As filed with the United States Securities and Exchange Commission on August 8, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ASCEND WELLNESS HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 82-0602006 |

(State or other jurisdiction of

incorporation or organization) | (I.R.S. Employer Identification No.) |

| |

1411 Broadway

16th Floor

New York, NY | 10018 |

(Address of principal executive offices) | (Zip code) |

Ascend Wellness Holdings, Inc. 2021 Stock Incentive Plan, as amended

Non-Plan Restricted Stock Unit Award (August 2023)

(Full title of the plan)

Daniel Neville

Chief Financial Officer

Ascend Wellness Holdings, Inc.

1411 Broadway

16th Floor

New York, NY 10018

(Name and address of agent for service)

(646) 661-7600

(Telephone number, including area code, of agent for service)

Copies to:

James Guttman

Dorsey & Whitney LLP

TD Canada Trust Tower

Brookfield Place, 161 Bay Street, Suite 4310

Toronto, Ontario, Canada, M5J 2S1

(416) 367-7376

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated Filer | ☒ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY NOTE

At the 2023 annual meeting of stockholders of Ascend Wellness Holdings, Inc. (the “Company”), the stockholders of the Company approved an amendment to the Company’s 2021 Stock Incentive Plan (as amended, the “2021 Plan”) to increase the maximum number of shares of the Company’s Class A common stock, $0.001 par value per share (the “Class A common stock”) available for issuance under the 2021 Plan to an amount not to exceed 10% of the total number of issued and outstanding shares of the Company’s Class A common stock, on a non-diluted basis, as constituted on the grant date of an award. This Registration Statement on Form S-8 (this “Registration Statement”) relates to the additional 20,000,000 shares of Class A common stock authorized for future issuance under the 2021 Plan.

In addition, this Registration Statement relates to 4,000,000 shares of Class A common stock issuable upon the vesting of restricted stock units (“RSUs”) granted to a newly hired employee outside of the Company’s equity incentive plans, including the 2021 Plan.

Pursuant to General Instruction E to Form S-8, the contents of the registration statement on Form S-8 with respect to the 2021 Plan filed with the Securities and Exchange Commission on July 9, 2021 (File No. 333-257780), including the information contained therein, is hereby incorporated by reference in the Registration Statement, except to the extent supplemented, amended or superseded by the information set forth herein.

This Registration Statement also includes a prospectus prepared in accordance with General Instruction C of Form S-8 and in accordance with the requirements of Part I of Form S-3 (the “Reoffer Prospectus”). The Reoffer Prospectus may be used for reofferings and resales of up to 15,219,558 shares of Class A common stock (the “Class A Shares”) that may be deemed to be “control securities” or “restricted securities” under the Securities Act of 1933, as amended, (the “Securities Act”) and the rules and regulations promulgated thereunder that were issued to the selling securityholders identified in the Reoffer Prospectus (collectively, the “Selling Securityholders”).

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The information specified in Item 1 and Item 2 of Part I of Form S-8 is omitted from this Registration Statement in accordance with the provisions of Rule 428 under the Securities Act and the introductory note to Part I of Form S-8. The documents containing the information specified in Part I of Form S-8 will be delivered to the participants in the equity benefit plans covered by this Registration Statement as specified by Rule 428(b)(1) under the Securities Act.

REOFFER PROSPECTUS

15,219,558 Shares

Ascend Wellness Holdings, Inc.

Class A Common Stock

This reoffer prospectus relates to 15,219,558 shares of Class A common stock, par value $0.001 (the “Class A Shares”), of Ascend Wellness Holdings, Inc., a Delaware corporation (the “Company,” the “Registrant,” “we,” “us,” or “our”), which may be offered from time to time by certain stockholders that are our current or former executive officers or directors (collectively, the “Selling Securityholders”) for their own accounts. We will not receive any of the proceeds from the sale of the Class A Shares by the Selling Securityholders made hereunder.

The Selling Securityholders may sell the Class A Shares in a number of different ways and at varying prices, including sales in the open market, sales in negotiated transactions and sales by a combination of these methods. The Selling Securityholders may sell any, all or none of the Class A Shares and we do not know when or in what amount the Selling Securityholders may sell their Class A Shares hereunder following the effective date of the registration statement of which this prospectus forms a part. The price at which any of the Class A Shares may be sold, and the commissions, if any, paid in connection with any such sale, are unknown and may vary from transaction to transaction. The Class A Shares may be sold at the market price of the Class A Shares at the time of a sale, at prices relating to the market price over a period of time, or at prices negotiated with the buyers of shares. The Class A Shares may be sold through underwriters or dealers which the Selling Securityholders may select. If underwriters or dealers are used to sell the Class A Shares, we will name them and describe their compensation in a prospectus supplement. We provide more information about how the Selling Securityholders may sell their Class A Shares in the section titled “Plan of Distribution.” The Selling Securityholders will bear all sales commissions and similar expenses. Any other expenses incurred by us in connection with the registration and offering that are not borne by the Selling Securityholders will be borne by us.

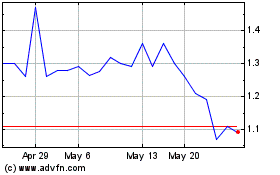

The Class A Shares are traded on the Canadian Securities Exchange (the “CSE”) under the symbol “AAWH.U” and quoted on the OTCQX® Best Market (the “OTCQX”) under the symbol “AWWH.” On August 4, 2023 the last reported price of our Class A Shares on the CSE was $0.62 per share and on August 7, 2023 the last reported price of our Class A Shares on the OTCQX was $0.66 per share.

We are an “emerging growth company,” as that term is defined under the federal securities laws and, as such, are subject to certain reduced public company reporting requirements.

Investing in our securities involves a high degree of risk that are described in the “Risk Factors” section beginning on page 3 of this prospectus. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is August 8, 2023.

TABLE OF CONTENTS

Neither we nor the Selling Securityholders have authorized anyone to provide any information or to make any representations other than those contained in this prospectus or any accompanying prospectus supplement that we have prepared. We and the Selling Securityholders take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the securities offered hereby and only under circumstances and in jurisdictions where it is lawful to do so. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus or any applicable prospectus supplement. This prospectus is not an offer to sell securities, and it is not soliciting an offer to buy securities, in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus or any prospectus supplement is accurate only as of the date on the front of those documents only, regardless of the time of delivery of this prospectus or any applicable prospectus supplement, or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, and the documents incorporated by reference herein, contain “forward-looking statements” that involve risks and uncertainties, as well as assumptions that, if they never materialize or prove incorrect, could cause our results to differ materially from those expressed or implied by such forward-looking statements. The statements contained in this prospectus that are not purely historical are “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements are identified by the use of words such as, but not limited to, “anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,” “intend,” “likely,” “may,” “outlook,” “will,” “plan,” “predict,” “should,” “target,” and similar expressions or variations intended to identify forward-looking statements. These statements are based on the beliefs and assumptions of our management based on information currently available to management. Such forward-looking statements are subject to risks, uncertainties and other important factors that could cause actual results and the timing of certain events to differ materially from future results expressed or implied by such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, factors discussed in the section entitled “Risk Factors” in this prospectus.

