false 0001419041 0001419041 2024-05-13 2024-05-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 13, 2024

FORTE BIOSCIENCES, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

| Delaware |

|

001-38052 |

|

26-1243872 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 3060 Pegasus Park Dr. |

|

|

| Building 6 |

|

|

| Dallas, Texas |

|

75247 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (310) 618-6994

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock, $0.001 par value |

|

FBRX |

|

The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On May 13, 2024, Forte Biosciences, Inc. issued a press release reporting its financial results for the quarter ended March 31, 2024. A copy of the press release is furnished herewith as Exhibit 99.1 to this Current Report on Form 8-K.

The information furnished in this Current Report under Item 2.02 and the exhibit attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 8.01. Other Events.

The Company has updated its corporate presentation that it uses when meeting with investors, analysts and others. A copy of the Company’s updated corporate presentation is attached as Exhibit 99.2 to this Current Report on Form 8-K.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

FORTE BIOSCIENCES, INC. |

|

|

|

|

| Date: May 13, 2024 |

|

|

|

By: |

|

/s/ Antony Riley |

|

|

|

|

|

|

Antony Riley |

|

|

|

|

|

|

Chief Financial Officer |

Exhibit 99.1

FORTE BIOSCIENCES, INC. ANNOUNCES FIRST QUARTER 2024 RESULTS AND

PROVIDES BUSINESS UPDATE

DALLAS, TX

– MAY 13, 2024 – Forte Biosciences, Inc. (www.fortebiorx.com) (NASDAQ: FBRX), a clinical-stage biopharmaceutical company focused on autoimmune and autoimmune-related diseases, today announced

first quarter 2024 results and provided a business update.

First Quarter 2024 Business Highlights

“Forte continues to make excellent progress with FB102. As we indicated last quarter, the single ascending dose (SAD) portion of the FB102 phase 1 trial

was successfully completed. We expect the dosing of the multiple ascending dose (MAD) cohorts of the phase 1 trial in the healthy volunteers to complete around mid-year. To date, FB102 has demonstrated a good

safety profile, including in the MAD cohorts.” said Paul Wagner, Ph.D., Chairman and Chief Executive Officer of Forte Biosciences. “We look forward to initiating patient-based studies before the end of the year. We believe the data to date

supports the significant potential for FB102 across a variety of autoimmune and autoimmune-related diseases with large addressable markets and we look forward to addressing these opportunities as we continue to advance the FB102 program.”

First Quarter 2024 Operating Results

Research and development expenses were $4.4 million for the three months ended March 31, 2024, compared to $4.8 million for the same period in

2023. The decrease was primarily due to a decrease of approximately $2.7 million in manufacturing costs partially offset by an increase of approximately $1.4 million in clinical expenses as we advanced our FB102 program through clinical

trials, and a net increase of approximately $0.9 million in payroll and related expenses due to an increase in our average headcount.

General and

administrative expenses were $3.5 million for the three months ended March 31, 2024, compared to $2.1 million for the same period in 2023. The increase was primarily due to increases in legal and professional expenses.

Net losses per share were ($0.16) and ($0.32) for the three months ended March 31, 2024 and 2023, respectively.

Forte ended the first quarter 2024 with approximately $30.4 million in cash and cash equivalents. Forte had approximately 36.4 million shares of

common stock outstanding as of March 31, 2024.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands except share and par value data)

|

|

|

|

|

|

|

|

|

| |

|

March 31, 2024 |

|

|

December 31, 2023 |

|

| |

|

(unaudited) |

|

|

|

|

| Assets |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

30,444 |

|

|

$ |

37,125 |

|

| Prepaid expenses and other current assets |

|

|

1,058 |

|

|

|

1,202 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

31,502 |

|

|

|

38,327 |

|

|

|

|

|

|

|

|

|

|

| Property and equipment, net |

|

|

106 |

|

|

|

109 |

|

| Other assets |

|

|

409 |

|

|

|

544 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

32,017 |

|

|

$ |

38,980 |

|

|

|

|

|

|

|

|

|

|

| Liabilities and stockholders’ equity |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

1,685 |

|

|

$ |

1,424 |

|

| Accrued liabilities |

|

|

1,647 |

|

|

|

2,242 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

3,332 |

|

|

|

3,666 |

|

|

|

|

|

|

|

|

|

|

| Commitments and contingencies (Note 6) |

|

|

|

|

|

|

|

|

| Stockholders’ equity |

|

|

|

|

|

|

|

|

| Common stock, $0.001 par value: 200,000,000 shares authorized as of March 31, 2024 (unaudited) and

December 31, 2023; 36,394,882 and 36,335,105 shares issued and outstanding as of March 31, 2024 (unaudited) and December 31, 2023, respectively |

|

|

36 |

|

|

|

36 |

|

| Additional paid-in capital |

|

|

154,591 |

|

|

|

153,794 |

|

| Accumulated other comprehensive income (loss) |

|

|

(2 |

) |

|

|

4 |

|

| Accumulated deficit |

|

|

(125,940 |

) |

|

|

(118,520 |

) |

|

|

|

|

|

|

|

|

|

| Total stockholders’ equity |

|

|

28,685 |

|

|

|

35,314 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and stockholders’ equity |

|

$ |

32,017 |

|

|

$ |

38,980 |

|

|

|

|

|

|

|

|

|

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(in thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months Ended March 31, |

|

| |

|

2024 |

|

|

2023 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

| Research and development (including $29 and $0 of related party transactions for the 3 months

ending March 31, 2024 and 2023, respectively) |

|

$ |

4,353 |

|

|

$ |

4,787 |

|

| General and administrative |

|

|

3,451 |

|

|

|

2,068 |

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

7,804 |

|

|

|

6,855 |

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

|

|

(7,804 |

) |

|

|

(6,855 |

) |

| Other income, net |

|

|

384 |

|

|

|

102 |

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(7,420 |

) |

|

$ |

(6,753 |

) |

|

|

|

|

|

|

|

|

|

| Per share information: |

|

|

|

|

|

|

|

|

| Net loss per share - basic and diluted |

|

$ |

(0.16 |

) |

|

$ |

(0.32 |

) |

| Weighted average shares and pre-funded warrants

outstanding, basic and diluted |

|

|

46,082,861 |

|

|

|

21,006,680 |

|

| Comprehensive Loss: |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(7,420 |

) |

|

$ |

(6,753 |

) |

| Unrealized loss on available-for-sale securities |

|

|

(6 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Comprehensive loss |

|

$ |

(7,426 |

) |

|

$ |

(6,753 |

) |

|

|

|

|

|

|

|

|

|

Additional details on our first quarter 2024 financial results can be found in Forte’s Form 10-Q as filed with the SEC on May 13, 2024. You can also find more information in the investor relations section of our website at www.fortebiorx.com.

About Forte

Forte Biosciences, Inc. is a clinical-stage

biopharmaceutical company that is advancing its product candidate, FB102, which is a proprietary molecule with potentially broad autoimmune and autoimmune-related applications including in such indications as graft-versus-host disease, vitiligo and

alopecia areata.

Forward-Looking Statements

Forte

cautions you that statements included in this press release that are not a description of historical facts are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “may,” “will,”

“should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplates,” “believes,” “estimates,”

“predicts,” “potential” or “continue” or the negatives of these terms or other similar expressions. These statements are based on the Company’s current beliefs and expectations. Forward-looking statements include

statements regarding the Company’s beliefs, goals, intentions and expectations regarding its product candidate, FB102 and the therapeutic and commercial market potential of FB102. Actual results and the timing of events could differ materially

from those anticipated in such forward-looking statements as a result of various risks and uncertainties, which include, without limitation: risks related to Forte’s ability to obtain sufficient additional capital to continue to advance

Forte’s product candidate, FB102; uncertainties associated with the clinical development and regulatory approval of Forte’s product candidate, FB102, including potential delays in the commencement, enrollment and completion of clinical

trials, including the timing of the commencement of the Company’s patient-based studies; the risk that results from preclinical and any interim result of our ongoing phase 1

clinical trials may not be predictive of future results from clinical trials; risks associated with the failure to realize any value from FB102 in light of inherent risks, expense and

difficulties involved in successfully bringing product candidates to market; and additional risks, uncertainties, and other information affecting Forte’s business and operating results is contained in Forte’s Annual Report on Form 10-K for the year ended December 31, 2023, as filed with the Securities and Exchange Commission on March 18, 2024, in the Company’s subsequent Quarterly Report on Form 10-Q filed on May 13, 2024 and in its other filings with the Securities and Exchange Commission. All forward-looking statements in this press release are current only as of the date hereof and, except as

required by applicable law, Forte undertakes no obligation to revise or update any forward-looking statement, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise. All forward-looking

statements are qualified in their entirety by this cautionary statement. This caution is made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

|

|

|

| Contact: |

|

|

| LifeSci Advisors |

|

Forte Biosciences, Inc. |

| Mike Moyer, Managing Director |

|

Paul Wagner, CEO |

| mmoyer@lifesciadvisors.com |

|

investors@fortebiorx.com |

Exhibit 99.2 FORTE BIOSCIENCES FB-102 OVERVIEW CORPORATE DECK MAY 13,

2024 1

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS ¡ Certain

statements contained in this presentation regarding matters that are not historical facts, are forward-looking statements within the meaning of Section 21E of the Securities and Exchange Act of 1934, as amended, and the Private Securities Litigation

Act of 1995, known as the PSLRA. These include statements regarding management’s intention, plans, beliefs, expectations or forecasts for the future, and, therefore, you are cautioned not to place undue reliance on them. No forward-looking

statement can be guaranteed, and actual results may differ materially from those projected. Forte Biosciences, Inc. (“we”, the “Company” or “Forte”) undertakes no obligation to publicly update any forward-looking

statement, whether as a result of new information, future events or otherwise, except to the extent required by law. We use words such as “anticipates,” “believes,” “plans,” “expects,”

“projects,” “intends,” “may,” “will,” “should,” “could,” “estimates,” “predicts,” “potential,” “continue,”

“guidance,” and similar expressions to identify these forward-looking statements that are intended to be covered by the safe-harbor provisions of the PSLRA. ¡ Such forward-looking statements are based on our expectations and involve

risks and uncertainties; consequently, actual results may differ materially from those expressed or implied in the statements due to a number of factors, including, but not limited to, risks relating to the business and prospects of the Company;

