false

0001269026

0001269026

2025-02-19

2025-02-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 19, 2025

SINTX

Technologies, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-33624 |

|

84-1375299 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

1885

West 2100 South

Salt

Lake City, UT 84119

(Address

of principal executive offices, including Zip Code)

Registrant’s

telephone number, including area code: (801) 839-3500

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class: |

|

Trading

Symbol(s): |

|

Name

of each exchange on which registered: |

| Common

Stock, par value $0.01 per share |

|

SINT |

|

The

NASDAQ Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On

February 19, 2025, Sintx Technologies, Inc., (the “Company”), entered into an Entity Acquisition Agreement (the “Agreement”)

with Tethon Corporation (“Tethon”), pursuant to which the Company sold to Tethon all of the issued and outstanding shares

of Technology Assessment and Transfer, Inc. (“TA&T”), a wholly owned subsidiary of the Company, in exchange for the assumption

by Tethon of the outstanding liabilities of TA&T (the “Sale”).

The

Agreement contains representations, warranties, covenants and indemnities by the parties customary for transactions of this type. The

representations, warranties and covenants contained in the Agreement were made only for purposes of the Agreement and as of specified

dates, were solely for the benefit of the parties to the Agreement and may be subject to limitations agreed upon by the contracting parties,

including being qualified by confidential disclosures exchanged between the parties in connection with the execution of the Agreement.

The representations and warranties have been made for the purpose of allocating contractual risk between the parties to the Agreement

instead of establishing these matters as facts and may be subject to a contractual standard of materiality different from what might

be viewed as material to investors. Investors should not rely on the representations, warranties and covenants or any description thereof

as characterizations of the actual state of facts or condition of the Company or Tethon. Moreover, information concerning the subject

matter of the representations, warranties and covenants may change after the date of the Agreement, which subsequent information may

or may not be fully reflected in public disclosures.

The

foregoing summary of the Agreement and the Sale does not purport to be complete and is subject to, and qualified in its entirety by,

the full text of the Agreement, a copy of which is attached hereto as Exhibit 1.1 and incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

|

|

SINTX Technologies,

Inc. |

| |

|

|

|

|

| Date: |

February

20, 2025 |

|

By: |

/s/

Eric Olson |

| |

|

|

|

Eric Olson |

| |

|

|

|

President and Chief Executive

Officer |

Exhibit

1.1

ENTITY

ACQUISITION AGREEMENT

This

EQUITY ACQUISITION AGREEMENT (this “Agreement”) is made and entered into as of February 19, 2025, by and between

SINTX Technologies, Inc., a corporation organized under the laws of the State of Delaware (“Seller”), and Tethon

Corporation, a corporation organized under the laws of Nevada (“Buyer”) and Technology Assessment and Transfer,

Inc., a corporation organized under the laws of the State of Maryland (the “Company”). Buyer, Seller and Company

are collectively referred to as the “Parties” and individually as a “Party.”

RECITALS

WHEREAS,

Seller is the record and beneficial owner of five hundred (500) issued and outstanding shares of common stock, a no par value (the “Purchased

Shares”) of Company, which shares are all of the issued and outstanding shares of the Company;

WHEREAS,

Buyer desires to acquire from Seller all of the Purchased Shares, upon the terms and subject to the conditions set forth in this Agreement;

and

WHEREAS,

Seller desires to sell the Purchased Shares to Buyer upon the terms and subject to the conditions of this Agreement.

NOW,

THEREFORE, in consideration of the mutual representations, warranties, covenants, and agreements contained in this Agreement, and

for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:

| 1. | PURCHASE

AND SALE OF STOCK. |

| 1.1. | Purchase

and Sale of Stock. Upon the terms and subject to the conditions set forth in this Agreement,

on the Closing Date, Seller shall sell to Buyer, and Buyer shall purchase from Seller, all

of Seller’s right, title and interest in and to the Purchased Shares, free and clear

of all liens, claims and encumbrances of any nature whatsoever (collectively, “Liens”). |

| 1.2. | Consideration.

