Canacol Energy Ltd. Provides Gas Sales and Drilling Update

October 10 2023 - 7:00AM

Canacol Energy Ltd. ("Canacol" or the "Corporation") (TSX:CNE;

OTCQX:CNNEF; BVC:CNEC) provides the following gas sales and

drilling operations update.

September Gas Sales of 161

MMscfpd

Realized contractual natural gas sales (which

are gas produced, delivered, and paid for) were 161 million

standard cubic feet per day for September 2023. Average realized

contractual natural gas sales for the month of October 2023 to date

are 162 MMscfpd, with current contractual natural gas sales as of

October 9, 2023 being 180 MMscfpd of gas.

Realized contractual natural gas sales for the

third quarter of 2023 averaged 178 MMscfpd, down slightly from the

185 MMscfpd and 186 MMscfpd reported in the second and first

quarters respectively. Preliminary adjusted EBITDAX for the third

quarter is estimated to be $61 million and in line with the $60.7

million and $60.9 million reported in the second and first quarters

respectively.

Commencing the second week of August 2023 the

Corporation experienced unusual and unexpected production capacity

restrictions at some of its gas fields as a result of issues at the

Jobo gas treatment facility as well as certain of its producing

wells. As a result of the foregoing the Corporation has had to

restrict gas deliveries under certain supply contracts dedicated to

supplying non-essential gas demand, all in accordance with

applicable Colombian regulations and in consultation with the

relevant authorities. The Corporation is presently working on

remediating this short-term disruption and expects to have

production back to normal levels shortly. The Corporation

anticipates that it will be able to make up lost sales volumes by

year end and meet its average production and financial targets and

therefore does not expect this situation to have a material impact

on its operations and results.

Near Term Drilling Program

The Corporation completed the drilling of the

Aguas Vivas 4 development well on September 16, 2023, encountering

357 feet true vertical depth (“ft TVD”) of net gas pay within the

main Cienaga de Oro sandstone (“CDO”) target. The well was tied

into permanent production and has been on production since

September 26, 2023.

The Corporation completed the drilling of the

Clarinete 9 development well on October 5, 2023. The well

encountered 236 ft TVD of net gas pay within the CDO sandstone

reservoir and is currently being cased and completed prior to tying

into the permanent production facility by October 24, 2023.

The Corporation completed the drilling of the

Fresa 2 appraisal well targeting sandstones of the upper CDO

sandstone reservoir that are productive in the offsetting Fresa 1

exploration well drilled in 2021. Fresa 2 encountered 10 ft TVD of

net gas pay within the upper CDO target. The Corporation is

scheduling to complete and tie in the Fresa 2 well in November

2023.

The Corporation is currently drilling the

Pandereta 9 and Nelson 15 development wells, both targeting infill

drilling locations within the respective producing fields. The

Corporation plans to have both wells tied in and on production

prior to the end of October 2023.

About Canacol

Canacol is a natural gas exploration and

production company with operations focused in Colombia. The

Corporation's common stock trades on the Toronto Stock Exchange,

the OTCQX in the United States of America, and the Colombia Stock

Exchange under ticker symbol CNE, CNNEF, and CNEC,

respectively.

Forward-Looking Statements

This press release contains certain

forward-looking statements within the meaning of applicable

securities law. Forward-looking statements are frequently

characterized by words such as "plan", "expect", "project",

"intend", "believe", "anticipate", "estimate" and other similar

words, or statements that certain events or conditions "may" or

"will" occur, including without limitation statements relating to

estimated production rates from the Corporation's properties and

intended work programs and associated timelines. Forward-looking

statements are based on the opinions and estimates of management at

the date the statements are made and are subject to a variety of

risks and uncertainties and other factors that could cause actual

events or results to differ materially from those projected in the

forward-looking statements. The Corporation cannot assure that

actual results will be consistent with these forward-looking

statements. They are made as of the date hereof and are subject to

change and the Corporation assumes no obligation to revise or

update them to reflect new circumstances, except as required by

law. Prospective investors should not place undue reliance on

forward looking statements. These factors include the inherent

risks involved in the exploration for and development of crude oil

and natural gas properties, the uncertainties involved in

interpreting drilling results and other geological and geophysical

data, fluctuating energy prices, the possibility of cost overruns

or unanticipated costs or delays and other uncertainties associated

with the oil and gas industry. Other risk factors could include

risks associated with negotiating with foreign governments as well

as country risk associated with conducting international

activities, and other factors, many of which are beyond the control

of the Corporation.

Realized contractual gas sales is defined as gas

produced and sold plus gas revenues received from nominated take or

pay contracts.

For more information please contact:

Investor Relations

South America: +571.621.1747 IR-SA@canacolenergy.com

Global: +1.403.561.1648 IR-GLOBAL@canacolenergy.com

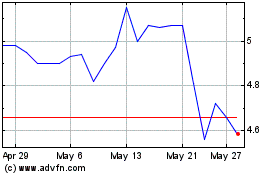

Canacol Energy (TSX:CNE)

Historical Stock Chart

From Jan 2025 to Feb 2025

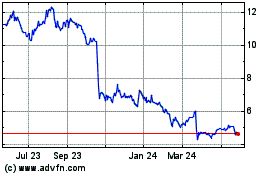

Canacol Energy (TSX:CNE)

Historical Stock Chart

From Feb 2024 to Feb 2025