Paysafe Limited (“Paysafe” or the “Company”) (NYSE: PSFE), a

leading payments platform, today announced its financial results

for the second quarter of 2024.

Second Quarter 2024 Financial Highlights (Metrics

compared to second quarter of 2023, unless otherwise noted)

- Revenue of $439.9 million, increased 9%; increased 10% on a

constant currency basis

- Total Payment Volume of $38.1 billion, increased 7%

- Net loss of $1.4 million, or ($0.02) per diluted share,

compared to net loss of $1.8 million, or ($0.03) per diluted

share

- Adjusted net income of $36.3 million, or $0.59 per diluted

share, compared to $34.7 million, or $0.56 per diluted share

- Adjusted EBITDA of $119.0 million, increased 5%; increased 6%

on a constant currency basis

- Net leverage1 decreased to 4.8x as of June 30, 2024, compared

to 5.0x as of December 31, 2023

Bruce Lowthers, CEO of Paysafe, commented: “Paysafe’s momentum

continues with higher quality revenue growth accelerating to 9% in

the second quarter, driven by strong performance across all major

product lines and execution on our 2024 strategic initiatives and

investments. These efforts continue to strengthen our foundation

and position us for sustainable long-term success. Given our robust

performance in the first half of the year, we are raising our

revenue guidance for 2024 to a growth range of 7% to 8%, 125 basis

point increase at the mid-point from our original 2024 guidance

mid-point.”

Full Year 2024 Financial Guidance

($ in millions) (unaudited)

Full Year 2024 - prior

Full Year 2024 -

updated

Revenue

$1,688 - $1,712

$1,713 - $1,729

Adjusted EBITDA

$473 - $488

$471 - $484

Recent Strategic and Operational Highlights

- Continue to execute our 2024 new sales hires and portfolio

optimization initiatives with each remaining on track or ahead of

schedule, enhancing Paysafe’s go-to-market capabilities and drive

long-term growth

- Sales team continues to execute on selling more value-add

services in the quarter helping to boost Merchant Solutions' take

rates

- iGaming revenue growth continues to benefit from deals signed

in second half of 2023 and U.S. states that legalized online

gambling in 2023

- Continue to rationalize portfolio to reduce risk and improve

quality of earnings

- Established partnership with Riot Games to provide gamers with

the ability to use paysafecard for a seamless and secure

transactional experience

- Capital returns – repurchased 686,396 shares for $11.0

million

(1)

Paysafe defines net leverage as net debt

(total debt less cash and cash equivalents) divided by the sum of

the last twelve months (LTM) Adjusted EBITDA. For the period ended

June 30, 2024, total debt was $2,451.4 million and cash and cash

equivalents was $222.4 million, and LTM Adjusted EBITDA was $468.7

million. For the period ended December 31, 2023, total debt was

$2,501.8 million and cash and cash equivalents was $202.3 million,

and LTM Adjusted EBITDA was $458.7 million.

Second Quarter of 2024 Summary of Consolidated

Results

Three Months Ended

Six Months Ended

June 30,

June 30,

($ in thousands) (unaudited)

2024

2023

2024

2023

Revenue

$

439,924

$

402,338

$

857,662

$

790,187

Gross Profit (excluding depreciation and

amortization)

$

256,099

$

235,724

$

503,464

$

464,634

Net (loss) / income

$

(1,430

)

$

(1,765

)

$

1,626

$

(5,573

)

Adjusted EBITDA

$

119,006

$

113,031

$

230,922

$

220,846

Adjusted net income

$

36,279

$

34,678

$

71,585

$

67,754

Total revenue for the second quarter of 2024 was $439.9 million,

an increase of 9%, compared to $402.3 million in the prior year

period, reflecting 7% growth in total payment volume. Excluding a

$2.1 million unfavorable impact from changes in foreign exchange

rates, total revenue increased 10%. Revenue from the Merchant

Solutions segment increased 13%, reflecting double-digit growth in

e-commerce as well as growth from small and medium-sized businesses

("SMBs") driven by initiatives to expand our sales capabilities and

optimize the portfolio. Revenue from the Digital Wallets segment

increased 6% as reported and 7% in constant currency, reflecting

growth from gambling merchants as well as ongoing initiatives

related to product and consumer engagement.

