | $ | (743) | | | $ | (5,432) | | | $ | (4,746) | |

| Less: Net income attributable to noncontrolling interest | | — | | | 1 | | | — | | | 1 | |

| Net loss attributable to common stockholders | | $ | (1,521) | | | $ | (744) | | | $ | (5,432) | | | $ | (4,747) | |

| Net loss attributable to common stockholders, basic and diluted | | $ | (1,521) | | | $ | (744) | | | $ | (5,432) | | | $ | (4,747) | |

| Net loss per share attributable to common stockholders, basic and diluted | | $ | (1.58) | | | $ | (0.70) | | | $ | (5.74) | | | $ | (4.69) | |

| Weighted-average common shares outstanding, basic and diluted | | 963 | | | 1,058 | | | 947 | | | 1,013 | |

1 The prior periods have been recast to conform to current period presentation. |

| | | | | | | | |

| | | | | | | | |

| Q4 2024 Shareholder Letter | © 2025 Rivian. All rights reserved. 19 |

| | | | | | | | | | | | | | |

Consolidated Statements of Cash Flows 1 |

| | | | |

| (in millions) |

| | | | |

| | | | | | | | | | | | | | | | |

| | | | Years Ended December 31, |

| | | | 2023 | | 2024 |

| Cash flows from operating activities: | | | | | | |

| Net loss | | | | $ | (5,432) | | | $ | (4,746) | |

| Depreciation and amortization | | | | 937 | | | 1,031 | |

| Stock-based compensation expense | | | | 821 | | | 692 | |

| | | | | | |

| Loss on convertible notes, net | | | | — | | | 112 | |

| Inventory LCNRV write-downs and losses on firm purchase commitments | | | | 107 | | | — | |

| Other non-cash activities | | | | 115 | | | 28 | |

| Changes in operating assets and liabilities: | | | | | | |

| Accounts receivable, net | | | | (59) | | | (282) | |

| Inventory | | | | (1,604) | | | 307 | |

| Other assets | | | | (146) | | | (221) | |

| | | | | | |

| Accounts payable and accrued liabilities | | | | 105 | | | (572) | |

| Deferred revenue | | | | 149 | | | 1,619 | |

| Other liabilities | | | | 141 | | | 316 | |

| | | | | | |

| Net cash used in operating activities | | | | (4,866) | | | (1,716) | |

| | | | | | |

| Cash flows from investing activities: | | | | | | |

| Purchases of short-term investments | | | | (2,410) | | | (4,392) | |

| Maturities of short-term investments | | | | 925 | | | 3,553 | |

| | | | | | |

| Capital expenditures | | | | (1,026) | | | (1,141) | |

| | | | | | |

| Net cash used in investing activities | | | | (2,511) | | | (1,980) | |

| | | | | | |

| Cash flows from financing activities: | | | | | | |

| | | | | | |

| Proceeds from issuance of capital stock including employee stock purchase plan | | | | 61 | | | 64 | |

| Proceeds from issuance of convertible notes | | | | 3,195 | | | 1,000 | |

| | | | | | |

| Proceeds from funding of 50% interest in Rivian and VW Group Technology, LLC | | | | — | | | 79 | |

| Purchase of capped call options | | | | (108) | | | — | |

| | | | | | |

| Other financing activities | | | | (18) | | | (7) | |

| Net cash provided by financing activities | | | | 3,130 | | | 1,136 | |

| | | | | | |

| Effect of exchange rate changes on cash and cash equivalents | | | | 5 | | | (3) | |

| Net change in cash | | | | (4,242) | | | (2,563) | |

| Cash, cash equivalents, and restricted cash—Beginning of period | | | | 12,099 | | | 7,857 | |

| Cash, cash equivalents, and restricted cash—End of period | | | | $ | 7,857 | | | $ | 5,294 | |

| | | | | | |

| Supplemental disclosure of cash flow information: | | | | | | |

| Cash paid for interest | | | | $ | 169 | | | $ | 279 | |

| Supplemental disclosure of non-cash investing and financing activities: | | | | | | |

| Capital expenditures included in liabilities | | | | $ | 374 | | | $ | 423 | |

| Capital stock issued to settle bonuses | | | | $ | 137 | | | $ | 179 | |

| Conversion of convertible notes | | | | $ | — | | | $ | 1,133 | |

1 The prior period has been recast to conform to current period presentation. | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | | | |

| Q4 2024 Shareholder Letter | © 2025 Rivian. All rights reserved. 20 |

| | | | | | | | | | | | | | |

| Depreciation and Amortization |

| | | | |

| (in millions) |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2023 | | 2024 | | 2023 | | 2024 |

