Intermap Technologies (TSX: IMP; OTCQB: ITMSF) (“Intermap” or the

“Company”), a global leader in 3D geospatial products and

intelligence solutions, today announced that Česká podnikatelská

pojišťovna (ČPP), a subsidiary of the Vienna Insurance Group, has

subscribed to Intermap’s innovative solution for determining the

market price of real estate properties.

Intermap and its partner Dataligence recently launched a

solution that combines Intermap’s data and analytics for

underwriting, reinsurance and claims with Dataligence’s world-class

pricing and real estate databases. ČPP, a long-term user of

Intermap’s Aquarius RMA, is the newest major EU insurance group

customer to adopt this innovative solution.

This advanced property valuation process meets the growing

demand for digitized property services in the Czech market,

improving transparency in real estate data.

By utilizing Intermap’s up-to-date flood and natural hazard maps

within its Aquarius RMA software, alongside Dataligence’s extensive

real estate data, this solution enables accurate online property

valuation. It processes comprehensive databases of flood, natural

hazard, and real estate information to streamline transactions,

providing insurers with reliable and precise property valuations

for underwriting purposes.

“We chose this innovative solution because it will make it

easier and more convenient for our clients to arrange insurance. At

the same time, we see our partners as technology leaders whose data

is accurate, robust and reliable,” said Michal Šimon, manager of

non-life insurance at Česká podnikatelská pojišťovna.

“We are always excited when we find new ways to use our

world-class pricing and real estate datasets,” said Milan Roček,

founder and CEO of Dataligence. “Last year, we made our innovative

tools available to the general public through the www.hypox.cz app,

and the continued integration of online pricing into insurance

companies’ systems embodies our vision for modern insurance and

real estate services, where clients don't have to worry about

anything, yet their assets are reliably protected.”

“Intermap’s solutions for the insurance market use proprietary

datasets that are integrated into insurance processes to provide

insurers with comprehensive tools that can be used throughout a

portfolio lifecycle,” said Patrick A. Blott, Intermap Chairman and

CEO. “Our state-of-the-art software, analytics and data enable

insurers to understand and underwrite natural hazard risks, then

leverage data intelligence to actively manage and reinsure risk

with attractive margins.”

Intermap’s services are more important than ever. According to

Resources for the Future, “the private residential flood insurance

market in the United States is currently small relative to the

NFIP. We estimate that private flood insurance accounts for roughly

3.5 to 4.5 percent of all primary residential flood policies

currently purchased.” With historic flooding recently, this

demonstrates the need for dramatic increase in coverage. CoreLogic

“estimates Hurricane Helene industry insured loss at $10.5B –

$17.5B. Uninsured losses are estimated at $20B - $30B.” Moody’s RMS

Event Response estimates total U.S. private market insured losses

from the recent Hurricanes Helene and Milton will likely range

between US$35 billion and US$55 billion. This estimate is for

insured losses associated with wind, storm surge, and

precipitation-induced flooding from these events.”

In Europe, the flood protection gap is 25%. Recent European

Commission studies “show that insurance premiums written should at

least be doubled to reach a harmonized level of penetration equal

to 50%.” Intermap is uniquely positioned to meet this demand and

address this need.

To learn more about Intermap’s European solutions, visit

intermap.com/european-solutions.

Intermap Reader AdvisoryCertain

information provided in this news release, including reference to

revenue growth and run-rate, constitutes forward-looking

statements. The words "anticipate", "expect", "project",

"estimate", "forecast", “will be”, “will consider”, “intends” and

similar expressions are intended to identify such forward-looking

statements. Although Intermap believes that these statements are

based on information and assumptions which are current, reasonable

and complete, these statements are necessarily subject to a variety

of known and unknown risks and uncertainties. Intermap’s

forward-looking statements are subject to risks and uncertainties

pertaining to, among other things, cash available to fund

operations, availability of capital, revenue fluctuations, nature

of government contracts, economic conditions, loss of key

customers, retention and availability of executive talent,

competing technologies, common share price volatility, loss of

proprietary information, software functionality, internet and

system infrastructure functionality, information technology

security, breakdown of strategic alliances, and international and

political considerations, as well as those risks and uncertainties

discussed Intermap’s Annual Information Form and other securities

filings. While the Company makes these forward-looking statements

in good faith, should one or more of these risks or uncertainties

materialize, or should underlying assumptions prove incorrect,

actual results may vary significantly from those expected.

