Prairie Provident Resources Inc. ("Prairie Provident" or the

"Company") (TSX:PPR) announces its operating and financial results

for the three and six months ended June 30, 2024. The Company's

interim consolidated financial statements and related Management's

Discussion and Analysis (MD&A) for the second quarter are

available on its website at www.ppr.ca and filed on SEDAR+ at

www.sedarplus.ca.

SECOND QUARTER 2024 FINANCIAL AND

OPERATING HIGHLIGHTS

- Production

averaged 2,045 boe/d (52% oil and liquids) in the second quarter of

2024, a 44% or 1,596 boe/d decrease from the same period in 2023,

primarily due to the sale of the Evi CGU, production declines and

wells requiring maintenance.

- Operating

expenses of $39.36/boe for the three months ended June 30, 2024, an

increase of $2.83/boe from the same period in 2023 principally due

to costs associated with workovers that commenced in May and June.

The majority of the anticipated production increases from the

workover program are expected to be realized in Q3.

- Production

Enhancements: PPR completed a total of 12 operations which included

well optimization and workovers providing initial production rates

of approximately 274 boe/d.

- Operating

netback1 before the impact of realized gains on derivatives was

$0.6 million or $3.47/boe for the second quarter of 2024, a

decrease of $7.0 million or 92% from the same period in 2023. On a

per boe basis, operating netback decreased by $19.55/boe from Q2

2023 driven by lower natural gas prices, a higher natural gas

production weighting and higher operating costs from the workover

program. Approximately $3.25/boe in operating costs related to the

workover program.

- Net loss for

the second quarter of 2024 was $6.5 million, compared to a net loss

of $8.8 million in the same period of 2023. The $2.3 million

decrease in the net loss was primarily due to a 2023 impairment of

the Evi CGU of $14.5 million, offset by a 2023 $6.9 million gain on

valuation of financial liabilities and a $10.1 million decrease in

oil and natural gas revenue primarily due to the sale of the Evi

CGU.

- In May 2024,

the Company received additional funding of US$2.3 million through

an issue of additional Second Lien Notes to its current lender, a

portion of which was used for the Company's workover program.

- The Company

remained active in its decommissioning program with $1.4 million

spent during the first six months of 2024.

- The Company has

significant tax pool coverage, including approximately $329 million

of non-capital losses.

Note:

(1) Operating netback is a non-GAAP

financial measure and is defined below under "Non-GAAP and Other

Financial Measures".

BASAL QUARTZ DEVELOPMENT

OPPORTUNITIES

The Basal Quartz/Ellerslie fairway in south

central Alberta has seen a rapid increase in horizontal drilling

activity by area operators in response to the success of high

intensity frac completions. This has resulted in prolific oil wells

with disclosed initial production rates that are substantially

higher than with conventional completions, generating attractive

economics.

The Company's large land position of 167,869 net

acres in its Michichi core area has been internally evaluated for

Basal Quartz potential. Prairie Provident is excited by the results

being achieved by offsetting activity, with offset wells having

disclosed initial production rates of approximately 800 boe/d.

Prairie Provident has identified more than 40 Basal Quartz

potential drilling opportunities targeting light/medium oil on its

Michichi lands. Internal estimates forecast a payout period of

approximately eight months and average estimated first year

production of approximately 270 bbl/d of light/medium oil. These

potential drilling opportunities are not booked locations to which

any reserves have been attributed in the most recent independent

evaluation of Prairie Provident's reserves data, effective December

31, 2023, by Sproule Associates Limited. The Company's existing

proved undeveloped reserves bookings at Michichi, as reflected in

the 2023 year-end evaluation, consist primarily of Banff formation

oil reserves.

Production from successful Basal Quartz drilling

will be processed through existing Company-owned infrastructure in

the Michichi area. Prairie Provident currently owns and operates

two oil batteries (one with LACT connection to Inter Pipeline), two

natural gas plants with a combined inlet capacity of approximately

10 MMscf/d, three field booster compressor stations, and an

extensive pipeline network at Michichi. Owning and controlling key

infrastructure within the Basal Quartz/Ellerslie fairway provides

Prairie Provident with a competitive advantage for the future

development of this play.