Net loss for the second quarter decreased to $1.4 million,

compared to $1.8 million in the prior year period. This was largely

due to increased operating income, mainly driven by higher

revenues, and decreased tax expense, slightly offset by a reduction

in other income.

Adjusted net income for the second quarter increased 5% to $36.3

million, compared to $34.7 million in the prior year period.

Adjusted EBITDA for the second quarter was $119.0 million, an

increase of 5%, compared to $113.0 million in the prior year

period. Excluding a $0.7 million unfavorable impact from changes in

foreign exchange rates, Adjusted EBITDA increased 6%, primarily

reflecting revenue growth, partially offset by incremental expenses

related to previously announced initiatives to expand the sales

team and optimize the portfolio.

Second quarter operating cash flow was $54.1 million, compared

to $50.2 million in the prior year period, which was mainly driven

by movements in working capital. Unlevered free cash flow was $70.0

million, compared to $76.2 million in the prior year period, driven

by the timing of bonus payments.

Balance Sheet

As of June 30, 2024, total cash and cash equivalents was $222.4

million, total debt was $2.5 billion and net debt was $2.2 billion.

Compared to December 31, 2023, total debt decreased by $50.4

million, reflecting net repayments of $13.3 million as well as

movement in foreign exchange rates.

Summary of Segment Results

Three Months Ended

Six Months Ended

June 30,

YoY

June 30,

YoY

($ in thousands) (unaudited)

2024

2023

change

2024

2023

change

Revenue:

Merchant Solutions

$

254,978

$

225,698

13

%

$

486,376

$

434,219

12

%

Digital Wallets

$

189,673

$

179,079

6

%

$

380,130

$

360,527

5

%

Intersegment

$

(4,727

)

$

(2,439

)

94

%

$

(8,844

)

$

(4,559

)

94

%

Total Revenue

$

439,924

$

402,338

9

%

$

857,662

$

790,187

9

%

Adjusted EBITDA:

Merchant Solutions

$

56,511

$

55,769

1

%

$

105,689

$

108,105

-2

%

Digital Wallets

$

82,413

$

77,211

7

%

$

165,687

$

156,420

6

%

Corporate

$

(19,918

)

$

(19,949

)

0

%

$

(40,454

)

$

(43,679

)

7

%

Total Adjusted EBITDA

$

119,006

$

113,031

5

%

$

230,922

$

220,846

5

%

Webcast and Conference Call

Paysafe will host a live webcast to discuss the results today at

8:30 a.m. (ET). The webcast and supplemental information can be

accessed on the investor relations section of the Paysafe website

at ir.paysafe.com. An archive will be available after the

conclusion of the live event and will remain available via the same

link for one year.

Time

Tuesday, August 13 2024, at 8:30 a.m.

ET

Webcast

Go to the Investor Relations section of

the Paysafe website to listen and view slides

Dial in

877-407-0752 (U.S. toll-free);

201-389-0912 (International)

About Paysafe

Paysafe Limited (“Paysafe”) (NYSE: PSFE) (PSFE.WS) is a leading

payments platform with an extensive track record of serving

merchants and consumers in the global entertainment sectors. Its

core purpose is to enable businesses and consumers to connect and

transact seamlessly through industry-leading capabilities in

payment processing, digital wallet, and online cash solutions. With

over 25 years of online payment experience, an annualized

transactional volume of $140 billion in 2023, and approximately

3,200 employees located in 12+ countries, Paysafe connects

businesses and consumers across 260 payment types in over 40

currencies around the world. Delivered through an integrated

platform, Paysafe solutions are geared toward mobile-initiated

transactions, real-time analytics and the convergence between

brick-and-mortar and online payments. Further information is

available at www.paysafe.com.