By way of example, and without implied limitation, such risks and uncertainties include:

•the effect of the volatility of the market price and liquidity risks on shares of our Class A common stock;

•the effect of the voting control exercised by holders of Class B common stock;

•our ability to attract and maintain key personnel;

•our ability to continue to open new dispensaries and cultivation facilities as anticipated;

•the illegality of cannabis under federal law;

•our ability to comply with state and federal regulations;

•the uncertainty regarding enforcement of cannabis laws;

•the effect of restricted access to banking and other financial services;

•the effect of constraints on marketing and risks related to our products;

•the effect of unfavorable tax treatment for cannabis businesses;

•the effect of proposed legislation on our tax liabilities and financial performance;

•the effect of security risks;

•the effect of infringement or misappropriation claims by third parties;

•our ability to comply with potential future U.S. Food and Drug Administration (the “FDA”) regulations;

•our ability to enforce our contracts;

•the effect of unfavorable publicity or consumer perception;

•the effect of risks related to material acquisitions, dispositions and other strategic transactions;

•the effect of agricultural and environmental risks;

•the effect of climate change;

•the effect of risks related to information technology systems;

•the effect of unknown health impacts associated with the use of cannabis and cannabis derivative products;

•the effect of product liability claims and other litigation to which we may be subjected;

•the effect of risks related to the results of future clinical research;

•the effect of intense competition in the industry;

•the effect of the maturation of the cannabis market;

•the effect of adverse changes in the wholesale and retail prices;

•the effect of sustained inflation;

•the effect of political and economic instability;

•the effect of outbreaks of pandemic diseases, fear of such outbreaks or economic disturbances due to such outbreaks, particularly the impact of the COVID-19 pandemic; and

•the effect of general economic risks, such as the unemployment level, interest rates and inflation, and challenging global economic conditions.

For more information regarding these and other uncertainties and factors that could cause our actual results to differ materially from what we have anticipated in our forward-looking statements or otherwise could materially adversely affect our business, financial condition or operating results, see the section entitled “Risk Factors” in this prospectus. The risks and uncertainties described above and in the section entitled “Risk Factors” in this prospectus

are not exclusive and further information concerning us and our business, including factors that potentially could materially affect our financial results or condition, may emerge from time to time. We assume no obligation to update, amend or clarify any forward-looking statement, except as required by applicable law.

PROSPECTUS SUMMARY

This summary highlights selected information from this prospectus and does not contain all of the information that is important to you in making an investment decision. This summary is qualified in its entirety by the more detailed information included in this prospectus, including the documents incorporated by reference herein. Potential investors should read the entire prospectus carefully, including the risks of purchasing our common stock discussed in “Risk Factors.”

Overview

Ascend Wellness Holdings, Inc. (“AWH,” “Ascend,” “we,” “us,” “our,” or the “Company”) is a vertically integrated multi-state operator focused on adult-use or near-term adult-use cannabis states in limited license markets. Our core business is the cultivation, manufacturing, and distribution of cannabis consumer packaged goods, which are sold through company-owned retail stores and to third-party licensed retail cannabis stores. The Company is a reporting issuer in the United States and in each of the provinces and territories of Canada. The Company’s shares of Class A common stock are listed in Canada on the Canadian Securities Exchange (“CSE”) under the symbol “AAWH.U.” and are quoted in the United States on the OTCQX Best Market (the “OTCQX”) under the symbol “AAWH.” Ascend is an emerging growth company under federal securities laws and as such Ascend is able to elect to follow scaled disclosure requirements for this filing.

The Company was founded in 2018 with initial operations in Illinois and has since expanded its operational footprint, primarily through acquisitions, and now has operations or financial interests in six U.S. geographic markets: Illinois, Michigan, Ohio, Massachusetts, New Jersey, and Pennsylvania. In April 2023, we closed on a definitive agreement that expanded operations into the state of Maryland and represents our seventh United States geographic market.

As of March 31, 2023, we had 26 open dispensaries, 20 of which are in states which have passed legislation permitting recreational cannabis. We have fully-financed expansion plans to achieve 39 total open dispensaries by mid-2024 through licenses we already own or licenses which we are under definitive agreement to acquire. This includes the four dispensaries that we acquired in Maryland in April 2023. As of March 31, 2023, we operate cultivation facilities in seven states with approximately 245,000 square feet of canopy with an estimated total annual production capacity of approximately 123,000 pounds.

We believe in bettering lives through cannabis. Our mission is to improve the lives of our employees, patients, customers, and the communities we serve through the use of the cannabis plant. We currently employ approximately 2,200 people across the cultivation, processing, retail, and corporate functions.

Recent Developments

June 2023 Debt Acquisition

On June 14, 2023, we acquired approximately $12 million of the outstanding secured indebtedness, at par, of an owner and operator of a cannabis grow facility, a cannabis processing facility, and a cannabis dispensary for cash consideration in a private transaction.

June 2023 Private Placement Offering

On June 15, 2023, we entered into a subscription agreement for a private placement offering of an aggregate of 9,859,155 shares of Class A common stock to a single investor at a purchase price of $0.71 per share (the “Private Placement”). The closing of the offering occurred on June 23, 2023, generating an aggregate of $7,000,000 in gross proceeds to the Company.

We intend to use the net proceeds from the Private Placement to pursue potential acquisitions of debt or equity in, or the assets of, certain companies in the cannabis industry consistent with our current business strategy.

The shares of Class A common stock offered and sold in the Private Placement were sold pursuant to the exemption from registration provided by Rule 506(b) of Regulation D under the Securities Act. The Company relied

on this exemption from registration based in part on the nature of the transaction and the various representations made by the investor.

Emerging Growth Company

As a company with less than $1.235 billion in revenue during our most recently completed fiscal year, we qualify as an “emerging growth company” as defined in Section 2(a) of the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012. As an emerging growth company, we may take advantage of specified reduced disclosure and other exemptions from requirements that are otherwise applicable to public companies that are not emerging growth companies. These provisions include:

•reduced disclosure about our executive compensation arrangements;

•exemptions from non-binding stockholder advisory votes on executive compensation or golden parachute arrangements; and

•exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting.

We may take advantage of these exemptions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company if we have more than $1.235 billion in annual revenues as of the end of a fiscal year, if we are deemed to be a large-accelerated filer under the rules of the United States Securities and Exchange Commission (the “SEC”) or if we issue more than $1.0 billion of non-convertible debt over a three-year period.

About This Offering

This reoffer prospectus relates to the public offering, which is not being underwritten, by the Selling Securityholders listed in this prospectus, of up to 15,219,558 shares of Class A common stock previously issued to each Selling Securityholder. The Selling Securityholders may from time to time sell, transfer or otherwise dispose of any or all of the shares of the Class A Shares covered by this prospectus through underwriters or dealers, directly to purchasers (or a single purchaser) or through broker-dealers or agents. We will receive none of the proceeds from the sale of the Class A Shares by the Selling Securityholders. We will bear all expenses of registration incurred in connection with this offering, but all selling and other expenses incurred by the Selling Securityholders will be borne by them.