| FINANCIAL

AND OPERATING SUMMARY |

|

|

|

Three Months EndedJune 30, |

Six Months EndedJune 30, |

|

($000s except per unit amounts) |

|

2024 |

2023 |

2024 |

2023 |

|

Production Volumes |

|

|

|

|

|

|

Crude oil and condensate (bbl/d) |

|

993 |

2,292 |

1,244 |

2,279 |

|

Conventional natural gas (Mcf/d) |

|

5,923 |

7,518 |

6,211 |

7,629 |

|

Natural gas liquids (bbl/d) |

|

65 |

97 |

62 |

98 |

|

Total (boe/d) |

|

2,045 |

3,641 |

2,341 |

3,648 |

|

% Liquids |

|

52% |

66% |

56% |

65% |

|

|

|

|

|

|

|

| Average Realized

Prices |

|

|

|

|

|

|

Crude oil and condensate ($/bbl) |

|

94.21 |

84.40 |

86.13 |

84.59 |

|

Conventional natural gas ($/Mcf) |

|

1.21 |

2.23 |

1.96 |

2.74 |

|

Natural gas liquids ($/bbl) |

|

54.61 |

55.24 |

68.50 |

59.25 |

|

Total ($/boe) |

|

50.98 |

59.19 |

52.77 |

60.15 |

|

Operating Netback ($/boe) 1 |

|

|

|

|

|

|

Realized price |

|

50.98 |

59.19 |

52.77 |

60.15 |

|

Royalties |

|

(8.15) |

(5.32) |

(7.95) |

(7.87) |

|

Operating costs |

|

(39.36) |

(30.85) |

(36.53) |

(33.87) |

|

Operating netback |

|

3.47 |

23.02 |

8.29 |

18.41 |

|

Realized losses on derivative instruments |

|

— |

0.86 |

(1.14) |

(0.47) |

|

Operating netback, after realized losses on derivative

instruments |

|

3.47 |

23.88 |

7.15 |

17.94 |

Note:

(1) Operating netback is a non-GAAP

financial measure and is defined below under “Non-GAAP and Other

Financial Measures”.

ABOUT PRAIRIE PROVIDENT

Prairie Provident is a Calgary-based company

engaged in the exploration and development of oil and natural gas

properties in Alberta, including a position in the emerging Basal

Quartz trend in the Michichi area of Central Alberta.

For further information, please contact:

Prairie Provident Resources Inc.Ryan Rawlyk, President and

CEOPhone: (403) 292-8180Email: info@ppr.ca

Forward-Looking Statements

This news release contains certain statements

("forward-looking statements") that constitute forward-looking

information within the meaning of applicable Canadian securities

laws. Forward-looking statements relate to future performance,

events or circumstances, are based upon internal assumptions,

plans, intentions, expectations and beliefs, and are subject to

risks and uncertainties that may cause actual results or events to

differ materially from those indicated or suggested therein. All

statements other than statements of current or historical fact

constitute forward-looking statements. Forward-looking statements

are typically, but not always, identified by words such as

"anticipate", "believe", "expect", "intend", "plan", "budget",

"forecast", "target", "estimate", "propose", "potential",

"project", "seek", "continue", "may", "will", "should" or similar

words suggesting future outcomes or events or statements regarding

an outlook.

Without limiting the foregoing, this news

release contains forward-looking statements pertaining to: Basal

Quartz, drilling opportunities, including estimated payout periods

and first year production on potential Basal Quartz wells; and the

processing of production from successful Basal Quartz drilling.

Forward-looking statements are based on a number

of material factors, expectations or assumptions of Prairie

Provident which have been used to develop such statements, but

which may prove to be incorrect. Although the Company believes that

the expectations and assumptions reflected in such forward-looking

statements are reasonable, undue reliance should not be placed on

forward-looking statements, which are inherently uncertain and

depend upon the accuracy of such expectations and assumptions.

Prairie Provident can give no assurance that the forward-looking

statements contained herein will prove to be correct or that the

expectations and assumptions upon which they are based will occur

or be realized. Actual results or events will differ, and the

differences may be material and adverse to the Company. In addition

to other factors and assumptions which may be identified herein,

assumptions have been made regarding, among other things: results

from drilling and development activities; consistency with past

operations; the quality of the reservoirs in which Prairie

Provident operates and continued performance from existing wells

(including with respect to production profile, decline rate and

product type mix); the continued and timely development of

infrastructure in areas of new production; the accuracy of the

estimates of Prairie Provident's reserves volumes; future commodity

prices; future operating and other costs; future USD/ CAD exchange

rates; future interest rates; continued availability of external

financing and internally generated cash flow to fund Prairie

Provident's current and future plans and expenditures, with

external financing on acceptable terms; the impact of competition;

the general stability of the economic and political environment in

which Prairie Provident operates; the general continuance of

current industry conditions; the timely receipt of any required

regulatory approvals; the ability of Prairie Provident to obtain

qualified staff, equipment and services in a timely and cost

efficient manner; drilling results; the ability of the operator of

the projects in which Prairie Provident has an interest in to

operate the field in a safe, efficient and effective manner; field

production rates and decline rates; the ability to replace and

expand oil and natural gas reserves through acquisition,

development and exploration; the timing and cost of pipeline,

storage and facility construction and expansion and the ability of

Prairie Provident to secure adequate product transportation; the

regulatory framework regarding royalties, taxes and environmental

matters in the jurisdictions in which Prairie Provident operates;

and the ability of Prairie Provident to successfully market its oil

and natural gas production.

