0001846069False00018460692024-11-062024-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): November 6, 2024

Nextdoor Holdings, Inc.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | |

| Delaware | 001-40246 | 86-1776836 |

(State or Other Jurisdiction

of Incorporation) | (Commission File Number) | (IRS Employer

Identification No.) |

420 Taylor Street

San Francisco, California

(Address of principal executive offices)

(415) 344-0333

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol | Name of each exchange on which registered |

Class A common stock, par value $0.0001 per share | KIND | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 ((§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 6, 2024, Nextdoor Holdings, Inc. (the “Company”) issued a letter to shareholders and press release (together, the “Letter and Press Release”) announcing its financial results for the third quarter ended September 30, 2024. The Company also announced that it would be holding a conference call on November 6, 2024 to discuss its financial results. Copies of the Letter and Press Release are furnished as Exhibit 99.1 and Exhibit 99.2, respectively, to this Current Report on Form 8-K.

This information included in this Item 2.02 of this Current Report on Form 8-K and the exhibits hereto are being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it been deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | |

| Exhibit Number | Description |

| 99.1 | |

| 99.2 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| NEXTDOOR HOLDINGS, INC. |

| | |

| | |

Date: November 6, 2024 | By: | /s/ Matt Anderson |

| | Matt Anderson |

| | Chief Financial Officer |

A Letter from Our CEO

Dear Shareholders:

We made solid progress in Q3, driving improved business results and advancing the future of Nextdoor with NEXT. Of course, we have much work ahead, and continue to be deeply committed to building the right foundation to unlock long-term value. Here are some specific updates:

Improving metrics and margins. We drove growth in both weekly active users and revenue. Advertisers using the Nextdoor Ads Platform continue to see better performance, which has improved retention and increased total spending. In Q3, enterprise customers returned to growth and contributed to the momentum across channels. We continue to find a balance between investments in growth and improvements in efficiency, which together enhanced productivity and enabled adjusted EBITDA margin to improve meaningfully in Q3. Our performance and visibility continue to improve, and we are raising our guidance for full-year 2024 revenue and adjusted EBITDA.

Building a winning culture. We continue to use a “Founder’s Mentality” as our cultural north star. The benefits of acting like an owner are not solely the provenance of startups: the best companies successfully blend the dueling attributes of upstart and mature companies. We must find a way to combine innovation with execution, simultaneously “delivering” ongoing value while “developing” future value. “Deliver” means operating as effectively as possible and continually raising the bar in everything that we do. “Develop” means invention such as the NEXT initiative, our longer-term effort to transform our product into an essential local application that can enrich the lives of neighbors everywhere.

Expanding intent to discovery. We are optimized today for intent-centric use cases. Intent occurs when neighbors have a specific need: find a trusty plumber, locate a lost dog, or get critical updates during a natural disaster. Intent-centric use cases are vital and we take pride in being there when needed most. Yet as we continue to build for our community, we can pair the existing value of intent with the additive value of discovery-centric use cases. Discovery happens when users build the habit of visiting frequently simply to stay informed. And with 86% of our users expressing a desire to discover local content, we see a clear opportunity here for Nextdoor — and the initial focus of NEXT.

Focusing on what is NEXT. If users rely on Nextdoor to more generally discover content that is useful, we will have a tremendous opportunity to drive deeper and more frequent engagement within our already material user base. This is the overarching goal of NEXT: to create a significantly better user experience, which in turn drives profitable growth and shareholder value. Our work here is progressing nicely, but will be a multi-phase effort, as innovation is neither predictable nor linear. With that in mind, our timeline is unchanged and we do not expect to see meaningful signs of product-related progress until mid-2025. But we are optimistic that we’re on the right track and look forward to keeping you updated along the way.

Looking ahead, we continue to approach the future with gratitude, humility, and optimism. We embrace the challenge of “delivering” quarterly results and strong operational performance, while simultaneously “developing” innovative new products and features that combine our local expertise with modern and unique technologies. It will be a challenging journey, but it is well worth it: a revitalized platform, a renewed growth trajectory, and a reinvigorated company.

Sincerely,

Nirav Tolia

Founder and CEO

Q3 2024 Highlights

| | | | | | | | |

| | |

Revenue growth continued to improve. Q3 revenue of $66M grew +17% year-over-year, reflecting increasing self-serve revenue momentum, a return to growth for enterprise advertisers, and improved monetization of search activity. Increased adoption of ad product improvements – notably, performance-optimized campaigns – were at the core of our progress. | User growth persisted. Q3 Weekly Active Users (WAU) of 45.9 million grew +13% year-over-year, again reflecting sustained organic user acquisition, progress re-engaging existing users, and more varied and personalized content and notifications. Nextdoor remains an essential place to gather information and connect, particularly during significant events affecting local communities. | Margins increased substantially. Q3 adjusted EBITDA1 of ($1M) represented 33 percentage points of year-over-year margin improvement. Strong margin flow-through from increased revenue, further leverage in sales and marketing, and a 60% year-over-year improvement in employee productivity each contributed to our progress. |

| | | | | |

Revenue ($M) | WAU (M) |

| |

Net Loss ($M)2 | Adjusted EBITDA ($M) |

| |

__________________

1 Adjusted EBITDA margin is calculated as adjusted EBITDA divided by revenue. A reconciliation of non-GAAP metrics used in this letter to their most comparable GAAP measures is provided at the end of the letter.