Forte’s plans to develop and potentially commercialize its product candidates, including FB-102; the risk that results from preclinical and early clinical studies may not be predictive of results from later-stage studies or clinical trials;

the timing of initiation of Forte’s planned clinical trials; the timing of the availability of data from Forte’s clinical trials; the timing of any planned investigational new drug application or new drug application; Forte’s plans

to research, develop and commercialize its current and future product candidates; Forte’s projections of the size of the market for FB-102; Forte’s ability to successfully enter into collaborations, and to fulfill its obligations under

any such collaboration agreements; the clinical utility, potential benefits and market acceptance of Forte’s product candidates; Forte’s commercialization, marketing and manufacturing capabilities and strategy; developments and

projections relating to Forte’s competitors and its industry; the impact of government laws and regulations; Forte’s ability to protect its intellectual property position; Forte’s estimates regarding future revenue, expenses,

capital requirements and need for additional financing; and the impact of global events on the Company, the Company’s industry or the economy generally. ¡ We have based these forward-looking statements largely on our current expectations

and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy and financial needs, and these statements represent our views as of the date of this presentation. We may not

actually achieve the plans, intentions or expectations disclosed in these forward-looking statements, and you should not place undue reliance on these forward-looking statements. Forward-looking statements are inherently subject to risks and

uncertainties, some of which cannot be predicted or quantified. Information regarding certain risks, uncertainties and assumptions may be found in our filings with the Securities and Exchange Commission, including under the caption “Risk

Factors” and elsewhere in our Annual Report on Form 10-K for the year ending December 31, 2023, as filed with the Securities and Exchange Commission on March 18, 2024, our Quarterly Report on Form 10-Q filed on May 13, 2024, and other filings

with the Securities and Exchange Commission. New risk factors emerge from time to time and it is not possible for our management team to predict all risk factors or assess the impact of all factors on the business or the extent to which any factor,

or combination of factors, may cause actual results to differ materially from those contained in, or implied by, any forward-looking statements. While we may elect to update these forward- looking statements at some point in the future, we

specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this presentation. 2

FORTE BIOSCIENCES OVERVIEW • Forte Biosciences, Inc is a clinical

stage public biotechnology company (Nasdaq: FBRX) • Strong Board of Directors comprised of leaders in industry including: • Scott Brun, MD – Former head of Abbvie product development • David Gryska – Former CFO of

Incyte and Celgene • Barbera Finck, MD – Led Enbrel development at Immunex and Humira biosimilar development at Coherus • Steve Doberstein, PhD – Former Chief Scientific Officer of Nektar • Steve Kornfeld –

Co-Managing Partner of Castle Peak Partners and former Healthcare Sector Team Leader and PM at Franklin Templeton • Don Williams – Former Ernst and Young and Grant Thornton Partner 3

EXPERIENCED MANAGEMENT Forte’s management has extensive experience

in manufacturing, quality, regulatory and clinical development Paul Wagner, Ph.D., CFA – CEO Tony Riley – Chief Financial Officer Chris Roenfeldt, PMP – Chief Operating Officer Steven Ruhl – Chief Technical Officer Barbara

Finck, M.D. – Senior Medical Clinician 4 5

FB-102 PROGRAM OVERVIEW 5

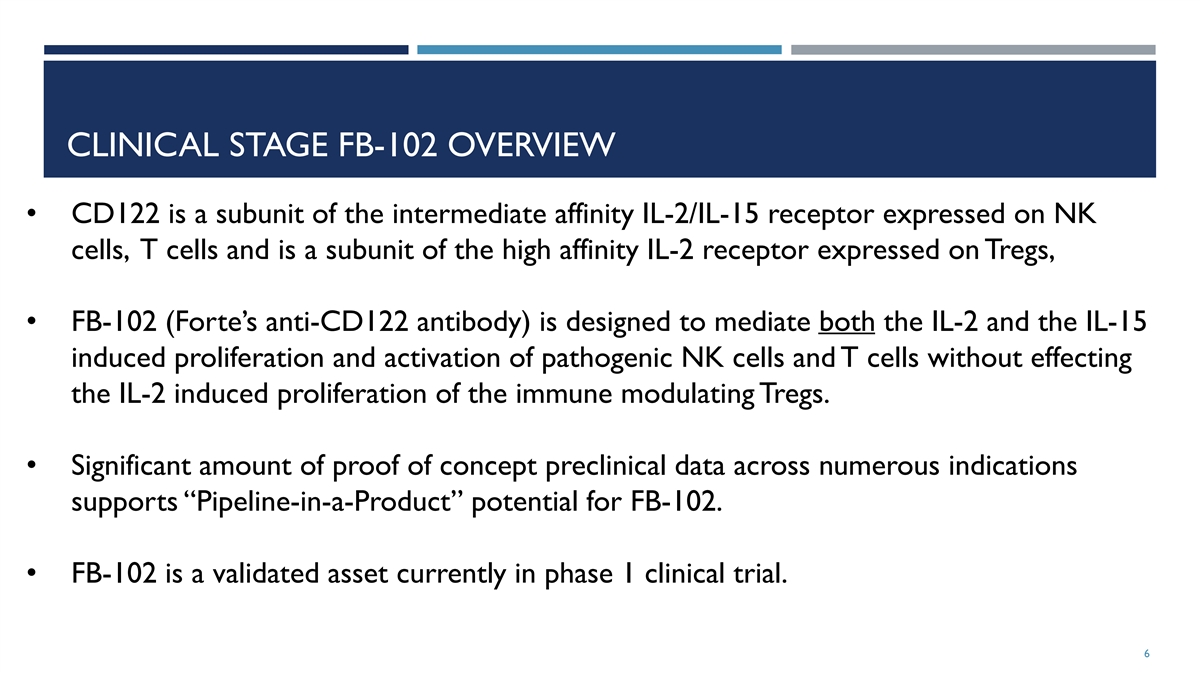

CLINICAL STAGE FB-102 OVERVIEW • CD122 is a subunit of the

intermediate affinity IL-2/IL-15 receptor expressed on NK cells, T cells and is a subunit of the high affinity IL-2 receptor expressed on Tregs, • FB-102 (Forte’s anti-CD122 antibody) is designed to mediate both the IL-2 and the IL-15

induced proliferation and activation of pathogenic NK cells and T cells without effecting the IL-2 induced proliferation of the immune modulating Tregs. • Significant amount of proof of concept preclinical data across numerous indications

supports “Pipeline-in-a-Product” potential for FB-102. • FB-102 is a validated asset currently in phase 1 clinical trial. 6

HIGHLIGHTS OF EXISTING PRECLINICAL ANTI-CD122 PROOF OF CONCEPT DATA

7

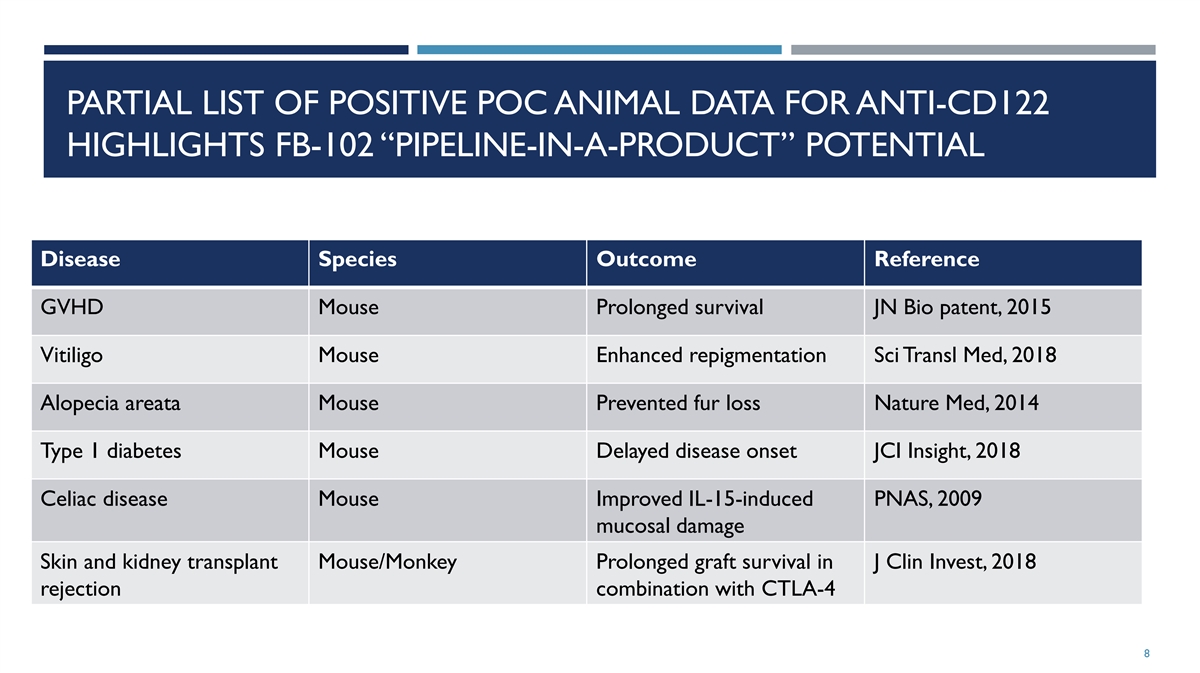

PARTIAL LIST OF POSITIVE POC ANIMAL DATA FOR ANTI-CD122 HIGHLIGHTS

FB-102 “PIPELINE-IN-A-PRODUCT” POTENTIAL Disease Species Outcome Reference GVHD Mouse Prolonged survival JN Bio patent, 2015 Vitiligo Mouse Enhanced repigmentation Sci Transl Med, 2018 Alopecia areata Mouse Prevented fur loss Nature Med,

