Current Report Filing (8-k)

May 16 2022 - 5:25PM

Edgar (US Regulatory)

0001460602

false

0001460602

2022-05-16

2022-05-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): May 16, 2022

ORGENESIS

INC.

(Exact name of registrant as specified in its

charter)

| Nevada

|

|

000-54329

|

|

98-0583166

|

| (State

or other jurisdiction |

|

(Commission

File |

|

(IRS

Employer |

| of

incorporation |

|

Number) |

|

Identification

No.) |

20271

Goldenrod Lane, Germantown, MD 20876

(Address

of principal executive offices) (Zip Code)

Registrant’s

telephone number, including area code: (480) 659-6404

Not

Applicable

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

ORGS |

|

The

Nasdaq Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b -2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

Amendment

to Convertible Loan Agreement

As

previously disclosed, on April 21, 2022, Orgenesis Inc. (the “Company”) entered into a convertible loan agreement (the “Convertible

Loan Agreement”) with Yehuda Nir (the “Lender”), pursuant to which the Lender loaned the Company $5,000,000 (the “Loan

Amount”) with an interest rate of 6% per annum (based on a 365-day year) and which was payable, along with the principal, on or

before October 21, 2022 (the “Maturity Date”). Pursuant to the Convertible Loan Agreement, the Maturity Date may be extended

by the Lender in the Lender’s sole and absolute discretion and any such extension(s) shall be in writing signed by the Parties

and the Loan Amount may be prepaid by the Company in whole or in part at any time or at the Lender’s option, following any financing

by the Company pursuant to which gross proceeds to the Borrower exceed $10,000,000. On May 16, 2022, the Company and the Lender entered

into an amendment to such Convertible Loan Agreement (the “Amendment”) pursuant to which the Maturity Date was extended to

July 21, 2023 and which allows for the Outstanding Amount (as defined in the Agreement) to be prepaid by the Company, at the Lender’s

option, following any financing by the Company pursuant to which gross proceeds to the Company exceed $13,125,000.

The

foregoing summary of the Amendment does not purport to be complete and is subject to, and qualified in its entirety by, the Amendment

attached as Exhibit 10.1 to this Current Report on Form 8-K, which is incorporated herein by reference.

Item

2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The

information required by this Item 2.03 is included under Item 1.01 of this Current Report on Form 8-K.

Item

8.01. Other Events.

On

April 5, 2022, the Company previously announced that it had entered into a Securities Purchase Agreement with certain investors, dated

as of March 30, 2022, for a private placement of 4,933,333 shares of the Company’s common stock, par value $0.0001 per share (the

“Common Stock”), at a purchase price of $3.00 per share and warrants to purchase up to 1,000,000 shares of Common Stock at

an exercise price of $4.50 per share, which was anticipated to result in approximately $14.8 million of gross proceeds (the “Private

Placement”). As of May 16, 2022, the Company has received an aggregate of $1.7 million out of the expected $14.8 million from the

Private Placement. Certain of the Private Placement investors have requested an extension for closing until June 30, 2022 and the Company

has agreed to such extension to receive the remaining funds.

Item

9.01. Financial Statements and Exhibits.

The

exhibit listed in the following Exhibit Index is filed as part of this Current Report on Form 8-K.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

ORGENESIS

INC. |

| |

|

|

| Date:

May 16, 2022 |

By: |

/s/

Neil Reithinger |

| |

|

Neil

Reithinger |

| |

|

Chief

Financial Officer, Treasurer and |

| |

|

Secretary |

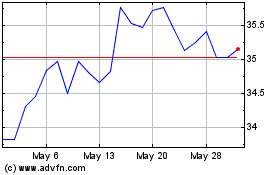

Innovator Ibd Breakout O... (AMEX:BOUT)

Historical Stock Chart

From Mar 2025 to Apr 2025

Innovator Ibd Breakout O... (AMEX:BOUT)

Historical Stock Chart

From Apr 2024 to Apr 2025