Perseus Mining Limited: Half Year Financial Results

PERTH, WESTERN AUSTRALIA--(Marketwired - Feb 14, 2014) -

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR

DISSEMINATION IN THE UNITED STATES

Perseus Mining Limited ("Perseus" or the "Company")

(TSX:PRU)(ASX:PRU) today announced a net after tax loss of $4.024

million or 0.84 cents per share for the six-month period ended 31

December 2013.

|

RESULT HIGHLIGHTS(1) |

31 December 2013 Half Year A$'000 |

|

|

Revenue from gold sales |

135,276 |

|

|

Net Profit / (Loss) after tax |

(4,024 |

) |

|

Earnings per Share (A$ cents per share) |

(0.84 |

) |

|

Return on Funds Employed(2) (%) |

n/a |

|

|

Net cash flows from operating activities |

(1,782 |

) |

|

Net cash flows used in investing activities |

(17,811 |

) |

|

Net cash flows from financing activities |

- |

|

|

Available Cash Balance(3) |

16,016 |

|

|

Total assets |

603,192 |

|

|

Shareholders' equity |

486,059 |

|

| 1. Assumes 31

December 2013 half year average AUD:USD exchange rate of 0.9218 and

exchange rate as at 31 December 2013 of 0.8874 |

| 2. Defined as assets less current liabilities |

| 3. Excludes value of 8,984 ounces of bullion on hand or at the

refinery. |

Comments from Perseus's Managing Director, Jeff Quartermaine

The six months to 31 December 2013, have presented

challenging trading conditions for many participants in the gold

sector, and we are no exception.

In response to a falling gold price, Perseus adopted a

production strategy aimed at minimising capital investment. This

meant that part of our mill feed for the period was drawn from

existing low grade ore stockpiles in preference to targeting higher

grade ore from new mining areas that required investment of

significant amounts of capital to pre-strip waste.

Notwithstanding very material improvements in productivity

measures including mill runtime, throughput rates and recoveries,

processing lower grade ore resulted in lower gold production and

when combined with significantly lower gold prices, our

profitability and cash flow declined relative to prior

periods.

Looking forward, given the material productivity

improvements made to our operation along with a reduction in our

operating cost base during the last six months, we are now well

positioned for the future, when in accordance with our updated Life

of Mine Plan higher grade ore will be available for processing. If

combined with gold prices at or above current levels then

improvements in financial performance are expected to

eventuate.

Financial Commentary

Profit Overview

The group's net after tax loss for the half-year ended 31

December 2013 was $4.024 million. The decrease in profitability

relative to prior periods was due mainly to a 9% decrease in gold

production at the Edikan Gold Mine ("EGM"), resulting from a

planned 28% decrease in the head grade of ore processed, coupled

with an unplanned 12.5% decrease in the realised sale price per

ounce for gold relative to the corresponding prior period.

Revenue

Revenue of $135.276 million was earned during the period from

the sale of 93,686 ounces of gold at an average sale price of

US$1,330 per ounce. A total of 46,000 ounces of gold were delivered

into forward sales contracts at an average of US$1,259 per ounce

while the balance of gold sales was made at prevailing spot prices

for gold.

Cost of Sales

Costs of sales included mining, processing and site G&A

costs (excluding salaries) totalling $94.256 million and employee

salaries and share based payments of $14.697 million (including

termination payments made to employees made redundant during the

period) before adjusting for a positive movement in inventories

including ore stockpiles, gold-in-circuit and gold bullion on hand

of $5.358 million. Costs associated with financing during the

period totalled $0.912 million and depreciation and amortisation

totalling $20.712 million (including $8.401 million of amortisation

of a deferred stripping asset) were also charged to the Income

Statement during the period.

Royalties

Royalties totalling $8.507 million were paid to external parties

during the financial year. The largest royalty of 5% of revenue

earned from the EGM was paid to the Ghanaian government. Lesser

royalties of 1.5% of revenue and 0.25% of gold produced were also

payable to unrelated private parties in accordance with the terms

of purchase of the Edikan mining lease.

Impairment of Available-for-sale financial asset

The value of the Company's investment in Manas Resources Limited

(13.1% interest) which is recognised as an available-for-sale

financial asset, was impaired by $2.225 million to a carrying value

of $1.736 million, reflecting market value as at 31 December

2013.

Income Tax Expense

The income tax gain that has been recognised in the Income

Statement comprises $0.517 million, primarily relating to the loss

incurred at the EGM during the period. The corporate tax rate in

Ghana is 35% for mining companies.

Cash Flow

Cash receipts from the sale of gold totalled $130.962 million

during the period while total cash out flow from operating

activities during the period totalled $1.782 million. The total net

cash outflow for the period of $19.593 million (4.3 cents per

share) included cash out flow from operating activities referred to

above plus an outflow of $17.811 million for investing activities,

most notably exploration, and capital works at the EGM in Ghana.

There was no cash flow relating to financing activities during the

period.

Financial Position

As at 31 December 2013, the Company's net assets totalled

$486.059 million (10.6 cents per share) including working capital

(defined as the excess of current assets over current liabilities)

of $21.597 million.