2014 Type 1 diabetes Mouse Delayed disease onset JCI Insight, 2018 Celiac disease Mouse Improved IL-15-induced PNAS, 2009 mucosal damage Skin and kidney transplant Mouse/Monkey Prolonged graft survival in J Clin Invest, 2018 rejection combination

with CTLA-4 8

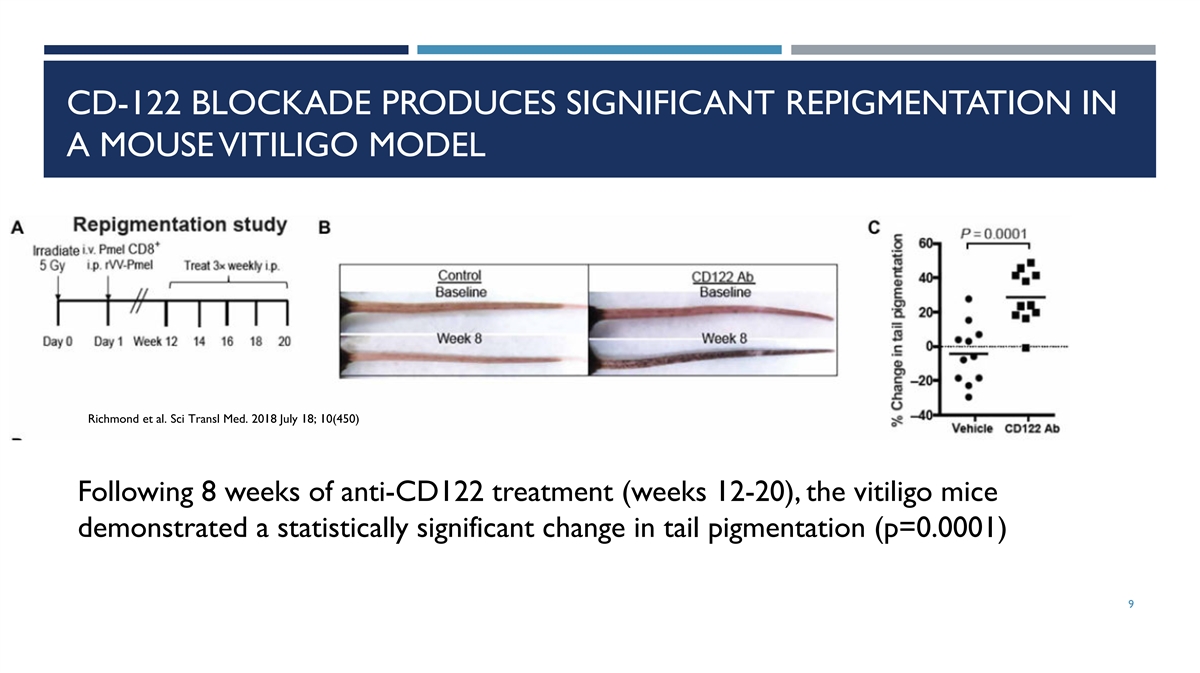

CD-122 BLOCKADE PRODUCES SIGNIFICANT REPIGMENTATION IN A MOUSE VITILIGO

MODEL Richmond et al. Sci Transl Med. 2018 July 18; 10(450) Following 8 weeks of anti-CD122 treatment (weeks 12-20), the vitiligo mice demonstrated a statistically significant change in tail pigmentation (p=0.0001) 9

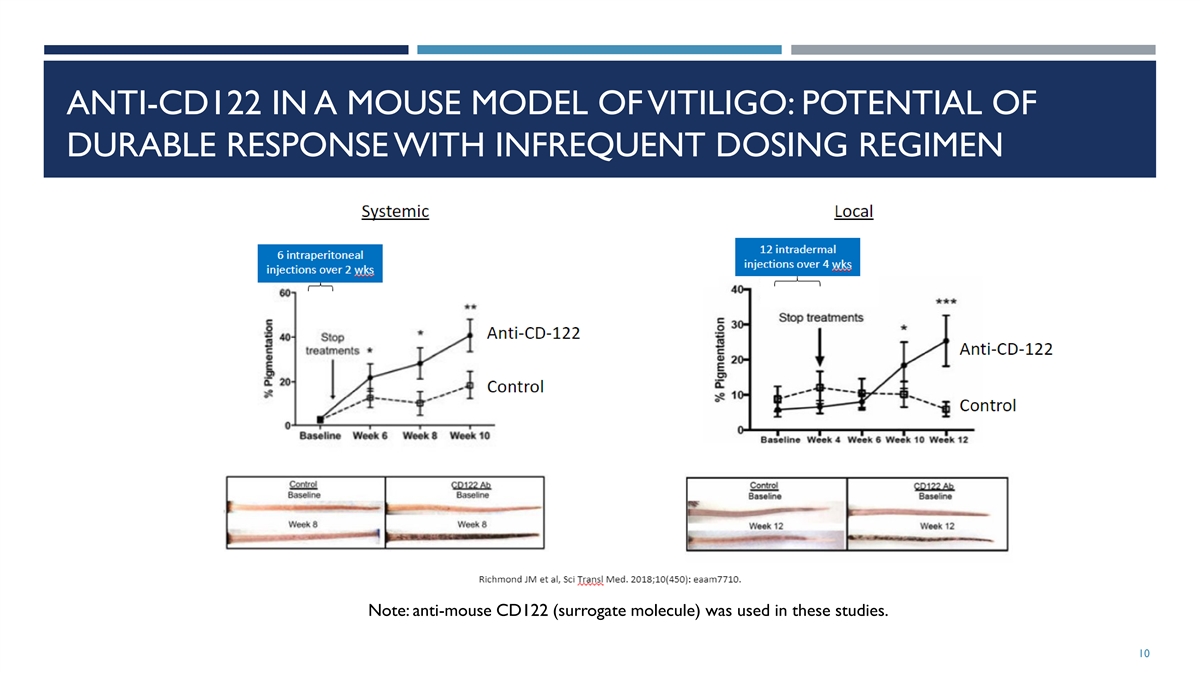

ANTI-CD122 IN A MOUSE MODEL OF VITILIGO: POTENTIAL OF DURABLE RESPONSE

WITH INFREQUENT DOSING REGIMEN Note: anti-mouse CD122 (surrogate molecule) was used in these studies. 10

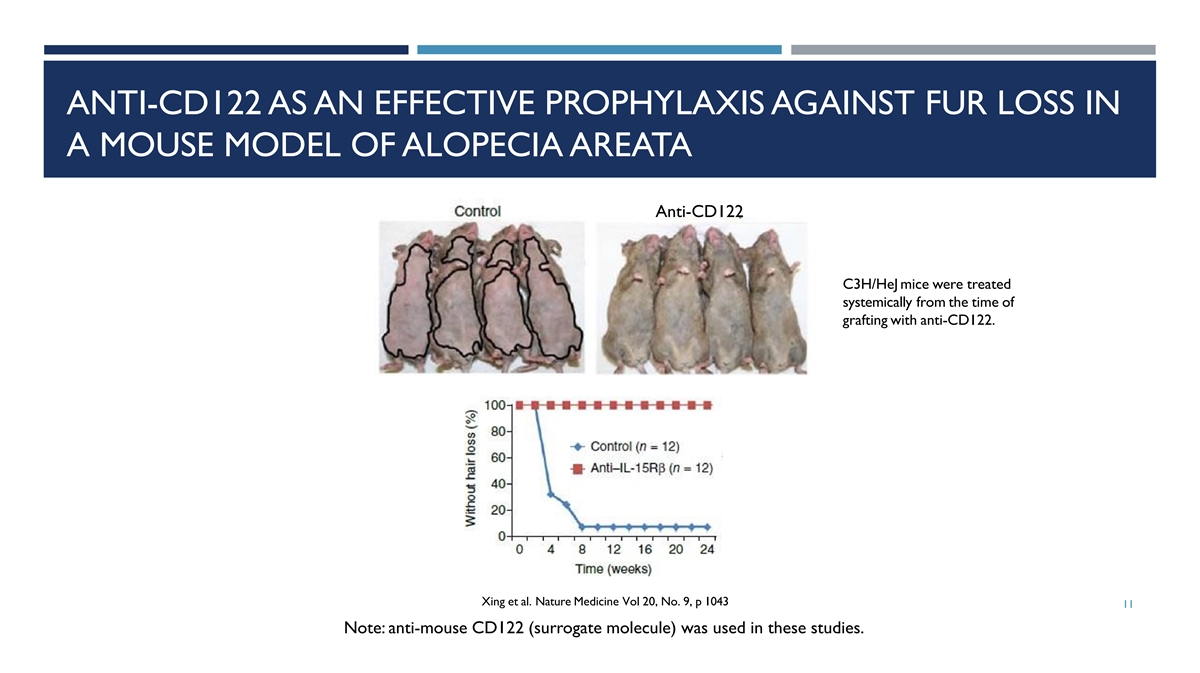

ANTI-CD122 AS AN EFFECTIVE PROPHYLAXIS AGAINST FUR LOSS IN A MOUSE

MODEL OF ALOPECIA AREATA Anti-CD122 C3H/HeJ mice were treated systemically from the time of grafting with anti-CD122. Xing et al. Nature Medicine Vol 20, No. 9, p 1043 11 Note: anti-mouse CD122 (surrogate molecule) was used in these

studies.

FB-102 DEVELOPMENT STRATEGY 12

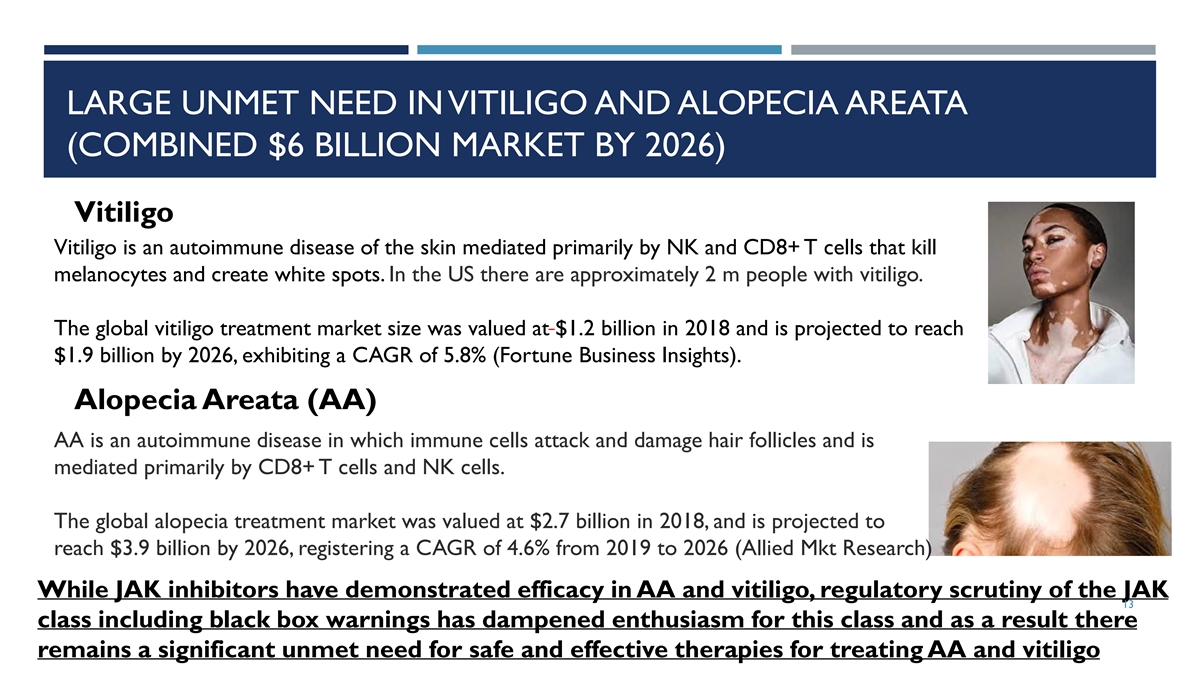

LARGE UNMET NEED IN VITILIGO AND ALOPECIA AREATA (COMBINED $6 BILLION

MARKET BY 2026) Vitiligo Vitiligo is an autoimmune disease of the skin mediated primarily by NK and CD8+ T cells that kill melanocytes and create white spots. In the US there are approximately 2 m people with vitiligo. The global vitiligo treatment

market size was valued at $1.2 billion in 2018 and is projected to reach $1.9 billion by 2026, exhibiting a CAGR of 5.8% (Fortune Business Insights). Alopecia Areata (AA) AA is an autoimmune disease in which immune cells attack and damage hair

follicles and is mediated primarily by CD8+ T cells and NK cells. The global alopecia treatment market was valued at $2.7 billion in 2018, and is projected to reach $3.9 billion by 2026, registering a CAGR of 4.6% from 2019 to 2026 (Allied Mkt

