false000178453500017845352025-01-012025-01-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 1, 2025

PORCH GROUP, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39142 | | 83-2587663 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | |

411 1st Avenue S., Suite 501 | |

Seattle, Washington | 98104 |

| (Address of principal executive offices) | (Zip Code) |

(855) 767-2400

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

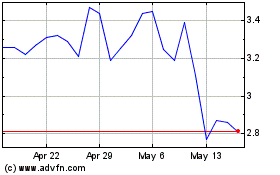

| Common stock, par value $0.0001 | | PRCH | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 1.01. Entry into a Material Definitive Agreement.

On January 2, 2025, Porch Group, Inc. (the “Company”) completed the formation of Porch Insurance Reciprocal Exchange, a new homeowners insurance reciprocal exchange (the “Reciprocal”). The formation follows prior approval by the Texas Department of Insurance (the “TDI”) to form and license a reciprocal exchange. The Reciprocal will offer homeowners tailored insurance products and connect them to services for every stage of homeownership.

In connection with the formation, the Company completed the planned sale of its homeowners insurance carrier, Homeowners of America Insurance Company (“HOAIC”), to the Reciprocal (the “Sale”). Following such Sale, HOAIC became a wholly owned subsidiary of the Reciprocal. The Company will fully manage and operate the Reciprocal and HOAIC pursuant to an Attorney-In-Fact Agreement (the “AIF Agreement”) between the Reciprocal and the Company’s new wholly owned subsidiary, Porch Risk Management Services LLC (“PRMS”).

The AIF Agreement, dated January 1, 2025, sets forth the terms and conditions of the management arrangement between PRMS and the Reciprocal. The services that will be provided by PRMS to the Reciprocal include, but are not limited to, underwriting, policy renewal, risk management, insurance portfolio management, financial management, and setting investment guidelines. PRMS will maintain the Reciprocal’s books and records and be responsible for its accounting and financial reporting. Another wholly owned subsidiary of the Company, Homeowners of America MGA, Inc., will serve as a general agent and provide services to PRMS and the Reciprocal.

As compensation for the services provided, the Company will receive ongoing commissions and policy fees equal to a blended take rate of approximately 20% of the Reciprocal’s gross written premium. The Reciprocal will be responsible for payment of all claims and claims adjustment expenses, reinsurance costs, agency commissions, taxes, and license fees. Further, the Reciprocal will indemnify PRMS and its affiliates from and against any claims, losses, damages, or similar costs and expenses that may relate to or arise out of the services provided to the Reciprocal. The AIF Agreement will remain in effect until terminated and may only be terminated by mutual agreement or by the Reciprocal for cause.

The Sale was completed pursuant to a Stock Purchase Agreement, dated and effective as of January 1, 2025 (the “SPA”). Pursuant to the Agreement, the Company’s wholly owned subsidiary, Homeowners of America Holding Company ("HOAHC"), sold all of the issued and outstanding shares of common stock of HOAIC to the Reciprocal for a purchase price equal to HOAIC’s estimated surplus at December 31, 2024 of approximately $105 million, less $58 million, which is the $49 million principal plus $9 million unpaid interest under a surplus note issued by HOAIC to the Company in 2023 (the “Purchase Price”). The SPA contained customary representations, warranties, and covenants. As part of the aforementioned transactions, subject to regulatory approval, the Reciprocal will become the sole obligor on the surplus note issued by HOAIC to the Company in 2023.

The Purchase Price was financed by a surplus note (the “Note”) issued by PIRE to HOAHC, bringing the total surplus notes held by the Company and its subsidiaries to approximately $106 million. The Note has a ten-year term but is redeemable at any time subject to a 2% early redemption penalty in the first three years. The Note has a variable interest rate of SOFR + 9.75%, payable quarterly, and allows for payments on scheduled dates.

The foregoing description of the SPA and the AIF Agreement do not purport to be complete and are qualified in their entirety by reference to the actual text of the SPA and AIF Agreement, copies of which are filed as Exhibits 2.1 and Exhibit 10.1, respectively, to this Current Report on Form 8-K and incorporated by reference herein.

Item 2.01. Completion of Acquisition of Disposition of Assets.

Effective January 1, 2025, the Company completed the sale of HOAIC as disclosed in Item 1.01 above. The information set forth in Item 1.01 above is incorporated by reference into this Item 2.01 in its entirety.

Item 7.01. Regulation FD Disclosure.

On January 7, 2025, the Company issued a press release announcing the sale of HOAIC and formation of PIRE. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits.

| | | | | | | | |

Exhibit No. | | Description |

| | |

| 2.1* | | |

| 10.1 | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

* Schedules and exhibits have been omitted pursuant to Item 601(a)(5) of Regulation S-K and Instruction 4 to Item 1.01 of Form 8-K. The Company will furnish supplementally a copy of any omitted schedule or exhibit to the SEC upon request. The Company may request confidential treatment pursuant to Rule 24b-2 of the Exchange Act for any schedules or exhibits so furnished.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| PORCH GROUP, INC. |

| | |

| By: | /s/ Shawn Tabak |

| | Name: | Shawn Tabak |

| | Title: | Chief Financial Officer |

Date: January 7, 2025

STOCK PURCHASE AGREEMENT

by and between

HOMEOWNERS OF AMERICA HOLDING CORPORATION

and

PORCH INSURANCE RECIPROCAL EXCHANGE

January 1, 2025

STOCK PURCHASE AGREEMENT

THIS STOCK PURCHASE AGREEMENT (this “Agreement”), dated as of January 1, 2025, is made by and between HOMEOWNERS OF AMERICA HOLDING CORPORATION, a Delaware corporation (the “Seller”), and PORCH INSURANCE RECIPROCAL EXCHANGE, a Texas unincorporated reciprocal inter-insurance exchange (the “Buyer”). Seller and Buyer are sometimes referred to herein as the “Parties” and each, individually, as a “Party”.

RECITALS

WHEREAS, Seller directly owns all of the issued and outstanding shares of capital stock of Homeowners of America Insurance Company, a Texas domiciled property and casualty insurance company (the “Company”); and

WHEREAS, Seller desires to sell and transfer to Buyer, and Buyer desires to purchase from Seller, all of the issued and outstanding shares of capital stock of the Company (the “Company Shares”), presently consisting of 1,000,000 shares of common stock, par value $3.00 per share;

NOW, THEREFORE, in consideration of the premises and the representations, warranties, and covenants contained herein and for other good and valuable consideration the receipt and sufficiency of which is hereby acknowledged, and intending to be legally bound hereby, the Parties agree as follows:

ARTICLE I

DEFINITIONS

Section 1.1 Defined Terms. For purposes of this Agreement, the following terms shall have the respective meanings set forth below:

“Accounting Principles” means (i) the accounting principles, policies, procedures, methodologies, practices, asset recognition bases, classifications, categorizations, estimation techniques, and assumptions (including in respect of the exercise of management judgment) as interpreted and applied in the preparation of the balance sheets included in Company Financial Statements; and (ii) to the extent not inconsistent with (i), SAP consistently applied.

“Action” means any civil, criminal, administrative, investigative or informal action, audit, demand, suit, claim, arbitration, hearing, litigation, dispute, investigation or other proceeding of any kind or nature.

“Adjusted Book Value” means the Company’s book value less all unpaid principal and unpaid interest on all outstanding surplus notes (but only to the extent such interest was not accrued as a liability in such book value calculation).

“Affiliate” means, with respect to any Person, any Person that directly, or indirectly through one or more intermediaries, controls, or is controlled by, or is under common control with, the Person in question. For purposes of the foregoing, “control”, including the terms “controlling”, “controlled by” and “under common control with”, means the possession, direct or indirect, of the

power to direct or cause the direction of the management and policies of a Person, whether through the ownership of voting securities, by Contract or otherwise.

