0000895665

false

0000895665

2023-08-29

2023-08-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event Reported): August 29, 2023 (August 28, 2023)

Clearday,

Inc.

(Exact

Name of Registrant as Specified in its Charter)

| Delaware |

|

0-21074 |

|

77-0158076 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

Number) |

8800

Village Drive, Suite 106, San Antonio, TX 78217

(Address

of Principal Executive Offices) (Zip Code)

(210)

451-0839

(Registrant’s

telephone number, including area code)

(Former

name or former address, if changed since last report)

NA

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☒ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 |

|

CLRD |

|

OTCQX |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 |

Entry into a Material Definitive Agreement. |

As

previously disclosed on April 11, 2023, Clearday, Inc., a Delaware corporation (“Clearday”), entered into a

Merger Agreement, dated as of April 5, 2023 (the “Merger Agreement”), by and among Viveon Health Acquisition Corp.,

a Delaware corporation (“Viveon”), VHAC2 Merger Sub, Inc., a Delaware corporation (“Merger Sub”), Viveon

Health LLC, a Delaware limited liability company (“SPAC Representative”), and Clearday SR LLC, a Delaware limited liability

company (“Company Representative”). Pursuant to the terms of the Merger Agreement, a business combination between Viveon

and Clearday will be effected through the merger of Merger Sub with and into Clearday, with Clearday surviving the merger as a wholly

owned subsidiary of Viveon (the “Merger”), and Viveon will change its name to “Clearday Holdings, Inc.” Defined

terms not otherwise defined herein shall the meanings ascribed to such terms in the Merger Agreement.

On

August 28, 2023, Viveon, Clearday, Merger Sub, SPAC Representative and Company Representative entered into the First Amendment to Merger

Agreement (the “First Amendment”) that amended and modified the Merger Agreement to, among other things, (i) increase the

merger consideration from $250,000,000 to $500,000,000 (plus the aggregate exercise price for all Clearday options and warrants),

payable in shares of common stock of Viveon, (ii) provide that holders of all Company Capital Stock (including Company Common Stock,

Company Series A Preferred Stock and Company Series F Preferred Stock) as of the effective time of the Merger will be entitled to receive

a pro rata portion of the Earnout Shares, and (iii) amend the mechanics for appointing a successor Company Representative.

The

foregoing description of the First Amendment is not complete and is subject to and qualified in its entirety by reference to the First

Amendment which is filed with this Current Report on Form 8-K as Exhibit 2.1, the terms of which are incorporated by reference herein.

| Item 7.01 |

Regulation FD Disclosure. |

On August 29, 2023, Viveon

and Clearday issued a joint press release announcing the signing of the First Amendment. A copy of the press release is furnished hereto

as Exhibit 99.1.

The information in this Item 7.01

and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of

1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated

by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific

reference in such filing.

Important

Information About the Proposed Business Combination and Where to Find It

In

connection with the proposed business combination, Viveon and Clearday

intend to file relevant materials with the SEC, including a registration statement on Form S-4 containing a joint preliminary proxy statement/prospectus

(the “Form S-4”) with the SEC and after the registration statement is declared effective, each of Viveon and Clearday will

mail a definitive proxy statement/final prospectus relating to the proposed business combination to their respective stockholders.

The Form S-4 will include a joint proxy statement to be distributed to (i)

holders of Viveon’s common stock in connection with the solicitation of proxies for the vote by Viveon’s stockholders, and

(ii) holders of Clearday’s common stock in connection with the solicitation of proxies for the vote by Clearday’s stockholders

with respect to the proposed transaction and other matters as described in the Form S-4, as well as the prospectus relating to the offer

of securities to be issued to Clearday’s stockholders in connection with the proposed business combination. After the Form S-4 has

been filed and declared effective, each of Viveon and Clearday will mail a definitive proxy statement/prospectus, when available, to their

respective stockholders. Investors, security holders and other interested parties are urged to read the Form S-4, any amendments thereto

and any other documents filed with the SEC carefully and in their entirety when they become available because they will contain important

information about Viveon, Clearday and the proposed business combination. Additionally, each of Viveon and Clearday will file other relevant

materials with the SEC in connection with the proposed business combination. Copies may be obtained free of charge at the SEC’s

web site at www.sec.gov. The documents filed by Viveon with the SEC also may be obtained free of charge upon written request to

Viveon at: 3480 Peachtree Road NE 2nd Floor - Suite #112 Atlanta, Georgia 30326. The documents filed by Clearday with the SEC also may

be obtained free of charge upon written request to Clearday at: 8800 Village Drive, Suite 106, San Antonio, Texas 78217.