2 Net loss margin is calculated as net loss divided by revenue. Net loss includes restructuring costs of $11M in Q4'23 and $26M in Q2'24.

Perspectives on Q3

Users continue to join organically and engage on Nextdoor. Q3 WAU reached 45.9M, up 13% year-over-year. Key contributors to Q3 growth included (1) engagement with inactive users who clicked on notifications, experienced Nextdoor without being logged in first, and tended to log in and stay, (2) further machine learning (ML)-driven improvements in our feed ranking and personalization efforts, (3) sustained organic user acquisition, and (4) timely and relevant content and notifications that helped users stay safe during storms and power outages.

While we made product progress, we also saw an added boost in the period from two specific weather-related events that drove meaningful engagement: Hurricane Beryl and the California heat wave. Nextdoor’s reach, relevance, and public agency relationships allow us to serve as a core source of critical, real-time local information for our users and customers.

The Nextdoor Ads Platform is driving better performance for advertisers. In turn, that drove stronger financial results in Q3. Revenue reached $66M, a 17% year-over-year increase reflecting improved ease of use and better performance for advertisers, best demonstrated by higher click-through rates and lower cost-per-click for click-optimized campaigns.

Our Nextdoor Ads Platform also continues to scale. Our self-serve growth in Q3 remained weighted toward mid-market advertisers, which posted strong year-over-year account and revenue growth. While improved sales execution helped us drive managed enterprise and mid-market customer growth, we remain focused on expanding our advertising capabilities to those customers who have not yet transitioned to the Nextdoor Ads Platform.

We saw green shoots among our largest managed advertisers. Managed advertisers, a group that includes enterprise and larger mid-market customers, increased their spend year-over-year in Q3. Top 50 customer retention remained strong, with improved customer and net revenue retention and key contributions from the home services vertical.

Search emerging as a contributor to revenue growth. While the initial phase of NEXT centers on coupling intent with discovery, we expect intent-centric use cases will remain a critical part of the Nextdoor experience. In fact, users searching on Nextdoor often do so with clear commercial intent. Recent campaigns that retargeted users based on their search history and leveraged our improved search and real-time audience capabilities saw an over 10x higher return on ad spend (ROAS) relative to traditional campaigns. We are encouraged by our recent momentum in search and its potential to contribute to monetization over time.

Improving growth and cost discipline are driving margin improvement. Q3 adjusted EBITDA was ($1M), a 33 percentage point year-over-year improvement as we remain focused on more effectively allocating resources toward growth. Our Q3 adjusted EBITDA and margin improvement were enabled by (1) increasing revenue scale, (2) lower personnel costs, and (3) continued focus on efficiently scaling hosting and data-related expenses.

Productivity, as measured by revenue per employee, improved by more than 60% year-over-year. We believe this measure reflects our “owner’s mindset” – a focus on both customer growth and operating efficiency. With that in mind, in Q4 2024 we expect to generate positive quarterly free cash flow, which we define as operating cash flow less capital expenditures.

We are committed to disciplined capital allocation and our balance sheet is strong. Our cash position and improving profitability profile provide us with flexibility to strategically invest in the business, whether through focused operating investments or share repurchases.

We ended Q3 with $425M in cash and cash equivalents and marketable securities, and zero debt. During Q3, we repurchased 8M shares at an average share price of $2.64. Year-to-date, we have repurchased 30M shares at an average share purchase price of $2.44. Since the beginning of the year, we have repurchased 8% of basic shares outstanding and 6% of fully diluted shares outstanding. Our repurchase authorization had approximately $100M remaining at quarter-end.

Fully diluted share count (quarter-end, in millions)

Product and Advertiser Updates

We are bringing in new content to improve our product. One of our initial NEXT priorities is bringing more relevant local content to Nextdoor, which we believe will make users’ experiences more compelling and drive deeper engagement. This transformation of our product experience will span quarters, but we are encouraged by what we are learning.

Our efforts to improve the advertiser experience are yielding results. We have seen this most clearly via increased advertiser spending on Nextdoor. A growing set of advertisers is seeing better performance enabled by our Nextdoor Ads Platform, which harnesses our first-party data to improve click optimization, conversion, and targeting. Simply put, advertisers who want to reach Nextdoor’s unique and growing audience can now do so more effectively.

Seamless self-serve access and improved ad serving are driving improved performance for advertisers of all sizes – and also benefiting Nextdoor. During Q3, we observed the following in our self-serve channel:

•For mid-market advertisers using self-serve, net revenue retention improved year-over-year, driven by better account retention.