“Assigned Trademarks” means the trademarks as described on Exhibit A hereto.

“Books and Records” means all books and records of the Company (including all data and other information stored on discs, tapes or other media) relating exclusively to the assets, properties, business and operations of the Company, including, without limitation, the articles of incorporation, bylaws, minute books and stock records of the Company, and all items relating to the Company’s legal existence, stock ownership, and corporate management, and all financial records, licenses, correspondence, and records or documents of every kind and nature used exclusively in the Company’s business, including all records concerning policies and any other data and information contained therein, but excluding in all cases (a) copies of the tax returns of Seller (including any consolidated or combined tax return), (b) files, records, data and information with respect to the employees of Seller or its Affiliates (other than the Company), (c) any materials prepared for the boards of directors or similar governing bodies of Seller or any of its Affiliates (other than the Company), (d) any corporate minute books, stock records or similar corporate records of Seller or its Affiliates (other than the Company), (e) any materials to the extent privileged or confidential for which Seller or its Affiliates do not have a common interest with Buyer, (f) any information that Seller believes in good faith is not permitted to be disclosed or transferred by Seller to Buyer or its Affiliates pursuant to Law, (g) any internal drafts, opinions, valuations, correspondence or other materials produced by, or provided between or among, Seller and its Affiliates or representatives with respect to the negotiation, valuation and consummation of the transactions contemplated under this Agreement or the terms of engagement of such representatives with respect thereto, (h) financial records (including general ledgers) of Seller or its Affiliates (other than the Company), regulatory filings made by Seller or its Affiliates (other than the Company) and any related correspondence with Governmental Entities, except to the extent the information contained therein specifically and separately identifies the Company’s business and is not otherwise included in a Book and Record, and (i) Contracts between third party vendors and Seller or any of its Affiliates (other than the Company).

“Business Day” means any day other than a Saturday, a Sunday or any other day on which commercial banks in the Borough of Manhattan, the City of New York are required to be closed for regular banking business.

“Buyer” has the meaning specified in the introductory paragraph of this Agreement.

“Buyer “Disclosure Schedule” has the meaning specified in the introductory paragraph of Article IV.

“Closing” has the meaning specified in Section 2.2(b). “Closing Date” has the meaning specified in Section 2.2(b).

“Closing SAP Balance Sheet” has the meaning specified in Section 2.2(c)(i)(A).

“Company Financial Statements” means the Company’s audited annual statutory financial statement as of December 31, 2023 and its unaudited financial statements for the first three quarters of 2024.

“Company Shares” has the meeting specified in the Recitals.

“Constituent Documents” of a Person means, as applicable, the certificate of incorporation, articles of organization, certificate of designations, bylaws, or any similar organizational or governing document or instrument of a Person.

“Contract” means any oral or written contract, agreement, mortgage, indenture, debenture, note, loan, bond, lease, sublease, license, franchise, obligation, instrument, promise, understanding or other binding commitment, arrangement or undertaking to which a Person is a party or by which any property or assets owned or used by such Person may be bound or affected.

“Encumbrance” means any lien, claim, charge, security interest, mortgage, pledge, easement, conditional sale or other title retention agreement, defect in title or other restrictions of a similar kind.

“Enforceability Exceptions” has the meaning specified in Section 3.3.

“Funds Flow Memorandum” has the meaning specified in Section 2.2(a).

“Governmental Entity” means any federal, state, local or foreign governmental or regulatory authority, agency, commission, department, body, court or other legislative, executive, or judicial or quasi-judicial governmental entity.

“Insurance Licenses” has the meaning specified in Section 3.6(a)(ii).

“Insurance Regulatory Authority” means any Governmental Entity responsible for the regulation of the business of insurance.

“Law” means any law, treaty, convention, code, statute, ordinance, directive, rule, regulation or common law imposed by any Governmental Entity applicable to the Person, place and situation in question.

“Note Purchase Agreement” has the meaning specified in Section 2.2(C)(i)(H).

“Order” means any award, decision, injunction, judgment, decree, settlement, order, process, ruling, subpoena or verdict (whether temporary, preliminary or permanent) entered, issued, made or rendered by any Governmental Entity or other authority of competent jurisdiction.

“Permitted Encumbrance” means (a) liens for taxes and other charges and assessments by a Governmental Entity that are not yet due and payable or delinquent or that are being contested in good faith by appropriate proceedings, (b) liens of landlords, carriers, warehousemen, mechanics, repairmen and materialmen and other like liens arising in the ordinary course of business for sums not yet due and payable or delinquent or that are being contested in good faith by appropriate proceedings, (c) pledges and deposits made in the ordinary course of business in compliance with workers’ compensation, unemployment insurance and other social security laws or regulations, (d) deposits to secure the performance of bids, trade Contracts, leases, statutory obligations, surety and appeal bonds, performance bonds and other obligations of a like nature incurred in the ordinary course of business, (e) defects of title, easement, rights-of-way, restrictions and other similar

charges or encumbrances not materially detracting from the value of real property or materially interfering with the ordinary conduct of the Company’s business, (f) Encumbrances that have been placed by any landlord’s financing sources on real property over which the Company and/or its Affiliates have a leasehold interest, (g) zoning, building and other generally applicable land use restrictions, (h) liens resulting from any facts or circumstances relating to Buyer or its Affiliates, (i) liens incurred or deposits made to a Governmental Entity in connection with any Governmental Entity consent and (j) other Encumbrances or imperfections on property that are not material in amount or do not materially detract from the value of or materially impair the existing use of the property affected by such lien or imperfection.

“Person” means any natural person, corporation, partnership, limited liability company, joint venture, association, trust, estate, unincorporated organization or other entity.

“Purchase Price” has the meaning specified in Section 2.2(a).

“SAP” means, as applicable, the statutory accounting practices prescribed or permitted by the Texas Department, applied on a consistent basis.

“Seller” has the meaning specified in the introductory paragraph of this Agreement.

“Seller Disclosure Schedule” has the meaning specified in the introductory paragraph of Article III.

“Texas Department” means the Texas Department of Insurance.

“Trademark Assignment Agreement” has the meaning specified in Section 2.2(c)(i)(E).

“Trademark License Agreement” has the meaning specified in Section 2.2(c)(i)(F).

“Transaction Documents” means this Agreement, the Funds Flow Memorandum, the Trademark Assignment Agreement, the Trademark License Agreement, and all other agreements to be executed and delivered by a Party in connection with the consummation of the transactions contemplated by this Agreement.

ARTICLE II

PURCHASE AND SALE OF COMPANY SHARES

Section 2.1 Purchase and Sale. Upon the terms and subject to the conditions of this Agreement, at the Closing, in exchange for the Purchase Price, Seller shall sell to Buyer, and Buyer shall purchase from Seller, the Company Shares, which constitute and represent all of the issued and outstanding shares of capital stock of the Company, free and clear of all Encumbrances except Permitted Encumbrances.

Section 2.2 Purchase Price.

(a) Payment of Purchase Price. The aggregate purchase price for the Company Shares is an amount equal to the Adjusted Book Value as of 12:01 a.m. New York City

time on the Closing Date (the “Purchase Price”). At the Closing, Seller shall sell to Buyer the Company Shares in exchange for the payment of the Purchase Price in accordance with the terms of the Funds Flow Memorandum set out in Exhibit B (the “Funds Flow Memorandum”). The calculation of the Purchase Price is attached hereto as Schedule 2.2(a).

(b) The Closing. The closing of the transactions contemplated by this Agreement (the “Closing”) shall be held electronically by the exchange of documents and signatures (or their electronic counterparts) at 10:00 a.m. New York City time, on January 2, 2025, or at such other time and place as may be agreed upon by Buyer and Seller, and shall be deemed to be effective as of 12:01 a.m. New York City time on January 1, 2025. The effective time and date of the Closing is referred to herein as the “Closing Date.”