Security holders of Viveon and security holders of Clearday are urged to read the

Form S-4 and the other relevant materials when they become available before making any voting decision with respect to the proposed business

combination because they will contain important information about the business combination and the parties to the business combination.

The information contained on, or that may be accessed through, the websites referenced in this Current Report on Form 8-K (this “Current

Report”) is not incorporated by reference into, and is not a part of, this Current Report.

Participants

in the Solicitation

Viveon

and its directors and executive officers may be deemed participants in the solicitation of proxies from Viveon’s and

Clearday’s stockholders with respect to the business combination. A list of the names of those directors and executive officers

and a description of their interests in Viveon will be included in the Form S-4 for the proposed business combination and be available

at www.sec.gov. Additional information regarding the interests of such participants will be contained in the proxy statement/prospectus

for the proposed business combination when available. Information about Viveon’s directors and executive officers and their ownership

of Viveon’s common stock is set forth in Viveon’s Annual Report on Form 10-K for the year ended December 31, 2022 and filed

with the SEC on August 24, 2023, as modified or supplemented by any Form 3 or Form 4 filed with the SEC since the date of such filing.

Other information regarding the direct and indirect interests of the participants in the proxy solicitation will be included in the proxy

statement/prospectus pertaining to the proposed business combination when it becomes available. These documents can be obtained free

of charge from the SEC’s web site at www.sec.gov.

Clearday

and its directors and executive officers may also be deemed to be participants in the solicitation of proxies from the stockholders of

Viveon and Clearday in connection with the proposed business combination. A list of the names of such directors and executive officers

and information regarding their interests in the proposed business combination will be included in the Form S-4 for the proposed business

combination. Information about Clearday’s directors and executive officers and their ownership in Clearday is set forth in Clearday’s

Annual Report on Form 10-K for the year ended December 31, 2022 and filed with the SEC on May 25, 2023, as modified or supplemented by

any Form 3 or Form 4 filed with the SEC since the date of such filing.

Forward-Looking

Statements

Certain

statements made in this Current Report are “forward-looking statements”

within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking

statements may be identified by the use of words such as “target,” “believe,” “expect,” “will,”

“shall,” “may,” “anticipate,” “assume,” “estimate,” “would,” “could,”

“positioned,” “future,” “forecast,” “intend,” “plan,” “project,”

“outlook” and other similar expressions that predict or indicate future events or trends or that are not statements of historical

matters. Examples of forward-looking statements include, among others, statements made in this Current Report regarding: the proposed

transactions contemplated by the Merger Agreement, including the benefits of the proposed business combination, integration plans, expected

synergies and revenue opportunities; anticipated future financial and operating performance and results, including estimates for growth,

the expected management and governance of the combined company, continued expansion of product portfolios and the availability or effectiveness

of the technology for such products; the longevity health care sector’s continued growth; and the expected timing of the proposed

business combination. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are

based only on Viveon’s and Clearday’s current beliefs, expectations and assumptions. Because forward-looking statements relate

to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of

which are outside of our control. Actual results and outcomes may differ materially from those indicated in the forward-looking statements.

Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause actual results and outcomes

to differ materially from those indicated in the forward-looking statements include, among others, the following: (1) the occurrence of

any event, change, or other circumstances that could give rise to the termination of the Merger Agreement; (2) the institution or outcome

of any legal proceedings that may be instituted against Viveon and/or Clearday following the announcement of the Merger Agreement and

the transactions contemplated therein; (3) the inability of the parties to complete the proposed business combination, including due to

failure to obtain approval of the stockholders of Viveon or Clearday, certain regulatory approvals, or satisfy other conditions to closing

in the Merger Agreement; (4) the occurrence of any event, change, or other circumstance that could give rise to the termination of the

Merger Agreement or could otherwise cause the transaction to fail to close; (5) the impact of COVID-19 pandemic on Clearday’s business

and/or the ability of the parties to complete the proposed business combination; (6) the inability to obtain or maintain the listing of

Viveon’s shares of common stock on the NYSE American following the proposed business combination; (7) the risk that the proposed

business combination disrupts current plans and operations as a result of the announcement and consummation of the proposed business combination;

(8) the ability to recognize the anticipated benefits of the proposed business combination, which may be affected by, among other things,

competition and the ability of Clearday to grow and manage growth profitably and retain its key employees; (9) costs related to the proposed

business combination; (10) changes in applicable laws or regulations; (11) the possibility that Clearday may be adversely affected by

other economic, business, and/or competitive factors; (12) the amount of redemption requests made by Viveon’s stockholders; and

(13) other risks and uncertainties indicated from time to time in the final prospectus of Viveon for its initial public offering dated

December 22, 2020 filed with the SEC, Viveon’s Annual Report on Form 10-K, Clearday’s Annual Report on Form 10-K and the Form

S-4 relating to the proposed business combination, including those under “Risk Factors” therein, and in Viveon s and Clearday’s

other filings with the SEC. The foregoing list of factors is not exclusive and Viveon and Clearday caution readers not to place undue

reliance upon any forward-looking statements, which speak only as of the date made. Viveon and Clearday do not undertake or accept any

obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in their

expectations or any change in events, conditions, or circumstances on which any such statement is based, whether as a result of new information,

future events, or otherwise, except as may be required by applicable law. Neither Viveon nor Clearday gives any assurance that the combined

company will achieve its expectations.