Risk Factors

Our business is subject to numerous risks and uncertainties, including those highlighted in the section titled “Risk Factors” that represent challenges that we face in connection with the successful implementation of our strategy and growth of our business. Before you invest in the Class A Shares, you should carefully consider all the information in this prospectus, including matters set forth in the section captioned “Risk Factors.”

Corporate Information

We were originally formed as Ascend Group Partners, LLC on May 15, 2018 as a Delaware limited liability company. We changed our name to “Ascend Wellness Holdings, LLC” on September 10, 2018. On April 22, 2021, we converted into a Delaware corporation pursuant to a statutory conversion and were renamed “Ascend Wellness Holdings, Inc.”

Our principal executive offices are located at 1411 Broadway, 16th Floor, New York, NY 10018. Our telephone number is (646) 661-7600. Our website address is www.awholdings.com. The information contained on our website or connected to our website is not incorporated by reference into, and should not be considered part of, this prospectus.

RISK FACTORS

Investing in the Class A Shares involves a high degree of risk. You should carefully consider the risks and uncertainties described in this prospectus and the documents incorporated herein by reference, including the risks described under the heading “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 filed with the SEC on March 15, 2023, and any documents we incorporate by reference into this prospectus, including future filings that we make with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act of 1934, as amended (the “Exchange Act”). See “Incorporation by Reference” and “Where You Can Find More Information.” Our business, financial condition or results of operations could be materially adversely affected by the materialization of any of these risks. The trading price of our securities could decline due to the materialization of any of these risks, and you may lose all or part of your investment.

DETERMINATION OF OFFERING PRICE

The Selling Securityholders will determine at what price they may sell the Class A Shares, and such sales may be made at prevailing market prices or at privately negotiated prices. See the section captioned “Plan of Distribution” for more information.

USE OF PROCEEDS

The Class A Shares offered hereby are being registered for the account of the Selling Securityholders named in this prospectus. All proceeds from the sales of Class A Shares will go to the Selling Securityholders and we will not receive any proceeds from the resale of the Class A Shares by the Selling Securityholders.

DESCRIPTION OF CAPITAL STOCK

The description of our Class A common stock set forth in the section titled “Description of Capital Stock” in our Registration Statement on Form S-3 (File No. 333-268534) filed with the SEC on November 22, 2022 is incorporated herein by reference.

SELLING SECURITYHOLDERS

The following table sets forth information with respect to the Selling Securityholders and the shares of our Class A common stock beneficially owned by the Selling Securityholders as of July 27, 2023. The percentage of beneficial ownership is calculated based on 205,250,304 shares of common stock outstanding, comprised of 205,185,304 shares of Class A common stock and 65,000 shares of Class B common stock, $0.001 par value per share, outstanding, as of such date.

The Selling Securityholders may offer all, some, or none of the Class A Shares covered by this prospectus. See “Plan of Distribution.” For the purposes of the table below, we assume that each Selling Securityholder will sell all of their shares of Class A Shares covered by this prospectus. The Selling Securityholders identified below may have sold, transferred, or otherwise disposed of some or all of their Class A Shares since the date on which the information in the following table is presented in transactions exempt from, or not subject to, the registration requirements of the Securities Act. Information concerning the Selling Securityholders may change from time to time and, if necessary, we will amend or supplement this prospectus accordingly. We cannot give an estimate as to the number of Class A Shares that will actually be held by the Selling Securityholders upon termination of this offering because the Selling Securityholders may offer some or all of their Class A Shares under the offering contemplated by this prospectus or acquire additional Class A Shares. We cannot advise you as to whether the Selling Securityholders will, in fact, sell any or all of such Class A Shares. For further information regarding material relationships and transactions between us and certain Selling Securityholders, see the “Interest of Management & Others in Material Transactions” section of our Definitive Proxy Statement on Schedule 14A that was filed with the SEC on March 4, 2023 and is incorporated by reference in this prospectus.

We have determined beneficial ownership in accordance with the rules of the SEC and the information is not necessarily indicative of beneficial ownership for any other purpose. Unless otherwise indicated below, to our knowledge, the persons and entities named in the tables have sole voting and sole investment power with respect to all securities that they beneficially own, subject to community property laws where applicable. Unless otherwise indicated, the business address of all listed stockholders is c/o Ascend Wellness Holdings, Inc., 1411 Broadway, 16th Floor, New York, NY 10018.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Class A Common Stock Beneficially Owned Prior to the Offering | | % of Total Voting Power Prior to the Resale | | Number of Class A Shares Being Offered for Resale | | Class A Common Stock Beneficially Owned After the Resale of the Class A Shares Offered Hereby | | % of Total Voting Power After Completion of the Resale |

Name of Selling Securityholder | | Number of Shares | | Percentage | | | | Number of Shares | | Percentage | |

John Hartmann(1) | | — | | | — | | | — | | | 6,000,000 | | | — | | | — | | | — | |

Abner Kurtin(2) | | 24,466,481 | | 11.8 | % | | 27.3 | % | | 4,179,622 | | | 20,286,859 | | | 7.5 | % | | 26.2 | % |

Francis Perullo(3) | | 8,712,218 | | 4.2 | % | | 8.3 | % | | 2,791,561 | | | 5,920,657 | | | 2.2 | % | | 7.5 | % |

Scott Swid(4) | | 4,509,101 | | 2.2 | % | | 1.6 | % | | 162,885 | | | 4,346,216 | | | 1.6 | % | | 1.6 | % |

Daniel Neville(5) | | 1,582,179 | | | * | | * | | 1,861,040 | | | — | | | — | | | — | |

Joshua Gold(6) | | 1,252,910 | | | * | | * | | 201,300 | | | 1,051,610 | | | * | | * |

Samuel Brill(7) | | 23,150 | | | * | | * | | 23,150 | | | — | | | — | | | — | |

__________________

*Less than 1%.

(1)The Class A Shares being offered includes (a) 2,000,000 shares of Class A common stock underlying RSUs granted pursuant to the 2021 Plan and (b) 4,000,000 shares of Class A common stock underlying RSUs granted outside of the Company’s equity incentive plans, including the 2021 Plan. Mr. Hartmann is our Chief Executive Officer and serves on our board of directors.

(2)Beneficial ownership prior to this offering includes 1,265,359 shares of Class A common stock underlying RSUs and 76,219 shares of Class A stock issuable under stock options that have vested or that are scheduled to vest within 60 days of July 27, 2023. This also includes 16,979,882 shares of Class A common stock owned by AGP Partners, LLC which are owned by Mr. Kurtin (Mr. Kurtin owns 61.6% of the entity which owns 27,578,175 shares of Class A common stock). The Class A Shares being offered includes 1,965,055 shares of Class A common stock underlying RSUs and 949,208 shares of Class A common stock issuable under stock options. Mr. Kurtin serves on our board of directors as Executive Chair.

(3)Beneficial ownership prior to this offering includes 674,542 shares of Class A common stock underlying RSUs and 45,731 shares of Class A stock issuable under stock options that have vested or that are scheduled to vest within 60 days of July 27, 2023. This also includes 6,097,534 shares of Class A common stock owned by AGP Partners, LLC which are owned by Mr. Perullo (Mr. Perullo owns 22.1% of the entity which owns 27,578,175 shares of Class A common stock). The Class A Shares being offered includes 1,547,494 shares of Class A

common stock underlying RSUs and 569,525 shares of Class A common stock issuable under stock options. Mr. Perullo serves on our board of directors.