(c) Closing Deliveries. In addition to any other documents to be delivered under other provisions of this Agreement, at the Closing:

(i) Seller shall have delivered or caused to be delivered to Buyer, the following:

(A) a balance sheet of the Company setting forth the Sellers calculation of the Adjusted Book Value of the Company as of the Closing Date, prepared by Seller in good faith and in accordance with the Accounting Principles, attached hereto as Exhibit C (the “Closing SAP Balance Sheet”);

(B) a certificate signed by an officer of Seller (which shall include reasonable documentation supporting the amounts set forth thereon), dated as of the Closing Date, stating that there has been conducted under the supervision of an officer of Seller a good faith review of all relevant information and data then available with respect to the Closing SAP Balance Sheet and the Closing SAP Balance Sheet has been prepared by Seller in good faith and in accordance with the Accounting Principles;

(C) one or more stock certificates representing the Company Shares, endorsed for transfer to Buyer or accompanied by a duly endorsed stock transfer power separate from the certificate;

(D) the Funds Flow Memorandum, duly executed by Seller;

(E) a Trademark Assignment Agreement in the form of Exhibit D hereto (the “Trademark Assignment Agreement”), duly executed by Seller and the Company, whereby, effective immediately prior to the Closing, the Company will transfer to Seller the right, title and interest to the Assigned Trademarks;

(F) a Trademark License Agreement in the form of Exhibit E hereto (the “Trademark License Agreement”), duly executed by Seller,

whereby effective as of the Closing, Seller will license to the Company the Assigned Trademarks; and

(G) a Surplus Note Purchase Agreement in the form of Exhibit F hereto (the “Note Purchase Agreement”), duly executed by the Seller whereby, effective as of the Closing, Seller or an Affiliate of Seller designated in writing by the Seller will purchase a surplus note in the form attached to the Note Purchase Agreement in an amount equal to the Purchase Price.

(ii) Buyer shall have delivered or caused to be delivered to Seller:

(A) the Funds Flow Memorandum, duly executed by Buyer;

(B) the Trademark License Agreement, duly executed by the Company; and

(C) the Note Purchase Agreement, duly executed by the Buyer.

ARTICLE III

REPRESENTATIONS AND WARRANTIES OF THE SELLER

Subject to the matters set forth in the disclosure schedule supplied by the Seller to Buyer dated the date hereof and attached hereto as Schedule 3 (the “Seller Disclosure Schedule”), Seller hereby represents and warrants to Buyer as follows:

Section 3.1 Organization and Good Standing of Seller and the Company.

(a) Organization and Good Standing of the Seller. The Seller is a corporation duly organized, validly existing and in good standing under the Laws of the State of Delaware. The Seller has all requisite corporate power and authority to carry on its business as now being conducted. The Seller is duly qualified to do business and, to the extent legally applicable, is in good standing in each jurisdiction where the character of its owned, operated or leased properties or the conduct of its business makes such qualification necessary.

(b) Organization and Good Standing of the Company. The Company is a property and casualty insurance company duly organized, validly existing and in good standing under the Laws of the State of Texas. The Company has all requisite corporate power and authority to carry on its business as now being conducted. The Company is duly qualified to do business and, to the extent legally applicable, is in good standing in each jurisdiction where the character of its owned, operated or leased properties or the conduct of its business makes such qualification necessary.

(c) Constituent Documents. Seller has furnished to Buyer a complete and correct copy of the Constituent Documents of the Company, as amended or restated

through the date hereof. Such Constituent Documents of the Company are in full force and effect. The Company has no subsidiaries.

Section 3.2 Capitalization. The authorized capital stock of the Company consists solely of 2,000,000 shares of common stock, par value $3.00 per share, of which 1,000,000 shares are issued and outstanding. The Company Shares, both as of the date of this Agreement and at Closing, constitute all of the issued and outstanding shares of the Company’s capital stock. Seller owns (of record or beneficially) all of the Company Shares, free and clear of all Encumbrances (other than Permitted Encumbrances). All of the Company Shares are duly authorized, validly issued, fully paid and non-assessable. Except as set forth in Section 3.2 of the Seller Disclosure Schedule, there are no preemptive or other outstanding rights, options, warrants, conversion rights, stock appreciation rights, redemption rights, repurchase rights, agreements, arrangements, calls, commitments or rights of any kind that obligate the Company to issue or sell any shares of capital stock or other equity securities of the Company or any securities or obligations convertible or exchangeable into or exercisable for, or giving any Person a right to subscribe for or acquire, any equity securities of the Company, and no securities or obligations evidencing such rights are authorized, issued or outstanding.

Section 3.3 Authority; No Violation.

(a) Authority. The Seller has all requisite corporate power and authority to execute and deliver this Agreement. The execution and delivery of this Agreement have been duly and validly approved by all necessary corporate action on the part of the Seller and no other corporate proceedings on the part of Seller are necessary to approve this Agreement and to consummate the transactions contemplated hereby. This Agreement has been duly and validly executed and delivered by Seller and (assuming due authorization, execution and delivery of this Agreement by Buyer) constitutes a valid and binding obligation of Seller, enforceable against Seller in accordance with its terms, subject in each case to bankruptcy, reorganization, insolvency, moratorium, rehabilitation, liquidation, fraudulent conveyance and similar Laws relating to or affecting creditors’ rights generally and to general equity principles (regardless of whether enforceability is considered in a proceeding in equity or at law) (such exceptions, the “Enforceability Exceptions”).

(b) No Violation. Neither the execution and delivery of this Agreement by Seller nor performance by Seller of its obligations hereunder will (i) conflict with or result in a breach of any provision of the Constituent Documents of Seller or the Company, or (ii) assuming the consents, permits, authorizations, approvals, filings and registrations set forth in Section 3.4 of the Seller Disclosure Schedule are obtained or made (A) violate any material statute, code, ordinance, rule, regulation, judgment, Order, writ, decree or injunction applicable to the Seller or the Company or any of their properties or assets or (B) violate, conflict with, result in a breach of any provision of or the loss of any benefit under, constitute a default (or an event which, with notice or lapse of time, or both, would constitute a default) under, result in the termination of, accelerate the performance required by, or result in a right of termination or acceleration under or the creation of any Encumbrance upon any of the respective properties or assets of the Seller or the Company under, any of the terms, conditions or provisions of any note, bond, mortgage, indenture, deed of trust, license, lease, agreement or other instrument or obligation to which the Seller

or the Company is a party, or by which it or any of its respective properties or assets may be bound or affected.

Section 3.4 Consents and Approvals. Except for the approval of the Texas Department and as otherwise set forth on Section 3.4 of the Seller Disclosure Schedule, no consents, permits, approvals, authorizations or Orders of or filings or registrations with any Governmental Entity or with any third party are required to be obtained or made by or on behalf of the Seller or the Company in connection with (i) the execution and delivery by Seller of this Agreement and (ii) the consummation by Seller of transactions contemplated hereby.

Section 3.5 Sufficiency of Consideration. The Purchase Price is sufficient and valuable consideration in exchange for the Company Shares.

Section 3.6 Financial Information.

(a) Company Financial Statements. Seller has delivered on made available to Buyer copies of the Company Financial Statements. Except as set forth in Section 3.5(a) of the Seller Disclosure Schedule, (i) the Company Financial Statements were prepared in accordance with SAP and the applicable internal controls of the Company, (ii) the Company Financial Statements fairly present in all material respects the statutory financial position of the Company at the respective date thereof and the statutory results of operations, capital and surplus and cash flows of the Company for the respective periods then ended, (iii) the Company Financial Statements complied in all material respects with all Law when filed, (iv) the Company Financial Statements were filed with or submitted to the Texas Department, in a timely manner on forms prescribed or permitted by the Texas Department, and (v) no material deficiency has been asserted by the Texas Department with respect to any of the Company Financial Statements that has not been cured or remedied to the satisfaction of the Texas Department. Company Financial Statements.