•Click optimization drove a 2x improvement in advertiser performance, and contributed to more than half of our mid-market self-serve revenue during Q3.

•The average spend of new mid-market self-serve advertisers more than doubled year-over-year, maintaining momentum from Q2.

We continue to provide more actionable insights and improve return on investment (ROI) for advertisers. Click optimization and conversion API (CAPI) are two key capabilities in the early days of adoption.

•Click optimization for ad delivery improves advertisers’ ROI by attracting high-intent users who drive down the cost per click. For the second straight quarter, click optimization adoption rose as advertisers’ awareness improved. In Q3, advertisers using click optimization for ad delivery saw an 82% increase in click-through rates and a 16% decrease in cost-per-click compared to non-optimized campaigns, driving better returns with less effort.

•CAPI is important as we expand from optimizing clicks to driving conversions — a top goal for many advertisers. CAPI helps advertisers track and improve ROAS, optimize future campaigns by better understanding which strategies worked best, and improve audience targeting and retargeting. It also allows Nextdoor to attribute conversion events to specific ad exposures, giving advertisers a better understanding of the performance of their campaigns on Nextdoor. Going forward, we expect advertisers who use CAPI will tend to spend more and retain better. Though we are still in the early stages of adoption, we see significant potential in scaling CAPI to drive performance-focused spending on our platform.

Nextdoor is also delivering relevant experiences for users and local businesses. Our focus in recent updates has been on ad platform progress and improving operating metrics, but there is more to our story than just advertising. Nextdoor delivers value for a range of local stakeholders, including businesses, users, and public agencies. Our continued relevance to these stakeholders is why local is at the center of NEXT. The below examples demonstrate the value we deliver:

•For local businesses Nextdoor is a resource to boost awareness, generate leads, and connect with nearby users. Our data demonstrates that home improvement professionals are 25% more engaged on the platform than our neighbors overall, and tend to be younger than our overall neighbor base. Further, 50% of these professionals secured jobs through leads found on Nextdoor in the last three months. Local businesses using Nextdoor realize value from our local footprint, verified user base, and first-party data.

•For users, finding compelling content drives engagement and, ultimately, satisfaction. Nextdoor is a trusted resource for users intentionally seeking out moving-related content. About 25% of users used Nextdoor to help with key needs like finding movers or buying and selling belongings, and 80% used Nextdoor to help get settled into their new neighborhoods. Once relocated, users shift from intent to discovery — almost two-thirds searched for local events and things to do in their new neighborhoods, and were more likely to search for businesses and service providers including home security, daycare, and dog walking services.

We are driving growth with what we already have in place today — nearly 100 million Verified Neighbors driving engagement, a growing base of advertisers driving performance, and an existing team driving operating leverage. Our current efforts, along with our work on NEXT and the potential of further integrating artificial intelligence (AI) into our user and advertiser experiences, will help us further grow our user base and make us better at delivering relevant, high-quality experiences for everyone on Nextdoor.

Outlook

FY 2024 financial outlook

•We expect FY 2024 revenue of $245 million, implying 12% year-over-year growth.

•We expect FY 2024 adjusted EBITDA margin improvement approaching 25 percentage points year-over-year, versus our prior expectation for improvement approaching 20 percentage points.

Q4 2024 financial outlook

•We expect Q4 2024 revenue of $63 million, implying 13% year-over-year growth.

•We expect Q4 2024 adjusted EBITDA loss of $2 million.

•We expect to generate positive free cash flow in the period.

As a reminder, we define free cash flow as operating cash flow minus capital expenditures. We have consistently generated approximately $5M of quarterly interest income, and expect changes in net working capital will be favorable. Additionally, our Q4 guidance reflects natural seasonality related to home services spending.

Summing Up

We are encouraged by our progress through Q3, as demonstrated by:

•Continued user growth, including a 13% year-over-year increase WAU.

•Improvement in key monetization metrics, with sustained growth in self-serve revenue, improved revenue retention, and better monetization of search activity.

•Further margin improvement and team productivity.

Most importantly, we are committed to driving value for users and advertisers. In turn, we expect those efforts to enable profitable growth and shareholder returns over the long-term. We have seen stronger results through more consistent execution, and set a renewed growth trajectory with NEXT.

Q3 2024 Conference Call and Webcast

We will host a Q&A webcast on Wednesday, November 6, 2024, at 2:00 pm PT/5:00 pm ET to discuss these results and outlook. An audio webcast archive will be available following the live webcast for approximately one year on Nextdoor’s Investor Relations website at investors.nextdoor.com. Thank you for your support in building stronger neighborhoods across the globe and for being active users in your own neighborhoods. We look forward to your questions and comments.