(4)Beneficial ownership prior to this offering includes 146,218 shares of Class A common stock underlying RSUs that have vested or that are scheduled to vest within 60 days of July 27, 2023. The Class A Shares being offered includes 16,667 shares of Class A common stock underlying RSUs. Mr. Swid serves on our board of directors.

(5)Beneficial ownership prior to this offering includes 512,195 shares of Class A common stock underlying RSUs and 30,487 shares of Class A stock issuable under stock options that have vested or that are scheduled to vest within 60 days of July 27, 2023. The Class A Shares being offered includes 969,162 shares of Class A common stock underlying RSUs and 379,683 shares of Class A common stock issuable under stock options. Mr. Neville is our Chief Financial Officer.

(6)Beneficial ownership prior to this offering includes 76,300 shares of Class A common stock underlying RSUs that have vested or that are scheduled to vest within 60 days of July 27, 2023; 188,000 warrants with an exercise price of $2.64, which Mr. Gold received on November 23, 2022 and which expire May 23, 2025; and 912,310 shares of Class A common stock Mr. Gold indirectly holds through his ownership of two funds that are holders of Class A common stock (Mr. Gold owns 839,003 shares of Class A common stock through his 11.2% ownership of TBC 222, LLC and 73,307 shares of Class A common stock through his 50.0% ownership of Seven Deuce, LLC). The Class A Shares being offered includes 125,000 shares of Class A common stock underlying RSUs. Mr. Gold serves on our board of directors.

(7)Mr. Brill serves on our board of directors.

Listing of Common Stock

Our Class A common stock is listed on the CSE under the symbol “AAWH.U” and is quoted on the OTCQX under the symbol “AWWH.”

Other Material Relationships with the Selling Securityholders

Employment Relationships

We have entered into employment agreements with each of John Hartmann, Abner Kurtin, Francis Perullo, and Daniel Neville.

Indemnification

Our bylaws provide that we will indemnify our directors and officers to the fullest extent permitted by the laws of the State of Delaware in effect from time to time, subject to certain exceptions contained in our bylaws. In addition, our certificate of incorporation provides that our directors will not be personally liable for monetary damages for breaches of fiduciary duty as a director.

We have entered into indemnification agreements with each of our executive officers and directors. The indemnification agreements provide the executive officers and directors with contractual rights to indemnification, and expense advancement and reimbursement, to the fullest extent permitted under the laws of the State of Delaware in effect from time to time, subject to certain exceptions contained in those agreements.

Secured Promissory Note

In May 2022, the Company issued a secured promissory note to a retail dispensary license holder in Massachusetts providing up to $3.5 million of funding (the “Massachusetts Note”), of which approximately $1 million was outstanding as of December 31, 2022. The Massachusetts Note accrues interest at a fixed annual rate of 11.5%. No principal or interest was paid during 2022. Following the opening of the borrower’s retail dispensary, the principal amount is due monthly through the maturity date of May 25, 2026. The borrower may prepay the outstanding principal amount, plus accrued interest thereon. Borrowings under the Massachusetts Note are secured by the assets of the borrower. The borrower is partially owned by an entity that is managed, in part, by Abner Kurtin, the Executive Chair of the Company.

Promoters

Abner Kurtin and Francis Perullo may each be considered a promoter of us within the meaning of applicable securities legislation.

PLAN OF DISTRIBUTION

The Class A Shares covered by this reoffer prospectus are being registered by the Company for the account of the Selling Securityholders. The Class A Shares offered may be sold from time to time directly by or on behalf of each Selling Securityholder in one or more transactions on the CSE, OTCQX, or any other stock exchange or marketplace on which the Class A Shares may be listed or quoted at the time of sale, in privately negotiated transactions, or through a combination of such methods, at market prices prevailing at the time of sale, at prices related to such prevailing market prices, at fixed prices (which may be changed) or at negotiated prices. The Selling Securityholders may sell shares through one or more agents, brokers or dealers, or directly to purchasers. Such brokers or dealers may receive compensation in the form of commissions, discounts, or concessions from the Selling Securityholders and/or purchasers of the shares or both. Such compensation as to a particular broker or dealer may be in excess of customary commissions.

In connection with their sales, a Selling Securityholder and any participating broker or dealer may be deemed to be “underwriters” within the meaning of the Securities Act, and any commissions they receive and the proceeds of any sale of shares may be deemed to be underwriting discounts and commissions under the Securities Act. We are bearing all costs relating to the registration of the Class A Shares. Any commissions or other fees payable to brokers or dealers in connection with any sale of the shares will be borne by the Selling Securityholders or other party selling such shares. Sales of the shares must be made by the Selling Securityholders in compliance with all applicable state and federal securities laws and regulations, including the Securities Act. In addition to any shares sold hereunder, Selling Securityholders may sell Class A Shares in compliance with Rule 144.

For so long as the Company does not meet the requirements for registering securities on Form S-3, the ordinary shares to be offered or resold by means of this reoffer prospectus by the Selling Securityholders may not exceed, during any three-month period, the amount specified in Rule 144(e) under the Securities Act. In addition, any securities covered by this reoffer, which otherwise qualify for sale pursuant to Rule 144 of the Securities Act may be sold under Rule 144 of the Securities Act rather than pursuant to this reoffer prospectus.

There is no assurance that the Selling Securityholders will sell all or a portion of the Class A Shares offered hereby. The Selling Securityholders may agree to indemnify any broker, dealer, or agent that participates in transactions involving sales of the shares against certain liabilities in connection with the offering of the shares arising under the Securities Act. We have notified the Selling Securityholders of the need to deliver a copy of this reoffer prospectus in connection with any sale of the shares.

The anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of the Class A Shares and activities of the Selling Securityholders, which may limit the timing of purchases and sales of any of the Class A Shares by the Selling Securityholders and any other participating person. Regulation M may also restrict the ability of any person engaged in the distribution of the shares of common stock to engage in passive market-making activities with respect to the shares of common stock. Passive market making involves transactions in which a market maker acts as both our underwriter and as a purchaser of our common stock in the secondary market. All of the foregoing may affect the marketability of the Class A Shares and the ability of any person or entity to engage in market-making activities with respect to the Class A Shares.

Once sold under the registration statement of which this prospectus forms a part, the Class A Shares will be freely tradable in the hands of persons other than our affiliates.

LEGAL MATTERS

The validity of the Class A Shares which are being offered under the registration statement of which this prospectus forms a part will be passed upon for the Company by Dorsey & Whitney LLP.

EXPERTS

Our consolidated financial statements as of and for the years ended December 31, 2021 and 2022 are incorporated by reference into this prospectus in reliance upon the report of Macias Gini & O’Connell LLP, independent registered public accounting firm incorporated herein by reference, and upon the authority of said firm as experts in accounting and auditing.

Our consolidated financial statements as of and for the year ended December 31, 2020 are incorporated by reference into this prospectus in reliance upon the report of Marcum LLP, independent registered public accounting firm, and upon the authority of said firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We are required to file certain periodic reports and other information with the SEC as required by the Exchange Act. You can read our SEC filings, including this prospectus, over the internet at the SEC’s website at www.sec.gov.

