Intermap Technologies (TSX: IMP; OTCQB: ITMSF) (“Intermap” or the

“Company”), a global leader in 3D geospatial products and

intelligence solutions, today announced results for the third

quarter of 2024.

Financial Highlights

- Revenue of $5 million, up 241% from

$1.5 million in the third quarter of 2023

- Acquisition Services revenue grew

to $2.9 million from nil in the third quarter of 2023 as the

Company accelerated data collection for the Indonesian mapping

program

- Value-added Data revenue increased

to $1.1 million, compared with $0.4 million in the third quarter of

2023

- 30% adjusted EBITDA margin,

compared with a loss in the third quarter of 2023 as the Company

benefited from operating leverage with higher revenue and

attractive contribution margins

“Intermap is building long-term, sustainable

value for shareholders and executing our business strategy,” said

Patrick A. Blott, Intermap Chairman and CEO. “We’re deployed in

Indonesia where we’re leveraging specialized sensors, proprietary

processing and advanced AI/ML technology to deliver

mission-critical, strategic geospatial solutions. We look forward

to a long-term, multi-faceted partnership with Indonesia.”

“Our global perils and defense businesses are

thriving because there is no substitute for Intermap’s exquisite

global-scale, military quality location data,” Mr. Blott continued.

“In a time of unprecedented natural catastrophes and conflict,

Intermap provides clients around the world with precision elevation

data that saves lives and property. As our customers see the value

of this data in the wake of recent events, they are renewing and

expanding their contracts.”

Intermap continues to execute on its Indonesia

mapping program, leveraging AI/ML and other advanced proprietary

technology. With recent advances in production processing

automation combined with unmatched expertise and experience in

feature extraction and radar interpretation, Intermap completed the

first 5,900+ map sheets at 1:5,000-scale in fewer than 3.5 months

from day one of data acquisition. This set of map sheets represents

over 25,000 square kilometers of contiguous area coverage of

elevation and multi-band, orthorectified radar imagery

deliverables; it also includes an orthorectified, full-feature

stack with land, feature and object classifications. The initial

processing was accomplished in parallel with ongoing production of

the remaining 85% of Phase 1 of the project. All remaining

deliverables will follow in a shorter timeframe relative to the

initial delivery.

Financial Results, Business Highlights and

Business Outlook by Segment

Acquisition Services

- Financial Results

- Revenue for the quarter totaled

$2.9 million, compared with nil for the prior year quarter. The

increase is due to acceleration of data collection for the Sulawesi

contract. Last year, Intermap experienced a delay in the award of

key government contracts, reducing its acquisition services

revenue

- Business Highlights

- Acquired 15% of the data as part of

the Company’s Sulawesi contract, which represents approximately 10%

of Indonesia’s land mass

- Business Outlook

- As Indonesia’s partner for phase

one of Indonesia’s national topographic basemap program, Intermap

is establishing the foundation for a multiyear Acquisition and

Value-added Data partnership to support Indonesia’s One Map

initiative through 2028

- One Map’s progress and World Bank’s

recent approval for a $653 million Integrated Land Administration

and Spatial Planning project underscores the importance of precise

3D geospatial data to fulfill mission-critical strategic data

infrastructure requirements

- Intermap is well positioned to

capitalize on this trend and anticipates further wins and the

expansion of existing contracts throughout Southeast Asia

Value-added Data

- Financial Results

- Revenue increased to $1.1 million

for the quarter compared with $0.4 million for the prior year

quarter. The increase was primarily due to the expansion of the

U.S. Air Force contract

- Business Highlights

- Selected with CACI, Inc. by the

National Geospatial-Intelligence Agency as one of the qualified

vendors for an important program, with a total project value of up

to $290 million over five years – 10x the size of the initial

budget

- Won a second phase in its prime

contract with the U.S. Air Force to support its development of

navigation solutions for GPS-denied environments. Revenue in this

second phase is 5x the size of phase one

- Business Outlook

- Customers continue to renew and add

capacity as their usage surpasses their expectations and contract

limits. Further bolstering subscription revenue, customers are

adding on Intermap’s innovative solutions

Software and Solutions

- Financial Results

- Revenue decreased slightly to $1.0

million from $1.1 million for the third quarters of 2024 and 2023,

respectively. While recurring subscription revenue increased 3%,

2023 included $0.2 of one-time set up fees that were not duplicated

in the third quarter of 2024

- Excluding one-time payments from

two European accounts, Intermap’s continuing global customers grew

subscription revenue 8% to $0.8 million in the third quarter

compared with the same period a year ago

- For the first nine months of 2024,

Software and Solutions revenue represented 30% of total

revenue

- Business Highlights

- Expanded the multiyear subscription

contract value with a Top-15 global insurance carrier by over

50%

- Business Outlook

- The Company projects its insurance

software subscription business to continue growing at a CAGR of

approximately 20% over the next few years

Operating Costs

- Increased to $3.5 million, compared

with $2.1 million for the prior year quarter, driven by an increase

of $1.2 million in Purchased Services & Materials and $162

thousand in deployment travel

- Both cost increases were related to

increased activity, subcontractor and other project related costs

for the data acquisition project that accelerated in the third

quarter of 2024

Balance Sheet & Capital Expenditures

Cash and accounts receivable totaled $1.5

million at September 30, 2024. Cash milestone payments for

Indonesia are heavily weighted towards finished product deliveries

during the fourth quarter of 2024 and first quarter of 2025.

In the third quarter, the Company raised

aggregate gross proceeds of approximately CAD $3,305,956 through

the issuance of an aggregate 7.3 million Class “A” common shares at

a price of CAD $0.45 per common share. Aggregate net proceeds are

being used for the execution of contracts with the Indonesian

government, U.S. Air Force and other clients as well as for working

capital.

