- Achieved Q4 2024 gross profit of $170 million

- Closed Joint Venture with Volkswagen Group and loan from the

Department of Energy which provides up to $10 billion of

incremental capital*

- $729 million improvement in Q4 2024 Adjusted EBITDA compared

to Q4 2023**

- Over 1 billion Amazon packages delivered by EDVs

Rivian Automotive, Inc. (NASDAQ: RIVN) today announced fourth

quarter and full year 2024 financial results. Rivian reported a

gross profit of $170 million in the fourth quarter of 2024,

primarily driven by improvements in variable costs, revenue per

delivered unit, and fixed costs. Rivian expects these improvements

to benefit it over the long-term and position the company well to

achieve modest gross profit for 2025. Rivian achieved record

revenues in the fourth quarter of 2024 driven by the sale of

regulatory credits and software and services revenue growth as well

as increasing R1 average selling prices with the increased

availability of its Tri-Motor offering.

In the fourth quarter, Rivian produced 12,727 vehicles at its

manufacturing facility in Normal, Illinois and delivered 14,183

vehicles. For the full-year 2024, Rivian produced 49,476 vehicles

and delivered 51,579.

During the fourth quarter of 2024, Rivian and Volkswagen Group

closed their joint venture, Rivian and Volkswagen Group Technology

(the “Joint Venture”). With a total deal size of up to $5.8

billion, including $3.5 billion of proceeds expected to be received

over the next several years, the Joint Venture plans to bring

next-generation electrical architecture and best-in-class software

technology for Rivian and Volkswagen Group future electric

vehicles, starting with the R2. Furthermore, Rivian closed a loan

agreement with the U.S. Department of Energy’s (DOE) Loan Programs

Office (LPO) for up to $6.6 billion (including $6 billion of

principal and approximately $600 million of capitalized interest).

The loan is expected to support the construction of Rivian’s next

U.S. manufacturing facility in Georgia, which aims to create

approximately 7,500 jobs in the local area. The capital associated

with the Joint Venture and DOE loan, in addition to Rivian’s

current cash, cash equivalents, and short-term investments, is

expected to provide the capital resources to fund operations

through the ramp of R2 in Normal, as well as the midsize platform

in Georgia - enabling a path to positive free cash flow and

meaningful scale.

Rivian’s commercial van offering continues to progress. In 2024

more than 1 billion packages were delivered by Amazon in the Rivian

Electric Delivery Van (EDV) in the U.S. alone. Earlier this month,

Rivian opened sales for its commercial van to fleets of all sizes

in the U.S. The Rivian Commercial Van is the platform on which

Amazon’s custom EDV is based, and is designed from the ground up,

prioritizing safety, driver comfort, total cost of ownership and

sustainability.

RJ Scaringe, Founder and CEO, Rivian said:

“This quarter we achieved positive gross profit and removed

$31,000 in automotive cost of goods sold per vehicle delivered in

Q4 2024 relative to Q4 2023. Our focus on cost efficiency across

the business is critical for the launch of our mass market product,

R2. The R2 bill of materials is approximately 95% sourced and is

expected to be approximately half that of the improved R1 bill of

materials. I couldn't be more excited about R2, and I believe the

combination of capabilities and cost efficiencies along with the

amazing level of excitement from customers will make R2 a truly

transformational product for Rivian."

External factors could impact Rivian's 2025 expectations,

including changes to government policies and regulations and a

challenging demand environment. Rivian’s guidance represents

management's current view on potential adjustments to incentives,

regulations, and tariff structures.

2025 Guidance

Vehicles Delivered

46,000 - 51,000

Adj. EBITDA

$(1,700) million - $(1,900) million

Capital Expenditures

$1,600 million - $1,700 million

Rivian will host an audio webcast to discuss the company’s

results and provide a business update at 2:00pm PT / 5:00pm ET on

Thursday, February 20, 2025. The link to the webcast will be

available at

https://rivian-q4-earnings-webcast-2025.open-exchange.net/registration.