No

Offer or Solicitation

This

Current Report shall not constitute a solicitation of a proxy, consent, or authorization with respect to any securities or in respect

of the proposed business combination. This Current Report shall also not constitute an offer to sell or the solicitation of an offer

to buy any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation, or

sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities

shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or an

exemption therefrom.

Item

9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated:

August 29, 2023

| Clearday, Inc. |

|

| |

|

| By: |

/s/

James T. Wales |

|

| Name:

|

James

T. Walesa |

|

| Title: |

Chief

Executive Officer |

|

Exhibit 2.1

FIRST AMENDMENT TO MERGER AGREEMENT

This First Amendment to Merger

Agreement (this “Amendment”), dated as of August 28, 2023 is entered into by and among Clearday, Inc., a Delaware corporation

(the “Company”), Viveon Health Acquisition Corp., a Delaware corporation (“Parent”), VHAC2 Merger

Sub, Inc., a Delaware corporation (“Merger Sub”), Viveon Health LLC, a Delaware limited liability Company, in the capacity

as the representative from and after the Effective Time for the stockholders of Parent (other than the Company Stockholders) as of immediately

prior to the Effective Time (and their successors and assigns) in accordance with the terms and conditions of the Original Merger Agreement

(as defined below) (the “SPAC Representative”), and Clearday SR LLC, a Delaware limited liability company, in the capacity

as the representative from and after the Effective Time for the holders of Company Preferred Stock as of immediately prior to the Effective

Time (and their successors and assigns) in accordance with the terms and conditions of the Original Merger Agreement (the “Company

Representative” and each of the SPAC Representative and the Company Representative, a “Representative Party”).

RECITALS

WHEREAS, the Company, Parent,

Merger Sub and the Representative Parties entered into that certain Merger Agreement dated as of April 5, 2023 (the “Original

Merger Agreement”);

WHEREAS, the Company, Parent,

Merger Sub and the Representative Parties desire to amend certain definitions in the Original Merger Agreement: “Company Earnout

Holders”, “Company Knowledge Persons”, “Earnout Pro Rata Share” and “Per Share Merger Consideration

Amount”;

WHEREAS, the Company, Parent,

Merger Sub and the Representative Parties desire to amend certain other terms of the Original Merger Agreement as more fully set forth

in this Amendment; and

WHEREAS, capitalized and other

defined terms used in this Amendment and not otherwise defined herein have the respective meanings given to them in the Original Merger

Agreement.

NOW, THEREFORE, in consideration

of the mutual covenants and promises set forth in this Amendment, and other good and valuable consideration, the receipt and sufficiency

of which are hereby acknowledged, the parties hereby agree as follows:

1.

Amendments of the Original Merger Agreement.

(a)

Section 1.1 of the Original Merger Agreement. Section 1.1 of the Original Merger Agreement is hereby amended to amend and

restate and/or add the following definitions:

(i)

“Company Earnout Holders” means the holders of shares of Company Capital Stock as of immediately prior to the

Effective Time, determined on the basis assuming that all of the shares of the Company Series A Preferred Stock and all of the shares

of the Company Series F Preferred Stock were converted into shares of Company Common Stock immediately prior to the Effective Time, in

accordance with their respective terms, who hold for a period of at least six (6) months following the Closing Date: (1) shares of Parent

Common Stock issued upon exchange of their Company Capital Stock or (2) shares of Parent New Series A Preferred Stock or Parent New Series

F Preferred Stock (as the case may be) issued in exchange of the Company Preferred Stock or shares of Parent Common Stock issued upon

conversion of any such Company Preferred Stock.

(ii)

“Company Knowledge Persons” means each of the following individuals: Roberta Otto, Linda Carrasco, Richard Morris,

BJ Parrish, Daniel Policy, Gary Sawina and James Walesa.