We use our Investor Relations website (investors.nextdoor.com), our X handle (twitter.com/Nextdoor), and our LinkedIn Home Page (linkedin.com/company/nextdoor-com) as a means of disseminating or providing notification of, among other things, news or announcements regarding our business or financial performance, investor events, press releases, and earnings releases, and as a means of disclosing material nonpublic information and for complying with our disclosure obligations under Regulation FD. The content of our websites and information that we may post on or provide to online and social media channels, including those mentioned above, and information that can be accessed through our websites or these online and social media channels are not incorporated by reference into this shareholder letter or in any report or document we file with the SEC, and any references to our websites or these online and social media channels are intended to be inactive textual references only.

Safe Harbor Statement

This shareholder letter includes forward-looking statements, which are statements other than statements of historical facts and statements in the future tense. These statements include, but are not limited to, statements regarding our future performance and our market opportunity, including expected financial results for the fourth quarter of 2024 and full year 2024, the implementation and potential impact of our NEXT initiative, the migration of our customers to our Nextdoor Ads Platform, trends and expectations regarding our business and operating results, including trends impacting our operating leverage, the expected cost reductions associated with the reduction in force, our capital allocation strategy, our business strategy and plans, and our objectives and future operations, including our expansion into new markets.

Forward-looking statements are based upon various estimates and assumptions, as well as information known to us as of the date of this shareholder letter, and are subject to risks and uncertainties. Accordingly, actual results could differ materially due to a variety of factors, including: our ability to scale our business and monetization efforts; our ability to expand business operations abroad; our limited operating history; risks associated with managing our growth; our ability to achieve and maintain profitability in the future; the effects of the highly competitive market in which we operate; the impact of macroeconomic conditions on our business; our ability to attract new and retain existing customers and users, or renew and expand our relationships with them; our ability to anticipate and satisfy customer preferences; market acceptance of our platform; our ability to successfully develop and timely introduce new products and services; risks associated with the use of AI and ML-driven features in our platform; our ability to achieve our objectives of strategic and operational initiatives; cybersecurity risks to our various systems and software; the impact of privacy and data security laws; and other general market, political, economic, and business conditions.

Additional risks and uncertainties that could affect our financial results and business are more fully described in our Annual Report on Form 10-K for the period ended December 31, 2023, our Quarterly Report on Form 10-Q for the period ended June 30, 2024 filed with the SEC on August 7, 2024, our Quarterly Report on Form 10-Q for the period ended September 30, 2024, expected to be filed on or about November 6, 2024, and our other SEC filings, which are available on the Investor Relations page of our website at investors.nextdoor.com and on the SEC’s website at www.sec.gov.

All forward-looking statements contained herein are based on information available to us as of the date hereof and you should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, performance, or achievements. We undertake no obligation to update any of these forward-looking statements for any reason after the date of this shareholder letter or to conform these statements to actual results or revised expectations, except as required by law. Undue reliance should not be placed on the forward-looking statements in this shareholder letter.

A Note on Guidance

We have not reconciled our adjusted EBITDA, adjusted EBITDA margin, or free cash flow outlook to GAAP net loss, GAAP net loss margin or net cash used in operating activities, respectively, because certain items that impact these measures are uncertain or out of our control and cannot be reasonably predicted. In particular, with respect to adjusted EBITDA and adjusted EBITDA margin, stock-based compensation expense is impacted by the future fair market value of our common stock and other factors, all of which are difficult to predict, subject to frequent change, or not within our control. The actual amount of these expenses during 2024 will have a significant impact on our future GAAP financial results. Accordingly, a reconciliation of adjusted EBITDA outlook to net loss, adjusted EBITDA margin to GAAP net loss margin and free cash flow to net cash used in operating activities is not available without unreasonable efforts.

Condensed Consolidated

Balance Sheets

in thousands, except per share data (unaudited)

| | | | | | | | | | | |

| September 30, | | December 31 |

| 2024 | | 2023 |

| | | |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 49,700 | | | $ | 60,233 | |

| Marketable securities | 375,045 | | | 470,868 | |

| Accounts receivable, net of allowance of $425 and $385 as of September 30, 2024 and December 31, 2023, respectively | 29,514 | | | 26,233 | |

| Prepaid expenses and other current assets | 14,729 | | | 9,606 | |

| Total current assets | 468,988 | | | 566,940 | |

| Restricted cash, non-current | 11,171 | | | 11,171 | |

| Property and equipment, net | 3,196 | | | 8,082 | |

| Operating lease right-of-use assets | 15,126 | | | 56,968 | |

| Intangible assets, net | 311 | | | 1,301 | |

| Goodwill | 1,211 | | | 1,211 | |

| Other assets | 17,660 | | | 8,891 | |

| Total assets | $ | 517,663 | | | $ | 654,564 | |

| | | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 239 | | | $ | 1,895 | |

| Operating lease liabilities, current | 8,269 | | | 6,208 | |

| Accrued expenses and other current liabilities | 18,248 | | | 27,308 | |

| Total current liabilities | 26,756 | | | 35,411 | |

| Operating lease liabilities, non-current | 34,471 | | | 60,378 | |

| Other liabilities, non-current | 391 | | | 218 | |

| Total liabilities | 61,618 | | | 96,007 | |

| | | |

| Stockholders’ equity: | | | |

| Class A common stock, $0.0001 par value; 2,500,000 shares authorized, 212,189 and 186,415 shares issued and outstanding as of September 30, 2024 and December 31, 2023, respectively | 21 | | | 19 | |