*$10B for potential future funds incremental to the $2 billion

of funds already received in association with the Joint Venture.

Receipt of funds is subject to certain conditions and milestones,

as discussed further in Rivian’s Current Reports on Form 8-K filed

on November 12, 2024 and January 16, 2025. ** A reconciliation of

non-GAAP financial measures to the most comparable GAAP measure is

provided below.

Consolidated Balance Sheets (in millions, except per share

amounts)

Assets

December 31, 2023

December 31, 2024

Current assets:

Cash and cash equivalents

$

7,857

$

5,294

Short-term investments

1,511

2,406

Accounts receivable, net

161

443

Inventory

2,620

2,248

Other current assets

164

192

Total current assets

12,313

10,583

Property, plant, and equipment, net

3,874

3,965

Operating lease assets, net

356

416

Other non-current assets

235

446

Total assets

$

16,778

$

15,410

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable

$

981

$

499

Accrued liabilities

1,145

835

Current portion of deferred revenues,

lease liabilities, and other liabilities

361

917

Total current liabilities

2,487

2,251

Long-term debt

4,431

4,441

Non-current lease liabilities

324

379

Other non-current liabilities

395

1,777

Total liabilities

7,637

8,848

Commitments and contingencies

Stockholders' equity:

Preferred stock, $0.001 par value; 10

shares authorized and 0 shares issued and outstanding as of

December 31, 2023 and 2024

—

—

Common stock, $0.001 par value; 3,508 and

3,508 shares authorized and 968 and 1,131 shares issued and

outstanding as of December 31, 2023 and 2024, respectively

1

1

Additional paid-in capital

27,695

29,866

Accumulated deficit

(18,558

)

(23,305

)

Accumulated other comprehensive income

(loss)

3

(4

)

Noncontrolling interest

—

4

Total stockholders' equity

9,141

6,562

Total liabilities and stockholders'

equity

$

16,778

$

15,410

Consolidated Statements of Operations 1 (in millions,

except per share amounts)

Three Months Ended December

31,

Twelve Months Ended December

31,

2023

2024

2023

2024

Automotive

$

1,208

$

1,520

$

4,132

$

4,486

Software and services

107

214

302

484

Total revenues

1,315

1,734

4,434

4,970

Automotive

1,819

1,410

6,150

5,693

Software and services

102

154

314

477

Total cost of revenues

1,921

1,564

6,464

6,170

Gross profit

(606

)

170

(2,030

)

(1,200

)

Operating expenses

Research and development

526

374

1,995

1,613

Selling, general, and administrative

449

457

1,714

1,876

Total operating expenses

975

831

3,709

3,489

Loss from operations

(1,581

)

(661

)

(5,739

)

(4,689

)

Interest income

131

83

522

385

Interest expense

(73

)

(81

)

(220

)

(318

)

Loss on convertible notes, net

—

(82

)

—

(112

)

Other income (expense), net

2

1

6

(7

)

Loss before income taxes

(1,521

)

(740

)

(5,431

)

(4,741

)

Provision for income taxes

—

(3

)

(1

)

(5

)

Net loss

$

(1,521

)

$

(743

)

$

(5,432

)

$

(4,746

)

Less: Net income attributable to

noncontrolling interest

—

1

—

1

Net loss attributable to common

stockholders

$

(1,521

)

$

(744

)

$

(5,432

)

$

(4,747

)

Net loss attributable to common

stockholders, basic and diluted

$

(1,521

)

$

(744

)

$

(5,432

)

$

(4,747

)

Net loss per share attributable to

common stockholders, basic and diluted

$

(1.58

)

$

(0.70

)

$

(5.74

)

$

(4.69

)

Weighted-average common shares

outstanding, basic and diluted

963

1,058

947

1,013

1 The prior periods have been recast to

conform to current period presentation.