(b) Closing SAP Balance Sheet. The Closing SAP Balance Sheet has (i) been prepared in accordance with SAP and the Accounting Principles and (ii) fairly presents in all material respects the statutory financial position of the Company as of the Closing Date.

Section 3.7 Insurance Operations; Compliance with Law; Legal Proceedings.

(a) Insurance Operations. Except as set forth in Section 3.6(a)(i) of the Seller Disclosure Schedule, (i) the Company is conducting, and at all times since December 31, 2021 has conducted, its business in compliance in all material respects with all applicable insurance Laws and in the ordinary course, including using commercially reasonable efforts to maintain the goodwill of the Company and of its customers and others having business relations with the Company, (ii) Section 3.6(a)(ii) of the Seller Disclosure Schedule lists those in-force qualifications (including any commercial domiciles), registrations, filings, licenses, permits, certificates, certificates of authority, consents, approvals or authorizations issued or granted by an Insurance Regulatory Authority to the Company to write the lines of insurance business reflected in such licenses (the “Insurance Licenses”), and (iii) all of the Insurance Licenses are valid and in full force and effect without restriction on the ability to write the lines of business specified in the Insurance Licenses.

(b) Compliance With Law. The Company is, and has been since December 31, 2021, in compliance in all material respects with all Laws regulating its business and operations.

(c) Legal Proceedings. Except as set forth in Section 3.6(c) of the Buyer Disclosure Schedule, (i) neither the Seller nor the Company is a party to any pending, and to Seller’s knowledge, there are no threatened, Actions against Seller or the Company that challenge the validity or propriety of the transactions contemplated by this Agreement and (ii) the Company is not a party to any pending, and to Seller’s knowledge, threatened Actions which if adversely determined, would reasonably be expected to be materially adverse on the Company or its operations.

Section 3.8 Books and Records. The Books and Records (a) have been maintained, in all material respects, in accordance with Law and the Company’s policies and procedures in effect on the date hereof, applied on a consistent basis, (b) are accurate and complete in all material respects.

Section 3.9 Renewal Rights. The Company has good title to the Renewal Rights free and clear of any Encumbrance.

Section 3.10 Broker’s or Finder’s Fees. Other than certain advisory fees and expenses due to Aon Securities LLC in connection with the formation and financing of the Buyer (which fees and expenses of which will be borne by Porch.com, Inc.), neither Seller nor any of its officers or directors, has employed any broker or finder or incurred any liability for any broker’s fees, commissions or finder’s fees in connection with any of the transactions contemplated by this Agreement.

ARTICLE IV

REPRESENTATIONS AND WARRANTIES OF THE BUYER

Subject to the matters set forth in the disclosure schedule dated the date hereof and supplied by the Buyer to the Seller and attached hereto as Schedule 4 (the “Buyer Disclosure Schedule”), Buyer hereby represents and warrants to Seller as follows:

Section 4.1 Organization and Good Standing of Buyer. The Buyer is a reciprocal insurance exchange, duly organized, validly existing, and in good standing under the laws of the State of Texas. The Buyer has all requisite power and authority to carry on its business as now being conducted. The Buyer is duly qualified to do business and, to the extent legally applicable, is in good standing in each jurisdiction where the character of its owned, operated or leased properties or the conduct of its business makes such qualification necessary.

Section 4.2 Authority; No Violation.

(a) Authority. The Buyer has all requisite power and authority to execute and deliver this Agreement. The execution and delivery of this Agreement have been duly and validly approved by all necessary organizational action on the part of the Buyer and no other organizational proceedings on the part of Buyer are necessary to approve this

Agreement and to consummate the transactions contemplated hereby. This Agreement has been duly and validly executed and delivered by Buyer and (assuming due authorization, execution and delivery of this Agreement by Seller) constitutes a valid and binding obligation of Seller, enforceable against Seller in accordance with its terms, subject to the Enforceability Exceptions.

(b) No Violation. Neither the execution and delivery of this Agreement by Buyer nor performance by Buyer of its obligations hereunder will (i) conflict with or result in a breach of any provision of the Constituent Documents of the Buyer, or (ii) assuming the consents, permits, authorizations, approvals, filings and registrations set forth in Section 4.4 of the Buyer Disclosure Schedule are obtained or made (A) violate any material statute, code, ordinance, rule, regulation, judgment, Order, writ, decree or injunction applicable to the Buyer or any of its properties or assets or (B) violate, conflict with, result in a breach of any provision of or the loss of any benefit under, constitute a default (or an event which, with notice or lapse of time, or both, would constitute a default) under, result in the termination of, accelerate the performance required by, or result in a right of termination or acceleration under or the creation of any Encumbrance upon any of the properties or assets of the Buyer under, any of the terms, conditions or provisions of any note, bond, mortgage, indenture, deed of trust, license, lease, agreement or other instrument or obligation to which the Buyer is a party, or by which it or any of its respective properties or assets may be bound or affected.

Section 4.3 Consents and Approvals. Except for the approval of the Texas Department and as otherwise set forth on Section 4.4 of the Buyer Disclosure Schedule, no consents, permits, approvals, authorizations or Orders of or filings or registrations with any Governmental Entity or with any third party are required to be obtained or made by or on behalf of the Buyer in connection with (i) the execution and delivery by Seller of this Agreement and (ii) the consummation by Buyer of transactions contemplated hereby. Buyer has prepared and filed with the Texas Department a request for approval of the transactions contemplated by this Agreement and the Texas Department has approved the transactions contemplated this Agreement.

Section 4.4 Sufficiency of Consideration. The Buyer has sufficient and valuable consideration to pay to Seller, in the form of the Purchase Price in exchange for the Company Shares and enable the Buyer to consummate the transactions contemplated hereby.

Section 4.5 Legal Proceedings. The Buyer is not a party to any pending, and to Seller’s knowledge, there are no threatened, Actions against the Buyer that challenge the validity or propriety of the transactions contemplated by this Agreement.

Section 4.6 Broker’s or Finder’s Fees. Other than certain advisory fees and expenses due to Aon Securities LLC in connection with the formation and financing of the Buyer (which fees and expenses of which will be borne by Porch.com, Inc.), neither the Buyer nor any of its officers or directors, has employed any broker or finder or incurred any liability for any broker’s fees, commissions or finder’s fees in connection with any of the transactions contemplated by this Agreement.

ARTICLE V

COVENANTS

Section 5.1 Governmental Entity Notices. Following the Closing, each Party shall give to the other Party prompt written notice if it receives any material notice or other communication from the Texas Department or any other Governmental Entity in connection with the transactions contemplated by this Agreement, and, in the case of any such written notice or communication, shall promptly furnish the other Party with a copy thereof.

Section 5.2 Further Assurances. Each of the Parties shall execute and deliver such additional documents, instruments, conveyances and assurances and take such further action as may be reasonably required to carry out the provisions hereof and give effect to the transactions contemplated by this Agreement.

ARTICLE VI

SIMULTANEOUS SIGNING AND CLOSING

The Parties intend that the transactions provided for in this Agreement shall close simultaneously with the signing of this Agreement. Upon signing of this Agreement there are no conditions to either Party’s obligations to complete, conclude, and close the transactions provided for in this Agreement. This Agreement and the Transaction Documents shall be deemed effective and delivered as of the Closing.