Research) While JAK inhibitors have demonstrated efficacy in AA and vitiligo, regulatory scrutiny of the JAK 13 class including black box warnings has dampened enthusiasm for this class and as a result there remains a significant unmet need for safe

and effective therapies for treating AA and vitiligo

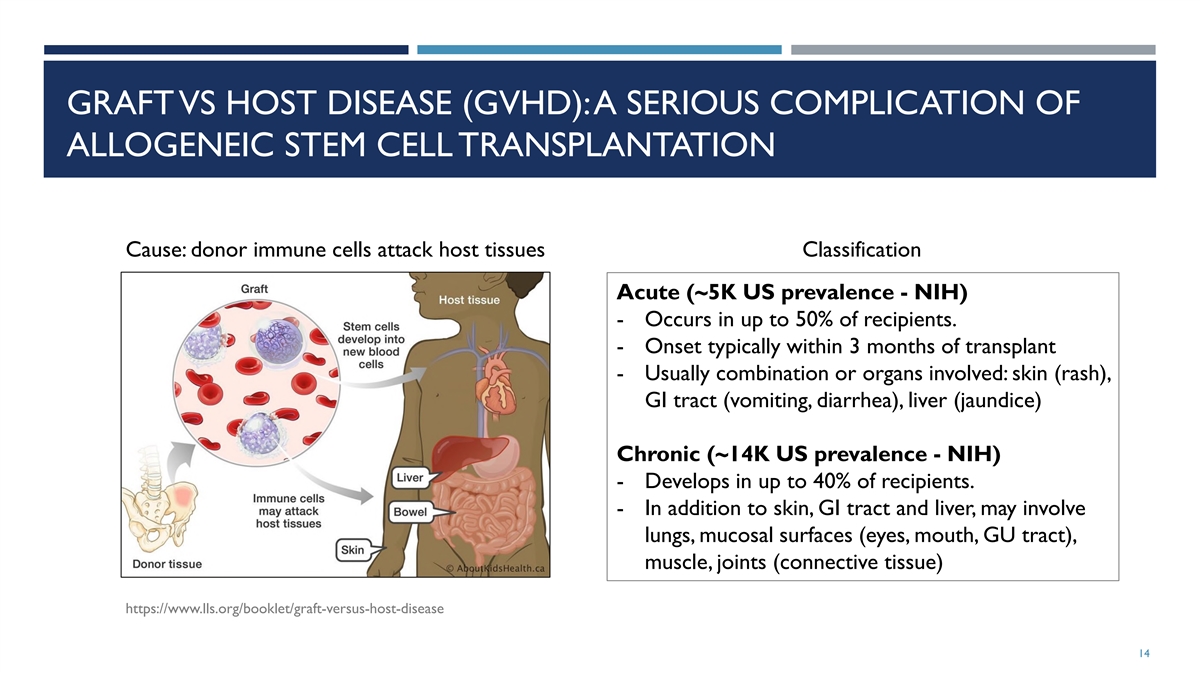

GRAFT VS HOST DISEASE (GVHD): A SERIOUS COMPLICATION OF ALLOGENEIC STEM

CELL TRANSPLANTATION Cause: donor immune cells attack host tissues Classification Acute (~5K US prevalence - NIH) - Occurs in up to 50% of recipients. - Onset typically within 3 months of transplant - Usually combination or organs involved: skin

(rash), GI tract (vomiting, diarrhea), liver (jaundice) Chronic (~14K US prevalence - NIH) - Develops in up to 40% of recipients. - In addition to skin, GI tract and liver, may involve lungs, mucosal surfaces (eyes, mouth, GU tract), muscle, joints

(connective tissue) https://www.lls.org/booklet/graft-versus-host-disease 14

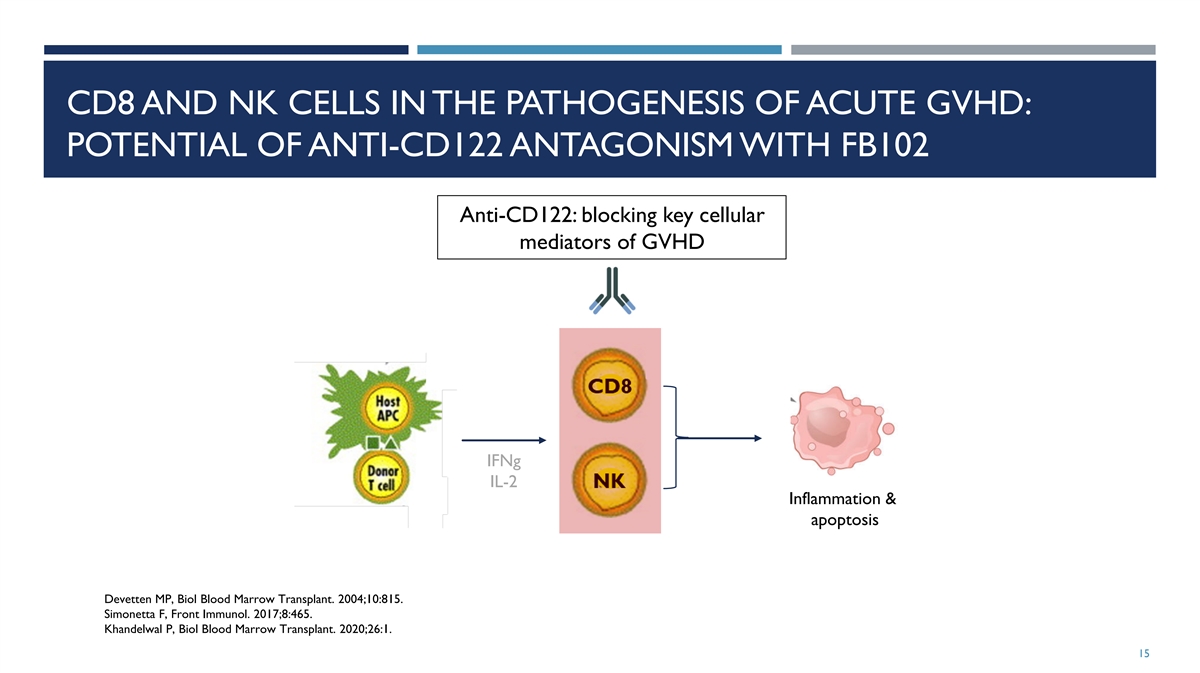

CD8 AND NK CELLS IN THE PATHOGENESIS OF ACUTE GVHD: POTENTIAL OF

ANTI-CD122 ANTAGONISM WITH FB102 Anti-CD122: blocking key cellular mediators of GVHD IFNg IL-2 Inflammation & apoptosis Devetten MP, Biol Blood Marrow Transplant. 2004;10:815. Simonetta F, Front Immunol. 2017;8:465. Khandelwal P, Biol Blood

Marrow Transplant. 2020;26:1. 15

BACKGROUND ON GRAFT VS HOST DISEASE 16

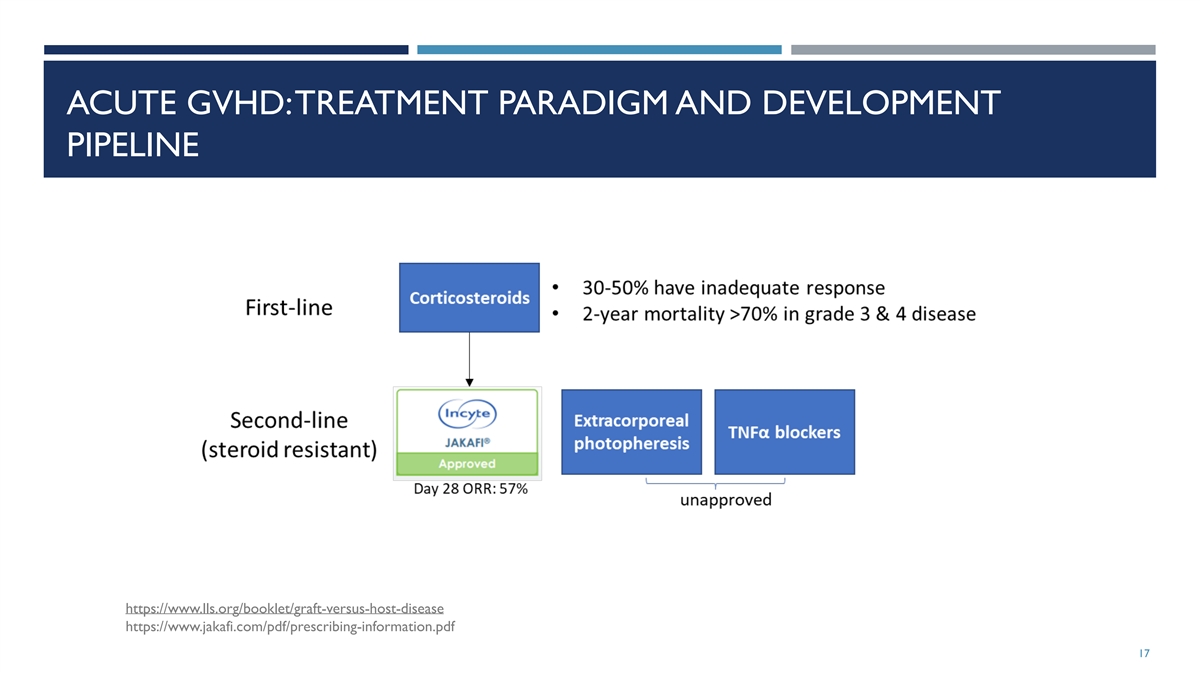

ACUTE GVHD: TREATMENT PARADIGM AND DEVELOPMENT PIPELINE

https://www.lls.org/booklet/graft-versus-host-disease https://www.jakafi.com/pdf/prescribing-information.pdf 17

