Ethereum Consolidates Since ‘The Big Dump’ – Local Trend Reversal Or Continuation?

March 14 2025 - 6:30PM

NEWSBTC

Ethereum (ETH) has been stuck in a tight range, trading below

$1,900 and above $1,750 after days of heavy selling pressure. The

broader crypto market remains under stress, with fear dominating

sentiment and keeping ETH from regaining momentum. Related Reading:

Dogecoin Network Activity Surges 47% In A Month – What’s Next for

DOGE? The downturn is largely driven by macroeconomic uncertainty

and escalating trade war fears, which have shaken both crypto and

the U.S. stock markets. As investors brace for further volatility,

some fear that the market is setting up for a deeper correction.

However, not all analysts are bearish. Some believe that a recovery

could be on the horizon in the coming months, especially if

technical indicators begin to show strength. Top analyst Daan

shared insights on X, revealing that Ethereum has been

consolidating since the major sell-off and has formed a falling

wedge pattern—a bullish formation that could indicate a local trend

reversal. For now, ETH remains at risk of further declines, but if

this pattern plays out, Ethereum could soon break out of its

consolidation range and start building momentum for a recovery. The

next few weeks will be crucial in determining whether ETH can

stabilize or if more downside is ahead. Ethereum Falling Wedge

Could Signal a Reversal Ethereum has lost over 57% of its value,

creating a challenging environment for bulls as selling pressure

continues. ETH is now trading below a multi-year support level,

which has flipped into strong resistance. As long as Ethereum

remains below the $1,900–$2,000 range, bulls will struggle to

regain momentum, keeping bearish sentiment intact. The entire

crypto market has mirrored this weakness, experiencing a

significant breakdown alongside the U.S. stock market. Global trade

war fears and uncertainty surrounding U.S. President Trump’s

policies have further fueled the sell-off in risk assets. Since the

U.S. elections in November 2024, macroeconomic volatility and

rising uncertainty have driven markets lower. With the U.S. stock

market hitting its lowest levels since September 2024, investors

remain on edge, questioning if Ethereum has further downside ahead.

Despite this bleak outlook, there is some optimism. Daan’s insights

suggest that Ethereum has been consolidating since the major

drop and has formed a falling wedge pattern. This bullish formation

could lead to a local trend reversal if ETH breaks out and holds

above resistance. For this potential recovery to materialize, ETH

must break above the white zone and reclaim $2,000. If this

happens, bulls could start testing higher levels and build momentum

for a broader market recovery. However, the ETH/BTC ratio remains

near multi-year lows, showing only minor resilience in recent days.

Sustained strength is needed before a real reversal can take place.

Related Reading: Ethereum Net Taker Volume Signals Huge Selling

Pressure – Can Bulls Hold Key Levels? With Ethereum still

struggling, the next few weeks will be crucial in determining

whether this falling wedge breakout can lead to a meaningful rally

or if the downtrend will continue. Bulls Struggle Around

$1,900 Ethereum is currently trading at $1,900, after days of

struggling below the crucial $2,000 mark. Bulls have lost control,

and ETH is now at its lowest levels since October 2023, reflecting

the broader market uncertainty and ongoing bearish sentiment. With

macroeconomic volatility and trade war fears weighing heavily on

risk assets, Ethereum continues to face selling pressure, making it

difficult for bulls to build momentum for a recovery. The longer

ETH stays below $2,000, the stronger the resistance at this level

becomes, pushing buyers further out of the market. For Ethereum to

avoid deeper losses, bulls must reclaim the $2,000 mark as soon as

possible and establish it as a new support level. A break and hold

above this threshold could trigger a recovery rally, allowing ETH

to test higher resistance zones. However, losing current levels

would leave ETH vulnerable to another drop, potentially retesting

support near $1,750 or lower. Related Reading: Bitcoin Lost And

Retested The 200-Day MA As Resistance – Here’s What Happened Last

Time The next few days will be critical, as bulls need to step in

and defend current demand to prevent further downside. If they fail

to do so, Ethereum could extend its bearish trend into deeper

territory. Featured image from Dall-E, chart from TradingView

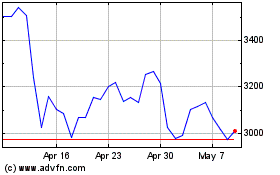

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Mar 2025 to Apr 2025

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Apr 2024 to Apr 2025