Forward-looking Statements

This press release includes “forward-looking statements” within

the meaning of U.S. federal securities laws. These forward-looking

statements are provided for illustrative purposes only and are not

intended to serve as, and must not be relied on by any investor as,

a guarantee, an assurance, a prediction or a definitive statement

of fact or probability. Paysafe Limited’s (“Paysafe,” “PSFE,” the

“Company,” “we,” “us,” or “our”) actual results may differ from

their expectations, estimates, and projections and, consequently,

you should not rely on these forward-looking statements as

predictions of future events. Words such as “anticipate,” “appear,”

“approximate,” “believe,” “budget,” “continue,” “could,”

“estimate,” “expect,” “forecast,” “foresee,” “guidance,” “intends,”

“likely,” “may,” “might,” “plan,” “possible,” “potential,”

“predict,” “project,” “seek,” “should,” "will," “would” and

variations of such words and similar expressions (or the negative

version of such words or expressions) may identify forward-looking

statements, but the absence of these words does not mean that a

statement is not forward-looking. These forward-looking statements

include, without limitation, Paysafe’s expectations with respect to

future performance.

These forward-looking statements involve significant risks,

uncertainties, and events that may cause the actual results to

differ materially, and potentially adversely, from those expressed

or implied in the forward-looking statements. While the Company

believes its assumptions concerning future events are reasonable, a

number of factors could cause actual results to differ materially

from those projected, including, but not limited to: cyberattacks

and security vulnerabilities; complying with and changes in money

laundering regulations, financial services regulations,

cryptocurrency regulations, consumer and business privacy and data

use regulations or other regulations in Bermuda, the UK, Ireland,

Switzerland, the United States, Canada and elsewhere; risks related

to our focus on specialized and high-risk verticals; geopolitical

events and the economic and other impacts of such geopolitical

events and the responses of governments around the world; acts of

war and terrorism; the effects of global economic uncertainties,

including inflationary pressure and rising interest rates, on

consumer and business spending; risks associated with foreign

currency exchange rate fluctuations; changes in our relationships

with banks, payment card networks, issuers and financial

institutions; risk related to processing online payments for

merchants and customers engaged in the online gambling and foreign

exchange trading sectors; risks related to becoming an unwitting

party to fraud or being deemed to be handling proceeds resulting

from the criminal activity by customers; the effects of

chargebacks, merchant insolvency and consumer deposit settlement

risk; changes to our continued financial institution sponsorships;

failure to hold, safeguard or account accurately for merchant or

customer funds; risks related to the availability, integrity and

security of internal and external IT transaction processing systems

and services; our ability to manage regulatory and litigation

risks, and the outcome of legal and regulatory proceedings; failure

of fourth parties to comply with contractual obligations; changes

and compliance with payment card network operating rules;

substantial and increasingly intense competition worldwide in the

global payments industry; risks related to developing and

maintaining effective internal controls over financial reporting;

managing our growth effectively, including growing our revenue

pipeline; any difficulties maintaining a strong and trusted brand;

keeping pace with rapid technological developments; risks

associated with the significant influence of our principal

shareholders; the effect of regional epidemics or a global pandemic

on our business; and other factors included in the “Risk Factors”

in our Form 20-F and in other filings we make with the SEC, which

are available at https://www.sec.gov. Readers are cautioned not to

place undue reliance upon any forward-looking statements, which

speak only as of the date made.

The Company expressly disclaims any obligations or undertaking

to release publicly any updates or revisions to any forward-looking

statements contained herein to reflect any change in their

expectations with respect thereto or any change in events.