(iii)

“Earnout Pro Rata Share” means, for each Company Earnout Holder, a percentage determined by the quotient of:

(1)

The sum of (i) the total number of shares of Company Common Stock held by such Company Earnout Holder immediately prior to the

Effective Time, plus (ii) the total number of shares of Company Common Stock issuable upon conversion of all shares of Company Series

A Preferred Stock and Company Series F Preferred Stock that are held by such Company Earnout Holder immediately prior to the Effective

Time;

divided by

(2)

The sum of (i) the total number of shares of Company Common Stock and (ii) the total number of shares of the Company Common Stock

issuable upon conversion of all shares of Company Series A Preferred Stock and Company Series F Preferred Stock, in each case, that are

issued and outstanding immediately prior to the Effective Time.

(iv)

“Per Share Merger Consideration Amount” means an amount equal to (a) the sum of (i) Five Hundred Million Dollars ($500,000,000),

plus (ii) the Aggregate Exercise Price, divided by (b) the number of Fully Diluted Company Shares.”

(b)

Amendment to Section 3.1(c). Section 3.1(c) of the Original Merger Agreement is hereby amended to read in its entirety as

follows

(c) Conversion of Shares of

Company Common Stock. Each share of Company Common Stock issued and outstanding immediately prior to the Effective Time (other than any

such shares of Company Common Stock cancelled pursuant to Section 3.1(a) and any Dissenting Shares) shall, in accordance with the Company

Certificate of Incorporation, be converted into the right to receive (i) a number of shares of Parent Common Stock equal to the Conversion

Ratio; and (ii) a number of Earnout Shares in accordance with, and subject to the contingencies, set forth in Section 3.7.

(c)

Amendment to Section 3.5. Section 3.5(a)(xiii)(E) of the Original Merger Agreement is hereby amended to read in its entirety

as follows

(E) for each holder of Company

Common Stock, Company Series A Preferred Stock and Company Series F Preferred Stock, its respective Earnout Pro Rata Share.

(d)

Amendment to Section 11.21. Section 11.21(d) of the Original Merger Agreement is hereby amended to read in its entirety

as follows

(d) If the Company Representative

shall die, become disabled, dissolve, resign or otherwise be unable or unwilling to fulfill its responsibilities as representative and

agent of the Company Earnout Holders, then the Company Earnout Holders shall, within ten (10) Business Days after notice of such death,

disability, dissolution, resignation or other event is provided by Parent to the Company Earnout Holders (which notice may be provided

by the filing of a press release and Form 8-K with the SEC by Parent), appoint a successor Company Representative (by vote or written

consent of the holders of Company Capital Stock that was held by such Company Earnout Holders that hold a plurality of the votes or consents

provided by such Company Earnout Holders provided in writing to Parent, attention Secretary of the Corporation that are received on or

prior to such tenth (10th) Business Day. Any such successor so appointed shall become the “Company Representative”

for purposes of this Agreement.

2.

Representations and Warranties of the Company and the Company Representative. The Company and the Company Representative

(each, a “Company Party”) hereby represent and warrant to Parent that each of the following representations and warranties

are true, correct and complete as of the date of this Amendment and as of the Closing Date:

(a)

Each Company Party has all requisite corporate power and authority to execute and deliver this Amendment and to consummate the

transactions contemplated hereby, in the case of the Merger, subject to receipt of the Company Stockholder Approval. The execution and

delivery by each Company Party of this Amendment and the consummation by each Company Party of the transactions contemplated hereby have

been duly authorized by all necessary corporate action on the part of the Company. No other corporate proceedings on the part of either

Company Party are necessary to authorize this Amendment or to consummate the transactions contemplated by this Amendment (other than,

in the case of the Merger, the receipt of the Company Stockholder Approval). This Amendment has been duly executed and delivered by each

Company Party and, assuming the due authorization, execution and delivery by each of the other parties hereto, this Amendment constitutes

a legal, valid and binding obligation of such Company Party, enforceable against the Company in accordance with its terms, subject to

the Enforceability Exceptions.

(b)

None of the execution, delivery or performance by either Company Party of this Amendment or the consummation by such Company Party

of the transactions contemplated hereby does or will, in each case, subject to receipt of the Company Stockholder Approval, (a) contravene

or conflict with the contravene or conflict with the organizational or constitutive documents of the Company Parties, (b) contravene or

conflict with or constitute a violation of any provision of any Law or Order binding upon or applicable to the Company Parties or to any

of its respective properties, rights or assets, (c) (i) require consent, approval or waiver under, (ii) constitute a default under or

breach of (with or without the giving of notice or the passage of time or both), (iii) violate, (iv) give rise to any right of termination,

cancellation, amendment or acceleration of any right or obligation of the Company Parties or to a loss of any material benefit to which

the Company Parties are entitled, in the case of each of clauses (i) – (iv), under any provision of any Permit, Contract or other

instrument or obligations binding upon the Company Parties or any of its respective properties, rights or assets, other than the obligation

to pay indebtedness or other liabilities or convert such indebtedness or other liabilities into (A) Parent Common Stock or (B) Company

Common Stock (which conversion into Company Common Stock would be on or prior to the Effective Time), (d) result in the creation or imposition

of any Lien (except for Permitted Liens) on any of the Company Parties’ properties, rights or assets, or (e) require any consent,

approval or waiver from any Person pursuant to any provision of the organizational or constitutive documents of the Company Parties.

