false000185884800018588482025-03-102025-03-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): March 10, 2025 |

Tenaya Therapeutics, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-40656 |

81-3789973 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

171 Oyster Point Boulevard Suite 500 |

|

South San Francisco, California |

|

94080 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (650) 825-6990 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.0001 per share |

|

TNYA |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On March 10, 2025, Tenaya Therapeutics, Inc. (“Tenaya or the “Company”) issued a press release announcing Tenaya’s financial results for the quarter and the year ended December 31, 2024 (“the Earnings Press Release”). The full text of the Earnings Press Release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

All of the information furnished in this Item 2.02 and Item 9.01 (including Exhibit 99.1) shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (“Exchange Act”), and shall not be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

TENAYA THERAPEUTICS, INC. |

|

|

By: |

|

/s/ Jennifer Drimmer Rokovich |

|

|

|

|

Jennifer Drimmer Rokovich |

|

|

|

|

General Counsel and Secretary |

Date: March 10, 2025 |

|

|

|

|

Exhibit 99.1

Tenaya Therapeutics Reports Fourth Quarter and Full Year 2024 Financial Results and Provides Business Update

Dosing Initiated in Cohort 2 of the MyPEAK™-1 Phase 1b/2 Clinical Trial of TN-201 for Treatment of MYBPC3-Associated Hypertrophic Cardiomyopathy

MyPEAK-1 Cohort 1 Data Accepted for Late-Breaker Presentation at the American College of Cardiology Meeting

Initial Data from RIDGE™-1 Phase 1b Clinical Trial of TN-401 for PKP2-Associated Arrhythmogenic Right Ventricular Cardiomyopathy Expected in 2H25

Recent $48.9 Million Financing Extends Cash Runway into mid-2026

SOUTH SAN FRANCISCO, Calif., March 10, 2025 – Tenaya Therapeutics, Inc. (NASDAQ: TNYA), a clinical-stage biotechnology company with a mission to discover, develop and deliver potentially curative therapies that address the underlying causes of heart disease, today announced financial results for the fourth quarter and full year ended December 31, 2024, and provided a corporate update.

“Throughout 2024, Tenaya made important advances across our cardiovascular gene therapy development pipeline that have positioned us for a data-rich 2025. We look forward to sharing data from both the TN-201 MyPEAK-1 clinical trial for MYBPC3-associated HCM and the RIDGE-1 clinical trial of TN-401 for PKP2-associated ARVC in the months ahead,” said Faraz Ali, Chief Executive Officer of Tenaya. “The recent financing with support from existing and new shareholders allows us to maintain our focus on driving our gene therapy programs for cardiomyopathies toward later-stage development. In the first half of next year, we expect to have greater than one-year of follow-up in the high-dose cohort of MyPEAK-1, as well as one-year follow-up for the first few patients enrolled in the RIDGE-1 clinical trial.

Business and Program Updates

TN-201 – Gene Therapy for MYBPC3-Associated Hypertrophic Cardiomyopathy

•In December 2024, Tenaya reported promising early data from the first cohort of patients in the MyPEAK-1 Phase 1b/2 clinical trial of TN-201 gene therapy.

oPreliminary data from the first three patients dosed at 3E13 vg/kg (Cohort 1) showed that TN-201 was generally well tolerated with readily detectable vector DNA in the heart, evidence of transgene RNA expression, and increasing TN-201 mRNA and MyBP-C protein levels over time. Circulating biomarkers of cardiac muscle strain and injury remained largely stable, and certain clinical markers of disease remained stable or improved from baseline in the first two individuals dosed, while other measures were not yet available, interpretable or mixed.

oMyPEAK-1 is a Phase 1b/2 multi-center, open-label, dose-escalation trial designed to assess safety, tolerability and clinical efficacy of a one-time intravenous infusion of TN-201 in treating patients with HCM caused by mutations in the MYBPC3 gene. The trial is being conducted in the U.S. with ten active clinical sites.

