Dogecoin Crash? Analyst Predicts Drop To $0.12 Before Rebound

March 10 2025 - 6:15AM

NEWSBTC

A recently published Dogecoin (DOGE) chart by analyst Paul

(@Zig_ZagTrades) suggests that the popular meme-based

cryptocurrency could slide as low as $0.12 in a final corrective

phase before attempting a significant rebound. The 1-day chart,

shared on X, outlines a textbook Elliott Wave structure that Paul

interprets as a larger (A)–(B)–(C) correction, culminating in a

potential Wave 2 near the $0.12–$0.15 region. More Downside For

Dogecoin Ahead? In Paul’s analysis, Dogecoin has been tracing a

five-subwave decline since reaching a prominent peak labeled as

Wave 1 on his chart. This top coincided with a multi-day surge that

lost momentum and reversed lower, leading to a series of smaller

waves marked as 1, 2, 3, 4, and now 5. The analyst indicates that

this fifth and final subwave is likely concluding a broader C wave

(or 2nd wave if counting at a higher degree). Paul’s notations

highlight a “GZ” (a “Golden Zone” commonly used by traders to

pinpoint Fibonacci support clusters), and his markings pinpoint

Fibonacci ratios that could define DOGE’s near-term floor. Related

Reading: Buy Dogecoin Now? Analyst Says This Is the Spot The chart

shows a cluster of key retracement levels spanning from $0.16 down

to the mid-$0.11 range. Paul highlights Fibonacci levels at 61.8%

around $0.160257 and $0.150508, alongside deeper retracements at

78.6% near $0.118726 and a 100% projection around $0.126709. These

numeric zones appear to bracket the “GZ” in which Paul believes

DOGE may complete its final subwave. According to the chart, the

$0.12–$0.15 pocket stands out as the most critical price territory

for bulls seeking to halt the ongoing downtrend. The path from the

current price region toward this lower objective is labeled with a

subwave count that suggests a final push beneath prior lows.

Candlestick patterns on the chart confirm a sequence of lower highs

and lower lows in recent weeks, a sign that the bearish momentum

remains intact. Volume bars at the bottom indicate steady selling

pressure accompanying downward impulses, in line with the view that

DOGE could still be carving out its terminal leg of the correction.

Related Reading: Dogecoin Analyst Predicts Massive Price

Explosion—Is $6.24 Far-Fetched? Paul’s use of Ichimoku Cloud

settings shows that the price has consistently traded below the

cloud since late January, indicating that DOGE has yet to

reestablish any bullish momentum. The shaded green cloud area on

his chart appears to have acted as dynamic resistance, backing up

the notion that the market has remained in a corrective posture for

several weeks. The analyst’s labeling of the waves beyond the

purported bottom, marked as (1) to (5), suggests an expectation of

an eventual upward cycle if and when the coin finds support in the

“GZ” zone. While the chart projects a subsequent rally from the

anticipated low, no guarantees exist that DOGE will definitely hold

the $0.12–$0.15 band. Failure to do so would theoretically extend

the corrective pattern and undermine the bullish wave count, but

Paul’s annotation implies that he sees the current downswing as a

last flush of sellers. In his own words, “DOGE 1D: A Subwave 5 drop

setting up a wave C/2 finish in the GZ for DOGE,” suggests an

expectation of a local bottom in this area, although the market’s

overall direction will hinge on whether enough buyers step in at

those Fibonacci levels. At press time, DOGE traded at $0.17

Featured image created with DALL.E, chart from TradingView.com

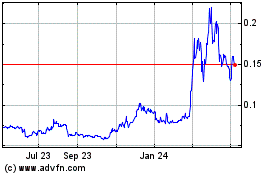

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

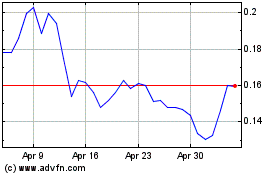

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025