Paysafe Limited Condensed Consolidated

Statements of Operations (unaudited)

Three Months Ended

Six Months Ended

June 30,

June 30,

($ in thousands)

2024

2023

2024

2023

Revenue

$

439,924

$

402,338

$

857,662

$

790,187

Cost of services (excluding depreciation

and amortization)

183,825

166,614

354,198

325,553

Selling, general and administrative

150,059

133,600

294,867

261,911

Depreciation and amortization

68,630

66,425

136,940

129,972

Impairment expense on goodwill and

intangible assets

23

193

676

275

Restructuring and other costs

728

1,340

1,180

3,330

Loss on disposal of subsidiary and other

assets, net

144

—

321

—

Operating income

36,515

34,166

69,480

69,146

Other income, net

4,397

7,376

16,752

9,923

Interest expense, net

(37,135

)

(36,762

)

(72,100

)

(74,218

)

Income before taxes

3,777

4,780

14,132

4,851

Income tax expense

5,207

6,545

12,506

10,424

Net (loss) / income

$

(1,430

)

$

(1,765

)

$

1,626

$

(5,573

)

Net (loss) / income per share – basic

$

(0.02

)

$

(0.03

)

$

0.03

$

(0.09

)

Net (loss) / income per share –

diluted

$

(0.02

)

$

(0.03

)

$

0.03

$

(0.09

)

Net (loss) / income

$

(1,430

)

$

(1,765

)

$

1,626

$

(5,573

)

Other comprehensive (loss) / income, net

of tax of $0:

(Loss)/gain on foreign currency

translation

(6,055

)

8,204

(13,667

)

10,378

Total comprehensive (loss) /

income

$

(7,485

)

$

6,439

$

(12,041

)

$

4,805

Paysafe Limited Consolidated Net (loss) /

income per share

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

Numerator ($ in thousands)

Net (loss) / income - basic

$

(1,430

)

$

(1,765

)

$

1,626

$

(5,573

)

Net (loss) / income - diluted

$

(1,430

)

$

(1,765

)

$

1,626

$

(5,573

)

Denominator (in millions)

Weighted average shares – basic

60.7

61.5

61.2

61.2

Weighted average shares – diluted (1)

60.7

61.5

61.7

61.2

Net (loss) / income per share

Basic

$

(0.02

)

$

(0.03

)

$

0.03

$

(0.09

)

Diluted

$

(0.02

)

$

(0.03

)

$

0.03

$

(0.09

)

(1)

The denominator used in the calculation of

diluted net income per share for the six months ended June 30,

2024, includes an additional 0.5 million shares, representing the

dilutive effect of the Company's restricted stock units.

Paysafe Limited Condensed Consolidated

Balance Sheets (unaudited)

($ in thousands)

June 30, 2024

December 31, 2023

Assets

Current assets

Cash and cash equivalents

$

222,382

$

202,322

Customer accounts and other restricted

cash

1,069,269

1,295,947

Accounts receivable, net of allowance for

credit losses of $5,677 and $5,240, respectively

177,323

162,081

Settlement receivables, net of allowance

for credit losses of $4,334 and $5,197, respectively

166,877

171,224

Prepaid expenses and other current

assets

66,810

74,919

Total current assets

1,702,661

1,906,493

Deferred tax assets

77,273

77,273

Property, plant and equipment, net

22,175

17,213

Operating lease right-of-use assets

26,110

22,120

Derivative financial assets

9,888

10,427

Intangible assets, net

1,062,881

1,163,935

Goodwill

2,000,689

2,023,402

Other assets – non-current

8,689

6,838

Total non-current assets

3,207,705

3,321,208

Total assets

$

4,910,366

$

5,227,701

Liabilities and equity

Current liabilities

Accounts payable and other liabilities

$

190,541

$

202,699

Short-term debt

10,190

10,190

Funds payable and amounts due to

customers

1,254,680

1,477,017

Operating lease liabilities – current

8,073

8,233

Contingent consideration payable –

current

9,908

11,828

Liability for share-based compensation –

current

3,405

2,701

Total current liabilities

1,476,797

1,712,668

Non-current debt

2,441,205

2,491,643

Operating lease liabilities –

non-current

21,740

16,963

Deferred tax liabilities

103,618

111,705

Warrant liabilities

1,283

1,423

Liability for share-based compensation –

non-current

2,545

3,108

Contingent consideration payable –

non-current

325

6,878

Total non-current liabilities

2,570,716

2,631,720

Total liabilities

4,047,513

4,344,388

Commitments and contingent liabilities

Total shareholders' equity

862,853

883,313

Total liabilities and shareholders'

equity

$

4,910,366

$

5,227,701

Paysafe Limited Condensed Consolidated

Statements of Cash Flow (unaudited)