Consolidated Statements of Cash Flows 1 (in millions)

Years Ended December

31,

2023

2024

Cash flows from operating activities:

Net loss

$

(5,432

)

$

(4,746

)

Depreciation and amortization

937

1,031

Stock-based compensation expense

821

692

Loss on convertible notes, net

—

112

Inventory LCNRV write-downs and losses on

firm purchase commitments

107

—

Other non-cash activities

115

28

Changes in operating assets and

liabilities:

Accounts receivable, net

(59

)

(282

)

Inventory

(1,604

)

307

Other assets

(146

)

(221

)

Accounts payable and accrued

liabilities

105

(572

)

Deferred revenue

149

1,619

Other liabilities

141

316

Net cash used in operating

activities

(4,866

)

(1,716

)

Cash flows from investing activities:

Purchases of short-term investments

(2,410

)

(4,392

)

Maturities of short-term investments

925

3,553

Capital expenditures

(1,026

)

(1,141

)

Net cash used in investing

activities

(2,511

)

(1,980

)

Cash flows from financing activities:

Proceeds from issuance of capital stock

including employee stock purchase plan

61

64

Proceeds from issuance of convertible

notes

3,195

1,000

Proceeds from funding of 50% interest in

Rivian and VW Group Technology, LLC

—

79

Purchase of capped call options

(108

)

—

Other financing activities

(18

)

(7

)

Net cash provided by financing

activities

3,130

1,136

Effect of exchange rate changes on cash

and cash equivalents

5

(3

)

Net change in cash

(4,242

)

(2,563

)

Cash, cash equivalents, and restricted

cash—Beginning of period

12,099

7,857

Cash, cash equivalents, and restricted

cash—End of period

$

7,857

$

5,294

Supplemental disclosure of cash flow

information:

Cash paid for interest

$

169

$

279

Supplemental disclosure of non-cash

investing and financing activities:

Capital expenditures included in

liabilities

$

374

$

423

Capital stock issued to settle

bonuses

$

137

$

179

Conversion of convertible notes

$

—

$

1,133

1 The prior periods have been recast to

conform to current period presentation.

Reconciliation of Non-GAAPFinancial Measures (in

millions)

Adjusted EBITDA1

Three Months Ended December

31,

Twelve Months Ended December

31,

2023

2024

2023

2024

Net loss attributable to common

shareholders

$

(1,521

)

$

(744

)

$

(5,432

)

$

(4,747

)

Interest income, net

(58

)

(2

)

(302

)

(67

)

Provision for income taxes

—

3

1

5

Depreciation and amortization

270

218

937

1,031

Stock-based compensation expense

215

154

821

692

Other (income) expense, net

(2

)

(1

)

(6

)

7

Loss on convertible note, net

—

82

—

112

Cost of revenue efficiency initiatives

60

—

95

193

Restructuring expenses

—

—

42

30

Asset impairments and write-offs

30

—

55

30

Joint venture formation expenses and other

items2

—

13

—

25

Adjusted EBITDA (non-GAAP)

$

(1,006

)

$

(277

)

$

(3,789

)

$

(2,689

)

1 The prior periods have been recast to

conform to current period presentation.

2 Defined in Non-GAAP Financial Measures

below.

Forward-Looking Statements:

This press release and statements that are made on our earnings

call contain forward looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. All statements