| Class B common stock, $0.0001 par value; 500,000 shares authorized, 164,900 and 201,960 shares issued and outstanding as of September 30, 2024 and December 31, 2023, respectively | 17 | | | 20 | |

| Additional paid-in capital | 1,305,704 | | | 1,323,595 | |

| Accumulated other comprehensive income | 2,263 | | | 943 | |

| Accumulated deficit | (851,960) | | | (766,020) | |

| Total stockholders’ equity | 456,045 | | | 558,557 | |

| | | |

| Total liabilities and stockholders’ equity | $ | 517,663 | | | $ | 654,564 | |

Condensed Consolidated Statements of Operations

in thousands, except per share data (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| Revenue | $ | 65,610 | | | $ | 56,092 | | | $ | 182,048 | | | $ | 162,752 | |

| Costs and expenses: | | | | | | | |

| Cost of revenue | 11,129 | | | 10,723 | | | 31,387 | | | 31,074 | |

| Research and development | 31,897 | | | 39,649 | | | 94,318 | | | 109,748 | |

| Sales and marketing | 26,158 | | | 30,564 | | | 86,468 | | | 91,159 | |

| General and administrative | 17,203 | | | 19,532 | | | 74,417 | | | 55,401 | |

| Total costs and expenses | 86,387 | | | 100,468 | | | 286,590 | | | 287,382 | |

| Loss from operations | (20,777) | | | (44,376) | | | (104,542) | | | (124,630) | |

| Interest income | 5,804 | | | 6,766 | | | 19,059 | | | 18,635 | |

| Other income (expense), net | 243 | | | (217) | | | 226 | | | (526) | |

| Loss before income taxes | (14,730) | | | (37,827) | | | (85,257) | | | (106,521) | |

| Provision for income taxes | 168 | | | 289 | | | 683 | | | 714 | |

| Net loss | $ | (14,898) | | | $ | (38,116) | | | $ | (85,940) | | | $ | (107,235) | |

| | | | | | | |

| Net loss per share attributable to Class A and Class B common stockholders, basic and diluted | $ | (0.04) | | | $ | (0.10) | | | $ | (0.22) | | | $ | (0.28) | |

| Weighted average shares used in computing net loss per share attributable to Class A and Class B common stockholders, basic and diluted | 378,437 | | | 381,482 | | | 386,220 | | | 376,832 | |

Condensed Consolidated Statements of Cash Flows

in thousands (unaudited)

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2024 | | 2023 |

| | | |

| Cash flows from operating activities | | | |

| Net loss | $ | (85,940) | | | $ | (107,235) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Depreciation and amortization | 3,307 | | | 4,356 | |

| Stock-based compensation | 54,181 | | | 60,735 | |

| Non-cash impairment charges related to lease abandonment | 22,760 | | | — | |

| | | |

| Accretion of investments | (4,858) | | | (6,505) | |

| Other | 830 | | | 320 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable, net | (3,423) | | | (296) | |

| Prepaid expenses and other assets | (6,392) | | | 2,815 | |

| Operating lease right-of-use assets | 3,050 | | | 3,539 | |

| Accounts payable | (1,656) | | | (1,228) | |

| Operating lease liabilities | (4,931) | | | (4,230) | |

| Accrued expenses and other liabilities | (8,886) | | | 3,393 | |

| Net cash used in operating activities | (31,958) | | | (44,336) | |

| Cash flows from investing activities | | | |

| Purchases of property and equipment | (315) | | | (268) | |

| Purchases of marketable securities | (195,627) | | | (454,897) | |

| Sales of marketable securities | 138,443 | | | 81,266 | |

| Maturities of marketable securities | 158,409 | | | 416,587 | |

| Loan to Opportunity Finance Network | (7,500) | | | (2,500) | |

| Net cash provided by investing activities | 93,410 | | | 40,188 | |

| Cash flows from financing activities | | | |

| Proceeds from exercise of stock options | 11,505 | | | 6,676 | |

| Proceeds from issuance of common stock under employee stock purchase plan | 1,075 | | | 2,016 | |

| Tax withholdings on release of restricted stock units | (11,353) | | | (237) | |

| Repurchase of common stock | (73,300) | | | — | |

| Net cash provided by (used in) financing activities | (72,073) | | | 8,455 | |

| Effect of exchange rate changes on cash and cash equivalents | 88 | | | 72 | |

| Net increase (decrease) in cash, cash equivalents, and restricted cash | (10,533) | | | 4,379 | |

| Cash, cash equivalents, and restricted cash at beginning of period | 71,404 | | | 55,236 | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 60,871 | | | $ | 59,615 | |

Non-GAAP Financial Measures

To supplement our condensed consolidated financial statements, which are prepared in accordance with GAAP, we present non-GAAP cost of revenue, non-GAAP research and development, non-GAAP sales and marketing, non-GAAP general and administrative, non-GAAP total operating expenses, adjusted EBITDA and adjusted EBITDA margin in this shareholder letter. Our use of non-GAAP financial measures has limitations as an analytical tool, and these measures should not be considered in isolation or as a substitute for analysis of financial results as reported under GAAP.