Our website address is https://awholdings.com. Through our website, we have or will make available, free of charge, the following documents as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC: our Annual Reports on Form 10-K; our Quarterly Reports on Form 10-Q; our Current Reports on Form 8-K; and amendments to those documents. The information contained on, or that may be accessed through, our website is not a part of, and is not incorporated into, this prospectus.

We incorporate information into this prospectus by reference, which means that we disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus, except to the extent superseded by information contained in this prospectus or by information contained in documents filed with the SEC after the date of this prospectus. This prospectus incorporates by reference the documents set forth below that have been previously filed with the SEC; provided, however, that, except as noted below, we are not incorporating any documents or information deemed to have been furnished rather than filed in accordance with the rules of the SEC. These documents contain important information about us and our financial condition:

•Our Annual Report on Form 10-K for the year ended December 31, 2022 filed with the SEC on March 15, 2023; •Our Quarterly Report on Form 10-Q for the quarter ended March 31, 2023 filed with the SEC on May 10, 2023; •Those portions of our Definitive Proxy Statement on Schedule 14A, filed with the SEC on March 24, 2023, which are incorporated by reference in our Form 10-K; and •The description of our Class A common stock set forth in the section titled “Description of Capital Stock” of our amended Registration Statement on Form S-3 filed with the SEC on November 22, 2022 (File No. 333-268534). All documents subsequently filed by us with the SEC pursuant to Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act, prior to the filing of a post-effective amendment to the registration statement of which this prospectus forms a part which indicates that all securities offered have been sold or which deregisters all securities then remaining unsold, shall be deemed incorporated by reference into this prospectus and to be a part hereof from the date of the filing of such documents, except that information furnished to the SEC under Item 2.02 or Item 7.01 in

Current Reports on Form 8-K and any exhibit relating to such information, shall not be deemed to be incorporated by reference in this prospectus.

For purposes of this prospectus, any statement contained in a document incorporated, or deemed to be incorporated, by reference herein shall be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained herein or in any other subsequently filed document which also is, or is deemed to be, incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

We will provide without charge upon written or oral request to each person, including any beneficial owner, to whom a prospectus is delivered, a copy of any and all of the documents which are incorporated by reference in this prospectus but not delivered with this prospectus (other than exhibits unless such exhibits are specifically incorporated by reference in such documents). You may request a copy of these documents by writing or telephoning us at:

Ascend Wellness Holdings, Inc.

1411 Broadway

16th Floor

New York, NY

(646) 661-7600

15,219,558 Shares

ASCEND WELLNESS HOLDINGS, INC.

Class A Common Stock

REOFFER PROSPECTUS

August 8, 2023

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents filed by the Registrant with the SEC are incorporated by reference into this Registration Statement:

(a)Our Annual Report on Form 10-K for the year ended December 31, 2022 filed with the SEC on March 15, 2023. (b)Our Quarterly Report on Form 10-Q for the quarter ended March 31, 2023 filed with the SEC on May 10, 2023. (d)Those portions of our Definitive Proxy Statement on Schedule 14A, filed with the SEC on March 24, 2023, which are incorporated by reference in our Form 10-K. (e)The description of our Class A common stock set forth in the section titled “Description of Capital Stock” of our amended Registration Statement on Form S-3 filed with the SEC on November 22, 2022 (File No. 333-268534). (f)All other reports and documents subsequently filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act (other than Current Reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits furnished on such form that relate to such items) on or after the date of this Registration Statement and prior to the filing of a post-effective amendment to this Registration Statement which indicates that all securities offered have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference herein and to be a part of this Registration Statement from the date of the filing of such reports and documents. Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any subsequently filed document that also is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Item 4. Description of Securities.

The description of our Class A common stock set forth in the section titled “Description of Capital Stock” of our Registration Statement on Form S-3 filed with the SEC on November 22, 2022 (File No. 333-268534) is incorporated herein by reference.

Item 5. Interests of Named Experts and Counsel.

Not applicable.

Item 6. Indemnification of Directors and Officers.

Section 102 of the General Corporation Law of the State of Delaware permits a corporation to eliminate the personal liability of directors of a corporation to the corporation or its stockholders for monetary damages for a breach of fiduciary duty as a director, except where the director breached his or her duty of loyalty, failed to act in good faith, engaged in intentional misconduct or knowingly violated a law, authorized the payment of a dividend or approved a stock repurchase in violation of Delaware corporate law or obtained an improper personal benefit. Our certificate of incorporation provides that none of our directors shall be personally liable to us or to our stockholders for monetary damages for any breach of fiduciary duty as a director, notwithstanding any provision of law imposing

such liability, except to the extent that the General Corporation Law of the State of Delaware prohibits the elimination or limitation of liability of directors for breaches of fiduciary duty.

Section 145 of the General Corporation Law of the State of Delaware provides that a corporation has the power to indemnify a director, officer, employee or agent of the corporation, or a person serving at the request of the corporation for another corporation, partnership, joint venture, trust or other enterprise in related capacities, against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by the person in connection with an action, suit or proceeding to which he or she was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding by reason of such position, if such person acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the best interests of the corporation, and, in any criminal action or proceeding, had no reasonable cause to believe his or her conduct was unlawful, except that, in the case of actions brought by or in the right of the corporation, no indemnification shall be made with respect to any claim, issue or matter as to which such person shall have been adjudged to be liable to the corporation unless and only to the extent that the Court of Chancery or other adjudicating court determines that, despite the adjudication of liability but in view of all of the circumstances of the case, such person is fairly and reasonably entitled to indemnity for such expenses which the Court of Chancery or such other court shall deem proper.

Our certificate of incorporation and bylaws provide indemnification for our directors and officers to the fullest extent permitted by the General Corporation Law of the State of Delaware, subject to certain limited exceptions. We will indemnify each person who was or is a party or threatened to be made a party to any threatened, pending or completed action, suit or proceeding (other than an action by or in the right of us) by reason of the fact that he or she is or was, or has agreed to become, a director or officer, or is or was serving, or has agreed to serve, at our request as a director, officer, partner, employee or trustee of, or in a similar capacity with, another corporation, partnership, joint venture, trust or other enterprise (all such persons being referred to as an “Indemnitee”), or by reason of any action alleged to have been taken or omitted in such capacity, against all expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred in connection with such action, suit or proceeding and any appeal therefrom, if such Indemnitee acted in good faith and in a manner he or she reasonably believed to be in, or not opposed to, our best interests, and, with respect to any criminal action or proceeding, he or she had no reasonable cause to believe his or her conduct was unlawful. Our certificate of incorporation and bylaws provide that we will indemnify any Indemnitee who was or is a party to an action or suit by or in the right of us to procure a judgment in our favor by reason of the fact that the Indemnitee is or was, or has agreed to become, a director or officer, or is or was serving, or has agreed to serve, at our request as a director, officer, partner, employee or trustee of, or in a similar capacity with, another corporation, partnership, joint venture, trust or other enterprise, or by reason of any action alleged to have been taken or omitted in such capacity, against all expenses (including attorneys’ fees) and, to the extent permitted by law, amounts paid in settlement actually and reasonably incurred in connection with such action, suit or proceeding, and any appeal therefrom, if the Indemnitee acted in good faith and in a manner he or she reasonably believed to be in, or not opposed to, our best interests, except that no indemnification shall be made with respect to any claim, issue or matter as to which such person shall have been adjudged to be liable to us, unless a court determines that, despite such adjudication but in view of all of the circumstances, he or she is entitled to indemnification of such expenses. Notwithstanding the foregoing, to the extent that any Indemnitee has been successful, on the merits or otherwise, he or she will be indemnified by us against all expenses (including attorneys’ fees) actually and reasonably incurred in connection therewith. Expenses must be advanced to an Indemnitee under certain circumstances.