3.

Representations and Warranties of the Parent Parties. Parent , Merger Sub and the SPAC Representative (the “Parent

Parties”) hereby represent and warrant to the Company that each of the following representations and warranties are true, correct

and complete as of the date of this Amendment and as of the Closing Date:

(a)

Each of the Parent Parties has all requisite corporate power and authority to execute and deliver this Amendment and to consummate

the transactions contemplated hereby, in the case of the Merger, subject to receipt of the Parent Stockholder Approval. The execution

and delivery by each of the Parent Parties of this Amendment and the consummation by each of the Parent Parties of the transactions contemplated

hereby have been duly authorized by all necessary corporate action on the part of such Parent Party. No other corporate proceedings on

the part of such Parent Party are necessary to authorize this Amendment or to consummate the transactions contemplated by this Amendment

(other than, in the case of the Merger, the receipt of the Parent Stockholder Approval). This Amendment has been duly executed and delivered

by such Parent Party and, assuming the due authorization, execution and delivery by each of the other parties hereto and thereto (other

than a Parent Party), this Amendment constitutes a legal, valid and binding obligation of such Parent Party, enforceable against such

Parent Party in accordance with its terms, subject to the Enforceability Exceptions.

(b)

The execution, delivery and performance by a Parent Party of this Amendment or the consummation by a Parent Party of the transactions

contemplated hereby do not and will not (a) contravene or conflict with the organizational or constitutive documents of the Parent Parties,

or (b) contravene or conflict with or constitute a violation of any provision of any Law or any Order binding upon the Parent Parties.

4.

No Waiver. No waiver of any breach or default hereunder shall be considered valid unless in writing, and no such waiver

shall be deemed a waiver of any subsequent breach or default of the same or similar nature.

5.

Miscellaneous.

(a)

Entire Agreement. The Original Merger Agreement, as amended by this Amendment, together with the Additional Agreements,

sets forth the entire agreement of the parties with respect to the subject matter hereof and thereof and supersedes all prior and contemporaneous

understandings and agreements related thereto (whether written or oral), all of which are merged herein.

(b)

Ratification. Except as amended hereby, the terms and provisions of the Original Merger Agreement shall remain unchanged

and in full force and effect. In the event of any conflict between the terms of the Original Merger Agreement and the terms of this Amendment,

the terms of this Amendment shall govern and control.

(c)

Counterparts; Electronic Signatures. This Amendment may be executed in counterparts, each of which shall constitute an original,

but all of which shall constitute one agreement. This Amendment shall become effective upon delivery to each party of an executed counterpart

or the earlier delivery to each party of original, photocopied, or electronically transmitted signature pages that together (but need

not individually) bear the signatures of all other parties.

(d)

Governing Law. This Amendment and all disputes or controversies arising out of or relating to this Amendment or the transactions

contemplated hereby, including the applicable statute of limitations, shall be governed by and construed in accordance with the Laws of

the State of Delaware, without giving effect to any choice of law or conflict of law provision or rule (whether of the State of Delaware

or any other jurisdiction) that would cause the application of the Law of any jurisdiction other than the State of Delaware.

(e)

Incorporation by Reference. Sections 11.1 (Notices), 11.2 (Amendments; No Waivers; Remedies), 11.3 (Arm’s Length Bargaining;

No Presumption Against Drafter), 11.5 (Expenses), 11.6 (No Assignment or Delegation), 11.10 (Severability), 11.11 (Further Assurances),

11.12 (Third Party Beneficiaries), 11.13 (Waiver), 11.14 (No Other Representations; No Reliance), 11.15 (Waiver of Jury Trial), 11.16

(Submission to Jurisdiction), 11.17(Attorneys’ Fees), 11.18 (Remedies) and 11.19 (Non-Recourse of the Merger Agreement) are hereby

incorporated by reference herein mutatis mutandis.

