- Total Revenue, Less Transaction-Based Expenses of $19.1 million

in 3Q24, up 4% over the year-ago quarter

- Total Marketplace Revenues, Less Transaction-Based Expenses of

$8.6 million in 3Q24, up 21% over the year-ago quarter

- Trading Volume of $338.1 million in 3Q24, up 44% over the

year-ago quarter

- Forge announces Forge Price and the Private Magnificent 7

Forge Global Holdings, Inc. (“Forge,” or the “Company”) (NYSE:

FRGE), a leading private securities marketplace, today announced

its financial results for the quarter ended September 30, 2024.

“In Q3, we remained focused on technology and product

innovations that expand access and improve the experience for all

participants in the private market,” said Kelly Rodriques, CEO of

Forge. “Our continued investment in the Forge Next Generation

Platform allows us to better expose pricing information, improve

the client experience, and drive further efficiency into the

trading process. And our launch of Forge Price is a breakthrough in

pricing transparency, revolutionizing how investors access and

interpret private market valuations, benchmarking, and

indexing.”

Financial Highlights for the Third

Quarter 2024

Revenue: Total revenue, less transaction-based expenses

was $19.1 million, compared to $22.0 million last quarter, and

$18.4 million in the year-ago quarter.

Operating Loss: Total operating loss was $20.9 million,

compared to $17.7 million last quarter, and $21.5 million in the

year-ago quarter.

Net Loss: Net loss was $18.8 million, compared to $14.0

million last quarter, and $19.0 million in the year-ago

quarter.

Adjusted EBITDA Loss: Total adjusted EBITDA loss was

$11.4 million, compared to $7.9 million last quarter, and $10.4

million in the year-ago quarter.

Cash Flow from Operating Activities: Net cash used in

operating activities was $5.8 million, compared to $14.4 million

last quarter, and $3.5 million in the year-ago quarter.

Cash Flow from Investing Activities: Net cash used in

investing activities was $0.2 million, compared to cash provided by

investing activities of $6.3 million last quarter, and cash used in

investing activities of $0.5 million in the year-ago quarter.

Cash Flow from Financing Activities: Net cash used in

financing activities was $0.4 million, compared to $0.9 million

last quarter, and cash provided by financing activities of less

than $0.1 million in the year-ago quarter.

Ending Cash Balance: Cash and cash equivalents as of

September 30, 2024 was $114.5 million.

Share Count: Basic weighted-average number of shares used

to compute net loss per share attributable to common stockholders

for the quarter ended September 30, 2024, was 184 million shares

and fully diluted outstanding share count as of September 30, 2024

was 201 million shares.

We estimate for the quarter ended December 31, 2024 that Forge

will have 186 million weighted average basic shares outstanding,

which will be used to calculate earnings per share in a loss

position.

Fully diluted outstanding share count includes all common shares

outstanding plus shares that would be issued in respect to

outstanding restricted stock units, options and warrants, net of

shares to be withheld in respect to exercise price of the

respective instruments. Instruments that are out of the money are

excluded from the fully diluted outstanding share count.

KPIs for the Third Quarter

2024

- Trading Volume was $338.1 million, compared to $426.3 million

last quarter, and $234.1 million in the year-ago quarter.

- Net Take Rate was 2.6%, compared to 2.7% last quarter, and 3.0%

in the year-ago quarter.

- Total Marketplace revenues, less transaction-based expenses was

$8.6 million, compared to $11.4 million last quarter, and $7.1

million in the year-ago quarter.

- Total Custodial Administration Fee revenues was $10.5 million,

compared to $10.6 million last quarter, and $11.3 million in the

year-ago quarter.

- Total Custodial Accounts was 2.28 million, compared to 2.21

million last quarter, and 2.02 million in the year-ago

quarter.

- Total Assets Under Custody was $16.6 billion, compared to $16.6

billion last quarter, and $15.1 billion in the year-ago

quarter.

Additional Business Metrics for the

Third Quarter 2024

- Forge Trust Custodial Cash: Forge Trust Custodial Cash

was $470.0 million, compared to $495.0 million last quarter, and

$518.0 million in the year-ago quarter.

- Total Number of Companies with Indications of Interest

(IOIs): The total number of companies with IOIs was 516,

compared to 551 last quarter, and 502 in the year-ago quarter.

- Employee Headcount: Forge finished out the quarter with

a total employee headcount of 307.

Please refer to the section titled “Use of Non-GAAP Financial

Information” and the tables within this press release which contain

explanations and reconciliations of the Company’s non-GAAP

financial measures.