We have entered into indemnification agreements with each of our executive officers and directors. The indemnification agreements provide the executive officers and directors with contractual rights to indemnification, and expense advancement and reimbursement, to the fullest extent permitted under the laws of the State of Delaware in effect from time to time, subject to certain exceptions contained in those agreements.

We maintain a general liability insurance policy that covers certain liabilities of directors and officers of our corporation arising out of claims based on acts or omissions in their capacities as directors or officers.

Item 7. Exemption from Registration Claimed.

The shares being reoffered and resold pursuant to the Reoffer Prospectus were deemed to be exempt from registration under the Securities Act in reliance on Section 4(a)(2) of the Securities Act and/or Rule 701 promulgated thereunder, as transactions by an issuer not involving a public offering or pursuant to a written compensatory benefit plan.

Item 8. Exhibits

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Incorporated by Reference |

| Exhibit No. | | Exhibit Description | | Form | | File No. | | Exhibit | | Filing Date |

| 3.1 | | | | S-1 | | 333-254800 | | 3.4 | | April 23, 2021 |

| 3.2 | | | | S-1 | | 333-254800 | | 3.5 | | April 23, 2021 |

| | | | | | | | | | |

| | | | | | | | | | |

| 4.1 | | | | S-8 | | 333-257780 | | 4.2 | | July 9, 2021 |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| 4.2 | | | | 8-K | | 333-254800 | | 10.1 | | May 9, 2023 |

| 5.1* | | | | | | | | | | |

| 10.1* | | | | | | | | | | |

| 23.1* | | | | | | | | | | |

| 23.2* | | | | | | | | | | |

| 23.3* | | | | | | | | | | |

| 24.1* | | | | | | | | | | |

| 107* | | | | | | | | | | |

_________________

*Filed herewith.

Item 9. Undertakings.

a.The undersigned Registrant hereby undertakes:

(1)To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i)To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii)To reflect in the prospectus any facts or events arising after the effective date of the Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the Registration Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective Registration Statement; and

(iii)To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the Registration Statement;

Provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii) of this section do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with

or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement.

(2)That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3)To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

b.The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the Registration Statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

c.Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding), is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act of 1933 and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of New York, State of New York, on August 8, 2023.

| | | | | |

| ASCEND WELLNESS HOLDINGS, INC. |

| |

| By: | /s/ John Hartmann |

| Name: | John Hartmann |

| Title: | Chief Executive Officer |

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below hereby constitutes and appoints John Hartmann and Daniel Neville, and each of them singly, as such person’s true and lawful attorneys-in-fact and agents, with full power of substitution and resubstitution, for such person and in such person’s name, place and stead, in any and all capacities, to sign any or all amendments (including, without limitation, post-effective amendments) to this Registration Statement (or any registration statement for the same offering that is to be effective upon filing pursuant to Rule 462(b) under the Securities Act of 1933), and to file the same, with all exhibits thereto, and all documents in connection therewith, with the Securities and Exchange Commission, granting unto each said attorney-in-fact and agent full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as such person might or could do in person, hereby ratifying and confirming all that any said attorney-in-fact and agent, or any substitute or substitutes of any of them, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated:

| | | | | | | | | | | | | | |

| Name and Signature | | Title | | Date |

| | | | |

/s/ Abner Kurtin | | Executive Chair and Director | | August 8, 2023 |

| Abner Kurtin | | |

| | | | |

/s/ John Hartmann | | President, Chief Executive Officer (Principal Executive Officer) and Director | | August 8, 2023 |

| John Hartmann | | |

| | | | |

/s/ Daniel Neville | | Chief Financial Officer | | August 8, 2023 |

| Daniel Neville | | (Principal Financial Officer) | |

| | | | |

/s/ Roman Nemchenko | | Executive Vice President, Chief Accounting Officer | | August 8, 2023 |

| Roman Nemchenko | | (Principal Accounting Officer) | |

| | | | |

/s/ Francis Perullo | | Director | | August 8, 2023 |

| Francis Perullo | | |

| | | | |

/s/ Scott Swid | | Director | | August 8, 2023 |

| Scott Swid | | |

| | | | |

/s/ Joshua Gold | | Director | | August 8, 2023 |

| Joshua Gold | | |

| | | | |

| /s/ Samuel Brill | | Director | | August 8, 2023 |

| Samuel Brill | | |

August 8, 2023

Ascend Wellness Holdings, Inc.

1411 Broadway 16th Floor

New York, NY 10016

Re: Registration Statement on Form S-8

Ladies and Gentlemen:

We have acted as counsel to Ascend Wellness Holdings, Inc., a Delaware corporation (the “Company”), in connection with a Registration Statement on Form S-8 (the “Registration Statement”) filed by the Company with the Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933, as amended (the “Securities Act”), relating to (i) up to 20,000,000 shares (the “Shares”) of Class A common stock of the Company, par value $0.001 per share (the “Class A common stock”), that may be issued pursuant to the Ascend Wellness Holdings, Inc. 2021 Stock Incentive Plan, as amended (the “2021 Plan”) and (ii) 4,000,000 shares (the “Resale Shares”) of Class A common stock being registered for resale by John Hartmann.

The Company previously registered a total of 26,600,000 shares of Class A common stock on a registration statement on Form S-8 (the “Prior Registration Statement”), filed with the Commission pursuant to the Securities Act on July 9, 2021, pursuant to which 17,000,000 shares of Class A common stock were issuable under the 2021 Plan and 5,600,000 shares of Class A common stock were registered for resale.

The Prior Registration Statement is incorporated in the Registration Statement by reference and made a part thereof. The Registration Statement includes a revised reoffer prospectus covering certain shares of Class A common stock registered under the Prior Registration Statement and the Shares being registered under the Registration Statement.

We have examined such documents and have reviewed such questions of law as we have considered necessary or appropriate for the purposes of our opinions set forth below. In rendering our opinions set forth below, we have assumed the authenticity of all documents submitted to us as originals, the genuineness of all signatures and the conformity to authentic originals of all documents submitted to us as copies. We have also assumed the legal capacity for all purposes relevant hereto of all natural persons. As to questions of fact material to our opinions, we have relied upon certificates or comparable documents of officers and other representatives of the Company and of public officials.

Based on the foregoing, we are of the opinion that:

1. The Shares, when issued, delivered and paid for in accordance with the 2021 Plan, will be validly issued, fully paid and, to our knowledge, non-assessable.