contained in this press release and made on our earnings call that

do not relate to matters of historical fact should be considered

forward-looking statements, including without limitation statements

regarding our future operations, initiatives and business strategy,

including expected cost reduction initiatives, our future financial

results, vehicle profitability and future gross profits, our future

capital expenditures, the underlying trends in our business

(including customer preferences and expectations, and potential

tailwinds for 2025), our market opportunity, and our potential for

growth, our production ramp and manufacturing capacity expansion

and anticipated production levels, our expected future production

and deliveries, scaling our service infrastructure, our expected

future products and technology and product enhancements (including

the launches of R2 and R3), potential expansion of commercial van

sales, future revenue opportunities, including with respect to the

emerging autonomous driving market, our joint venture with

Volkswagen Group, including the expected benefits from the

partnership and future VW investments, and other expected

incremental available capital pursuant to agreements with VW and

the U.S. Department of Energy. These statements are neither

promises nor guarantees and involve known and unknown risks,

uncertainties, and other important factors that may cause our

actual results, performance, or achievements to be materially

different from any future results, performance, or achievements

expressed or implied by the forward-looking statements, including,

but not limited to: our history of losses as a growth-stage company

and our limited operating history; we may underestimate or not

effectively manage our capital expenditures and costs; that we will

require additional financing and capital to support our business;

our ability to maintain strong demand for our vehicles and attract

and retain a large number of consumers; our ability to grow sales

of our commercial vehicles, risks relating to the highly

competitive automotive market, including competitors that may take

steps to compete more effectively against us; consumers’

willingness to adopt electric vehicles; risks associated with our

joint venture with Volkswagen Group, risks associated with

additional strategic alliances or acquisitions, that we may

experience significant delays in the manufacture and delivery of

our vehicles; that our long-term results depend on our ability to

successfully introduce and market new products and services; that

we have experienced and could continue to experience cost increases

or disruptions in supply of raw materials or other components used

in our vehicles; our dependence on suppliers and volatility in

pricing of components and raw materials; our ability to accurately

estimate the supply and demand for our vehicles and predict our

manufacturing requirements; our ability to scale our business and

manage future growth effectively; our ability to maintain our

relationship with one customer that has generated a significant

portion of our revenues; that we are highly dependent on the

services and reputation of our Founder and Chief Executive Officer;

our ability to offer attractive financing and leasing options; that

we may not succeed in maintaining and strengthening our brand; that

our focus on delivering a high-quality and engaging Rivian

experience may not maximize short-term financial results; risks

relating to our distribution model; that we rely on complex

machinery, and production involves a significant degree of risk and

uncertainty; that our operations, IT systems and vehicles rely on

highly technical software and hardware that could contain errors or

defects; that we may not successfully develop the complex software

and technology systems in coordination with the Volkswagen Group

joint venture and our other vendors needed to produce our vehicles;

inadequate access to charging stations and not being able to

realize the benefits of our charging networks; risks related to our

use of lithium-ion battery cells; that we have limited experience

servicing and repairing our vehicles; that the automotive industry

is rapidly evolving and may be subject to unforeseen changes; risks

associated with advanced driver assistance systems technology; the

unavailability, reduction or elimination of government and economic

incentives and credits for electric vehicles; that we may not be

able to obtain the government grants, loans, and other incentives,

including regulatory credits, for which we apply or on which we

rely; that vehicle retail sales depend heavily on affordable

interest rates and availability of credit; insufficient warranty

reserves to cover warranty claims; that future field actions,

including product recalls, could harm our business; risks related

to product liability claims; risks associated with international

operations; our ability to attract and retain key employees and

qualified personnel; our ability to maintain our culture; that our

business may be adversely affected by labor and union activities;

that our financial results may vary significantly from period to

period; that we have incurred a significant amount of debt and

expect to incur significant additional indebtedness; risks related

to third-party vendors for certain product and service offerings;

potential conflicts of interest involving our principal

stockholders or their affiliates; risks associated with exchange

rate and interest rate fluctuations; that breaches in data

security, failure of technology systems, cyber-attacks or other

security or privacy-related incidents could harm our business;

risks related to our use of artificial intelligence technologies;

risk of intellectual property infringement claims; that our use of

open source software in our applications could subject our

proprietary software to general release; our ability to prevent

unauthorized use of our intellectual property; risks related to

governmental regulation and legal proceedings; delays, limitations

and risks related to permits and approvals required to operate or

expand operations; our internal control over financial reporting;

effect of trade tariffs or other trade barriers; and the other

factors described in our filings with the SEC. These factors could

cause actual results to differ materially from those indicated by

the forward-looking statements made in this press release. Any such

forward looking statements represent management’s estimates as of

the date of this press release. While we may elect to update such

forward-looking statements at some point in the future, except as

may be required by law, we disclaim any obligation to do so, even

if subsequent events cause our views to change.