In exchange for Seller’s transfer of the Purchased Shares to Buyer, Seller and

Buyer have agreed to the following terms: |

| (a) | Buyer

will pay $0 and assume all of the operating expenses of Company going forward from the Closing

Date, all accrued but unpaid liabilities and assets set forth on the Balance Sheet set forth

in Section 2.8 of the Disclosure Schedule and will be entitled to the proceeds collected

on the Accounts Receivable set forth in the Disclosure Schedule, Section 2.14. |

1.

| 1.3. | Closing.

The closing shall take place on or before February 19th, 2025. If the closing has not

occurred by this date, this potential agreement is terminated. The closing of the transactions

contemplated by this Agreement (the “Closing”) shall take place simultaneously

with the execution of this Agreement on the date of this Agreement (the “Closing

Date”). At the Closing, Buyer will deliver to Seller the initial payment of the

purchase price as set forth in Section 1.2(a)(1) above, and Seller shall convey, transfer,

assign and deliver to Buyer all rights, title and interest in the Purchased Shares, which

shall represent 100% of the equity interests in the Company. |

| 1.4. | Closing

Deliverables. |

| (a) | At

the Closing, Seller shall deliver, or cause to be delivered, to Buyer: |

| (1) | An

irrevocable stock power duly endorsed transfer ownership of the Purchased Shares to Buyer. |

| (2) | Evidence

that all members of the board of directors of the Company have resigned from the Company’s

board of directors effective on the Closing Date. |

| 2. | REPRESENTATIONS

AND WARRANTIES OF SELLER. |

Seller

hereby represents and warrants to Buyer, as of the Closing Date, as follows:

| 2.1. | Organization.

The Company is a corporation duly organized, validly existing and in good standing under

the laws of the jurisdiction of its incorporation and has the requisite corporate power to

carry on its business as now conducted. |

| 2.2. | Capitalization.

The authorized capital stock of the Company consists of 1,000 shares of common stock,

no par value per share. As of immediately preceding the Closing, 500 shares of common stock

were issued and outstanding and all such shares are fully paid and non-assessable. The Purchased

Shares represent 100% of the outstanding equity interests in the Company. |

| 2.3. | Authorization

and Execution. Seller has the requisite corporate power and authority to execute and

deliver this Agreement and to consummate the transactions contemplated hereby and to perform

its obligations hereunder. This Agreement has been duly and validly executed and delivered

by Seller and, constitutes a legal, valid and binding agreement of Seller, enforceable against

Seller in accordance with its terms, except to the extent that enforceability may be limited

by applicable bankruptcy, insolvency, reorganization, moratorium, and similar laws, now or

hereafter in effect, affecting creditors’ rights generally and by general principles

of equity. The execution, delivery and performance by Seller of this Agreement, and the consummation

by Seller of the transactions contemplated hereby, have been duly and validly authorized

by the board of directors of Seller and no other corporate proceedings on the part of Seller

are necessary to authorize this Agreement or to consummate the transactions contemplated

hereby or to perform the obligations of Seller hereunder. |

| 2.4. | Title.

Seller is the record and beneficial owner of the Purchased Shares, free and clear of

any Liens and, upon delivery of and payment for such Purchased Shares as herein provided,

Buyer will acquire good and valid title thereto, free and clear of any Lien, other than Liens

imposed by applicable federal and state securities law restrictions. |

| 2.5. | Employment

Liabilities. Company is not delinquent in payments to any of its employees, consultants,

or independent contractors for any wages, salaries, commissions, bonuses, or other direct

compensation for any service performed for it prior to Closing or amounts required to be

reimbursed to such employees, consultants or independent contractors. Company has withheld

and paid to the appropriate governmental entity or is holding for payment not yet due to

such governmental entity all amounts required to be withheld from employees of Company and

is not liable for any arrears of wages, taxes, penalties or other sums for failure to comply

with any of the foregoing. The Company has no liabilities related to employees other than

outstanding accrued, but unpaid, vacation or paid-time-off. |

| 2.6. | Consents

and Approvals. The execution and delivery of this Agreement by Seller and the consummation

by Seller of the transactions contemplated hereby require no consent, approval, authorization,

or filing with or notice to any governmental authority. |

| 2.7. | Non-Contravention.