We use these non-GAAP financial measures in conjunction with financial measures prepared in accordance with GAAP for planning purposes, including in the preparation of our annual operating budget, as a measure of our core operating results and the effectiveness of our business strategy, and in evaluating our financial performance. These measures provide consistency and comparability with past financial performance, facilitate period-to-period comparisons of core operating results, and also facilitate comparisons with other peer companies, many of which use similar non-GAAP financial measures to supplement their GAAP results. In addition, adjusted EBITDA is widely used by investors and securities analysts to measure a company's operating performance. We exclude the following items from one or more of our non-GAAP financial measures: stock-based compensation expense (non-cash expense calculated by companies using a variety of valuation methodologies and subjective assumptions), depreciation and amortization (non-cash expense), interest income, provision for income taxes, and, if applicable, restructuring charges and acquisition-related costs.

Investors are cautioned that there are material limitations associated with the use of non-GAAP financial measures as an analytical tool. In particular, (1) stock-based compensation expense has recently been, and will continue to be for the foreseeable future, a significant recurring expense for our business and an important part of our compensation strategy, (2) although depreciation and amortization expense are non-cash charges, the assets subject to depreciation and amortization may have to be replaced in the future, and our non-GAAP measures do not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements, and (3) adjusted EBITDA does not reflect: (a) changes in, or cash requirements for, our working capital needs; (b) interest expense (if any), or the cash requirements necessary to service interest or principal payments on debt (if any), which reduces cash available to us; or (c) tax payments that may represent a reduction in cash available to us. The non-GAAP measures we use may be different from non-GAAP financial measures used by other companies, limiting their usefulness for comparison purposes. We compensate for these limitations by providing specific information regarding the GAAP items excluded from these non-GAAP financial measures. A reconciliation of these non-GAAP measures has been provided below:

Non-GAAP Financial Measures

in thousands (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| Net loss | $ | (14,898) | | | $ | (38,116) | | | $ | (85,940) | | | $ | (107,235) | |

| Depreciation and amortization | 777 | | | 1,451 | | | 3,307 | | | 4,356 | |

| Stock-based compensation | 18,440 | | | 23,343 | | | 54,181 | | | 60,735 | |

| Interest income | (5,804) | | | (6,766) | | | (19,059) | | | (18,635) | |

| Provision for income taxes | 168 | | | 289 | | | 683 | | | 714 | |

| Restructuring charges | — | | | — | | | 25,517 | | | — | |

| Adjusted EBITDA | $ | (1,317) | | | $ | (19,799) | | | $ | (21,311) | | | $ | (60,065) | |

Net loss % Margin | (23 | %) | | (68 | %) | | (47 | %) | | (66 | %) |

Adjusted EBITDA % Margin | (2 | %) | | (35 | %) | | (12 | %) | | (37 | %) |

| Cost of Revenue Reconciliation: | | | | | | | |

| Cost of Revenue, GAAP | $ | 11,129 | | | $ | 10,723 | | | $ | 31,387 | | | $ | 31,074 | |

| Stock-based compensation | (729) | | | (835) | | | (1,964) | | | (2,311) | |

| Cost of Revenue, Non-GAAP | $ | 10,400 | | | $ | 9,888 | | | $ | 29,423 | | | $ | 28,763 | |

| % of revenue, GAAP | 17 | % | | 19 | % | | 17 | % | | 19 | % |

| % of revenue, Non-GAAP | 16 | % | | 18 | % | | 16 | % | | 18 | % |

| Research and Development Reconciliation: | | | | | | | |

| Research and Development, GAAP | $ | 31,897 | | | $ | 39,649 | | | $ | 94,318 | | | $ | 109,748 | |

| Stock-based compensation | (9,776) | | | (12,107) | | | (28,217) | | | (31,804) | |

| Depreciation and amortization | (282) | | | (496) | | | (1,103) | | | (1,485) | |

| Restructuring charges | — | | | — | | | (250) | | | — | |

| Research and Development, Non-GAAP | $ | 21,839 | | | $ | 27,046 | | | $ | 64,748 | | | $ | 76,459 | |

| % of revenue, GAAP | 49 | % | | 71 | % | | 52 | % | | 67 | % |

| % of revenue, Non-GAAP | 33 | % | | 48 | % | | 36 | % | | 47 | % |

| Sales and Marketing Reconciliation: | | | | | | | |

| Sales and Marketing, GAAP | $ | 26,158 | | | $ | 30,564 | | | $ | 86,468 | | | $ | 91,159 | |

| Stock-based compensation | (2,233) | | | (3,582) | | | (7,144) | | | (9,140) | |