ARTICLE VII

MISCELLANEOUS

Section 7.1 Notices. All notices, requests, demands and other communications under this Agreement shall be in writing and shall be deemed to have been duly given when delivered personally, when sent by confirmed facsimile, when sent by electronic mail, one (1) Business Day after being sent by overnight courier service (providing written proof of delivery) or three (3) Business Days after being mailed by certified or registered mail, return receipt requested, with postage prepaid to the Persons at the following addresses (or at such other address as shall be specified by like notice):

(a) If to Buyer, to:

Porch Insurance Reciprocal Exchange

c/o Porch Risk Management Services LLC

1400 Corporate Drive, Suite 300

Irving, Texas 75038

Attention: President

with a copy to (which shall not constitute notice):

Eversheds Sutherland (US) LLP

The Grace Building, 40th Floor

1114 Avenue of the Americas

New York, NY 10036-7703

Attention: John S. Pruitt

Email: johnpruitt@eversheds-sutherland.us

(b) If to Seller, to:

Homeowners of America Holding Corporation

c/o Porch Group, Inc.

411 1st Avenue South, Suite 501

Seattle, Washington 98104

Attention: President

with a copy to (which shall not constitute notice):

Eversheds Sutherland (US) LLP

The Grace Building, 40th Floor

1114 Avenue of the Americas

New York, NY 10036-7703

Attention: John S. Pruitt

Email: johnpruitt@eversheds-sutherland.us

Section 7.2 Remedies. Each Party agrees that any failure to perform, or breach of its obligations under this Agreement will result in irreparable injury to the other Party, that the remedies available to such other Party at law alone will be an inadequate remedy for such failure or breach and that, in addition to any other legal or equitable remedies that such other Party may have, such other Party may enforce its rights in court by an Action for specific performance and the Parties expressly waive the defense that a remedy in damages will be adequate or that an award of specific performance is not an appropriate remedy for any reason at law or equity. Any Party seeking an order or injunction to prevent or cure breaches of this Agreement and to enforce specifically the terms and provisions of this Agreement shall not be required to provide any bond or other security in connection with any such order or injunction.

Section 7.3 Governing Law. This Agreement, and all Actions (whether in contract, tort or statute) that may be based upon, arise out of or relate to this Agreement, or the negotiation, execution or performance of this Agreement (including any claim or cause of action based upon, arising out of or related to any representation or warranty made in or in connection with this Agreement or as an inducement to enter into this Agreement), shall in all respects be governed by, and construed and enforced in accordance with, the Laws of the State of Texas applicable to agreements made and to be performed entirely within such state without giving effect to any conflicts of law principles of such state that might refer the governance, construction or interpretation of such agreements to the Laws of another jurisdiction.

Section 7.4 Jurisdiction; Venue. The Parties irrevocably agrees that any and all Actions arising out of, relating to or in connection with this Agreement or its subject matter and the rights and obligations arising hereunder, or for recognition and enforcement of any settlement or judgment in respect of this Agreement and the rights and obligations arising hereunder brought by any other Party hereto or its successors or assigns, shall be brought and determined exclusively in the courts of the State of Texas located in Dallas County, Texas.

Section 7.5 Jury Waiver. EACH PARTY WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY IN RESPECT OF ANY ACTION ARISING OUT OF OR RELATING TO THIS AGREEMENT, AND WHETHER MADE BY CLAIM, COUNTERCLAIM, THIRD PERSON CLAIM OR OTHERWISE. EACH PARTY HERETO ACKNOWLEDGES THAT IT AND THE OTHER PARTIES HERETO HAVE BEEN INDUCED TO ENTER INTO THIS AGREEMENT BY, AMONG OTHER THINGS, THE MUTUAL WAIVERS IN THIS SECTION.

Section 7.6 Successors and Assigns; Third Party Beneficiaries. The rights and obligations of either Party under this Agreement shall not be assignable or delegable by such Party hereto without the written consent of the other Party. Any attempted or purported assignment without the prior written consent of the other Party shall be void and have no effect. This Agreement shall be binding upon and inure to the benefit of the Parties hereto and their successors and permitted assigns. Nothing in this Agreement, expressed or implied, is intended or shall be construed to confer upon any Person any right, remedy or claim under or by reason of this Agreement.

Section 7.7 Waivers. Any term or provision of this Agreement may be waived, or the time for its performance may be extended, in writing at any time by the Party or Parties entitled to the benefit thereof. Any such waiver shall be validly and sufficiently authorized for the purposes of this Agreement if, as to any Party, it is authorized in writing by an authorized representative of such Party. The failure of any Party hereto to enforce at any time any provision of this Agreement shall not be construed to be a waiver of such provision, nor in any way to affect the validity of this Agreement or any part hereof or the right of any Party thereafter to enforce each and every such provision. No waiver of any breach of this Agreement shall be held to constitute a waiver of any preceding or subsequent breach.

Section 7.8 Partial Invalidity. Wherever possible, each provision hereof shall be interpreted in such manner as to be effective and valid under Law, but in case any one or more of the provisions contained herein shall, for any reason, be held to be invalid, illegal or unenforceable in any respect, such provision shall be ineffective to the extent, but only to the extent, of such invalidity, illegality or unenforceability without invalidating the remainder of such invalid, illegal or unenforceable provision or provisions or any other provisions hereof, unless such a construction would be unreasonable.

Section 7.9 Execution in Counterparts. This Agreement may be executed in one or more counterparts, including by facsimile or by electronic delivery in pdf format, each of which shall be considered an original instrument, but all of which shall be considered one and the same agreement, and shall become binding when one or more counterparts have been signed by each of the Parties hereto and delivered to Seller and Buyer.

Section 7.10 Entire Agreement; Amendments. This Agreement, the Exhibits and Schedules referred to herein, and the documents delivered pursuant hereto, contain the entire understanding of the Parties with regard to the subject matter contained herein or therein, and supersede all other prior representations, warranties, agreements, understandings or letters of intent between or among any of the Parties hereto which representations, warranties, agreements, understandings or letters of intent shall be of no force or effect for any purpose. This Agreement shall not be amended, modified or supplemented except by a written instrument signed by each of the Parties hereto.

[signature page immediately follows]

IN WITNESS WHEREOF, this Agreement has been duly executed and delivered by the duly authorized officers of the Parties as of the date first written above.

SELLER:

HOMEOWNERS OF AMERICA HOLDING CORPORATION

By: /s/ Nathan Smith

Name: Nathan Smith

Title: Chief Accounting Officer and Treasurer

BUYER:

PORCH INSURANCE RECIPROCAL EXCHANGE

By: /s/ Efram Ware

Name: Efram Ware

Title: President, Porch Risk Management Services LLC, as its attorney-in-fact

[Signature page to Stock Purchase Agreement]

PORCH RISK MANAGEMENT SERVICES LLC

ATTORNEY-IN-FACT AGREEMENT

This Attorney-in-Fact Agreement (this “Agreement”) is made effective this first day of January 2025 (the “Effective Date”), by and between Porch Insurance Reciprocal Exchange, a Texas reciprocal insurance exchange (“Exchange”), and Porch Risk Management Services LLC, a Texas limited liability company (“AIF”). The Exchange and AIF may each be referred to individually as a “Party” or collectively as the “Parties.”

RECITALS

WHEREAS, as part of an initial application for insurance from the Exchange, each subscriber (each a “Subscriber” and, together, the “Subscribers”) will execute and deliver to AIF a Subscriber’s Agreement and Power of Attorney (the “Subscriber’s Agreement”) and, pursuant thereto, will appoint AIF to act as such Subscriber’s attorney-in-fact with the authority to exchange reciprocal insurance contracts ( the “Policies”) among the Subscribers and to manage and conduct the business of the Exchange, and

WHEREAS, the Exchange and AIF desire to set forth the terms and conditions upon which AIF will accept its appointment as attorney-in-fact for the Subscribers to exchange their Policies and to manage and conduct the business and affairs of the Exchange;

NOW, THEREFORE, in consideration of the mutual covenants and consideration contained in this Agreement and intending to be legally bound hereby, the Exchange and AIF agree as follows:

1. Acceptance of Appointment as Attorney-in-Fact. AIF hereby accepts its appointment as attorney-in-fact pursuant to the Subscriber’s Agreement executed by each Subscriber and agrees, as Attorney-in-Fact, to exchange the Policies among the Subscribers as set forth in the Subscriber’s Agreement.