Accordingly, no assurances can be given that any of the events

anticipated by the forward-looking statements will transpire or

occur, or if any of them do so, what benefits that the Company will

derive therefrom. All subsequent forward-looking statements,

whether written or oral, attributable to Intermap or persons acting

on its behalf are expressly qualified in their entirety by these

cautionary statements. The forward-looking statements contained in

this news release are made as at the date of this news release and

the Company does not undertake any obligation to update publicly or

to revise any of the forward-looking statements made herein,

whether as a result of new information, future events or otherwise,

except as may be required by applicable securities law.

About ČPPČeská podnikatelská

pojišťovna (ČPP), a subsidiary of the Vienna Insurance Group, is a

universal insurance company that offers its clients modern products

and comprehensive insurance solutions in life and non-life

insurance. The company operates through 6 regional headquarters,

100 branches and 220 offices throughout the Czech Republic. It has

been operating on the Czech insurance market since 1995. Currently,

ČPP manages 2.4 million contracts and its services are used by more

than 1.3 million clients. ČPP is one of the Czech top five largest

insurance companies.

About DataligenceThe investment

group Trigema bought a majority stake in CenovaMapa.org in 2022,

largest real estate data platform on the Czech market. The

cooperation has already resulted in a new application for end

customers, www.hypox.cz, as well as the development of existing

Dataligence platforms. Over the past few years, Dataligence, with

the help of consulting company Deloitte, has become the most

important provider of online real estate valuation data in the

Czech Republic. For more information, please visit

www.dataligence.cz.

About Intermap

TechnologiesFounded in 1997 and headquartered in Denver,

Colorado, Intermap (TSX: IMP; OTCQB: ITMSF) is a global leader in

geospatial intelligence solutions, focusing on the creation and

analysis of 3D terrain data to produce high-resolution thematic

models. Through scientific analysis of geospatial information and

patented sensors and processing technology, the Company provisions

diverse, complementary, multi-source datasets to enable customers

to seamlessly integrate geospatial intelligence into their

workflows. Intermap’s 3D elevation data and software analytic

capabilities enable global geospatial analysis through artificial

intelligence and machine learning, providing customers with

critical information to understand their terrain environment. By

leveraging its proprietary archive of the world’s largest

collection of multi-sensor global elevation data, the Company’s

collection and processing capabilities provide multi-source 3D

datasets and analytics at mission speed, enabling governments and

companies to build and integrate geospatial foundation data with

actionable insights. Applications for Intermap’s products and

solutions include defense, aviation and UAV flight planning, flood

and wildfire insurance, disaster mitigation, base mapping,

environmental and renewable energy planning, telecommunications,

engineering, critical infrastructure monitoring, hydrology, land

management, oil and gas and transportation.

For more information, please

visit www.intermap.com or

contact:Jennifer BakkenExecutive Vice President and

CFOCFO@intermap.com +1 (303) 708-0955

Sean PeasgoodInvestor RelationsSean@SophicCapital.com+1 (647)

260-9266

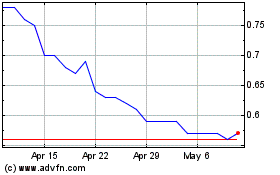

Intermap Technologies (TSX:IMP)

Historical Stock Chart

From Jan 2025 to Feb 2025

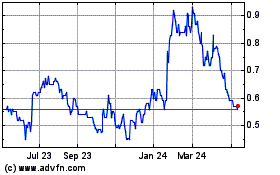

Intermap Technologies (TSX:IMP)

Historical Stock Chart

From Feb 2024 to Feb 2025