Cash and Investments

At 31 December 2013 available cash totalled $16.016 million (3.5

cents per share) while additional deposits totalling $10.634

million (2.3 cents per share) supported performance guarantees for

environmental rehabilitation of the EGM.

In addition, the Group held 8,984 ounces of gold at its EGM, at

the refinery while in the process of being refined or in the

Company's metal account on this date.

Perseus also held $0.652 million of equity accounted investments

comprising security holdings in the ASX listed company Burey Gold

Limited (23.0% interest). The Company's investment in Manas

Resources Limited was carried at a value of $1.736 million.

Receivables

At 31 December 2013 the Company's current receivables were

$9.270 million and non-current receivables amounted to $55.050

million including $44.416 million attributable to a VAT refund from

the Ghana Revenue Authority ("GRA"). The GRA has acknowledged the

validity of the debt and has been working with the Company to agree

a mutually acceptable mechanism for repaying the outstanding

amount. Subsequent to the half year end, GRA agreed to grant GHS 60

million of treasury credit notes to be offset against payments to

the government (including royalties and other taxes) in partial

settlement of the outstanding liability.

Debt Finance

At 31 December 2013 the group's borrowings were nil.

Derivative financial instruments

As at 31 December 2013 the Company held forward sales contracts

for 124,000 ounces of gold and recorded an asset of $35.464 million

on its balance sheet. These contracts are designated as effective

hedge contracts, and the movement in mark-to-market value has been

recorded in equity. A total of $4.971 million of the asset has been

classified as a current asset as these forward sales contracts will

settle within twelve months while the balance of $30.493 million

has been classified as a non-current asset.

The asset in each case reflects the difference in value of the

hedge contracts on the respective balance dates relative to the

value of the contracts on the date of inception of hedge

accounting.

The amount of gold sold forward under hedging agreements

represents 4% of the gold contained in the group's currently

defined total Ore Reserves and approximately 30% of the group's

total forecast gold production to the end of 2015.

Dividends

The Company has established a dividend policy that provides for

the payment of dividends to shareholders when Directors are

confident that such payments can be sustained from cash flow on an

ongoing basis.

No dividends were declared or paid during the period.

Jeff Quartermaine, Managing Director and Chief Executive

Officer

Caution Regarding Forward Looking Information: This

report contains forward-looking information which is based on the

assumptions, estimates, analysis and opinions of management made in

light of its experience and its perception of trends, current

conditions and expected developments, as well as other factors that

management of the Company believes to be relevant and reasonable in

the circumstances at the date that such statements are made, but

which may prove to be incorrect. Assumptions have been made by the

Company regarding, among other things: the price of gold,

continuing commercial production at the Edikan Gold Mine without

any major disruption, development of a mine at Tengrela, the

receipt of required governmental approvals, the accuracy of capital

and operating cost estimates, the ability of the Company to operate

in a safe, efficient and effective manner and the ability of the

Company to obtain financing as and when required and on reasonable

terms. Readers are cautioned that the foregoing list is not

exhaustive of all factors and assumptions which may have been used

by the Company. Although management believes that the assumptions

made by the Company and the expectations represented by such

information are reasonable, there can be no assurance that the

forward-looking information will prove to be accurate.

Forward-looking information involves known and unknown

risks, uncertainties, and other factors which may cause the actual

results, performance or achievements of the Company to be

materially different from any anticipated future results,

performance or achievements expressed or implied by such

forward-looking information. Such factors include, among others,

the actual market price of gold, the actual results of current

exploration, the actual results of future exploration, changes in

project parameters as plans continue to be evaluated, as well as

those factors disclosed in the Company's publicly filed documents.

The Company believes that the assumptions and expectations

reflected in the forward-looking information are reasonable.

Assumptions have been made regarding, among other things, the

Company's ability to carry on its exploration and development

activities, the timely receipt of required approvals, the price of

gold, the ability of the Company to operate in a safe, efficient

and effective manner and the ability of the Company to obtain

financing as and when required and on reasonable terms. Readers

should not place undue reliance on forward-looking information.

Perseus does not undertake to update any forward-looking

information, except in accordance with applicable securities

laws.

Perseus Mining LimitedJeff Quartermaine+61 8 6144

1700jeff.quartermaine@perseusmining.comPerseus Mining LimitedElissa

BrownCFO+61 8 6144 1700elissa.brown@perseusmining.comNathan

RyanMedia+61 3 9622 2159nathan.ryan@nwrcommunications.com.au

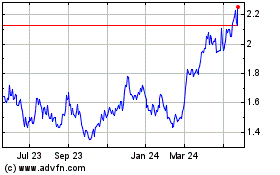

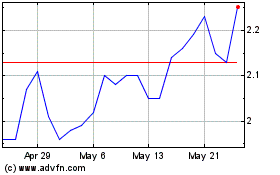

Perseus Mining (TSX:PRU)

Historical Stock Chart

From Mar 2025 to Apr 2025

Perseus Mining (TSX:PRU)

Historical Stock Chart

From Apr 2024 to Apr 2025