The execution, delivery and performance of this Agreement by Seller and the Company and

the consummation of the transactions contemplated by this Agreement do not and will not (with

or without notice or lapse of time or both) (a) contravene, conflict with, or result in any

violation or breach of any provision of the certificate of incorporation or bylaws of Seller

or the Company; (b) contravene, conflict with or result in a violation or breach of any law

or order from any governmental authority; or (c) require any consent or approval under, violate,

conflict with, result in any breach of any loss of any benefit under, or constitute a change

of control or default under, or result in termination or give to others any right of termination,

vesting, amendment, acceleration or cancellation of any contract to which Company is a party,

or by which its properties or assets may be bound or affected, with such exceptions, in the

case of each of clauses (b) and (c) of this section, would not reasonably be expected to

prevent, materially delay, or materially impair the ability of Buyer to own and operate the

business of the Company. |

| 2.8. | Undisclosed

Liabilities. Except as set forth on Section 2.8 of the Disclosure Schedule, there

is no liability, debt, or legally binding commitment or obligation of any nature whatsoever,

whether accrued or fixed, absolute or contingent, matured or unmatured or determined or determinable

or otherwise (any such liability, debt or legally binding commitment or obligation, a “Liability”)

against the Company, or any other fact or circumstance that would reasonably be likely to

result in any claims against, or any obligations or liabilities of, the Company, except for

liabilities and obligations arising in the ordinary course under any Real Property Lease

or Material Contract set forth on Section 2.12 or 2.13 of the Disclosure Schedule

or not required to be disclosed in the schedules (other than any such liability, debt or

obligation resulting from a breach or a default thereunder). |

| 2.9. | Litigation.

There is no action pending or, to the knowledge of the Company threatened by or against

the Company which could reasonably be expected to have a material adverse effect on the Company,

nor does the Company have any material claims against any third party arising out of any

breach of contract. |

| 2.10. | Compliance

with Laws; Permits. The Company is in compliance with all existing laws, rules, regulations,

ordinances, orders, judgments and decrees now applicable to the business and operations of

the Company as presently conducted , including, but not limited to, federal, state, local

and foreign laws, ordinances and regulations, and, neither the execution of this Agreement,

nor the sale of the Purchased Shares, will result in a violation of any such laws. |

| 2.11. | Intellectual

Property. |

| (a) | The

Company has not granted ownership to any person, or permitted any person to retain, any exclusive

rights, or joint ownership in any intellectual property rights owned or purported to be owned

by the Company, including the proprietary formulations of the additive formulations and resins

noted on Section 2.11(d) of the Disclosure Schedule, (the “Company Intellectual

Property”). Following the Closing, all Company Intellectual Property will be fully

transferable, alienable or licensable by Buyer without restriction and without payment of

any kind to any third party. No Company Intellectual Property is jointly owned by Company,

on the one hand, with any third party, on the other hand. None of Company’s employees,

members, independent contractors, or other vendors owns or has any rights in any of the Company

Intellectual Property (other than pursuant to agreements with customers, contractors, or

vendors entered into in the ordinary course of business). |

| (b) | Neither

the Company Intellectual Property, nor the past or current conduct or operations of the Company

has or does infringe or misappropriate the intellectual property rights of any third party,

or has, or does, constitute unfair competition or trade practices under the laws of any jurisdiction. |

| (c) | There

are no agreements under which the Company has granted rights to others in any Company Intellectual