| Cost of revenues | | $ | 195 | | | $ | 145 | | | $ | 661 | | | $ | 744 | |

| Research and development | | 19 | | | 18 | | | 138 | | | 74 | |

| Selling, general, and administrative | | 56 | | | 55 | | | 138 | | | 213 | |

| Total depreciation and amortization expense | | $ | 270 | | | $ | 218 | | | $ | 937 | | | $ | 1,031 | |

| | | | | | | | | | | | | | |

| Stock-Based Compensation Expense |

|

| (in millions) | | | |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| | 2023 | | 2024 | | 2023 | | 2024 |

| Cost of revenues | | $ | 21 | | | $ | 16 | | | $ | 85 | | | $ | 62 | |

| Research and development | | 119 | | | 79 | | | 408 | | | 360 | |

| Selling, general, and administrative | | 75 | | | 59 | | | 328 | | | 270 | |

| Total stock-based compensation expense | | $ | 215 | | | $ | 154 | | | $ | 821 | | | $ | 692 | |

|

| | | | | | | | |

| Q4 2024 Shareholder Letter | © 2025 Rivian. All rights reserved. 21 |

| | | | | | | | | | | | | | |

| Reconciliation of Non-GAAP |

| Financial Measures |

| | | | |

(in millions) |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted Research and Development Expenses | | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2023 | | 2024 | | 2023 | | 2024 |

| | | | | | | | |

| Total research and development expenses | | $ | 526 | | | $ | 374 | | | $ | 1,995 | | | $ | 1,613 | |

| R&D depreciation and amortization expenses | | (19) | | | (18) | | | (138) | | | (74) | |

| R&D stock-based compensation expenses | | (119) | | | (79) | | | (408) | | | (360) | |

| Adjusted research and development (non-GAAP) | | $ | 388 | | | $ | 277 | | | $ | 1,449 | | | $ | 1,179 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted Selling, General, and Administrative Expenses | | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2023 | | 2024 | | 2023 | | 2024 |

| | | | | | | | |

| Total selling, general, and administrative expenses | | $ | 449 | | | $ | 457 | | | $ | 1,714 | | | $ | 1,876 | |

| SG&A depreciation and amortization expenses | | (56) | | | (55) | | | (138) | | | (213) | |

| SG&A stock-based compensation expenses | | (75) | | | (59) | | | (328) | | | (270) | |

| Adjusted selling, general, and administrative (non-GAAP) | | $ | 318 | | | $ | 343 | | | $ | 1,248 | | | $ | 1,393 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted Operating Expenses | | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2023 | | 2024 | | 2023 | | 2024 |

| | | | | | | | |

| Total operating expenses | | $ | 975 | | | $ | 831 | | | $ | 3,709 | | | $ | 3,489 | |

| R&D depreciation and amortization expenses | | (19) | | | (18) | | | (138) | | | (74) | |

| R&D stock-based compensation expenses | | (119) | | | (79) | | | (408) | | | (360) | |

| SG&A depreciation and amortization expenses | | (56) | | | (55) | | | (138) | | | (213) | |

| SG&A stock-based compensation expenses | | (75) | | | (59) | | | (328) | | | (270) | |

| Total adjusted operating expenses (non-GAAP) | | $ | 706 | | | $ | 620 | | | $ | 2,697 | | | $ | 2,572 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA1 | | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2023 | | 2024 | | 2023 | | 2024 |

| | | | | | | | |

| Net loss attributable to common shareholders | | $ | (1,521) | | | $ | (744) | | | $ | (5,432) | | | $ | (4,747) | |

| Interest income, net | | (58) | | | (2) | | | (302) | | | (67) | |

| Provision for income taxes | | — | | | 3 | | | 1 | | | 5 | |

| Depreciation and amortization | | 270 | | | 218 | | | 937 | | | 1,031 | |

| Stock-based compensation expense | | 215 | | | 154 | | | 821 | | | 692 | |

| Other (income) expense, net | | (2) | | | (1) | | | (6) | | | 7 | |

| Loss on convertible note, net | | — | | | 82 | | | — | | | 112 | |

| | | | | | | | |

| Cost of revenue efficiency initiatives | | 60 | | | — | | | 95 | | | 193 | |

| Restructuring expenses | | — | | | — | | | 42 | | | 30 | |

| Asset impairments and write-offs | | 30 | | | — | | | 55 | | | 30 | |

Joint venture formation expenses and other items2 | | — | | | 13 | | | — | | | 25 | |

| Adjusted EBITDA (non-GAAP) | | $ | (1,006) | | | $ | (277) | | | $ | (3,789) | | | $ | (2,689) | |

| | | | | | | | |

1 The prior periods have been recast to conform to current period presentation. |

2 Defined in Non-GAAP Financial Measures later in this letter. |

| | | | | | | | |

| Q4 2024 Shareholder Letter | © 2025 Rivian. All rights reserved. 22 |

| | | | | | | | | | | | | | |

| Reconciliation of Non-GAAP |

| Financial Measures Continued |

| | | | |

| (in millions, except per share amounts) |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted Net Loss1

| | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2023 | | 2024 | | 2023 | | 2024 |

| | | | | | | | |

| Net loss attributable to common stockholders, basic and diluted | | $ | (1,521) | | | $ | (744) | | | $ | (5,432) | | | $ | (4,747) | |

| Stock-based compensation expense | | 215 | | | 154 | | | 821 | | | 692 | |

| Other (income) expense, net | | (2) | | | (1) | | | (6) | | | 7 | |

| Loss on convertible note, net | | — | | | 82 | | | — | | | 112 | |

| Cost of revenue efficiency initiatives | | 60 | | | — | | | 95 | | | 193 | |

| Restructuring expenses | | — | | | — | | | 42 | | | 30 | |

| Asset impairments and write-offs | | 30 | | | — | | | 55 | | | 30 | |

Joint venture formation expenses and other items2 | | — | | | 13 | | | — | | | 25 | |

| Adjusted net loss attributable to common stockholders, basic and diluted (non-GAAP) | | $ | (1,218) | | | $ | (496) | | | $ | (4,425) | | | $ | (3,658) | |

1 The prior periods have been recast to conform to current period presentation. |

2 Defined in Non-GAAP Financial Measures later in this letter. |

| | | | | | | | |

| | | | | | | | |

Adjusted Net Loss Per Share1 | | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2023 | | 2024 | | 2023 | | 2024 |

| | | | | | | | |

| Net loss per share attributable to common stockholders, basic and diluted | | $ | (1.58) | | | $ | (0.70) | | | $ | (5.74) | | | $ | (4.69) | |

| Stock-based compensation expense per share | | 0.22 | | | 0.15 | | | 0.87 | | | 0.68 | |

| Other (income) expense, net per share | | — | | | — | | | (0.01) | | | 0.01 | |

Loss on convertible note, net per share | | — | | | 0.08 | | | — | | | 0.11 | |

| | | | | | | | |

Cost of revenue efficiency initiatives per share | | 0.06 | | | — | | | 0.10 | | | 0.19 | |

Restructuring expenses per share | | — | | | — | | | 0.04 | | | 0.03 | |

Asset impairments and write-offs per share | | 0.03 | | | — | | | 0.06 | | | 0.03 | |

Joint venture formation expenses and other items2 per share | | — | | | 0.01 | | | — | | | 0.02 | |

| Adjusted net loss per share attributable to common stockholders, basic and diluted (non-GAAP) | | $ | (1.27) | * | | $ | (0.46) | * | | $ | (4.68) | * | | $ | (3.62) | * |

| Weighted-average common shares outstanding, basic and diluted (GAAP) | | 963 | | | 1,058 | | | 947 | | | 1,013 | |

1 The prior periods have been recast to conform to current period presentation. | | | | |

2 Defined in Non-GAAP Financial Measures later in this letter. |

*Does not calculate due to rounding. |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Free Cash Flow | | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2023 | | 2024 | | 2023 | | 2024 |

| | | | | | | | |

Net cash (used)/provided by operating activities | | $ | (1,107) | | | $ | 1,183 | | | $ | (4,866) | | | $ | (1,716) | |

| Capital expenditures | | (298) | | | (327) | | | (1,026) | | | (1,141) | |

| Free cash flow (non-GAAP) | | $ | (1,405) | | | $ | 856 | | | $ | (5,892) | | | $ | (2,857) | |

| | | | | | | | |

| | | | | | | | |

| Q4 2024 Shareholder Letter | © 2025 Rivian. All rights reserved. 23 |

| | | | | | | | | | | | | | |

| Quarterly Financial Performance |

| Reconciliation of Non-GAAP |

| Financial Measures |

| | | | |

(in millions) |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| | December 31,

2023 | | March 31,

2024 | | June 30,

2024 | | September 30,

2024 | | December 31,

2024 |

| | | | | | | | | | |

| Adjusted Research and Development Expenses | | | | | | | | | | |

| Total research and development expenses | | $ | 526 | | | $ | 461 | | | $ | 428 | | | $ | 350 | | | $ | 374 | |

| R&D depreciation and amortization expenses | | (19) | | | (18) | | | (18) | | | (20) | | | (18) | |

| R&D stock-based compensation expenses | | (119) | | | (124) | | | (98) | | | (59) | | | (79) | |

| Adjusted research and development (non-GAAP) | | $ | 388 | | | $ | 319 | | | $ | 312 | | | $ | 271 | | | $ | 277 | |

| | | | | | | | | | |

| Adjusted Selling, General, and Administrative Expenses | | | | | | | | | | |