2. Management Services. AIF, either directly or indirectly by contracting with a third-party on behalf of the Exchange, shall furnish all senior management, employees and resources necessary to provide the services to the Exchange set forth in the Subscriber’s Agreement, including, without limitation, the following services and functions on behalf of the Exchange:

(a) Establish and enforce the terms of the Subscriber’s Agreement, and establish and maintain underwriting guidelines, classification plans, rates, and insurance policies, endorsements, applications, binders, and other forms required for the Exchange’s business in accordance with applicable laws and industry standards;

(b) Receive applications for insurance, determine the acceptability of risks in accordance with the underwriting standards established by AIF, and issue policies;

(c) Administer all matters relating to the renewal, nonrenewal, conditional renewal, cancellation, endorsement, or other modifications of existing Policies;

(d) Administer all matters relating to risk management and insurance portfolio management;

(e) Establish and maintain complete and accurate records of all Subscriber’s Agreements entered into with Subscribers, all Policies exchanged by AIF on behalf of the Exchange, and all other financial, tax, and business records required of the Exchange by applicable laws and industry standards;

(f) Administer all matters relating to the preparation and filing of reports required by governmental and nongovernmental regulatory and supervisory authorities in accordance with the policies and standards established by AIF;

(g) Collect, maintain and account for all funds received as payments of insurance premiums, contributions to surplus and other receipts, including all funds borrowed by AIF in the name of the Exchange, and the timely deposit of all such funds in a Federal Reserve System member bank or banks in the name of the Exchange in accordance with applicable laws and the policies and procedures established by AIF;

(h) Establish and maintain investment guidelines, invest assets in accordance with applicable laws and industry standards, and work with investment advisors retained by AIF at the expense of the Exchange;

(i) Monitor the Exchange’s legal affairs, respond on behalf of the Exchange to policyholder complaints and regulatory inquiries, and oversee the Exchange’s participation in guaranty funds, residual market mechanisms, and other mandatory or voluntary insurance organizations;

(j) Develop and implement marketing strategies, including preparation of mailings, advertisements, and content for newsletters, websites, and social media, together with all other promotional and marketing materials;

(k) Obtain access to proprietary customer and home data available to the AIF through its affiliates’ business-to-business software-as-a-service channels, and use such data for marketing, sales, underwriting, pricing and risk management purposes;

(l) Recruit, appoint, supervise and terminate managing general agents, general agents, retail agents, brokers, program managers and other distribution partners, including affinity programs and agents, brokers, program managers and distribution partners affiliated with AIF, including without limitation Homeowners of America MGA, Inc. (or its successor), provided, commissions and fees paid to such partners and out-of-pocket costs of such licensing, appointment and termination shall be at the expense of the Exchange;

(m) Determine producer compensation levels, administer payments to and return payments from producers, if applicable, and establish and administer referral and other cross-marketing ventures, all in accordance with applicable laws and industry standards;

(n) Receive proofs of loss, investigate and pay claims on behalf of and at the expense of the Exchange and, in connection therewith, provide, directly or indirectly through one or more third-party claims administrator(s), adequate claims supervision and facilities for the timely processing of all claims, notices and proofs of loss against the Exchange and for the timely investigation and payment of claims, including the employment of claims adjusters, attorneys, experts and others, with all allocated costs, unallocated costs and claim expenses to be paid by the Exchange;

(o) Bring suit on behalf of and defend claims against the Exchange, at the Exchange’s expense, in all legal and administrative proceedings deemed necessary, in the Exchange’s judgment, to defend the Exchange’s rights, including acceptance of service of process on behalf of the Exchange, entering legal appearances on behalf of the Exchange, and the compromise, litigation, defense and settlement of losses and claims

(p) Operate and oversee customer service centers;

(q) Assess and utilize technology and data available from or through its affiliates for customer acquisition, pricing, risk assessment and claims administration;

(r) Develop and maintain all systems and procedures necessary to comply with all applicable insurer anti-fraud requirements and other governmental authorities having jurisdiction over the Exchange;

(s) Establish and monitor loss reserves in accordance with sound insurance and actuarial practices and procedures;

(t) Place assumed and ceded reinsurance and all related security for statement credit, and receive or pay premiums or loss settlements thereon, as the case may be, for the benefit of and at the expense of the Exchange, all in accordance with applicable laws and industry standards;

(u) At AIF’s sole discretion, develop Subscriber Savings Accounts (“SSAs”) and other Subscriber benefits and awards programs, and, if created, administer the SSAs and Subscriber awards and benefits programs in compliance with guidelines developed and maintained by AIF;

(v) Participate in the Subscribers’ Advisory Committee in the manner set forth in the Exchange’s Bylaws;

(w) Perform any of the foregoing services and functions on behalf of any subsidiary or other affiliate of the Exchange in accordance with the terms and conditions of any written agreement between the Exchange and such subsidiary or affiliate; and

(x) Take all such other actions as AIF determines to be necessary, advisable or proper in order for AIF to discharge its responsibilities and duties under this Agreement and the Exchange’s Declaration of Subscribers, Bylaws and Subscriber’s Agreement and Power of Attorney.

3. Management Fee. AIF will be compensated for the management services to be performed by AIF as attorney-in-fact by the payment of attorney-in-fact fees as provided in the Subscriber’s Agreement and Power of Attorney (the “Management Fee”).

4. Payment of Expenses of the Exchange. The Exchange shall be responsible for the following expenses of the Exchange as set forth in Schedule A: losses, loss adjustment expenses, investment expenses, legal expenses, commissions to agents and brokers, direct out-of- pocket marketing costs, court costs, taxes, assessments, license fees, membership fees, the fees of attorneys, actuaries, accountants and investment and other advisors, governmental fines and penalties, reinsurance premiums and costs, audit fees, guaranty fund assessments, fees related to the startup and formation of the Exchange, and all other costs necessary for the proper and efficient operation of the Exchange not specifically allocated to the AIF in Schedule A. Additionally, AIF may procure, at the expense of the Exchange, directors and officers liability insurance coverages for AIF and the members of the Subscribers’ Advisory Committee. AIF is authorized to utilize the funds of the Exchange, or utilize its own funds and be reimbursed by the Exchange, to pay such expenses. Such payments or reimbursements shall not reduce the Management Fee.

5. Intellectual Property. The Exchange acknowledges and agrees that all intellectual property developed by AIF, whether or not developed or utilized in connection with the foregoing functions or otherwise associated with the Exchange’s operations, remains the sole and exclusive property of AIF. Such intellectual property includes, without limitation, all predictive models, studies, algorithms, rating plans, software and third-party license rights, Subscriber data acquired in connection with transactions and experiences between the Exchange and its Subscribers (including rights to “expirations”), producer lists and producer premium and experience data, and rights to exclusive use of the “Porch” name, brand, trademarks and service marks. AIF grants to the Exchange a license for the use of such intellectual property for so long as this Agreement remains in effect; in the event this Agreement terminates, AIF grants the Exchange or its statutory successor a limited license to use such intellectual property, but solely to the extent necessary to run-off liabilities to policyholders existing as of the time of termination.

6. Financial Reporting. AIF shall maintain the Exchange’s books and records in accordance with the Accounting Practices and Procedures Manual of the National Association of Insurance Commissioners or its successor.