Business Highlights

- Forge Price: Forge announced in September the launch of

Forge Price, a derived, indicative price calculated daily for

approximately 250 pre-IPO venture-backed late-stage companies. The

innovative pricing model provides a derived price per share for

each company by synthesizing data from various sources, including

secondary market transactions, recent funding rounds, and

indications of interest on Forge.

- Forge Names the Private Magnificent 7: In September,

Forge announced the Private Market Magnificent 7, which represent a

group of private, venture-backed, late-stage companies that have

demonstrated resilience and propped up the performance of the

private market over the recent market cycle, much like their public

market counterparts.

Forge will host a webcast conference call today, November 6th,

2024, at 4:30 p.m. Eastern Time / 1:30 p.m Pacific Time to discuss

these financial results and business highlights. The listen-only

webcast is available at https://ir.forgeglobal.com. Investors and

participants can access the conference call over the phone by

dialing 1 (800) 715-9871 from the United States, or +1 (646)

307-1963 internationally. The conference ID is 6194475.

Following the conference call, an on-demand replay of the

webcast will be made available on the Investor Relations page of

the Company’s website at https://ir.forgeglobal.com.

Use of Non-GAAP Financial

Information

In addition to our financial results determined in accordance

with generally accepted accounting principles in the United States

of America ("GAAP"), we present Adjusted EBITDA, a non-GAAP

financial measure. We use Adjusted EBITDA to evaluate our ongoing

operations and for internal planning and forecasting purposes. We

believe that Adjusted EBITDA, when taken together with the

corresponding GAAP financial measure, provides meaningful

supplemental information regarding our performance by excluding

specific financial items that have less bearing on our core

operating performance. We consider Adjusted EBITDA to be an

important measure because it helps illustrate underlying trends in

our business and our historical operating performance on a more

consistent basis.

However, non-GAAP financial information is presented for

supplemental informational purposes only, has limitations as an

analytical tool and should not be considered in isolation or as a

substitute for financial information presented in accordance with

GAAP. In addition, other companies, including companies in our

industry, may calculate similarly titled non-GAAP financial

measures differently or may use other measures to evaluate their

performance, all of which could reduce the usefulness of Adjusted

EBITDA as a tool for comparison. A reconciliation is provided below

for Adjusted EBITDA to net loss, the most directly comparable

financial measure stated in accordance with GAAP. Investors are

encouraged to review Adjusted EBITDA and the reconciliation of

Adjusted EBITDA to net loss, and not to rely on any single

financial measure to evaluate our business. We define Adjusted

EBITDA as net loss attributable to Forge Global Holdings, Inc.,

adjusted to exclude: (i) net loss attributable to noncontrolling

interest, (ii) provision for income taxes, (iii) interest (income)

expense, net, (iv) depreciation and amortization, (v) share-based

compensation expense, (vi) change in fair value of warrant

liabilities, and (vii) other significant gains, losses, and

expenses such as impairments or acquisition-related transaction

costs that we believe are not indicative of our ongoing

results.

Forward-Looking

Statement

This press release contains “forward-looking statements,” which

generally are accompanied by words such as “believe,” “may,”

“could,” “will,” “estimate,” “continue,” “anticipate,” “intend,”

“target,” “goal,” “expect,” “should,” “would,” “plan,” “predict,”

“project,” “forecast,” “potential,” “seem,” “seek,” “future,”

“outlook,” and similar expressions that predict, indicate or relate

to future events or trends or Forge’s future financial or operating

performance, or that are not statements of historical matters.

These forward-looking statements include, but are not limited to,

statements regarding Forge’s beliefs regarding its financial

position and operating performance, as well as future opportunities

for Forge to expand its business. Forward-looking statements are

predictions, projections and other statements about future events

that are based on current expectations and assumptions and, as a

result, while considered reasonable by Forge and its management,

are subject to risks and uncertainties that may cause actual

results to differ materially from current expectations. You should

carefully consider the risks and uncertainties described in Forge’s

documents filed, or to be filed, with the SEC, including in its

Quarterly Report on Form 10-Q that will be filed on or around the

date of this press release. There may be additional risks that

Forge presently does not know of or that it currently believes are

immaterial that could also cause actual results to differ

materially from those contained in the forward-looking statements.

In addition, forward-looking statements reflect Forge’s

expectations, plans or forecasts of future events and views as of

the date of this press release. Forge anticipates that subsequent

events and developments will cause its assessments to change.

However, while Forge may elect to update these forward-looking

statements at some point in the future, Forge specifically

disclaims any obligation to do so. These forward-looking statements

should not be relied upon as representing Forge’s assessments as of

any date subsequent to the date of this press release. Accordingly,

undue reliance should not be placed upon the forward-looking

statements.