Six Months Ended

June 30,

($ in thousands)

2024

2023 (1)

Cash flows from operating

activities

Net income / (loss)

$

1,626

$

(5,573

)

Adjustments for non-cash items:

Depreciation and amortization

137,461

129,972

Unrealized foreign exchange (gain) /

loss

(3,872

)

7,207

Deferred tax (benefit) / expense

(6,191

)

8,104

Interest expense, net

(4,962

)

(666

)

Share-based compensation

22,325

18,123

Other income, net

(9,542

)

(14,627

)

Impairment expense on goodwill and

intangible assets

676

275

Allowance for credit losses and other

19,205

9,241

Loss on disposal of subsidiary and other

assets, net

321

—

Non-cash lease expense

4,335

4,501

Movements in working capital:

Accounts receivable, net

(31,131

)

(17,648

)

Prepaid expenses and other current

assets

(3,646

)

(7,488

)

Accounts payable and other liabilities

(10,909

)

(37,174

)

Income tax receivable

(2,721

)

(24,033

)

Net cash flows from operating

activities

112,975

70,214

Cash flows in investing

activities

Purchase of property, plant &

equipment

(8,227

)

(6,339

)

Purchase of merchant portfolios

—

(23,488

)

Other intangible asset expenditures

(46,666

)

(49,487

)

Receipts under derivative financial

instruments

4,949

4,784

Cash inflow from merchant reserves

6,510

—

Other investing activities, net

1,626

(478

)

Net cash flows used in investing

activities

(41,808

)

(75,008

)

Cash flows from financing

activities

Cash settled equity awards

—

(484

)

Repurchases of shares withheld for

taxes

(5,320

)

(6,709

)

Purchase of treasury shares

(25,000

)

—

Settlement funds - merchants and

customers, net

(195,156

)

(423,099

)

Repurchase of borrowings

(67,928

)

(83,635

)

Proceeds from loans and borrowings

129,291

55,781

Repayments of loans and borrowings

(73,412

)

(55,044

)

Proceeds under line of credit

450,000

450,000

Repayments under line of credit

(450,000

)

(450,000

)

Contingent consideration paid

(8,597

)

(7,642

)

Net cash flows used in financing

activities

(246,122

)

(520,832

)

Effect of foreign exchange rate

changes

(31,663

)

31,553

Decrease in cash and cash equivalents,

including customer accounts and other restricted cash during the

period

$

(206,618

)

$

(494,073

)

Cash and cash equivalents, including

customer accounts and other restricted cash at beginning of the

period

1,498,269

2,127,195

Cash and cash equivalents at end of the

period, including customer accounts and other restricted

cash

$

1,291,651

$

1,633,122

Six Months Ended

June 30,

2024

2023

Cash and cash equivalents

$

222,382

$

206,703

Customer accounts and other restricted

cash

1,069,269

1,426,419

Total cash and cash equivalents,

including customer accounts and other restricted cash

$

1,291,651

$

1,633,122

(1)

During the fourth quarter of 2023, the

Company elected to change its presentation of the cash flows

associated with "Settlement receivables, net" and "Funds payable

and amounts due to customers" from operating activities, to present

them as financing activities within its Consolidated Statements of

Cash Flows. Comparative amounts have been recast to conform to

current period presentation. These recasts had no impact on the

Consolidated Statements of Comprehensive Loss, Consolidated

Statements of Financial Position or Consolidated Statements of

Shareholders' Equity.