| Depreciation and amortization | (389) | | | (785) | | | (1,767) | | | (2,344) | |

| Restructuring charges | — | | | — | | | (1,956) | | | — | |

| Sales and Marketing, Non-GAAP | $ | 23,536 | | | $ | 26,197 | | | $ | 75,601 | | | $ | 79,675 | |

| % of revenue, GAAP | 40 | % | | 54 | % | | 47 | % | | 56 | % |

| % of revenue, Non-GAAP | 36 | % | | 47 | % | | 42 | % | | 49 | % |

| General and Administrative Reconciliation: | | | | | | | |

| General and Administrative, GAAP | $ | 17,203 | | | $ | 19,532 | | | $ | 74,417 | | | $ | 55,401 | |

| Stock-based compensation | (5,702) | | | (6,819) | | | (16,856) | | | (17,480) | |

| Depreciation and amortization | (106) | | | (170) | | | (437) | | | (527) | |

| Restructuring charges | — | | | — | | | (23,311) | | | — | |

| General and Administrative, Non-GAAP | $ | 11,395 | | | $ | 12,543 | | | $ | 33,813 | | | $ | 37,394 | |

| % of revenue, GAAP | 26 | % | | 35 | % | | 41 | % | | 34 | % |

| % of revenue, Non-GAAP | 17 | % | | 22 | % | | 19 | % | | 23 | % |

| Total Operating Expenses Reconciliation: | | | | | | | |

| Operating Expenses, GAAP | $ | 86,387 | | | $ | 100,468 | | | $ | 286,590 | | | $ | 287,382 | |

| Stock-based compensation | (18,440) | | | (23,343) | | | (54,181) | | | (60,735) | |

| Depreciation and amortization | (777) | | | (1,451) | | | (3,307) | | | (4,356) | |

| Restructuring charges | — | | | — | | | (25,517) | | | — | |

| Total Operating Expenses, Non-GAAP | $ | 67,170 | | | $ | 75,674 | | | $ | 203,585 | | | $ | 222,291 | |

| % of revenue, GAAP | 132 | % | | 179 | % | | 157 | % | | 177 | % |

| % of revenue, Non-GAAP | 102 | % | | 135 | % | | 112 | % | | 137 | % |

Nextdoor Reports Third Quarter 2024 Results

•Revenue of $66 million, +17% year-over-year; WAU of 45.9 million, +13% year-over-year

•GAAP net loss of $15 million; Adjusted EBITDA loss of $1 million, representing year-over-year margin improvement of 33 percentage points

•Increases full-year 2024 financial outlook

SAN FRANCISCO, CA, November 6, 2024 — Nextdoor Holdings, Inc. (NYSE: KIND), the essential neighborhood network, today reported financial results for the third quarter ended September 30, 2024.

Nextdoor's highlighted metrics for the quarter ended September 30, 2024 include:

•Total Weekly Active Users (WAU) of 45.9 million increased 13% year-over-year.

•Revenue of $66 million increased 17% year-over-year.

•Net loss was $15 million, compared to $38 million in the year-ago period.

•Adjusted EBITDA loss was $1 million, compared to $20 million in the year-ago period.

•Ending cash, cash equivalents, and marketable securities were $425 million as of September 30, 2024.

"Our Q3 results demonstrate improved growth and operational efficiency," said Nextdoor CEO Nirav Tolia. "WAU increased 13% year-over-year as we continue to attract and engage users with relevant local content. Revenue increased 17% year-over-year reflecting improved ease of use and better performance for advertisers using our Nextdoor Ads Platform."

"We are executing with precision and purpose, better allocating resources toward growth, and have raised our FY 2024 outlook. I'm confident we will continue to deliver solid performance, while also developing NEXT, our complete platform transformation."

For more detailed information on our operating and financial results for the third quarter ended September 30, 2024, as well as our outlook for Q4 and fiscal year 2024, please reference our Shareholder Letter posted to our Investor Relations website located at investors.nextdoor.com.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| (in thousands) | 2024 | | 2023 | | 2024 | | 2023 |

| Revenue | $ | 65,610 | | | $ | 56,092 | | | $ | 182,048 | | | $ | 162,752 | |

| Loss from operations | $ | (20,777) | | | $ | (44,376) | | | $ | (104,542) | | | $ | (124,630) | |

| Net loss | $ | (14,898) | | | $ | (38,116) | | | $ | (85,940) | | | $ | (107,235) | |

Adjusted EBITDA(1) | $ | (1,317) | | | $ | (19,799) | | | $ | (21,311) | | | $ | (60,065) | |