[Signature Page Follows]

* * * * *

IN WITNESS WHEREOF, the undersigned,

intending to be legally bound hereby, have duly executed this Amendment as of the day and year first above written.

| |

Parent: |

| |

|

| |

VIVEON HEALTH ACQUISITION CORP. |

| |

|

|

| |

By: |

/s/ Jagi Gill |

| |

Name: |

Jagi Gill |

| |

Title: |

Chief Executive Officer |

| |

|

|

| |

Merger Sub: |

| |

|

| |

VHAC2 MERGER SUB, INC. |

| |

|

|

| |

By: |

/s/ Jagi Gill |

| |

Name: |

Jagi Gill |

| |

Title: |

Director |

| |

|

|

| |

SPAC Representative: |

| |

|

| |

VIVEON HEALTH, LLC, solely in the capacity as the SPAC Representative hereunder |

| |

|

|

| |

By: |

/s/ Romilos Papadopoulos |

| |

Name: |

Romilos Papadopoulos |

| |

Title: |

Managing Member |

| |

Company: |

| |

|

| |

CLEARDAY, INC. |

| |

|

|

| |

By: |

/s/ James Walesa |

| |

Name: |

James Walesa |

| |

Title: |

Chief Executive Officer |

| |

|

|

| |

Company Representative: |

| |

|

| |

Clearday SR LLC, solely in the capacity as the Company Representative hereunder |

| |

|

|

| |

By: |

/s/ James Walesa |

| |

Name: |

James Walesa, Manager |

| |

Title: |

Authorized Signatory |

Exhibit

99.1

Viveon

Health Acquisition Corp. and Clearday, Inc. Announce

Amendment

to their Definitive Merger Agreement

Norcross

GA and San Antonio, TX (Aug. 29, 2023) (GLOBE NEWSWIRE) —Viveon Health Acquisition Corp. (NYSE American: VHAQ)

(“Viveon”), a special purpose acquisition company, and Clearday, Inc. (CLRD) (“Clearday”), an innovative

longevity technology company using an integrated platform of robotic companion care and AI-driven technology to serve the senior

adult care sector, announced today that they have amended the terms of their previously announced Merger Agreement, dated as of

April 5, 2023 (the “Merger Agreement”). Pursuant to the terms of the Merger Agreement, a business combination between

Viveon and Clearday will be effected through the merger of a wholly owned subsidiary of Viveon with and into Clearday, with Clearday

surviving the merger as a wholly owned subsidiary of Viveon (the “Merger”).

The

amendment to the Merger Agreement provides for, among other things, (i) an increase in the merger consideration from $250,000,000 to

$500,000,000 (plus the aggregate exercise price for all Clearday options and warrants), payable in shares of Viveon’s common stock,

(ii) that holders of all of Clearday’s capital stock (including Clearday’s common stock and preferred stock) at the effective

time of the Merger will be entitled to receive a pro rata portion of the earnout shares, and (iii) amending the mechanics for appointing

a successor Clearday representative.

“We

continue to believe Clearday to be the right partner for Viveon and look forward to closing the transaction in the near future,”

said Jagi Gill, CEO of Viveon. Mr Gill added, “We have been working closely with the Clearday team during the last few months

to further develop their longevity-tech platform and believe Clearday has added considerably to the platform’s ability to meet

the significant addressable longevity care market that is estimated to be more than $275 billion and provide meaningful benefits to residential

care communities and their staff. We remain committed to working with the Clearday team to optimize their novel technology platform and

executing on the sales channel expansion delivering companion care solutions for residents and operators in the burgeoning senior care

market.”

Jim

Walesa, CEO of Clearday, stated, “We appreciate working with Viveon to better transition Clearday into a high-growth technology

business serving the pressing and expensive longevity care crisis facing our aging population. Clearday’s care solutions combine

AI-enabled robotics and a software platform that enables autonomous companionship, care intelligence, and a patient data platform to

address the challenges in the longevity care market with proven results in our communities.”

Additional

information about the proposed transaction, including a copy of the amendment to the Merger Agreement, can be found in a Current Report

on Form 8-K to be filed each of Viveon and Clearday with the U.S. Securities and Exchange

Commission (the “SEC”) and will be available at www.sec.gov.

Advisors

Dykema

Gossett PLLC is acting as legal counsel to Clearday.

Loeb

and Loeb LLP is acting as legal counsel to Viveon.

ClearThink

Capital LLC is acting as a transactional and strategic advisor to the parties.

About

Clearday Inc.

Clearday™ is

an innovative longevity healthcare technology company with a modern, hopeful vision for making high-quality care solutions more accessible,

affordable, and empowering for aging individuals and their families. Clearday has a decades-long experience in non-acute care through

its subsidiary, which operates highly-rated residential memory care and adult daycare communities. Its Longevity Care Platform brings

Clearday solutions to people wherever they are. Its platform is at the intersection of telehealth, remote monitoring, and patient engagement

— all delivered across mobile, and robotic endpoints in a Software-as-a-Service (SaaS) and Robotics as a Service (RaaS)

model. Learn more about Clearday and its pioneering legislative efforts to bring the “Innovative Cognitive Care Act for Veterans”

to Congress at www.myclearday.com/viveon/.