Property other than customer, contractor, and vendor agreements entered into in the ordinary

course of business. |

| (d) | The

Company has taken commercially reasonable measures to protect its trade secrets, including

the proprietary formulations of the additive formulations and resins noted on Section

2.11(d) of the Disclosure Schedule. Without limiting the generality of the foregoing,

the Company enforced a policy requiring each

employee, consultant, and independent contractor involved in the creation of any Company

Intellectual Property for the Company to execute proprietary information, confidentiality

and invention assignment agreement, and all current and former employees, consultants, independent

contractors of the Company involved in the creation of any Company Intellectual Property

have executed such an agreement. |

| (e) | To

the knowledge of the Company, there are no material defects, malfunctions or nonconformities

in any of the Company Intellectual Property, and Company has not received any written notice

from any third party regarding any of the foregoing. |

| 2.12. | Properties.

Section 2.12 of the Disclosure Schedule contains a true and correct list of all

real property leases (“Leased Real Property”) to which the Company is

a party (the “Real Property Leases”). True and correct copies of all Real

Property Leases have been provided to Buyer. |

| 2.13. | Material

Contracts. Section 2.13 of the Disclosure Schedule lists as of the date hereof,

and Seller have caused the Company to make available to Buyer true, correct and complete

copies of each of the contracts (each, a “Material Contract”) to which

the Company is a party or which bind or affect its properties or assets (excluding leases,

subleases, or other agreements for Leased Real Property, all of which contracts are disclosed

in Section 2.11 of the Disclosure Schedule). |

| 2.14. | Accounts

Receivable. Section 2.14 of the Disclosure Schedule contains a true and correct list

of the Accounts Receivable (“Accounts Receivable”) for the Company. The accounts

receivable of the Company (collectively, the “Accounts Receivable”) represent

or will represent valid obligations arising from sales actually made or services actually

performed by the Company in the ordinary course of business consistent with past practices.

Except for allowances, promotions, discounts and rebates granted in the ordinary course of

Company’s business, there are no contests, claims or rights of set-off relating to

the amount or validity of any of the Accounts Receivable. |

| 2.15. | Sufficiency

of Acquired Assets. The Company holds all property and assets necessary for operation

of its business as it has been historically conducted. The assets of the Company are in good

operating condition and repair, and are not in need of maintenance or repairs except for

ordinary, routine maintenance and repairs. |

| 3. | REPRESENTATIONS

AND WARRANTIES OF BUYER. |

Buyer

represents and warrants to Seller, as of the Closing Date, as follows:

| 3.1. | Organization.

Buyer (a) is a Nevada corporation duly formed, validly existing, and in good standing

under the laws of the State of Nevada; (b) is duly authorized to transact business in the

State of Nevada; (c) has the power and authority to carry on its business as now being conducted;

and (d) has the power and authority to enter into and perform its obligations under this

Agreement in accordance with its terms.. |

| 3.2. | Authorization

and Execution. The execution, delivery and performance of this Agreement by Buyer and

the consummation of the transactions contemplated shall be duly and effectively authorized

by all necessary company action on the part of Buyer, including approval by Buyer’s

members, directors, officers, if necessary. This Agreement and all closing documents upon

due execution by Buyer will constitute the legal, valid and binding obligation of Buyer,

enforceable in accordance with their terms, except as the same may be limited by applicable

bankruptcy, insolvency, reorganization, or other laws affecting the enforcement of creditors

rights generally and the application of general equity principles, and will not contravene

any of Buyer’s obligations under other agreements of Buyer. |

| 4. | SURVIVAL

AND INDEMNIFICATION. |

| 4.1. | Survival.