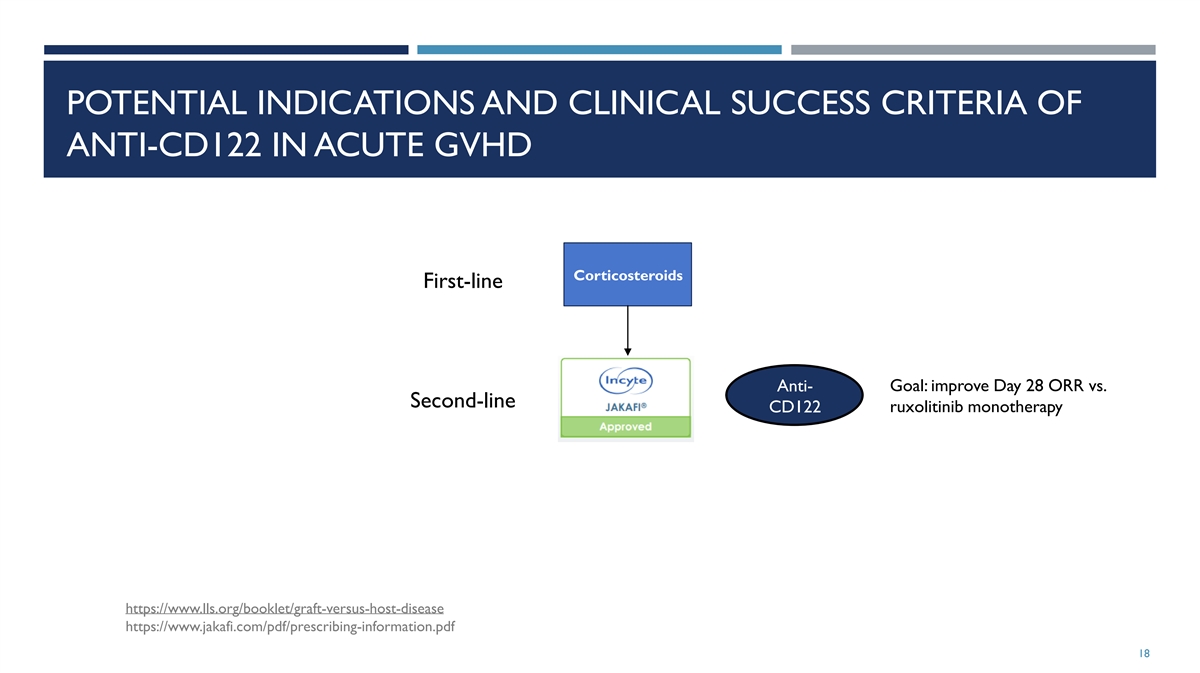

POTENTIAL INDICATIONS AND CLINICAL SUCCESS CRITERIA OF ANTI-CD122 IN

ACUTE GVHD Corticosteroids First-line Goal: improve Day 28 ORR vs. Anti- Second-line CD122 ruxolitinib monotherapy https://www.lls.org/booklet/graft-versus-host-disease https://www.jakafi.com/pdf/prescribing-information.pdf 18

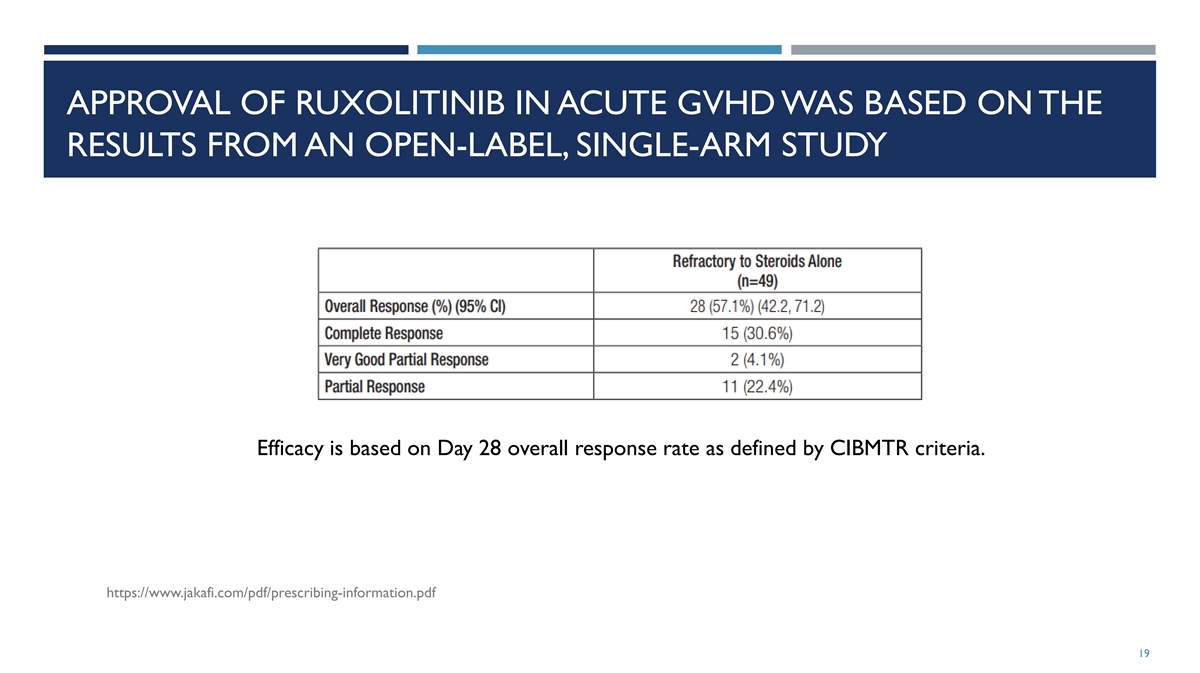

APPROVAL OF RUXOLITINIB IN ACUTE GVHD WAS BASED ON THE RESULTS FROM AN

OPEN-LABEL, SINGLE-ARM STUDY Efficacy is based on Day 28 overall response rate as defined by CIBMTR criteria. https://www.jakafi.com/pdf/prescribing-information.pdf 19

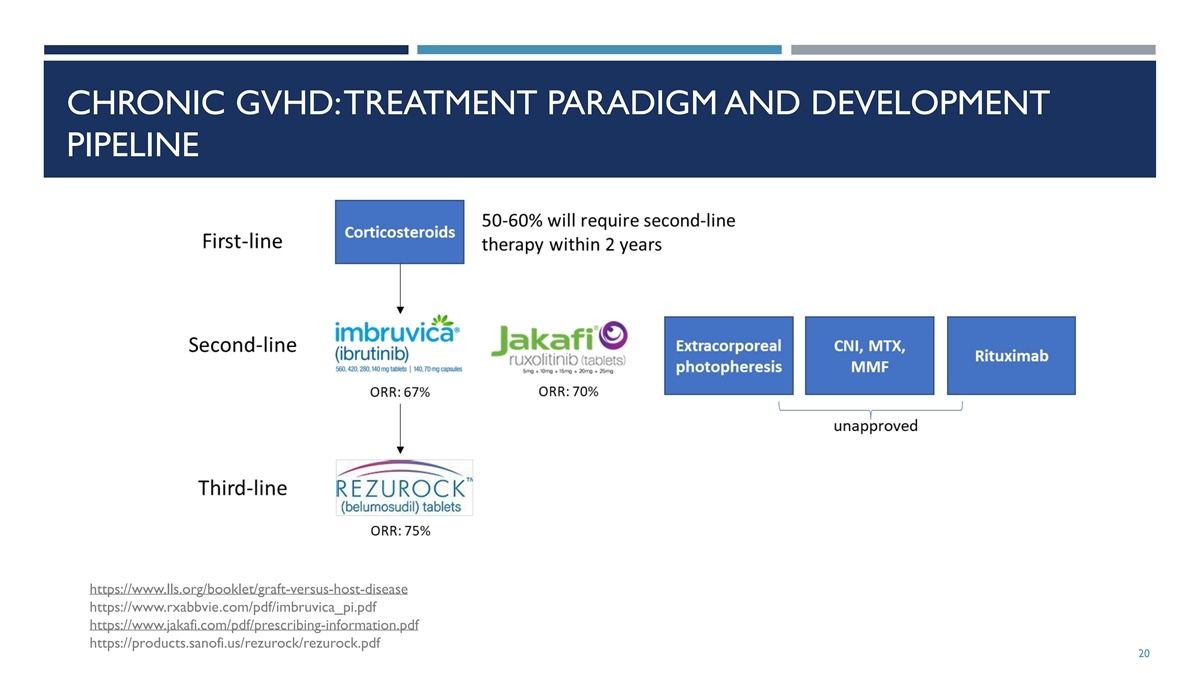

CHRONIC GVHD: TREATMENT PARADIGM AND DEVELOPMENT PIPELINE

https://www.lls.org/booklet/graft-versus-host-disease https://www.rxabbvie.com/pdf/imbruvica_pi.pdf https://www.jakafi.com/pdf/prescribing-information.pdf https://products.sanofi.us/rezurock/rezurock.pdf 20

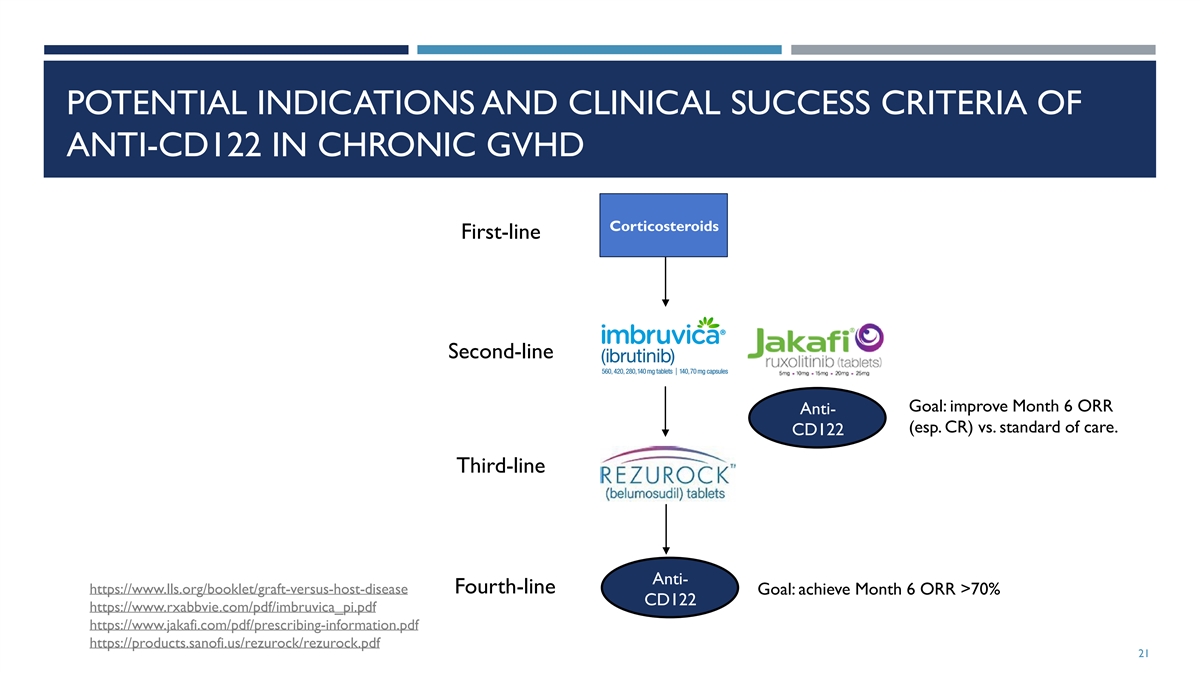

POTENTIAL INDICATIONS AND CLINICAL SUCCESS CRITERIA OF ANTI-CD122 IN

CHRONIC GVHD Corticosteroids First-line Second-line Goal: improve Month 6 ORR Anti- (esp. CR) vs. standard of care. CD122 Third-line Anti- Fourth-line https://www.lls.org/booklet/graft-versus-host-disease Goal: achieve Month 6 ORR >70% CD122

https://www.rxabbvie.com/pdf/imbruvica_pi.pdf https://www.jakafi.com/pdf/prescribing-information.pdf https://products.sanofi.us/rezurock/rezurock.pdf 21