The forward-looking statements included in this

news release are not guarantees of future performance or promises

of future outcomes and should not be relied upon. Such statements,

including the assumptions made in respect thereof, involve known

and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those

anticipated in such forward-looking statements including, without

limitation: reduced access to external debt financing; higher

interest costs or other restrictive terms of debt financing;

changes in realized commodity prices; changes in the demand for or

supply of Prairie Provident's products; the early stage of

development of some of the evaluated areas and zones; the potential

for variation in the quality of the geologic formations targeted by

Prairie Provident's operations; unanticipated operating results or

production declines; changes in tax or environmental laws, royalty

rates or other regulatory matters; changes in development plans of

Prairie Provident or by third party operators; increased debt

levels or debt service requirements; inaccurate estimation of

Prairie Provident's oil and reserves volumes; limited, unfavourable

or a lack of access to capital markets; increased costs; a lack of

adequate insurance coverage; the impact of competitors; and such

other risks as may be detailed from time-to-time in Prairie

Provident's public disclosure documents (including, without

limitation, those risks identified in this news release and Prairie

Provident's current Annual Information Form dated April 1, 2024 as

filed with Canadian securities regulators and available from the

SEDAR+ website (www.sedarplus.ca) under Prairie Provident's issuer

profile).

The forward-looking statements contained in this

news release speak only as of the date of this news release, and

Prairie Provident assumes no obligation to publicly update or

revise them to reflect new events or circumstances, or otherwise,

except as may be required pursuant to applicable laws. All

forward-looking statements contained in this news release are

expressly qualified by this cautionary statement.

Non-GAAP and Other Financial

Measures

This news release discloses certain financial

measures that are 'non-GAAP financial measures' or 'supplementary

financial measures' within the meaning of applicable Canadian

securities laws. Such measures do not have a standardized or

prescribed meaning under International Financial Reporting

Standards (IFRS) and, accordingly, may not be comparable to similar

financial measures disclosed by other issuers. Non-GAAP and other

financial measures are provided as supplementary information by

which readers may wish to consider the Company's performance but

should not be relied upon for comparative or investment purposes.

Readers must not consider non-GAAP and other financial measures in

isolation or as a substitute for analysis of the Company's

financial results as reported under IFRS. For a reconciliation of

each non-GAAP measure to its nearest IFRS measure, please refer to

the "Non-GAAP and Other Financial Measures" section of the

MD&A.

This news release also includes reference to

certain metrics commonly used in the oil and natural gas industry,

but which do not have a standardized or prescribed meanings under

the Canadian Oil and Gas Evaluation (COGE) Handbook or applicable

law. Such metrics are similarly provided as supplementary

information by which readers may wish to consider the Company's

performance but should not be relied upon for comparative or

investment purposes.

The following is additional information on

non-GAAP and other financial measures and oil and gas metrics used

in this news release.

Operating Netback – Operating netback is a

non-GAAP financial measure commonly used in the oil and natural gas

industry, which the Company believes is a useful measure to assist

management and investors to evaluate operating performance at the

oil and natural gas lease level. Operating netbacks included in

this news release were determined as oil and natural gas revenues

less royalties less operating costs. Operating netback may be

expressed in absolute dollar terms or a per unit basis. Per unit

amounts are determined by dividing the absolute value by gross

working interest production. Operating netback after gains or

losses on derivative instruments, adjusts the operating netback for

only the realized portion of gains and losses on derivative

instruments. Operating netback per boe and operating netback, after

realized gains (losses) on derivatives per boe are non-GAAP

financial ratios.