About Forge

Forge is a leading provider of marketplace infrastructure, data

services and technology solutions for private market participants.

Forge Securities LLC is a registered broker-dealer and a Member of

FINRA that operates an alternative trading system.

FORGE GLOBAL HOLDINGS,

INC.

Consolidated Balance

Sheets

(In thousands of U.S. dollars,

except share and per share data)

September 30, 2024

(Unaudited)

December 31,

2023

Assets

Current assets:

Cash and cash equivalents

$

114,454

$

144,722

Restricted cash

1,103

1,062

Accounts receivable, net

4,955

4,067

Prepaid expenses and other current

assets

8,891

13,253

Total current assets

129,403

163,104

Internal-use software, property and

equipment, net

3,500

5,192

Goodwill and other intangible assets,

net

126,983

129,919

Operating lease right-of-use assets

6,654

4,308

Payment-dependent notes receivable,

noncurrent

7,436

5,593

Other assets, noncurrent

2,597

2,615

Total assets

$

276,573

$

310,731

Liabilities and stockholders’

equity

Current liabilities:

Accounts payable

$

1,640

$

1,831

Accrued compensation and benefits

11,306

11,004

Accrued expenses and other current

liabilities

7,694

8,861

Operating lease liabilities, current

3,453

2,516

Total current liabilities

24,093

24,212

Operating lease liabilities,

noncurrent

4,492

2,707

Payment-dependent notes payable,

noncurrent

7,436

5,593

Warrant liabilities

1,958

9,616

Other liabilities, noncurrent

313

185

Total liabilities

38,292

42,313

Commitments and contingencies

Stockholders’ equity:

Common stock, $0.0001 par value;

184,320,636 and 176,899,814 shares issued and outstanding as of

September 30, 2024 and December 31, 2023, respectively

19

18

Treasury stock, at cost; 157,193 shares as

of September 30, 2024 and December 31, 2023, respectively

(625

)

(625

)

Additional paid-in capital

565,529

543,846

Accumulated other comprehensive income

933

911

Accumulated deficit

(331,328

)

(280,638

)

Total Forge Global Holdings, Inc.

stockholders’ equity

234,528

263,512

Noncontrolling interest

3,753

4,906

Total stockholders’ equity

238,281

268,418

Total liabilities and stockholders’

equity

$

276,573

$

310,731

FORGE GLOBAL HOLDINGS,

INC.

Unaudited Condensed

Consolidated Statements of Operations

(In thousands of U.S. dollars,

except share and per share data)

Three Months Ended

Nine Months Ended

September 30, 2024

June 30, 2024

September 30, 2023

September 30, 2024

September 30, 2023

Revenues:

Marketplace revenues

$

8,713

$

11,679

$

7,283

$

28,912

$

17,638

Custodial administration fees

10,503

10,603

11,280

31,828

33,124

Total revenues

19,216

22,282

18,563

60,740

50,762

Transaction-based expenses:

Transaction-based expenses

(73

)

(256

)

(148

)

(358

)

(250

)

Total revenues, less transaction-based

expenses

19,143

22,026

18,415

60,382

50,512

Operating expenses:

Compensation and benefits

28,750

28,784

27,650

87,377

78,566

Technology and communications

3,185

2,649

3,763

8,894

10,628

Professional services

2,435

1,605

2,883

6,257

8,884

Advertising and market development

1,015

1,243

910

3,348

2,463

Rent and occupancy

1,036

1,107

1,142

3,278

3,616

General and administrative

1,877

2,508

1,870

9,447

8,143

Depreciation and amortization

1,748

1,781

1,710

5,345

5,246

Total operating expenses

40,046

39,677

39,928

123,946

117,546

Operating loss

(20,903

)

(17,651

)

(21,513

)

(63,564

)

(67,034

)

Interest and other income

(expense):

Interest income

1,307

1,495

1,725

4,511

4,553

Change in fair value of warrant

liabilities

931

2,280

907

7,659

(2,715

)

Other income, net

119

94

215

288

647

Total interest and other income

2,357

3,869

2,847

12,458

2,485

Loss before provision for income

taxes

(18,546

)

(13,782

)

(18,666

)

(51,106

)

(64,549

)

Provision for income taxes

298

258

291

772

769

Net loss

(18,844

)

(14,040

)

(18,957

)

(51,878

)

(65,318

)

Net loss attributable to noncontrolling

interest

(502

)

(316

)

(609

)

(1,188

)

(893

)

Net loss attributable to Forge Global

Holdings, Inc.