About

Viveon Health Acquisition Corp.

Viveon

Health Acquisition Corp. is a blank check company, also commonly referred to as a special purpose acquisition company, or SPAC, formed

for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination

with one or more businesses. It is Viveon’s intention to pursue prospective targets that are focused on the healthcare sector in

the United States and other developed countries.

Important

Information About the Proposed Business Combination and Where to Find It

In

connection with the proposed business combination, Viveon and Clearday intend to file relevant materials with the SEC, including a registration

statement on Form S-4 containing a joint preliminary proxy statement/prospectus (the “Form S-4”) with the SEC and after the

registration statement is declared effective, each of Viveon and Clearday will mail a definitive proxy statement/final prospectus relating

to the proposed business combination to their respective stockholders.

The

Form S-4 will include a joint proxy statement to be distributed to (i) holders of Viveon’s common stock in connection with the

solicitation of proxies for the vote by Viveon’s stockholders, and (ii) holders of Clearday’s common stock in connection

with the solicitation of proxies for the vote by Clearday’s stockholders with respect to the proposed transaction and other matters

as described in the Form S-4, as well as the prospectus relating to the offer of securities to be issued to Clearday’s stockholders

in connection with the proposed business combination. After the Form S-4 has been filed and declared effective, each of Viveon and Clearday

will mail a definitive proxy statement/prospectus, when available, to their respective stockholders. Investors, security holders and

other interested parties are urged to read the Form S-4, any amendments thereto and any other documents filed with the SEC carefully

and in their entirety when they become available because they will contain important information about Viveon, Clearday and the proposed

business combination. Additionally, each of Viveon and Clearday will file other relevant materials with the SEC in connection with the

proposed business combination. Copies may be obtained free of charge at the SEC’s web site at www.sec.gov. The documents

filed by Viveon with the SEC also may be obtained free of charge upon written request to Viveon at: 3480 Peachtree Road NE, 2nd

Floor - Suite #112 Atlanta, Georgia 30326. The documents filed by Clearday with the SEC also may be obtained free of charge upon written

request to Clearday at: 8800 Village Drive, Suite 106, San Antonio, Texas 78217.

Security

holders of Viveon and security holders of Clearday are urged to read the Form S-4 and the other relevant materials when they become available

before making any voting decision with respect to the proposed business combination because they will contain important information about

the business combination and the parties to the business combination. The information contained on, or that may be accessed through,

the websites referenced in this Press Release (this “Press Release”) is not incorporated by reference into, and is not a

part of, this Press Release.

Participants

in the Solicitation

Viveon

and its directors and executive officers may be deemed participants in the solicitation of proxies from Viveon’s and Clearday’s

stockholders with respect to the business combination. A list of the names of those directors and executive officers and a description

of their interests in Viveon will be included in the Form S-4 for the proposed business combination and be available at www.sec.gov.

Additional information regarding the interests of such participants will be contained in the proxy statement/prospectus for the proposed

business combination when available. Information about Viveon’s directors and executive officers and their ownership of Viveon’s

common stock is set forth in Viveon’s Annual Report on Form 10-K for the year ended December 31, 2022 and filed with the SEC on

August 24, 2023, as modified or supplemented by any Form 3 or Form 4 filed with the SEC since the date of such filing. Other information

regarding the direct and indirect interests of the participants in the proxy solicitation will be included in the proxy statement/prospectus

pertaining to the proposed business combination when it becomes available. These documents can be obtained free of charge from the SEC’s

web site at www.sec.gov.

Clearday

and its directors and executive officers may also be deemed to be participants in the solicitation of proxies from the stockholders of

Viveon and Clearday in connection with the proposed business combination. A list of the names of such directors and executive officers

and information regarding their interests in the proposed business combination will be included in the Form S-4 for the proposed business

combination. Information about Clearday’s directors and executive officers and their ownership in Clearday is set forth in Clearday’s

Annual Report on Form 10-K for the year ended December 31, 2022 and filed with the SEC on May 25, 2023, as modified or supplemented by

any Form 3 or Form 4 filed with the SEC since the date of such filing.

Forward-Looking

Statements

Certain

statements made in this Press Release are “forward-looking statements” within the meaning of the “safe harbor”

provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words

such as “target,” “believe,” “expect,” “will,” “shall,” “may,”

“anticipate,” “assume,” “estimate,” “would,” “could,” “positioned,”

“future,” “forecast,” “intend,” “plan,” “project,” “outlook”

and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Examples

of forward-looking statements include, among others, statements made in this Press Release regarding: the proposed transactions contemplated

by the Merger Agreement, including the benefits of the proposed business combination, integration plans, expected synergies and revenue

opportunities; anticipated future financial and operating performance and results, including estimates for growth, the expected management

and governance of the combined company, continued expansion of product portfolios and the availability or effectiveness of the technology

for such products; the longevity health care sector’s continued growth; and the expected timing of the proposed business combination.