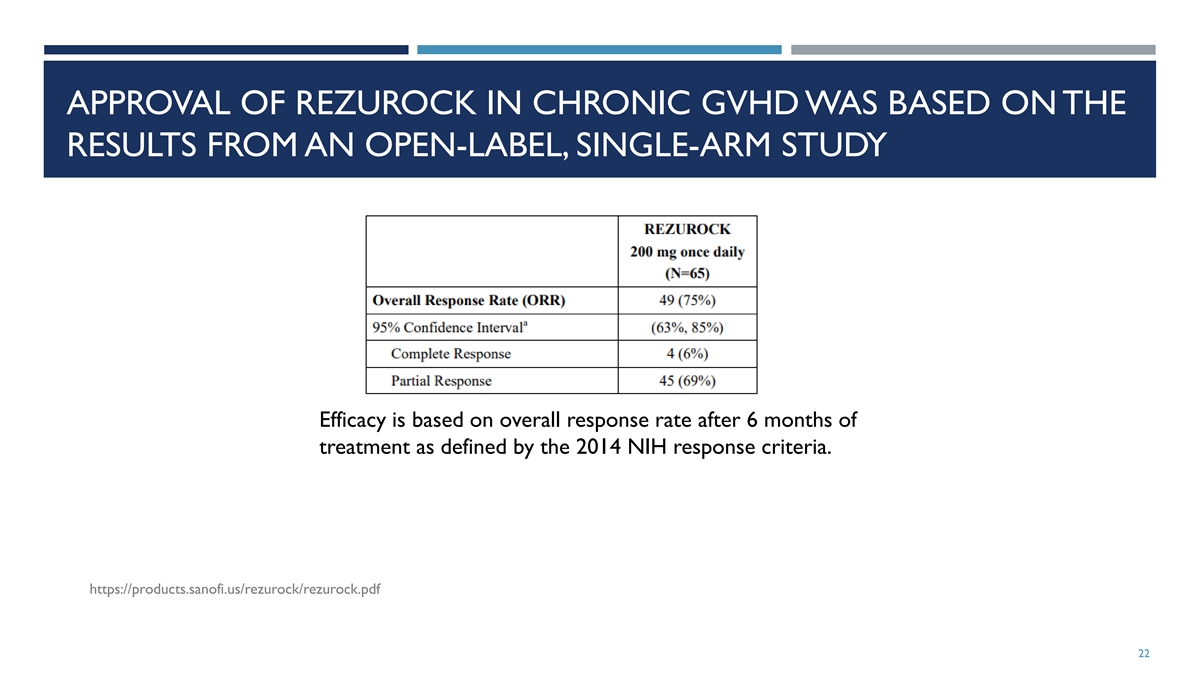

APPROVAL OF REZUROCK IN CHRONIC GVHD WAS BASED ON THE RESULTS FROM AN

OPEN-LABEL, SINGLE-ARM STUDY Efficacy is based on overall response rate after 6 months of treatment as defined by the 2014 NIH response criteria. https://products.sanofi.us/rezurock/rezurock.pdf 22

23

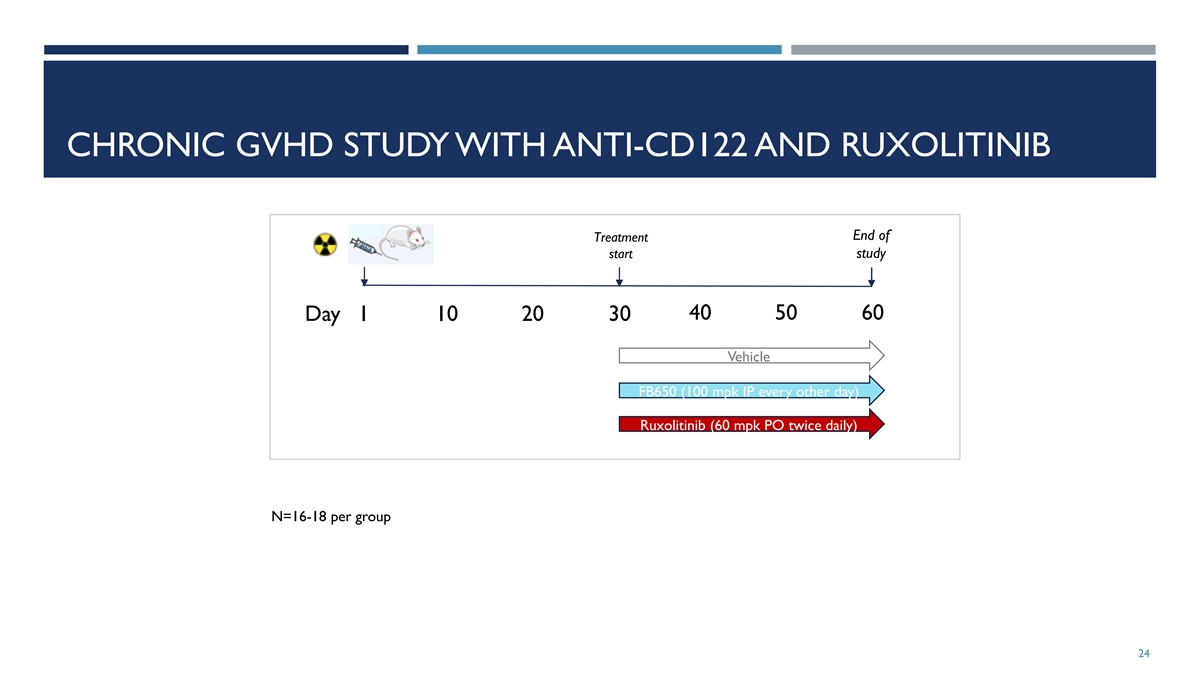

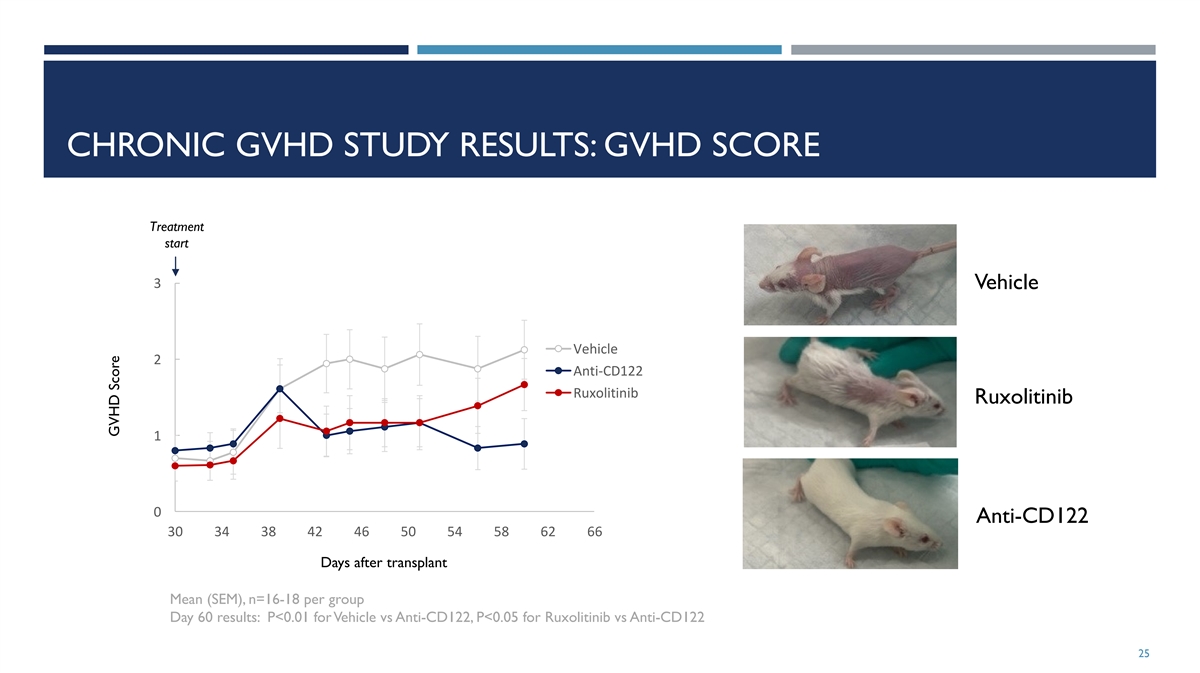

CHRONIC GVHD STUDY WITH ANTI-CD122 AND RUXOLITINIB End of Treatment

start study 40 50 60 Day 1 10 20 30 Vehicle FB650 (100 mpk IP every other day) Ruxolitinib (60 mpk PO twice daily) N=16-18 per group 24

CHRONIC GVHD STUDY RESULTS: GVHD SCORE Treatment start 3 Vehicle

Vehicle 2 Anti-CD122 Ruxolitinib Ruxolitinib 1 0 Anti-CD122 30 34 38 42 46 50 54 58 62 66 Days after transplant Mean (SEM), n=16-18 per group Day 60 results: P<0.01 for Vehicle vs Anti-CD122, P<0.05 for Ruxolitinib vs Anti-CD122 25 GVHD