Following a successful capital upgrade and

certification of its sensor payload and airborne platform to meet

stringent geospatial data specifications in Indonesia, total assets

increased by $4.4 million to $8.9 million.

2024 GuidanceIntermap affirms its 2024 guidance

for total bookings in the range of $20 – 25 million, with revenue

in the range of $16 – 18 million and Adjusted EBITDA margin of

approximately 25%.

Q3 2024 Conference Call today at 4:30pm EST

Intermap’s CEO Patrick A. Blott, CFO Jennifer

Bakken and COO Jack Schneider will host a live

webinar today, at 4:30 pm ET / 2:30 pm MT to review the

results, provide Company updates and answer investor questions

following the presentation.

Intermap invites shareholders, analysts,

investors, media representatives and other stakeholders to attend

the earnings webinar to discuss Q3 2024 results.

Webinar Details

|

DATE: |

Thursday, November 14, 2024 |

|

TIME: |

4:30 pm ET / 2:30 pm MT |

|

WEBINAR: |

Register |

|

|

|

Investor ConferencesIntermap Chairman and CEO

Patrick Blott presented on September 26, 2024 at Planet MicroCap

Showcase: VANCOUVER 2024 and will continue to meet investors at

industry conferences.

Quarterly FilingThe Company’s consolidated

financial statements for the quarter ended September 30, 2024,

along with management’s discussion and analysis for the

corresponding period and related management certifications for

third quarter financial results will be filed on SEDAR+ at

www.sedarplus.ca on November 14, 2024.

Adjusted EBITDA is a non-GAAP measure. The term

Earnings before interest, taxes, depreciation and amortization

(EBITDA) consists of net loss and excludes interest (financing

costs), taxes, and depreciation. Adjusted EBITDA also excludes

share-based compensation, fair value adjustments and foreign

currency translation.

See “Reconciliation of Non-GAAP Measures” in

Company’s Management’s Discussion and Analysis filed on SEDAR+ at

www.sedarplus.ca.

Learn more about Intermap at

intermap.com/investors.

Intermap Reader AdvisoryCertain

information provided in this news release constitutes

forward-looking statements, including reference to revenue,

bookings and adjusted EBITDA projections or growth. The words

"anticipate", "expect", "project", "estimate", "forecast", “will

be”, “will consider”, “intends” and similar expressions are

intended to identify such forward-looking statements. Although

Intermap believes that these statements are based on information

and assumptions which are current, reasonable and complete, these

statements are necessarily subject to a variety of known and

unknown risks and uncertainties. Intermap’s forward-looking

statements are subject to risks and uncertainties pertaining to,

among other things, cash available to fund operations, availability

of capital, revenue fluctuations, nature of government contracts,

economic conditions, loss of key customers, retention and

availability of executive talent, competing technologies, common

share price volatility, loss of proprietary information, software

functionality, internet and system infrastructure functionality,

information technology security, breakdown of strategic alliances,

and international and political considerations, as well as those

risks and uncertainties discussed Intermap’s Annual Information

Form and other securities filings. While the Company makes these

forward-looking statements in good faith, should one or more of

these risks or uncertainties materialize, or should underlying

assumptions prove incorrect, actual results may vary significantly

from those expected. Accordingly, no assurances can be given that

any of the events anticipated by the forward-looking statements

will transpire or occur, or if any of them do so, what benefits

that the Company will derive therefrom. All subsequent

forward-looking statements, whether written or oral, attributable

to Intermap or persons acting on its behalf are expressly qualified

in their entirety by these cautionary statements. The

forward-looking statements contained in this news release are made

as at the date of this news release and the Company does not

undertake any obligation to update publicly or to revise any of the

forward-looking statements made herein, whether as a result of new

information, future events or otherwise, except as may be required

by applicable securities law.

About Intermap

TechnologiesFounded in 1997 and headquartered in Denver,

Colorado, Intermap (TSX: IMP; OTCQX: ITMSF) is a global leader in

geospatial intelligence solutions. The Company’s proprietary

3D NEXTMap® elevation datasets and value-added geospatial

collection, processing, analytics, fusion and orthorectification

software and solutions are utilized across a range of industries

that rely on accurate, high-resolution elevation data. Intermap

helps governments build authoritative geospatial datasets and

provides solutions for base mapping, transportation, environmental

monitoring, topographic mapping, disaster mitigation, smart city

integration, public safety and defense. The Company’s commercial

applications include aviation and UAV flight

planning, flood and wildfire

insurance, environmental and renewable

energy planning, telecommunications, engineering,

critical infrastructure monitoring, hydrology, land management, oil

and gas and transportation. For more information,

please visit www.intermap.com.

For more information, please contact: Jennifer

BakkenExecutive Vice President and CFOCFO@intermap.com+1 (303)

708-0955

Sean PeasgoodInvestor RelationsSean@SophicCapital.com+1 (647)

260-9266

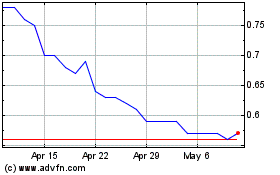

Intermap Technologies (TSX:IMP)

Historical Stock Chart

From Jan 2025 to Feb 2025

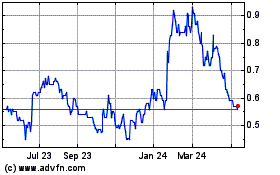

Intermap Technologies (TSX:IMP)

Historical Stock Chart

From Feb 2024 to Feb 2025