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on Viveon’s

and Clearday’s current beliefs, expectations and assumptions. Because forward-looking statements relate to the future, they are

subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of

our control. Actual results and outcomes may differ materially from those indicated in the forward-looking statements. Therefore, you

should not rely on any of these forward-looking statements. Important factors that could cause actual results and outcomes to differ

materially from those indicated in the forward-looking statements include, among others, the following: (1) the occurrence of any event,

change, or other circumstances that could give rise to the termination of the Merger Agreement; (2) the institution or outcome of any

legal proceedings that may be instituted against Viveon and/or Clearday following the announcement of the Merger Agreement and the transactions

contemplated therein; (3) the inability of the parties to complete the proposed business combination, including due to failure to obtain

approval of the stockholders of Viveon or Clearday, certain regulatory approvals, or satisfy other conditions to closing in the Merger

Agreement; (4) the occurrence of any event, change, or other circumstance that could give rise to the termination of the Merger Agreement

or could otherwise cause the transaction to fail to close; (5) the impact of COVID-19 pandemic on Clearday’s business and/or the

ability of the parties to complete the proposed business combination; (6) the inability to obtain or maintain the listing of Viveon’s

shares of common stock on the NYSE American following the proposed business combination; (7) the risk that the proposed business combination

disrupts current plans and operations as a result of the announcement and consummation of the proposed business combination; (8) the

ability to recognize the anticipated benefits of the proposed business combination, which may be affected by, among other things, competition

and the ability of Clearday to grow and manage growth profitably and retain its key employees; (9) costs related to the proposed business

combination; (10) changes in applicable laws or regulations; (11) the possibility that Clearday may be adversely affected by other economic,

business, and/or competitive factors; (12) the amount of redemption requests made by Viveon’s stockholders; and (13) other risks

and uncertainties indicated from time to time in the final prospectus of Viveon for its initial public offering dated December 22, 2020

filed with the SEC, Viveon’s Annual Report on Form 10-K, Clearday’s Annual Report on Form 10-K and the Form S-4 relating

to the proposed business combination, including those under “Risk Factors” therein, and in Viveon s and Clearday’s

other filings with the SEC. The foregoing list of factors is not exclusive and Viveon and Clearday caution readers not to place undue

reliance upon any forward-looking statements, which speak only as of the date made. Viveon and Clearday do not undertake or accept any

obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in their

expectations or any change in events, conditions, or circumstances on which any such statement is based, whether as a result of new information,

future events, or otherwise, except as may be required by applicable law. Neither Viveon nor Clearday gives any assurance that the combined

company will achieve its expectations.

No

Offer or Solicitation

This

Press Release shall not constitute a solicitation of a proxy, consent, or authorization with respect to any securities or in respect

of the proposed business combination. This Press Release shall also not constitute an offer to sell or the solicitation of an offer to

buy any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation, or sale

would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities

shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or an

exemption therefrom.

Contacts:

Viveon

Health Acquisition Corporation

Chief

Financial Officer

Rom

Papadopoulos

rom@viveonhealth.com

(404)

861-5393

Clearday

Inc.

Investor

Relations

Ginny

Connolly

info@myclearday.com

210-451-0839

v3.23.2

Cover

|

Aug. 29, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 29, 2023

|

| Entity File Number |

0-21074

|

| Entity Registrant Name |

Clearday,

Inc.

|

| Entity Central Index Key |

0000895665

|

| Entity Tax Identification Number |

77-0158076

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

8800

Village Drive

|

| Entity Address, Address Line Two |

Suite 106

|

| Entity Address, City or Town |

San Antonio

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

78217

|

| City Area Code |

(210)

|

| Local Phone Number |

451-0839

|

| Written Communications |

true

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.001

|

| Trading Symbol |

CLRD

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

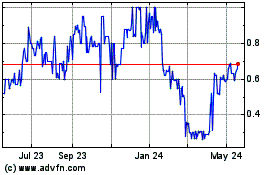

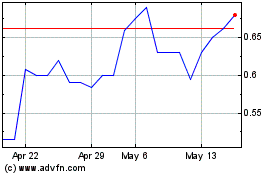

Clearday (CE) (USOTC:CLRD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Clearday (CE) (USOTC:CLRD)

Historical Stock Chart

From Nov 2023 to Nov 2024