Score

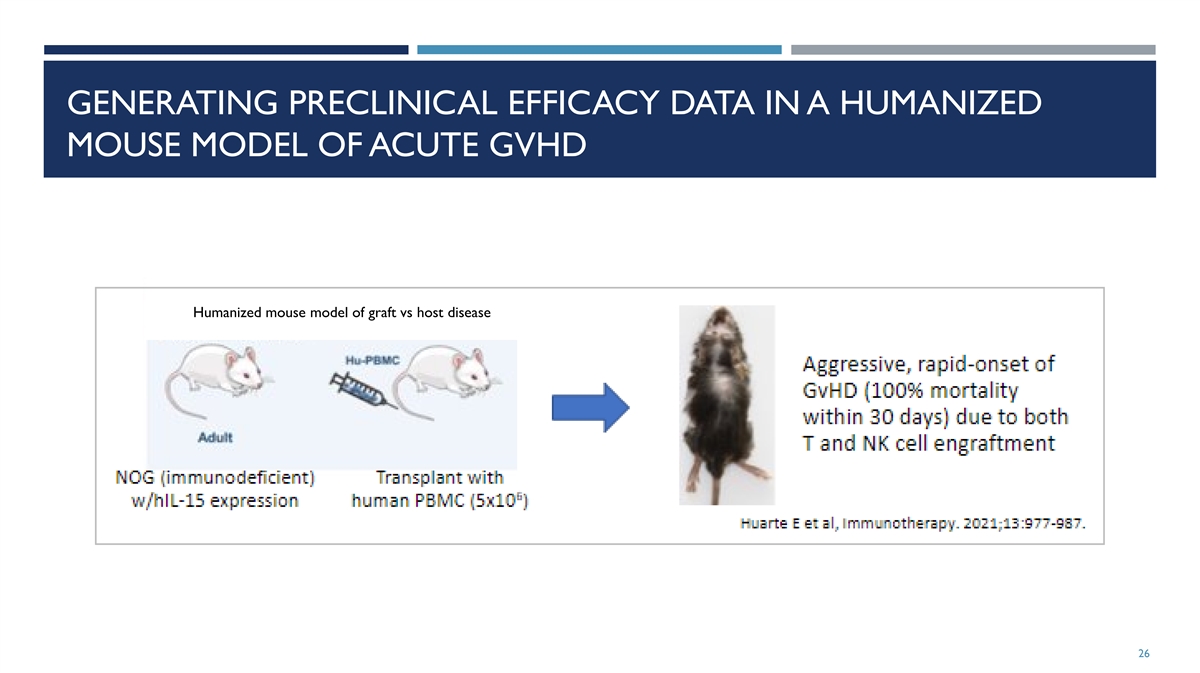

GENERATING PRECLINICAL EFFICACY DATA IN A HUMANIZED MOUSE MODEL OF

ACUTE GVHD Humanized mouse model of graft vs host disease 26

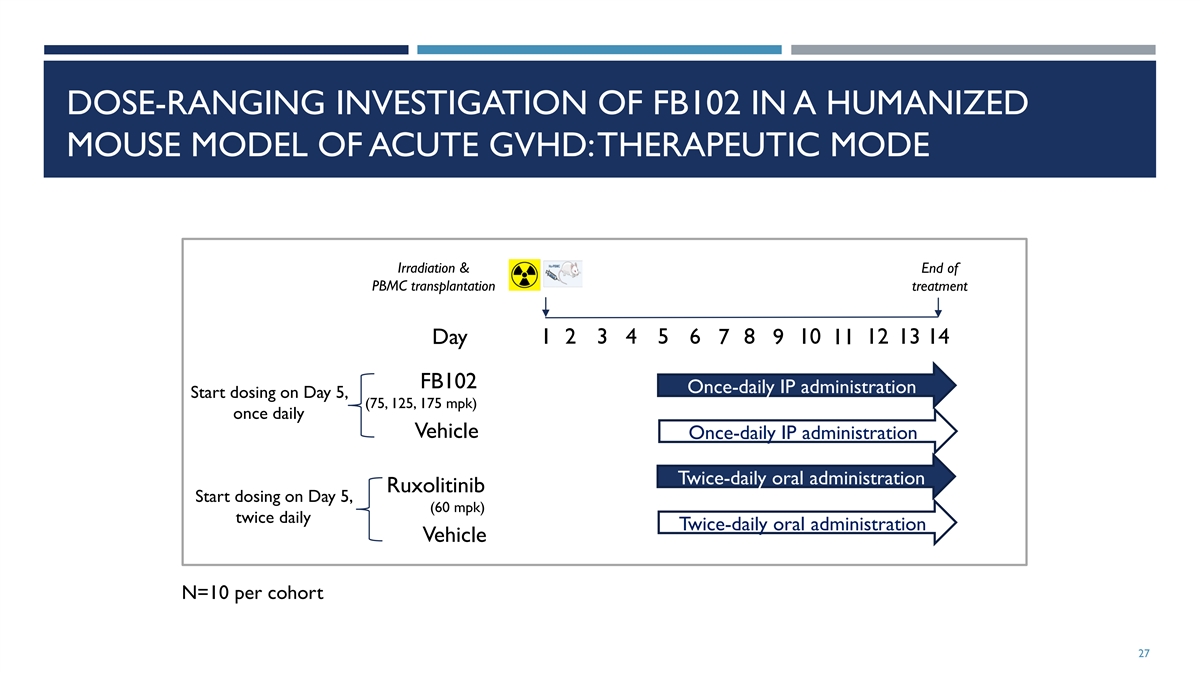

DOSE-RANGING INVESTIGATION OF FB102 IN A HUMANIZED MOUSE MODEL OF ACUTE

GVHD: THERAPEUTIC MODE Irradiation & End of PBMC transplantation treatment 1 2 3 4 5 6 8 10 12 13 14 Day 7 9 11 FB102 Once-daily IP administration Start dosing on Day 5, (75, 125, 175 mpk) once daily Vehicle Once-daily IP administration

Twice-daily oral administration Ruxolitinib Start dosing on Day 5, (60 mpk) twice daily Twice-daily oral administration Vehicle N=10 per cohort 27

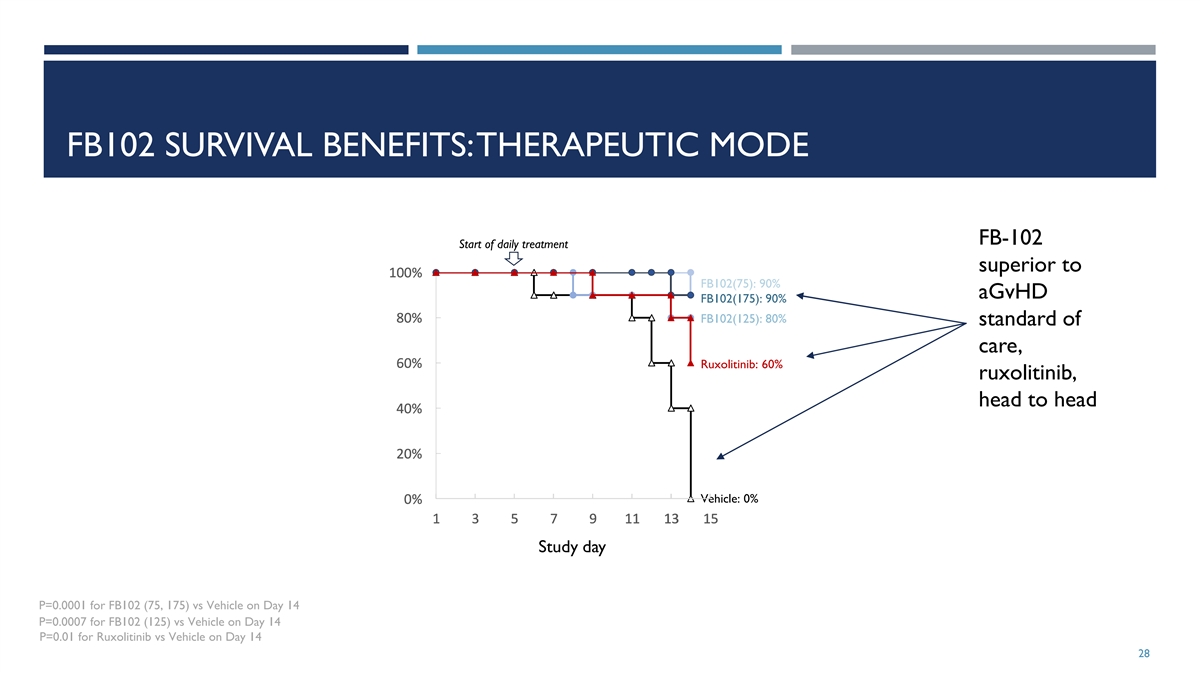

FB102 SURVIVAL BENEFITS: THERAPEUTIC MODE FB-102 Start of daily

treatment superior to 1 1 1 1 10 0 0 0 00 0 0 0 0% % % % % FB102(75): 90% aGvHD FB102(175): 90% 8 8 8 8 80 0 0 0 0% % % % % FB102(125): 80% standard of care, 6 6 6 6 60 0 0 0 0% % % % % Ruxolitinib: 60% ruxolitinib, head to head 4 4 4 4 40 0 0 0 0%

% % % % 2 2 2 2 20 0 0 0 0% % % % % Vehicle: 0% 0 0 0 0 0% % % % % 1 1 1 1 1 3 3 3 3 3 5 5 5 5 5 7 7 7 7 7 9 9 9 9 9 1 1 1 1 11 1 1 1 1 1 1 1 1 13 3 3 3 3 1 1 1 1 15 5 5 5 5 Study day P=0.0001 for FB102 (75, 175) vs Vehicle on Day 14 P=0.0007 for