2. The Resale Shares, when issued, delivered and paid for in accordance with the Hartmann Grant Agreement (as defined below) will be validly issued and, to our knowledge, fully paid and non-assessable.

161 Bay Street | Suite 4310 | Toronto, ON M5J 2S1 Canada | T 416.367.7370 | F 416.367.7371 | dorsey.com

Ascend Wellness Holdings, Inc.

August 8, 2023

Page 2

Our opinions expressed above are limited to the Delaware General Corporation Law. As used in this opinion, the phrase “to our knowledge” refers to the conscious awareness of facts or other information, without independent investigation or inquiry, by James Guttman, Dale Williams and Amelia Messa.

In rendering our opinion, we have assumed that (i) the issuances of the Shares and the Resale Shares have been or will be duly recorded in the stock ledger of the Corporation at the time of such issuance, (ii) prior to or contemporaneously with the issuance of the Resale Shares pursuant to the related grant agreement between the Corporation and John Hartmann (the “Hartmann Grant Agreement”), the Corporation has received or will receive the consideration therefor specified in the Hartmann Grant Agreement, and (iii) prior to or contemporaneously with the issuance of the Shares pursuant to 2021 Plan, the Corporation has received or will receive the consideration therefor specified in any related grant agreement.

We hereby consent to the filing of this opinion as an exhibit to the Registration Statement. In giving this consent, we do not admit that we are within the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission thereunder.

| | |

| Very truly yours, |

|

| /s/ Dorsey & Whitney LLP |

JBG/ARM

ASCEND WELLNESS HOLDINGS, INC.

2021 Stock Incentive Plan

Non-Plan Restricted Stock Unit Agreement

THIS NON-PLAN RESTRICTED STOCK UNIT AGREEMENT is made as of this 8th day of August, 2023 (the “Grant Date”) by and between the Company and John Hartmann (“Participant”).

All capitalized terms in this Agreement shall have the meaning assigned to them in the Ascend Wellness Holdings, Inc. 2021 Stock Incentive Plan (attached hereto as Exhibit I, the “Plan”), except where otherwise defined in Section 8.

The Company and the Participant hereby acknowledge and agree that those provisions of the Employment Agreement relating to the issuance of the 4,000,000 RSUs (as defined below) under the Plan are superceded and replaced hereby. Although the RSUs are not granted under the Plan or any other equity plan of the Company, for purposes of giving this award meaning and interpreting its terms, the RSUs will be subject to the terms and conditions set forth in the Plan as if the RSUs were a restricted stock unit granted under the Plan provided that, for the avoidance of doubt, Shares subject to the RSUs shall not reduce and shall have no impact on the number of shares available for grant under the Plan.

1.Grant of RSUs. The Company hereby grants to the Participant, as of the Grant Date, 4,000,000 of restricted stock units (the “RSUs”). Each RSU represents the right to receive a Share of the Company.

2.Stockholder Rights. Prior to the issuance of Shares with respect to RSUs, the RSUs shall not have ownership or rights of ownership of any Shares underlying the RSUs. The RSUs may not be sold, assigned, transferred or pledged, other than by will or the laws of descent and distribution, and any such attempted transfer shall be void. Notwithstanding the foregoing, the Participant shall accumulate an unvested right to dividend equivalent amounts on the RSUs if cash dividends are declared on the underlying Shares on or after the Grant Date. Each time a dividend is paid on Shares, the Participant shall accrue an amount equal to the amount of the dividend payable on the Participant’s RSUs as if they were Shares on the dividend record date. The accrued amounts shall be subject to the same vesting, forfeiture and share delivery terms in Section 3 herein as if they had been awarded on the Grant Date. The Participant shall not be entitled to amounts with respect to dividends declared prior to the Grant Date. All dividend amounts accumulated with respect to forfeited RSUs shall also be irrevocably forfeited.

3.Vesting and Forfeiture of the RSUs. The RSUs will vest on the schedule set forth in Section 4(c) of the Employment Agreement with regard to the Performance-Based Initial RSUs (as defined in the Employment Agreement), or to the extent otherwise provided in either Section 4(d) or Section 5(d), of the Employment Agreement. For purposes of this Agreement, the vesting commencement date of the RSUs shall be May 19, 2023. Upon the Participant’s separation from Service, any remaining unvested RSUs shall cease vesting immediately, and shall be irrevocably forfeited unless vesting is accelerated under the Employment Agreement.

4.Taxes. The Participant is liable for any federal, state and local income or other taxes (“Tax-Related Items”) upon the receipt of the RSUs, the lapse of restrictions relating to the RSUs or the subsequent disposition of any of the RSUs, and the Participant acknowledges that he or she should consult with his or her own tax advisor regarding the applicable tax

consequences. Upon vesting of the RSUs, the Participant shall promptly pay to the Company in cash, and/or the Company may withhold from the Employee’s compensation, all applicable taxes required by the Company to be withheld or collected upon such vesting. Absent a timely election of a withholding method, all withholding shall be accomplished by withholding of Shares that would otherwise be released upon vesting having a Fair Market Value equal to the required withholding amounts for Tax-Related Items.

5.General Provisions.

(a)Governing Law. The interpretation, performance and enforcement of this Agreement shall be governed by the laws of the State of Delaware without giving effect to that State’s choice-of-law or conflict-of-law rules.

(b)Agreement is Entire Contract. The Plan and the Employment Agreement are hereby incorporated by reference. This Agreement (and any addendum hereto), the Plan, and the Employment Agreement constitute the entire contract between the parties hereto with regard to the subject matter hereof. Unless otherwise outlined in the Employment Agreement, to the extent there is a conflict between the terms of this Agreement, the terms of the Plan, or the Terms of the Employment Agreement, the terms of the Plan shall prevail. All decisions of the Committee with respect to any question or issue arising under the Plan, the Employment Agreement, or this Agreement shall be binding on all persons having an interest in the RSUs.

(c)Counterparts. This Agreement may be executed in counterparts, each of which shall be deemed to be an original, but all of which together shall constitute one and the same instrument.

(d)Successors and Assigns. The provisions of this Agreement shall inure to the benefit of, and be binding upon, the Company and its successors and assigns and upon Participant, Participant’s permitted assigns and the legal representatives, heirs and legatees of Participant’s estate, whether or not any such person shall have become a party to this Agreement and have agreed in writing to join herein and be bound by the terms hereof.

(e)Consultation with Professional Tax and Investment Advisors. Participant acknowledges that the grant, issuance, vesting or any payment with respect to any RSUs, and the sale or other taxable disposition of the RSUs, may have tax consequences pursuant to the Code or under local, state or international tax laws. Participant further acknowledges that he or she is relying solely and exclusively on his or her own professional tax and investment advisors with respect to any and all such matters (and is not relying, in any manner, on the Company or any of its employees, agents or representatives). Finally, Participant understands and agrees that any and all tax consequences resulting from the RSUs and their grant, issuance, vesting or any payment with respect thereto, and the sale or other taxable disposition of the RSUs, is solely and exclusively the responsibility of Participant without any expectation or understanding that the Company or any of its employees, agents or representatives will pay or reimburse Participant for such taxes or other items.

6.Definitions. The following definitions shall be in effect under the Agreement:

(a)Agreement shall mean this Non-Plan Restricted Stock Unit Agreement.