•Additional data from Cohort 1 of the MyPEAK-1 clinical trial has been accepted as a late-breaker presentation at the American College of Cardiology (ACC) Scientific Sessions taking place March 29-31 in Chicago. These

data are expected to include safety and available assessments from the first three patients dosed, 52-week biopsy data for Patient 2, and baseline and post-dose biopsy data for Patient 3.

oData from Cohort 1 of the MyPEAK-1 clinical trial of TN-201 will be presented on Monday, March 31, 2025, at 9:00 am CT during the Clinical and Investigative Horizons Session.

•Tenaya is on track to complete enrollment in Cohort 2 of MyPEAK-1 in the first half of 2025, with two participants having received TN-201 at the 6E13 vg/kg dose to date.

oAll patients in Cohort 2 will receive three biopsies: one at baseline, one post-dose and one at 52 weeks.

oIn the second half of 2025, Tenaya plans to release initial Cohort 2 data, as well as further follow-up data from patients in Cohort 1.

•Tenaya anticipates releasing data from its pediatric non-interventional natural history study, known as MyClimb, in the second half of 2025.

oMyClimb has enrolled more than 200 patients at 29 sites worldwide in an effort to characterize the disease burden for MYBPC3 patients diagnosed before age 18 for whom there are currently no approved therapeutic agents.

TN-401 – Gene Therapy for PKP2-Associated Arrhythmogenic Right Ventricular Cardiomyopathy (ARVC)

•In November 2024, the first patient received TN-401 at a dose of 3E13vg/kg (Cohort 1) as part of the RIDGE-1 Phase 1b clinical trial. With two participants dosed to date, Tenaya expects to complete enrollment of Cohort 1 of the RIDGE-1 Phase 1b clinical trial in the first half of 2025.

oInitial data, including safety and post-dose biopsy results, from the first cohort of patients receiving TN-401 at the 3E13 vg/kg dose is anticipated in the second half of 2025.

oRIDGE-1 is a multi-center, open-label, dose escalation trial designed to assess the safety, tolerability and preliminary clinical efficacy of a one-time intravenous infusion of TN-401 for the treatment of plakophilin-2 (PKP2)-associated ARVC. Seven clinical sites have been activated in the U.S.

•Tenaya anticipates sharing data from the ongoing RIDGE seroprevalence and natural history study. RIDGE has enrolled more than 100 adults with PKP2-associated ARVC and is being conducted at more than 20 sites in six countries.

•In February 2025, Tenaya was awarded an $8 million clinical grant from the California Institute for Regenerative Medicine (CIRM), which will help fund clinical trial costs associated with the ongoing Phase 1b RIDGE-1 clinical trial of TN-401.

Leadership Team

•Hiro Higa has been promoted to the position of Senior Vice President, Finance and serves as the company’s interim principal accounting officer. Mr. Higa joined Tenaya in 2020 bringing more than 20 years of experience in finance-focused roles for biopharmaceutical companies. While at Tenaya, he led the establishment of key financial systems and processes, including the company’s transition from private to public. Prior to Tenaya, Mr. Higa held positions of increasing responsibility for CytomX Therapeutics, OncoMed Pharmaceuticals, Amgen and Abgenix. Mr. Higa received his B.A. in economics from the University of Chicago and an M.B. A. from the University of Chicago Booth School of Business.

Business Updates

•In March 2025, Tenaya completed an underwritten public offering with net proceeds of approximately $48.9 million after discounts, commissions, and other offering expenses. The offering consisted of 75,000,000 units priced at $0.70 per unit, consisting of one share of Tenaya common stock, one warrant to purchase one share of Tenaya common stock at an exercise price of $0.80 per share and one warrant to purchase one half of a share of Tenaya common stock at an exercise price of $0.70 per share. The warrants are immediately exercisable and expire five years from the date of issuance and June 30, 2026, respectively.

•In January 2025, the U.S. Patent and Trademark Office issued U.S Patent Number 12,201,617 (the ’617 patent). The ’617 patent is directed to a method of treating heart failure with preserved ejection fraction (HFpEF) with Tenaya’s proprietary HDAC6 inhibitors, including TN-301. The ’617 patent provides method of treatment protection for Tenaya’s TN-301 for the treatment of HFpEF and is expected to expire no earlier than 2040.