7. Records; Right to Audit. AIF will keep records for the express purpose of recording the nature and details of the management services and financial transactions undertaken for the Exchange pursuant to this Agreement. Except with respect to intellectual property expressly reserved to AIF in Section 5 above, all books and records maintained by AIF pertaining to the management services performed by AIF as attorney-in-fact for the Subscribers pursuant to this Agreement are owned by the Exchange. The Exchange, acting through the Subscribers’ Advisory Committee (“SAC”), and any regulatory authority having jurisdiction over the Exchange, will have the right to examine and audit, at the offices of AIF, at all reasonable times, all books and records of the Exchange that pertain to the management services performed by AIF as attorney-in-fact for the Subscribers, pursuant to this Agreement. This right of examination and audit will survive the termination of this Agreement and will remain in effect for as long as either the Exchange or AIF has any rights or obligations under this Agreement, or the period required by applicable law, whichever is longer.

8. Term and Termination. This Agreement shall become effective as of the Effective Date and shall continue in effect until terminated as provided in this Section 8.

(a) Mutual Termination. This Agreement may be terminated at any time by the written mutual agreement of AIF and the Exchange, acting through the SAC.

(b) Termination for Cause. The Exchange, acting through the SAC, may terminate this Agreement at any time if (i) its Texas certificate of authority has been revoked by the Texas Department of Insurance (the “Department”) and not reinstated after a period of ninety (90) days following such revocation, (ii) there has been a continued and material failure by AIF to perform or cause to be performed services in accordance with the Subscriber’s Agreement and this Agreement, and such failure remains uncured for a period of ninety (90) days following determination that such failure has occurred by a final order of the Department or court of competent jurisdiction, or (iii) the Exchange has been adjudicated as bankrupt or insolvent, or admitted in writing its inability to pay its debts as they mature, or applied for or consented to the appointment of any receiver, trustee, liquidator or similar officer for it or for all or any substantial part of its property, or such receiver, trustee, liquidator or similar officer has been appointed without the application or consent of the Exchange or AIF and such appointment shall continue undischarged for a period of sixty (60) days.

9. Arbitration.

(a) As a condition precedent to any right of action arising under or out of this Agreement, the Parties agree that any and all disputes or differences, including disputes concerning the formation and/or validity of this Agreement, shall be submitted to arbitration before a panel of three arbitrators, each of whom shall be an active or retired disinterested officer of a property and casualty insurance company. One arbitrator shall be chosen by the Exchange, and one arbitrator shall be chosen by AIF. The third arbitrator will be chosen by the other two arbitrators. In the event any Party does not appoint an arbitrator within sixty (60) days after the other Party requests it to do so, or if the two arbitrators selected by the Exchange and AIF fail to agree upon a third arbitrator within thirty (30) days of the appointment of the second arbitrator to be appointed, the arbitrator or arbitrators, as the case may be, will, upon the application of any Party, be appointed by the American Arbitration Association, and the arbitrators will proceed. The decision of the majority of the arbitrators will be final and binding on all Parties. Each Party will bear the expense of its own arbitrator and one-half of the expenses of the third arbitrator and of the arbitration. Arbitration taking place under this section will take place in Dallas County, Texas, unless otherwise agreed by the Parties in writing. The arbitrators shall make a decision and award with regard to the terms of this Agreement and the original intentions of the Parties to the extent reasonably ascertainable. The arbitrators’ decision and award shall be in writing and shall state the factual and legal basis for the decision and award. The arbitrators may award interest calculated at a reasonable rate from the date they determine that any amounts due to the prevailing Party should have been paid to the prevailing Party.

(b) Either Party may apply to any court having jurisdiction for an order compelling arbitration or confirming any decision and the award; a judgment of that court shall thereupon be entered on any decision or award. If such an order is issued, the attorneys’ fees of the Party so applying and court costs will be paid by the Party against whom confirmation is sought.

(c) Nothing herein shall be construed to prevent any Party from applying to any court having jurisdiction to issue a restraining order or other equitable relief to maintain the “status quo” of the Parties participating in the arbitration pending the decision and award by the arbitrators or to prevent any Party from incurring irreparable harm or damage at any time prior to the decision and award of the Board. The arbitrators shall also have the authority to issue interim decisions or awards.

(d) Notwithstanding any dispute or difference of opinion arising under this Agreement, the Exchange and AIF must fulfill all obligations under the reciprocal insurance contracts exchanged by the Subscribers.

(e) For purposes of this Section 9, the Exchange shall act by and through the

SAC.

10. Indemnification.

(a) The Exchange will indemnify, defend and hold harmless AIF and each member, officer, director, employee and agent thereof (each an “Indemnified Party”) from and against all claims, losses, damages, liabilities and expenses including, without limitation, settlement costs and any reasonable legal fees and expenses or other expenses for investigating and defending any actions or threatened actions incurred by an Indemnified Party as a result of any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative, including an action by or in the right of the Exchange, relating to or arising out of the services provided by AIF hereunder, except to the extent the act or failure to act giving rise to the claim for indemnification is determined by a court to be the direct result of the willful misconduct or gross negligence of the Indemnified Party.

(b) The Exchange will pay expenses incurred by an Indemnified Party in defending any action or proceeding referred to in this Section 10 as they are incurred in such action or proceeding, provided the Exchange receives an undertaking by or on behalf of such person to repay such amount if it shall ultimately be determined that such person is not entitled to be indemnified by the Exchange.

(c) As soon as practicable after receipt by any Indemnified Party of notice of the commencement of any action, suit or proceeding specified in Section 10(a) above (“Action”), such person shall, if a claim may be made against the Exchange under this Section 10, notify the Exchange, by notification in writing to the SAC, of the Action; however, the omission to notify the Exchange will not relieve the Exchange of any liability under this Section 10 unless the Exchange is prejudiced thereby. With respect to any such Action as to which such person notifies the Exchange, the Exchange may participate in the

Action at its own expense. The Exchange may, independently or jointly with any other indemnifying party assume the defense of the Action, with counsel selected by the Exchange. Counsel selected by the Exchange shall be reasonably satisfactory to the Indemnified Party. After notice from the Exchange of its election to assume the defense, the Exchange will not be liable to the Indemnified Party under this Section 10 for any legal or other expenses subsequently incurred by such Indemnified Party in connection with the defense of the Action. The Indemnified Party will have the right to hire his or her own counsel in such action, but the fees of such counsel incurred after notice from the Exchange of its assumption of the defense of the Action will be at the expense of the Indemnified Party unless: (i) the employment of counsel by the Indemnified Party shall have been authorized by the Exchange, (ii) the Indemnified Party shall have reasonably concluded that there may be a conflict of interest between the Exchange and such person in the conduct of the defense of such proceeding, or (iii) the Exchange did not employ counsel to assume the defense of the Action and the Indemnified Party shall have reasonably concluded that there may be a conflict of interest if indemnification under this Section 10 is not paid or made by the Exchange, or on its behalf, within ninety (90) days after a written claim for indemnification has been received by the Exchange. The Indemnified Party may, at any time thereafter, bring suit against the Exchange to recover the unpaid amount of the claim.

(d) The right to indemnification and the right to advancement of expenses provided in this Section 10 shall be enforceable by such person in any court of competent jurisdiction. The burden of proving that indemnification is not appropriate shall be on the Exchange. Expenses reasonably incurred by such person in connection with successfully establishing the right to indemnification or advancement of expenses, in whole or in part, shall be indemnified by the Exchange. For purposes of this Section 10, the Exchange shall act by and through the SAC.

11. Notices. All notices, requests, demands, claims, and other communications between the Parties concerning the content and purpose of this Agreement shall be sent in writing by personal delivery, fax or by mail, registered or certified, postage pre-paid. Notices shall be addressed to the Parties as follows or to such other addresses as may be specified by a Party from time to time by like written notice to the other Party:

If to the Exchange:

1400 Corporate Drive, Suite 300

Irving, Texas 75038 If If to AIF:

1400 Corporate Drive, Suite 300

Irving, Texas 75038

Notices delivered personally shall be deemed communicated as of actual receipt; faxed notices shall be deemed communicated upon confirmation of having been sent; and mailed notices shall be deemed communicated as of three (3) business days after mailing.