(b)Change in Control shall mean the consummation, after the Commencement Date, of (i) the sale of all or substantially all of the Company’s assets or at least

a majority of voting power of the capital stock of the Company, (ii) any liquidation, dissolution or winding up of the Company, or (iii) the merger or consolidation of the Company with or into another entity, except a merger or consolidation in which the holders of capital stock of the Company immediately prior to such merger or consolidation continue to hold at least 50% of the voting power of the capital stock of the Company or the surviving or acquiring entity, as applicable; provided, however, that no event described in the foregoing clauses (i), (ii) and (iii) shall constitute a Change of Control Event for purposes of this Agreement unless it satisfies the requirements of Treasury Regulation Section 1.409A-3(i)(5)(v) or (vii).

(c)Employment Agreement shall mean the employment agreement executed between the Company and Participant on May 15, 2023 (attached hereto as Exhibit II).

(d)Grant Date shall mean the date of grant of the RSUs as specified in the introductory paragraph of this Agreement.

(e)Service shall mean Participant’s performance of services for the Company (or any Affiliate) in the capacity of an employee, a member of the Board, a consultant, independent contractor or an advisor.

Remainder of Page Left Blank Intentionally

| | | | | |

| ASCEND WELLNESS HOLDINGS, INC.: |

| By: | /s/ Daniel Neville |

Name: | Daniel Neville |

| Title: | Chief Financial Officer |

| |

PARTICIPANT: | |

| Signature: | /s/ John Hartmann |

Printed Name: | John Hartmann |

Exhibit I to Restricted Stock Unit Agreement

2021 Stock Incentive Plan and 1st Amendment

ASCEND WELLNESS HOLDINGS, INC.

2021 STOCK INCENTIVE PLAN

Section 1. Purpose

The purpose of the Plan is to promote the interests of the Company and its shareholders by aiding the Company in attracting and retaining employees, officers, consultants, advisors, independent contractors and non-employee Directors capable of assuring the future success of the Company, to offer such persons incentives to put forth maximum efforts for the success of the Company’s business and to compensate such persons through stock-based awards and provide them with opportunities for stock ownership in the Company, thereby aligning the interests of such persons with the Company’s shareholders.

Section 2. Definitions

As used in the Plan, the following terms shall have the meanings set forth below:

(a) “Affiliate” shall mean any entity that, directly or indirectly through one or more intermediaries, is controlled by the Company.

(b) “Award” shall mean any Option, Stock Appreciation Right, Restricted Stock, Restricted Stock Unit or Dividend Equivalent granted under the Plan.

(c) “Award Agreement” shall mean any written agreement, contract or other instrument or document evidencing an Award granted under the Plan (including a document in an electronic medium) executed in accordance with the requirements of Section 10(b).

(d) “Board” shall mean the Board of Directors of the Company.

(e) “Code” shall mean the Internal Revenue Code of 1986, as amended from time to time, and any regulations promulgated thereunder.

(f) “Committee” means a committee or subcommittee of the Board appointed from time to time by the Board. Notwithstanding the foregoing, if, and to the extent that no Committee exists which has the authority to administer this Plan, the functions of the Committee shall be exercised by the Board and all references herein to the Committee shall be deemed to be references to the Board.

(g) “Company” shall mean Ascend Wellness Holdings, Inc., a corporation incorporated under the laws of Delaware and any successor corporation.

(h) “CSE” means the Canadian Securities Exchange.

(i) “Director” shall mean a member of the Board.

(j) “Dividend Equivalent” shall mean any right granted under Section 6(b) of the Plan.

(k) “Eligible Person” shall mean any employee, officer, non-employee Director, consultant, independent contractor or advisor providing services to the Company or any Affiliate, or any such person to whom an offer of employment or engagement with the Company or any Affiliate is extended. An Eligible Person must be a natural person and any consultants or advisors must not be engaged in connection with the offer or sale of securities in a capital-raising transaction, or to directly or indirectly promote or maintain a market for the Company’s securities.

(l) “Fair Market Value” with respect to one Share as of any date shall mean (a) if the Shares are listed on the CSE or any established stock exchange, the price of one Share at the close of the regular trading session of such market or exchange on the last trading day prior to such date, and if no sale of Shares shall have occurred on such date, on the next preceding date on which there was a sale of Shares. Notwithstanding the foregoing, in the event that the Shares are listed on the CSE, for the purposes of establishing the exercise price of any Options, the Fair Market Value shall not be lower than the greater of the closing market price of the Shares on the CSE on (i) the trading day prior to the date of grant of the Options, and (ii) the date of grant of the Options; (b) if the Shares are not so listed on the CSE or any established stock exchange, the average of the closing “bid” and “asked” prices quoted by the OTC Markets, the National Quotation Bureau, or any comparable reporting service on such date or, if there are no quoted “bid” and “asked” prices on such date, on the next preceding date for which there are such quotes for a Share; or (c) if the Shares are not publicly traded as of such date, the per share value of one Share, as determined by the Board, or any duly authorized Committee of the Board, in its sole discretion, by applying principles of valuation with respect thereto.

(m) “Incentive Stock Option” shall mean an option granted under Section 6(a) of the Plan that is intended to meet the requirements of Section 422 of the Code or any successor provision.

(n) “Non-Qualified Stock Option” shall mean an option granted under Section 6(a) of the Plan that is not intended to be an Incentive Stock Option.

(o) “Option” shall mean an Incentive Stock Option or a Non-Qualified Stock Option to purchase Shares of the Company.

(p) “Participant” shall mean an Eligible Person designated to be granted an Award under the Plan.

(q) “Plan” shall mean the Ascend Wellness Holdings, Inc. 2021 Stock Incentive Plan, as amended from time to time.

(r) “Prior Equity Plan” shall mean current equity incentive plan of the Company, as amended from time to time.

(s) “Restricted Stock” shall mean any Share granted under Section 6(c) of the Plan.

(t) “Restricted Stock Unit” shall mean any unit granted under Section 6(c) of the Plan evidencing the right to receive a Share (or a cash payment equal to the Fair Market Value of a Share) at some future date, provided that in the case of Participants who are liable to taxation under the Tax Act in respect of amounts payable under this Plan, that such date shall not be later than December 31 of the third calendar year following the year services were performed in respect of the corresponding Restricted Stock Unit awarded.

(u) “Section 409A” shall mean Section 409A of the Code, or any successor provision, and applicable Treasury Regulations and other applicable guidance thereunder.

(v) “Securities Act” shall mean the Securities Act of 1933, as amended.

(w) “Share” or “Shares” shall mean shares or common shares in the capital of the Company (or such other securities or property as may become subject to Awards pursuant to an adjustment made under Section 4(c) of the Plan), provided that such class is listed on a securities exchange.

(x) “Specified Employee” shall mean a specified employee as defined in Section 409A(a)(2)(B) of the Code or applicable proposed or final regulations under Section 409A, determined in accordance with procedures established by the Company and applied uniformly with respect to all plans maintained by the Company that are subject to Section 409A.

(y) “Stock Appreciation Right” shall mean any right granted under Section 6(b) of the Plan.

(z) “Tax Act” means the Income Tax Act (Canada).