Fourth Quarter and Full 2024 Financial Highlights

•Cash Position and Guidance: As of December 31, 2024, cash, cash equivalents and investments in marketable securities were $61.4 million, compared to $104.6 million as of December 31, 2023. With the additional estimated net proceeds of $48.9 million from the March 2025 public offering, the company expects

that its current funds are sufficient to support planned company operations into mid-2026. Tenaya has not drawn on the $45 million credit facility established with Silicon Valley Bank and is not obligated to do so.

•Research & Development (R&D) Expenses: R&D expenses were $18.7 million for the fourth quarter and $86.7 million for the full year ended December 31, 2024, compared to $22.9 million and $98.0 million for the same periods in 2023. Non-cash stock-based compensation included in R&D expense was $1.9 million for the fourth quarter and $8.2 million for the full year ended December 31, 2024.

•General & Administrative (G&A) Expenses: G&A expenses were $6.0 million for the fourth quarter and $29.2 million for the full year ended December 31, 2024, compared to $8.6 million and $33.2 million for the same periods in 2023. Non-cash stock-based compensation included in G&A expense was $1.8 million for the fourth quarter and $8.3 million for the full year ended December 31, 2024.

•Net Loss: Net loss was $23.8 million, or $0.28 per share for the fourth quarter ended December 31, 2024. For the full year 2024, net loss was $111.1 million, or $1.31 per share.

About Tenaya Therapeutics

Tenaya Therapeutics is a clinical-stage biotechnology company committed to a bold mission: to discover, develop and deliver potentially curative therapies that address the underlying drivers of heart disease. Tenaya employs a suite of integrated internal capabilities, including modality agnostic target validation, capsid engineering and manufacturing, to generate a portfolio of genetic medicines aimed at the treatment of both rare genetic disorders and more prevalent heart conditions. Tenaya’s pipeline includes TN-201, a gene therapy for MYBPC3-associated hypertrophic cardiomyopathy (HCM), TN-401, a gene therapy for PKP2-associated arrhythmogenic right ventricular cardiomyopathy (ARVC), TN-301, a small molecule HDAC6 inhibitor intended for heart failure with preserved ejection fraction (HFpEF), and multiple early-stage programs in preclinical development. For more information, visit www.tenayatherapeutics.com.

Forward Looking Statements

This press release contains forward-looking statements as that term is defined in Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Statements in this press release that are not purely historical are forward-looking statements. Words such as “expected,” “look forward,” “promising,” “will,” “on track,” “plans,” “anticipated,” and similar expressions are intended to identify forward-looking statements. Such forward-looking statements include, among other things, planned timing for sharing data from MyPEAK-1 and RIDGE-1 and the expected content of such data releases; Tenaya’s plans and expectations regarding its clinical development efforts and activities, including site activation, enrollment and dosing of patients and generating data for MyPEAK-1 and RIDGE-1; planned timing for sharing data from MyClimb and RIDGE, Tenaya’s noninterventional studies; the sufficiency of Tenaya’s cash resources to fund the company into mid-2026; and statements made by Tenaya’s chief executive officer. The forward-looking statements contained herein are based upon Tenaya’s current expectations and involve assumptions that may never materialize or may prove to be incorrect. These forward-looking statements are neither promises nor guarantees and are subject to a variety of risks and uncertainties, including but not limited to: availability of data at the referenced times; the timing and progress of Tenaya’s clinical trials; unexpected concerns that may arise as a result of the occurrence of adverse safety events in Tenaya’s clinical trials; the potential failure of Tenaya’s product candidates to demonstrate safety and/or efficacy in clinical testing; the potential for any clinical trial results to differ from preclinical, interim, preliminary, topline or expected results; risks associated with the process of discovering, developing and commercializing drugs that are safe and effective for use as human therapeutics and operating as an early stage company; Tenaya’s ability to develop, initiate or complete preclinical studies and clinical trials, and obtain approvals, for any of its product candidates; Tenaya’s continuing compliance with applicable legal and regulatory requirements; Tenaya’s ability to raise any additional funding it will need to continue to pursue its business and product development plans; Tenaya’s reliance on third parties; Tenaya’s manufacturing, commercialization and marketing capabilities and strategy; the loss of key scientific or management personnel; competition in the industry in which Tenaya operates; Tenaya’s ability to comply with specified operating covenants and restrictions in its loan agreement; Tenaya’s ability to obtain and maintain intellectual property protection for its product candidates; general economic and market conditions; and other risks. Information regarding the foregoing and additional risks may be found in the section entitled “Risk Factors” in documents that Tenaya files from time to time with the Securities and Exchange Commission. These forward-looking statements are made as of the date of this press release, and Tenaya assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Contacts