(1) The following is a reconciliation of net loss, the most comparable GAAP measure, to adjusted EBITDA for the periods presented above:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| (in thousands) | 2024 | | 2023 | | 2024 | | 2023 |

| Net loss | $ | (14,898) | | | $ | (38,116) | | | $ | (85,940) | | | $ | (107,235) | |

| Depreciation and amortization | 777 | | | 1,451 | | | 3,307 | | | 4,356 | |

| Stock-based compensation | 18,440 | | | 23,343 | | | 54,181 | | | 60,735 | |

| Interest income | (5,804) | | | (6,766) | | | (19,059) | | | (18,635) | |

| Provision for income taxes | 168 | | | 289 | | | 683 | | | 714 | |

| Restructuring charges | — | | | — | | | 25,517 | | | — | |

| Adjusted EBITDA | $ | (1,317) | | | $ | (19,799) | | | $ | (21,311) | | | $ | (60,065) | |

| | | | | | | |

Net loss % Margin | (23) | % | | (68) | % | | (47) | % | | (66) | % |

Adjusted EBITDA % Margin | (2) | % | | (35) | % | | (12) | % | | (37) | % |

Nextdoor will host a conference call at 2:00 p.m. PT/5:00 p.m. ET today to discuss these results and outlook. A live webcast of our third quarter 2024 earnings release call will be available in the Events & Presentations section of Nextdoor’s Investor Relations website. After the live event, the audio recording for the webcast can be accessed on the same website for approximately one year.

Nextdoor uses its Investor Relations website (investors.nextdoor.com), its X handle (twitter.com/Nextdoor), and its LinkedIn Home Page (linkedin.com/company/nextdoor-com) as a means of disseminating or providing notification of, among other things, news or announcements regarding its business or financial performance, investor events, press releases, and earnings releases, and as a means of disclosing material nonpublic information and for complying with its disclosure obligations under Regulation FD.

Non-GAAP Financial Measures

To supplement our condensed consolidated financial statements, which are prepared in accordance with GAAP, we present certain non-GAAP financial measures, such as adjusted EBITDA and adjusted EBITDA margin, in this press release. Our use of non-GAAP financial measures has limitations as an analytical tool, and these measures should not be considered in isolation or as a substitute for analysis of financial results as reported under GAAP.

We use non-GAAP financial measures in conjunction with financial measures prepared in accordance with GAAP for planning purposes, including in the preparation of our annual operating budget, as a measure of our core operating results and the effectiveness of our business strategy, and in evaluating our financial performance. Non-GAAP financial measures provide consistency and comparability with past financial performance, facilitate period-to-period comparisons of core operating results, and also facilitate comparisons with other peer companies, many of which use similar non-GAAP financial measures to supplement their GAAP results. In addition, adjusted EBITDA is widely used by investors and securities analysts to measure a company's operating performance. We exclude the following items from one or more of our non-GAAP financial measures: stock-based compensation expense (non-cash expense calculated by companies using a variety of valuation methodologies and subjective assumptions), depreciation and amortization

(non-cash expense), interest income, provision for income taxes, and, if applicable, restructuring charges or acquisition-related costs.

Investors are cautioned that there are material limitations associated with the use of non-GAAP financial measures as an analytical tool. In particular, (1) stock-based compensation expense has recently been, and will continue to be for the foreseeable future, a significant recurring expense for our business and an important part of our compensation strategy, (2) although depreciation and amortization expense are non-cash charges, the assets subject to depreciation and amortization may have to be replaced in the future, and our non-GAAP measures do not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements, and (3) adjusted EBITDA does not reflect: (a) changes in, or cash requirements for, our working capital needs; (b) interest expense, or the cash requirements necessary to service interest or principal payments on our debt, which reduces cash available to us; or (c) tax payments that may represent a reduction in cash available to us. The non-GAAP measures we use may be different from non-GAAP financial measures used by other companies, limiting their usefulness for comparison purposes. We compensate for these limitations by providing specific information regarding the GAAP items excluded from these non-GAAP financial measures.

About Nextdoor

Nextdoor (NYSE: KIND) is the essential neighborhood network. Neighbors, businesses of all sizes, and public agencies in more than 340,000 neighborhoods across 11 countries turn to Nextdoor to connect to the neighborhoods that matter to them so that they can thrive. As a purpose-driven company, Nextdoor leverages innovative technology to cultivate a kinder world where everyone has a neighborhood they can rely on — both online and in the real world. Download the app or join the neighborhood at nextdoor.com. For more information and assets, visit nextdoor.com/newsroom.

Contacts

Investor Relations:

John T. Williams

ir@nextdoor.com

or visit investors.nextdoor.com

Media Relations:

Kelsey Grady

Antonia Gray

press@nextdoor.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

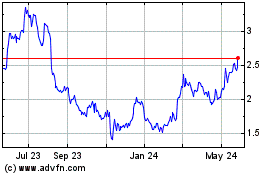

Nextdoor (NYSE:KIND)

Historical Stock Chart

From Dec 2024 to Jan 2025

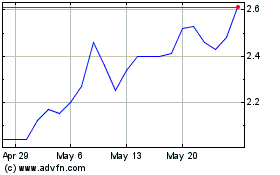

Nextdoor (NYSE:KIND)

Historical Stock Chart

From Jan 2024 to Jan 2025