12. Miscellaneous.

(a) This Agreement shall be governed by and construed in accordance with Texas law.

(b) AIF is authorized to contract with others, including affiliates of the AIF, for the performance of the management services it has agreed to provide to the Exchange under this Agreement, provided, however, that AIF will remain responsible to the Exchange for the proper and timely performance of all management services set forth in this Agreement and, provided further, the charges and fees under such contracts shall be borne by the AIF or the Exchange, respectively, in accordance with Section 4 of this Agreement.

(c) No delay on the part of any party in exercising any right, power or privilege hereunder shall operate as a waiver thereof, nor shall any waiver on the part of any party of any right, power or privilege, nor any single or partial exercise of any such right, power or privilege, preclude any further exercise thereof or the exercise of any other such right, power or privilege.

(d) This Agreement may be amended at any time by an instrument in writing executed by the Parties, subject to any required notice to or approval by any regulatory authority. This Agreement may not be terminated except as provided in Section 8.

(e) This Agreement may not be assigned, in whole or in part, except upon the prior written agreement of the Parties, and subject to any required notice to or approval by any regulatory authority.

(f) This Agreement, together with the Declaration of Subscribers, Subscriber’s Agreement and Power of Attorney and Bylaws, constitutes the entire agreement between the Parties and supersedes any prior understandings, agreements, or representations by or between the Parties, written or oral, to the extent they related in any way to the subject matter of this Agreement.

(g) This Agreement is for the sole benefit of the Parties hereto and their respective successors and permitted assigns and nothing herein, express or implied, is intended to or shall confer upon any other person any legal or equitable right, benefit or remedy of any nature whatsoever, under or by reason of this Agreement.

(h) The headings contained in this Agreement are for convenience of reference purposes only and shall not affect in any way the meaning or interpretation of this Agreement.

(i) All words used in this Agreement will be construed to be of such gender or number as the circumstances require.

(j) Whenever possible, each provision or portion of any provision of this Agreement shall be interpreted in such manner as to be effective and valid under applicable law, but if any provision or portion of any provision of this Agreement is held to be invalid, illegal or unenforceable in any respect under any applicable law or rule in any jurisdiction,

such invalidity, illegality or unenforceability shall not affect any other provision or portion of any provision in such jurisdiction, and this Agreement shall be reformed, construed and enforced in such jurisdiction as if such invalid, illegal or unenforceable provision or portion of any provision had never been contained herein.

(k) This Agreement may be executed in one or more counterparts, each of which shall be deemed an original but all of which together shall be deemed one and the same agreement. Each Party may deliver its signed counterpart of this Agreement to the other Party by means of electronic mail or any other electronic medium utilizing image scan technology, and such delivery will have the same legal effect as hand delivery of an originally executed counterpart.

IN WITNESS WHEREOF, the Parties have executed this Agreement on the day and year first above written by the undersigned thereunto duly authorized.

PORCH INSURANCE RECIPROCAL EXCHANGE

/s/ Efram Ware

Efram Ware

President, Porch Risk Management Services LLC

Attorney-in-Fact of Porch Insurance Reciprocal Exchange

PORCH RISK MANAGEMENT SERVICES LLC

/s/ Nathan Smith

Nathan Smith

Chief Accounting Officer and Treasurer

SCHEDULE A

Expenses that are the sole responsibility of the Exchange

1. Allocated Loss adjustment expense (calculated in accordance with customary insurance accounting practices)

2. Direct out-of-pocket expenses for advertising, marketing, promotions or sponsorships

3. Reinsurance premiums and costs

4. Premium Taxes and Excise Taxes calculated based in insurance premiums

5. Agency commissions and fees

6. Subscribers Advisory Committee meeting fees and any compensation to SAC members

7. Surplus Note interest expense

8. Investment advisor and management expenses

9. Banking and custodial services fees

10. Court costs

11. Franchise Taxes, Income Taxes and other taxes based on the revenues or net income of the Exchange

12. Property taxes, value added taxes or any other tax levied on any property owned or expenditures for property of the Exchange

13. Interest and penalties on any taxes for which the Exchange is responsible

14. Guaranty fund assessments

15. Boards, bureaus and rating fees

16. Membership fees and subscriptions for rating bureaus and other organizations required or used to conduct business

17. Any other assessments or fees calculated on the basis written premiums or other revenues of the Exchange or otherwise levied on the property or business of the Exchange

18. Attorneys, actuaries, accountants and investment and other advisors fees

19. Governmental fines and penalties

20. Audit fees

21. License fees

22. Insurance premiums for insurance covering the property and operations of the Exchange including D&O insurance for SAC members

23. Fees related to the startup and formation of the Exchange

24. Other expenses not directly allocated to the AIF

Expenses that are the sole responsibility of the AIF:

Overhead and administration for the following functional areas:

1. Marketing, sales and product development

2. Producer recruitment and oversight

3. Underwriting and rating

4. Policy issuance and administration

5. Claims expense (other than allocated loss adjustment expense)

6. Reinsurance placement and administration

7. Assessing, establishing and monitoring reserves

8. Investment strategy, oversight, execution and accounting

9. Capital management and strategy

10. Treasury and banking

11. Accounting and audits

12. Financial, statistical and regulatory reporting

13. Federal state and other tax planning and administration

14. Information technology

15. Legal and compliance

16. Facilities management

17. Human resources, payroll and benefits administration

18. Business development and strategy

Real property and other facilities and equipment costs for facilities and equipment used by AIF personnel

Software licenses

Porch Group Completes Formation of Porch Insurance Reciprocal Exchange and Corresponding Sale of Homeowners of America Insurance Company

SEATTLE, January 7, 2025 (BUSINESS WIRE) – Porch Group, Inc. (“Porch” or “the Company”) (NASDAQ: PRCH), a homeowners insurance and vertical software platform, today announced the completed formation of the Porch Insurance Reciprocal Exchange ("PIRE") and sale of Homeowners of America Insurance Company (“HOA”) to PIRE.

The final terms of the transaction were consistent with expectations, with Porch selling HOA to PIRE for a purchase price equal to HOA’s December 31, 2024 expected surplus1 of approximately $105 million, less the existing 2023 surplus note of $49 million and less $9 million of outstanding interest expected to be paid in 2025. This brings the total surplus notes2 held by Porch to approximately $106 million. With this transaction now complete, going forward all insurance policies, premium and related claims, as well as all HOA assets and liabilities will be owned by PIRE. Porch Group will receive commissions and fees for providing operating and other services to PIRE, which is expected to deliver more predictable and higher-margin financial results for Porch Group Shareholders.

The upcoming launch marks a pivotal milestone in Porch’s journey to build a large, highly profitable homeowners insurance company that makes the home simple. Porch differentiates by leveraging its unique property data to provide more accurate pricing and by utilizing Porch’s unique capabilities to tailor solutions for homebuyers. With PIRE now in place, Porch plans to scale insurance written premiums.

“We are thrilled to announce the formation of the Porch Insurance Reciprocal Exchange, a transformative step in our journey to redefine the homeowner experience while enhancing profitability for Porch shareholders,” said Matt Ehrlichman, Chief Executive Officer. “This is just the beginning of an exciting new chapter. We look forward to delivering exceptional value to our stakeholders and continuing to innovate in the homeowners insurance industry.”

1.HOA’s expected surplus of $105 million as at December 31, 2024 is based on Company’s best estimate to facilitate the transaction closing.

2.A surplus note is a subordinated financial instrument that pays an interest-bearing coupon with excess surplus generated by the Reciprocal.

About Porch Group