|

Michelle Corral

VP, Corporate Communications and Investor Relations

IR@tenayathera.com |

|

Investors |

|

Anne-Marie Fields

Precision AQ

annemarie.fields@precisionaq.com |

Media

Wendy Ryan

Ten Bridge Communications

wendy@tenbridgecommunications.com |

TENAYA THERAPEUTICS, INC.

Condensed Statements of Operations

(In thousands, except share and per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

18,688 |

|

|

$ |

22,865 |

|

|

$ |

86,742 |

|

|

$ |

98,038 |

|

General and administrative |

|

|

5,964 |

|

|

|

8,581 |

|

|

|

29,206 |

|

|

|

33,155 |

|

Total operating expenses |

|

|

24,652 |

|

|

|

31,446 |

|

|

|

115,948 |

|

|

|

131,193 |

|

Loss from operations |

|

|

(24,652 |

) |

|

|

(31,446 |

) |

|

|

(115,948 |

) |

|

|

(131,193 |

) |

Other income, net: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

812 |

|

|

|

1,470 |

|

|

|

4,737 |

|

|

|

7,056 |

|

Other income, net |

|

|

4 |

|

|

|

41 |

|

|

|

82 |

|

|

|

53 |

|

Total other income, net |

|

|

816 |

|

|

|

1,511 |

|

|

|

4,819 |

|

|

|

7,109 |

|

Net loss before income tax expense |

|

|

(23,836 |

) |

|

|

(29,935 |

) |

|

|

(111,129 |

) |

|

|

(124,084 |

) |

Income tax expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Net loss |

|

$ |

(23,836 |

) |

|

$ |

(29,935 |

) |

|

$ |

(111,129 |

) |

|

$ |

(124,084 |

) |

Net loss per share, basic and diluted |

|

$ |

(0.28 |

) |

|

$ |

(0.40 |

) |

|

$ |

(1.31 |

) |

|

$ |

(1.68 |

) |

Weighted-average shares used in computing net loss per share, basic and diluted |

|

|

86,406,072 |

|

|

|

74,097,642 |

|

|

|

84,822,468 |

|

|

|

73,786,126 |

|

TENAYA THERAPEUTICS, INC.

Condensed Balance Sheet Data

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

Cash, cash equivalents and marketable securities |

|

$ |

61,446 |

|

|

$ |

104,642 |

|

Total assets |

|

$ |

119,940 |

|

|

$ |

170,515 |

|

Total liabilities |

|

$ |

27,086 |

|

|

$ |

31,091 |

|

Total liabilities and stockholders’ equity |

|

$ |

119,940 |

|

|

$ |

170,515 |

|

v3.25.0.1

Document And Entity Information

|

Mar. 10, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Mar. 10, 2025

|

| Entity Registrant Name |

Tenaya Therapeutics, Inc.

|

| Entity Central Index Key |

0001858848

|

| Entity Emerging Growth Company |

true

|

| Entity File Number |

001-40656

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

81-3789973

|

| Entity Address, Address Line One |

171 Oyster Point Boulevard

|

| Entity Address, Address Line Two |

Suite 500

|

| Entity Address, City or Town |

South San Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94080

|

| City Area Code |

(650)

|

| Local Phone Number |

825-6990

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

TNYA

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

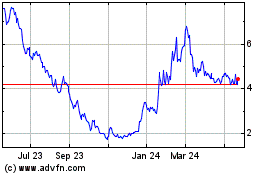

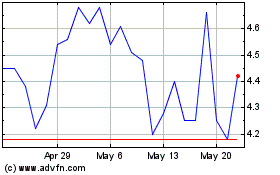

Tenaya Therapeutics (NASDAQ:TNYA)

Historical Stock Chart

From Feb 2025 to Mar 2025

Tenaya Therapeutics (NASDAQ:TNYA)

Historical Stock Chart

From Mar 2024 to Mar 2025