Non-GAAP Financial Measures

To supplement the Company’s condensed consolidated financial

statements presented in accordance with generally accepted

accounting principles, or GAAP, the company uses non-GAAP measures

of certain components of financial performance. This includes Gross

Profit (excluding depreciation and amortization), Adjusted EBITDA,

Unlevered free cash flow, Adjusted net income, Adjusted net income

per share, and Net leverage which are supplemental measures that

are not required by, or presented in accordance with, accounting

principles generally accepted in the United States (“U.S.

GAAP”).

Gross Profit (excluding depreciation and amortization) is

defined as revenue less cost of services (excluding depreciation

and amortization). Management believes Gross Profit to be a useful

profitability measure to assess the performance of our businesses

and ability to manage cost.

Adjusted EBITDA is defined as net income/(loss) before the

impact of income tax (benefit)/expense, interest expense, net,

depreciation and amortization, share-based compensation, impairment

expense on goodwill and intangible assets, restructuring and other

costs, loss/(gain) on disposal of a subsidiaries and other assets,

net, and other income/(expense), net. These adjustments also

include certain costs and transaction items that are not reflective

of the underlying operating performance of the Company. Management

believes Adjusted EBITDA to be a useful profitability measure to

assess the performance of our businesses and improves the

comparability of operating results across reporting periods.

Adjusted net income excludes the impact of certain

non-operational and non-cash items. Adjusted net income is defined

as net income/(loss) attributable to the Company before the impact

of other non-operating income / (expense), net, impairment expense

on goodwill and intangible assets, restructuring and other costs,

accelerated amortization of debt fees, amortization of acquired

assets, loss/(gain) on disposal of subsidiaries and other assets,

share-based compensation, discrete tax items and the income tax

(benefit)/expense on these non-GAAP adjustments. Adjusted net

income per share is adjusted net income as defined above divided by

adjusted weighted average dilutive shares outstanding. Management

believes the removal of certain non-operational and non-cash items

from net income enhances shareholders ability to evaluate the

Company’s business performance and profitability by improving

comparability of operating results across reporting periods.

Unlevered free cash flow is defined as net cash flows provided

by/used in operating activities, adjusted for the impact of capital

expenditure, payments relating to restructuring and other costs and

cash paid for interest. Capital expenditure includes purchases of

property plant & equipment and purchases of other intangible

assets, including software development costs. Capital expenditure

does not include purchases of merchant portfolios. Management

believes unlevered free cash flow to be a liquidity measure that

provides useful information about the amount of cash generated by

the business.

Net leverage is defined as net debt (gross debt less cash and

cash equivalents) divided by the last twelve months Adjusted

EBITDA. Management believes net leverage is a useful measure of the

Company's credit position and progress towards leverage

targets.

Management believes the presentation of these non-GAAP financial

measures, including Gross Profit, Adjusted EBITDA, Unlevered free

cash flow, Adjusted net income, Adjusted net income per share, and

Net leverage when considered together with the Company’s results

presented in accordance with GAAP, provide users with useful

supplemental information in comparing the operating results across

reporting periods by excluding items that are not considered

indicative of Paysafe’s core operating performance. In addition,

management believes the presentation of these non-GAAP financial

measures provides useful supplemental information in assessing the

Company’s results on a basis that fosters comparability across

periods by excluding the impact on the Company’s reported GAAP

results of acquisitions and dispositions that have occurred in such

periods. However, these non-GAAP measures exclude items that are

significant in understanding and assessing Paysafe’s financial

results or position. Therefore, these measures should not be

considered in isolation or as alternatives to revenue, net income,

cash flows from operations or other measures of profitability,

liquidity or performance under GAAP.