Oil and Gas Reader

Advisories

Barrels of Oil Equivalent. The oil and natural

gas industry commonly expresses production volumes and reserves on

a "barrel of oil equivalent" basis ("boe") whereby natural gas

volumes are converted at the ratio of six thousand cubic feet to

one barrel of oil. The intention is to sum oil and natural gas

measurement units into one basis for improved analysis of results

and comparisons with other industry participants. A boe conversion

ratio of six thousand cubic feet to one barrel of oil is based on

an energy equivalency conversion method primarily applicable at the

burner tip. It does not represent a value equivalency at the

wellhead nor at the plant gate, which is where Prairie Provident

sells its production volumes. Boe's may therefore be a misleading

measure, particularly if used in isolation. Given that the value

ratio based on the current price of crude oil as compared to

natural gas is significantly different from the energy equivalency

ratio of 6:1, utilizing a 6:1 conversion ratio may be misleading as

an indication of value.

Analogous Information. Information in this news

release regarding initial production rates from offset wells

drilled by other industry participants located in geographical

proximity to the Company's lands may constitute "analogous

information" within the meaning of National Instrument 51-101 –

Standards of Disclosure for Oil and Gas Activities

(NI 51-101). This information is derived from publicly

available information sources (as at the date of this news release)

that Prairie Provident believes (but cannot confirm) to be

independent in nature. The Company is unable to confirm that the

information was prepared by a qualified reserves evaluator or

auditor within the meaning of NI 51-101, or in accordance with

the Canadian Oil and Gas Evaluation (COGE) Handbook. Although the

Company believes that this information regarding geographically

proximate wells helps management understand and define reservoir

characteristics of lands in which Prairie Provident has an

interest, the data relied upon by the Company may be inaccurate or

erroneous, may not in fact be indicative or otherwise analogous to

the Company's land holdings, and may not be representative of

actual results from wells that may be drilled or completed by the

Company in the future.

Potential Drilling Opportunities vs Booked

Locations. This news release refers to potential drilling

opportunities and booked locations. Unless otherwise indicated,

references to booked locations in this news release are references

to proved drilling locations or probable drilling locations, being

locations to which Sproule Associated Limited (Sproule) attributed

proved or probable reserves in its most recent year-end evaluation

of Prairie Provident's reserves data, effective December 31, 2023.

Sproule's year-end evaluation was in accordance with NI 51-101 and,

pursuant thereto, the COGE Handbook. References in this news

release to potential drilling opportunities are references to

locations for which there are no attributed reserves or resources,

but which the Company internally estimates can be drilled based on

current land holdings, industry practice regarding well density,

and internal review of geologic, geophysical, seismic, engineering,

production and resource information. There is no certainty that the

Company will drill any particular locations, or that drilling

activity on any locations will result in additional reserves,

resources or production. Locations on which Prairie Provident in

fact drills wells will ultimately depend upon the availability of

capital, regulatory approvals, seasonal restrictions, commodity

prices, costs, actual drilling results, additional reservoir

information and other factors. There is a higher level of risk

associated with locations that are potential drilling opportunities

and not booked locations. Prairie Provident generally has less

information about reservoir characteristics associated with

locations that are potential drilling opportunities and,

accordingly, there is greater uncertainty whether wells will

ultimately be drilled in such locations and, if drilled, whether

they will result in additional reserves, resources or

production.

Type Well Information. Information contained in

this news release regarding estimated payout periods and first year

production on potential Basal Quartz wells is based on the

Company's internally-defined type wells. Type well information

reflects Prairie Provident's expectations and experience in

relation to wells of the indicated types, including with respect to

costs, production and decline rates. There is no assurance that

actual well-related results (including payout periods and first

year production) will be in accordance with those suggested by the

type well information, or that initial production rates will be

indicative of long-term well or reservoir performance or of

ultimate recovery. Actual results will differ, and the

difference may be material.

Initial Production Rates. This news release

discloses initial production rates for certain wells as indicated.

Initial production rates are not necessarily indicative of

long-term well or reservoir performance or of ultimate recovery.

Actual results will differ from those realized during an initial

short-term production period, and the difference may be

material.

Payout. Prairie Provident considers payout on a

well to be achieved when future net revenue from the well is equal

to the capital costs to drill, complete, equip and tie-in the well.

Forecasted payout periods disclosed in this news release are based

on the following commodity price and CAD/USD exchange rate

assumptions: USD $75.00/bbl WTI, CAD $3.00/Mcf AECO,

CAD $1.35-to-USD $1.00.

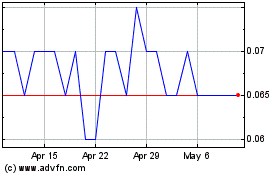

Prairie Provident Resour... (TSX:PPR)

Historical Stock Chart

From Jan 2025 to Feb 2025

Prairie Provident Resour... (TSX:PPR)

Historical Stock Chart

From Feb 2024 to Feb 2025