As with the two other biggest banks in the UK, The Royal Bank of Scotland (LSE:RBS) has also set aside an enormous amount of money to cover for the infamous mis-sold payment protection insurance that has weighed heavy on the banks bottom lines since it was uncovered.

RBS said today it has added some £400 million more for PPI costs, putting the total provision for the said claims at £1.7 billion for the bank alone, £1 billion of which was paid out on 30th September 2012.

Barclays (LSE:BARC) and Lloyds Banking Group (LSE:LLOY) have deducted £700 million and £1 billion, respectively, from their operating profits during the third quarter, for an aggregate of £2.1 billion for the July to September period from the three banks.

HSBC Group (LSE:HSBA) is yet to release its third quarter results and complete the quartet. Meanwhile, the total PPI costs have just been raised to £12.4 billion to date against the UK Financial Services Authority’s (FSA) report that about £6.5 billion had already been paid out since January 2011 by 24 firms that comprised 96% of all the claims.

“RBS continues to work hard to remedy a number of past issues,” RBS stated in its July to September financial period, which has brought the bank £1.047 billion in operating profit, 61% more than what it made during the second quarter, and over 500 hundred times more than what it earned during the same period last year!

That may well be a cause for celebration amongst the UK public, who owns at least 80% of the bank, up until one finds out that at the end the double lines rest on a loss of £1.3 billion for the quarter and £3.374 billion in the past nine months, 17 times more than the loss last year covering the same duration.

Reputational Issues

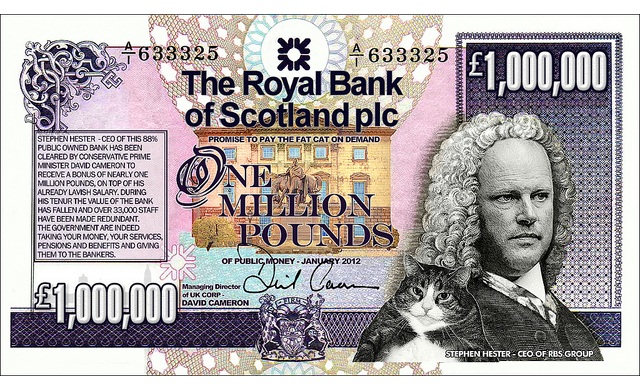

Stephen Hester, RBS Group’s Chief Executive, admitted that the bank still has many “important work to do”, including “dealing with reputational issues” but also said the bank is doing well in making the bank “safer and stronger”.

But while that was reiterated by Mr. Hester, the bank continues to be mired in controversies as a host of government regulators across the Atlantic, in Europe, and in Asia have their eyes set on the bank over scandals as the Libor rate fixing.

“The Group continues to cooperate fully with a number of regulatory investigations and reviews,” RBS said.

“In some of these investigations the Group believes that the likely outcome is that it will incur financial penalties or provide redress, and these may be significant,” RBS continued, saying it has fired employees relating to the ongoing investigations.

Meanwhile, the usual heavy trading of RBS stocks was not seen today as only about 6.5 million shares were traded by 10:30 AM GMT but nonetheless resulted in a drop of 1.3% to 283.5 pence, following the lengthy report.

Hot Features

Hot Features

If you’re talking about Kurgman, he qualifies under major media outlet,’ not Serious Economist.’