You should be aware that Paysafe’s presentation of these

measures may not be comparable to similarly titled measures used by

other companies. In addition, the forward-looking non-GAAP

financial measure of Adjusted EBITDA provided herein have not been

reconciled to the comparable GAAP measure due to the inherent

difficulty in forecasting and quantifying certain amounts that are

necessary for such reconciliations. We have reconciled the

historical non-GAAP financial measures presented herein to their

most directly comparable GAAP financial measures. A reconciliation

of our forward-looking non-GAAP financial measures to their most

directly comparable GAAP financial measures cannot be provided

without unreasonable effort because of the inherent difficulty of

accurately forecasting the occurrence and financial impact of the

adjusting items necessary for such reconciliations that have not

yet occurred, are out of our control, or cannot be reasonably

predicted. For the same reasons, we are unable to address the

probable significance of the unavailable information, which could

be material to future results.

Reconciliation of GAAP Net (Loss) / Income to Adjusted

EBITDA

Three Months Ended

Six Months Ended

June 30,

June 30,

($ in thousands)

2024

2023

2024

2023

Net (loss) / income

$

(1,430

)

$

(1,765

)

$

1,626

$

(5,573

)

Income tax expense

5,207

6,545

12,506

10,424

Interest expense, net

37,135

36,762

72,100

74,218

Depreciation and amortization

68,630

66,425

136,940

129,972

Share-based compensation expense

12,966

10,907

22,325

18,123

Impairment expense on goodwill and

intangible assets

23

193

676

275

Restructuring and other costs

728

1,340

1,180

3,330

Loss on disposal of subsidiaries and other

assets, net

144

—

321

—

Other income, net

(4,397

)

(7,376

)

(16,752

)

(9,923

)

Adjusted EBITDA

$

119,006

$

113,031

$

230,922

$

220,846

Reconciliation of Operating Cash Flow to Non-GAAP Unlevered

Free Cash Flow

Three Months Ended

Six Months Ended

June 30,

June 30,

($ in thousands)

2024

2023 (1)

2024

2023 (1)

Net cash inflows from operating

activities

$

54,140

$

50,200

$

112,975

$

70,214

Capital expenditure

(30,468

)

(25,458

)

(54,893

)

(55,826

)

Cash paid for interest

45,731

45,991

77,062

74,884

Payments relating to Restructuring and

other costs

598

5,481

4,051

29,165

Unlevered Free Cash Flow

$

70,001

$

76,214

$

139,195

$

118,437

Adjusted EBITDA

119,006

113,031

230,922

220,846

(1)

During the fourth quarter of 2023, the Company elected to change

its presentation of "Settlement receivables, net" and "Funds

payable and amounts due to customers" from operating activities, to

present them as financing activities within its Consolidated

Statements of Cash Flows. As a result, the reconciling item related

to "Movements in customer accounts and other restricted cash" is no

longer required in the unlevered free cash flow reconciliation.

Comparative amounts have been recast to conform to current period

presentation.

Reconciliation of GAAP Gross Profit to Non-GAAP Gross Profit

(excluding depreciation and amortization)

Three Months Ended

Six Months Ended

June 30,

June 30,

($ in thousands)

2024

2023

2024

2023

Revenue

$

439,924

$

402,338

$

857,662

$

790,187

Cost of services (excluding depreciation

and amortization)

183,825

166,614

354,198

325,553

Depreciation and amortization

68,630

66,425

136,940

129,972

Gross Profit (1)

$

187,469

$

169,299

$

366,524

$

334,662

Depreciation and amortization

68,630

66,425

136,940

129,972

Gross Profit (excluding depreciation

and amortization)

$

256,099

$

235,724

$

503,464

$

464,634

(1)

Gross Profit has been calculated as revenue, less cost of

services and depreciation and amortization. Gross profit is not

presented within the Company's consolidated financial

statements.