The representations and warranties of the Buyer and the Seller contained in this Agreement

shall survive the Closing for a period of eighteen (18) months. Any and all claims and causes

of action for indemnification under this Article IV arising out of the inaccuracy of breach

of any representation or warranty of the Buyer or the Seller must be made prior to the termination

of such survival period. |

| 4.2. | Indemnification

by Seller. Seller shall defend, indemnify, and hold harmless Buyer and the Company and

their respective directors, officers, employees and agents from and against any and all claims

(including without limitation any investigation, action, or other proceeding, damages, losses,

liabilities, costs, and expenses (including without limitation reasonable attorneys’

fees and court costs)) that constitute, or arise out of or in connection with any misrepresentation

or breach of warranty under Article II or any other breach of this Agreement. In the event

of any claim by Buyer hereunder, the amount of such claim may be offset against any amount

owing from Buyer to Seller under tis Agreement or otherwise. |

| 4.3. | Indemnification

by Buyer. Buyer shall defend, indemnify, and hold harmless Seller and its partners, directors,

officers, employees and agents from and against any and all claims (including without limitation

any investigation, action, or other proceeding, damages, losses, liabilities, costs, and

expenses (including without limitation reasonable attorneys’ fees and court costs))

that constitute, or arise out of or in connection with any misrepresentation or breach of

warranty under Article III. |

| 4.4. | Limitation

on Indemnification. Except in the case of intentional misrepresentation or fraud, in

no event shall the total amount of indemnification paid by any Party in accordance with this

Article IV exceed $1,000,000. |

| 4.5. | Effect

of Investigation. Buyer’s right to indemnification or other remedy based on the

representations, warranties, and covenants of Seller contained herein will not be affected

by any investigation conducted by Buyer with respect to, or any knowledge acquired by Buyer

at any time, with respect to the accuracy or inaccuracy of or compliance with, any such representation,

warranty, or covenant. |

| 5.1. | Entire

Agreement; Assignment; Amendments. This Agreement constitutes the entire agreement and

supersedes all oral agreements and understandings and all written agreements prior to the

date hereof between or on behalf of the Parties with respect to the subject matter hereof.

This Agreement shall not be assigned by any Party by operation of law or otherwise without

the prior written consent of the other Party hereto. This Agreement may be amended only by

a writing signed by each of the Parties, and any amendment shall be effective only to the

extent specifically set forth in that writing. |

| 5.2. | Confidentiality.

Both Parties agree to maintain the confidentiality of the terms of this Agreement and

any proprietary information disclosed during the due diligence process, in accordance with

the Confidentiality Agreement between the Parties dated June 19, 2024. |

| 5.3. | Legal

Construction. In case any one or more of the provisions contained in this Agreement shall

for any reason be held to be invalid, illegal, or unenforceable in any respect, such invalidity,

illegality, or unenforceability shall not affect any other provision hereof, and this Agreement

shall be construed as if such invalid, illegal, or unenforceable provision had never been

contained herein. This Agreement shall be construed as a whole and in accordance with its

fair meaning and without regard to any presumption or other rule requiring construction against

the party preparing this Agreement or any part hereof. |

| 5.4. | Governing

Law; Jurisdiction; No Jury Trial. |

| (a) | This

Agreement, and any dispute arising out of, relating to, or in connection with this Agreement,

shall be governed by and construed in accordance with the laws of the State of Delaware,

without giving effect to any choice or conflict of law provision or rule that would cause

the application of the laws of any jurisdiction other than the State of Delaware. |

| (b) | EACH

PARTY TO THIS AGREEMENT HEREBY IRREVOCABLY AND UNCONDITIONALLY WAIVES, TO THE FULLEST EXTENT

PERMITTED BY APPLICABLE LAW, ANY RIGHT SUCH PARTY MAY HAVE TO A TRIAL BY JURY IN RESPECT

OF ANY SUIT, ACTION, OR OTHER PROCEEDING DIRECTLY OR INDIRECTLY ARISING OUT OF, UNDER, RELATING

TO OR IN CONNECTION WITH THIS AGREEMENT, OR THE TRANSACTIONS CONTEMPLATED BY THIS AGREEMENT.