*Non-GAAP Financial Measures

In addition to our results determined in accordance with

generally accepted accounting principles in the United States

(“GAAP”), we review financial measures that are not calculated and

presented in accordance with GAAP (“non-GAAP financial measures”).

We believe our non-GAAP financial measures are useful in evaluating

our operating and cash performance. We use the following non-GAAP

financial information, collectively, to evaluate our ongoing

operations and for internal planning and forecasting purposes. We

believe that non-GAAP financial information, when taken

collectively, may be helpful to investors, because it focuses on

underlying operating results and trends, provides consistency and

comparability with past financial performance, and assists in

comparisons with other companies, some of which use similar

non-GAAP financial information to supplement their GAAP results.

The non-GAAP financial information is presented for supplemental

informational purposes only, should not be considered a substitute

for financial information presented in accordance with GAAP, and

may be different from similarly titled non-GAAP measures used by

other companies. A reconciliation of each historical non-GAAP

financial measure to the most directly comparable financial measure

stated in accordance with GAAP is provided above. Reconciliations

of forward-looking non-GAAP financial measures are not provided

because we are unable to provide such reconciliations without

unreasonable effort due to the uncertainty regarding, and potential

variability of, certain items, such as stock-based compensation

expense and other costs and expenses that may be incurred in the

future. Investors are encouraged to review the related GAAP

financial measures and the reconciliation of these non-GAAP

financial measures to their most directly comparable GAAP financial

measures.

Our non-GAAP financial measures include adjusted EBITDA, defined

as net loss before interest expense (income), net, provision for

income taxes, depreciation and amortization, stock-based

compensation, other expense (income), net, and special items. Our

management team ordinarily excludes special items from its review

of the results of ongoing operations. Special items is comprised of

(i) cost of revenue efficiency initiatives which include costs

incurred as we transition between major vehicle programs, cost

incurred for negotiations with major suppliers regarding changing

demand forecasts or design modifications, and other costs for

enhancing our capital and cost optimization, (ii) restructuring

expenses for significant actions taken, (iii) significant asset

impairments and write-offs, and (iv) other items that we do not

necessarily consider to be indicative of earnings from ongoing

operating activities, including loss (gain) on convertible note,

net, and joint venture formation expenses.

About Rivian:

Rivian (NASDAQ: RIVN) is an American automotive

manufacturer that develops and builds category-defining electric

vehicles as well as software and services that address the entire

lifecycle of the vehicle. The company creates innovative and

technologically advanced products that are designed to excel at

work and play with the goal of accelerating the global transition

to zero-emission transportation and energy. Rivian vehicles are

built in the United States and are sold directly to consumer and

commercial customers. Whether taking families on new adventures or

electrifying fleets at scale, Rivian vehicles all share a common

goal — preserving the natural world for generations to come.

Learn more about the company, products, and careers at

www.rivian.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250220451890/en/

Investors: ir@rivian.com

Media: Harry Porter: media@rivian.com

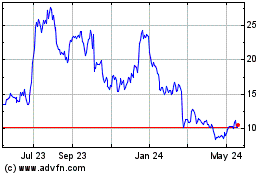

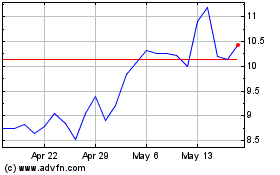

Rivian Automotive (NASDAQ:RIVN)

Historical Stock Chart

From Feb 2025 to Mar 2025

Rivian Automotive (NASDAQ:RIVN)

Historical Stock Chart

From Mar 2024 to Mar 2025