Reconciliation of GAAP Net (Loss) / Income to Adjusted Net

Income

Three Months Ended

Six Months Ended

June 30,

June 30,

($ in thousands)

2024

2023

2024

2023

Net (loss) / income

$

(1,430

)

$

(1,765

)

$

1,626

$

(5,573

)

Other non operating income, net (1)

(1,864

)

(4,814

)

(11,638

)

(5,578

)

Impairment expense on goodwill and

intangible assets

23

193

676

275

Amortization of acquired assets (2)

33,527

34,095

67,130

67,768

Restructuring and other costs

728

1,340

1,180

3,330

Loss on disposal of subsidiaries and other

assets, net

144

—

321

—

Share-based compensation expense

12,966

10,907

22,325

18,123

Discrete tax items (3)

4,608

5,406

10,073

10,885

Income tax expense on non-GAAP adjustments

(4)

(12,423

)

(10,684

)

(20,108

)

(21,476

)

Adjusted net income

$

36,279

$

34,678

$

71,585

$

67,754

(in millions)

Weighted average shares -

diluted

60.7

61.5

61.7

61.2

Adjusted diluted impact

0.5

0.1

0.0

0.3

Adjusted weighted average shares -

diluted

61.2

61.6

61.7

61.5

(1)

Other non-operating income, net primarily consists of income and

expenses outside of the Company's operating activities, including,

fair value gain / loss on warrant liabilities and derivatives, gain

/ loss on repurchases of debt, gain / loss on foreign exchange and

the release of certain provisions.

(2)

Amortization of acquired asset represents amortization expense

on the fair value of intangible assets acquired through various

Company acquisitions, including brands, customer relationships,

software and merchant portfolios.

(3)

Discrete tax items mainly represent (a)

valuation allowance recorded on deferred tax assets of $3,804 and

$4,013 for the three months ended June 30, 2024 and 2023,

respectively, and $9,306 and $4,753 for the six months ended June

30, 2024 and 2023, respectively (b) measurement period adjustments

which were ($325) and ($1,612) for the three months ended June 30,

2024 and 2023, respectively, and ($382) and $917 for the six months

ended June 30, 2024 and 2023, respectively, and (c) discrete tax

expense on share-based compensation, which would not have been

incurred as share-based compensation expense is removed from

adjusted net income, of $2,290 and $3,741 for the three months

ended June 30, 2024 and 2023, respectively, and $2,472 and $3,741

for the six months ended June 30, 2024 and 2023, respectively. The

remaining discrete tax items relate to the remeasurement of certain

deferred tax balances due to changes in the statutory tax rates in

certain jurisdictions.

(4)

Income tax expense on non-GAAP adjustments reflects the tax

expense on each taxable adjustment using the current statutory tax

rate of the applicable jurisdiction specific to that

adjustment.

Adjusted Net Income per Share

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

Numerator ($ in thousands)

Adjusted net income - basic

$

36,279

$

34,678

$

71,585

$

67,754

Adjusted net income - diluted

$

36,279

$

34,678

$

71,585

$

67,754

Denominator (in millions)

Weighted average shares – basic

60.7

61.5

61.2

61.2

Adjusted weighted average shares – diluted

(1)

61.2

61.6

61.7

61.5

Adjusted net income per share

Basic

$

0.60

$

0.56

$

1.17

$

1.11

Diluted

$

0.59

$

0.56

$

1.16

$

1.10

(1)

The denominator used in the calculation of diluted adjusted net

income per share for the three and six months ended June 30, 2024

and 2023 includes the dilutive effect of the Company's restricted

stock units.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240812783901/en/

Media Crystal Wright Paysafe crystal.wright@paysafe.com +1 (904)

328-7740

Investors Matthew Parker Paysafe +1 (904) 663-2143

matthew.parker@paysafe.com

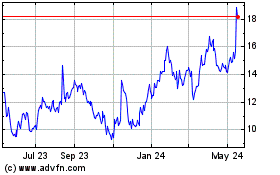

Paysafe (NYSE:PSFE)

Historical Stock Chart

From Oct 2024 to Nov 2024

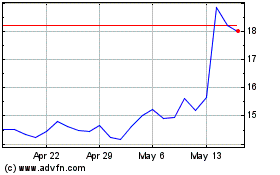

Paysafe (NYSE:PSFE)

Historical Stock Chart

From Nov 2023 to Nov 2024