EACH PARTY HERETO CERTIFIES THAT (I) NO REPRESENTATIVE, AGENT OR ATTORNEY OF ANY OTHER PARTY

HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT SUCH OTHER PARTY WOULD NOT, IN THE EVENT OF

ANY ACTION, SUIT OR PROCEEDING, SEEK TO ENFORCE THE FOREGOING WAIVER, (II) EACH PARTY UNDERSTANDS

AND HAS CONSIDERED THE IMPLICATIONS OF THIS WAIVER, (III) EACH PARTY MAKES THIS WAIVER VOLUNTARILY

AND (IV) EACH PARTY HAS BEEN INDUCED TO ENTER INTO THIS AGREEMENT BY, AMONG OTHER THINGS,

THE MUTUAL WAIVERS AND CERTIFICATIONS IN THIS (c). |

| 5.5. | Notices.

Any and all notices or other communications or deliveries required or permitted to be

provided hereunder shall be in writing and shall be deemed given and effective on the earliest

of (a) upon confirmation of receipt by the addressee, if such notice or communication is

delivered via email to the email address specified in this Section 5.5 or (b) upon receipt

at address of the addressee specified in this Section 5.5, if such notice or communication

is delivered by U.S. mail, courier, or other physical delivery service. The addresses for

such notices and communications shall be as follows: |

If

to Seller, to:

SINTX

Technologies, Inc.

1885 West 2100 South

Salt Lake City, UT 84119

Email: [*************]

Attention:

Eric Olson, CEO

If

to Buyer, to:

Tethon

Corporation

5078 S 111th St.

Omaha,

NE 68137

Email:

[*************]

Attention:

Trent Allen, CEO

or

to such other address as the person to whom notice is given may have previously furnished to the others in writing in the manner set

forth above. Rejection or other refusal to accept or the inability for delivery to be effected because of changed address of which no

notice was given shall be deemed to be receipt of the notice as of the date of such rejection, refusal, or inability to deliver.

| 5.6. | Descriptive

Headings. The descriptive headings herein are inserted for convenience of reference only

and are not intended to be part of or to affect the meaning or interpretation of this Agreement. |

| 5.7. | Counterparts.

This Agreement may be executed in counterparts, each of which shall be deemed to be an

original, but all of which, taken together, shall constitute one and the same agreement.

At the Closing, signature pages of counterparts may be exchanged by facsimile or by electronic

transmittal of scanned images thereof, in each case subject to appropriate customary confirmations

in respect thereof by the signatory for the party providing a facsimile or scanned image

and that Party’s Closing counsel. |

[SIGNATURE

PAGE FOLLOWS]

IN

WITNESS WHEREOF, each of the parties has caused this Agreement to be executed on its behalf by its officers thereunto duly authorized,

all at or on the date and year first above written.

| |

SELLER: |

| |

|

| |

SINTX

TECHNOLOGIES, INC. |

| |

|

|

| |

By: |

/s/

Eric Olson |

| |

|

|

| |

Name: |

Eric

Olson |

| |

|

|

| |

Title: |

CEO |

| |

|

|

| |

COMPANY: |

| |

|

| |

TECHNOLOGY

ASSESSMENT AND TRANSFER, INC. |

| |

|

|

| |

By: |

/s/

Eric Olson |

| |

|

|

| |

Name: |

Eric

Olson |

| |

|

|

| |

Title: |

CEO |

| |

|

|

| |

BUYER: |

| |

|

| |

TETHON

CORPORATION |

| |

|

|

| |

By: |

/s/

Trent Allen |

| |

|

|

| |

Name: |

Trent

Allen |

| |

|

|

| |

Title: |

CEO |

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

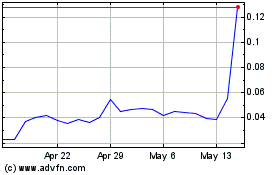

SiNtx Technologies (NASDAQ:SINT)

Historical Stock Chart

From Jan 2025 to Feb 2025

SiNtx Technologies (NASDAQ:SINT)

Historical Stock Chart

From Feb 2024 to Feb 2025