$

(18,342

)

$

(13,724

)

$

(18,348

)

$

(50,690

)

$

(64,425

)

Net loss per share attributable to Forge

Global Holdings, Inc. common stockholders:

Basic

$

(0.10

)

$

(0.08

)

$

(0.11

)

$

(0.28

)

$

(0.37

)

Diluted

$

(0.10

)

$

(0.08

)

$

(0.11

)

$

(0.28

)

$

(0.37

)

Weighted-average shares used in computing

net loss per share attributable to Forge Global Holdings, Inc.

common stockholders:

Basic

184,158,571

182,681,065

173,957,880

182,261,198

173,045,721

Diluted

184,158,571

182,681,065

173,957,880

182,261,198

173,045,721

FORGE GLOBAL HOLDINGS,

INC.

Unaudited Condensed

Consolidated Statements of Cash Flows

(In thousands of U.S.

dollars)

Three Months Ended

Nine Months Ended

September 30, 2024

June 30, 2024

September 30, 2023

September 30, 2024

September 30, 2023

Cash flows from operating

activities:

Net loss

$

(18,844

)

$

(14,040

)

$

(18,957

)

$

(51,878

)

$

(65,318

)

Adjustments to reconcile net loss to net

cash used in operations:

Share-based compensation

7,622

7,859

9,233

24,948

25,443

Depreciation and amortization

1,748

1,781

1,711

5,345

5,247

Amortization of right-of-use assets

670

662

748

1,975

2,327

Loss on impairment of long lived

assets

—

—

—

—

536

Impairment of right-of-use assets

—

—

—

186

—

Allowance for doubtful accounts

34

107

358

250

529

Change in fair value of warrant

liabilities

(932

)

(2,280

)

(907

)

(7,659

)

2,715

Changes in operating assets and

liabilities:

Accounts receivable

(466

)

923

456

(1,139

)

(857

)

Prepaid expenses and other assets

2,049

(5,353

)

1,371

(2,179

)

1,590

Accounts payable

(120

)

(1,004

)

(89

)

(58

)

(1,318

)

Accrued expenses and other liabilities

922

(4,636

)

723

(931

)

2,011

Accrued compensation and benefits

2,228

2,041

3,042

302

(4,472

)

Operating lease liabilities

(739

)

(491

)

(1,236

)

(1,785

)

(3,317

)

Other

—

—

—

(10

)

—

Net cash used in operating

activities

(5,828

)

(14,431

)

(3,547

)

(32,633

)

(34,884

)

Cash flows from investing

activities:

Purchases of term deposits

—

—

(515

)

—

(3,180

)

Receipts of term deposit maturities

—

6,559

—

6,559

—

Capitalized internal-use software

development costs

(48

)

—

—

(48

)

—

Purchases of property and equipment

(125

)

(267

)

(14

)

(792

)

(113

)

Net cash (used in) provided by

investing activities

(173

)

6,292

(529

)

5,719

(3,293

)

Cash flows from financing

activities:

Proceeds from exercise of options

12

235

23

473

353

Taxes withheld and paid related to net

share settlement of equity awards

(406

)

(1,135

)

—

(3,843

)

(557

)

Net cash (used in) provided by

financing activities

(394

)

(900

)

23

(3,370

)

(204

)

Effect of changes in currency exchange

rates on cash and cash equivalents

388

(78

)

(333

)

57

(158

)

Net decrease in cash and cash

equivalents

(6,007

)

(9,117

)

(4,386

)

(30,227

)

(38,539

)

Cash, cash equivalents and restricted

cash, beginning of the period

121,564

130,681

160,812

145,784

194,965

Cash, cash equivalents and restricted

cash, end of the period

$

115,557

$

121,564

$

156,426

$

115,557

$

156,426

Reconciliation of cash, cash

equivalents and restricted cash to the amounts reported within the

consolidated balance sheets

Cash and cash equivalents

$

114,454

$

120,475

$

155,127

$

114,454

$

155,127

Restricted cash

1,103

1,089

1,299

1,103

1,299

Total cash, cash equivalents and

restricted cash, end of the period

$

115,557

$

121,564

$

156,426

$

115,557

$

156,426

FORGE GLOBAL HOLDINGS,

INC.

Reconciliation of GAAP to

Non-GAAP Results

(In thousands of U.S.

dollars)

Three Months Ended

Nine Months Ended

September 30, 2024

June 30, 2024

September 30, 2023

September 30, 2024

September 30, 2023

Net loss attributable to Forge Global

Holdings, Inc.