FB102 (125) vs Vehicle on Day 14 P=0.01 for Ruxolitinib vs Vehicle on Day 14 28

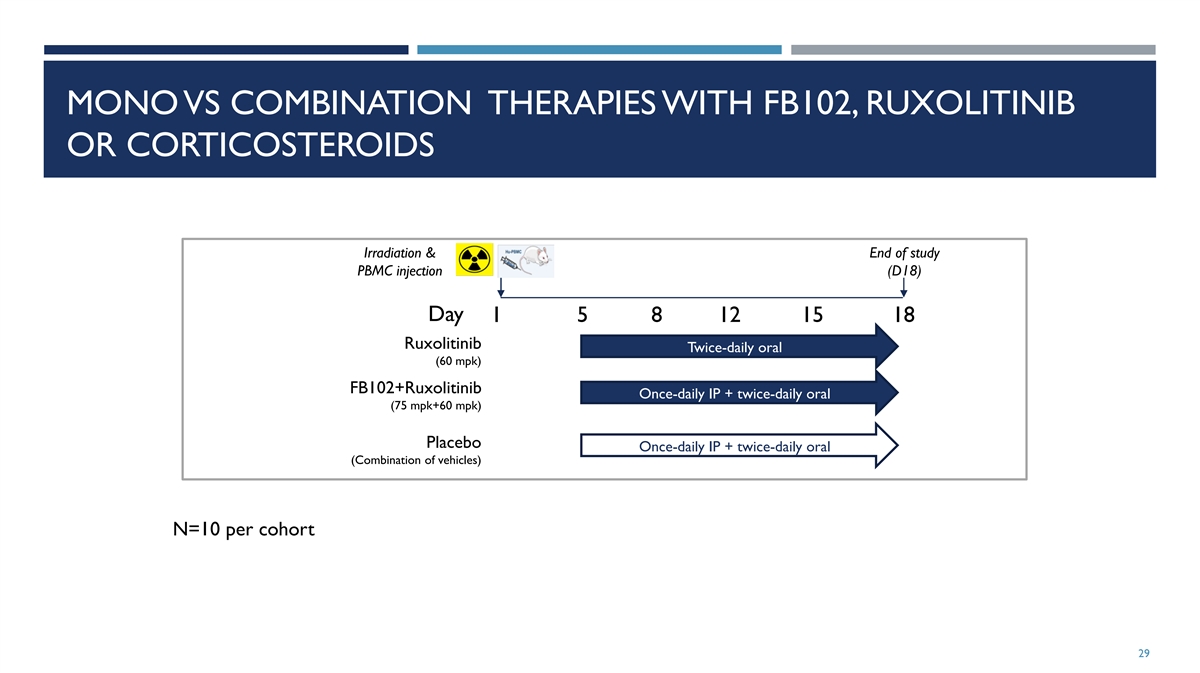

MONO VS COMBINATION THERAPIES WITH FB102, RUXOLITINIB OR

CORTICOSTEROIDS Irradiation & End of study PBMC injection (D18) Day 1 5 8 12 15 18 Ruxolitinib Twice-daily oral (60 mpk) FB102+Ruxolitinib Once-daily IP + twice-daily oral (75 mpk+60 mpk) Placebo Once-daily IP + twice-daily oral (Combination of

vehicles) N=10 per cohort 29

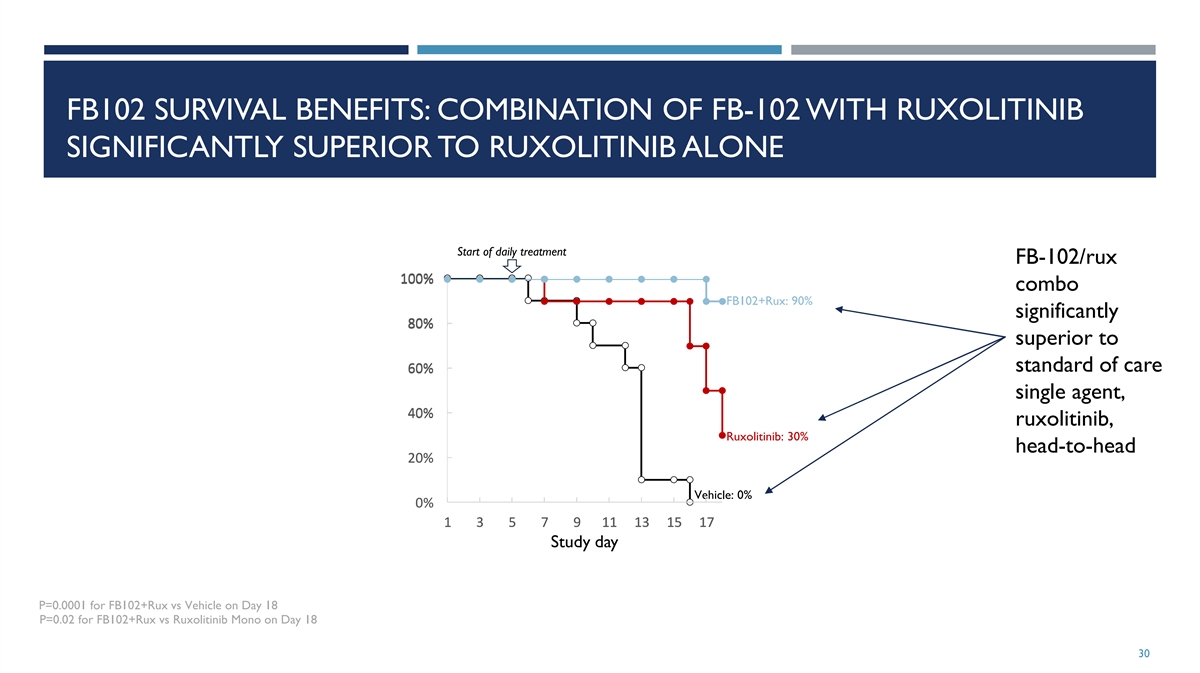

FB102 SURVIVAL BENEFITS: COMBINATION OF FB-102 WITH RUXOLITINIB

SIGNIFICANTLY SUPERIOR TO RUXOLITINIB ALONE Start of daily treatment FB-102/rux 100% 1 10 00 0% % combo FB102+Rux: 90% significantly 8 8 80 0 0% % % superior to standard of care 6 6 60 0 0% % % single agent, 4 4 40 0 0% % % ruxolitinib, Ruxolitinib:

30% head-to-head 2 2 20 0 0% % % Vehicle: 0% 0 0 0% % % 1 1 1 3 3 3 5 5 5 7 7 7 9 9 9 1 1 11 1 1 1 1 13 3 3 1 1 15 5 5 1 1 17 7 7 Study day P=0.0001 for FB102+Rux vs Vehicle on Day 18 P=0.02 for FB102+Rux vs Ruxolitinib Mono on Day 18 30

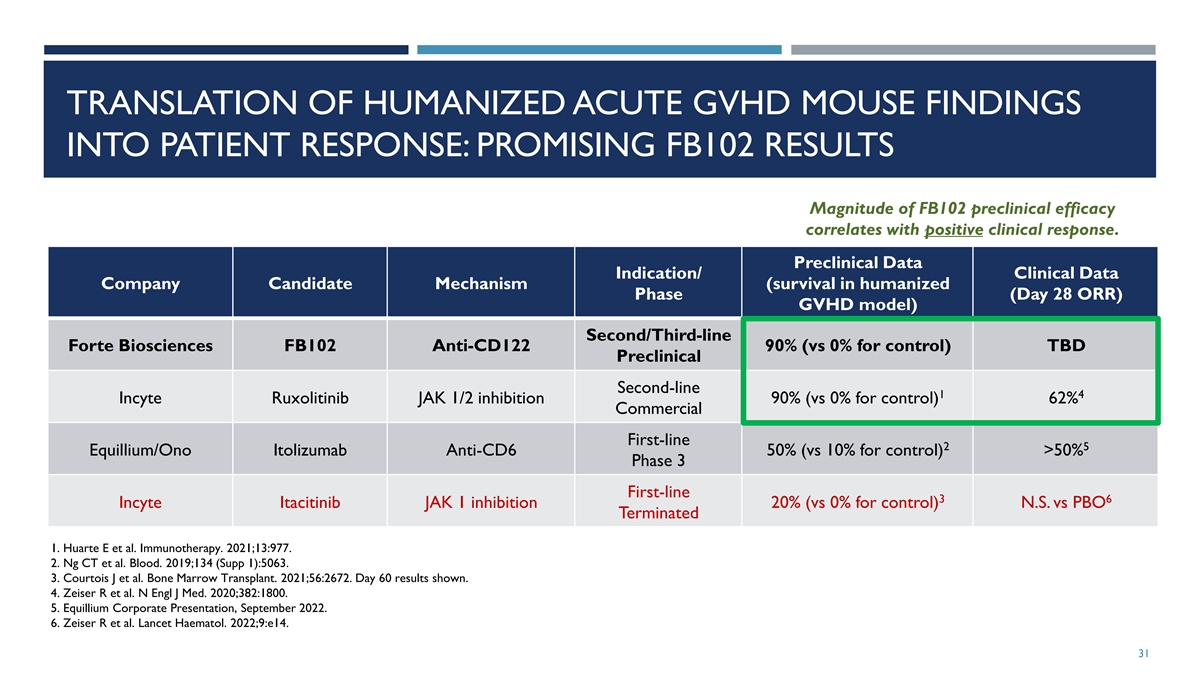

TRANSLATION OF HUMANIZED ACUTE GVHD MOUSE FINDINGS INTO PATIENT

RESPONSE: PROMISING FB102 RESULTS Magnitude of FB102 preclinical efficacy correlates with positive clinical response. Preclinical Data Indication/ Clinical Data Company Candidate Mechanism (survival in humanized Phase (Day 28 ORR) GVHD model)

Second/Third-line Forte Biosciences FB102 Anti-CD122 90% (vs 0% for control) TBD Preclinical Second-line 1 4 Incyte Ruxolitinib JAK 1/2 inhibition 90% (vs 0% for control) 62% Commercial First-line 2 5 Equillium/Ono Itolizumab Anti-CD6 50% (vs 10%

for control) >50% Phase 3 First-line 3 6 Incyte Itacitinib JAK 1 inhibition 20% (vs 0% for control) N.S. vs PBO Terminated 1. Huarte E et al. Immunotherapy. 2021;13:977. 2. Ng CT et al. Blood. 2019;134 (Supp 1):5063. 3. Courtois J et al. Bone

Marrow Transplant. 2021;56:2672. Day 60 results shown. 4. Zeiser R et al. N Engl J Med. 2020;382:1800. 5. Equillium Corporate Presentation, September 2022. 6. Zeiser R et al. Lancet Haematol. 2022;9:e14. 31

CLINICAL STAGE FB-102 OVERVIEW • CD122 is a subunit of the

intermediate affinity IL-2/IL-15 receptor expressed on NK cells, T cells and is a subunit of the high affinity IL-2 receptor expressed on Tregs. • FB-102 (Forte’s anti-CD122 antibody) is designed to mediate both the IL-2 and the IL-15

induced proliferation and activation of pathogenic NK cells and T cells without effecting the IL-2 induced proliferation of the immune modulating Tregs. • Significant amount of proof of concept preclinical data across numerous indications

supports “Pipeline-in-a-Product” potential for FB-102. • FB-102 is a validated asset currently in phase 1 clinical trial. 32

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Forte Biosciences (NASDAQ:FBRX)

Historical Stock Chart

From Oct 2024 to Nov 2024

Forte Biosciences (NASDAQ:FBRX)

Historical Stock Chart

From Nov 2023 to Nov 2024