$

(18,342

)

$

(13,724

)

$

(18,348

)

$

(50,690

)

$

(64,425

)

Add:

Net loss attributable to noncontrolling

interest

(502

)

(316

)

(609

)

(1,188

)

(893

)

Provision for income taxes

298

258

291

772

769

Interest (income) expense, net

(1,307

)

(1,495

)

(1,725

)

(4,511

)

(4,553

)

Depreciation and amortization

1,748

1,781

1,710

5,345

5,246

Share-based compensation expense

7,622

7,859

9,233

24,948

25,443

Change in fair value of warrant

liabilities

(931

)

(2,280

)

(907

)

(7,659

)

2,715

Impairment of right-of-use assets

—

—

—

186

—

Loss on impairment of long lived

assets

—

—

—

—

536

Adjusted EBITDA

$

(11,414

)

$

(7,917

)

$

(10,355

)

$

(32,797

)

$

(35,162

)

FORGE GLOBAL HOLDINGS, INC.

SUPPLEMENTAL FINANCIAL INFORMATION KEY OPERATING

METRICS (In thousands of U.S. dollars)

Key Business Metrics

We monitor the following key business metrics to help us

evaluate our business, identify trends affecting our business,

formulate business plans and make strategic decisions. The tables

below reflect period-over-period changes in our key business

metrics, along with the percentage change between such periods. We

believe the following business metrics are useful in evaluating our

business:

Three Months Ended

Nine Months Ended

Dollars in thousands

September 30, 2024

June 30, 2024

September 30, 2023

September 30, 2024

September 30, 2023

TRADING

SOLUTIONS

Trades

680

831

567

2,116

1,321

Volume

$

338,075

$

426,318

$

234,141

$

1,026,931

$

515,486

Net Take Rate

2.6

%

2.7

%

3.0

%

2.8

%

3.4

%

Marketplace revenues, less

transaction-based expenses

$

8,640

$

11,423

$

7,135

$

28,554

$

17,388

- Trades are defined as the total number of orders executed by us

and entities we have acquired on behalf of private investors and

stockholders. Increasing the number of orders is critical to

increasing our revenue and, in turn, to achieving

profitability.

- Volume is defined as the total sales value for all securities

traded through our Forge Markets platform which is the aggregate

value of the issuer company’s equity attributed to both the buyer

and seller in a trade and as such a $100 trade of equity between

buyer and seller would be captured as $200 volume for us. Although

we typically capture a commission on each side of a trade, we may

not in certain cases due to factors such as the use of a

third-party broker by one of the parties or supply factors that

would not allow us to attract sellers of shares of certain issuers.

Volume is influenced by, among other things, the pricing and

quality of our services as well as market conditions that affect

private company valuations, such as increases in valuations of

comparable companies at IPO.

- Net Take Rates are defined as our marketplace revenues, less

transaction-based expenses, divided by Volume. These represent the

percentage of fees earned by our marketplace on any transactions

executed from the commission we charged on such transactions (less

transaction-based expenses), which is a determining factor in our

revenue. The Net Take Rate can vary based upon the service or

product offering and is also affected by the average order size and

transaction frequency.

As of

Dollars in thousands

September 30, 2024

June 30, 2024

September 30, 2023

CUSTODY

SOLUTIONS

Total Custodial Accounts

2,281,976

2,211,108

2,023,756

Assets Under Custody

$

16,620,450

$

16,600,408

$

15,148,480

- Total Custodial Accounts are defined as our customers’

custodial accounts that are established on our platform and

billable. These relate to our Custodial Administration fees revenue

stream and are an important measure of our business as the number

of Total Custodial Accounts is an indicator of our future revenues

from certain account maintenance, transaction and cash

administration fees.

- Assets Under Custody is the reported value of all client

holdings held under our agreements, including cash submitted to us

by the responsible party. These assets can be held at various

financial institutions, issuers and in our vault. As the custodian

of the accounts, we collect all interest and dividends, handle all

fees and transactions, and any other considerations for the assets

concerned. Our fees are earned from the overall maintenance

activities of all assets and are not charged on the basis of the

dollar value of Assets Under Custody, but we believe that Assets

Under Custody is a useful metric for assessing the relative size

and scope of our business.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106401663/en/

Investor Relations Contact: Dominic Paschel

ir@forgeglobal.com

Media Contact: Lindsay Riddell press@forgeglobal.com

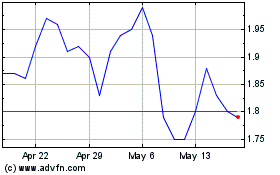

Forge Global (NYSE:FRGE)

Historical Stock Chart

From Oct 2024 to Nov 2024

Forge Global (NYSE:FRGE)

Historical Stock Chart

From Nov 2023 to Nov 2024